Professional Documents

Culture Documents

17 Wall Paints

Uploaded by

King Nitin AgnihotriOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

17 Wall Paints

Uploaded by

King Nitin AgnihotriCopyright:

Available Formats

PREFACE

Marketing should not be looked upon in a vacuum or in isolation. It is an essence taking a view of the whole business organization and its ultimate objective concern for marketing must penetrate all areas of the enterprise. Market survey in todays competitive world is a must for every organization. This project is a study of market potential of Wallpaints. The rational behind this particular study is to find out the present market scenario of various brands & to find out the corporate need and perception. It was a pleasurable experience to conduct a research on behalf of Wallpaints pertaining to the study of the Wallpaints Sector. Conclusion and there by recommendation has been arrived at by proper and justified interpretation of the result derived from the above said analytical tools and techniques.

ACKNOWLEDGEMENT

Preparing a project of this nature is an arduous task and I was fortunate enough to get support from a large number o persons. I wish to express my deep sense of gratitude to all those who generously helped in successful completion of this report by sharing their invaluable time and knowledge. It is my proud and previledge to express my deep regards to Respected Principal Sir Dr.J.P.N. Pandey , Head of Department Dr. Anand Tiwari , Mrs. Shikha Urmil Khan and Miss Deepti Patel Department of Business Management , Govt. Autonomous Girls P.G. College of Excellence Sagar for allowing me to undertake this project. I feel extremely exhilarated to have completed this project under the able and inspiring guidance of Miss. Deepti Patel she rendered me all possible help me guidance while reviewing the manuscript in finalising the report. I also extend my deep regards to my teachers , family members , friends and all those whose encouragement has infused courage in me to complete to work successfully.

(NARGIS KUSHWAHA) B.B.A IInd Semester IInd Batch

DELCLARATION BY THE CANDIDATE

Date : I declare that the project report titled " WALL PAINTS " on Market Segmentation is nay own work conducted under the supervision of Miss.Deepti Patel Department of Business Management Govt. Girls P.G. College of Excellence Sagar. To the best of my knowledge the report does not contain any work , which has been submitted for the award of any degree , anywhere.

(NARGIS KUSHWAHA) B.B.A IInd Semester IInd Batch

CERTIFICATE

The project report titled "WALL PAINTS " been prepared by Miss. Nargis Kushwaha BBA IInd Semester , IInd Batch under the guidance and supervision of Miss. Deepti Patel for the partial fulfillment of the Degree of B.B.A.

Signature of the Supervisor

Signature of the Head of the Department

Signature of the Examiner

CONTENTS

TOPIC TITLE 1. 2. 3. 4. 5. 6. 7. 8. 9.

10 11 12 13 14 15 16

Preface Acknowledgement Declaration of the Candidate Certificate Introduction

Limitations Suggestions & Recommendations Conclusion Bibliography Questionaire

INTRODUCTION

A major focus of channel of distribution is delivery. It is only through distribution that public and private goods and services can be made available for use or

6 consumption. Producers of such gods and services are individually cWallpaints able of generation only the form or structural utility for their products and services. They can organize their production cWallpaints abilities in such a way that the products they have developed can, in fact, be seen, analyzed and sold in the market. The emergence and arrangement of a wide variety of distribution oriented institutions and agencies, typically called intermediaries because they stand between production on the one hand and consumption.

Intermediaries can improve the efficiency n the other, can be explained in They help in the proper arrangement of routes of transactions. They help in the searching process. They help in the sorting process.

the following terms: of the process.

Marketing channels are set of interdependent organizations involved in the process of making a product of service available for use or consumption. According to American Marketing Association, A Channel of distribution, or marketing channel, is the structure of intra-company organization units and extracompany agents and dealers, wholesale and retail through which is a commodity, product or service is marketed. According to Phillip Kotler, Every producer seeks to link together the set of marketing intermediaries that best. Fulfill the firms objectives. This set of marketing intermediaries is called the marketing channel (also trade channel of channel of distribution).

According to William J Stanton, A channel of distribution for a product is the route taken by the title to the goods as they move from the producer to the ultimate consumers or industrial user.

HISTORY

INFORMATION: Middlemen have a role in providing information about

the market to the manufacturer. Developments like changes in consumer demogr Wallpaints hy, psychogrWallpaints hy, media habits and the entry of a new competitor or a new brand and changes in customers preferences are some of the information that all manufacturers want. Since these middlemen are present in the market place and close to the customer they can provide this information at no additional cost. PRICE STABILITY: Maintained price stability in the market is another

function a middlemen performs. Many a time the middlemen absorb as increase in the price of the products and continue to charge the customer the same old price. This is because of the intra-middlemen competition. The middleman also maintains price stability by keeping his overheads low. PRIMITON: Promoting the products in his territory is another function a

middleman performs. Many of them design their own sales incentive programmes, aimed at building customers traffic at the other outlets. FINANCING: Middlemen finance manufacturers operation by providing

the necessary working cWallpaints ital in the form of advance payments for goods and services. The payment is in advance even through the manufacturer may extend credit, because it has to be made even before the products are bought, consumed and paid for by the ultimate customer. TITLE: Most middlemen take the title to the goods, services and trade in

their own name. This helps in diffusing the risks between the manufacturer and middlemen. This also enabled middleman to be in physical possession of the

goods, which in turn enables them to meet customer demand at vary moment it arises. HELP IN PRODUCTION FUNTION: The producer can concentrate on

the production function leaving the marketing problem to middlemen who specialize in the profession. Their services can best utilized for selling the production where the rate of return would be greater. MATCHING DEMAND AND SUPPLY: The chief function of

intermediaries is to assemble the goods from many producers in such a manner that a customer can affect purchases with ease. According to Wroe Alderson, The goal of marketing is the matching of segments of supply and demand. PRICING: In pricing a product, the producer should invite the suggestions

from the middlemen who are very close to the ultimate users and know what they can pay for the product. Pricing may be different for different markets or products depending upon the channel of distribution.

