Professional Documents

Culture Documents

Credit Instruments

Uploaded by

Revanth NannapaneniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Instruments

Uploaded by

Revanth NannapaneniCopyright:

Available Formats

1

Credit means lending money on trust. All money is credit. Defined as any item agreed upon that can be used as currency Generally in use are cheques, bills of exchanges, bank overdraft ,credit card etc. Any item can serve as a credit instrument, as long as both parties have agreed on the use of that instrument Ever popular due to convenience

2

A written evidence of the existence of an obligation on the part of the debtor, or a claim on the part of the creditor Shows the degree of risk that confronts the creditor with respect to the collection of the debt Shows the nature of the debtor-creditor relationship

Enables the creditor to hold the host instrument to collect from his debtor Debtor is protected of his rights with respect to the amount of the obligation, interest and maturity date Facilitate exchange transactions Minimize disputes among the contracting parties Instrument facilitates production and consumption

4

Negotiable Instruments Non-negotiable instruments

A cheque promissory note and a bill of exchange which are payable to the bearer of the instrument or the person to be ordered A document guaranteeing the payment of a specific amount of money, either on demand, or at a set time Unconditional, written and is to be payable on demand or the period for the payment which is determined

Four primary commercial types of negotiable instruments are: 1) Promissory note 2) Bills of Exchange 3) Open Book Account 4) Check

An unconditional promise in writing made by one person to another Referred to as a note

A non-interest-bearing written order Used primarily in international trade Binds one party to pay a fixed sum of money to another party at a predetermined future date Can be drawn by individuals or banks and are generally transferable by endorsements

If bills are issued by

A bank-bank drafts An individual-trade drafts

If drawn on

A person, firm or corporation-trade bills A banking institution-bankers' bills

10

Most elementary type of credit instrument Means of recording or measuring credit

11

Earliest forms of a credit instrument is the cheque Value of the check is underwritten by funds that are placed in a bank account Utilized by consumers as a legitimate means of paying for goods and services received No longer the main credit instrument employed

12

13

Cannot be transferred or the documents which are restricted to transfer by the issuer Examples: Money order Postal order Shares certificate

14

A payment order for a pre-specified amount of money Purchased for the amount desired Commonly used for transferring funds to a payee who is in a remote, rural area The most economical way of sending money in india for small amounts

15

Used for sending money through the mail Not legal tender A type of promissory note Similar to a cheque

16

Credit Instruments with General Acceptability Credit Instruments with Limited Acceptability

17

Pass from hand to hand without question as to their source Possess the characteristics of money Only credit instrument of general acceptability is credit money (bank notes, treasury certificates)

18

Constitutes future claims of a valuable item against an entity. The holder use it to purchase goods and services Credit money is made of a material that has low intrinsic value Forms of credit money are IOUs, bonds and money market accounts Any form of financial instrument that cannot be repaid immediately is considered credit money

19

CREDIT MONEY QUALITIES 1) Must be issued by a promissory in whom all the people have confidence 2) Must be in convenient denominations 3) Easily recognizable 4) Must be difficult to counterfeit

20

Acceptance will depend on the credit standing of the issuer or maker. Subdivided into two types: instruments for investment purpose and instruments for commercial purpose. Accepted only by few

21

These are subdivided into stock certificates, bond certificates and money market bills Stock Certificates:legal document that certifies ownership of a specific number of shares of stock in a corporation.Two forms:

bearer stock certificates entitles the holder to exercise all legal rights associated with the stock they are rarely seen in practice

22

registered stock certificates evidence of title, and a record of the true holders of the shares will appear in the stockholder's register of the corporation

Degree of negotiability depends on whether or not it is registered Registered bond is payable only to the party whose name is designated on the instrument and recorded on the books of the corporation. It can be transferred only by the endorsement of the payee Interest on the registered bond is paid directly to the party specified Unregistered bond is more readily transferred Interest given to any holder of the coupons attached to the instrument, so usually called a coupon bond.

