Professional Documents

Culture Documents

University of Nebraska-Lincoln College of Business Administration

Uploaded by

ridwan irawanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

University of Nebraska-Lincoln College of Business Administration

Uploaded by

ridwan irawanCopyright:

Available Formats

University of Nebraska-Lincoln College of Business Administration

Systematic Risk Behavior of Financially Distressed Firms Author(s): Richard W. McEnally and Rebecca B. Todd Reviewed work(s): Source: Quarterly Journal of Business and Economics, Vol. 32, No. 3 (Summer, 1993), pp. 3-19 Published by: University of Nebraska-Lincoln College of Business Administration Stable URL: http://www.jstor.org/stable/40473088 . Accessed: 13/04/2012 04:47

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at . http://www.jstor.org/page/info/about/policies/terms.jsp JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

University of Nebraska-Lincoln College of Business Administration is collaborating with JSTOR to digitize, preserve and extend access to Quarterly Journal of Business and Economics.

http://www.jstor.org

Risk Behavior Systematic of FinanciallyDistressedFirms

Richard W. McEnally Carolina- ChapelHill University North of Rebecca B. Todd New YorkUniversity

declinein systematic beta riskwith onsetoffinancialdistress a or the is The apparent This studyvalidatesthis resultwith resultthathas puzzled a number researchers. of data and a new criterion identifying different for financial distress.An analytical modelpresentedin thisstudy suggeststhatthe leverage-increasing impactoffinancial distress- systematic maybe morethanoutweighed possible declines in on risk by and itprovidesempiricalevisystematic earningsriskassociatedwithsuch distress, dence that is generally consistent with this proposition. The diminutionof risk in the by including systematic is unaffected severalvariants beta riskestimation, Whilenumerically schemeand allowancefor the turn-of-year index-weighing effect. riskdecline is not highlysignificant a statistical in large, the average systematic sense due to considerablevariationin the behaviorof betasfromcompanyto company.

This paperinvestigates behavior thesystematic of financially the of risk distressed firms. Conventional wisdomsuggests thesystematic of suchcompanies that risk should in becauseof increases leverage associatedwithfinancial distress. increase, presumably that risk shows,however, changesin systematic also dependon changesin the Analysis covariances a distressed firm's with earnings theaggregate of the of market. This earnings find that risk with onsetoffinancial the the distress, study systematic declines confirming of results a number prior of studies. This conclusion insensitive severalalternative is to forms systematic estimation. empirical of risk The also thatthis investigation suggests declineis consistent decreasesin systematic with risk earnings associatedwithfinancial distress. firm one forwhichthepossibility This paperdefines financially a distressed as of and elimination existing of is shareholder interests viewedin themarbankruptcy partial as This of distress not is ketplace significant. ex ante,probabilistic conception financial intoan objective for firms. rulesout translated criterion identifying distressed It readily for whichriskexcluding suchas filing involuntary manyex post criteria, reorganization, firms market the at but wereable to overmayhaveviewedas distressed sometime that cometheir difficulties. The ex ante approachin thisstudy utilizesa sampleof NYSE-listedfirms whose bondratings werereduced Caa ora lower to from higher a grade by rating Moody's some-

INTRODUCTION

3 0747-5535/93/1400-0003$01.00 University Nebraska-Lincoln of

OF QUARTERLY JOURNAL BUSINESS AND ECONOMICS

1982.1 Although this is not an obvious selection time in the period 1972 through it is shownto identify groupof firms market a viewedas experiencing the criterion, financial thebehavior thefirms' of distress before rating the sysdowngrade. Accordingly, of tematic risksis examined thererating as For is approached. a subsample these point firms continued be listedon theNYSE following rerating, is also possible that the it to risk becameavailablein to examinethebehavior thesystematic after information of this themarketplace. rearisk for The behavior distressed of firms' systematic is significant at leastthree in forfirms financial sons.First, bearsuponthebehavior thecostof equity it of capital distress. to model(CAPM) and mostof its variants, According thecapitalassetpricing of is function itssystematic therequired return equity on a capitalfor firm an increasing If do riskonly;nonsystematic is notrelevant. financially distressed firms experience risk in in an a reduction systematic and themarket risk accordsthem improvement theterms such firms in effect, market supplying is the on whichequitycapitalis supplied, then, with boostin overcoming a financial difficulty. is distress nonsystematic thattheriskassociatedwithfinancial Second,thenotion in an underlies investment and henceunimportant well-diversified implicitly portfolios in that companies.2 strategy has becomepopular: consciously investing troubled in of risk the as morefully thenextsection, behavior thesystematic Third, discussed of has offinancially distressed companies evidential bearing uponthequestion theroleof in risk rate-making process. systematic considerations theutility rate In an earlypaperconcerned of with application theCAPM to utility regulathe to returns shareholders tion, Brighamand Crum (1977) argue thatlow investment beta coefficients tendto bias estimated occasionedby adversebusinessdevelopments declinesin the In downward.3 support, citesomecasualevidence apparent regarding they and NationalBank,PennCentral, twoREITs of Franklin beta coefficients W.T. Grant,

Such issues maybe in default, 'Moody's statesthat"Bonds whichare ratedCaa are of poorstanding. Withrespectto bonds to or of or theremay be present elements dangerwithrespect principal interest." of lack characteristics ratedB, the nexthighest category, theystate"Bonds whichare ratedB generally of of or Assurance interest principal of and desirableinvestment. payments of maintenance otherterms the is characteristic the the the contract over any long runperiodmaybe small." Apparently differentiating presenceof elementsof danger,as in practiceMoody's appears to assign the ratingof D to bonds in default. in thatinvesting companiesoperating ^See the Wall StreetJournal(January 1983) to the effect 4, returns. Fortune(June25, 1984) investment underChapter11 bankruptcy mayoffer superior proceedings two mutualfundsexplicitlydesigned to exploit it: Merrill also discusses this strategy and identifies and HeineSecurities' MutualShares. Lynch'sPhoenixfund 's betasof the24 Moody utilities only ^Brighamand Crum(1977) observethattheaverageestimated rose from0.74 in the latter1960s to 0.75 in the 1971-1975 period while the beta of AT&T declined utilities were experiencing between two periods.They arguethat, lightof a wholehostof problems the in overthisperiod.They to for diminished in theseyears, is unlikely required it the returns equity thesefirms assertinsteadthatit is more probablethatthe betas were underestimated. They state that"It simply wouldreallythink thathe was reducinghis portfolio's thata portfolio manager bogglesthe mindto think their calculatedbetas even though their troubles becomeapparent, had riskif he added a REIT stockafter had fallen."

