Professional Documents

Culture Documents

Joint Living Trust Funding Worksheet

Uploaded by

RocketLawyerCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Joint Living Trust Funding Worksheet

Uploaded by

RocketLawyerCopyright:

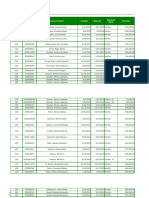

JOINT LIVING TRUST FUNDING WORKSHEET Name of the Living Trust: Dorian M.

Rothschild Revocable Living Trust, dated March 25, 1993. Additional Information: Assets should be transferred to "The Trustee of Dorian M. Rothschild Revocable Living Trust, dated March 25, 1993.." Later-acquired property should also be titled in the name of the Trust. Dorian Mayhew Rothschild 60 Arthur St. San Rafael, CA 94901

Initial Trustee:

Tax Identification Number: Same as Grantor Additional Information: The first responsibility of the trustee is to make certain that all of the (appropriate) assets owned by the grantor are transferred to the living trust. Any assets that remain titled in the name of the grantor will be subject to potential probate administration at the death of the grantor. (The exceptions include assets which (a) are held jointly with another person with rights of survivorship, for example a home, (b) pass pursuant to "transfer on death" or "pay on death" designations, for example a bank account, or (c) pass by beneficiary designation, for example retirement plans and life insurance.) If the initial trustee is not the grantor, it will be necessary to obtain a tax identification number for the trust and begin filing trust tax returns. Successor Trustee Name: Peter R. Olsen 123 Main St. Mill Valley, CA 94941 When the successor trustee assumes that office, the successor trustee must become familiar with the trust provisions, inventory the assets for proper control and maintenance, and attend to the requirements of accounting for the receipts and disbursements of the trust. If the grantor was the immediately-past trustee, it will be necessary to now obtain a federal tax identification number for the trust and begin filing trust tax returns.

Additional Information:

Category: Household Goods, Furniture and Furnishings Description: All of Mary Holis Rothschild's household goods, furniture and furnishings, now owned or later acquired. Include in Bill of Transfer? Additional Information: Yes Untitled tangible personal property, including household goods, furniture and furnishings, are transferred into the living trust through the use of a "bill of transfer" document. The description can be generic and all-encompassing, or it can be specific, or it can be a combination of both. Items with significant value should be separately and carefully described in the bill of transfer, even though, presumably, they are included in the generic description "all of the grantor's household goods, furniture and furnishings." This will clarify the grantor's intent that the trust is to own these items so that probate on their account can be avoided. Because household goods, furniture and furnishings change frequently, and therefore continuous transfers would be impractical, the typical initial transfer should describe all of the grantor's household goods, furniture and furnishings "now owned or later acquired." If items are located in more than one residence, a reference to each residence should also be included. Category: Clothing and Personal Effects Description: All of Dorian Mayhew Rothschild's clothing and personal effects, now owned or later acquired. Include in Bill of Transfer? Additional Information: Yes Untitled tangible personal property including clothing and personal effects, are transferred into the living trust through the use of a "bill of transfer" document. The description can be generic and all-encompassing, or it can be specific, or it can be a combination of both. Items with significant value should be separately and carefully described in the bill of transfer, even though, presumably, they are included in the

generic description "all of the grantor's clothing and personal effects." This will clarify the grantor's intent that the trust is to own these items so that probate on their account can be avoided. Because clothing and personal effects change frequently, and continuous transfers would be impractical, the typical initial transfer should describe all clothing and personal effects "now owned or later acquired." Category: Jewelry Description: All of Mary Holis Rothschild's jewelry, now owned or later acquired. Include in Bill of Transfer? Additional Information: Yes Untitled tangible personal property including jewelry, is transferred into the living trust through the use of a "bill of transfer" document. The description can be generic and allencompassing, or it can be specific, or it can be a combination of both. Items with significant value should be separately and carefully described in the bill of transfer, even though, presumably, they are included in the generic description "all of the grantor's jewelry." This will clarify the grantor's intent that the trust is to own these items so that probate on their account can be avoided. Because jewelry items may change, and continuous transfers would be impractical, the typical initial transfer should describe all jewelry "now owned or later acquired." Category: Untitled Recreational Equipment Description: All of Dorian Mayhew Rothschild's untitled recreational equipment, now owned or later acquired. Include in Bill of Transfer? Additional Information: Yes Untitled tangible personal property including untitled recreational equipment, is transferred into the living trust through the use of a "bill of transfer" document. The description can be generic and all-encompassing, or it can be

