Professional Documents

Culture Documents

Registrar & Transfer Agent: Submitted By: Pranesh P. Khambe Roll No

Uploaded by

Pranesh KhambeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Registrar & Transfer Agent: Submitted By: Pranesh P. Khambe Roll No

Uploaded by

Pranesh KhambeCopyright:

Available Formats

SUB: FINANCIAL MANAGEMENT

Registrar & Transfer Agent

BACHELOR OF COMMERCE BANKING & INSURANCE SEMESTER- IV (2011-12)

Submitted By: Pranesh P. Khambe ROLL NO. 21

V.E.S. COLLEGE OF ARTS, SCIENCE & COMMERCE, SINDHI SOCIETY, CHEMBUR, MUMBAI 400071

1

SUB: FINANCIAL MANAGEMENT

V.E.S. COLLEGE OF ARTS, SCIENCE & COMMERCE, SINDHI SOCIETY, CHEMBUR, MUMBAI 400071

C E R T I F I C A T E

This is to certify that Shri/Miss ______________________________________ of B.Com Banking & Insurance Semester IV (2011-12) has successfully completed the project on __________________________________________

Examiner

SUB: FINANCIAL MANAGEMENT

DECLARATION

I, ______________________________________, the student of B.Com Banking & Insurance Semester IV (2011-12) hereby declare that I have completed this project on __________________________________________

The information submitted is true & original to the best of my knowledge.

Name ROLL NO.

SUB: FINANCIAL MANAGEMENT

ACKNOWLEDGEMENT

This project of Registrar & Transfer Agent is the result of co-operation, hard work, and good wishes of many people. I also kindly appreciate the involvement of the teaching and non teaching staff and the library staff and to those too who have directly or indirectly contributed in making this project successful. Lastly, I would like to thanks my parents, family members and friends for their moral support that kept my spirit going during the endeavour. Thank you!

SUB: FINANCIAL MANAGEMENT

EXECUTIVE SUMMARY

I have covered the brief introduction about the Transfer Agent. I have also covered their functions and role in brief. I have also covered types of R&T Agents. In that I have covered some important types i.e. Stock Registrar, Bond Registrar, Stock Transfer Agent and Mutual Fund Transfer Agent. And then there are some important financial regulators who regulate the R&T Agent e.g., SEBI, who play a crucial role in the developing country like India. These regulators are necessary for the smooth functioning of the R&T agents work.

SUB: FINANCIAL MANAGEMENT

INDEX

No 1 2 3 4 5 6 7

PARTICULARS

INTRDUCTION TRANSFER AGENT & ITS FUNCTIONS ROLE OF TRANSFER AGENT TYPES OF R&T AGENTS EXAMPLE OF R&T AGENT-KARVY CONCLUSION BIBLOGRAPHY

Pg. No. 7 8-9 10-11 12-17 18-19 20 21

SUB: FINANCIAL MANAGEMENT

INTRODUCTION Registrar & Transfer Agents - Registrars to Issue

R&T Agents form an important link between the investors and issuers in the securities market. A company, whose securities are issued and traded in the market, is known as the Issuer. The R&T Agent is appointed by the Issuer to act on its behalf to service the investors in respect of all corporate actions like sending out notices and other communications to the investors as well as dispatch of dividends and other non-cash benefits. R&T Agents perform an equally important role in the depository system as well.

Definition of 'Transfer Agent'

A trust company, bank or similar financial institution assigned by a corporation to maintain records of investors and account balances and transactions, to cancel and issue certificates, to process investor mailings and to deal with any associated problems (i.e. lost or stolen certificates). Companies that have publicly traded securities typically use transfer agents to keep track of the individuals and entities that own their stocks and bonds. Most transfer agents are banks or trust companies, but sometimes a company acts as

its own transfer agent.