SELECTED PRIOR RESEARCH

SUMMER 1993, VOLUME 32, NUMBER 3

5_

the financial distress. wereexperiencing around timethey the Theyconcludethat use of in cases. is returns inappropriaterate-making estimates required of C APM-based Hamada (1972), Rubenstein (1973), Galai and Masulis (1976), Kim (1978), and in of risk the Dejong and Collins(1985) investigate systematic behavior firms theconthat evidencesuggests claimsmodels.This analytical textof theCAPM and contingent withincreasing risk shouldincrease thesystematic of a firm leverage.Some empirical is for proposition provided HamadaandDejongandCollins. by support this It firms. is reasondistressed with None ofthese papersdeals specifically financially to woulddeclinerelative thevalue that able toanticipate, however, thevalueof theequity of the of thedebtforsuch firms, and, as a consequence, proportion debtin thefirms' effect leverageon of wouldincrease. market value capitalstructures Thus,thepositive firms. distressed risk systematic wouldseemtoapplytofinancially and a On theother Jones, Swary studies, Aharony, hand, seriesofprior by empirical the and and (1981),andBaldwin Mason(1983) examine system(1980),4Alunan Brenner firms findthatthebetasof such firms and distressed atic riskof financially appear to risk the eventhough unsystematic and total financial condition declinewith deteriorating are to The riskare increasing. findings attributed (unidentified) variables, confounding result This empirical the of thebetastoward mean,or estimation problems. regression and risk puzzledmostinvestigators, no plausible has with to declining systematic respect has explanation beenvalidated.5

THE THEORETICAL RELATIONSHIP BETWEEN FINANCIAL DISTRESS AND SYSTEMATIC RISK

in securities thepresence risk relates No fully systematic of equity theory developed It is possibleto idenbusiness of risk of default to dimensions theunderlying enterprise. of witha variation a modelproposedby some of theissues in thisarea,however, tify Bowman (1979). that Blackand Scholes(1973) andGalai andMasulis(1976) have shown analytically is: with of securities a company oftheequity thebetarisk debt, Bsm, risky (1) Bs,m=[(8S/S)/(8Vf/Vf)]Bf,m where: to of / S, stock, withrespect [(S/S) (Vf/Vf)] = The elasticity thevalueof thefirm's and market itstotal value,Vf;

Altman wentbankrupt. thatsubsequently ^Aharonyet al. examinethebetasfora sampleof 45 firms firmsusing the Z-score model. Baldwin and Mason's a and Brenneridentify sample of 92 distressed of analysisis based upon a case study MasseyFerguson. ^The Altmanand Brenner(1981) studyappears to be the most recentlooking directlyat the A distressed firms. recent risk paperby Kaplan and Stein (1990) findswhatthe systematic of financially small" increasesin equityrisk forfirmsundergoing authorsdescribeas "surprisingly public leveraged of to attribute the new debt bearinga substantial a component the recapitalizations, resultthese authors and risk.At one timethe literature firms'systematic restructurings othercorporate examining underlying eventsoccasionallyconsidered risk;see, forexample,Mandelker systematic changesin pre-and postevent to and werefound be erratic, to have marginal impacton results. (1974). Such riskshifts generally

OF QUARTERLY JOURNAL BUSINESS AND ECONOMICS

to as risk Bf,m = The systematic forthefirm a wholewithrespect the market. can as: Thisrelationship be rewritten (la) = Bg,m (8S/6Vf)(Vf/S)(Bf,J

D valueoftheoutstanding as: debt, or,becauseVf= S + D, where is themarket db) = Bs,m (5S/8Vf)(l + (D/S))(Bf)m)

of to In equation factor theright a measure theextent which on is (lb) thefirst equity in thevalue of thefirm. Bowmanobserves, thisfactor is As interests sharein changes free. debtis default- The secfrom above by 1.0 and is 1.0 onlywhenthefirm's bounded than1.0, and it conveysthe ond factor thefirm's is leverageratio, equal to or greater Galai of function firm that betais a positive commonobservation6 theequity leverage.7 of which of twofactors, andMasulisprovethat product these the equals theelasticity the in market value(theexpression brackets with to valueofthefirm's respect itstotal equity is that a in equation than1.0. Theyalso establish result be (1)), must equal to or greater of that for distress relevant thefinancial namely, thederivative thiselasticity question: be 0. to must less than Thatis, ceteris with paribus,as the respect thevalue of thefirm of firm in valueterms, responsiveness changesin equity the (smaller) market getslarger in valuedecreases market valuerelative changes thefirm's to (increases). Bowmanhas shown that: (Vm/Vf)Cov(Xf,Xm)] n. n (2) Bfm" Vai

n, l2a) where:

- (Vm/Vf)Std(Xf)p(Xf,Xm) StoKXm)

Vm = Totalvalueofall firms; of and of respectively; XfandXm = Economic earnings thefirm aggregate firms, Cov(Xf, Xm) = Covariances;

and deviation; Std(Xf) = Standard

"This is as showninitially Hamada (1972). by 7See theexchange between Kim (1978) and Bowman(1979).

SUMMER 1993, VOLUME 32, NUMBER 3

7_

coefficients. Xm) = Correlation p(Xf, 0. with to is than1.0,and itsderivative respect Vfis less than The factor (Vm/Vf) greater into (1) (2a) equation gives: Substituting equation ^ R Std(Xf)p(Xf,Xm) [(8S/S)/(SVf/Vf)] (Vm/Vf)

due to decrease Its valueshould distressed. total becomesfinancially Now,supposea firm and costsof bankruptcy as and costsof negotiations reorganization well as theexpected as does the on Xf.The elasticity, a (8S/S)/(8Vf increases, /Vf), possibly lowerexpectation in of raisestheproduct thesefacratio(Vm/Vf). Thus,thedecrease valueunambiguously be less thanprior risk torsand hence thesystematic of theequity.These effects may researchers by may have assumed,and theymay be morethanoffset changesin the of in of elements thenumerator equation(3), thesystematic component the remaining firm's earnings. as: (3) Equation can be written (SS/8Vf)(Vm/S)Std(Xf)p(Xf,Xm) n , VV os,mStd(Xm) in ratio(Vm/S) equation(3a) reathe In thepresence financial distress valuation of as be sonablymight expectedto increaseby severalmultiples thevalue of theequity ratio the On hand, equity is, declines;that itmaydoubleor triple.8 theother participation in thetotalvalueof the share which measures (8S/8Vf), equity's proportionate ofchanges ratio This firm, participation is akinto a call option's maydecreasesubstantially. equity stock'sprice.A to of delta,thederivative theoption'svaluewith respect theunderlying in to movesfrom themoney outof themoney. as call option'sdeltadecreases theoption in are Underthecommon conceptualization whichequityinterests viewedas holdinga the assetswritten thefirm's call on thefirm's bondholders, equityoptionof finanby and firms apt tobe deep outof themoney have a smalldelta.Thatis, is ciallydistressed thanto sharein rather accrueto bondholders mostof thechanges thevalueof suchfirms holders. Recent indirectevidence suggests thata decline in this delta or equity it or ratio Therefore, is possiblethat participation by 70 percent moreis notunrealistic.9

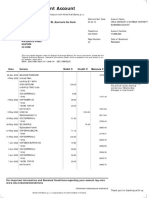

mean excess return the sample of distressedfirms for As is shown in Figure 1, the cumulative 36 examinedin thisstudyaveragesaroundzero untilapproximately months priorto the bond downrating; it over the next36 months declinesto about -0.6. This lattervalue impliesan increasein the valuation ratioof 2.5. ^Kaplan and Stein (1990) look at the implicitbetas of debt issued in conjunctionwith public which and leveragedrecapitalizations in theprocessexaminetheincreasein theequityriskof thesefirms, theiraverage equity beta goes small." Using several estimation methods, theyfindto be "surprisingly of in from1.02 to 1.47. At the same timethe averagefirm their sample increasedthe proportion senior to from 0.260 to 0.845, corresponding an increasein the leverageratio,the capitalin its capitalstructure thattherewas no change in the second termin equation(lb), from1.34 to 6.45. Underthe assumption in risk of the firms theirsample,thesechangesimplya decrease in the equityparticipation systematic decline. The decline in the equity termin equation(lb), from0.76 to 0.23, a 70 percent ratio,the first

