Professional Documents

Culture Documents

Greenlight Q4 2010

Uploaded by

Hamilton MaddenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Greenlight Q4 2010

Uploaded by

Hamilton MaddenCopyright:

Available Formats

January 18, 2011

Dear Partner: Greenlight Capital, L.P., Greenlight Capital Qualified, L.P. and Greenlight Capital Offshore (collectively, the Partnerships) returned 8.4%, 7.5% and 7.2%1 net of fees and expenses, respectively, in the fourth quarter of 2010, bringing the respective full year net returns to 15.9%, 14.0%, and 12.5%.1 Since inception in May 1996, Greenlight Capital, L.P. has returned 1,635% cumulatively or 21.5% annualized, both net of fees and expenses. On August 27, 2010, Federal Reserve Bank Chairman Ben Bernanke gave a speech in Jackson Hole, Wyoming where he hinted that the Fed would provide additional monetary easing. At the time, the S&P 500 was down more than 3% for the year. From that point through the end of the year, the S&P rallied 19%. At the same time, oil prices rose 16%, copper prices rose 32%, coffee prices rose 34%, corn prices rose 43% and cotton prices rose 57%. In front of Congress, Mr. Bernanke credited his policies for significant improvements in stock prices which are contributing to a better outlook for the economy. Mr. Bernanke also said his policies are not to blame for the sharp increase in the price of oil, which he claimed is the result of strong demand from emerging markets. Does Mr. Bernanke really believe anyone buys that? Ostensibly, its a coincidence that many of the necessities of life came into simultaneous shortage and shot up in price just as Mr. Bernanke promised additional monetary stimulus. Mr. Bernanke told the news show 60 Minutes that he was 100% certain that the Fed could control inflation should it become a problem. As for the future, we are 100% certain of nothing. The good news is that our job is not to know the future, but rather to understand that it is uncertain and to construct a portfolio that should generate attractive results under a wide variety of outcomes. That may mean achieving lower (but still acceptable) returns than long-only stock indices when they travel straight north. This is what happened during the fourth quarter of 2010.

These returns are net of the modified high-water mark incentive allocation of 10% and reflect the returns for partners who were invested on or prior to January 1, 2008. For partners who participated in our most recent capital opening, their individual results will reflect our standard 20% incentive allocation. The disparity in the returns for the Partnerships for 2010 is due mainly to differences in weightings of historical positions.

Letter brought to you by MarketFolly.com

2 G rand Cen tr a l Tower 140 East 45 t h S tr e e t, 2 4 t h F lo o r N ew Yo rk, NY 10017 Phon e: 212-973-1900 Fax 212-973-9219 www.g reen ligh tcap ital. com

Page 2

Overall, the 2010 environment was a challenging one for our core long-short strategy, particularly considering our defensive posture. For the first time in a number of years, momentum-driven speculation drove the market. Nonetheless, we generated a satisfactory result as our longs significantly outperformed the market, our shorts modestly underperformed the market (good for us), and our macro hedges, most notably gold, generated additional profits. The result was a full year net return that approximated the S&P 500, with very low correlation to the market and much less volatility. During the quarter Greenlight Capital Offshore exceeded its modified high water mark and is now back to earning normal fees. Both domestic partnerships still have to return approximately an additional 5% to exceed their modified high water marks. During the quarter Arkema (France: AKE), Ensco (ESV), and MI Developments (MIM) each contributed more than 1% to the gross return. We had no positions that generated similar sized losses. AKE shares rose from 37.53 to 53.87 in the fourth quarter. The company benefitted from sharply rising chemical prices (thanks Mr. Bernanke) and solid execution including the integration of its 2009 acquisition of the United States acrylics business from Dow Chemical and the announcement of a new acquisition of the resin unit from Total, its former parent. Consensus earnings estimates for 2011 have risen from 4.00 to 5.50 per share since the end of September. In 2009, consensus estimates for 2011 were as low as 1.80 and the stock price bottomed at 9.71. It has been much more fun holding AKE through the recovery than it was through the sell-off. In the fourth quarter ESV shares advanced from $44.73 to $53.38 as higher oil prices (thanks again Mr. Bernanke) and increased drilling budgets in the oil and gas industry led to expectations that rig rates and utilization would increase in 2011. MIM shares advanced from $10.99 to $27.10 during the quarter. In early October, Frank Stronach, the companys chairman, offered to purchase the outstanding shares for $13 each. In December, Mr. Stronach and a majority of the shareholders proposed an agreement (which we did not agree to support) that Mr. Stronach give up control of the company in exchange for receiving hundreds of millions of dollars of company assets. The shares reacted favorably to the proposal. During the quarter we established a new position in BP plc (BP), one of the world's largest integrated energy companies, at an average price of $41.18 per share. The Deepwater Horizon oil spill in April 2010 caused a significant decline in BP's share price. BP has reserved nearly $40 billion pre-tax to account for costs related to this accident and has thus far sold $22 billion of non-core assets (with a stated target of up to $30 billion in divestitures), leaving the balance sheet in excellent shape. Pro forma for these asset sales and after taking into account our estimate of BP's eventual oil spill related expenses, we expect BP will still be able to earn nearly $20 billion per year from continuing operations. At less than 7x pro forma earnings, we purchased BP at a 25% discount to its peers. The company is well positioned to reinstate a dividend in early 2011 and generate higher

