Professional Documents

Culture Documents

Facilities With Tally 1

Uploaded by

s_balvantOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Facilities With Tally 1

Uploaded by

s_balvantCopyright:

Available Formats

Facilities with Tally 9.

1-4-2009

Mr. Swayam Satpathy started a Swayam Agencies by bringing in Capital of Rs.15,00,000 by cheque and deposited the same in ICICI Bank by opening a new account. Note : Mr. Swayam Satpathy wants to have separate Vouchers for Bank Payment and Receipts. He also wants separate Serial Numbers to be displayed for Bank Receipt (i.e. BK-REC / 001 / 08-09 )and Bank Payment (i.e. BK-PMT / 001 / 08-09 ). Hence, Two new Voucher Types Bank Payment under Payment and Bank Receipt under Receipt have to be created.

3-4-2009 5-4-2009 8-4-2009

Mr. Swayam withdrew Rs.50,000 cheque for Shop Expenditure from ICICI Bank . ( Cheque No-123451) Mr. Swayam purchased Furniture and Fixture worth Rs. 1,50,000 for the Shop by cheque. (Ch. No-123452) Mr. Swayam rented a premises on 1-4-2009 for his business at Rs. 3,500 per month. He paid a Security Deposit of Rs.25,000 by cheque. ( Ch. No-123453) Mr. Swayam issued a cheque to purchase the following Assets. ( Ch. No-123454)

10-4-2009 12-4-2009

Mr. Swayam has appointed the following people. Name Designation Monthly Salary Rahul Bhatt Sales Executive 4,000 Jairam Sengupta Salesman 3,500 Shishir Mathur Accountant 2,500 Ajith V Nair Clerk 1,500 Ajith is also in charge of Petty Cash and submitting the statement of Expenses at the end of every monty. Note : No Entry is required because this is not an Accounting Transaction.

20-4-2009

Mr. Swayam Purchased the following Items from A2Z Traders on Credit.

Item Quantity High Capacity Stabilizers 100

21-4-2009

Rate 600

Value 60,000

Input VAT 12.5%

Total 67,500

Mr. Swayam Purchased the following Items from A2Z Traders on Credit.

Item High Capacity Stabilizers Open Well Pumps Submersible Pumps

Quantity 100 50 100

Rate 400 1500 2000

Value 40,000 75,000 2,00,000

Input VAT 12.5% 4% 4% Gross Total

Total 45,000 78,000 2,08,000 3,31,000

22-4-2009

Mr. Swayam paid Carriage Inward Expenses of Rs.500 in cash on purchase made on 20-4-2009 and 21-4-2009.

27-4-2009 28-4-209 30-4-2009 30-4-2009

Mr. Swayam transferred Rs. 10,000 to Petty Cash from Cash to meet the day to day expenses. Mr. Swayam withdrew Rs.5,000 in cash for personal use. VAT adjustment entry. Make an entry for the Salary Due of all staff for the month of April 2009. The details are as follows :

Name Rahul Bhatt Jairam Sengupta Shishir Mathur Ajith V Nair

Salary Paid Rs. 2,400 Rs, 2,100 Rs. 1,500 Rs. 900

Number of Days 18 18 18 18

Note : Create the all above individual staff Ledger Account under Loan & Advance ( Asset)

1-5-2009

Mr. Swayam paid Name Rahul Bhatt Jairam Sengupta Shishir Mathur Ajith V Nair

Salaries through cheque for April 2009 . ( Ch. No-123455). The details are as follows : Salary Paid Number of Days Rs. 2,400 18 Rs, 2,100 18 Rs. 1,500 18 Rs. 900 18

Note : Cost Center has to be created in each employees name. Ensure that Maintain Cost Centers is set to YES in F11 : Features > Accounting Features.

2-5-2009 3-5-2009

Mr. Swayam paid Rs.2500 in Cash for stationery, printing invoices and vouchers to Cannon Traders. Mr. Swayam received the statement of expenditure from the Petty Cashier for April 2009. the statement is as follows : Name of Expenses Amount (Rs.) Printing & Stationery 2,500 Cell phone bill 600 Shop maintenance Expenses 450 Conveyance expenses for Marketing Executives

6-5-209

Mr. paid Rs. 3,500 by cheque towards Shop Rent for April 2009. (Ch. No-123456) Note : Set the field Cost Center are applicable ? to No at the time of creating Ledger Printing Shop Rent. Make an entry of the Transaction in a Payment Voucher ( F5 ) : Bank Payment Header Account : ICICI Bank Line Account ( Particulars) : Rent Expenses Rs.3,500 To see the Bank Payment Voucher Screen (See Transaction Dated : 10-04-2009 )

