Professional Documents

Culture Documents

Practice of - SYED MOUDUD - Bangladesh

Uploaded by

global-marketin8184Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practice of - SYED MOUDUD - Bangladesh

Uploaded by

global-marketin8184Copyright:

Available Formats

International Journal of Accounting and Financial Management Research (IJAFMR) ISSN:2249-6882 Vol.

2, Issue 2 June 2012 14-23 TJPRC Pvt. Ltd.,

PRACTICE OF HUMAN RESOURCE ACCOUNTING IN BANKING SECTOR OF BANGLADESH

SYED MOUDUD-UL-HUQ1 & PANUEL ROZARIO PRINCE 2

Lecturer Department Of Business Administration, Mawlana Bhashani Science And Technology University, Santosh, Tangail. 2 Lecturer, Department Of Business Administration, Victoria University Of Bangladesh, 15/11/APanthapath,Dhaka.

ABSTRACT

Success and failure of corporate undertakings purely depends upon the human resources. Now-adays human resource is a prime concern for all the institutions especially for financial institutions as they have required investing a huge amount of capital. In this context, it is worth while to examine human resource accounting practices in corporate sector i.e. banking sector in Bangladesh. For the convenience of completing the research paper successfully it has been prepared based on a sample of 25 commercial banks and practice of human resource accounting has been measured on five broad indicators which incorporates several sub indicators. In the survey it has found only few banks had mechanism to practice of human resource accounting in 2010 and now in 2011 almost the same number of banks has such mechanism and score improved by .09 due to the some enhancement program in this regard and it has been found that banking sectors in Bangladesh are often alleged as too vague in the issues of practicing human resource accounting. KEY WORDS: Human Resource Accounting (HRA), Practice, Commercial Bank, Indicators, Weighted Scoring Model.

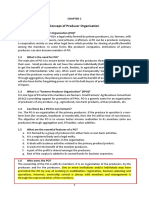

INTRODUCTION

The concept of HRA is one of the branches of modern accounting systems. Earlier, this accounting system developed by an Italian monk, Luca Paciolo who used his analytical skills to discuss the system of double-entry accounting. By laps of time, the span of accounting has been accelerated and as a part of it; the demand of the public and the organizations have turned into diversification in practicing of accounting systems. Most of them want to know the actual cost of human resources and future economic value of human resources because they have required investing a huge amount of capital to develop human resources. As a result of this human resource accounting has been developed.

Practice of Human Resource Accounting in Banking Sector of Bangladesh

15

However, from the various sources of data it is agreed that Rensis Likert, R. Lee Brummet, William C. Pyle and Eric Flamholtz are the most prominent pioneer of developing human resource accounting through formulating of concepts and methods. One outcome of the research (Brummet, Flamholtz & Pyle, 1968) the term Human Resource Accounting was used for the first time. From the analysis of different literatures we see that the practice of HRA has been developed with five phases, these are: 1st phase: (1961-65): Introduction of concepts 2nd phase: (1966-71): Development and formulation of models for HRA. 3rd phase: (1971-76): Growth of research for HRA. 4th phase: (1976-1980): Declining the interest for HRA. 5th phase: (1980 onwards): Improvement of practices. Generally, it is the managerial technique which helps the management to identifying cost for HR and considering its future economic value to the organization so that strategic business decisions can be taken regarding human resources and providing information to the stakeholders. If such accounting is not done, then the management runs the risk of taking decisions that may improve profits in the short run but it will cause immense long term impairment by reducing their productivity and by creating salary distortions across the organizational structure in future. So, by the practicing of HRA an organization can be benefited in case of * cost effectiveness * ensuring the best use of human resources * sound & effective basis for human asset control * Providing information to the stakeholders about, how much value addition is created by the organization to countrys human resource as part of the corporate social responsibility. * Enhancing the internal assets of the particular concern by considering the HR as assets. * The productivity of human resources.