7

SUB: FINANCIAL MANAGEMENT

'Transfer Agent'

Because publicly-traded companies, mutual funds and similar entities often have many investors who own a small portion of the organization, require accurate records and have rights regarding information provision, the role of the transfer agent is an important one. Some corporations choose to act as their own transfer agents, but most choose a third-party financial institution to fill the role. If a transfer agent or registrar is not registered with the appropriate regulatory agency, it will not be able to use the mails or any means of interstate commerce regarding a security registered under the Exchange Act. Public companies typically use transfer agents to keep track of the individuals and entities that own their stocks and bonds. Most transfer agents are banks or trust companies, but sometimes a company acts as its own transfer agent.

SUB: FINANCIAL MANAGEMENT

Transfer agents perform three main functions:

1. Issue and cancel certificates to reflect changes in ownership. For example, when a company declares a stock dividend or stock split, the transfer agent issues new shares. Transfer agents keep records of who owns a company's stocks and bonds and how those stocks and bonds are heldwhether by the owner in certificate form, by the company in book-entry form, or by the investor's brokerage firm in street name. They also keep records of how many shares or bonds each investor owns. 2. Act as an intermediary for the company. A transfer agent may also serve as the company's paying agent to pay out interest, cash and stock dividends, or other distributions to stock- and bondholders. In addition, transfer agents act as proxy agent (sending out proxy materials), exchange agent (exchanging a company's stock or bonds in a merger), tender agent (tendering shares in a tender offer), and mailing agent (mailing the company's reports). 3. Handle lost, destroyed, or stolen certificates. Transfer agents help shareholders and bondholders when a stock or bond certificate has been lost, destroyed, or stolen. quarterly, annual, and other

SUB: FINANCIAL MANAGEMENT

Role of the Transfer Agent:

Section 3(a) (25) of the 1934 Act defines a "transfer agent" as any person who, on behalf of an issuer of securities or on behalf of itself as an issuer of securities, performs one or more of the following activities: Countersigning securities upon issuance Monitoring the issuance of securities with a view to preventing unauthorized issuance, a function commonly performed by a person called a registrar Registering the transfer of such securities Exchanging or converting securities Transferring recorded ownership of securities by bookkeeping entry,

without the physical issuance of securities certificates

Ownership of a security is expressed by the registration of a bond or stock certificate. A purchaser of a security is entitled to a certificate registered in his or her name. There is an exception to this requirement in regards to debt issued by the United States government, which is issued in bookentry form. Book-entry ownership means that the ownership of bonds and bills issued by the United States government is recorded in computer records maintained by the Treasury, with no paper certificate issued.

10

SUB: FINANCIAL MANAGEMENT

In the case of stock, the purchaser always has the right to receive a certificate of ownership. Virtually all securities are issued in registered form, which means that the person entitled to the security and to the rights associated with a security, such as voting rights for common stock, is specified in the books maintained by or on behalf of the issuer of the security. In the past, debt securities, both corporate and government were issued in bearer form, which meant that anyone possessing the physical certificate or any of the attached interest coupons, was entitled to payment upon presentation of the bond upon maturity or call, or to interest when the bond coupon was presented to a paying agent. The issuer of a bearer bond did not know the identity of the persons who owned the issuers bonds. Since bearer bonds are negotiable instruments, making them easily converted into cash without the ability to identify the parties receiving payment, concerns arose over the issue of taxpayers failing to declare interest income received on bearer bonds. In response, Congress passed the Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA). TEFRA prohibited the United States government from issuing bearer bonds and provided sanctions against corporations, municipalities, and other organizations issuing bearer obligations. The sanctions included disallowing the deduction of interest expense by issuers of bearer bonds and denying the holder of bear bonds the tax exemption for interest earned on the bonds. In addition, TEFRA imposed an excise tax equal to 1 percent of the principal amount of the debt multiplied by the number of years in the term of the bonds. These measures effectively ended the issuance of bearer debt instruments, and all debt securities are issued in registered form now.