MARKETING SEGMENTATION :

A flow is a set of function performed in sequence by channel members. In the flow process, producers, wholesalers, retailers and

10

consumers are linked. The functions that need to be necessarily performed in a channel system include transfer of ownership through transportation, order processing, inventory carrying, storage, sorting negotiations and promotions. The same function in a give channel system, may be performed at more than one level and, in such a case, the workload for the function would need to be shared between channel members. A channel symbolizes the path for the movement of title, possession and payment for goods and services.

CHANNELS

OF

DISTRIBUTION

FOR

INDUSTRIAL

PRODUCTS:

Figure below Shows channels commonly used is

industrial marketing. An industrial-goods manufacturer can use its sales force to sell directly to industrial customers. It can sell to industrial distributors, who sell to the industrial customers, or it can sell through manufacturers representatives or its own sales branches directly to industrial customers, or indirectly to industrial customers through industrial distributors. 1-1-2-level marketing channels are quite common in industrial marketing channels.

TYPES OF INTERMEDIARIES

11 SOLE-SELLING AGENT/MARKETER: when a manufacturer

prefers to stay out of the marketing and distribution task, he Wallpaints points a suitable agency as his sole-selling agent/marketer and entrusts the marketing job with him. A sole-selling agent or a marketer is usually a large marketing intermediary with large resources and extensive territory of operation. He will be having his own network of distrinutors/stokists/wholesalers, semi-wholesalers and retailers. He takes care of most of the marketing and distribution functions on behalf of the manufacturer. Obviously, a sole-selling agent/marketer will earn a large margin/commission compared to other types of intermediaries.

C & F AGENTS (CFAs): In many cases, manufacturers employ

carrying and forwarding agent, often referred to as C & F Agents, or CFAs. The CFAs can be describe as special category wholesalers. They supply stocks on behalf of the manufacturer to the wholesale sector or the retail sector. Their function is distribution. Their distinguishing characteristic is that they do not resell products, but act as the agent/representative of the manufacturer. They act so behalf of the manufacturer and as his extended arm. In essence, they are manufacturers branches.

WHOLESALER/STOKIST/DISTRIBUTOR: A wholesaler or

stokist or distributor also a large operator but not on a level comparable with a marketer of sole selling agent, in size, resources, and territory of operation. The wholesaler/stokist/distributor operates

12

under the marketer-soleselling agent, where such an arrangement is used by the manufacturer.

SEMI-WHOLESALERS: Semi-wholeseller are intermediaries who

buy product either from producers or wholesellers in bulk, break the bulk or resell the goods (mostly) to retailers in assortment needed by them. Like the wholesalers, semi-wholesellers too perform the various wholesaling functions that are part of the distribution process. In some cases, they may also perform the retailing functions. Their strength is specialization by region. They assist the producer in reaching a large number of retailers efficiently.

RETAILER/DEALER: retailers sell to the household/ultimate

consumers. They are at the bottom of the distribution hierarchy, working under wholesalers/stokists/distributors/semi-whosalers,as the case may be. In cases where the company operates a single-tier distribution system, they operate directly under the company. The retailers are also sometimes referred to as dealers of authorized representatives. They operate in a relatively smaller territory or at a specific location; they do not normally perform stock-holding and sub-distribution functions. The stocks they keep are operational stocks necessary for immediate sale at the retail outlet.

VALUE-ADDED RESELLERS: they are intermediaries that buy the

basic product from producers and add value to it or, depending on the nature of the product, modify it and then resell it of final customers.

13 MERCHANTS: They are intermediaries that assume that ownership

of the goods that they sell to customers or other intermediaries. Marchants usually take physical possession of the goods that they sell.

RESEARCH METHODOLOGY

14

The methodology used in conducting the research work on TWOWHEELER with major emphasis on its sales and marketing strategies involve the following steps:

Why I have selected TWO-WHEELER only?

I have selected Two-Wheeler for my summer training because it is the company that is growing day by day. It has maximum market share with comparison to its competitors. And it is the company that gives highest sales and it is also the highest two-wheeler manufacturer.

Defining the problem and deciding research objectives:

Defining the objective is the most important part of any study process. Proper defining of the problem is a must for proceeding further with the research process. The type of study to be carried out, the questions to be raised, the sampling procedure to be followed, and the data to be collected, all depends on a correct understanding of the problem. Also, by clearly focusing on the real problem, the research job can be simplified and completed with the minimum cost, effort and data. Identified problem or the objectives of the research discussed in the report are:

1. Developing the research plan:

15

In this a plan was developed about how to collect the require information i.e. whom to contact for gathering the relevant data. Data is the foundation of all research. It is the raw material with which a researcher functions. Therefore, it requires great care to select the sources of data. Data, or facts, may be obtained from several sources. Data sources can either be primary or secondary. A. Secondary data: The sources from which secondary data was collected: Press releases of the company. Newsletters and In-house journals. Brochures and detailed descriptive leaflets Magazines like Business World, Outlook, Auto India, etc.

Websites such as www.herohonda.com, www.google.com. These were the sources from which secondary data has been gathered. Most of the information presented in this report was extracted from the above data sources.

16

B. Primary data: Collection of primary data was conducted by visiting the people personally for the preparation of the report. 2. Research approach: It means the way by which the information was collected. Visiting the various places of Delhi, getting the questionnaire filled by different individuals. Beside this, frequent visit to the showrooms of the company was of great help to conduct the analysis and research work. 3. Contact methods: Instrument or Data collected Forms: It is the method by which data is gathered. It could be done through various instruments like questionnaires, observations, getting information from the staff members of the agency, contacting to the motor mechanics was sufficient enough to conduct the study. 4. Collection of information : The primary information was collected by face-toface and direct interviews with the peoples and the customers. They provide the relevant information regarding the profile of the company as compared to the other company in the Indian market. Most

17

employees suggested visiting companys web site, as it was not possible for them to spare time from their busy schedules. The secondary sources of information were various web sites of the companies, newspapers & magazines such as The times of India, The Hindustan Times, Business world, Auto India, etc. 5. Analyzing the information: The data collected was carefully analyzed. The research and analysis of the information has been done on the basis of various sales and marketing strategies adopted by the company during its tenure. 6. Reporting and conclusions and recommendations: This is the most vital part of the work undertaken. After collection and analysis of data, it was recorded in the form as prescribed. The major part of the report is the findings. The finding also includes charts, tables and diagrams etc. The report also mentioned the limitations of the project undertaken. Then conclusion has been drawn out of the findings and various recommendations have

18

been given at the end of the report. Certain tables on the basis of which the findings were made have been included in the appendices section followed by the bibliography.