23

Bond certificates Promise written in a formal manner, for it is always under seal It is a promise by the maker to pay interest and principal at a designated time in the future The maker is usually a government or a corporation Bears a fixed rate of interest which is generally payable semi annually. May be either secured or unsecured

24

Subdivided into two types as Promise-to-pay instrument and Order-to-pay instrument. 1. Promise-to-pay Instruments:

Promissory notes Open book accounts

2. Order-to-pay Instruments

Bill of exchange Cheque

25

A payment card issued to users as a system of payment. Allows cardholder to pay for goods and services based on the holder's promise to pay for them. Issued by a credit card issuer, such as a bank or credit union, after an account has been approved by the credit provider

26

Credit card user is obligated to repay the credit card company. Companies charge high interest rates on credit card balances Grace usually range from 20 to 55 days Good for short-term borrowing of small amounts

27

Defined as an electronic store of monetary value on a technical device that may be widely used for making payments to undertakings other than the issuer without necessarily involving bank accounts in the transaction, but acting as a prepaid bearer instrument. Operations are card based (electronic purses, pre-charged cards, chip cards, contactless cards) or software based products.

28

Electronic money products use cryptography to authenticate transactions and to protect the confidentiality and the integrity of data No longer needs to be physically exchanged More easily used for remote payments Cannot be used again Promise of vastly increasing payments traffic through this channel, particularly in the consumer space

29

The foreign exchange operations of banks consist primarily of purchase and sale of credit instruments They differ in speed with which money can be received by the creditor at the other end Different rates of exchange applicable to different types of credit instruments.

30

Order for the payment of money sent by telegraph or cable. Customer pays money to the bank in the currency of his country and the bank informs its foreign correspondent through currency to a designated payee A system of private codes by which the genuineness of the instruction can be tested

31

Quickest method of transferring money No gain or loss of interest No risk of loss of the instrument in transit Used by banks for transfer of funds from one center to another for short term investment Payment within the next 24 hours, excluding bank holidays and no stamp duties are to be fixed on such transfers

32

An order by a bank to its correspondent bank but the instructions are sent by mail Takes longer time to reach destinations Some time elapses between the purchaser and payee Loss of interest to the purchaser A gain of interest for the bank When the customer does not require the use of foreign currently immediately, an MT is quite suitable. An m.T is like cheque but not negotiable or transferable

33

A draft or a cheque is drawn by a bank of its foreign correspondents or an office at the centre where the payment is to be made, and is remitted by the buyer to one to whom the payment is to be made. The buyer pays the required sum to the bank, gets the draft, and sends it to the payee Draft may be drawn in the currency of the country of the payee

34

Drawing of personal cheques in foreign currency by resident indians is not permitted Needs specified approval of RBI Can be received by him or drawn by a nonresident from his bank account overseas, the proceeds of which can be collected and credited to the account of a resident indian

35

Convenient mean of international trade finance. Certificate issued by bank, based on account holding that applicant will be paying the beneficiary the amount denoted in letter The letter is being pursued as a much safer option than making an advance payment To ensure the security of transactions financial instruments are employed: forfeiting and hedging Other instruments include export credit insurance and export credit guarantee The unsafe methods of payment guarantees include advance payment and open accounts.

36

Wholesale transactions are completed by the passing of instruments of credit or negotiable paper, as notes, drafts, checks etc. It is the function of banks to deal with these transferable instruments legally called titles Are representative of the property passing by title in money from the producers to the consumers. The trade in instruments of credit amounts to around fifty billions of dollars yearly Pay checks in denominations are mostly used.

37

Term drafts means orders drawn upon a bank or by one bank upon another Term bills of exchange used to include drafts Negotiable paper is the usual economic class of credit instrument used by lawyers Negotiability is defined by lawyers as the power to transfer title absolutely and without the necessity of notice incurring liability on the part of the recipient.

38

Use of Credit Instruments as a medium or short-term investment is obvious Truly embody the best risk/reward ratio in todays investment marketplace.

39

You might also like

- Credit Instruments Power PointDocument11 pagesCredit Instruments Power PointEd Leen Ü80% (10)

- Types of Credit BSBA 3B, GROUP 2Document20 pagesTypes of Credit BSBA 3B, GROUP 2Rizzle RabadillaNo ratings yet

- Loans and Discounts Functions ExplainedDocument2 pagesLoans and Discounts Functions ExplainedMegan Adeline Hale100% (2)

- Nature of CreditDocument6 pagesNature of CreditMikk Mae GaldonesNo ratings yet

- Types of Credit TransactionDocument2 pagesTypes of Credit Transactionjoshua aguirre0% (1)

- Lecture Credit and Collection Chapter 1Document7 pagesLecture Credit and Collection Chapter 1Celso I. MendozaNo ratings yet

