Professional Documents

Culture Documents

Foreign Institutional Investment

Uploaded by

Hamza ShaikhOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Foreign Institutional Investment

Uploaded by

Hamza ShaikhCopyright:

Available Formats

Indian Markets have been one of the most attractive investment places for the FII's.

India being a developing nation attracts the foreign flows looking at the growth potential in the Indian Economy. The FII's contribute a major chunk of volumes on the Indian bourses and this in turn impacts the market moves. In case of recession in the world economies, the foreign investors look for saver bets and India with a rising GDP where other nations GDP / Growth is shrinking has always offered greater investment avenues. Indian Markets have been the clear outperformers vis-a-vis the global markets in the past years.

Introduction to Foreign Institutional Investors (FIIs)

Since 1990-91, the Government of India embarked on liberalization and economic reforms with a view of bringing about rapid and substantial economic growth and move towards globalization of the economy. As a part of the reforms process, the Government under its New Industrial Policy revamped its foreign investment policy recognizing the growing importance of foreign direct investment as an instrument of technology transfer, augmentation of foreign exchange reserves and globalization of the Indian economy. Simultaneously, the Government, for the first time, permitted portfolio investments from abroad by foreign institutional investors in the Indian capital market. The entry of FIIs seems to be a follow up of the recommendation of the Narsimhan Committee Report on Financial System. While recommending their entry, the Committee, however did not elaborate on the objectives of the suggested policy. The committee only suggested that the capital market should be gradually opened up to foreign portfolio investments. From September 14, 1992 with suitable restrictions, Foreign Institutional Investors were permitted to invest in all the securities traded on the primary and secondary markets, including shares, debentures and warrants issued by companies which were listed or were to be listed on the Stock Exchanges in India. While presenting the Budget for 1992-93, the then Finance Minister Dr. Manmohan Singh had announced a proposal to allow reputed foreign investors, such as Pension Funds etc., to invest in Indian capital market.

Foreign Institutional Investment As defined by the European Union Foreign Institutional Investment is an investment in a foreign stock market by the specialized financial intermediaries managing savings collectively on behalf of investors, especially small investors, towards specific objectives in term of risk, return and maturity of claims. SEBIs Definition of FIIs presently includes foreign pension funds, mutual funds, charitable/endowment/university funds, asset management companies and other money managers operating on their behalf in a foreign stock market. Foreign institutional investment is liquid nature investment, which is motivated by international portfolio diversification benefits for individuals and institutional investors in industrial country. Currently, the following entities are eligible to invest under FII route:

Currently, entities eligible to invest under the FII route are as follows:

As FII: Overseas pension funds, mutual funds, investment trust, asset management company, nominee company, bank, institutional portfolio manager, university funds, endowments, foundations, charitable trusts, charitable societies, a trustee or power of attorney holder incorporated or established outside India proposing to make proprietary investments or with no single investor holding more than 10 per cent of the shares or units of the fund.

As Sub-accounts: The sub account is generally the underlying fund on whose behalf the FII invests. The following entities are eligible to be registered as sub-accounts, viz. partnership firms, private company, public company, pension fund, investment trust, and individuals. A domestic portfolio manager or a domestic asset management company shall also be eligible to be registered as FII to manage the funds of sub-accounts.

FIIs registered with SEBI fall under the following categories: Regular FIIs- those who are required to invest not less than 70 % of their investment in equity-related instruments and 30 % in non-equity instruments. 100 % debt-fund FIIs- those who are permitted to invest only in debt instruments.

Who can be registered as an FII?

The applicant should be any of the following categories: 1. Pension funds 2. Mutual funds 3. Investment trust 4. Insurance or reinsurance companies 5. Endowment funds 6. University funds 7. Foundations or charitable trusts or charitable societies who propose to invest on their own behalf and a) Asset management companies b) Nominee companies c) Institutional portfolio managers d) Trustees e) Power of attorney holders f) Bank Who propose to invest their proprietary funds or on behalf of broad based funds or on of foreign corporate and individuals.