19

COMPANY COMPARISON OF WALL PANTS Asian Paints, Goodlass Nerolac, ICI (India), Berger, Jenson & Nicholson and Shalimar are the leading companies in the organized in the organized sector. The top six manufacturers account for about 80 per cent of the market in the organized sector in value terms. WALLPAINTS is the industry leader, with an overall market share of 33 per cent in the organized sector. Threat of global competition is minimal in the industry. WALLPAINTS dominates the decorative segment, with a 38 per cent market share. Goodlass, a Tata

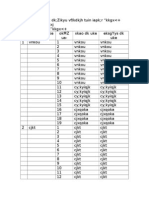

Market Shares of Five Major Players Company 1. Wallpaints 2. Goodlass Nerolac 3. Berger Paints 4. ICI Paints 5. Shalimar 38 14 9 9 6 Market share (%) Decorative Industrial Overall 15 41 10 9 8 33 18 9 9 7

20

company, is number two with a 14 per cent market share. Berger and ICI have 9 per cent and 8 per cent shares, respectively, in this segment followed by Shalimar, with 6 per cent. Goodlass dominates the industrial paints segment, with 41 per cent market share. WALLPAINTS is a poor second here, with a 15 per cent market share. Berger, ICI, and Shalimar are the other substantive players in the sector, with 10 per cent, 9 per cent and 8 per cent shares, respectively. The dominance of Goodlass in industrial paints is largely the result of its technical association with the JWallpaints anese paint major, Kansai Paints, which has a 29.5 per cent equity stake in the company. Goodlass has a lions share of 70 per cent in the OEM passenger car segment, 40 per cent share of two-wheeler OEM market and 20 per cent of commercial vehicle OEM market. Goodlass also holds 20 per cent to the white-goods segment.

THE COMPANY As already mentioned, Wallpaints is Indias largest paints company and the market leader in decorative paints. WALLPAINTS manufactures and markets a wide spectrum of coatings and ancillaries, which include decorative, production paints and heavy-duty coatings. The manufacturing facilities of the company for paint products are currently spread over four locationsBhandup, Mumbai, which was established in 1955; Taloja, Maharashtra, where WALLPAINTS

21

established its second unit in 1980; Ankelshwar, Gujrat, where operations started in 1981; and Patancheru, Andhra Pradesh, where manufacturing started in 1985. Wallpaints offers the widest range of paints in terms of products and shades, as well as pack sizes, Availability of wide range of shades is in fact, one major critical success factor in the decorative paints business. And WALLPAINTS paints (SKU). PERFORMANCE WALLPAINTS has been consistently turning out a good scores high in this factor. WALLPAINTS manufactures and markets more then 2,800 items of

performance over the years. For more than two decades now, it has been the market leader. Besides, the company has also consistently proved its excellence in operating performance. Exhibit 1 gives details of WALLPAINTS s sales performance during the last four years. Exhibit 1 gives some other important details of WALLPAINTS s performance. WALLPAINTS has set a target of gross sales of Rs 2,100 crore by 2003. It aims to be amongst the top ten decorative paints manufacturers in the world by 2003 and among the top five by 2005.

22

_____________________________________________________________ WALLPAINTS STRIKES A NEW PATH IN DISTRIBUTION At the time WALLPAINTS entered the Indian paint business,

distribution was the most crucial task for any new entrant. Both physical distribution and channel management posed formidable challenges. The foreign companies and their wholesale distributors dominated the business. The foreign companies Wallpaints pointed a few traders as their wholesale distributors and allowed them to perpetuate a situation of monopoly. Each distributor was assigned a large territory and was given the right to operate the exclusive channel of the company in the assigned territory. The trade terms were also very liberal. The companies also extended virtually unlimited credit to the distribution. The credit outstanding for the supplies made throughout the year were required to be settled by the wholesales distributors only at the year-end, at Diwali time. These distributors had neither the compulsion nor the motivation to invest in distributions infrastructure. They were not required to move out to semi-urban and rural areas. They concentrated on big cities where they could make the sales without much investment in distribution infrastructure and market development. Also, they were shutting the doors on any new paint company seeking an entry into the business. In other words, these distributors controlled the paint business and were making it impossible for a new paint company to enter and establish itself in the business.

23

WALLPAINTS

sized up the scenario correctly and formulated a

unique distribution strategy. In the normal course, a firm entering the industry in this scenario would have opted for the low risk strategy of gaining a limited access to the wholesale traders and be satisfied with a small share of the existing business. But WALLPAINTS went in for a strategy that differed totally from the existing pattern. WALLPAINTS s strategy, in fact, meant the polar opposite of the established/existing pattern. Chart presents the elements of WALLPAINTS s distribution strategy. We shall see the details in the page that follow. WALLPAINTS Bypasses the Bulk Buyer Segment and Goes to Individual Consumers Bulk buyer segment was the major segment of the paint business in the earlier days and any Chart Elements of WALLPAINTS s Distribution Strategy

WALLPAINTS

bypassed the bulk buyer segment and went to

individual consumers of paints.