10-5-2009

Mr. Swayam sold the following items Item Quantity High Capacity Stabilizers 50 Open Well Pumps 15

for Cash. The details are as follows : Rate Value Output VAT Total 850 42,500 12.5% 47,813 1700 25,500 4% 26,520 Gross Total 74,333

Step-1 : Make an entry of the transaction in a Sales Voucher ( F8) : Go to Gateway of Tally Accounting Vouchers F8 : Sales displays the Sales Voucher screen. Note : 1. Ensure that As Invoice and Item Invoice buttons are activated. This is because the sales entry has to be recorded as an item invoice. 2. Ensure that in F12 ( Configuration) in Sales Voucher ,

15-5-2009

Mr. Swayam issued a cheque to A2Z Traders for Rs.3,96,500 after deducting the Discount of Rs. 2,000. He receive a Discount as he agreed to pay the entire Bill Amount. ( Ch No-123457) Mr. Swayam withdrew Rs. 4,000 in cash for personal use. Mr. Swayam received the statement of Expenditure from the petty Cashier for May 2009 . the statement is as follows : Name of Expenses Amount (Rs.) Cell phone bill 1,500 Shop maintenance Expenses 200 Conveyance expenses for Marketing Executives 800 VAT adjustment entry.

28-5-2009 30-5-2009

31-5-2009

You might also like

- Class Exercise AccountingDocument4 pagesClass Exercise AccountingMohsin Farooq100% (1)

- Mock TestDocument3 pagesMock Testnidhi_020633677No ratings yet

- MBA-I Semester MB0025 - Financial & Management Accounting - 3 Credits Book ID - (B0907) Assignment Set 1 - (60 Marks)Document2 pagesMBA-I Semester MB0025 - Financial & Management Accounting - 3 Credits Book ID - (B0907) Assignment Set 1 - (60 Marks)Nigist WoldeselassieNo ratings yet

- Tally Erp9 EnglisheditionDocument31 pagesTally Erp9 Englisheditionapi-262072056No ratings yet

- Intermediate Exam Question Compilation for ICWAI Syllabus 2002Document30 pagesIntermediate Exam Question Compilation for ICWAI Syllabus 2002Reshma RajNo ratings yet

- Journal and ledger assignmentsDocument39 pagesJournal and ledger assignmentsIndu GuptaNo ratings yet

- SAMPLE PAPER - (Solved) : For Examination March 2017Document13 pagesSAMPLE PAPER - (Solved) : For Examination March 2017ankush yadavNo ratings yet

- Final Practical NAVTTCDocument8 pagesFinal Practical NAVTTCParwaiz Ali JiskaniNo ratings yet

- Record Transactions of Swayam Agencies Pvt. LtdDocument124 pagesRecord Transactions of Swayam Agencies Pvt. Ltdmastermind_asia9389100% (2)

- DU B.com (H) First Year (Financial Acc.) - Q Paper 2010Document7 pagesDU B.com (H) First Year (Financial Acc.) - Q Paper 2010mouryastudypointNo ratings yet

- Get Answers of Following Questions Here: MB0041 - Financial and Management AccountingDocument3 pagesGet Answers of Following Questions Here: MB0041 - Financial and Management AccountingRajesh SinghNo ratings yet

- MB0041 Financial and Management AccountingDocument12 pagesMB0041 Financial and Management AccountingDivyang Panchasara0% (2)

- Cash BudgetDocument11 pagesCash BudgetQuenia ZahirahNo ratings yet

- Mba025 Set1 Set2 520929319Document16 pagesMba025 Set1 Set2 520929319tejas2111No ratings yet

- For Girl Pa A RDocument3 pagesFor Girl Pa A RMuhammad BilalNo ratings yet

- Class 11 Accountancy Worksheet - 2023-24Document17 pagesClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarNo ratings yet

- ARS Waltham Case TransactionsDocument2 pagesARS Waltham Case TransactionsRajnikaanth SteamNo ratings yet

- Financial Accounting (Unsolved Papers of ICMAP)Document48 pagesFinancial Accounting (Unsolved Papers of ICMAP)Platonic0% (1)

- Uspense Account DRDocument4 pagesUspense Account DRYousaf JamalNo ratings yet

- MBA Semester 1 Spring 2015 Solved Assignments - MB0041Document3 pagesMBA Semester 1 Spring 2015 Solved Assignments - MB0041SolvedSmuAssignmentsNo ratings yet

