Professional Documents

Culture Documents

Basel I, II, III Sec K

Uploaded by

wal_lovinglifeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basel I, II, III Sec K

Uploaded by

wal_lovinglifeCopyright:

Available Formats

BASEL

I, II, III

BASEL

A set of international banking regulations put

forth by the Basel Committee on Bank

Supervision, which set out the minimum

capital requirements of financial institutions

with the goal of minimizing credit risk.

Basle concordat

Basle agreement was originated by a committee

of central bank members of the bank for

international settlement (BIS) in 1975 and since

then amended.

The major amendments were done in 1983; the

agreement stipulates standards and guidelines

for international banking supervision.

The amendments also provide guidelines for

supervision for both domestic and cross-border

banking; a system of loan classification and a

system of provisions of bad loans.

Basle Capital Accord

Basle capital accord of 1988 and its amendments

provide internationally acceptable standards for

capital adequacy of banking institutions and

stipulates constituent elements of banks core

and supplementary capital, providing a uniform

standard for banks concerning their financial

evaluation, performance and reporting.

These capital adequacy standards are being

widely adopted by many countries, including

Pakistan. (see capital adequacy; capital, core,

supplementary)

Calculation of Capital

Tier One Capital

the ordinary share capital (or equity) of the

bank; and

audited revenue reserves e.g.. retained

earnings; less

current year's losses;

future tax benefits; and

intangible assets, e.g. goodwill.

Calculation of Capital

Upper Tier Two Capital

Un-audited retained earnings;

revaluation reserves;

general provisions for bad debts;

perpetual cumulative preference shares (i.e.

preference shares with no maturity date whose

dividends accrue for future payment even if the

bank's financial condition does not support

immediate payment);

perpetual subordinated debt (i.e. debt with no

maturity date which ranks in priority behind all

creditors except shareholders).

Calculation of Capital

Lower Tier Two Capital

Subordinated debt with a term of at least 5

years;

Sedeemable preference shares which may not

be redeemed for at least 5 years.

Capital Adequacy

Capital Adequacy: for a bank, adequacy is the

sufficiency of capital of a bank to sustain its

lending operations and other activities; in

particular, sufficiency of capital of a bank as

determined by central bank or supervisory

authority to meet its obligation as they fall

due, and to meet its loan losses as they arise,

or to absorb unexpected trading losses from a

banks asset portfolio and its off-balance sheet

commitments.

Capital adequacy for banks is measured in

terms of the ratio of banks capital.

Capital Adequacy Ratio

CAR is calculated as the sum of tier 1 and tier

2 capital divided by the sum of risk weighted

assets in the balance sheet and credit

equivalents of off- balance sheet assets.

BASEL I

The first accord was the Basel I. It was issued in 1988 and focused

mainly on credit risk by creating a bank asset classification system. This

classification system grouped a bank's assets into five risk categories:

0% - cash, central bank and government debt and any OECD

government debt

20% - development bank debt, OECD bank debt, non-OECD bank debt

(under one year maturity) and non-OECD public sector debt

50% - residential mortgages

100% - private sector/corporate debt (maturity over a year), real

estate, plant and equipment, capital instruments issued at other banks

Banks with international presence are required to hold capital equal to 8

% of the risk-weighted assets.

Member Countries

Since 1988, this framework has been

progressively introduced in member countries

of G10, currently comprising 13 countries, na

mely;

Belgium, Canada, France,Germany, Italy, Japan

, Luxembourg, Netherlands, Spain, Sweden, S

witzerland, UK and USA.

Basel II

The purpose of Basel II, which was initially

published in June 2004, is to create an

international standard that banking regulators

can use when creating regulations about how

much capital banks need to put aside to guard

against the types of financial and operational

risks banks face.

Basel II

In practice, Basel II attempts to set up rigorous

risk and capital management requirements

designed to ensure that a bank holds capital

reserves appropriate to the risk the bank

exposes itself to through its lending and

investment practices.

Generally speaking, these rules mean that

the greater risk to which the bank is exposed,

the greater the amount of capital the bank needs

to hold to safeguard its solvency and overall

economic stability.