WALLPAINTS went slow on urban areas and concentrated on semiurban and rural areas. WALLPAINTS went retail WALLPAINTS went in for an open-door dealer policy WALLPAINTS voted for nationwide marketing/distribution

24

Paint Company needed a share of this major segment for sheer survival. Though this segment was dominated totally by foreign companies and their wholesale distributors, a new entrant to the business like WALLPAINTS would normally have rushed to this segment and tried to garner a share of it. WALLPAINTS , however, had a totally different game plan. Seeing that this segment was not a growth segment, though it was certainly the major segment at that point of time, WALLPAINTS decided to ignore this segment for the present and go to individual consumers. And that was crucial decision. It influenced every subsequent decision WALLPAINTS took in the realm of distribution. Over time, WALLPAINTS proved to the paint industry that there existed a large and bottomless segment in the paint business of India, outside the bulk buyer segment, comprising of individual consumers. WALLPAINTS Goes to Semi-Urban and Rural Areas Along with the decision to go to individual consumer segment leaving aside the bulk buyer segment, WALLPAINTS also decided that within the individual consumer segment, semi-urban and rural areas would constitute WALLPAINTS s priority market. Prior to WALLPAINTS s entry, the paint business was by and large concentrated in the urban areas. All the major paint companies and their wholesale distributors were content with the market that was available in the urban areas. In contrast, WALLPAINTS clearly saw that a large market for paints was emerging in the semi-urban and

25

rural areas, and felt it wise to tWallpaints WALLPAINTS also understood that a new

this market. entrant like

WALLPAINTS had also a compulsion to go to the semi-urban and rural areas. The major companies and their wholesale distributors were not giving any worthwhile opening in the big cities for new entrants. WALLPAINTS found it difficult to attract the wholesalers in the cities to deal in its products. It had to necessarily turn to the semi-urban and rural areas for support. WALLPAINTS wisely decided against committing all its resources on a head on collision with the foreign companies and their big wholesale distributors in the urban areas. WALLPAINTS Goes Retail Going directly to retail dealers was the next major strategic decision of WALLPAINTS in the realm of marketing and distribution. Here too, WALLPAINTS totally broke with the prevailing distribution practice. As mentioned earlier, the foreign companies, who were the main players, were practicing a wholesale distributor-dependant marketing system. WALLPAINTS did not see any great merit in the system. It totally bypassed the well-entrenched wholesale distributors and went directly to the retailers. While WALLPAINTS s competitors remained content with their linkage with a handful of wholesale distributors, WALLPAINTS preferred direct contact with hundreds of retail dealers.

26

WALLPAINTS Goes in for an Open-Door Dealer Policy WALLPAINTS followed an open-door policy in the matter of adding retail dealers to its network. The prevailing trend in those days was to limit the number of dealers to the barest minimum. WALLPAINTS broke this trend and chose to use practically everyone in the trade, who was willing to function as its dealer. It was a combined result to the policy of going directly to retailers and the policy of open door to dealership that WALLPAINTS s dealer network swelled rWallpaints idly. Even after achieving stability and maturity in distribution, WALLPAINTS continued to follow a policy of continuous expansion of dealer network. By 1990, WALLPAINTS was having a 7,000 strong dealer network. By the year 2000, the number had swelled to 12,000. And even now, on an average, WALLPAINTS is adding 200 to 250 new dealers every year.

WALLPAINTS Votes for Nationwide Marketing/Distribution

WALLPAINTS took yet another important and strategic decision in the realm of distribution. Those days, nationwide distribution/marketing was not the standard practice in the paint business. On the one side, there were the 1,000 odd small paint companies who, as a class, believed in marketing their paints in limited territories in and around their point of production. On the other side were the big companies, who as a class, believed in limiting their distribution to the big cities. In contrast to both these existing practices. WALLPAINTS voted for a nationwide distribution/marketing. It wanted to have an active presence

27

throughout the country, in the geogrWallpaints hical zones, states and territories. THE IMPLICATION OF WALLPAINTS S DISTRIBUTION STRATEGY WALLPAINTS s distribution strategy described in the preceding paragrWallpaints hs had its associated implications. WALLPAINTS had to take due note of them and face them squarely. Going to Individual Consumers Implied Wide Product Range and Complex Distribution Had WALLPAINTS concentrated on the bulk buyer segment. It

could have managed with a limited product range, at least, in the initial years. But, WALLPAINTS s decision to turn to the individual consumers necessarily meant a wide product range. In the nature of things, the individual consumer segment involves a very wide choice in terms of products, materials, shades and pack sizes. On top of this, WALLPAINTS believed in making products based on the preferences of consumers. It gathered feedback from the consumers and turned out products, shades and pack sizes on the basis of such feedback. This policy resulted in a further burgeoning of the product range.

28

Smaller Packs Proliferated the Product Depth Further At the time of WALLPAINTS s entry, paint companies were supplying paints in containers of 500 ml or larger. WALLPAINTS saw that there was a felt need in the market for paints in smaller packs. All end uses did not require a large quantity. Moreover, it was common practice for consumers to buy paint initially in a larger quantity and supplement it with small size purchase to complete the job. WALLPAINTS decided to harness the business opportunity and started supplying its paints in small packs-in 200 ml and 50 ml packs. This proliferation in pack sizes also contributed to WALLPAINTS s growing product range. WALLPAINTS was by now manufacturing and marketing as many as 2,000 distinct items of paints, none of which was strictly a substitute for the other. Wide Product Range Implied Distribution The policy of having the widest range of products, colurs and pack sizes had its implication on WALLPAINTS s distribution. When 2,000 different items had to be made available to the consumers, it automatically meant that the company had to be prepared for high inventory holding in its various depots/retail outlets. Accounting and sales arrangements had also to be provided for on a matching level. Naturally, distribution was becoming more complex and expensive for WALLPAINTS .