Though the practice of HRA is enough significant to implement in any organization but from the early stage of practicing HRA is struggling and vague in the issues of acceptance over the world. As a

16

Syed Moudud-Ul-Huq & Panuel Rozario Prince

part of it Bangladesh and its corporate culture has not yet been improved this practice at such satisfactory level. Hopefully, it can be said that many organizations in Bangladesh has become aware of the application of HRA and they realized that the practice of this mechanism will improve the quality of human resources by considering their future earnings power. They also realized that if they can implement this practice within the boundaries of organization then it can prevent the misuse and underuse due to thoughtless, rather reckless transfers, demotions, lay-offs and day to day maltreatment by supervisors or other superiors in the administrative hierarchy, efficient allocation of resources in the economy, effecting economy and efficiency in the use of human resources and proper understanding of the evil effects of avoidable labor unrest on the quality of internal human resources. Specially, the majority responses of practicing HRA in Bangladesh increasing from financial institutions; where human resources are the main elements to flourish the economy.

OBJECTIVES

In this paper an initiative has been taken to evaluate the present state of practicing HRA and to determine the barriers and remedies for implementing HRA practice in banking sector of Bangladesh.

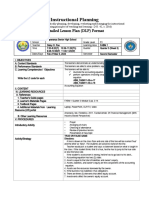

METHODOLOGY

As this study is pragmatic one, it uses primary and secondary data analysis to assess the practice of HRA of financial institutions (i.e. commercial banks) in Bangladesh. For conducting this study we have randomly selected 25 commercial banks out of 44 commercial banks. We have been composed data from various books, journals, articles, published literature, periodical and annual reports. Moreover, we have been collected data from the skilled personnel of HRD and Finance and Accounts Dept. of various commercial banks through providing semi-structured questionnaire. This paper has been analyzed by using Weighted Factor Scoring Model on the basis of five broad indicators along with its some of subindicators and considered the data in between 2010 and 2011 in order to make this research work more informative and reliable.

EXPLANATION OF INDICATORS

To measure the status of human resource accounting practice in banking sector five indicators have been used. These are as follows Nature of HRA- This indicator is used to get the idea about the priority concern of banks towards practicing HRA.

Practice of Human Resource Accounting in Banking Sector of Bangladesh

17

Valuation of HR- This indicators focus on about the valuation of HR with help of cost approach, economic value addition approach or the other approach i.e. NPV approach or standard cost approach.

Financial statement and HRA- This indicator indicates the treatment of cost for HR (i.e. the cost for recruitment, selection, hiring, training and development of human assets). It also indicates whether the transparency and financial accounting disclosure followed by the bank or not about HRA.

Auditing Practice- This indicator indicates that the practice of auditing in consideration of HR.

Enhancement program for practicing of HRA- It indicates the training program to make the people understand about the concept of HRA and make them cautious about the benefit for practicing HRA in the organizations.

These indicators are developed for the convenience of making this paper more relevant and reliable (included with sub-indicators: details are provided with responses in the table no-1) to get the idea of level of practicing HRA in banking sectors in Bangladesh. Indicators have been prepared in light of relevant issues of practicing HRA. Here an initiative has been taken to get idea whether any progress has taken place in the area of practicing HRA in banking sector of Bangladesh.

WEIGHT ALLOCATIOON AND SCORING OF INDICATORS

All five indicators are equally weighted in case of scoring overall score and each sub indicator is also equally weighted to score each indicator. For example to calculate the score of the indicator titled as Nature of HRA there are three sub indicators: 1st is Having the priority concern of banks towards practicing of HRA, the 2nd is Having any designated person assigned or any department in the bank and the last one is Having any isolated segment of cost regarding HR and these three sub indicators are weighted equally. Here is to be noted that the third indicators have two sub indicators but the first sub indicator Application of cost for HR have different dimensions and all the dimensions of this sub indicator is weighted equally and then consider the second sub indicator for allocation of weight. In this manner according to the nature of response score has been allocated to each indicator as the score can be attributed a well balanced reflection of reality. Following weighted Factor Scoring Model is used to calculate the score of each indicator and the overall score.