11

SUB: FINANCIAL MANAGEMENT

Types of Registrar & Transfer Agents:

Stock Registrar

As described above, the stock registrar's duty is to prevent the over- or under-issuance of securities, a condition referred to as an out-ofproof or out-of-balance condition. New York Stock Exchange rules allow an institution to serve as both a transfer agent and registrar for listed securities, other than its own. It is fairly common to find a transfer agent of an issue also serving the function of registrar. Although rarely encountered, there are instances where banks serve as registrar without being appointed the transfer agent. In such a case the registrar is referred to as an "outside registrar". When an "outside registrar" is used, the transfer agent, after canceling the surrendered certificates and drawing up the replacement certificates, sends both the cancelled and replacement certificates to the registrar, who verifies that the shares represented by the replacement certificate(s) equals the shares represented by the surrendered stock certificates.

12

SUB: FINANCIAL MANAGEMENT

Bond Registrar

The issuers of bonds, such as corporate and municipal bonds, and other debt instruments, also require securities transfer services. In the case of debt securities, however, the person or entity providing securities transfer and registrar services is referred to as the bond registrar. The function of the bond registrar should not be confused with that of the stock registrar. Often, the indenture trustee for the bond issue also serves as the bond registrar, although separate a bond there can be a bond registrar for issue.

13

SUB: FINANCIAL MANAGEMENT

In the past, debt securities, both corporate and government were issued in bearer form. However, with the enactment of TEFRA in 1982, the Act effectively ended bearer issued the debt in issuance of instruments, securities are registered bond maintains registered transfers

and all debt form. It is the registrar who the records of owners and

ownership when bonds are subsequently acquired or sold. Interest and principal payments on registered bonds are made to the owners of record at the time when interest and/or principal are paid.

Stock Transfer Agent

14

SUB: FINANCIAL MANAGEMENT

In view of the principal transfer agent functions described above, stock transfer agents occupy a central role in the issuance of securities and the subsequent transfer of such securities resulting from sales, purchases, reorganizations, tender offers, and other transfers of ownership. In particular, stock transfer agents issue stock certificates representing increases in the number of shares outstanding, e.g., initial issuance, stock dividends, stock splits and dividend reinvestment programs. As issued shares are traded on the open market, stock certificates are sent to the transfer agent who will cancel the shares registered in the name of the transferor (e.g. seller) and issue a stock certificate registered in the name of the transferee (e.g., buyer). Central to transactions involving the transfer of securities is the maintenance of accurate ownership records with respect to issued securities, since it is the registered owners of the securities who enjoy the associated ownership rights, e.g., the right to dividends and to vote shares owned. Transfer agents are responsible for maintaining current and accurate records with respect to issued securities. In view of the large volume of stock market transactions, transfer agents must perform their duties with a high degree of speed and accuracy in order for securities markets to function efficiently. In issuing or transferring stock certificates, transfer agents must examine all accompanying documentation, assignments and endorsements to ensure the propriety of the transfer and guard against fraudulent transfers, change recorded ownership to reflect the transfer and, in most cases, perform the role of stock registrar, which involves verifying the number of shares represented by the certificate(s) being issued against the number of shares represented by the stock certificate(s) being cancelled. The stock registrar function operates to guard against the over issuance of securities.

15

SUB: FINANCIAL MANAGEMENT

Finally, subsequent to cancellation, transfer agents must retain cancelled certificates in a secure location to ensure that they are not used in fraudulent transactions. When an over issuance of securities occurs the number of share over issued must be reduced, either by recovering the over issued shares from those to whom they were issued or by the person or entity responsible for the over issuance buying that number of shares on the open market and retiring the shares, which in effect represents a loss to that person or entity.