29

Going

to

Semi-Urban/Rural

Markets

Further

Enlarged

Distribution The decision to go to the semi-urban and rural markets instead of confining to the urban markets also meant enlargement of the distribution function. WALLPAINTS had to go in for more dealers in order to serve the scattered semi-urban and rural market. The decision also meant that WALLPAINTS could not opt for a simple, centralized distribution of its products form its factory. It had to go in for a decentralized, field-focused distribution, with a network of depots located all over the country/marketing territory. Without such extensive and intensive distribution network, it would not have been possible for WALLPAINTS markets. Going Retail Implied Deep Involvement in Channel Management Through its decision to go retail, WALLPAINTS was getting deeply involved in physical distribution and to cover the semi-urban and rural

30

Chart Main Steps in the Implementation Process WALLPAINTS s created a It successfully resolved the large network of dealers. cost-service conflict in It established a network of distribution. company depots to service the (i) A strong commitment to dealers. distribution cost control without It created a marketing compromising service level. (ii) Effective inventory organization that matched its management distribution. (iii) Effective control of credit outstanding (iv) IT initiatives in distribution cost control

Channel management. In the system chosen by WALLPAINTS , the physical distribution cum channel management task was far more demanding, compared to the wholesaler-oriented system practiced by the other paint companies. While, for companies that embraced the wholesaler-oriented system, it was enough to service a handful of distributors, WALLPAINTS had to service a network of thousand of retail dealers. Having taken the decision to go retail, WALLPAINTS necessarily had to create and service a vast dealer network. It also had to create the physical distribution facilities required for servicing such a large network. National Marketing Necessitated Nationwide Organisation Extend of marketing territory and complexity of distribution organization are interrelated. The moment WALLPAINTS voted for nationwide marketing, it was getting into intensive as well as extensive physical distribution and channel management. WALLPAINTS thus had to create a nationwide distribution-cummarketing organization. DISTRIBUTION BECOMES WALLPAINTS S SHOWCASE FUNCTION

31

WALLPAINTS s strategies made distribution the most important elements of its marketing mix. And, WALLPAINTS give to distributions all the inputs that were demanded by it. In fact, the rest of this case study is essentially a description of how WALLPAINTS managed its distribution activities-how it chalked out its distribution programmes, how it implemented them, what problem it encountered in this task, how it tackled them and how through distribution success, it achieved marketing and corporate success. THE IMPLEMENTATION PROCESS We shall see low WALLPAINTS went about the actual management of the distribution function. The main steps in WALLPAINTS s implementation process are shown in Chart 2. Let us see the details. WALLPAINTS Creates a Large Network of Dealers An extensive network of dealers, and a matching physical distribution infrastructure play a crucial role in the decorative paints segment. This is essential for ensuring easy accessibility of the product to customers. In this, Wallpaints scored over its competitors with a massive network of 15,000 dealers spread over 3,500 towns across the country. WALLPAINTS has the largest distribution network among all the players. Goodlass has a network of 8,000 dealers.

WALLPAINTS Establishes a Network of Company Depots WALLPAINTS established a large chain of company operated depots/stock points throughout its vast marketing territory, from where the retail dealers could conveniently pick up their requirements. WALLPAINTS s basic strategies explained in the earlier sections necessitated a liberal Wallpaints proach in the matter of stock points/depots. It also meant that the depots had to be company operated. After all, WALLPAINTS did not have any wholesale

32

distributors to whom the responsibility for operating the stock points could possibly have been assigned. As shown in Exhibit 32.4 established a network of 30 company-run depots, spread through out the country and serviced its retailers from them. The number of depots varied from city to city. For example, Bangalore had just one depots while Mumbai had four depots. The depots typically supplied to about 200-300 dealers. WALLPAINTS Creates a Marketing Organisation that Matched its Distribution Intensity Effective control of the large number of depots, each having substantial stocks of 2,000 odd distinct items necessitated a matching marketing organization structure. WALLPAINTS set up a marketing organization consisting of four regional sales offices, 35 branch sales offices and a large number of sales supervisors and sales representatives spread all over the country. The marketing organization of the company is presented in Exhibit 32.5. It can be seen from the chart that a very extensive structure has been created in the consumer division. It is primarily meant for taking care of the massive distribution task involved in this sector. Each branch sales office has its own depots and the various items are stocked in the depots under the control of the concerned branches. The branches service the dealers and customers in their territories. These are supported by six regional distribution centers, which cater to 55 depots. Each depot has a branch manager for supervision of several salesperson who cater to more than 14,500 dealers in the more that 3,500 big and small cities all over the country. WALLPAINTS faced many challenges. Of these, the cost-service dilemma was no doubt, the most important one. And, that is the aspect in which we are mainly interested in this case study.

33

Managing the cost-service conflict was the main challenge that WALLPAINTS faced in the implementation of its distribution strategy. WALLPAINTS met this challenge successfully. We have seen that WALLPAINTS has over 15,000 dealers in 3,500 towns in India. WALLPAINTS caters to all of them directly. As a result, for WALLPAINTS , the distribution task gets tremendously extended and distribution cost becomes a significant business parameter. Demand for decorative paints is characterized by seasonality. Demand drops during monsoons and picks up around a month-and-a-half before the festive season. Major part of the sales take place in the second half of the financial year. Manufacturers have to array huge inventories during the lean period. As a result, distribution cost becomes all the more significant. Naturally, distribution cost emerged as a major hurdle that WALLPAINTS had to cross. The strategy It went in for a very high service level in distribution. Service level is measured in terms of the number of stock keeping units (SKUs) available in stock as a percentage of the number of SKUs that should have been in stock. WALLPAINTS s service level is more than 85 per cent whereas that of other large paint companies falls between 50 and 60 per cent. This meant a further rise in WALLPAINTS s physical distribution costs. WALLPAINTS had to resolve this cost-service conflict.