OF QUARTERLY JOURNAL BUSINESS AND ECONOMICS

of and ratio changesin theproduct thevaluation equity participation mayriseonlyby a smallamount with onsetof financial the distress. The effect financial of distress the last two factors thenumerator, in on Std(Xf) be negative. Even ifthevariation thefirm's in economic stream may p(Xf,Xm), earnings as one might this effect couldbe morethan in offset a reduction increases, anticipate, by thecorrelation between earnings thefirm theaggregate firms. the of and of This correlationmaydropsubstantially becausethesurvival thefirm theleveland variation in of and itsearnings stream cometodepend moreon decisions managers, of customers, suppliers, and in that and creditors, bankruptcy judges matters arefirm-specificnature essentially unaffected economy-wide considerations.10 this does not Nevertheless, possibility by in literature thebehavior systematic on of risk appeartohavebeenconsidered theexisting in thepresence financial of distress. This paperexamines behavior thesetwoelethe of ments earnings explicitly. of risk

The samplefirms at leastone bondissue (including had convertible bonds)rerated from higher a to of the rating thegrade Caa orlowerbyMoody'sduring years1972-1982 and had common stocktraded theNew YorkStockExchangeforat least72 months on to The two severerecesprior thererating.11 period1972-1982 encompasses moderately thannormal of incidence financially sions,periodsthatwerecharacterized a higher by distressed firms. Unlikethecurrent occurrences financial of a of distress, sufficient period timehas passed to allow adequateex post data to be collectedon thesefirms. The 72 month criterion imposed insure is to risk The puradequatedataforsystematic analysis. criterion tominimize effects infrequent is the of on pose of thelisting trading systematic riskestimation. in firms metthesecriteria. Thirty-one Theyare identified Table 1 along withthe month theissueofMoody' BondRecordcontaining threshold of s the bondrerating, the laterof themonth first on listed theNYSE or 109 months years)prior thererating, to (9 and themonth listed theNYSE. last on The recognizable nameson thelistin Table 1 appearto meetthetestof beingwhat A reasonable wouldagree, leastinretrospect, financially at were distressed firms. persons moreobjectiveindication thesefirms that wereexperiencing financial distress that and thisfinancial distress was comprehended the marketplace provided Figure1. is by by

ratiois likelyto be even greater financially for distressed firms because of the lower chance participation of the implicit equitycall optionbeingexercised. ^Altman (1984) reviews number whathe call "indirect a of costs"of bankruptcy arguesthat and their is Most of theseappearidiosyncratic nature, in such as the cost of lost sales due to magnitude substantial. diminished customer confidence whichhe regards particularly as that It important. is interesting fourof the firms whose experience Alunandrawson to makehis pointabout lost sales appear in the sample of distressed firms in employed thispaper. **Of the31 bonds to in werererated Caa, five causingcompanies be included thesample,25 initially werererated Ca, and one wentintodefaulted status.By theend of the calendaryearin whichthe to (D) ten occurred, issues were in default;by the end of the followingyear,an additionalfive had rerating whileby thethird another issues defaulted. two defaulted; Thus, 17, or slightly year-end following rerating overhalf,of thecompanies thesamplehad defaulted their in on bondsafter to three two years.

SAMPLE SELECTION, DESCRIPTIVE CHARACTERISTICS, AND IMPLICATIONS FOR THE ESTIMATION OF SYSTEMATIC RISK

SUMMER 1993, VOLUME 32, NUMBER 3

9_

Table 1- Distressed Firm Sample

Name AM International AlliedSupermarkets American Industries Export ArlansDepartment Stores Braniff International Buttes Gas & Oil Cenco Chrysler ColumbiaPictures Industries Commonwealth Refining Oil Continental Lines Air Duplan FarahManufacturing Fedders Food Fair Grant (WT) International Harvester Interstate Stores Lionel Manville NationalHomes PennDixie Industries RevereCopper& Brass SeatrainUnes TexfiIndustries Trans World United Merchants Manufacturers & Western Unes Air WhiteMotor Wickes Companies World Airways Month Rerated 11/81 09/78 09/72 06/73 04/81 10/82 10/75 05/80 12/73 05/77 01/82 08/76 06/77 03/82 11/78 10/75 11/81 06/74 03/82 09/82 05/79 12/77 11/82 12/80 04/78 02/75 09/77 01/82 05/76 05/82 06/82 First Data Month 10/72 08/69 08/63 05/64 03/72 09/76 09/66 04/71 11/64 04/68 12/72 07/67 05/68 02/73 10/69 09/66 10/72 05/65 02/73 08/73 07/71 1 1/68 10/73 11/71 03/72 01/66 08/68 12/72 04/67 04/73 05/73 Last Data Month 03/82 10/78 09/73 04/73 04/82 11/85 06/82 12/85 05/82 10/77 09/82 07/76 12/85 12/83 09/78 08/75 12/85 04/74 02/82 12/85 12/85 03/80 12/85 01/81 12/85 12/85 12/85 12/85 08/80 04/82 12/85

Cumulative values of themeanexcess rateof return, out adjustedby differencing the CRSP value-weighted indexreturn from individual the securities' totalratesof monthly are for from months 108 of to return, presented a periodextending prior publication the to afterward. Thesedatareflect thesamplefirms which all for returns rerating 36 months wereavailablein each of these144 months. returns be thought can Thus,thecumulative ofas providing crude a indication theinvestment of returns a portfolio to constructed with in listedin a month to relative thedownrating, rebalanced equal investment all firms where problems the associated with of and monthly, foreknowledge thereratings thefact in that occurin different months calendar time notcontrolled. are they Until30 months before publication thererating cumulative the of the excess return of thisgroupof stocksis approximately Fromthispoint, zero. the however, cumulative excess returns decline by themonth thererating cumulative of the begina precipitous excess return to about-0.57, implying loss of value of 57 percent fell a relativeto an over thepreceding months. observation 72 This unmanaged portfolio provides justifica

K)

OF QUARTERLY JOURNAL BUSINESS AND ECONOMICS

Figure 1- Cumulative Mean Excess Returns and Mean Prices

-3 Period

Period -2

Period -1

+1 Period

aAV

^^^^ fV,* ^^'^

T 30.00 " 25.00

"20.00 Mean Price - 15.00

^^v^

0.1 ^<^

lo.oo

.-5.00

"02 " Cumulative Mean -03 Excess Return

V N*

-0.7 -108

. -96 -84 -72 -60 -48 -36 -24 -12 0 12 24 36

Rerating Month

tion for use of the reratingcriterionas well as for assuming that these companies' financial problems were evident to, or anticipatedby, the marketprior to the downrating.12 A similarimplicationis suggestedby themean actual ending monthly prices (thatis, in forstock splits and dividends) also portrayed Figure 1. In the period from unadjusted 108 to 99 monthsprior to the rerating mean price fluctuatesbetween approximately the $25 and $28, withno obvious trend.Aftermonth-99 it begins to decline, however, dropping approximately 50 percent by month -36, and on down to just over $5 by month zero. It seems likely thatmuch of thisdecline reflectsthe market'sreaction to the financially distressedconditionof these firms.Anotherimplicationof the low resultingprice level is thatthe stocks' return behaviormay be affected theturn-of-the-year January or by

Considerableliterature exists showingthe equitymarket appears to anticipated ratingchanges; see, e.g., Pinchesand Singleton(1978).