In order to these functions in a prompt and efficient manner, institutions acting as registered transfer agents need appropriate management oversight, experienced and knowledgeable staff, efficient operating procedures and effective internal controls. The failure by a registered transfer agent to promptly and accurately transfer and record ownership of securities can result in security holders suffering monetary damages by hampering their ability to buy and sell shares, or otherwise prevent shareholders from exercising the rights associated with stock ownership, such as the right to receive dividends and vote proxies. perform

16

SUB: FINANCIAL MANAGEMENT

Mutual Fund Transfer Agent:

A mutual fund transfer agent performs both the transfer agent and registrar functions. Mutual fund transfer agents maintain records of shareholder accounts; calculate and disburse dividends; and prepare and mail shareholder account statements, federal income tax information and other shareholder notices. Some mutual fund transfer agents may prepare and mail statements confirming shareholder transactions and account balances, and maintain customer service departments to respond to shareholder inquiries. There are two types of mutual funds: closed-end mutual funds and open-end mutual funds. In the case of closed-end mutual funds, there is a fixed number of shares authorized and outstanding. Once issued, shares in closed-end mutual funds are traded in the market in the same manner as stocks. With respect to open-end mutual funds, there is no fixed number of shares authorized and outstanding. Open-end mutual funds will generally issue additional shares to investors wishing to invest in the fund. An open-end mutual fund may, however, close the fund to additional investors. In the case of an open-end mutual fund, the transfer agent faces a changing number of shares outstanding on a daily basis, increasing or decreasing depending upon the volume purchases and redemptions. outnumber closed-end mutual funds. Open-end mutual funds greatly

17

SUB: FINANCIAL MANAGEMENT

Another important difference between mutual fund transfer and stock transfer is the general absence of physical certificates for mutual fund shares. The owners of shares of stock have a right to a physical certificate. Mutual funds, on the other hand, rarely issue physical certificates. On infrequent occasions, a mutual fund may upon special request issue a certificate, for example in order for a shareholder to pledge shares as collateral for a loan. The absence of physical certificates means that mutual fund transfer is a book-entry operations, with recorded ownership maintained in the transfer agent's computerized recordkeeping system. A mutual funds transfer agent is identified in the mutual fund's prospectus. A mutual fund transfer agent must be a registered transfer agent. See following section. The operation of mutual funds is subject to the Investment Company Act of 1940 and regulation by the SEC.

18

SUB: FINANCIAL MANAGEMENT

Example of Registrar & Transfer Agent:

Karvy Computershare

About Karvy

Computershare

Karvy Computershare Private Limited (KCPL) is Indias largest registrar today and amongst the top 5 in the world with presently servicing over 67 million investor accounts spread over 900 issuers including banks, PSUs and mutual funds. The Company has a work force of over 2500 experienced personnel drawn from various disciplines. KCPL has emerged as a market leader in Investor Servicing in the country by offering its services through its network of 400 + Branches in 300 + cities spread across the country, undoubtedly the largest in the country. KCPL is poised to set new benchmarks in Investor Servicing by establishing performance standards for Service Delivery and development and enhancement of Service Delivery competence through structured and custom built training and development initiatives. We are the first organization, in its line of business, to achieve the distinction of receiving an ISO 9002 certification and have now migrated to ISO 9001:2008 standards, for quality management systems, certified by DNV. Also, we have been awarded with ISO 27001:2000 certification by DNV, which sets the highest standards with respect to information security and management system.

19

SUB: FINANCIAL MANAGEMENT

Head quartered in Hyderabad, India KCPL is a 50:50 Joint Venture between Karvy and Computershare of Australia - the worlds largest Transfer Agent. The joint venture with Computershare Limited helps us adopt international practices in client and investor servicing and absorption of better technology. This also lends further credence to our professional business management approach with strong corporate governance skills. They offer their clients three key qualities: Certainty precision and reliability in the complex tasks we undertake Ingenuity a continued focus on finding new and better ways to meet their needs and solve their challenges Advantage through the certainty of our services and the ingenuity of our solutions, we deliver meaningful advantages in all that we do.

Service Network

Investor Service Centers (ISCs), more commonly known as Branches are the points of contact for all transactions. With a reach of more than 400 branches, we constantly strive to offer unparalleled across the counter services across the length and breadth of the country. All ISCs are equipped with state of the art infrastructure to allow easy access to information, products and services. Operations and customer interaction are facilitated by highly skilled and dedicated manpower deployed at ISCs with a single track mission Customer Satisfaction.

