Professional Documents

Culture Documents

Director's Remuneration

Uploaded by

Roshni BhatiaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Director's Remuneration

Uploaded by

Roshni BhatiaCopyright:

Available Formats

Presented By: Pradnya Naik (94) Darshana Shinde (111) Siddhi Koli (112) Dimple Thakkar (116)

Corporate governance reforms world over have brought into focus a dichotomy of performance and conformance of responsibilities

The main attention is on crucial questions about the true role and responsibility of Board of Directors in the modern organization Directors remuneration is of legitimate concern to the shareholders.

Company should establish a formal and transparent procedure for developing policy on executive remuneration and for fixing the remuneration packages of individual directors No director should be involved in deciding his or her own remuneration

Openness: Shareholders are entitled to a full and clear statement of benefits available to the directors

The

company must have a credible and transparent policy in determining and accounting for the remuneration of the directors

The

policy should avoid potential conflicts of interest between the shareholders, the directors, and the management

of importance of fixed and variable component of Directors Remuneration

Explanation

Information on performance criteria for share incentives or variable components of remuneration Linkage between remuneration and performance Parameters and rationale For annual bonus and other non-cash schemes

Description of supplementary pension or early retirement scheme for directors

Clause 49 of the listing agreement has recommended that the board should set up a remuneration committee Companies without remuneration committees may not have the appropriate mechanisms to determine Important monitoring and arbiter function in the setting of top pay Bring about objectivity in determining the remuneration package while striking a balance between the interest of the company and the shareholders

Levels of remuneration should be sufficient to attract and retain and motivate executive directors committee should judge where to position their company relative to other companies committee should be sensitive to the wider scene, including pay and employment conditions within the company, when determining annual salary increases

Remuneration

Remuneration

Remuneration committee should consist of independent non-executive directors The board itself or the share holders should determine the remuneration of the non-executive directors, including members of the remuneration committees within the limits set in the Articles of Association Members should be listed each year in the boards remuneration report to shareholders

Consult the chairman or CEO about their proposal relating to remuneration of executive directors and have access to advice inside or outside the company

The Chairman of the board should ensure that the company maintains contact with the principal shareholders about the remuneration in the same way as it does for other matters

By the articles of the company or by special resolution Amount and the mode of remuneration shall be in accordance with the provisions of section 198.

Amount: Not exceed eleven percent of the net profits of the

company in a particular year excluding the sitting fees payable to directors for attending board and committee meetings

Mode: The remuneration of a whole time or managing director

may be paid either by way of a monthly payment or at a specified percentage of the net profits of the company or partly by one way and partly by the other.

A director who in neither in the whole time employment of the company nor a managing director

By monthly, quarterly or annual payment

By way of commission

-Such commission shall not exceed 1%of net profits if the company has a managing or whole time director & -3% if the company has no managing or whole time director

If any director receives any remuneration in excess of the permissible limit, he will have to refund such sums to the company No director of a company who is in receipt of any commission from the company and who is either in the whole-time employment of the company or a managing director shall be entitled to receive any commission or other remuneration from any subsidiary of such company The above provisions pertaining to remuneration do not apply to a private company unless it is a subsidiary of a public company

Disclosure on the remuneration package:

All elements of remuneration package of all the

directors i.e. salary, benefits, bonuses, stock options, pension etc Details of fixed component and performance linked incentives, along with the performance criteria Service contracts, notice period, severance fees Stock option details, if any and whether issued at a discount as well as the period over which accrued and exercisable.