SUMMER 1993, VOLUME 32, NUMBER 3

11_

whichS tolland Whaley(1983) have shownis moreof a low pricestockeffect effect, will in risk of than smallfirm a effect. Therefore, estimation systematic an effort be made effects. tocope with possibleturn-of-the-year as timeinterare over for Beta coefficients each samplefirm estimated as many four -1 runsfrom month inclusive, month through -37 vals. The perioddesignated -2, period This periodencomthe thatMoody's reports rerating. wheremonth zero is themonth used of preceding publication thebonddownrating to passes thethree yearsimmediately the to back in timeone month accountforthefactthat selectthesamplefirms, moving in themonth As itspublication. indicated bondrerating occurred preceding presumably is of is the distress thesamplefirms the assumption that financial previously, operating -2 runsfrom or the months to -38, -73 this Period to evident themarket during period.13 Returns this to six during period years prior thedownrating. period approximately to three to theonsetof of risk are assumedto be representative thesystematic of thefirms prior in betasover For financial distress. mostfirms thesampleit is also possibleto estimate themonths -109 through and thiswas done to obtainsome idea of thesystematic -74, This periodwill be the a removedfrom rerating. riskbehaviorduring periodfurther betacoeffor it denoted period-3. Finally, 13 of thesamplefirms is possibleto estimate 1 the months through period+1. ficients thethree for 36, following downrating, years of of results estimates beta coefficients The first panel of Table 2 showssummary estimation overthese four equation: periods usingtheconventional (4) = + Ri>t ai +iRm,t ei>t

BEHAVIOR OF SYSTEMATIC RISK

where: Rit = Totalreturn securityin month and i of t;

return index. value the Rmt = Corresponding for CRSP value-weighted for of to The secondpanelshowstheresults a conventional approach controlling theturn of is oftheyeareffect. Heretheestimation theequation oftheform: (5) = +YiD + ei)t. Ritt a, +iRm,t

where: and withthevalueof unity whenmonth is January, zero t D = A dummy variable otherwise.

run had been delisted have a complete of data forthisperiod.Fourfirms ^Not all thesamplefirms the of weremissing finaltwo months on from had trading or -2; suspending theNYSE by month twofirms the of for returns thisperiod;and one was missing finalsevenmonths returns.

'2

JOURNAL BUSINESS OF ANDECONOMICS QUARTERLY

Table 2- Results of Beta Estimation

Number Firms of Entire Sample Firms Surviving Conventional Index Betas, ValueWeighted Entire Sample Mean Beta Standard Deviation MeanR^ Firms Surviving Mean Beta Standard Deviation MeanR2 Betas January Dummy Entire Sample Mean Beta Standard Deviation MeanR2 Firms Surviving Mean Beta Standard Deviation MeanR2 29 10 -2 31 13 Period 31 13 -hi 13 13

1.477* .730 .349 1.361* .532 .340

1.653* .604 .299 1.788* .696 .289

1.503* .589 .271 1.491* .455 .300

1.104 .734 .104 1.104 .734 .104

1.452* .763 .400 1.353* .487 .360

1.614* .625 .380 1.702* .748 .411

1.435* .614 .329 1.446* .539 .367

1.018 .726 .155 1.018 .726 .155

Conventional Index Betas, EquallyWeighted Entire Sample 1.274* Mean Beta Standard Deviation .697 .426 MeanR2 Firms Surviving Mean Beta Standard Deviation MeanR2 1.044 .418 .382

1.499* .496 .407 1.672* .561 .408

1.405* .670 .334 1.299* .378 .347

1.205* .524 .165 1.205* .524 .165

* Denotesvalue significantly different from 1.0 #All valuesofR2 areadjusted degrees freedom for of

in and absorb recurring to The dummy intended adjusttheintercept January thereby is any in month.14 in returns that that to return effect January is unrelated thelevelofmarket modelis reestimated withtheequally Finally,in thethird panel theconventional in is of CRSP index.The objective thisestimation to examinethesensitivity weighted in of to betacoefficient estimation indexchoice.Results theupper portion each panelof for dataare availableto makethebetaestiTable 2 arebased on all samplefirms which mates,and thisnumber changesfrom periodto period(exceptperiods-2 and -1). The the of the of lowerportion each panelreports results replicating analysisforonlythose

* The of the to only the estimate the utilizing January dummy modify analysisalso was conducted Such a modelassumesthatsystematic is different January risk in from beta coefficient, theintercept. not This estimation thatin othermonths. gives marginally poorerfitsthatthe modeldescribedin thetext.

SUMMER 1993, VOLUME 32, NUMBER 3

13_

13 firms had at least36 months post-downrating that of return on theCRSP NYSE data monthly tape. of the of of method, general Regardless theestimation pattern behavior themeanbeta in coefficients Table 2 is similar. The initial betasare substantially than1.0, a greater result found other researchers. result This that firms ultimately that by suggests experience financial distress likelyto have above averagelevels of debt and systematic are risk characterized highfinancial and/or earnings - simply put,firms by highoperating riskaremoreapttoexperience financial distress. betasuniformly The declinefrom period -2 to period-1 to period+1, representingconvergence unity. a on Betas estimated with theequallyweighted indexare notas largeinitially thoseestimated as withthevaluenor decline drastically. meanvaluesfor adjusted are as R2 The the index, do they weighted of theorder explanatory of encounters betaestimation this with of powerone customarily in but in type theearly periods, theexplanatory powerdeclines substantially period-1 and is with betasas wellas withtheincreasing period+1. Thisresult consistent thedeclining total return variation suchsecurities display. R2 the The meanadjusted for modelwith January R2 the exceedstheadjusted dummy for basicmodelbya considerable the that effect margin, suggesting theturn-of-the-year is with sample securities. introduction theJanuary this of The of reduces the present dummy in and results even morerapidregression towardthe mean. period-2 beta somewhat Resultsforthesurviving firms similar thosefortheentire are to sample.The period-2 betasappeartobe a bithigher these for securities for entire than the the sample;thus, rate ofregression their of betasis more than theoverall for rapid sample. 2 in evidence shifts theshapesofthebetafrequency on distributions. Figure provides In period-3 thedistribution approximately is normal. Period-2 displaysa substantial in shift theright thedistribution. period themeanremains In -1 to highwithpronounced skewness. a distribution for negative Finally, substantial changeoccursin thefrequency is with of +1; thebetadistributionflattened no obviouspoint central period tendency. Table 2 contains indication theresults testsof whether means of the an of of the in estimated coefficients thedistressed beta of firms eachperiod significantly are different from The teststatistic simply t-test thedifference themeanbetaand 1.0. in is a of unity. The pattern consistent. averagebetais alwayssignificantly is The than1.0 prior greater to thedownrating in forthesurviving firms period-3), eventhough converges it (except on unity withthepassageof time.Onlywiththeequallyweighted indexestimation are themeanbetassignificantly than thedownrating. greater unity following in Results a direct of shifts thesystematic of thedistressed of test risk firms proare videdin Table 3. Underlying tableis a conventional this in t-test thepaireddifferences of in theestimated coefficients various beta the where question whether mean is the periods, betacoefficient) significantly is less change(laterperiodbetacoefficientearlier period thanzero. The results again fairly are consistent acrossbeta estimation methodologies, butwith somewhat a in different risk message:noneof theshifts systematic fortheentire and of firms, sampleis statistically significant, forthesubsample surviving onlythesize of thedeclinesin thebetas from periodof 38 to 73 months the before(period -2) to after downrating the The immediately (period+1) is statistically significant. exception occurs with betasestimated the theequallyweighted the index;for surviving firms, using