20

SUB: FINANCIAL MANAGEMENT

Conclusion

The regulation of transfer agents is but one step in setting up an efficient securities market. Comparison, clearance, and settlement are already subject to regulations. Computerization, abolition of the stock certificate, and improved efficiency are all called for to continue to make the United States securities market the most efficient capital market in the world. Without such efficiency, a loss of preeminence is inevitable, and a feeling of insecurity is engendered.

21

SUB: FINANCIAL MANAGEMENT

Bibliography

T.Y B.F. M 5th Sem -CRM in Financial Services Capital Markets WWW.Google.com WWW.Karvy.com WWW.Scridb.com

THANK YOU

22

You might also like

- Registrar and Transfer AgentsDocument7 pagesRegistrar and Transfer AgentsjatinNo ratings yet

- Viva PresentationDocument5 pagesViva PresentationKaushal LalwaniNo ratings yet

- DepositoryDocument29 pagesDepositoryChirag VaghelaNo ratings yet

- Ketul SFPartiesFeb04Document7 pagesKetul SFPartiesFeb04api-3855915No ratings yet

- Bond Issues - Step by Step GuideDocument15 pagesBond Issues - Step by Step GuideQuantmetrix100% (1)

- Group 3 Module 3 Securities Regulation CodeDocument49 pagesGroup 3 Module 3 Securities Regulation Codemhel silvaNo ratings yet

- SEC (Securities & Exchange Commision) - Is The National Government Agency Charged With Supervision Over The Corporate Sector, TheDocument3 pagesSEC (Securities & Exchange Commision) - Is The National Government Agency Charged With Supervision Over The Corporate Sector, TheNhetzNo ratings yet

- Intermediaries: Custody Business: Broker / TraderDocument4 pagesIntermediaries: Custody Business: Broker / Trader1987abbyNo ratings yet

- SL& C Study 13Document21 pagesSL& C Study 13abhibth151No ratings yet

- FIN460 Assigment SecuritizationDocument3 pagesFIN460 Assigment Securitizationmohameed shoaibNo ratings yet

- Topic 1 Practice QuestionsDocument12 pagesTopic 1 Practice QuestionsLena ZhengNo ratings yet

- FM NotesDocument49 pagesFM Notesanuj goelNo ratings yet

- Financial Management by CA Umesh BhattaraiDocument10 pagesFinancial Management by CA Umesh Bhattaraiसम्राट सुबेदीNo ratings yet

- Capital Markets 0 Credit and CollectionDocument4 pagesCapital Markets 0 Credit and CollectionElizabeth OlarteNo ratings yet

- Registrars To An Issue and Share Transfer Agents Registrars To An Issue (RTI) and Share TransferDocument13 pagesRegistrars To An Issue and Share Transfer Agents Registrars To An Issue (RTI) and Share TransferselvamanagerNo ratings yet

- Credit-and-Collection-Module-567Document10 pagesCredit-and-Collection-Module-567Rudy Lyn VillasistaNo ratings yet

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersFrom EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNo ratings yet

- Regulation of Share Transfer AgentsDocument15 pagesRegulation of Share Transfer AgentsAmrutha GayathriNo ratings yet

- Financial Services & Institutions - An IntroductionDocument11 pagesFinancial Services & Institutions - An IntroductionMayank KumarNo ratings yet

- Indian Depository System: An OverviewDocument21 pagesIndian Depository System: An OverviewSimran SinghNo ratings yet

- FIN-310 Report PDFDocument15 pagesFIN-310 Report PDFHusen AliNo ratings yet

- Merchant Banking: Prepared By: Suraj DasDocument17 pagesMerchant Banking: Prepared By: Suraj DasSuraj DasNo ratings yet