- MIDTERM - LESSON 2 - Classifications of CreditDocument4 pagesMIDTERM - LESSON 2 - Classifications of CreditJc Quismundo63% (8)

- Lesson 6 - CreditDocument52 pagesLesson 6 - CreditDianne Joy MempinNo ratings yet

- The Negotiable Instruments Law in a NutshellDocument78 pagesThe Negotiable Instruments Law in a NutshelljaneNo ratings yet

- Types of Obligations Explained in DepthDocument24 pagesTypes of Obligations Explained in Depthfreya cuevasNo ratings yet

- Chattel MortgageDocument9 pagesChattel MortgageLess BalesoroNo ratings yet

- Examples of Credit InstrumentsDocument35 pagesExamples of Credit Instrumentsjessica anne100% (1)

- Bank ReconciliationDocument38 pagesBank Reconciliationpayos manuelNo ratings yet

- Chapter 2 - Overview of The Financial System PDFDocument20 pagesChapter 2 - Overview of The Financial System PDFAngel SisonNo ratings yet

- Obligations and Contracts ExplainedDocument27 pagesObligations and Contracts ExplainedEarl MagbanuaNo ratings yet

- LawDocument39 pagesLawShiela Mei Ong BulunanNo ratings yet

- Title 1 ObligationsDocument3 pagesTitle 1 ObligationsheyNo ratings yet

- LOSS OF THING AND DEBT EXTINGUISHMENTDocument61 pagesLOSS OF THING AND DEBT EXTINGUISHMENT.No ratings yet

- Extinguishment of ObligationsDocument9 pagesExtinguishment of ObligationsJamaica TungolNo ratings yet

- Credit InstrumentsDocument67 pagesCredit InstrumentsAnne Gatchalian100% (2)

- Credit and Collection Lecture 3Document25 pagesCredit and Collection Lecture 3Jackie RaborarNo ratings yet

- Credit and Collection 2Document8 pagesCredit and Collection 2Jaimee VelchezNo ratings yet

- Study Guide No. 4 Chapter 4 - Extinguishment of ObligationsDocument11 pagesStudy Guide No. 4 Chapter 4 - Extinguishment of ObligationsHannah Marie Aliño100% (1)

- Module 2 Credit - CollectionDocument14 pagesModule 2 Credit - CollectionAicarl JimenezNo ratings yet

- Negotiable instruments characteristics requisites roles partiesDocument4 pagesNegotiable instruments characteristics requisites roles partiesAndrolf CaparasNo ratings yet

- Credit and CollectionDocument16 pagesCredit and CollectionArajoyce Aguinaldo100% (2)

- Credit and CollectionDocument53 pagesCredit and CollectionApril CastilloNo ratings yet

- Chapter 8 Deposit FunctionDocument5 pagesChapter 8 Deposit FunctionMariel Crista Celda MaravillosaNo ratings yet

- Micro-Financing ProgramDocument21 pagesMicro-Financing ProgramRizzvillEspinaNo ratings yet

- Credit C7Document14 pagesCredit C7Chantelle Ishi Macatangay AquinoNo ratings yet

- 5 A Credit and Collection LetterDocument33 pages5 A Credit and Collection LetterEj AguilarNo ratings yet

- History of Finance CompanyDocument4 pagesHistory of Finance Companym.bqairNo ratings yet

- Money Markets and Related Financial Instruments: Polytechnic University of The PhilippinesDocument22 pagesMoney Markets and Related Financial Instruments: Polytechnic University of The PhilippinesAnjanette PunoNo ratings yet

- For UploadDocument6 pagesFor UploadDino AbieraNo ratings yet

- OBLICON Notes 2Document8 pagesOBLICON Notes 2Rachel RiveraNo ratings yet

- Regular - Limited To Cooperative Organizations Which Are Holders of Associate - Those Subscribing and Holding Preferred Shares of TheDocument3 pagesRegular - Limited To Cooperative Organizations Which Are Holders of Associate - Those Subscribing and Holding Preferred Shares of TheJaylordPataotaoNo ratings yet

- Cred&coll Reviewer MidtermsDocument24 pagesCred&coll Reviewer MidtermsElla Marie LopezNo ratings yet

- General Banking Law of 2000Document25 pagesGeneral Banking Law of 2000John Rey Bantay RodriguezNo ratings yet