OF QUARTERLY JOURNAL BUSINESS AND ECONOMICS

Figure 2- Beta Frequency Distributions

SUMMER 1993, VOLUME 32, NUMBER 3

15_

Table 3- Tests of Shifts in Betas of Distressed Firms (Later Beta - Earlier Beta)

Index Conventional Betas, ValueWeighted Entire Sample Shift Period-3 to Period-2 Period-2 to Period-1 Period-3 to Period-1 Period-3 to Period+1 Period-2 to Period+1 Period-1 to Period+1 Period-3 to Period-2 Period-2 to Period-1 Period-3 to Period-1 t-statistic 1.01 - 1.24 -.16 -.26 -3.49* -1.34 1.35 -1.39 .77

Firms Surviving

Betas January Dummy Entire Sample

Period-3 to Period-2 Period-2 to Period-1 Period-3 to Period-1 Period-3 to Period+1 Period-2 to Period+1 Period-1 to Period+1 Period-3 to Period-2 Period-2 to Period-1 Period-3 to Period-1

1.08 - 1.46 -.29 -.62 -3.17* -1.37 1.40 - 1.05 .26

Firms Surviving

Conventional Index Betas, EquallyWeighted Entire Sample

Period-3 to Period-2 Period-2 to Period-1 Period-3 to Period-1 Period-3 to Period+1 Period-2 to Period+1 Period-1 to Period+1 Period-3 to Period-2 Period-2 to Period-1 Period-3 to Period-1

1.42 -.67 1.02 1.19 -2.79* -.46 2.83* -2.16* 2.16*

Firms Surviving

* Denotes of that rejection nullhypothesis themeanchangesare equal to or less thanzero at the a = .05 level, one-sidedtest

from thebetasincrease significantly period-3 to periods-2 and -1, butdecreasesignifi-1 -2 from cantly period toperiods and+1.15 In sum,theseresults generally are consistent thoseof prior with studies. Neither the ex criterion several nor alternative to use of an explicit antesampleselection approaches risk conclusion betariskon average that changesthefundamental systematic estimation declineswith onsetof financial the distress. Thereis someimplication, that however, the of statistical significance thisshift maynotbe as greatas maybe supposedfrom prior

in of *^In view of the apparentnonnormality the beta distributions periods other than -3, a test in to Wilcoxonrank-sum of differences meansalso was employed examinetheseshifts. nonparametric wereconsistent withtheparametric results in The results reported thepaper.

]6

JOURNAL BUSINESS OF ANDECONOMICS QUARTERLY

in that possibly is to encountered estimating a attributable thelargeerrors studies, result for risk financially distressed systematic companies. marthat risk As notedpreviously, received theory suggests systematic in theequity risk. Prior is a positivefunction bothleverageand systematic of earnings ketplace firms have concentrated on risk distressed commentators thesystematic of financially on It that theleveragedimensions therelationship. is possible,however, declinesin the of for of riskmaymorethancompensate theincreasein component earnings systematic that the of distress. leverage accompanies onset financial for over this To investigate possibility formally, quarterly earnings thesamplefirms of wereretrieved Compustat's from theperiods interest tapes.The earnings figquarterly a item "IncomeBefore ureemployed Compustat's is Items," Extraordinary quarterly #8, Thisearnmodeldictates. total rather per-share than as levelfigure theanalytical earnings is before discontinued items)and (as operations well as extraordinary ingsfigure taken from Incomefrom thusis a measure income of continuing operaoperations. continuing most comparableto earningsrealizationsfor firmsnot tions,the earningsnumber thatmostclosely number financial distress, experiencing appearsto be theaccounting an is as economic earnings, regarded beingon average unbiased (long-term) approximates of to and the indicator economicearnings, is presumably number prime for importance willcontain somebig bathwritedowns this measure investors. equity Although earnings will suchwritedowns perof obsolete low market or value(relative bookvalue)assets, to are not tainlargely continuing to Thus,the operations, thosethat beingshutor spunoff. efforts associated from bias resulting number less subjectto downward is restructuring net distress than other withfinancial alternatives, including income.Earnings published estimation even greater estimation thesefirms likelyto have presented for is problems seriesshould regarded onlyan approxbe as the than usualand,consequently, earnings is of imationof the market'sperceptions the actual values duringthe timeperiodsin question. for are with numbers matched thecorresponding Theseearnings quarterly earnings the did to whosefiscalquarters notcorrespond Standard Poor's 500 index.Forcompanies & was the are thecalendar on the quarters which S&P 500 earnings reported, matching perof in months thequarter. formed orderto producean overlapin twoof thethree (For for in withtheindexearnings was a quarter ending January matched example, company in in as thequarter Simple quarter ending November.) ending December, was a company seriesfor between twoearnings the coefficients estimated are correlation product-moment in whenever fouror more each of the 12 quarter employed thebeta estimation periods of are quarters earnings available.16 deviations of correlation the the Table 4 reports meansofthese coefficients, standard earn of twoterms that thesystematic and the companyearnings, theproducts these is,

numbers period-3, 24 had 12 quarters in *"Of the 28 firms withearnings number) (the maximum of available; one had 11 quarters;two had ten quarters;and one firmhad fourquarters this pattern of for withfewerthan of is availability representative theother periods.Elimination the correlations firms the tenquarters data in each periodwouldnotaffect meancorrelations of reported significantly.

THE BEHAVIOR OF EARNINGS RISK

3 SUMMER1993,VOLUME32, NUMBER

'1_

Table 4- Behavior of Estimated Systematic Earnings Risk

-2

Entire Sample #Observations MeanpCXf^XJ p(Xf,Xm)>0 > Proportion p(Xf,Xm) 0 MeanStd(Xf) MeanStd(Xf)p(Xf,Xm) Firms Surviving # Observations MeanpPi^J p(Xf,Xm)>0 > Proportion p(Xf,Xm) 0 MeanStd(Xf) MeanStdP^pCX^XJ 28 .11 15 .54 4.30 0.72 12 -.08 4 .25 7.52 0.93

-2

31 .25 22 .71 6.72 3.00 13 .21 8 .62 12.29 6.25

Period

-J

28 -.08 12 .43 21.58 -7.30 13 -.09 5 .38 33.97 -15.68

1

20 .24 14 .70 30.48 3.69 13 .24 9 .69 43.78 7.88

in numerator are consistent ofequation These results largely risk (3). ings componentthe in of that firms' decline because a reduction systemwith proposition distressed betas the -2 from atic earnings risk.In particular, period to period-1 themeancorrelation of the series from to-.08;the 0.25 coefficient between earnings drops proportioncorrelafrom that decreases 0.71to0.43;andthestandard tion coefficients arepositively signed firms' increases a factor three. of Becauseof the deviation thesample of earnings by risk the the correlation, systematic component dropssubstantially despite declining in in that with decline increase total risk, earnings a result is consistent theconcurrent estimated atthis betas time.17 -2 with analysis from -3 and that Itis interesting consistent the period toperiod both in deviation the the correlation standard and increase, earnings paralleling increase estito later; the of mated betas from earlier the these period the periods precede onset financial for sample distress the firms arelesslikely be contaminatedchanging and to by leverage effects.