- Special Laws For RFBTDocument22 pagesSpecial Laws For RFBTJinky LongasaNo ratings yet

- Investor Relations 101 - Securities Laws and Stock PromotionsDocument14 pagesInvestor Relations 101 - Securities Laws and Stock PromotionsjeremyNo ratings yet

- A simple approach to bond trading: The introductory guide to bond investments and their portfolio managementFrom EverandA simple approach to bond trading: The introductory guide to bond investments and their portfolio managementRating: 5 out of 5 stars5/5 (1)

- What Is A Depository?Document10 pagesWhat Is A Depository?ARPITA MOHAPATRANo ratings yet

- Presentation On Merchant BankingDocument19 pagesPresentation On Merchant BankingSneha SumanNo ratings yet

- 2 Year Semester 4: Subject:Industrial LawDocument15 pages2 Year Semester 4: Subject:Industrial LawReebeccaNo ratings yet

- Project Report On Stock Market "Working of Stock Exchange & Depositary Services"Document11 pagesProject Report On Stock Market "Working of Stock Exchange & Depositary Services"Kruti NemaNo ratings yet

- IAPMDocument8 pagesIAPMPritam SahaNo ratings yet

- SHARE TRANSFER DEPODocument35 pagesSHARE TRANSFER DEPOShweta GujarNo ratings yet

- INDUSTRY PROFILE: ORIGIN AND EVOLUTION OF STOCK BROKING IN INDIADocument22 pagesINDUSTRY PROFILE: ORIGIN AND EVOLUTION OF STOCK BROKING IN INDIAWesly PaulNo ratings yet

- Accounting Principles & Practices An Overview DefinitionDocument10 pagesAccounting Principles & Practices An Overview DefinitionRibka MerachNo ratings yet

- 5) Notes On SecuritizationDocument4 pages5) Notes On SecuritizationJerome BrusasNo ratings yet

- What Is Securitization2Document14 pagesWhat Is Securitization2John Foster100% (2)

- Capital Markets and Credit and CollectionDocument3 pagesCapital Markets and Credit and CollectionlizNo ratings yet

- Q1-Module 2-Week 2-Financial Institutions, Instrument and Market Flow of FundsDocument27 pagesQ1-Module 2-Week 2-Financial Institutions, Instrument and Market Flow of FundsJusie ApiladoNo ratings yet

- Describe The Role and Responsibilities of Asset Management CompanyDocument2 pagesDescribe The Role and Responsibilities of Asset Management CompanySatyam ShrivastavaNo ratings yet

- WritingAssignment FinActg1B Michelle Kelsey Davis KristinDocument16 pagesWritingAssignment FinActg1B Michelle Kelsey Davis Kristinkrstn_hghtwrNo ratings yet

- Anna University BA7022 Merchant Banking and Financial Services Question BankDocument16 pagesAnna University BA7022 Merchant Banking and Financial Services Question Bankravipriya19No ratings yet

- Kahit Nalugi Yung Kumpanya, Secured Pa Rin Yung Pinautang Mo Na Babalik Sayo Plus Yung Mga InterestDocument14 pagesKahit Nalugi Yung Kumpanya, Secured Pa Rin Yung Pinautang Mo Na Babalik Sayo Plus Yung Mga InterestMc Reidgard RomblonNo ratings yet

- Law - Trust AccountingDocument2 pagesLaw - Trust AccountingjoanabudNo ratings yet

- Nism - 6Document29 pagesNism - 6vjeshnani100% (1)

- Accounts & Finance 15 Units NOTESDocument180 pagesAccounts & Finance 15 Units NOTESSURYA PRAKASAVELNo ratings yet

- Depository SystemDocument47 pagesDepository Systemsanyogeeta sahooNo ratings yet

- Hand-Book - IIIDocument60 pagesHand-Book - IIISachin SrivastavaNo ratings yet

- Ritholtz 150MMDocument16 pagesRitholtz 150MMZerohedgeNo ratings yet

- Philippine Financial System MaterialDocument24 pagesPhilippine Financial System MaterialLeneNo ratings yet