specific, or it can be a combination of both. Items with significant value should be separately and carefully described in the bill of transfer, even though, presumably, they are included in the generic description "all of the grantor's untitled recreational equipment." This will clarify the grantor's intent that the trust is to own these items so that probate on their account can be avoided. Because untitled recreational equipment may change, and continuous transfers would be impractical, the typical initial transfer should describe all untitled recreational equipment "now owned or later acquired." Category: Works of Art Description: All of Dorian Mayhew Rothschild's works of art, now owned or later acquired. Include in Bill of Transfer? Additional Information: Yes Tangible personal property without a title document, including works of art are transferred into the living trust through the use of a "bill of transfer" document. The description can be generic and all-encompassing, or it can be specific, or it can be a combination of both. Items with significant value should be separately and carefully described in the bill of transfer, even though, presumably, they are included in the generic description "all of the grantor's works of art." This will clarify the grantor's intent that the trust is to own these items so that probate on their account can be avoided. Because works of art may change, and continuous transfers would be impractical, the typical initial transfer should describe all works of art "now owned or later acquired." If items are located in more than one residence, a reference to each residence should also be included. Category: Titled Vehicles Description: Year: Make: Model: 1995 Cessna 172 Skyhawk

VIN: Year: Make: Model: VIN: Additional Information:

1020394611156 1967 Porsche 911R 12938571394831

It is usually recommended that the grantor's personal vehicles NOT be transferred into the living trust because of possible complications with liability insurance covering the vehicle and to avoid re-transfer inconveniences. Instead, consider titling the vehicles with another person, perhaps a spouse, in joint ownership with rights of survivorship. This will still allow the vehicles to avoid probate upon the grantor's death. To establish joint ownership with survivorship, the vehicle title should include the names of both joint owners, either followed by the words "joint tenants with survivorship" or separated by the word "or" (depending on local law). There are, however, at least two arguments in favor of keeping the title solely in the name of the grantor: (1) Adding the name of a second person to the title of a vehicle exposes the grantor ("all owners") to liability claims caused by any other driver of the vehicle, which is especially devastating where liability insurance coverage is insufficient, and (2) some states allow for post-death transfers of vehicles by affidavit anyway, without the need for probate, even if titled solely in one name. If a transfer into the living trust is desired, contact the local motor vehicle department for change-of-title forms and assistance.

Category: Bank Accounts Description: Bank: Address: Account Type: Account Number: Additional Information: Redwood National Bank 123 Main St., Mill Valley, CA 94941 Savings 123456 Bank accounts can be transferred into the living trust by contacting the bank and requesting the appropriate change of title form. (See this program's "Trust Letter to Bank or Broker" document.)

Checking Account. It is usually recommended that the grantor's regular checking account (used to pay monthly expenses) NOT be transferred to the trust, especially if that account can otherwise avoid probate by being titled with the grantor's spouse in joint tenancy with survivorship, or by designating a "pay-on-death" beneficiary. The reason for not placing the account in the trust is so that the trustee can avoid the inconveniences sometimes encountered when check recipients refuse to accept a check from a trust, absent proof of the trustee's authority to sign as the authorized trustee. Nevertheless, if the account usually maintains a large balance, the account SHOULD be transferred to the trust to allow for proper estate planning. Note: In order to avoid probate for your checking account, you may be tempted to add a non-spouse as a co-owner of the account for example, an adult child. But you should exercise caution when doing so because the account may then be subject to that co-owner's creditors. Certificates of Deposit. Before transferring certificates of deposit (or similar investments) to the living trust, it should be determined from the bank that the transfer will not adversely affect the interest being paid on the investment, for example, a penalty for early withdrawal. Most banks are willing to retitle the investment without any loss of interest, when there is no substantive change of owner, which is the case where an individual transfers the investment to his or her living trust. For all bank accounts and certificates. If the account is jointly owned by a husband and wife, it will be necessary for both spouses to sign the forms requesting the transfer. If the account to be transferred is owned by more than one person OTHER THAN SPOUSES, an attorney or tax consultant should be contacted because there may be gift tax implications. If the owner(s) of the account is/are not the currently-acting trustee(s) of the trust, the trustee(s) may also be required to sign the change of title form to establish authority over the account. In order to properly re-title the account, the bank will need to know the name of the trust. Furthermore, the bank will usually want to make sure that the trust is in existence, learn