18

Syed Moudud-Ul-Huq & Panuel Rozario Prince

Here, Si = Total score Sij = Score of the jth indicator in case of overall score and score of the jth sub indicator in case of each indicator. Wj = Weight of the jth indicator in case of overall score and weight of the jth sub indicator in case of each indicator. Score is calculated on scale of 1.00

FINDINGS AND ANALYSIS

To get the idea of level of practicing HRA in banking sectors in Bangladesh five indicators have been prepared in light of relevant issues of practicing HRA which has already been mentioned earlier. However, to analyze the present state of practicing HRA the table-1 shows the responses of practicing HRA on each indicator. Table 1 The number of responses of practicing HRA on each indicator.

Indicator 1.0 Nature of HRA 1.1 Having the priority concern of banks towards practicing of HRA 1.2 Having any designated person assigned or any department in the bank) 1.3 Having any isolated segment of cost regarding HR 2.0 Valuation of HR 2.1 Cost Approach 2.2 EVA Approach 2.3 Others

2010

2011

4 0 2

10 2 5

25 0 0

20 2 3

Practice of Human Resource Accounting in Banking Sector of Bangladesh

19

3.0 Financial statement and HRA 3.1 Application of cost for HR: 3.1.1 Income Statement Item 3.1.2 Balance Sheet Item as Assets (i.e. intangible or other assets) 3.2 Transparency and financial accounting disclosure about HRA (voluntary) 4.0 Auditing Practice 4.1 Regular practice of auditing 4.2 Is there any emphasis to asses the value of HR? 4.3 Is there any practice of auditing about HRA? 5.0 Enhancement program for practicing of HRA 25 1 0 0 25 4 0 4 23 2 0 20 5 5

The priority concern of banks towards practicing of HRA is increasing in 2011 than the year 2010. There is no assigned department to handle this technique to implement in recent past. In case of valuation of HR only two banks apply the EVA approach where 20 banks follow the historical cost approach or traditional approach of accounting. It is necessary to mention that 5 banks recently move the cost for HR to treat them as assets and shown in balance sheet where the other shown in income statement as revenue expenditure under the head of human resource development cost or other expenses. As the treatment of this in income statement, it doesnt show the actual financial position of the concern and it leads to decline the profit. Financial statement of each bank is audited by the qualified chartered accountants. But it is a matter of stun and awe that there is no ground measurement for valuation of HR or no practice of auditing regarding with HRA. In recent year four banks has given the emphasis to asses the value of HR. In accordance with the greater consciousness of few banks it undertakes some enhancement program to implement HRA as a measuring tool of HR and treat them as valuable assets. From the table-2 it is found that in 2010 among the five indicators Enhancement program for practicing of HRA the fifth indicator scored the marginal but in 2011 it has scored to its highest extent that means 0.16. This has happened because of increasing the importance at the top level of management about the practice of HRA but this not enough to implement HRA it requires a complete guidelines by IFRS and IAS.

20

Syed Moudud-Ul-Huq & Panuel Rozario Prince

Table 2 This table provides the score on each indicator and overall practice of HRA in the bank. Indicator Nature of HRA Valuation of HR Financial statement and HRA Auditing Practice Enhancement program for practicing of HRA Grand Score Score-2010 0.08 0.33 0.25 0.35 0.00 0.20 Score-2011 0.23 0.33 0.35 0.39 0.16 0.29 Improvement 0.15 0.00 0.10 0.04 0.16 0.09

