Professional Documents

Culture Documents

Sarbanes Oxley Act

Uploaded by

spicychaituCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sarbanes Oxley Act

Uploaded by

spicychaituCopyright:

Available Formats

SARBANES OXLEY

CORPORATE CERTIFICATION OF FINANCIAL STATEMENTS

Sarbanes Oxley Sections 302, 404 & 906a

Sections 302, 404 & 906a of the Sarbanes Oxley Act 2002 contain the following requirements:

302 Corporate responsibility for financial reports 404 Assessment of internal controls 906a Certification of periodic financial reports

Section 302 Overview

Section 302 of the Sarbanes Oxley Act 2002 requires that: an Issuers annual and quarterly financial statements are certified by the organisations principal officers for: correctness completeness effectiveness of underlying internal controls

Section 302 Summary of Requirements

Certification required by Issuers principal officers confirming that quarterly and annual financial statements: Disclose material untrue statements or omissions Fairly present financial condition and results Are supported by effective internal controls

Definition of Principal Officers (302)

The Sarbanes Oxley Act defines principal officers as:

principal executive officer (CEO) principal financial officer (CFO) officers performing similar roles to the CEO or CFO

Review of Report by Signing Officer (302)

The signing officers are to certify that they have actually reviewed the report being published The signing officers should understand all aspects of the report and raise any concerns they have about its contents

Review of Report by Signing Officer (302)

An effective process should exist within the organisation to pre-check correctness and completeness of the report Consideration should be given to introducing an upward certification process within the organisation

Untrue Statements or Omissions (302)

Based on their knowledge, the signing officers must certify that the report does not:

contain any material untrue statements

omit to state a material fact

that may be considered to be misleading

Financial Condition and Results (302)

Based on their knowledge, the signing officer must certify that the financial statements fairly and accurately reflect the Issuers:

Financial condition as at a specific date

Results for the specific periods as stated in the report - in all material respects.

Responsibility for Internal Control Systems (302)

The signing officer(s) must certify that they: are responsible for the disclosure controls and the internal control systems (ICS) have ensured that material information is communicated to the signing officers have evaluated the ICS in last 90 days to filing date have reported findings from evaluation process

Reporting on Internal Control Systems (ICS) (302)

Following their ICS evaluation, the signing officer(s) must report to the audit committee and external auditors: all significant deficiencies any material weaknesses Any fraud, whether material or not, involving any person involved in the ICS Any significant changes to the ICS since evaluation

Internal Control Report (404)

An Issuers annual report must include an internal control report that: Confirms management responsibility for the internal control structure Confirms management responsibility for the financial reporting procedures Includes an assessment of of the effectiveness of the ICS Requires the external auditor to provide an opinion on this assessment

Certification of Periodic Financial Reports (906a)

Section 906a requires certification of each periodic financial report by the CEO and CFO that:

the report complies with the Exchange Act

The information fairly presents, in all material aspects, the financial condition and results of the issuer.

Foreign Re-incorporations Ineffective

Sarbanes Oxley prohibit Issuers from trying to reduce the legal implications of Section 302 through:

Re-incorporation outside the United States

Engaging in a transaction that results in transfer of corporate domicile outside the United States

Upward Certification System

Relates to requirements of Sarbanes Oxley Act Sections 302, 404 and 906a

Creates chain of certifications for the internal control system (ICS) based on agreed procedures and check lists

Involves all levels of specialists and management in the ICS certification process

Upward Certification System

Each specialist responsible for a business process with a material risk profile certifies that specific business process Each level of management certifies their own area of responsibility based on the individual business process certifications received

Results can form basis of report required for Section 404 reporting

Upward Certification Benefits

All areas of the business are covered Provides structured audit trail Easier to re-certify specialist areas of the business Easier to follow up to correct deficiencies and problems All management have a corporate responsibility for the process

Upward Certification - Implementation

Develop procedures covering the certification process Design common forms and checklists Train staff in understanding internal control system (ICS) Train staff in evaluating the ICS and assessing risks Monitor and report on deficiencies identified

Upward Certification Enforcement

Make all specialists and management accountable for the certification process Ensure each process re-evaluated each time the certification forms are required Have evaluation process audited and checked Maintain audit trail of check lists and certifications