34

In the chWallpaints ter on Physical Distribution and Logistics Management, we had seen that a cost-service dilemma is inherent in any physical distribution situation. A high service level in physical distribution- in transportation, warehousing order processing and inventories-necessarily means a high level of costs. Every firm has to face this cost-service dilemma and work out a compromise. WALLPAINTS voted for a high service level and without compromising this service level, it tried to contain the distribution costs. Interestingly. WALLPAINTS succeeded in this endeavor. When we go in to the details as to how WALLPAINTS actually resolved the cost-service dilemma, four factors started out: A strong commitment to distribution cost control, without

compromising service level Effective inventory management Effective control of credit outstanding IT initiatives in support of distribution cost control Strong Commitment to Distribution Cost Control While following a totally customer-oriented distribution strategy, WALLPAINTS could not afford to ignore the cost angle. WALLPAINTS was in no position to pass on any additional costs to the consumers. WALLPAINTS s marketing philosophy demand that the consumer price of its paint should be on the lower side, so as to

35

suit the pockets of the average Indian. Moreover, WALLPAINTS s business growth demand more and more investment in manufacturing and distribution. WALLPAINTS had to find the resources. This Wallpaints art, the intensity of competition had also been on increase. Naturally, profitability was coming under greater strain in these circumstance. WALLPAINTS had to control its distribution costs in order to maintain its profitability and market leadership. The question was how to control the costs without sacrificing the service level. Effective Inventory Management Effective inventory management is the first major component of WALLPAINTS s strategy on distribution cost control. And, WALLPAINTS achieved high efficiency in this regard. Actually, in inventory cost, WALLPAINTS took the lowest position in the industry. WALLPAINTS s average inventory level equals only 28 days sales, while the industry average is 51 days sales. This right away provided a 45 cent edge in inventory costs to WALLPAINTS compared to its competitors. WALLPAINTS s stock of finished goods was just 7 per cent of its net sales while for the other in the industry it was nearly twice that level. What is particularly striking in this achievement is that WALLPAINTS offered customers and dealers a high level of service in product delivery compared to its competitors and yet kept the inventory costs down by 45 per cent compared to the competitors.

36

Control of Credit Outstanding Large credit outstanding, running beyond two months or more, was natural concomitant of the distribution strategy chosen by WALLPAINTS . The dealers are required to maintain stocks of all the SKUs that are on demand in the territory. It pushes up inventory levels at the outlets. They need credit. WALLPAINTS allowed 15-21 days credit for dealers located in the major towns and 22-30 days credit for dealers in upcountry regions. WALLPAINTS had to pull of a smart credit control strategy for survival. It resolved the thorny problem through an innovative dealer incentive scheme. WALLPAINTS stipulated that each of its dealers should pay for the supplies within a specified time norm and offered them an attractive incentive scheme for doing so. It consisted of two components: (a) A special discount of 3.5 per cent. This was referred to as the discount for perfection in payments. It was passed on at the end of the year, provided each and every payment throughout the year was made within the stipulated time norms. (b) A cash discount of 5 per cent. This was paid for all outright cash purchases. It was given whenever payments were received within 24

37

hours of the supply/invoice. In respect of outstation accounts, the payments should have been made in advance by draft in order to be eligible for the discount. The scheme was a grand success. WALLPAINTS s credit outstanding always stood below 25 days, while the outstanding of the other major companies were in the range of 40 days and above. Systematic computerization also helped WALLPAINTS maintain the credit outstanding within limits. IT Initiatives in Distribution Cost Control WALLPAINTS s IT initiatives in respect of distribution-inventory control and control of credit outstanding, in particular-helped it no control distribution costs without lowering the service level. WALLPAINTS went in for a fully computerized distribution system. WALLPAINTS did this not only with an eye on distribution cost control, but also for the sake of distribution effectiveness per se. But for such an Wallpaints proach, WALLPAINTS s distribution management would have gone haywire. Here was a situation where 2,000 different items of paints, manufactured at four different plants, had to be distributed to 15,000 dealers in 35,00 towns spread all over the country. Through 55 depots. WALLPAINTS accomplished this, maintaining the average service level at 85 per cent, a clear 25 per cent above that of competition. The IT initiatives also ensured prompt billing, accurate customer accounting and effective control of credit outstanding.

38

Computerization also enabled WALLPAINTS to process recent sales data for the 100 fastest moving SKUs. This analysis was used to project sales of specific products, which helped plan production and raw material purchases. With computerization, WALLPAINTS was able to analyse past trends to arrive at a 90 per cent accurate sales forecast. Corrections were made every month between the sales projection and actual sales. Production was thus evened out month-tomonth. Sales statistics were maintained, classified by product, month, salesman, branch, region and dealer. Such computerized planning and control of production, sales and inventories helped WALLPAINTS cut distribution costs without compromising on the high level of service sought by it in physical distribution. WALLPAINTS later hired from the Department of

Telecommunications, satellite time and got all its offices in the country networked. They transmit data daily to the corporate had office in Mumbai, which uses it for sales and production planning. WALLPAINTS has consistently improved its IT systems over the years. It has linked all its factories and 55 depots through V-SAT terminals, and derived big benefits in terms of streamlined distribution. More recently, WALLPAINTS has implemented supply chain management software from i2 technologies. WALLPAINTS plans to upgrade its communication infrastructure through VSAT leased lines and ISDN lines all over India. It is also implementing an ERP solution from SWALLPAINTS to be completed in 2001.

39

WALLPAINTS Acquires a Competitive Advantage Through Its Inventory Management and Credit Control One can grasp the full import of WALLPAINTS s success in this sphere only when due not is taken of the fact that WALLPAINTS has achieved the lowest distribution cost as well as the highest differentiated position in the industry. WALLPAINTS s Wallpaints colite, the largest selling brand of paint in the country, is available in different shades and in eight different pack sizes. Being in the business of colours, WALLPAINTS differentiation, and none of its utilized colour to achieve competitors could match

WALLPAINTS in this aspect. Simultaneously, WALLPAINTS also achieved the lowest cost position in the industry. Normally, when a firm consciously opts for the differentiation route with a wide product line, it automatically point towards higher inventory levels and consequently higher inventory and other costs. But WALLPAINTS , through its effective distribution management, inventory management and control of credit outstanding, in particular, managed to retain its inventory size and inventory costs at the lowest possible level. WALLPAINTS actually saved so much on inventory carrying costs that it almost earned its promotion budget through these savings. This is again praiseworthy because WALLPAINTS spends as much as per cent of its sales on promotion, the highest in the industry. It has to spend so much in order to maintain its differentiation advantage. But strikingly, it has kept its total marketing costs the lowest in the industry. The two factors together-the lowest cost position as well as

40

the highest differentiation position-has conferred a significant competitive advantage on WALLPAINTS .