However, this process is not all perfect as there are some deviations. Have a close look on the indicators Nature of HRA and Financial statement and HRA it can be observed that level of progress has taken in two years (from 2010 to 2011) by 0.15 and 0.10 and the indicators score were 0.08 (2010), 0.23 (2011) and 0.25 (2010), 0.35 (2011) respectively. There is no improvement of second indicator while the third indicator slightly moves positively. Organizations success not only depends on efficiency of professional management body it is also very important to have a mechanism to practice of HRA. In the survey it has found only few banks had such mechanism in 2010 and now in 2011 almost the same number of banks has such mechanism and score improved by .09 in this regard. The overall practice of HRA in banking sector has not yet been at the satisfactory level because most of the resource personnel dont have the clear concept of HRA. In this point of view it is limited within the circle of complexities in the issues of its implementation.

BARRIERS FOR IMPLEMENTING HRA PRACTICE IN BANKING SECTOR

The problems involved for implementing HRA practice are as follows: Quantification of human resource: There is no specific measurement tool. Since the productive life of HR is uncertain, future benefit derived by him also is uncertain. As the useful life of human resources is uncertain, amortization of human resource cost is not possible. Lack of standard norms: There are no standard norms in case of practicing HRA as like as finance or accounting with which actual performance can be compared. Supremacy of financial accounting: Where the existence of financial accounting the interest of practicing HRA resulting the poor scope to implement.

Practice of Human Resource Accounting in Banking Sector of Bangladesh

21

Additional cost: Most of the financial analyst think the practice of HRA require the additional cost which lead the concern become expensive and non-profitable.

Poor concept of HRA: Resource personnel in the vital areas of business functions i.e. human resource, marketing, production, planning and development are unable to understand and recognize accounting as well as finance functions of an organization. But the case is different in case of human resource in the areas of finance and accounting. These human resources know the wide scope of finance and accounting and they do accordingly to their level best. But unfortunately in the context of Bangladesh the different people took place in the bank that have different educational background as these the human resource managers have little knowledge of HRA that is not enough to improve of practicing HRA in regular basis.

Lack of international accounting standard regarding HRA: Accounting has been developed day to day and it innovate new branches of accounting and issues new standard but still there is no complete and reliable standard of practicing HRA.

Lack of guidelines of BB towards practicing HRA: BB has not yet undertaken initiatives to practice HRA mandatory at all financial institutions (i.e. commercial banks) and disclose all about the information of HR for transparency.

SUGGESTIONS TO OVERCOME THE BARRIERS FOR IMPLEMENTING HRA PRACTICE IN BANKING SECTOR

The probable suggestions to overcome the barriers for implementing HRA practice in banking sectors are as follows: Quantification of human resources problem may be solved by applying economic value approach or present value approach. HRA is a modern branch of accounting so it is required the standard norms like accounting and finance with which actual performance can be compared. By giving the emphasis to practice of HRA more in the various concern then the banks can assist to formulate a standard for its own. Supremacy of financial accounting can alleviate by making the human resources more conscious about the significance of practicing human resource accounting. The perception of the financial analysts should be changed towards to the practice of HRA because the practice of HRA may lead the cost at bearable limit in the short-run but it will lead the maximum benefit in the long-run. At least a designated person or a department should be assigned in practicing of HRA in the bank.

22

Syed Moudud-Ul-Huq & Panuel Rozario Prince

The period of amortization of human resource assets may be taken as the certain percentage of effective useful life of the individual personnel of the organization.

By enforcing law, legislative problem of practicing HRA may be solved. International Accounting Standards Board should develop and issue standards immediately regarding the practice of HRA.

The Ministry of Finance should be into the driving force in promoting the HRA practices in public sector as well as in private sector financial and non-financial organizations. Moreover, the Ministry of Finance should set follow-up actions to further promote the introduction and implementation of the HR-statements, follow and support the completing of the HRstatements, carry out the necessary HRA development programs, take care of education and training, and provide information for comparison.

Bangladesh Bank should undertake initiatives to practice of HRA obligatory at all financial institutions (i.e. commercial banks) and disclose all about the information of HR for transparency. This central bank should provide guidelines for HRA as it has provided earlier which really a better path to perform in the competitive environment.