Page 3

production growth with its high-grade asset base. BP shares ended the year at $44.17 per share. We also established a new position in Sprint Nextel Corporation (S), a wireless communications provider, at an average price of $4.46 per share. Sprints disastrous Nextel acquisition in 2005 put the company on a painful downward spiral. We think S is now showing the early signs of a promising turnaround. Dan Hesse joined S in 2005 and became CEO in 2007. He has focused on customer service and improving the handset lineup, which have both improved considerably. This has driven subscriber additions and reduced customer churn. We believe S has a significant margin expansion opportunity as it consolidates two networks. Lastly, we think S uniquely large spectrum position through its direct holdings and via its interest in Clearwire is a valuable competitive advantage in an industry where spectrum is becoming a scarce resource. We value S at a discounted cash flow value of over $10 per share if management delivers on its targeted savings from network modernization. S shares ended the year at $4.23 per share. We finally resolved the Emerging Communications (ECM) litigation. Many of you probably remember our second quarter 1998 letter where we introduced the position as follows:

ECM is the U.S. Virgin Islands telephone company. The partnership established its position at an average price of $7.05. We purchased ECM because its adjusted enterprise value represented just 4.1x EBITDA. ECM was granted a five-year tax holiday beginning in October 1998 that we value at roughly $40 million. In lieu of a rate increase for capital spending following hurricane damage, the government agreed to no gross receipt, excise, or property taxes and only 10% of normal corporate taxes. ECM is controlled by a wellconnected businessman named Jeffrey Prosser who, shortly after we took our position, proposed a cash buyout of ECM at $9.13 per share. We believe the buyout price is unduly low and have communicated this belief to the companys independent directors. ECMS shares currently trade at $8.56.

There is no way to cut this long story short. That fall, Mr. Prosser took ECM private for $10.25 per share. We thought Mr. Prosser had bought the company too cheaply. We thought that Prossers attempt to buy the company at this price was the worst thing that anyone had done to us (we had not yet met Frank Stronach). Rather than take our gain and move on, we pursued appraisal rights and breach of fiduciary duty claims in Delaware court. The litigation took longer than we expected, to say the least. The case reached trial in 2001. From the end of the trial it took the judge almost two more years to rule. When he did, he found that Mr. Prosser had breached his fiduciary duty and the fair value of ECM stock at the time of the merger was $38.05 per share and not the $10.25 paid by Mr. Prosser. The court awarded us over $80 million plus interest, a sizable return on our $7 million investment. Unfortunately, in the intervening years the telecom bubble came and went, and Mr. Prosser took on more and more debt and left behind fewer assets. Though we went through several iterations of settlement negotiations, Prosser and the company went into bankruptcy in