41

OBJECTIVE OF THE STUDY

The study was done primarily with the following objective in mind. To study the brands of Two-Wheeler & consumers perception Aabout the product of Two-Wheeler. To know why people buy Two-Wheeler and why some people prefer other company. To study the features of different brands that give a good idea of various products and services offered by the company. To understand the competitive environment in which the company is operating and is desired to meet customer need and satisfaction. To provide useful information to the company about the product features of various competing companies.

42

SUGGESTIONS & RECOMMENDATION

It is clear from the report that the Two-Wheeler Motors is facing cutthroat competition; hence the companys manager has to be fast and smart so as to understand the customers needs. They have to come up with various new techniques or schemes to be able to cater to different categories of people. Customers are becoming more wise day by day and they are now willing to know all the in and out of the things happening around them. This has led to increased customer awareness. We can analyze that if the brand is reputed that doesnt win the customers delight unless its provided same value-added features or else we can say competitive advantage. For gaining a competitive advantage it has to continuously compare the product and services with the competitors and find the weak area of the rivals for gaining competitive advantage. Surveys revealed that awareness of Two-Wheeler Motors is low among its target segment for creativity awareness. The company has to take some keen step for promotional activity. The company should regularly send the sales person who have good communication skill to the customers so that they should be aware about the product and services in market and know the quality of the services offered by the company.

43

LIMITATIONS OF THE STUDY

As said a basic research was conducted at the company to enable the company to assess how far the customers are satisfied with product and services of Two-Wheeler. During the course of the study the following limitations were observed:

The method will be unsuitable if the number of persons to be surveyed is very less as it will be difficult to draw logical conclusions regarding the satisfaction level of customers. Interpretation of data may vary from individual depending on the individual understanding the product features and services of the company. The method lacks flexibility. In case of inadequate or incomplete information the result may deviate. It is very difficult to check the accuracy of the information provided. Since all the products and services are not widely used by all the customers it is difficult to draw realistic conclusions based on the survey.

44

45

CONCULSION

LEADERSHIP THROUGH DISTRIBUTION EXCELLENCE The story of Wallpaints is a story of distribution excellence. WALLPAINTS achieved an enviable leadership position through the distribution route. While WALLPAINTS did not ignore any of the other function of marketing, it was by mastering the distribution function that WALLPAINTS gained a distinct and powerful competitive advantage. WALLPAINTS s distribution strategy was truly innovative; it broke new ground in every aspect of distribution. In the final analysis, excellence in distribution led the company to marketing and corporate excellence.

46

BIBLIOGRAPHY WALLPAINTS

Widening the Net. Business India Intelligence, Auguest 2001,p2,2p. Anand, M Diary of Sales Associate. Business World. 21 October, 2002 Brown James R, Fern Edward F., Conflict in Management Channels: The Impact of Dual Distribution. International Review of Retail, Distribution & Consumer Research, Wallpaints ril92, Vol. Issue 2, p121, 12p Moriarty, Rowland T and Moran, Ursula Managing Hybrid Marketing Systems. Harvard Business Review, November/December 1990, Vol. 68 Issue. Marketing Management by Kotler / keller 2005 Edition. Marketing Management ICFAI Center for Management Research Marketing Management Planning, Implimentation & Control by V S Ramaswamy / S Nmakumari www.asianpaints.com www.mouthshut.com/product-reviews/Asian_Paints_Royale_Luxury_Emulsion en.wikipedia.org/wiki/Asian_Paints www.novWallpaints aint.org/webasia.html www.domain-b.com/companies/companies_a/asian_paints/index.html

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Verification FormDocument1 pageVerification FormKing Nitin AgnihotriNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Signature of Parent Name in FullDocument2 pagesSignature of Parent Name in FullKing Nitin AgnihotriNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Vkosnu IDocument4 pagesVkosnu IKing Nitin AgnihotriNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Izfr 1Document3 pagesIzfr 1King Nitin AgnihotriNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Poona Bai vs. ParshottamDocument44 pagesPoona Bai vs. ParshottamKing Nitin AgnihotriNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Project ActivityDocument12 pagesProject ActivityKing Nitin AgnihotriNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- In Words Rs. Four Thousand Nine Hundred Fourty Nine OnlyDocument1 pageIn Words Rs. Four Thousand Nine Hundred Fourty Nine OnlyKing Nitin AgnihotriNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- SKLDKJFDocument3 pagesSKLDKJFKing Nitin AgnihotriNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- SHAILESH Dubey SVN 9098569028Document1 pageSHAILESH Dubey SVN 9098569028King Nitin AgnihotriNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Paper ExcellenceDocument2 pagesPaper ExcellenceKing Nitin AgnihotriNo ratings yet

- Izfr 2Document2 pagesIzfr 2King Nitin AgnihotriNo ratings yet

- Kerwana 1STDocument707 pagesKerwana 1STKing Nitin AgnihotriNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Methods of StrugglDocument3 pagesMethods of StrugglKing Nitin AgnihotriNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Project Media1Document30 pagesProject Media1King Nitin AgnihotriNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- PrashantDocument59 pagesPrashantKing Nitin AgnihotriNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Ac 73112453Document1 pageAc 73112453King Nitin AgnihotriNo ratings yet

- Amit Kumar GoutaDocument56 pagesAmit Kumar GoutaKing Nitin AgnihotriNo ratings yet

- Management Information SystemDocument20 pagesManagement Information SystemKing Nitin AgnihotriNo ratings yet

- Project On Dainik Jagran Dushyant DuttDocument67 pagesProject On Dainik Jagran Dushyant DuttKing Nitin AgnihotriNo ratings yet

- Anjali Patel Final1Document52 pagesAnjali Patel Final1King Nitin AgnihotriNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Birla Whit CementDocument54 pagesBirla Whit CementKing Nitin AgnihotriNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Parle GDocument41 pagesParle GKing Nitin AgnihotriNo ratings yet