- MBA Financial Accounting Exercises SolutionsDocument17 pagesMBA Financial Accounting Exercises SolutionsRasanjaliGunasekeraNo ratings yet

- PAL0022 T1transaction&Double EntryDocument6 pagesPAL0022 T1transaction&Double EntrySamuel Koh0% (1)

- General Journal Entry - FABMDocument10 pagesGeneral Journal Entry - FABMHannah SophiaNo ratings yet

- CBSE Class 11 Accountancy Worksheet - Question Bank (1)Document17 pagesCBSE Class 11 Accountancy Worksheet - Question Bank (1)Umesh JaiswalNo ratings yet

- Basics of Accounting Question Bank PDDM Term 1Document34 pagesBasics of Accounting Question Bank PDDM Term 1sapitfin0% (1)

- MB0041Document3 pagesMB0041Smu DocNo ratings yet

- TALLY ERP9 EnglishEditionDocument31 pagesTALLY ERP9 EnglishEditionManjunathreddy Seshadri70% (10)

- Segment Sales Net Profit: Sample Questions For Written Test in ProjectsDocument3 pagesSegment Sales Net Profit: Sample Questions For Written Test in ProjectsvasantNo ratings yet

- Pac Mids With Solution 1,2,3,4,8Document67 pagesPac Mids With Solution 1,2,3,4,8Shahid MahmudNo ratings yet

- Pac All CAF MidtermsDocument130 pagesPac All CAF MidtermsShahid MahmudNo ratings yet

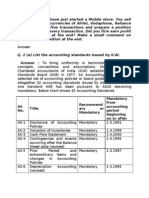

- Recommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterDocument7 pagesRecommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterdnbiswasNo ratings yet

- Assigment BBM Finacial AccountingDocument6 pagesAssigment BBM Finacial Accountingtripathi_indramani5185No ratings yet

- Pac Ver Finalans KeyDocument10 pagesPac Ver Finalans KeyArun LalNo ratings yet

- F AccountDocument39 pagesF AccountChandra Prakash SoniNo ratings yet

- Branch AccountingDocument8 pagesBranch AccountingMasoom FarishtahNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100kaitokid77No ratings yet

- TallyDocument34 pagesTallysriNo ratings yet

- Tally Assignment BookDocument30 pagesTally Assignment BookArun Babu100% (13)

- Banking AssignmentDocument2 pagesBanking AssignmentKatka WaleNo ratings yet

- Voucher System: Prepared By: Muhammad HassamDocument4 pagesVoucher System: Prepared By: Muhammad HassamIqra MughalNo ratings yet

- Accounting Equation and General JournalDocument3 pagesAccounting Equation and General JournalWaqar AhmadNo ratings yet

- Chapter 2: Basic Accounting Concepts: Accounting 1 (Aa015) Tutorial QuestionsDocument5 pagesChapter 2: Basic Accounting Concepts: Accounting 1 (Aa015) Tutorial QuestionsIna NaaNo ratings yet

- Accounting Equations-Practice MaterialDocument4 pagesAccounting Equations-Practice MaterialTejas DesaiNo ratings yet

- Tally ExerciseDocument16 pagesTally ExercisePavanSyamsundarNo ratings yet

- 22ODBBT103Document5 pages22ODBBT103Pallavi JaggiNo ratings yet

- Sample PaperDocument28 pagesSample PaperSantanu KararNo ratings yet

- Acconts Preliminary Paper 2Document13 pagesAcconts Preliminary Paper 2AMIN BUHARI ABDUL KHADERNo ratings yet

- Analyze The Effects of The Transactions On The Accounting Equation.eDocument4 pagesAnalyze The Effects of The Transactions On The Accounting Equation.eShesharam ChouhanNo ratings yet

- Must DoDocument27 pagesMust DoKuldeep SharmaNo ratings yet

- Activity in Basic Accounting - Analysis of TransactionsDocument10 pagesActivity in Basic Accounting - Analysis of TransactionsKyleZapantaNo ratings yet

- Accounting Practice Paper InsightsDocument3 pagesAccounting Practice Paper InsightsSameer Hussain100% (1)

- ProblemsDocument19 pagesProblemsJames CastañedaNo ratings yet

- IMT 57 Financial Accounting M1Document4 pagesIMT 57 Financial Accounting M1solvedcareNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- Economic SurveyDocument7 pagesEconomic SurveyJuliana Andrea GoNo ratings yet