- Explanation of SecuritizationDocument15 pagesExplanation of Securitizationchickie10No ratings yet

- Real Estate AccountingDocument47 pagesReal Estate AccountingDian Agustian100% (1)

- Financial Market Regulation ArticleDocument9 pagesFinancial Market Regulation ArticlearyanNo ratings yet

- Overview of Indian Securities Market: Chapter-1Document100 pagesOverview of Indian Securities Market: Chapter-1tamangargNo ratings yet

- CMR Unit IvDocument6 pagesCMR Unit Ivirtikahassan111No ratings yet

- Some What Solved QB-Financial Mnagement-MBM633Document7 pagesSome What Solved QB-Financial Mnagement-MBM633Amit KumarNo ratings yet

- Clearing and SettlementDocument12 pagesClearing and Settlementneelabh_singh_1No ratings yet

- Strategic AllianceDocument30 pagesStrategic AlliancePranesh Khambe100% (2)

- Types of ServicesDocument14 pagesTypes of ServicesPranesh KhambeNo ratings yet

- Accounting Standard 11Document21 pagesAccounting Standard 11Pranesh KhambeNo ratings yet

- HRMDocument19 pagesHRMPranesh KhambeNo ratings yet

- Strategic AllianceDocument30 pagesStrategic AlliancePranesh Khambe100% (2)

- Process CostingDocument12 pagesProcess CostingPranesh KhambeNo ratings yet

- 1ST FRMT OF Process CostingDocument9 pages1ST FRMT OF Process CostingPranesh KhambeNo ratings yet

- Strategic AllianceDocument30 pagesStrategic AlliancePranesh Khambe100% (2)

- E C Chemical Productions LTDDocument7 pagesE C Chemical Productions LTDPranesh KhambeNo ratings yet

- ADR ND GDRDocument15 pagesADR ND GDRPranesh KhambeNo ratings yet

- Differences Between Services and GoodsDocument21 pagesDifferences Between Services and GoodsPranesh KhambeNo ratings yet

- Process CostingDocument12 pagesProcess CostingPranesh KhambeNo ratings yet

- "Innovative Eye of Insurance": Sachin BhandarkarDocument11 pages"Innovative Eye of Insurance": Sachin BhandarkarPranesh KhambeNo ratings yet

- TRMDocument2 pagesTRMPranesh KhambeNo ratings yet

- ADR&GDRDocument18 pagesADR&GDRPranesh KhambeNo ratings yet

- Industrial RelationsDocument6 pagesIndustrial RelationsPranesh KhambeNo ratings yet

- Differences Between Services and GoodsDocument21 pagesDifferences Between Services and GoodsPranesh KhambeNo ratings yet

- SUB: Financial Market: Pre & Post Era of Banking Sector in IndiaDocument19 pagesSUB: Financial Market: Pre & Post Era of Banking Sector in IndiaPranesh KhambeNo ratings yet

- Health CareDocument14 pagesHealth CarePranesh KhambeNo ratings yet

- GlobalizationDocument20 pagesGlobalizationPranesh KhambeNo ratings yet

- History of Indian ArtDocument3 pagesHistory of Indian ArtPranesh Khambe100% (1)

- GlobalizationDocument20 pagesGlobalizationPranesh KhambeNo ratings yet

- GlobalizationDocument20 pagesGlobalizationPranesh KhambeNo ratings yet

- DR Reddy's LabDocument10 pagesDR Reddy's LabTarun GuptaNo ratings yet

- 07 Activity 1-BARIACTODocument2 pages07 Activity 1-BARIACTOdanibariactoNo ratings yet

- Financial Statements: An OverviewDocument41 pagesFinancial Statements: An OverviewGaluh Boga Kuswara100% (1)

- Trinomial Tree 2009Document12 pagesTrinomial Tree 2009shared classroomNo ratings yet