1 coefficient and the systematic risk Strictly speaking,the negativesign on the mean correlation measurein period -1 implies thatthe mean beta should be negativein this period,and it is not. The to market of firms tended declineduring period,whereasthequarterly this earnings thedistressed quarterly is The indexincomeincreased, correlation. -.08 correlation thereby causingsome of the negative earnings of correlation close to zero and probablyis viewed best as the mean of estimates actual unobservable coefficients are close to or equal to zero. that

l&

OF QUARTERLY JOURNAL BUSINESS AND ECONOMICS

An element these of risk at is the increase earnings measures oddswith analysis their -1 to period+1 at thesame timethat betascontinued decrease.18 from A to the period +1 is that period valuesnecessarily based onlyon surviving the are potential explanation firms whose leverageratiosweredecreasing in withrecovery their stockprices firms, In order explore inconsistency to this the12 firms whichtherelefor further, (Figure1). vantdata are availablein boththeperiodpreceding theperiodfollowing rating and the are partitioned to thesignof thechangein their beta.Five estimated change according in firms an a of betas experience increase beta,with meanincrease 0.2530; sevenfirms' in beta,the with meandeclineof 1.1546.For thefivefirms a with increase the decrease, meanchangein theearnings correlation measure an increase 0.5440 (four is of increase, one decreases). thesevenfirms For with betadecrease, meanchangein theearnings a the correlation also an increase, only0.1357 (three is four measure, increase, decrease).The of for risk is Thus,despite pattern behavior thesystematic earnings component similar. an increasein systematic risk is and less the earnings forbothgroups, increase smaller for firms a than those for consistently positive those experiencingbetadecrease experiencinga betaincrease. Like priorstudiesutilizing other criteria theidentification financial for of distress, thisinvestigation finds that systematic of financially the risk distressed firms initially is than but to to withtheonsetof greater average tends converge theaveragevalueof unity schemeand financial These resultsare unaffected the index-weighing difficulty. by allowancefortheturn-of-year Thisdeclineinbetarisk, effect. whilenumerically is large, in in not highlysignificant a statistical variation the considerable sense, suggesting of that has behavior betasfrom to The of company company. diminution betasis a result whohavefocused thetotal orleverage on risk of dispuzzledthose consequences financial tress. Standard to of that is it risk, approaches theanalysis systematic however, suggest also a function thelevelof systematic of risk. This investigation raisestheposearnings that of distress be morethan sibility theleverage may outweighed consequences financial declinesin systematic and evidencethat generis risk, itprovides by earnings empirical with consistent thisproposition. ally,butnotcompletely,

SUMMARY

1 . Aharony,Joseph,Charles P. Jones,and Itzhak S wary,"An Analysis of Risk and Return Characteristics CorporateBankruptcy of Using Capital MarketData," Journalof Finance (September 1980), pp. 1001-1016. of 2. Altman,Edward I., "A Further Cost Question," EmpiricalInvestigation the Bankruptcy Journalof Finance (September 1984), pp. 1067-1089. 3 . Altman, EdwardI., and Menachem "Information Effects StockMarket and Brenner, Responseto Journal Financialand Quantitative (March 1981), pp. 35-51. Analysis Signs of FirmDeterioration," of 4. Baldwin,Carliss Y., and ScottP. Mason, "The Resolution Claims in FinancialDistress the of Case of Massey Ferguson," Journal Finance (May 1983), pp. 505-516. of for This loEarnings data are available for20 firms period+1, the periodfollowingthe rerating. research that data a met however, returns on theNYSE be availableforeach of thefirms, criterion requires, by only 13 of the20 firms.

1R

REFERENCES

SUMMER1993,VOLUME32, NUMBER 3

19_

and Myron of Journal 5 . Black, Fisher, Scholes, "The Pricing Optionsand Corporate Liabilities," 1973), pp. 637-654. of Political Economy(May/June 6. Bowman, RobertG., "The TheoreticalRelationship Between SystematicRisk and Financial Variables,"Journal Finance (June1979),pp. 617-630. (Accounting) of 7. , "Reply,"Journal Finance (June1981), pp. 749-750. of

"On theUse of theCAPM in PublicUtility Rate Cases," 8. Brigham, EugeneF., and Roy L. Crum, Financial Management (Summer1977),pp. 7-15. of for 9. Dejong, Douglas V., and Daniel W. Collins, "Explanations the Instability Equity Beta: RiskFree Rate Changes and Leverage Effects," Journalof Financial and Quantitative Analysis(March 1985), pp. 73-94. 10. Fortune, "News/Trends: DistressInvesting" (June25, 1984). Model and theRisk Factorof Stock," 1 1. Galai, Dan, and RonaldW. Masulis,"The OptionPricing Journalof Financial Economics(January /March 1976), pp. 53-81. on 12. Hamada,Robert, "The Effect theFirm'sCapitalStructure theSystematic of Risk of Common Stock,"Journal Finance (May 1972), pp. 435-452. of C. 13. Kaplan, Steven N., and Jeremy Stein, "How Risky Is the Debt in Highly Leveraged Transactions?" Journalof Financial Economics(1990), pp. 215-245. 14. Kim, E. Ban, "A Mean Variance Theoryof OptimalCapital Structure and CorporateDebt Journal Finance (March 1978),pp. 45-64. Capacity," of 15. Kim, Kee S., "The Theoretical Relationship Between Systematic Risk and Financial Journal Finance (January Variables;Comment," 1981), pp. 747-748. (Accounting) of 16. Mandelker, Gershon,"Risk and Return:The Case of MergingFirms,"Journal of Financial Economics (1974), pp. 304-335. 's 's 17. Moody Investor Service, Moody BondRecord(New York). MarkE., "A MeanVarianceSynthesis Corporate of Journalof 18. Rubenstein, FinancialTheory," Finance (March 1973), pp. 167-181. "The Adjustment Stock Price Changes to Bond 19. Pinches,George E., and J. Clay Singleton, of of RatingChanges,"Journal Finance (March 1978), pp. 29-44. 20. Stoll, Hans, and RobertWhaley,"Transactions Costs and the Small FirmEffect," Journalof Financial Economics(June1983), pp. 57-88. 21 . Wall Street "Heardon theStreet," Journal, 4, (January 1983).

You might also like

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Blackwell Publishing American Finance AssociationDocument19 pagesBlackwell Publishing American Finance Associationlaryy2309No ratings yet

- Creating a Balanced Scorecard for a Financial Services OrganizationFrom EverandCreating a Balanced Scorecard for a Financial Services OrganizationNo ratings yet

- CbbeDocument15 pagesCbbeRisal RinofahNo ratings yet

- Are Banks Too Big To Fail Measuring Systemic Importance of Financial InstitutionsDocument46 pagesAre Banks Too Big To Fail Measuring Systemic Importance of Financial InstitutionsmdsharilNo ratings yet

- Financial Distress Prediction Models: A Review Their Usefulness'Document14 pagesFinancial Distress Prediction Models: A Review Their Usefulness'Amna NoorNo ratings yet

- Affect of Leverage On Risk and Stock Return .. International Research Jornal of Finance and Economincs1-With-Cover-Page-V2Document19 pagesAffect of Leverage On Risk and Stock Return .. International Research Jornal of Finance and Economincs1-With-Cover-Page-V2(FPTU HCM) Phạm Anh Thiện TùngNo ratings yet

- Systematic RIsk - Chris BrownlessDocument37 pagesSystematic RIsk - Chris BrownlessLeonardo MorenoNo ratings yet

- Determinants of Capital Structure PHD ThesisDocument6 pagesDeterminants of Capital Structure PHD ThesisHelpWithWritingPaperCanada100% (2)