the identity of the current trustee(s) and any successor trustee (s), and verify that the trustee(s) have the authority under the trust document to open and maintain the bank account. In order to provide the bank with this information, an original copy (or a photocopy) of the entire trust agreement can be supplied. However, if privacy is desired, the bank can be supplied instead with only the selected information about the trust that is needed by the bank. The simplest way to do this is to provide the bank with photocopies of selected pages attached to a cover letter, which letter is certified and signed as true. The selected pages should include those which contain the following information: (a) Declaration of Trust (first page); (b) Identity of the trustees (first page, plus other pages which describe alternate and/or successor trustees): (c) Powers of the trustees; and (d) Signature page (and notary page, if any). See this program's "Trust Letter to Bank or Broker" document. Category: Real Estate Description: Address: Legal Description: Type: Lender: Address: City, state, zip: Unpaid Balance: Assisting: Address: City, state, zip: 55 Elmo Heights as described in Exhibit A Grantor's Residence Smith Lending Company 770 Atherton Avenue Novato, CA 94944 $255,000.00 _________________ _________________ _________________, _________________ _________________

Additional Information:

Real estate is transferred into a living trust using an instrument called a "deed." When a transfer of ownership into a trust is desired, a deed is prepared, signed in the presence of a notary public, and then recorded by the local government office responsible for recording land transfers (for example, a county recorder). Because the form and

content of deeds and the documents required to accompany them and the requirements for recording them, vary widely from county to county and from state to state, it is not feasible for this program to provide you with the document(s) necessary to effectuate a transfer of real estate into the trust. It is recommended that an attorney be contacted for assistance with this transfer. If the residence is subject to a mortgage loan, obtain the permission of the lender before transferring the residence to the trust in order to avoid violating loan prohibitions on transfers. Most loans contain a "due-on-sale" clause, which allows the lender to "accelerate" the loan (i.e., require immediate payment of the entire remaining balance) if the real estate is transferred. The acceleration clause in the loan is designed to help protect the lender when the real estate is transferred (usually by sale) to a third party whose creditworthiness has not been approved by the lender. Where the personal residence of a borrower is transferred to the borrower's own living trust however, there is no meaningful change in the ownership or use of the property. For this reason, federal law prevents lenders from invoking the "dueon-sale" clause in those instances, provided that the owner continues to occupy the home (as the beneficiary of the trust). Nevertheless, it is still good practice to inform the lender of, and obtain the lender's consent to, the transfer. (See this program's "Trust Letter to Mortgage Lender" document.) For commercial or investment property on the other hand, there is no such law prohibiting the lender from accelerating the loan when the property is transferred into a trust. In these instances, it is critically important that the grantor of the trust (the owner of the real estate) obtain the advance written consent of the lender, confirming that the "due-on-sale" clause will not be invoked. Transfer of the grantor's residence to the grantor's living trust will not cause the grantor to forfeit any of the grantor's tax benefits associated with home ownership. Holding the grantor's principal residence in a living trust does not interfere with this tax provision. Similarly, home mortgage interest and property tax deductions are available to the grantor to the same extent as if the grantor owned the residence outright. Category: Patents, Copyrights, and Trademarks

Description: Description of Patent: Status: Include in Bill of Transfer? Additional Information: Yes Patents, copyrights and trademarks can be assigned through the use of a bill of transfer. (See this program's "Bill of Transfer" document.) Patents. An application for a patent with the United States Patent and Trademark Office can be made only in the name of the individual inventor(s). But the assignment to the living trust can be made (a) before the application is filed, (b) after the application is filed but before the "Letters Patent" are issued, or (c) after the Letters Patent have been issued. If the Letters Patent have been applied for or issued, the assignment should include not only the grantor's rights in the invention, but also the grantor's rights in the application, or the Letters Patent, as the case may be. After an assignment is made of ISSUED patents or Federally REGISTERED trademarks, a formal assignment should be recorded in the United States Patent and Trademark Office, similarly for copyrights in the office of the United States Copyright Office. Contact an attorney for assistance. Certification of Trust will include the following pages: (a) Declaration of Trust (first page): page(s) 1 (b) Identity of the trustees (first page, plus other pages which describe alternate and/or successor trustees: page(s) 1 (c) Powers of the trustees: page(s) 2 (d) Signature page (and notary page, if any): page(s) 7 Additional Information: These pages of the living trust contain the key information likely to be requested by banks, brokers and corporate secretaries. The pages can be attached to a "Certification of Trust" cover sheet and provided, instead of providing a copy of the entire trust document. See this program's "Trust Letter to Bank or Broker" document. Snuggie Fleece Blanket Registered