- Fraud (Partial) - Obligation and ContractsDocument4 pagesFraud (Partial) - Obligation and Contractsjayzzah100% (1)

- Credit Appraisal Means An InvestigationDocument3 pagesCredit Appraisal Means An InvestigationSoumava Paul100% (1)

- Report On Debt ManagementDocument79 pagesReport On Debt ManagementSiddharth Mehta100% (1)

- Loan RestructuringDocument22 pagesLoan RestructuringNazmul H. PalashNo ratings yet

- Sec 30-50 (Negotiation)Document10 pagesSec 30-50 (Negotiation)Arvin Glen BeltranNo ratings yet

- Setting Credit LimitDocument5 pagesSetting Credit LimitYuuna Hoshino100% (1)

- Rights of A Holder Objectives: To Be Able To Understand The Rights of A Holder, Concept of Alteration, and Shelter PrincipleDocument4 pagesRights of A Holder Objectives: To Be Able To Understand The Rights of A Holder, Concept of Alteration, and Shelter PrincipleAndrei ArkovNo ratings yet

- Active Subject (Creditor/Obligee) - or TheDocument2 pagesActive Subject (Creditor/Obligee) - or Thewenny capplemanNo ratings yet

- Collateral SecurityDocument2 pagesCollateral SecurityThanga pandiyanNo ratings yet

- BUSINESS LAW MODULE 2 RevisedDocument12 pagesBUSINESS LAW MODULE 2 RevisedArchill YapparconNo ratings yet

- Cecchetti-5e-Ch20 - Money Growth, Money Demand and Monetary PolicyDocument74 pagesCecchetti-5e-Ch20 - Money Growth, Money Demand and Monetary PolicyammendNo ratings yet

- Credit and Background: Microfinance Flow ChartDocument21 pagesCredit and Background: Microfinance Flow ChartJerry Sarabia JordanNo ratings yet

- Philippine Deposit Insurance Corporation (PDIC) ExplainedDocument4 pagesPhilippine Deposit Insurance Corporation (PDIC) ExplainedRia Evita RevitaNo ratings yet

- Module OneDocument95 pagesModule OneJoana Marie CabuteNo ratings yet

- Credit and Collection: Chapter 6 - Credit Decision MakingDocument51 pagesCredit and Collection: Chapter 6 - Credit Decision MakingQuenne Nova DiwataNo ratings yet

- Universal Bank's Core Functions and DepartmentsDocument1 pageUniversal Bank's Core Functions and Departmentshailene lorenaNo ratings yet

- TILA Shared PDFDocument8 pagesTILA Shared PDFGretchen Alunday SuarezNo ratings yet

- Credit InstrumentsDocument18 pagesCredit InstrumentsRichard100% (2)

- Credit Collection Module 2Document9 pagesCredit Collection Module 2Crystal Jade Apolinario RefilNo ratings yet

- Assignment in Credit TransactionsDocument17 pagesAssignment in Credit TransactionsNica09_forever100% (1)

- Importants of Letter of CreditDocument3 pagesImportants of Letter of CreditUnEeb WaSeemNo ratings yet

- Group No. 05 (BC18-05) (BC18-12)Document31 pagesGroup No. 05 (BC18-05) (BC18-12)Fiza GulzarNo ratings yet

- FinalDocument57 pagesFinalRevanth NannapaneniNo ratings yet

- Information Brochure CCMT2013Document170 pagesInformation Brochure CCMT2013Biswajit DebnathNo ratings yet

- Forms of Business Organization OverviewDocument13 pagesForms of Business Organization OverviewRevanth NannapaneniNo ratings yet

- Partial Differential EquationsDocument3 pagesPartial Differential EquationsRevanth NannapaneniNo ratings yet

- AcademicsDocument2 pagesAcademicsRevanth NannapaneniNo ratings yet

- Is 808-1989 Steel TableDocument24 pagesIs 808-1989 Steel TableAtul Kumar Engineer86% (28)

- Econom Sem 6Document14 pagesEconom Sem 6Revanth NannapaneniNo ratings yet

- IS-875-Part1 - Dead Loads For DesignDocument39 pagesIS-875-Part1 - Dead Loads For Designlokesh2325100% (7)

- Gate Syllubus, Civil EngineeringDocument4 pagesGate Syllubus, Civil Engineeringlokesh2325No ratings yet