Prohibitions on Investments: Foreign Institutional Investors are not permitted to invest in equity issued by an Asset Reconstruction Company. They are also not allowed to invest in any company which is engaged or proposes to engage in the following activities:

Business of chit fund Nidhi Company Agricultural or plantation activities

Real estate business or construction of farm houses (real estate business does not include development of townships, construction of residential/commercial premises, roads or bridges)

FII Activity for previous years Year Gross Purchase Gross Sale 270,034.00 613,770.80 633,017.10 540,814.70 774,594.30 743,392.00 439,084.10 238,840.90 146,706.80 63,953.50 42,849.80 Net Investment 42,263.30 -2,714.20 133,266.80 83,424.20 -52,987.40 71,486.30 36,540.20 47,181.90 38,965.80 30,459.00 3,629.60

2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002

312,297.50 611,055.60 766,283.20 624,239.70 721,607.00 814,877.90 475,624.90 286,021.40 185,672.00 94,412.00 46,479.10

Number of registered FIIs

According to the latest data available with SEBI, there are 1,728 registered FIIs and 5,726 subaccounts. FIIs are entities established or incorporated outside India who propose to make investment in India while sub-account includes those foreign corporates, foreign individuals, and institutions, funds or portfolios established or incorporated outside India on whose behalf investments are proposed to be made in India by a FII.

You might also like

- NEW CREW Fast Start PlannerDocument9 pagesNEW CREW Fast Start PlannerAnonymous oTtlhP100% (3)

- Collaboration Live User Manual - 453562037721a - en - US PDFDocument32 pagesCollaboration Live User Manual - 453562037721a - en - US PDFIvan CvasniucNo ratings yet

- AE383LectureNotes PDFDocument105 pagesAE383LectureNotes PDFPoyraz BulutNo ratings yet

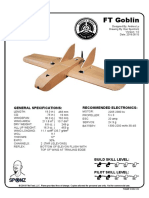

- FT Goblin Full SizeDocument7 pagesFT Goblin Full SizeDeakon Frost100% (1)

- Foreign Institutional InvestmentDocument61 pagesForeign Institutional InvestmentPrashantChauhanNo ratings yet

- Understanding Foreign Institutional Investors in IndiaDocument24 pagesUnderstanding Foreign Institutional Investors in IndiaPreeja ChandranNo ratings yet

- Final Economics ProjectDocument15 pagesFinal Economics ProjectNishant ShahNo ratings yet

- FIIs & HR Issues in IndiaDocument8 pagesFIIs & HR Issues in IndiaJayneel JadejaNo ratings yet

- FII guide on foreign investmentDocument11 pagesFII guide on foreign investmentMvs LegerdemainNo ratings yet

- FII Vs FDIDocument10 pagesFII Vs FDIChetan HardikarNo ratings yet

- Role of FIIs in Indian Stock MarketDocument25 pagesRole of FIIs in Indian Stock MarketWise MoonNo ratings yet

- The Role of FIIDocument3 pagesThe Role of FIIkushalsaxenaNo ratings yet

- Impact of FII's On Indian Stock Markets: ManagementDocument5 pagesImpact of FII's On Indian Stock Markets: ManagementpriyakedNo ratings yet

- Notes of Security Market Operations FiiDocument5 pagesNotes of Security Market Operations FiiHilal AhmadNo ratings yet

- Sources of Foreign CapitalDocument16 pagesSources of Foreign Capitalaayush_vermadei100% (1)

- FII Flows Could Increase in Spells, Says RBI: The Securities and Exchange Board of India DataDocument11 pagesFII Flows Could Increase in Spells, Says RBI: The Securities and Exchange Board of India DataPooja MaanNo ratings yet

- Foreign Investor ProjectDocument22 pagesForeign Investor ProjectwaghaNo ratings yet

- Role of Fii in Share MarketDocument7 pagesRole of Fii in Share MarketMukesh Kumar MishraNo ratings yet

- Fii TheoryDocument9 pagesFii TheorybabansalunkeNo ratings yet

- Foreign Direct InvestmentDocument6 pagesForeign Direct Investmentrohitalbert5No ratings yet

- FIIs Role in Indian Stock MarketsDocument38 pagesFIIs Role in Indian Stock MarketsKhushbu GosherNo ratings yet

- Mohan Babu Final ProjectDocument50 pagesMohan Babu Final ProjectMohan Babu Nandyala0% (1)

- Foreign Capital: FDI, ECB, Indian Investments AbroadDocument13 pagesForeign Capital: FDI, ECB, Indian Investments AbroadrishugNo ratings yet

- Industry Prof PraDocument23 pagesIndustry Prof Prabalki123No ratings yet

- ProjectDocument16 pagesProjectnazir7864No ratings yet

- FII and FDIDocument24 pagesFII and FDIbhumika_shah_9No ratings yet

- Indian stock markets overview and analysis of foreign investorsDocument15 pagesIndian stock markets overview and analysis of foreign investorsjagdish002No ratings yet

