Professional Documents

Culture Documents

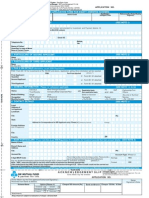

Terms of State Bank of India

Uploaded by

experinmentOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Terms of State Bank of India

Uploaded by

experinmentCopyright:

Available Formats

TERMS OF STATE BANK OF INDIA (with respect to Housing Loan)

CHECH LIST OF DOCUMENTS REQUIRED FOR HOUSING TERM LOAN FROM

[A] FROM SALARIED PERSON:

Salary slip for last three months Form 16 for last two years / Certificate of employer Income Tax return Last two years (if applicable) G.P.F. Statement/ Certificate from Employer for permanent job Proof of Identity Identity card of Employer/ PAN Card/ Driving Licence/ Passport Proof of residence Electricity Bill/ Telephone Bill/ Certificate from employer Statement of account of salary account for last six months Two passport size latest photograph House tax receipt

[B] FROM BUSINESSMEN:

Income tax return for last three years (Certified Copies) Assessment Order for last three years

Certified copies of financial reports Advance tax receipt for current year Partnership deed/ Registration Certificate Bank account statement for last six months (Personal and Business A/c) Proof of identity PAN card/ Driving Licence/ Passport Proof of address Electricity Bill/ Telephone Bill/ House tax receipt of Municipal Corporation Details of Investment (s) Proof of business Place Two passport size latest photograph

[C] FROM GUARRANTOR:

As per A or B above (in the Case of Take Over only)

PRE-PAYMENT PENALTY No pre-payment penalty is charged in housing loan availed from SBI

EMI IN ACCORDANCE WITH INCOME

Net Annual Income upto Rs 2 lacs > EMI upto 40% of monthly income Net Annual Income upto Rs 2 to Rs 5 lacs > EMI upto 50% of monthly income Net Annual Income above Rs 5 lacs > EMI upto 55% of monthly income

NOTES:

1. Charges: Processing charges will be 0.50% of Loan Amount, Advocate charges Rs 1500, Valuer charges Rs 850 Mortgage Charges 0.25 % + Rs 810 + Rs 5000 Registration Charges 2. While coming for documentation, do bring: 5 blank checques, 12 Advance EMI checques 2 checques for insurance & registration 3. At the time of disbursement bring: Builder / Partys Demand Letter Your Concent Letter All margin moneys receipts.

GENERAL INSURANCE:

Rs.600/- per Lac for 15 years.

CASE STUDY #7: HOUSING LOAN AT SBI

[1] Mr. Mukesh Thakur requires 25% of the margin money for purchasinf the plot.

[2] All of their income should be taken into account and wife can be made coborrower.

[3] 25 years would be the repayment period as as he will retire at the age of 60 years but extended to 70 years.

[4] A floating rate of interest depends on customers.

[5] Disbursement of the loan would be done as follows: First it would be given for the plot and then the loan would be disbursed as the construction goes on.

[6] Yes, he and co-borrowersget personal accident cover. In case the borrower dies, then the insurer will pay the amount not its legal heiers. Premium is non refundable, must be paid in advance & also given as loan. 1 year = 8.5 % 2 years = 9.25 % 3 years = 9.25 % 10 years = 10 %

You might also like

- How To Get RichDocument14 pagesHow To Get Richrameshprasad8No ratings yet

- Vehicle Loans: List of Documents Required To Be Submitted For Hire Purchase LoanDocument17 pagesVehicle Loans: List of Documents Required To Be Submitted For Hire Purchase LoanDr.K.PadmanabhanNo ratings yet

- The Millionaire Next Door - CompleteDocument2 pagesThe Millionaire Next Door - Completeapi-253711979No ratings yet

- Wills and Succession Case CompilationDocument144 pagesWills and Succession Case CompilationLudy Jane Feliciano100% (1)

- (Bank of America) Understanding Mortgage Dollar RollsDocument18 pages(Bank of America) Understanding Mortgage Dollar RollsJay Kab100% (2)

- Demat Request Form RetailDocument11 pagesDemat Request Form RetailHarsh YadavNo ratings yet

- Zero Balance Form - SFLBDocument3 pagesZero Balance Form - SFLBroshcrazyNo ratings yet

- STA MARIA Obligation Contracts 1 PDFDocument627 pagesSTA MARIA Obligation Contracts 1 PDFKristine Reontoy-LeysonNo ratings yet

- Consumer Durable Application FormDocument2 pagesConsumer Durable Application FormBrenda CoxNo ratings yet

- Nigerian Law of Equity and Trust by IsochukwuDocument19 pagesNigerian Law of Equity and Trust by IsochukwuVite Researchers100% (2)

- Multiple Choice Questions (Sales) SorianoDocument22 pagesMultiple Choice Questions (Sales) SorianoKatrizia Abad100% (1)