- The Effect of Monetary Policy On Corporate Bankruptcies Evidence From The United StatesDocument12 pagesThe Effect of Monetary Policy On Corporate Bankruptcies Evidence From The United StatesNeel NagarajanNo ratings yet

- Capital Structure On Bank Performance Report.Document25 pagesCapital Structure On Bank Performance Report.Aniba ButtNo ratings yet

- The Costs of Financial Distress Across Industries: Arthur Korteweg September 20, 2007Document59 pagesThe Costs of Financial Distress Across Industries: Arthur Korteweg September 20, 2007Fathimah Azzahra JafrilNo ratings yet

- 1 s2.0 S1043951X14000868 Main PDFDocument19 pages1 s2.0 S1043951X14000868 Main PDFIrene WijayaNo ratings yet

- 2.2 Article 2 - Accounting Comparability and Relative Performance Evaluation by Capital MarketsDocument40 pages2.2 Article 2 - Accounting Comparability and Relative Performance Evaluation by Capital MarketsMonica Ratu LeoNo ratings yet

- A Research ProposalDocument5 pagesA Research Proposalshahzad akNo ratings yet

- Forthcoming at European Accounting Review: MD Al Mamun - Balasingham Balachandran - Huu Nhan DuongDocument50 pagesForthcoming at European Accounting Review: MD Al Mamun - Balasingham Balachandran - Huu Nhan DuongmybondscribdNo ratings yet

- This Content Downloaded From 132.174.250.76 On Fri, 04 Sep 2020 01:33:22 UTCDocument42 pagesThis Content Downloaded From 132.174.250.76 On Fri, 04 Sep 2020 01:33:22 UTCBenjamin NaulaNo ratings yet

- V H R F B: Isible and Idden ISK Actors For AnksDocument46 pagesV H R F B: Isible and Idden ISK Actors For AnksArfin KazmiNo ratings yet

- Endogenous Expectations in Accounting ResearchDocument22 pagesEndogenous Expectations in Accounting ResearchrajeshriskNo ratings yet

- Thesis On Determinants of Capital StructureDocument4 pagesThesis On Determinants of Capital Structuredwbeqxpb100% (2)

- Size and Performance of Banking Afirms - Testing The Predictions of TheoryDocument21 pagesSize and Performance of Banking Afirms - Testing The Predictions of TheoryAlex KurniawanNo ratings yet

- Corporate Default Projection Using Machine Learning PDFDocument40 pagesCorporate Default Projection Using Machine Learning PDFaa aaNo ratings yet

- CSR TypesDocument29 pagesCSR Typessam2037No ratings yet

- Study On The Relationship Between Corporate Financial Leverage and Financial Performance Based On Linear Multiple Regression Model Via Stata SystemDocument10 pagesStudy On The Relationship Between Corporate Financial Leverage and Financial Performance Based On Linear Multiple Regression Model Via Stata SystemRicalyn VillaneaNo ratings yet

- Systemic Risks, Policy and Financial SystemsDocument8 pagesSystemic Risks, Policy and Financial SystemsinbyNo ratings yet

- Hamada 1972Document18 pagesHamada 1972Ivon SilvianaNo ratings yet

- Are Corporate Default Probabilities Consistent With The Static Trade-Off Theory?Document26 pagesAre Corporate Default Probabilities Consistent With The Static Trade-Off Theory?Granillo RafaNo ratings yet

- The Impact of Corporate Governance Characteristics On The of Financial DistressDocument15 pagesThe Impact of Corporate Governance Characteristics On The of Financial DistressFuad Achsan AlviaroNo ratings yet

- The Effect of Sales Growth On The Determinants of Capital Structure of Listed Companies in Tehran Stock ExchangeDocument6 pagesThe Effect of Sales Growth On The Determinants of Capital Structure of Listed Companies in Tehran Stock ExchangeJonathan SangimpianNo ratings yet

- 1515218362Document13 pages1515218362haymanotandualem2015No ratings yet

- How CSR Reporting Reduces Information Asymmetry and Increases LeverageDocument50 pagesHow CSR Reporting Reduces Information Asymmetry and Increases LeverageKuldeep Singh BidhuriNo ratings yet

- Financial Distress 1Document15 pagesFinancial Distress 1Alpian FraningNo ratings yet

- Corporate Risk Management: Costs and Benefits: Depaul UniversityDocument12 pagesCorporate Risk Management: Costs and Benefits: Depaul UniversityJuan RicardoNo ratings yet

- Corporate Governance and Firm Value in Emerging Markets An Empirical Analysis of Adr Issuing Emerging Market FirmsDocument15 pagesCorporate Governance and Firm Value in Emerging Markets An Empirical Analysis of Adr Issuing Emerging Market FirmsTaybunNessaKhanNo ratings yet

- Size and Performance of Banking Firms: Testing Predictions of TheoryDocument21 pagesSize and Performance of Banking Firms: Testing Predictions of TheoryVita NataliaNo ratings yet

- Allocate Capital and Measure Performances in A Financial InstitutionDocument20 pagesAllocate Capital and Measure Performances in A Financial InstitutionsamadbilgiNo ratings yet

- Determinants of Capital Structure ThesisDocument8 pagesDeterminants of Capital Structure Thesisgbwygt8n100% (1)

- Cepr DP8824Document49 pagesCepr DP8824Linh Chi HoangNo ratings yet

- Structural Differences Drive Small and Large Firm ReturnsDocument19 pagesStructural Differences Drive Small and Large Firm ReturnsBenjamin NaulaNo ratings yet

- The Role of Internal Corporate Governance Mechanisms On DefaultDocument29 pagesThe Role of Internal Corporate Governance Mechanisms On DefaultNishanthi udagamaNo ratings yet

- What Determines The Capital Structure of Ghanaian FirmsDocument12 pagesWhat Determines The Capital Structure of Ghanaian FirmsHughesNo ratings yet

- The Venture Capital Keiretsu Effect: An Empirical Analysis of Strategic Alliances Among Portfolio FirmsDocument47 pagesThe Venture Capital Keiretsu Effect: An Empirical Analysis of Strategic Alliances Among Portfolio FirmsestevezmolineroNo ratings yet

- Bankruptcy Prediction Models and The Cost of Debt: Sattar A. Mansi, William F. Maxwell, and Andrew ZhangDocument34 pagesBankruptcy Prediction Models and The Cost of Debt: Sattar A. Mansi, William F. Maxwell, and Andrew ZhangJeffrey WilliamsNo ratings yet

- A Usa Grenee Sfa 2004Document33 pagesA Usa Grenee Sfa 2004ridwanbudiman2000No ratings yet

- Do Banks Hedge in Response To The Financial Distress CostsDocument46 pagesDo Banks Hedge in Response To The Financial Distress Costsvidovdan9852No ratings yet

- The Fundamentals of Fundamental Factor Models Jun2010Document15 pagesThe Fundamentals of Fundamental Factor Models Jun2010Alexander GitnikNo ratings yet

- Aivazian, Ge and Qiu - 2005Document15 pagesAivazian, Ge and Qiu - 2005bildyNo ratings yet

- 貨幣銀行學作業1Document3 pages貨幣銀行學作業1Tin TinNo ratings yet

- Dividend Payout Prediction Using Discriminant Analysis: IQRA UniversityDocument19 pagesDividend Payout Prediction Using Discriminant Analysis: IQRA UniversitymiqbaaalllNo ratings yet