SARBANES OXLEY

CORPORATE CERTIFICATION OF FINANCIAL STATEMENTS End of Presentation

Copyright 2002 Easytec Solutions

You might also like

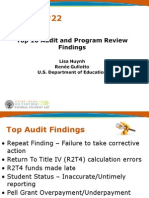

- 22 Top 10 Auditand Program Review Findings V1Document65 pages22 Top 10 Auditand Program Review Findings V1spicychaituNo ratings yet

- SA - Resume - SAP GRC Consultant - 10 - 2015Document3 pagesSA - Resume - SAP GRC Consultant - 10 - 2015spicychaituNo ratings yet

- Internal Control Presentation March 2010Document34 pagesInternal Control Presentation March 2010spicychaituNo ratings yet

- SAP GRC Process Controls Capabilities Overview - PWCDocument4 pagesSAP GRC Process Controls Capabilities Overview - PWCsakethram_gNo ratings yet

- A Technical PerspectiveDocument10 pagesA Technical PerspectivespicychaituNo ratings yet

- Consideration of Internal Control in An Information Technology EnvironmentDocument30 pagesConsideration of Internal Control in An Information Technology EnvironmentspicychaituNo ratings yet

- IIIB RICE Digital Audit ProgramsFromAuditNetDocument100 pagesIIIB RICE Digital Audit ProgramsFromAuditNetspicychaitu0% (1)

- Ensure Effective Controls and Ongoing ComplianceDocument17 pagesEnsure Effective Controls and Ongoing CompliancespicychaituNo ratings yet

- Audit Manual SAP R-3 PDFDocument353 pagesAudit Manual SAP R-3 PDFMönycka Delc100% (1)

- IA SAP Security Meeting Agenda VF 20151104 - PresentationDocument29 pagesIA SAP Security Meeting Agenda VF 20151104 - PresentationspicychaituNo ratings yet

- SAP Security FrameworkDocument36 pagesSAP Security Frameworkwdusif2No ratings yet

- Lu en Effective-Risk-Management 25112014Document8 pagesLu en Effective-Risk-Management 25112014spicychaituNo ratings yet

- WP Esso enDocument13 pagesWP Esso enspicychaituNo ratings yet

- RtegvDocument1 pageRtegvspicychaituNo ratings yet

- HOW-To SNC SinglePSE Abap JavaDocument13 pagesHOW-To SNC SinglePSE Abap JavaspicychaituNo ratings yet

- Easiest Linux Guide EverDocument162 pagesEasiest Linux Guide EverAlonso Godinez SalazarNo ratings yet

- Preparation: Snc/identity/as P:CN IDS, OU IT, O CSW, C DEDocument8 pagesPreparation: Snc/identity/as P:CN IDS, OU IT, O CSW, C DEspicychaituNo ratings yet

- SuccessionPlanning VSN30 SP3 Admin en PDFDocument214 pagesSuccessionPlanning VSN30 SP3 Admin en PDFspicychaitu100% (1)

- Asus33 320 040 - 46502Feb25Feb2613SL75aDocument1 pageAsus33 320 040 - 46502Feb25Feb2613SL75aspicychaituNo ratings yet

- PATTLNK 5312007 159 Rebranded Arbitration Demand Form 5 23 07 PDFDocument2 pagesPATTLNK 5312007 159 Rebranded Arbitration Demand Form 5 23 07 PDFspicychaituNo ratings yet

- Topoverhaul SparesDocument1 pageTopoverhaul SparesspicychaituNo ratings yet

- Sap DownloadsDocument33 pagesSap DownloadsspicychaituNo ratings yet

- Asus33 320 040 - 46502Feb25Feb2613SL75aDocument1 pageAsus33 320 040 - 46502Feb25Feb2613SL75aspicychaituNo ratings yet

- WP Esso enDocument13 pagesWP Esso enspicychaituNo ratings yet

- Asus33 320 040 - 46502Feb25Feb2613SL75aDocument1 pageAsus33 320 040 - 46502Feb25Feb2613SL75aspicychaituNo ratings yet

- Benefits - Aramco Services CompanyDocument2 pagesBenefits - Aramco Services CompanyspicychaituNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tax Saving Schemes: in Partial Fulfilment of The Requirements For The Award of The Degree inDocument8 pagesTax Saving Schemes: in Partial Fulfilment of The Requirements For The Award of The Degree inMOHAMMED KHAYYUMNo ratings yet