- BDO PersonalLoanAKAppliFormDocument4 pagesBDO PersonalLoanAKAppliFormAirMan ManiagoNo ratings yet

- Checklist of Every Loan FileDocument1 pageChecklist of Every Loan FileDheeraj VarkhadeNo ratings yet

- Non Face To Face Account Opening FormDocument10 pagesNon Face To Face Account Opening FormAlvin Samuel PandianNo ratings yet

- Taxrev Final Exam-InovictusDocument16 pagesTaxrev Final Exam-InovictusNikki GarciaNo ratings yet

- RFBT Booklet 1Document36 pagesRFBT Booklet 1jessel m. decenaNo ratings yet

- Union Bank of The Philippines Vs AriolaDocument2 pagesUnion Bank of The Philippines Vs AriolaRea RomeroNo ratings yet

- Types of Banks PDFDocument4 pagesTypes of Banks PDFaakash patilNo ratings yet

- 25 RESA vs. MO 39Document37 pages25 RESA vs. MO 39George Poligratis Rico100% (2)

- Bachrach V (1) (1) .Doc DigestDocument8 pagesBachrach V (1) (1) .Doc DigestAljeane TorresNo ratings yet

- Case Digest-De Mesa v. AceroDocument2 pagesCase Digest-De Mesa v. AceroAllanNo ratings yet

- Pecson Vs CADocument2 pagesPecson Vs CAErika Angela Galceran100% (1)

- Major Banks PrivateDocument3 pagesMajor Banks PrivateYashesh PatelNo ratings yet

- Check ListDocument4 pagesCheck Listcasantosh8No ratings yet

- BPI Family Housing Loans Requirements & ProcessDocument2 pagesBPI Family Housing Loans Requirements & ProcessAdrian FranciscoNo ratings yet

- Icici Doc ReqdDocument2 pagesIcici Doc ReqdSagar SoniNo ratings yet

- SBI & AXIS BANK Home LOANS INFORMATIONDocument57 pagesSBI & AXIS BANK Home LOANS INFORMATIONSakshi KadamNo ratings yet

- Consumer Finance at Bank AlfalahDocument29 pagesConsumer Finance at Bank AlfalahSana Khan100% (2)

- Check List - New Home Loan102013Document2 pagesCheck List - New Home Loan102013ShanmugamNo ratings yet

- Modified Vendor Registration Form PDFDocument3 pagesModified Vendor Registration Form PDFAnonymous cKGCdi100% (1)

- Requirements On Car Loan FacilityDocument2 pagesRequirements On Car Loan FacilityKarl Kenneth FloresNo ratings yet

- IT DeclarationDocument5 pagesIT Declarationkalpanagupta_purNo ratings yet

- Sbi Housing Loan - Documents RequiredDocument1 pageSbi Housing Loan - Documents RequiredCindyNo ratings yet

- Policy Criteria Review May 2011Document5 pagesPolicy Criteria Review May 2011api-99058398No ratings yet

- Scan 0086Document1 pageScan 0086Sanket ChouguleNo ratings yet

- Application Form For MSEsDocument5 pagesApplication Form For MSEsSenthil_kumar_palaniNo ratings yet

- HDFC List of DocsDocument1 pageHDFC List of Docsjain.gaurav7No ratings yet

- Circular Ay 2010 11Document4 pagesCircular Ay 2010 11shaitankhopriNo ratings yet

- ChecklistDocument1 pageChecklistvikrantgoudaNo ratings yet

- DPID Stamp: DPID Stamp:: NSDL Account Opening FormDocument20 pagesDPID Stamp: DPID Stamp:: NSDL Account Opening FormKalyan ChakravarthyNo ratings yet

- Bank Procedure and FormalitiesDocument59 pagesBank Procedure and Formalitiesrakesh19865No ratings yet

- Investment GuidelinesDocument11 pagesInvestment GuidelinestelugukhanNo ratings yet

- Non Face To Face Form With AMB Declaration PDFDocument10 pagesNon Face To Face Form With AMB Declaration PDFrohit.godhani9724No ratings yet

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Document11 pagesDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17No ratings yet

- Product Training PresentationDocument8 pagesProduct Training Presentationkhenry_hims6997No ratings yet

- One Time Mandate FormDocument4 pagesOne Time Mandate FormAshishNo ratings yet

- Common Loan Application FormDocument4 pagesCommon Loan Application FormRAM NAIDU CHOPPANo ratings yet

- Pmmy ApplicationDocument4 pagesPmmy ApplicationSureshNo ratings yet

- Small Biz LoanDocument4 pagesSmall Biz LoanJulian AlbaNo ratings yet

- B9-057-VanshPatel-Assignment 2Document9 pagesB9-057-VanshPatel-Assignment 2Vansh PatelNo ratings yet

- BDO Shop More Page 1Document1 pageBDO Shop More Page 1Pepeng NupaNo ratings yet