Above all the commercial banks should come forward towards to practicing HRA and set their facilities which supports to maintain HRA.

CONCLUSIONS

The commercial banks in Bangladesh are a long away from the touch of proper practicing of Human Resource Accounting. In addition, banking sectors of Bangladesh are often alleged as too vague in the issues of practicing human resource accounting along with a series of problems to implement. But, if the banks can formulate standards according to their priority basis to compare the actual performance, undertake training and development programs for better understand the utility of practicing HRA, Bangladesh Bank provides guidelines towards to practicing HRA, IASB issues a standard for implementing HRA, then the problems of practicing HRA can alleviate soon and commercial banks in Bangladesh may continue to boost the economy.

REFERENCES

a) Rahman. Abdur (2005): Human Resource Accounting its Reporting Practices, Pakistan Journal of Social Science, Vol. 3(6), p (889-891) b) Maria L. Bullen and Kel-Ann Eyler, Human resource accounting and international developments: implications for measurement of human capital, Journal of International Business and Cultural Studies, p2

Practice of Human Resource Accounting in Banking Sector of Bangladesh

23

c)

Anita Mishra and Monalika Rath, Role and Significance of Human Resource Accounting in the Era of Economic Recession, Global Institute of Management, Bhubaneswar, India

d) American Accounting Association Committee of Accounting for Human Resources (1973): Report of the Committee on Human Resource Accounting, The Accounting review Supplement to vol. XLVIII e) D. Prabhakar Rao (1993): Human Asset Accounting: An Evaluation of the Indian Practices, ASCI Journal of Management, Vol. 22 f) Eric G. Flamholtz (1971): A Model for Human Resource Valuation: A Stochastic Process with Service Rewards, The Accounting Review April g) Eric G. Flamholtz (1999; Third edition): Human Resource Accounting: Advances in Concepts, Methods and Applications, Kulwer Academic Publishers h) Karl-Erik Sveiby (2004): Methods for Measuring Intangible Assets, Retrieved from http://www.sveiby.com/articles/Intangible Methods. htm.

i)

Lev B, Schwartz B A (1971): On the Economic Concept of Human Capital in Financial Statements, The Accounting Review, January

j)

Likert R. (1971, May): Human Organizational Measurements: Key to Financial Success, Michigan Business Review, p1-5

k) R.G.Barry Corporation (1971): Annual Report, (Details in Flamholtz 1999) l) Gunnar Rimmel (2004): Perceptions of Human Resource Disclosures - Evidence from Annual Report Users of Two Corporations, Journal of Financial Reporting, Regulation and Governance m) Smith Jr., J. M. and Skousen, K. F. (1995): Intermediate Accounting, (Latest edition), (Comprehensive Volume), College Division, South-Western Pub. Co.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Federal Income Tax Outline Formula6Document2 pagesFederal Income Tax Outline Formula6Greg Beal100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Magazine Publishing Business PlanDocument60 pagesMagazine Publishing Business PlanChuck Achberger100% (4)

- Management Accounting SCDLDocument7 pagesManagement Accounting SCDLJeet Kathuria100% (1)

- An Analysis - Deepak Srivastava - Dual - IjbmrDocument8 pagesAn Analysis - Deepak Srivastava - Dual - Ijbmrglobal-marketin8184No ratings yet

- Brand Familiarity - Suresh K - UnpaidDocument6 pagesBrand Familiarity - Suresh K - Unpaidglobal-marketin8184No ratings yet

- A STUDY - Senthil NathanDocument17 pagesA STUDY - Senthil Nathanglobal-marketin8184No ratings yet

- Impact - Sakshi ModiDocument9 pagesImpact - Sakshi Modiglobal-marketin8184No ratings yet