- Sources of International Finance: Official and Non-Official SourcesDocument29 pagesSources of International Finance: Official and Non-Official SourcesghanjuNo ratings yet

- UNIT 4 Teaching PracticeDocument15 pagesUNIT 4 Teaching PracticeRishabh JainNo ratings yet

- F-69 FinanceDocument7 pagesF-69 FinanceNikita RaoNo ratings yet

- IMPACT OF FOREIGN INSTITUTIONAL INVESTORS (FIIs) AND MACRO ECONOMIC FACTORS ON INDIAN STOCK MARKETSDocument27 pagesIMPACT OF FOREIGN INSTITUTIONAL INVESTORS (FIIs) AND MACRO ECONOMIC FACTORS ON INDIAN STOCK MARKETSece_shreyas100% (2)

- Impact of Foreign Institutional Investment On Stock MarketDocument15 pagesImpact of Foreign Institutional Investment On Stock MarketVivek SahNo ratings yet

- FIIs in India: Role and ImpactDocument13 pagesFIIs in India: Role and ImpactNilam SawantNo ratings yet

- On Fdi and FiiDocument18 pagesOn Fdi and FiisrisaiuniversityNo ratings yet

- International Business: Foreign Direct InvestmentDocument23 pagesInternational Business: Foreign Direct InvestmentKapil PrabhuNo ratings yet

- Group-6 Presentation On FIIDocument42 pagesGroup-6 Presentation On FIIPankaj Kumar Bothra100% (1)

- What Institutional Investor Means and Why It's Important for Investment ManagementDocument12 pagesWhat Institutional Investor Means and Why It's Important for Investment ManagementawakerashmiNo ratings yet

- Foreign Portfolio Investment in IndiaDocument27 pagesForeign Portfolio Investment in IndiaSiddharth ShindeNo ratings yet

- L Project of FiiDocument53 pagesL Project of Fiimanisha_mithibaiNo ratings yet

- Project Title "Impact of Fii'S On Indian Stock Market"Document12 pagesProject Title "Impact of Fii'S On Indian Stock Market"Ganaie AhmadNo ratings yet

- Foreign Investment in India: An OverviewDocument25 pagesForeign Investment in India: An Overviewsonakshi100% (1)

- Foreign Institutional Investors in India: An OverviewDocument46 pagesForeign Institutional Investors in India: An OverviewPrince RajNo ratings yet

- Foreign Investment Regime in IndiaDocument4 pagesForeign Investment Regime in IndiaKriti KaushikNo ratings yet

- FII, BongoDocument9 pagesFII, BongomanoranjanpatraNo ratings yet

- Advantages FIIDocument10 pagesAdvantages FIIjatankitNo ratings yet

- Eco 2016 FiiDocument29 pagesEco 2016 FiiishanNo ratings yet

- FII Investment in IndiaDocument2 pagesFII Investment in IndiapoojathxNo ratings yet

- IEBDocument25 pagesIEBAnkit Kumar SinhaNo ratings yet

- Development of Venture Capital in IndiaDocument29 pagesDevelopment of Venture Capital in IndiaĄrpit RāzNo ratings yet

- First Chapter ManjuDocument14 pagesFirst Chapter ManjuManju MessiNo ratings yet

- Foreign Institutional InvestorsDocument15 pagesForeign Institutional InvestorsJagritiChhabraNo ratings yet

- FII (Foreign Institutional Investor) in India and Its Impact On Indian Stock Market For Last Five YearsDocument37 pagesFII (Foreign Institutional Investor) in India and Its Impact On Indian Stock Market For Last Five YearsAbhishek RathodNo ratings yet

- Economics ProjectDocument7 pagesEconomics ProjectelizaroyNo ratings yet

- Unit V FMDocument35 pagesUnit V FMHR HMA TECHNo ratings yet

- Fdi and FiiDocument19 pagesFdi and FiiManju TripathiNo ratings yet

- Assignment On IbDocument11 pagesAssignment On IbRajashree MuktiarNo ratings yet

- Origin of Venture Capital FinancingDocument26 pagesOrigin of Venture Capital FinancingTejal GuptaNo ratings yet