Living Trust Tax Return

As long as the grantor is a trustee (and, for a joint living trust, as long as the grantors file a joint return), it is not necessary to file a separate tax return for the trust. All income and deductions of both the grantor and the trust are reported on the grantor's personal income tax return (joint personal return for the grantors of a joint living trust). However, if and when the grantor is no longer a trustee, the trust must obtain its own tax identification number and file a separate income tax return. While the grantor is alive and can therefore still revoke the trust, the tax return is merely a "pass-through" return where the trust allocates the income to the beneficiaries who received the income. This allocation of income is detailed on schedules that are filed with the IRS by both the trust and the individual beneficiaries. When the grantor dies and the trust therefore becomes irrevocable, the beneficiaries are still taxed on the income paid to them. But if some of the income is retained in the trust, the trust pays the tax on that income. Especially after the grantor's death, the trust may provide that trust INCOME is to be paid to one beneficiary, perhaps the spouse, while the trust PRINCIPAL is to be maintained intact for the "remainder" beneficiaries, those who will receive the assets that remain in the trust after the death of the income beneficiary. In such cases, it is especially important for the trustee to follow the terms of the trust instrument, or established state law if the trust is silent, in making allocations between income and principal. Income receipts consist of earnings from the investment of the principal, usually including such items as dividends, interest, rents and royalties. Principal receipts consist of such items as the proceeds received from the sale of assets, stock dividends, casualty insurance proceeds, royalties from depletable resources, and principal payments from loans and installment obligations. Expenses attributable to income consist of the costs of administering and preserving the trust property. Expenses attributable to principal consist of the costs of investing and reinvesting the principal, including defending an action to protect the trust property, making capital improvements to the assets, and taxes on capital gains.

Tax Basis in Assets

Assets transferred to a living trust carry with them the same tax "basis" (used to compute taxable gain, if any, upon a sale of the asset) as the grantor had in those assets prior to the transfer. Upon the grantor's death, however, a living trust generally acquires a date-of-death value basis in all such

assets. This is the same tax benefit applicable at death to assets owned in the name of individuals. Thus, there is no disadvantage to transferring appreciated assets into the living trust. An example may be useful: Thomas purchased 100 shares of Acme stock in 1981 for $1000, which $1000 then constitutes his cost "basis" on which to compute taxable gain if he should later sell the stock. In 1998 the stock is worth $2500. If Thomas sells the stock in 1998, he must report $1500 in taxable gain. If he dies in 1998 still owning the stock, the basis is "stepped up" tax-free to the stock's $2500 date-ofdeath value, resulting in no taxable gain if his beneficiaries immediately sell it for $2500. Likewise, if Thomas transfers the stock to his living trust at any time before his death in 1998, the basis inside the trust remains at $1000 while Thomas is alive, but enjoys a step-up basis to $2500 at his death. Isolation of Trust Assets It is important to respect the distinction in the ownership of trust assets -- assets owned by the trust as opposed to owned individually by the grantor. The trustee is only a caretaker of the trust assets and must keep appropriate records of income, expenses, additions and distributions of the trust. Especially when a successor trustee assumes the trustee duties, all cash should be channeled through a separate trust-owned bank account.

Protecting Trust Assets Insurance Coverage: Insurance Company: Type of Coverage: Policy Number: Agent: Address: City, state, zip: _________________ _________________ _________________ _________________ _________________ _________________, _________________ _________________ _________________ When the trust has been signed and assets transferred to the trust, the trust is then a viable, legal entity and the trustee has full authority, power and control

Phone: Additional Information:

to manage the trust assets. The trustee also has certain responsibilities to preserve and protect the assets. Insurance. After insured assets have been transferred to a living trust, the insurance agent should be notified of the change. The named insured on the policy should be amended to add the trustee. The change should not affect the coverage or cost of the policy. Documents. After the title of each asset has been transferred from the grantor to the trustee, there will be various title documents such as deeds, stock certificates, bank certificates, etc., which evidence the fact that these assets are owned by the trust. Each such title document should be kept in a safe place, such as a safe deposit box, and the person named as the successor trustee should be notified as to the location of these documents. If any securities are held in "bearer" form, such as bearer bonds or unregistered securities, it is recommended that a separate safe deposit box be obtained and clearly identified as holding only trust assets. If such items were instead held in the grantor's safe deposit box or at the grantor's home, it could be argued that those assets should be subject to probate administration, that is, that they are not effectively owned by the trust. Additionally, the safe deposit box should be held in the name of the trust so that the successor trustee will have the right to gain entrance to the box.