- Modification Form: Customer Account Type: For Bank UseDocument2 pagesModification Form: Customer Account Type: For Bank UseAniket PandeyNo ratings yet

- Account Modification FormDocument2 pagesAccount Modification FormPruthvish ShuklaNo ratings yet

- Apr.12 - 871 App Nri FormDocument10 pagesApr.12 - 871 App Nri FormsnkrmNo ratings yet

- Home Equity LoanDocument2 pagesHome Equity LoanChintan JoshiNo ratings yet

- Full Set Applications BiDocument5 pagesFull Set Applications Biprince1900No ratings yet

- IBHL by Group 3Document15 pagesIBHL by Group 3Prakash ChandraNo ratings yet

- Tarun CheckListDocument1 pageTarun CheckListTanpreet SinghNo ratings yet

- Nepal Bank LimitedDocument9 pagesNepal Bank LimitedSuman ThakuriNo ratings yet

- GauriDocument12 pagesGauriRahul MittalNo ratings yet

- Application Form / Borang Permohonan: PG 1 of 8Document8 pagesApplication Form / Borang Permohonan: PG 1 of 8Hneriana HneryNo ratings yet

- Common Loan Application1Document9 pagesCommon Loan Application1AnkitNo ratings yet

- Retirement of BusinessDocument3 pagesRetirement of BusinessramiilaquintoNo ratings yet

- Check List For Loan - Housing - MortgageDocument1 pageCheck List For Loan - Housing - Mortgagecrmc999No ratings yet

- Latest NRI CHECKLISTDocument1 pageLatest NRI CHECKLIST9tngf6dzbhNo ratings yet

- Application Form Contract FinancingDocument6 pagesApplication Form Contract FinancingLinda MshanaNo ratings yet

- Check ListDocument2 pagesCheck ListAarthi PadmanabhanNo ratings yet

- LN TBond FormDocument90 pagesLN TBond FormboargzcrNo ratings yet

- BGCDocument3 pagesBGCKarim M Syed80% (10)

- Sop 2Document4 pagesSop 2Lalu VsNo ratings yet

- IMPEX SMC Private Limited RegistrationDocument11 pagesIMPEX SMC Private Limited RegistrationMuhammad Kazim MahmoodNo ratings yet

- List of Requirements Prior Turn inDocument1 pageList of Requirements Prior Turn indavid durianNo ratings yet

- MSE ApplicApplication For MSME Loan Upto Rs. 100 LakhsationDocument6 pagesMSE ApplicApplication For MSME Loan Upto Rs. 100 Lakhsationprabhu.gampalaNo ratings yet

- Kevin Cullen Resume 2018Document2 pagesKevin Cullen Resume 2018Kevin CullenNo ratings yet

- Carlos Alonzo and Casimira Alonzo, Petitioners, vs. Intermediate Appellate COURT and TECLA PADUA, RespondentsDocument23 pagesCarlos Alonzo and Casimira Alonzo, Petitioners, vs. Intermediate Appellate COURT and TECLA PADUA, RespondentsraemmmanlagradaNo ratings yet

- Lecture 3 Answers 2Document7 pagesLecture 3 Answers 2Thắng ThôngNo ratings yet

- Union Parivahan SchemeDocument1 pageUnion Parivahan SchemeBUDU GOLLARYNo ratings yet

- Working Capital in C.L. GUPTADocument106 pagesWorking Capital in C.L. GUPTAprince395No ratings yet

- Villamar Vs MangaoilDocument3 pagesVillamar Vs MangaoilbernayabonNo ratings yet

- CFF 308Document49 pagesCFF 308daidainaNo ratings yet

- Spouses Go Cinco vs. Ca, Ester ServacioDocument3 pagesSpouses Go Cinco vs. Ca, Ester ServacioQueenie SantosNo ratings yet

- Odekirk, David - Odekirk For Iowa House Committee - 1574 - DR2 - SummaryDocument1 pageOdekirk, David - Odekirk For Iowa House Committee - 1574 - DR2 - SummaryZach EdwardsNo ratings yet

- Department of Labor: 97 13672Document5 pagesDepartment of Labor: 97 13672USA_DepartmentOfLaborNo ratings yet

- Dealpro Purpose Code List 190515Document8 pagesDealpro Purpose Code List 190515Sreenivas SungadiNo ratings yet

- Partnership LiquidationDocument2 pagesPartnership LiquidationJapsNo ratings yet

- Grand Project On Micro FinanceDocument38 pagesGrand Project On Micro FinanceVidip ShahNo ratings yet

- iIIR - SHASHI PRABHADocument5 pagesiIIR - SHASHI PRABHAprashashiNo ratings yet

- Deed of Real Estate Mortgage: Mortgagor ID No. - Mortgagor ID No.Document2 pagesDeed of Real Estate Mortgage: Mortgagor ID No. - Mortgagor ID No.Danielle Edenor Roque PaduraNo ratings yet