- ChinchuDocument19 pagesChinchuAnu AndrewsNo ratings yet

- Presentation On: Venture Capital & SebiDocument14 pagesPresentation On: Venture Capital & Sebivineeta4604No ratings yet

- Investing Made Easy: Finding the Right Opportunities for YouFrom EverandInvesting Made Easy: Finding the Right Opportunities for YouNo ratings yet

- Learning HotMetal Pro 6 - 132Document332 pagesLearning HotMetal Pro 6 - 132Viên Tâm LangNo ratings yet

- Leases 2Document3 pagesLeases 2John Patrick Lazaro Andres100% (1)

- Internship Report Recruitment & Performance Appraisal of Rancon Motorbikes LTD, Suzuki Bangladesh BUS 400Document59 pagesInternship Report Recruitment & Performance Appraisal of Rancon Motorbikes LTD, Suzuki Bangladesh BUS 400Mohammad Shafaet JamilNo ratings yet

- Teleprotection Terminal InterfaceDocument6 pagesTeleprotection Terminal InterfaceHemanth Kumar MahadevaNo ratings yet

- Elaspeed Cold Shrink Splices 2010Document3 pagesElaspeed Cold Shrink Splices 2010moisesramosNo ratings yet

- Siemens Documentation - Modeling ComponentsDocument1 pageSiemens Documentation - Modeling ComponentsanupNo ratings yet

- Emperger's pioneering composite columnsDocument11 pagesEmperger's pioneering composite columnsDishant PrajapatiNo ratings yet

- The Value of Repeat Biopsy in SLEDocument8 pagesThe Value of Repeat Biopsy in SLESergio CerpaNo ratings yet

- Civil Aeronautics BoardDocument2 pagesCivil Aeronautics BoardJayson AlvaNo ratings yet

- I. ICT (Information & Communication Technology: LESSON 1: Introduction To ICTDocument2 pagesI. ICT (Information & Communication Technology: LESSON 1: Introduction To ICTEissa May VillanuevaNo ratings yet

- MCDO of Diesel Shed, AndalDocument12 pagesMCDO of Diesel Shed, AndalUpendra ChoudharyNo ratings yet

- Tata Group's Global Expansion and Business StrategiesDocument23 pagesTata Group's Global Expansion and Business Strategiesvgl tamizhNo ratings yet

- Circular 09/2014 (ISM) : SubjectDocument7 pagesCircular 09/2014 (ISM) : SubjectDenise AhrendNo ratings yet

- GS Ep Cor 356Document7 pagesGS Ep Cor 356SangaranNo ratings yet

- Green Management: Nestlé's Approach To Green Management 1. Research and DevelopmentDocument6 pagesGreen Management: Nestlé's Approach To Green Management 1. Research and DevelopmentAbaidullah TanveerNo ratings yet

- CASE DigeSTDocument2 pagesCASE DigeSTZepht BadillaNo ratings yet

- Complaint Handling Policy and ProceduresDocument2 pagesComplaint Handling Policy and Proceduresjyoti singhNo ratings yet

- Dell 1000W UPS Spec SheetDocument1 pageDell 1000W UPS Spec SheetbobNo ratings yet

- Nature and Effects of ObligationsDocument5 pagesNature and Effects of ObligationsIan RanilopaNo ratings yet

- 9 QP - SSC - MOCK EXAMDocument5 pages9 QP - SSC - MOCK EXAMramNo ratings yet

- Advanced Real-Time Systems ARTIST Project IST-2001-34820 BMW 2004Document372 pagesAdvanced Real-Time Systems ARTIST Project IST-2001-34820 BMW 2004كورسات هندسيةNo ratings yet

- Arizona Supreme CT Order Dismisses Special ActionDocument3 pagesArizona Supreme CT Order Dismisses Special Actionpaul weichNo ratings yet

- ASCE - Art Competition RulesDocument3 pagesASCE - Art Competition Rulesswarup babalsureNo ratings yet

- Discursive Closure and Discursive Openings in SustainabilityDocument10 pagesDiscursive Closure and Discursive Openings in SustainabilityRenn MNo ratings yet

- 13-07-01 Declaration in Support of Skyhook Motion To CompelDocument217 pages13-07-01 Declaration in Support of Skyhook Motion To CompelFlorian MuellerNo ratings yet

- BAM PPT 2011-09 Investor Day PDFDocument171 pagesBAM PPT 2011-09 Investor Day PDFRocco HuangNo ratings yet