- Sarla VarmaDocument28 pagesSarla VarmaKajeev KumarNo ratings yet

- Internal Generated Revenue and Economic Development: A Study of Akwa Ibom StateDocument85 pagesInternal Generated Revenue and Economic Development: A Study of Akwa Ibom Statevictor wizvikNo ratings yet

- CARS24 Business Environment ReportDocument12 pagesCARS24 Business Environment ReportBabu ShonaNo ratings yet

- ICMA Questions Dec 2011Document54 pagesICMA Questions Dec 2011Asadul HoqueNo ratings yet

- Kishore PRJCT FinalDocument64 pagesKishore PRJCT FinalKishore MahatoNo ratings yet

- Alcatraz Corp. 2011 Balance Sheet, Income Statement, and Financial RatiosDocument16 pagesAlcatraz Corp. 2011 Balance Sheet, Income Statement, and Financial RatiosRaul Dolo Quinones100% (1)

- Surigao Del Sur State University: - Financial AspectDocument8 pagesSurigao Del Sur State University: - Financial AspectGian CarloNo ratings yet

- Tugas Pengantar Akuntansi-1Document23 pagesTugas Pengantar Akuntansi-1Wiedya fitrianaNo ratings yet

- Wilderness Travel Service financial statementsDocument1 pageWilderness Travel Service financial statementscons theNo ratings yet

- Atlantic Tours General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003Document4 pagesAtlantic Tours General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003babe447No ratings yet

- Cash Flow Analysis: Restaurant Business PlanDocument44 pagesCash Flow Analysis: Restaurant Business Plankavirao87No ratings yet

- Budget Worksheet: Income ItemsDocument2 pagesBudget Worksheet: Income ItemsBusinessNo ratings yet

- Week4 ClosingTheAccounts TheAdjustingProcessDocument49 pagesWeek4 ClosingTheAccounts TheAdjustingProcessyow jing peiNo ratings yet

- A STUDY ON Financial Statement Analysis of Axis BankDocument94 pagesA STUDY ON Financial Statement Analysis of Axis BankKeleti Santhosh75% (8)

- Financial Statement Analysis: Charles H. GibsonDocument38 pagesFinancial Statement Analysis: Charles H. GibsonmohamedNo ratings yet

- Solution On Estimation of Working CapitalDocument5 pagesSolution On Estimation of Working Capitaljeta_prakash100% (2)

- Chapter 7 - Financial RatiosDocument8 pagesChapter 7 - Financial RatiosNatasha GhazaliNo ratings yet

- PCGG Should Vote Sequestered UCPB Shares Bought With Coconut Levy FundsDocument13 pagesPCGG Should Vote Sequestered UCPB Shares Bought With Coconut Levy FundsDon YcayNo ratings yet

- SD BD001 - Business Plan CBSA V1.0 (ID 161466)Document11 pagesSD BD001 - Business Plan CBSA V1.0 (ID 161466)Ṁysterious ṀarufNo ratings yet

- A Revenue Guide To Professional Services Withholding Tax (PSWT) For Accountable Persons and Specified PersonsDocument26 pagesA Revenue Guide To Professional Services Withholding Tax (PSWT) For Accountable Persons and Specified Personstere1330No ratings yet

- Basic Accounting Concepts and Case StudiesDocument114 pagesBasic Accounting Concepts and Case Studiesgajiniece429No ratings yet

- CV Raun Sintiya Daftar Akun Periode 31 Desember 2021Document4 pagesCV Raun Sintiya Daftar Akun Periode 31 Desember 2021BeertyavrillianNo ratings yet

- Sweet Menu RestaurantDocument13 pagesSweet Menu RestaurantYou VeeNo ratings yet

- Taxation May Board ExamDocument20 pagesTaxation May Board ExamjaysonNo ratings yet

- Financial and Managerial Accounting AssignmentDocument10 pagesFinancial and Managerial Accounting AssignmentAbdul AhmedNo ratings yet

- Minicases 5Document3 pagesMinicases 5dini sofiaNo ratings yet

- Differentiate Between Operating, Investing, and Financing ActivitiesDocument5 pagesDifferentiate Between Operating, Investing, and Financing ActivitiessanyaNo ratings yet

- UPERC Tariff Order 191012Document390 pagesUPERC Tariff Order 191012Jigyesh SharmaNo ratings yet

- Analisis Laporan Keuangan PT XL AXIATA TBKDocument9 pagesAnalisis Laporan Keuangan PT XL AXIATA TBKmueltumorang0% (1)