- The DOUBLE-EDGE - Olutayo Otubanjo - NigeriaDocument12 pagesThe DOUBLE-EDGE - Olutayo Otubanjo - Nigeriaglobal-marketin8184No ratings yet

- The ROLE - Richard RemediosDocument9 pagesThe ROLE - Richard Remediosglobal-marketin8184No ratings yet

- Effect of - Himanshu GuptaDocument13 pagesEffect of - Himanshu Guptaglobal-marketin8184No ratings yet

- FDI IN - Rama VDocument9 pagesFDI IN - Rama Vglobal-marketin8184No ratings yet

- The Battle of - Shivakanth ShettyDocument16 pagesThe Battle of - Shivakanth Shettyglobal-marketin8184No ratings yet

- Assess 1Document7 pagesAssess 1global-marketin8184No ratings yet

- Motivating Factors For Job Choice: Tool To Acquire & Retain Talent in The OrganizationDocument12 pagesMotivating Factors For Job Choice: Tool To Acquire & Retain Talent in The Organizationglobal-marketin8184No ratings yet

- Organizational - Vimala BDocument12 pagesOrganizational - Vimala Bglobal-marketin8184100% (1)

- Organization Change - Kahirol Mohd Salleh - Usa - PaidDocument12 pagesOrganization Change - Kahirol Mohd Salleh - Usa - Paidglobal-marketin8184100% (2)

- Human Resource - Srinibash Dash - PaidDocument17 pagesHuman Resource - Srinibash Dash - Paidglobal-marketin8184No ratings yet

- HOW A TEACHER - Ratish Kakkad - UnpaidDocument10 pagesHOW A TEACHER - Ratish Kakkad - Unpaidglobal-marketin8184No ratings yet

- Human Chalenges - Arun Behera - Dual - IJTFT - PaidDocument13 pagesHuman Chalenges - Arun Behera - Dual - IJTFT - Paidglobal-marketin8184No ratings yet

- CASTING - Rajesh PurohitDocument19 pagesCASTING - Rajesh Purohitglobal-marketin8184No ratings yet

- Service Standards - G Sivaramakrishnan - PaidDocument12 pagesService Standards - G Sivaramakrishnan - Paidglobal-marketin8184No ratings yet

- A STUDY On - G Sivaramakrishnan - PaidDocument12 pagesA STUDY On - G Sivaramakrishnan - Paidglobal-marketin8184No ratings yet

- Various Factors - Prahallada - PaidDocument20 pagesVarious Factors - Prahallada - Paidglobal-marketin8184No ratings yet

- A Study - Ts PrasannaDocument10 pagesA Study - Ts Prasannaglobal-marketin8184No ratings yet

- A Study of - Bs SavantDocument6 pagesA Study of - Bs Savantglobal-marketin8184No ratings yet

- A Study - Divya GuptaDocument9 pagesA Study - Divya Guptaglobal-marketin8184No ratings yet

- Business Process Reengineering in Malaysian Higher Education InstitutionsDocument6 pagesBusiness Process Reengineering in Malaysian Higher Education Institutionsglobal-marketin8184No ratings yet

- Mathematical - Bijan Krishna SDocument13 pagesMathematical - Bijan Krishna Sglobal-marketin8184No ratings yet

- An Analysis - Deepak Srivastava - Dual - IjrmrDocument8 pagesAn Analysis - Deepak Srivastava - Dual - Ijrmrglobal-marketin8184No ratings yet

- Credit Standards - G Sivaramakrishnan - PaidDocument11 pagesCredit Standards - G Sivaramakrishnan - Paidglobal-marketin8184No ratings yet

- NONWOVEN - Vinay Kumar MidhaDocument11 pagesNONWOVEN - Vinay Kumar Midhaglobal-marketin8184No ratings yet

- Human Chalenges - Arun Behera - Dual - IJHRMR - PaidDocument14 pagesHuman Chalenges - Arun Behera - Dual - IJHRMR - Paidglobal-marketin8184No ratings yet