- Assignment 3Document11 pagesAssignment 3Denny ChakauyaNo ratings yet

- Corporate Risk ManagementDocument17 pagesCorporate Risk ManagementkandriantoNo ratings yet

- Dungey jcf2022Document19 pagesDungey jcf2022zafarNo ratings yet

- 1 - Altman - Financial Ratios, Discriminant Analysis, and The Prediction of Corporate BankruptcyDocument22 pages1 - Altman - Financial Ratios, Discriminant Analysis, and The Prediction of Corporate Bankruptcydavidfpessoa100% (2)

- Bank Tail Risk 11-13-2012Document51 pagesBank Tail Risk 11-13-2012Tupperware Jardins d'ElmenzehNo ratings yet

- Fiancial LeverageDocument8 pagesFiancial LeverageanzenxNo ratings yet

- Earning Response Coefficients and The Financial Risks of China Commercial BanksDocument11 pagesEarning Response Coefficients and The Financial Risks of China Commercial BanksShelly ImoNo ratings yet

- Panel Threshold Effect Analysis Between Capital Structure and Operating Efficiency of Chinese Listed CompaniesDocument17 pagesPanel Threshold Effect Analysis Between Capital Structure and Operating Efficiency of Chinese Listed Companiesakita_1610No ratings yet

- SSRN Id770805Document47 pagesSSRN Id770805mishuk77No ratings yet

- Measuring Systemic RiskDocument46 pagesMeasuring Systemic Riskmohamed mansourNo ratings yet

- Determinants of The Capital Structure: Empirical Study From The Korean MarketDocument10 pagesDeterminants of The Capital Structure: Empirical Study From The Korean MarketSigit Anaklostime Stenby SellaluNo ratings yet

- Sample - Death Care & Funeral Service Market - Trends & Opportunities (2016-2020) PDFDocument6 pagesSample - Death Care & Funeral Service Market - Trends & Opportunities (2016-2020) PDFDiarany SucahyatiNo ratings yet

- PROPERTYDocument2 pagesPROPERTYChaMcband100% (1)

- Correction of Accounting Errors GuideDocument2 pagesCorrection of Accounting Errors GuideJean Emanuel100% (1)

- TMPVL Schemes 1 July To 31st July 2023Document8 pagesTMPVL Schemes 1 July To 31st July 2023Bandari GoverdhanNo ratings yet

- Secured PayoutDocument2 pagesSecured PayoutVishal BawaneNo ratings yet

- Analysis of E-Broking Marketing StrategiesDocument45 pagesAnalysis of E-Broking Marketing StrategiesAbhishekKaushikNo ratings yet

- Statement of AccountDocument5 pagesStatement of AccountMark WilliamsNo ratings yet

- Executive SummaryDocument100 pagesExecutive Summarycolriz99No ratings yet

- Senior Auditor MCQsDocument118 pagesSenior Auditor MCQsZia Ud Din81% (32)

- QUESTIONNAIRE SURVEY ON SBI BANK CUSTOMER SATISFACTIONDocument3 pagesQUESTIONNAIRE SURVEY ON SBI BANK CUSTOMER SATISFACTIONSelsiya AmulrajNo ratings yet

- Purchase order email for wooden souvenirsDocument5 pagesPurchase order email for wooden souvenirsArif Reza MaharamaNo ratings yet

- The Greatest Texas Bank Job: Felonious Balonias - ToxiczombiedevelopmentsDocument4 pagesThe Greatest Texas Bank Job: Felonious Balonias - ToxiczombiedevelopmentsBaqi-Khaliq BeyNo ratings yet

- Tender 58800Document213 pagesTender 58800adhirajn4073No ratings yet

- Current Affairs Study PDF - December 2016 by AffairsCloud PDFDocument168 pagesCurrent Affairs Study PDF - December 2016 by AffairsCloud PDFdinesh kumarNo ratings yet

- Nego Chap4 MelaiDocument1 pageNego Chap4 Melaimelaniem_1No ratings yet

- Ex-Servicemen Contributory Health Scheme (Echs)Document1 pageEx-Servicemen Contributory Health Scheme (Echs)Radhakrishnan ManikandanPillaiNo ratings yet

- Adyen Fraud & Excessive Charge-Back Manual V 5.0Document18 pagesAdyen Fraud & Excessive Charge-Back Manual V 5.0Chemencedji IgorNo ratings yet

- Regulation of Cryptocurrency and Combating Terrorist FinancingDocument26 pagesRegulation of Cryptocurrency and Combating Terrorist FinancingsafaafNo ratings yet

- SBI's Core Banking Systems and Networking TechnologiesDocument26 pagesSBI's Core Banking Systems and Networking TechnologiesUdit AnandNo ratings yet

- Registration Slip PDFDocument1 pageRegistration Slip PDFRakesh KanhuNo ratings yet

- ch03 Part6Document6 pagesch03 Part6Sergio HoffmanNo ratings yet

- Customer Satisfaction towards RTGS & NEFTDocument70 pagesCustomer Satisfaction towards RTGS & NEFTRajibKumar100% (1)

- Í (Zkfè Pagayunan Lemuelâââââ R Ç 3) 24lî Mr. Lemuel Rutaquio PagayunanDocument4 pagesÍ (Zkfè Pagayunan Lemuelâââââ R Ç 3) 24lî Mr. Lemuel Rutaquio PagayunanJohn Robertson DayaoNo ratings yet

- Chevron HeadquartersDocument2 pagesChevron HeadquartersGunjan DoshiNo ratings yet

- China Nigeria Bilateral Currency Swap Agreement A Cost Benefit Analysis of The PolicyDocument8 pagesChina Nigeria Bilateral Currency Swap Agreement A Cost Benefit Analysis of The PolicyMoussaLoloNo ratings yet

- 2008 LCCI Level 1 (1017) Specimen Paper QuestionsDocument6 pages2008 LCCI Level 1 (1017) Specimen Paper QuestionsTszkin Pak100% (2)

- CASE DIGEST Lopez Vs OrosaDocument1 pageCASE DIGEST Lopez Vs OrosaErica Dela Cruz100% (1)

- Forming Corps & RecognitionDocument3 pagesForming Corps & RecognitionDiane JulianNo ratings yet

- Valuation RulesDocument36 pagesValuation Rulesdsrathore25No ratings yet

- 29th July 2022Document2 pages29th July 2022Morena hartnettNo ratings yet

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- Key Performance Indicators: Developing, Implementing, and Using Winning KPIsFrom EverandKey Performance Indicators: Developing, Implementing, and Using Winning KPIsNo ratings yet

- Corporate Strategy: A Handbook for EntrepreneursFrom EverandCorporate Strategy: A Handbook for EntrepreneursRating: 4 out of 5 stars4/5 (1)

- LLC or Corporation?: Choose the Right Form for Your BusinessFrom EverandLLC or Corporation?: Choose the Right Form for Your BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- The Fundraising Strategy Playbook: An Entrepreneur's Guide To Pitching, Raising Venture Capital, and Financing a StartupFrom EverandThe Fundraising Strategy Playbook: An Entrepreneur's Guide To Pitching, Raising Venture Capital, and Financing a StartupNo ratings yet

- Startup Money Made Easy: The Inc. Guide to Every Financial Question About Starting, Running, and Growing Your BusinessFrom EverandStartup Money Made Easy: The Inc. Guide to Every Financial Question About Starting, Running, and Growing Your BusinessRating: 4.5 out of 5 stars4.5/5 (9)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionFrom EverandThe Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionRating: 5 out of 5 stars5/5 (3)