Basel I to Basel II

New credit risk approaches

o Market risk - unchanged

o Add operational risk portion

3 Pillars

1) Minimum capital requirements

2) Supervisory review

3) Market discipline

The Basel II Framework

Pillar 1:

Minimum capital

requirements

Pillar 2:

Supervisory

review

Pillar 3:

Market

discipline

A guiding

principle

for banking

supervision

Credit Risk

Market Risk

Operational Risk

Disclosure

requirements

Pillar 1: Minimum Capital

Requirements

The calculation of regulatory minimum capital

requirements:

% 8

assets weighted - risk Total

capital of amount the

>

The Capital and Assets

Definition of capital:

Tier 1 capital + Tier 2 capital (with some

adjustments)

Total risk-weighted assets are determined by:

Risk weighted assets of credit risk

plus

12.5* capital requirement for market risk

plus

12.5* capital requirement for operational risk

Minimum Capital Adequacy Ratios

Tier one capital to total risk weighted credit

exposures to be not less than 4 %;

Total capital (i.e. tier one plus tier two less

certain deductions) to total risk weighted

credit exposures to be not less than 8%

Credit Risk

Standardized Approach

IRB Approach

Credit Risk -

Standardized Approach

In determining the risk weights in the

standardized approach, banks may use

assessments by external credit assessment

institutions.

( )

Assets of Valus Book Assets for t Risk Weigh

Risk Weight for Assets

Credit

Assessment

Claims on sovereigns

Claims on banks and securities firms

Claims on

corporates

ECA risk

scores

Risk

Weight

Credit

assessment of

Sovereign

Credit assessment of Banks

Risk weight

Risk weight

for short-

term

AAA to AA-

1

0%

20%

20%

20%

20%

A+ to A-

2

20%

50%

50%

20%

50%

BBB+ to BBB-

3

50%

100%

50%

20%

100%

BB+ to BB-

4~6

100%

100%

100%

50%

100%

B+ to B-

4~6

100%

100%

100%

50%

150%

Below B-

7

150%

150%

150%

150%

150%

Unrated

-

100%

100%

50%

20%

100%

Credit Risk - IRB Approach

In the internal ratings-based (IRB) approach,

its based on banks internal assessment.

The approach combines the quantitative

inputs provides by banks and formula

specified by the Committee.

Credit Risk - IRB Approach

Four quantitative inputs (risk components):

Probability of default (PD)

Loss given default (LGD)

Exposure at default (EAD)

Maturity (M)

Use formula of the Committee to calculate the

minimum requirements.

Credit Risk - IRB Approach

Data Input

Foundation IRB

Advanced IRB

Probability of default

(PD)

From banks

From banks

Loss given default

(LGD)

Set by the Committee

From banks

Exposure at default

(EAD)

Set by the Committee

From banks

Maturity (M)

Set by the Committee or

from banks

From banks

Market Risk

Standardised method

- the standards of the Committee

Internal models

- use banks internal assessments

Operational Risk

The risk of losses results from inadequate or

failed internal processes, people and system,

or external events.

Basic Indicator Approach

Standardised Approach

Advanced Measurement Approaches(AMA)

Operational Risk -

Basic Indicator Approach

GI = average annual gross income(three years,

excepted the negative amounts)

= 15%

o =GI KBIA

Operational Risk -

Standardised Approach

GI

1-8

= average annual gross income from

business line from one to eight (three years,

excepted the negative amounts)

= A fixed percentage set by the Committee

( )

8 1 = | 8 1 GI KTSA

Beta of Business Lines

Business Lines

Beta Factors

Corporate finance (1)

18%

Trading and sales (2)

18%

Retail banking (3)

12%

Commercial banking (4)

15%

Payment and settlement (5)

18%

Agency services (6)

15%

Asset management (7)

12%

Retail brokerage (8)

12%

Operational Risk - Advanced

Measurement Approaches

Under the AMA, the regulatory capital

requirement will equal the risk measure

generated by the banks internal operational

risk measurement system using the

quantitative and qualitative criteria for the

AMA.

Use of the AMA is subject to supervisory

approval.

Pillar 2: Supervisory Review

Principle 1: Banks should have a process for

assessing and maintaining their overall capital

adequacy.

Principle 2: Supervisors should review and

evaluate banks internal capital adequacy

assessments and strategies.

Supervisory Review

Principle 3: Supervisors should expect banks

to operate above the minimum regulatory

capital ratios.

Principle 4: Supervisors should intervene at an

early stage to prevent capital from falling

below the minimum levels.

Pillar 3: Market Discipline

The purpose of pillar three is to complement

the pillar one and pillar two.

Develop a set of disclosure requirements to

allow market participants to assess

information about a banks risk profile and

level of capitalization.

Basel III

BIS began referring to this new international regulatory framework

for banks as "Basel III in September 2010. The draft Basel III

regulations include:

"tighter definitions of Tier 1 capital; banks must hold 4.5%

by January 2015, then a further 2.5%, totalling 7%.

the introduction of a leverage ratio,- (Put a floor under the build-up

of leverage in the banking sector)

Promote more forward looking provisions;

a framework for counter-cyclical capital buffers,

and short and medium-term quantitative liquidity ratios.(is

introducing a global minimum liquidity standard for internationally active banks )

What is procyclicality?