- Gauwelo ProfileDocument9 pagesGauwelo ProfileMONA TECHNo ratings yet

- Chapter 9 - Home WorkDocument8 pagesChapter 9 - Home WorkFaisel MohamedNo ratings yet

- Lat Ch5 SOFP - PT Mirana - Josafat Teguh Iman Sinaga - 023001906001Document2 pagesLat Ch5 SOFP - PT Mirana - Josafat Teguh Iman Sinaga - 023001906001Josafat SinagaNo ratings yet

- CFD Trading Explained For BeginnersDocument14 pagesCFD Trading Explained For BeginnersSimamkele NtwanambiNo ratings yet

- Trading Chart Patterns - Trading Guides - CMC MarketsDocument12 pagesTrading Chart Patterns - Trading Guides - CMC MarketsRohit PurandareNo ratings yet

- Chapter 5 - Teacher's Manual - Far Part 1aDocument9 pagesChapter 5 - Teacher's Manual - Far Part 1aMark Anthony TibuleNo ratings yet

- FINS1613 T1 2019 Week 5 SusanDocument44 pagesFINS1613 T1 2019 Week 5 SusanSharon LiNo ratings yet

- Garp MarchDocument5 pagesGarp MarchZerohedgeNo ratings yet

- KCM Valuation ReportDocument228 pagesKCM Valuation Reportpldev100% (1)

- ACMA Unit 1Document23 pagesACMA Unit 1Subhodeep Roy ChowdhuryNo ratings yet

- Research Methodology Presentation - Group AssignmentDocument11 pagesResearch Methodology Presentation - Group AssignmentsalsabilaharitsaNo ratings yet

- Indirect MethodDocument1 pageIndirect MethodYasir RahimNo ratings yet

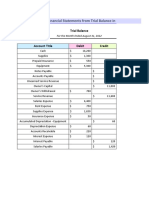

- Prepare Financial Statements From Trial Balance in ExcelDocument5 pagesPrepare Financial Statements From Trial Balance in ExcelShania FordeNo ratings yet

- Islamic Bonds: Learning ObjectivesDocument20 pagesIslamic Bonds: Learning ObjectivesAbdelnasir HaiderNo ratings yet

- Zeeshan Wadiwala ResDocument2 pagesZeeshan Wadiwala Resmba2135156No ratings yet

- FAR04-14 - Basic SHEDocument9 pagesFAR04-14 - Basic SHEAi NatangcopNo ratings yet

- Chapter 03Document33 pagesChapter 03liamNo ratings yet

- 31-The Forex GambitDocument6 pages31-The Forex Gambitlowtarhk100% (1)

- Financial Statements of BMW AgDocument52 pagesFinancial Statements of BMW AgSimranNo ratings yet

- The Term Structure of Interest Rates, Spot Rates, and Yield To MaturityDocument4 pagesThe Term Structure of Interest Rates, Spot Rates, and Yield To MaturityHANSHU LIUNo ratings yet

- ALFM Money Market Fund Key Facts and PerformanceDocument3 pagesALFM Money Market Fund Key Facts and Performanceippon_osotoNo ratings yet

- About Hantec MarketsDocument12 pagesAbout Hantec MarketsSrini VasanNo ratings yet

- 1.4 An Overview of The Capital Allocation Process: Self-TestDocument1 page1.4 An Overview of The Capital Allocation Process: Self-Testadrien_ducaillouNo ratings yet

- Presented By,: Snehal PatelDocument12 pagesPresented By,: Snehal Patelniket0No ratings yet

- Subjects Chapters DOC: I) Ethical and Professional Standards 1.ethics and Trust in The Investment ProfessionDocument2 pagesSubjects Chapters DOC: I) Ethical and Professional Standards 1.ethics and Trust in The Investment ProfessionHanako ChinatsuNo ratings yet

- Ikea Invades America Case StudyDocument3 pagesIkea Invades America Case StudyGeorge ThomasNo ratings yet