- Departmental Interpretation and Practice Notes No. 34 (Revised)Document14 pagesDepartmental Interpretation and Practice Notes No. 34 (Revised)Difanny KooNo ratings yet

- Land Acquisition by Housing Societies Through Illegal Contracts Cannot Be Legalised 2012 SCDocument112 pagesLand Acquisition by Housing Societies Through Illegal Contracts Cannot Be Legalised 2012 SCSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್No ratings yet

- DLP Fundamentals of Accounting 1 - Q3 - W3Document5 pagesDLP Fundamentals of Accounting 1 - Q3 - W3Daisy PaoNo ratings yet

- IRRI AR 2013 Audited Financial StatementsDocument62 pagesIRRI AR 2013 Audited Financial StatementsIRRI_resourcesNo ratings yet

- Fpo TranslationDocument28 pagesFpo TranslationprasunaNo ratings yet

- NYU Langone Q3 2019Document17 pagesNYU Langone Q3 2019Jonathan LaMantiaNo ratings yet

- Chart of AccountsDocument6 pagesChart of AccountsJenniferNo ratings yet

- Accounting Assignment 2Document4 pagesAccounting Assignment 2robertlim96No ratings yet

- Trend and Common Sized Analysis of Tagaytay CorporationDocument9 pagesTrend and Common Sized Analysis of Tagaytay CorporationKathlyn TajadaNo ratings yet

- 8.) Chapter 4Document32 pages8.) Chapter 4CA Chhavi GuptaNo ratings yet

- BPC Annual Report Highlights 2010Document38 pagesBPC Annual Report Highlights 2010Thakoon KumutNo ratings yet

- Singapore AirlinesDocument38 pagesSingapore Airlinesyesarmin100% (1)

- KEDC 2019 Financial StatementsDocument18 pagesKEDC 2019 Financial StatementsPhạm Thảo Vân100% (1)

- BofA Intake Sheet 092008Document2 pagesBofA Intake Sheet 092008Clint CarterNo ratings yet

- Financial Statement Analysis 11th Edition Subramanyam Solutions Manual DownloadDocument60 pagesFinancial Statement Analysis 11th Edition Subramanyam Solutions Manual DownloadDavid Williams100% (21)

- Module 4 - INTACC2 Intangible AssetsDocument20 pagesModule 4 - INTACC2 Intangible AssetsKhan TanNo ratings yet

- Analysis of Financial StatementsDocument208 pagesAnalysis of Financial StatementsThabo KholoaneNo ratings yet

- Full Download Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions ManualDocument36 pagesFull Download Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions Manualdrizitashao100% (43)

- Jimmy Lim - Perbaikan UAS ICAEWDocument9 pagesJimmy Lim - Perbaikan UAS ICAEWJimmy LimNo ratings yet

- SOCI Financial Statements Per 31 Dec 2022Document125 pagesSOCI Financial Statements Per 31 Dec 2022KhresnaNo ratings yet

- Chapter 1Document31 pagesChapter 1VirencarpediemNo ratings yet

- Case 1Document18 pagesCase 1Amit Kanti RoyNo ratings yet

- t1229 Fill 23eDocument2 pagest1229 Fill 23eShiblee Khalid AhmodNo ratings yet

- Construction AuditDocument6 pagesConstruction AuditHatem Hejazi100% (1)

- ITAD BIR Ruling No. 007-16 Dated March 4, 2016 - Business ProfitsDocument11 pagesITAD BIR Ruling No. 007-16 Dated March 4, 2016 - Business ProfitsKriszanFrancoManiponNo ratings yet

- Lease - Lessee's Perspective: Lecture NotesDocument9 pagesLease - Lessee's Perspective: Lecture NotesDonise Ronadel SantosNo ratings yet

- Adjusting Entries ActsDocument5 pagesAdjusting Entries ActsLori100% (1)