- Rain Water HarvestingDocument2 pagesRain Water HarvestingRevanth NannapaneniNo ratings yet

- Deloitte CX in Banking EnglishDocument12 pagesDeloitte CX in Banking EnglishalexNo ratings yet

- Royal Bank of ScotlandDocument8 pagesRoyal Bank of Scotlandnhdtrq100% (2)

- G.H. Patel Post Graduate Institute of Business Management: Summer Internship Training Project ReportDocument79 pagesG.H. Patel Post Graduate Institute of Business Management: Summer Internship Training Project ReportBoricha AjayNo ratings yet

- Texas Certified Lienholders ListDocument60 pagesTexas Certified Lienholders ListJohn StephensNo ratings yet

- What Kind of Text Is ItDocument3 pagesWhat Kind of Text Is ItahmadNo ratings yet

- Orban Co-Operative BankDocument27 pagesOrban Co-Operative BankYaadrahulkumar MoharanaNo ratings yet

- Homework #1: Nguyen Xuan Thanh Strategy division-TCBDocument2 pagesHomework #1: Nguyen Xuan Thanh Strategy division-TCBThanh NguyenNo ratings yet

- 126 UpdatedDocument112 pages126 UpdatednumantariqNo ratings yet

- Financial Analysis of HDFC BankDocument48 pagesFinancial Analysis of HDFC BankAbhay JainNo ratings yet

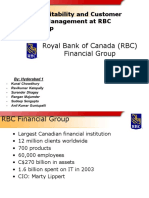

- RBC Case StudyDocument20 pagesRBC Case StudyIshmeet SinghNo ratings yet

- BRD transaction reportDocument5 pagesBRD transaction reportDavid GeorgeNo ratings yet

- 10.28.2017 MT (Audit of Receivables)Document7 pages10.28.2017 MT (Audit of Receivables)PatOcampo100% (1)

- What Are The Important Functions of MoneyDocument3 pagesWhat Are The Important Functions of MoneyGanesh KaleNo ratings yet

- Basel II- RBI Guidelines SummaryDocument70 pagesBasel II- RBI Guidelines SummaryHarsh MehtaNo ratings yet

- Financial Accountant JournalDocument55 pagesFinancial Accountant Journalburhan_qureshiNo ratings yet

- Application, Tuition & Fees at Les Roches Hotel Management SchoolDocument2 pagesApplication, Tuition & Fees at Les Roches Hotel Management SchoolShoaib ZaheerNo ratings yet

- OSP#16078878Document6 pagesOSP#16078878Guhanadh PadarthyNo ratings yet

- UnclaimedProperty2014 - Glenburn, Levant, Kenduskeag, Corinth MaineDocument10 pagesUnclaimedProperty2014 - Glenburn, Levant, Kenduskeag, Corinth MaineMaineHouseGOP2No ratings yet

- Security MarketDocument30 pagesSecurity Marketashish_k_srivastavaNo ratings yet

- Digital Banking Project - BubunaDocument20 pagesDigital Banking Project - BubunaRaghunath AgarwallaNo ratings yet

- Bookshoppe Jan 2013Document23 pagesBookshoppe Jan 2013ibnusina2013No ratings yet

- Banking For Muggles 101Document6 pagesBanking For Muggles 101Kurt KlingbeilNo ratings yet

- Retail Lending Policy 2010-11Document25 pagesRetail Lending Policy 2010-11Bhandup YadavNo ratings yet

- Financing Your: Massachusetts Institute of TechnologyDocument12 pagesFinancing Your: Massachusetts Institute of TechnologyTruong CaiNo ratings yet

- MCQ - BankingDocument4 pagesMCQ - Bankingbhaskar51178No ratings yet

- PayPass - MChip Reader Card Application Interface Specification (V2.0)Document80 pagesPayPass - MChip Reader Card Application Interface Specification (V2.0)Kiran Kumar Kuppa100% (3)

- Fee Based Activity in India BanksDocument12 pagesFee Based Activity in India BanksMu'ammar RizqiNo ratings yet

- Accounting For Foreign Currency TransactionsDocument16 pagesAccounting For Foreign Currency TransactionsAaron AraulaNo ratings yet

- Two EcosystemsDocument16 pagesTwo EcosystemsChloeNo ratings yet

- Fifteen Thousand Useful PhrasesDocument4 pagesFifteen Thousand Useful Phrasesrattan singhNo ratings yet