All

pecuniary relationship or transactions of the non-executive directors vis--vis the company

Criteria

of making payments to non-executive directors in its annual report

the number of shares and convertible instruments held by non-executive directors

Disclose

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Articles To ReferDocument20 pagesArticles To ReferRoshni BhatiaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Audit CommitteeDocument15 pagesAudit CommitteeRoshni Bhatia100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Citadelle Daily Scorecard - 13 August 2015Document333 pagesCitadelle Daily Scorecard - 13 August 2015Roshni BhatiaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Citadelle Daily Scorecard - 5 August 2015 ExcelDocument333 pagesCitadelle Daily Scorecard - 5 August 2015 ExcelRoshni BhatiaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- MBA Oath EthicsDocument19 pagesMBA Oath EthicsRoshni BhatiaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Insider Trading Is The Trading of A Corporation's Stock orDocument5 pagesInsider Trading Is The Trading of A Corporation's Stock orRoshni BhatiaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Goal planner for family financesDocument7 pagesGoal planner for family financesRoshni BhatiaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Kotak Sensex ETF Low ResDocument18 pagesKotak Sensex ETF Low ResRoshni BhatiaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Interest Rate: Wholesale Inflation Drops On Back of Softer Oil PricesDocument9 pagesInterest Rate: Wholesale Inflation Drops On Back of Softer Oil PricesRoshni BhatiaNo ratings yet

- Corporate GovernanceDocument13 pagesCorporate GovernanceRoshni BhatiaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Whistle Blower PolicyDocument26 pagesWhistle Blower PolicyRoshni BhatiaNo ratings yet

- Bhopal Gas IncidentDocument14 pagesBhopal Gas IncidentRoshni BhatiaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Wealth MaximizationDocument9 pagesWealth MaximizationRoshni Bhatia100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Kumar Mangalam Birla CommitteeDocument24 pagesKumar Mangalam Birla CommitteeRoshni Bhatia100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- CG Code by CiiDocument30 pagesCG Code by CiiRoshni BhatiaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Corporate Governance Board DirectorsDocument21 pagesCorporate Governance Board DirectorsRoshni BhatiaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Green WashedDocument50 pagesGreen WashedRoshni BhatiaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Hedonistic Calculus and Utilitarianism in IVFDocument15 pagesHedonistic Calculus and Utilitarianism in IVFRoshni BhatiaNo ratings yet

- CSR & EthicsDocument35 pagesCSR & EthicsRoshni BhatiaNo ratings yet

- Green WashedDocument50 pagesGreen WashedRoshni BhatiaNo ratings yet

- Teleology and Consequentialism ExplainedDocument31 pagesTeleology and Consequentialism ExplainedRoshni BhatiaNo ratings yet

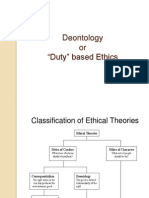

- Final DeontologyDocument31 pagesFinal DeontologyRoshni BhatiaNo ratings yet

- EuthanasiaDocument10 pagesEuthanasiaRoshni BhatiaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Factsheet August 2012 V10Document13 pagesFactsheet August 2012 V10Roshni BhatiaNo ratings yet

- IFB Training Slides - Session 1 2 - Nov2010Document45 pagesIFB Training Slides - Session 1 2 - Nov2010Roshni BhatiaNo ratings yet

- Income Tax Calculator in Excel 2012 2013Document2 pagesIncome Tax Calculator in Excel 2012 2013kirang gandhiNo ratings yet

- Calculator To Calculate Capital Gain On Sale of Shares and Mutual Funds LTCG STCGDocument1 pageCalculator To Calculate Capital Gain On Sale of Shares and Mutual Funds LTCG STCGRoshni BhatiaNo ratings yet

- Charts Put in Sector ReportDocument4 pagesCharts Put in Sector ReportRoshni BhatiaNo ratings yet

- Assignment 3 FinalDocument10 pagesAssignment 3 FinalRoshni BhatiaNo ratings yet

- Mortland v. Aughney Bankruptcy AppealDocument5 pagesMortland v. Aughney Bankruptcy AppealNorthern District of California BlogNo ratings yet

- Del Rosario Vs PeopleDocument10 pagesDel Rosario Vs PeopleajdgafjsdgaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- PPM169 Old Freelance AgreementDocument3 pagesPPM169 Old Freelance AgreementPitafi BalochNo ratings yet