Page 4

Click here for more hedge fund tracking @ MarketFolly.com

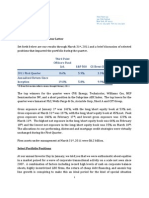

2006. We are pleased to report that we have managed to recover $27 million net of legal fees and believe the matter is now behind us. The 12-year IRR on this adventure was 13%. It is better than a kick in the teeth, but it hardly justified the effort. The other notable positions closed during the quarter were:

Closed Security African Barrick Gold L/S L Avg Entry Price 5.72 Avg Exit Price 5.80 IRR +14% Comments Barrick Gold spin-off that ran into severe operating problems. The rising price of gold prevented a worse outcome. Stock was inexpensive on mid-cycle earnings. We got tired of waiting for mid cycle. In addition, the unexpected CEO departure was cause for concern. The second most profitable investment we have ever made. We bought the stock in the low teens in 2005, sold most of it in the low 40s in 2007, bought it back in the teens in late 2008 and sold the position in the low 40s in 2010. A small victory. We sold to reduce exposure to European cyclicals. We surrender on another of our ill-timed REIT shorts.

Foster Wheeler

$26.25

$24.25

-10%

Lanxess

17.75

41.71

+56%

Rheinmetall AG HCP

L S

38.32 $24.62

48.07 $30.67

+25% -41%

We are sad to report that Helen Gorgoni and Nelson Heumann both retired at the end of the year. This is a first for Greenlight. For the past 10 years, Helen pleasantly greeted everyone on the phone and at the front desk. Nelson also worked for Greenlight for a decade, successfully investing in distressed debt without ever seeming stressed, let alone distressed. Never one to pass up a free meal, Nelson will continue to help us by staying on as the Chairman of Einstein Noah Restaurant Group. While their presence will be sorely missed in the office, we wish both of them great happiness as they enter the next stage of life. Amelia Wierzbicki has joined us to take over for Helen. Amelia worked at Caramoor Center for Music and the Arts after graduating from the University of Hartford with a B.A. in Journalism and a minor in Music. In addition to Amelia being an accomplished violinist and music teacher, her last name also scores an impressive 30 points in Scrabble! Welcome Amelia W4I1E1R1Z10B3I1C3K5I1. As of January 1 we changed the offshore funds administrator from Citco to Morgan Stanley Fund Services (MSFS). We have now consolidated all the Partnerships administration with MSFS, which will further simplify our back-office operations and investor interaction. We want to thank Citco for its many years of service to the Greenlight offshore funds.

Page 5

At quarter end, the largest disclosed long positions in the Partnerships were Arkema, Ensco, gold, Pfizer, and Vodafone Group. The Partnerships had an average exposure to equities and fixed income (excluding credit derivatives, gold and foreign currencies) of 101% long and 75% short. Its not the years in your life that count. Its the life in your years. -- Abraham Lincoln Best Regards,

Greenlight Capital, Inc.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- IO October 2011Document4 pagesIO October 2011the_knowledge_pileNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Durbin DimonDocument5 pagesDurbin Dimonthe_knowledge_pileNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Third Point Investor Letter 4.8.2011Document6 pagesThird Point Investor Letter 4.8.2011Absolute Return100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Why We Covered Our Netflix ShortDocument13 pagesWhy We Covered Our Netflix ShortTyler BurkeNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Dear Fellow ShareholdersDocument32 pagesDear Fellow Shareholdersthe_knowledge_pileNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Dailyschedules 101229-2Document491 pagesDailyschedules 101229-2ZerohedgeNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Unearthing Value at Nacco Industries Feb 2011Document32 pagesUnearthing Value at Nacco Industries Feb 2011the_knowledge_pileNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- LTR To Investors Jan 11Document6 pagesLTR To Investors Jan 11the_knowledge_pileNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Citadel LetterDocument3 pagesCitadel LetterDealBook100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Pershing Sq. Pres On Housing 11-3-10Document48 pagesPershing Sq. Pres On Housing 11-3-10the_knowledge_pileNo ratings yet

- T2 Accredited Fund LTR To Investors-Nov 10Document6 pagesT2 Accredited Fund LTR To Investors-Nov 10the_knowledge_pileNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)