- C.A. ProjectDocument62 pagesC.A. ProjectKing Nitin AgnihotriNo ratings yet

- Life Insurance Corporation of IndiaDocument2 pagesLife Insurance Corporation of IndiaKing Nitin AgnihotriNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Cricket ProjectDocument31 pagesCricket ProjectKing Nitin AgnihotriNo ratings yet

- Watch: A Project Report On Marketing Strategies of Top Five Brands ofDocument51 pagesWatch: A Project Report On Marketing Strategies of Top Five Brands ofKing Nitin AgnihotriNo ratings yet

- CastrolDocument50 pagesCastrolKing Nitin Agnihotri33% (3)

- Feuh Ihtk@Mini Pizza Ost Ihtk@Veg Pizza Vekvks Ihtk@Tomato PizzaDocument2 pagesFeuh Ihtk@Mini Pizza Ost Ihtk@Veg Pizza Vekvks Ihtk@Tomato PizzaKing Nitin AgnihotriNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Bajaj AlianceDocument49 pagesBajaj AlianceKing Nitin AgnihotriNo ratings yet

- Shahgarh ListDocument23 pagesShahgarh ListKing Nitin AgnihotriNo ratings yet

- Management of Cash, Receivables and InventoryDocument5 pagesManagement of Cash, Receivables and InventoryRuby EchavezNo ratings yet

- SC MGT - Supply Chain Management in Hospitality Industry (PRELIM NOTES)Document13 pagesSC MGT - Supply Chain Management in Hospitality Industry (PRELIM NOTES)chloekent loreNo ratings yet

- ProjectDocument49 pagesProjectHabeeb AhamedNo ratings yet

- ACEINT1 Intermediate Accounting 1 Midterm Exam AY 2021-2022Document10 pagesACEINT1 Intermediate Accounting 1 Midterm Exam AY 2021-2022Marriel Fate Cullano0% (1)

- Fs ExerciseDocument6 pagesFs ExerciseDIVINE GRACE ROSALESNo ratings yet

- Value stream mapping tools analysisDocument14 pagesValue stream mapping tools analysisMihir ZalawadiaNo ratings yet

- School of Engineering and Architecture SAINT LOUIS UNIVERSITYDocument12 pagesSchool of Engineering and Architecture SAINT LOUIS UNIVERSITYJerico Hercules MutiaNo ratings yet

- Internship Report On: Financial Analysis of KDS Accessories LimitedDocument50 pagesInternship Report On: Financial Analysis of KDS Accessories Limitedshohagh kumar ghoshNo ratings yet

- Ia Reviewer QuizzesandexamsDocument22 pagesIa Reviewer QuizzesandexamsReady PlayerNo ratings yet

- BUSN Distribution and Pricing - Operations ManagementDocument47 pagesBUSN Distribution and Pricing - Operations ManagementAvinash VermaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- FIN242Document3 pagesFIN2422022875508No ratings yet

- Unit-8: Profit PlanningDocument49 pagesUnit-8: Profit PlanningAbuShahidNo ratings yet

- Notes IA1 PirntDocument18 pagesNotes IA1 PirntBack upNo ratings yet

- Introduction To Operations and Logistics ManagementDocument76 pagesIntroduction To Operations and Logistics ManagementAbdulhmeed MutalatNo ratings yet

- QUIZ - CHAPTER 1 - STATEMENT OF FINANCIAL POSITION With SolutionsDocument9 pagesQUIZ - CHAPTER 1 - STATEMENT OF FINANCIAL POSITION With Solutionsfinn mertens100% (1)

- Chapter - 7Document33 pagesChapter - 7Arifur Rahman MSquareNo ratings yet

- SalesAndOperationsPlanning-Bozarth ch13Document47 pagesSalesAndOperationsPlanning-Bozarth ch13Ashish Batwara0% (1)

- Annex F - SOP For Warehouse and Inventory Management in UNHCRDocument38 pagesAnnex F - SOP For Warehouse and Inventory Management in UNHCRWilliam LeungNo ratings yet

- Dell Computer: Refining and Extending The Business Model With ITDocument18 pagesDell Computer: Refining and Extending The Business Model With ITTathagataNo ratings yet

- Financial Acct Midterm Study GuideDocument11 pagesFinancial Acct Midterm Study GuideRobin TNo ratings yet

- WESCO Distribution, Inc.: Harvard Business School 9-598-021Document28 pagesWESCO Distribution, Inc.: Harvard Business School 9-598-021Twinkle ChoudharyNo ratings yet

- Property, Plant and Equipment: Sri Lanka Accounting Standard-LKAS 16Document24 pagesProperty, Plant and Equipment: Sri Lanka Accounting Standard-LKAS 16Anuruddha RajasuriyaNo ratings yet

- Sales and Inventory System THESIS SURVEYS & QUESTIONNAIREDocument5 pagesSales and Inventory System THESIS SURVEYS & QUESTIONNAIREKhristine KateNo ratings yet

- BIR Ruling No. 253-16Document4 pagesBIR Ruling No. 253-16john allen MarillaNo ratings yet

- POM ReportDocument164 pagesPOM ReportShalemRajNo ratings yet

- Optimizing Supply Chain Operations with Effective WarehousingDocument8 pagesOptimizing Supply Chain Operations with Effective WarehousingbikramNo ratings yet

- GMF period close process OPM Financials period closeDocument9 pagesGMF period close process OPM Financials period closeChanda Vishnu KumarNo ratings yet

- Managerial Accounting and Cost Concepts: Mcgraw Hill/IrwinDocument29 pagesManagerial Accounting and Cost Concepts: Mcgraw Hill/IrwinMuhammad Zia KhanNo ratings yet

- Chap 12 Performance Measurement FINALDocument14 pagesChap 12 Performance Measurement FINALOnkar SawantNo ratings yet

- Odoo Documentation: Inventory Module GuideDocument171 pagesOdoo Documentation: Inventory Module GuidePetrus Idi DarmonoNo ratings yet

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)