- Litonjua Vs LDocument2 pagesLitonjua Vs LKling KingNo ratings yet

- Napoleon Prelim TranscriptDocument63 pagesNapoleon Prelim Transcriptjordon.grayNo ratings yet

- CivPro Atty. Custodio Case DigestsDocument12 pagesCivPro Atty. Custodio Case DigestsRachel CayangaoNo ratings yet

- Consummation Stage Key RequirementsDocument1 pageConsummation Stage Key RequirementsRalph Ronald CatipayNo ratings yet

- NAPOCOR V CoDocument6 pagesNAPOCOR V Coxeileen08No ratings yet

- Lease of Immovable Property: Rights and Liabilities of The LessorDocument5 pagesLease of Immovable Property: Rights and Liabilities of The LessorArunaMLNo ratings yet

- Prescription of Annulment of Extrajudicial SettlementDocument5 pagesPrescription of Annulment of Extrajudicial SettlementmasterfollowNo ratings yet

- DefensesDocument1 pageDefensesjNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Security Is Important To EveryoneDocument5 pagesSecurity Is Important To EveryoneDJ Rose Osias AllasgoNo ratings yet

- How Malaysia's court system worksDocument6 pagesHow Malaysia's court system worksYazid HanafiahNo ratings yet

- Thomas Paine's The Age of ReasonDocument62 pagesThomas Paine's The Age of ReasonGracee Umayam-FloraNo ratings yet

- Acknowledgement ReceiptDocument2 pagesAcknowledgement ReceiptArland Pasco BlancoNo ratings yet

- Sison Vs AnchetaDocument6 pagesSison Vs AnchetaMadelle PinedaNo ratings yet

- Holland & Knight Lobbying ContractDocument44 pagesHolland & Knight Lobbying ContractmilesmoffeitNo ratings yet

- Philippine Labor LawDocument3 pagesPhilippine Labor Lawtere_aquinoluna828No ratings yet

- Akbar's DMCA Counter Notice To SchmalfeldtDocument4 pagesAkbar's DMCA Counter Notice To SchmalfeldtBreitbart UnmaskedNo ratings yet

- Fact Sheet NR 4: Crimes Against Children (2003)Document3 pagesFact Sheet NR 4: Crimes Against Children (2003)Children's InstituteNo ratings yet

- Rosales vs. Rosales, G.R. No. L-40789, 148 SCRA 59, February 27, 1987Document3 pagesRosales vs. Rosales, G.R. No. L-40789, 148 SCRA 59, February 27, 1987AliyahDazaSandersNo ratings yet

- Miles Et Al v. Saroka Et Al - Document No. 4Document4 pagesMiles Et Al v. Saroka Et Al - Document No. 4Justia.comNo ratings yet

- Law 531 WK 3 Knowledge CheckDocument9 pagesLaw 531 WK 3 Knowledge CheckJuan Antonio Segura100% (1)

- Syllabus in Civil LawDocument5 pagesSyllabus in Civil LawPrime Antonio RamosNo ratings yet

- LabRel Full TextDocument78 pagesLabRel Full TextIrene PacaoNo ratings yet

- Question 2 2022 Zone BDocument6 pagesQuestion 2 2022 Zone BSharavana SaraNo ratings yet

- CARPER LAD Form No. 3 Notice of CoverageDocument3 pagesCARPER LAD Form No. 3 Notice of CoverageChris DianoNo ratings yet

- EVIDENCE - Group 1 - Preliminary ConsiderationDocument22 pagesEVIDENCE - Group 1 - Preliminary ConsiderationMitchay100% (1)

- Warrantless Arrest and Self-Defense in People vs ManluluDocument4 pagesWarrantless Arrest and Self-Defense in People vs ManluluDominic EmbodoNo ratings yet

- Introduction To The Philosophy To The Human PersonDocument28 pagesIntroduction To The Philosophy To The Human Persongemini googleNo ratings yet