In particular, the financial regulations of

the Basel II Accord have been criticized for

their possible procyclicality.

The accord requires banks to increase

their capital ratios when they face greater

risks. Unfortunately, this may require them to

lend less during a recession or a credit crunch,

which could aggravate the downturn.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Documents Required for Housing Loan TakeoverDocument1 pageDocuments Required for Housing Loan TakeoverRathinder RathiNo ratings yet

- Buying A HouseDocument4 pagesBuying A Houseapi-325824593No ratings yet

- Debt InstrumentsDocument5 pagesDebt InstrumentsŚáńtőśh MőkáśhíNo ratings yet

- APC311 CompletedDocument7 pagesAPC311 CompletedShahrukh Abdul GhaffarNo ratings yet

- Practice Problems - Audit of InvestmentsDocument10 pagesPractice Problems - Audit of InvestmentsAnthoni BacaniNo ratings yet

- Safe Shop Plan - 2022 JuneDocument40 pagesSafe Shop Plan - 2022 Juneshinu pokemon masterNo ratings yet

- Project Report On Mutual Fund Schemes of SBIDocument43 pagesProject Report On Mutual Fund Schemes of SBIRonak Jain100% (2)

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahNo ratings yet

- PDF Internship Report LcwuDocument125 pagesPDF Internship Report LcwuKashif IftikharNo ratings yet

- 2022 Thorwallet Pitch Deck V4Document19 pages2022 Thorwallet Pitch Deck V4Guillaume VingtcentNo ratings yet

- Toa Valix Vol 1Document451 pagesToa Valix Vol 1Joseph Andrei BunadoNo ratings yet

- SHARMODocument4 pagesSHARMOSHARATHNo ratings yet

- Derivatives: Forward ContractsDocument4 pagesDerivatives: Forward ContractsSAITEJA DASARINo ratings yet

- Is Gold A Safe Haven International EvidenceDocument38 pagesIs Gold A Safe Haven International EvidenceLuckade PoonnalimpakulNo ratings yet

- ICICI Financial StatementsDocument9 pagesICICI Financial StatementsNandini JhaNo ratings yet

- Plagiarism Scan Report: Date Words CharactersDocument2 pagesPlagiarism Scan Report: Date Words CharactersSaiyam ShahNo ratings yet

- Solution - Problems and Solutions Chap 10Document6 pagesSolution - Problems and Solutions Chap 10سارة الهاشميNo ratings yet

- FIN B488F - 2022 Autumn - Exam Formula Booklet - SVDocument7 pagesFIN B488F - 2022 Autumn - Exam Formula Booklet - SVNile SethNo ratings yet

- Financial Market and Services Bba 2 Notes 1Document18 pagesFinancial Market and Services Bba 2 Notes 1Sneha AroraNo ratings yet

- 03 Arbitrage and Financial Decision MakingDocument35 pages03 Arbitrage and Financial Decision MakingWesNo ratings yet

- DCF Analysis Coba2Document6 pagesDCF Analysis Coba2Main SahamNo ratings yet

- Front Office Cash Checkout and SettlementDocument21 pagesFront Office Cash Checkout and Settlementpranith100% (1)

- Free Cash FlowDocument6 pagesFree Cash FlowAnh KietNo ratings yet

- USAA HackingDocument6 pagesUSAA Hackingayina100% (1)

- MC single correct item template optionsDocument15 pagesMC single correct item template optionsRohit ChellaniNo ratings yet

- Generate Cashbook Public ReportDocument1 pageGenerate Cashbook Public Reportdr.rahul0210No ratings yet

- Meezan Bank - Report 2Document87 pagesMeezan Bank - Report 2SaadatNo ratings yet

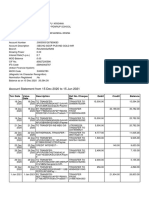

- Account statement for Mr. SAVARAPU KRISHNA from Dec 2020 to Jun 2021Document9 pagesAccount statement for Mr. SAVARAPU KRISHNA from Dec 2020 to Jun 2021SRINIVASARAO JONNALANo ratings yet

- FIN 6060 Module 2 WorksheetDocument2 pagesFIN 6060 Module 2 WorksheetemoshokemehgraceNo ratings yet

- HBL Financial AnalysisDocument27 pagesHBL Financial AnalysisRabab Ali0% (1)