- A Study On Perception of Internal AuditDocument12 pagesA Study On Perception of Internal AuditInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- MU1 Module 1 Powerpoint HandoutDocument2 pagesMU1 Module 1 Powerpoint HandoutCGASTUFFNo ratings yet

- 11b Reactions of Individuals To Financial Reporting An Examination of Behavioural Research 151202130557 Lva1 App6892 PDFDocument23 pages11b Reactions of Individuals To Financial Reporting An Examination of Behavioural Research 151202130557 Lva1 App6892 PDFpaulo henriqueNo ratings yet

- Index Internal Auditor 2004 - 2016Document222 pagesIndex Internal Auditor 2004 - 2016pembazak100% (1)

- Performance ManagementDocument19 pagesPerformance ManagementSigei Leonard100% (1)

- Participant Material 8.2.4.2A: Cash Receipts Controls Form SE CR Control 4Document8 pagesParticipant Material 8.2.4.2A: Cash Receipts Controls Form SE CR Control 4Haley TranNo ratings yet

- Contemporary Auditing 11th Edition Knapp Solutions ManualDocument25 pagesContemporary Auditing 11th Edition Knapp Solutions ManualMichaelWilliamscnot100% (56)

- Bill DeBurgerDocument4 pagesBill DeBurgerTatag Adi Sasono50% (2)

- Karnataka Bank 5326520315Document101 pagesKarnataka Bank 5326520315eepNo ratings yet

- Guideline On Agent Banking-Cbk PG 15Document45 pagesGuideline On Agent Banking-Cbk PG 15Jacobias100% (1)

- Pillar3 ENGDocument133 pagesPillar3 ENGInternal AuditNo ratings yet

- Pronto Plant Maintenance V700 PDFDocument155 pagesPronto Plant Maintenance V700 PDFRonald Chandhla100% (3)

- CAG DPC MCQsDocument8 pagesCAG DPC MCQsserekant gupta100% (1)

- AR SMART 2004 Section 2Document120 pagesAR SMART 2004 Section 2Madin PutriNo ratings yet

- Bulacan State University College of Architecture and Fine ArtsDocument9 pagesBulacan State University College of Architecture and Fine Artsvincent villanuevaNo ratings yet

- Corporate Office, Plot No-5, Sector-32, Institutional Area, GurugramDocument39 pagesCorporate Office, Plot No-5, Sector-32, Institutional Area, GurugramManoj GoyalNo ratings yet

- Legal Defense Fund GuidelinesDocument6 pagesLegal Defense Fund GuidelinesIsaias S. Pastrana Jr.No ratings yet

- China Furniture Revised Profile PDFDocument25 pagesChina Furniture Revised Profile PDFGkou DojkuNo ratings yet

- Master in Accounting and Finance CurriculumDocument8 pagesMaster in Accounting and Finance CurriculumJM KoffiNo ratings yet

- Budgetary Cycle in IndiaDocument4 pagesBudgetary Cycle in Indiasarayupedada1210No ratings yet

- ACCT115Document8 pagesACCT115LEXINE LOUISE NUBLANo ratings yet

- IAASB Agenda Item 5 A.1 Going Concern Question 1aDocument43 pagesIAASB Agenda Item 5 A.1 Going Concern Question 1aVanesa SyNo ratings yet

- Form No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GDocument10 pagesForm No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GsamaadhuNo ratings yet

- 17-Special Audit Points For Cement FactoryDocument2 pages17-Special Audit Points For Cement FactoryRaima Doll100% (2)

- PepsiCo Changchun JV Capital AnalysisDocument2 pagesPepsiCo Changchun JV Capital AnalysisLeung Hiu Yeung50% (2)

- Marichu Gonzales: Work ExperienceDocument2 pagesMarichu Gonzales: Work ExperienceMich NavorNo ratings yet

- ch14 SM RankinDocument18 pagesch14 SM Rankinhasan jabrNo ratings yet

- gROUP7 - BOSH REPORTT FinalDocument6 pagesgROUP7 - BOSH REPORTT FinalCarlo EguieronNo ratings yet

- NestleDocument150 pagesNestleMenahil MalikNo ratings yet