BILL OF TRANSFER We, Dorian Mayhew Rothschild and Mary Holis Rothschild (the "Grantors") hereby sell, transfer, and assign to the Trustee of Dorian M. Rothschild Revocable Living Trust, dated March 25, 1993., all of our right, title and interest in the assets listed on the attached Schedule A.

_____________________ Date

________________________________ Dorian Mayhew Rothschild

________________________________ Mary Holis Rothschild

Bill of Transfer Dorian M. Rothschild Revocable Living Trust, dated March 25, 1993. Schedule A All of Mary Holis Rothschild's household goods, furniture and furnishings, now owned or later acquired. All of Dorian Mayhew Rothschild's clothing and personal effects, now owned or later acquired. All of Mary Holis Rothschild's jewelry, now owned or later acquired. All of Dorian Mayhew Rothschild's untitled recreational equipment, now owned or later acquired. All of Dorian Mayhew Rothschild's works of art, now owned or later acquired. Snuggie Fleece Blanket (Registered)

________ Initials

________ Initials

You might also like

- Wisconsin LLC Articles of OrganizationDocument2 pagesWisconsin LLC Articles of OrganizationRocketLawyer91% (11)

- Utah Articles of IncorporationDocument1 pageUtah Articles of IncorporationRocketLawyer83% (6)

- Kentucky Articles of IncorporationDocument2 pagesKentucky Articles of IncorporationRocketLawyerNo ratings yet

- Colorado LLC Articles of OrganizationDocument3 pagesColorado LLC Articles of OrganizationRocketLawyer100% (1)

- Vermont Articles of OrganizationDocument1 pageVermont Articles of OrganizationRocketLawyerNo ratings yet

- Colorado Articles of IncorporationDocument3 pagesColorado Articles of IncorporationRocketLawyer100% (2)

- Delaware Certificate of IncorporationDocument3 pagesDelaware Certificate of IncorporationRocketLawyer100% (1)

- Florida Articles of IncorporationDocument4 pagesFlorida Articles of IncorporationRocketLawyer50% (2)

- Tennessee LLC Articles of OrganizationDocument1 pageTennessee LLC Articles of OrganizationRocketLawyerNo ratings yet

- Utah LLC Articles of OrganizationDocument1 pageUtah LLC Articles of OrganizationRocketLawyer100% (1)

- Delaware Certificate of IncorporationDocument3 pagesDelaware Certificate of IncorporationRocketLawyer100% (1)

- Maine Articles of IncorporationDocument3 pagesMaine Articles of IncorporationRocketLawyer100% (1)

- Alabama Certificate of FormationDocument4 pagesAlabama Certificate of FormationhowtoformanllcNo ratings yet

- Arizona Articles of IncorporationDocument5 pagesArizona Articles of IncorporationRocketLawyer100% (2)

- South Carolina Articles of OrganizationDocument3 pagesSouth Carolina Articles of OrganizationhowtoformanllcNo ratings yet

- West Virginia Articles of IncorporationDocument1 pageWest Virginia Articles of IncorporationRocketLawyerNo ratings yet

- New Hampshire LLC Certificate of FormationDocument5 pagesNew Hampshire LLC Certificate of FormationRocketLawyerNo ratings yet

- Texas LLC Certificate of FormationDocument6 pagesTexas LLC Certificate of FormationRocketLawyer100% (5)

- Ohio Articles of IncorporationDocument6 pagesOhio Articles of IncorporationRocketLawyerNo ratings yet

- Minnesota Articles of IncorporationDocument3 pagesMinnesota Articles of IncorporationRocketLawyer0% (1)

- Washington Application To Form A Profit CorporationDocument3 pagesWashington Application To Form A Profit CorporationRocketLawyer100% (2)

- Kentucky LLC Articles of OrganizationDocument2 pagesKentucky LLC Articles of OrganizationRocketLawyer100% (2)

- Wyoming Articles of OrganizationDocument3 pagesWyoming Articles of OrganizationhowtoformanllcNo ratings yet

- South Carolina Articles of IncorporationDocument3 pagesSouth Carolina Articles of IncorporationRocketLawyerNo ratings yet

- Michigan LLC Articles of OrganizationDocument3 pagesMichigan LLC Articles of OrganizationRocketLawyer100% (2)

- Arkansas Articles of IncorporationDocument2 pagesArkansas Articles of IncorporationRocketLawyer100% (1)

- South Dakota Articles of OrganizationDocument3 pagesSouth Dakota Articles of OrganizationhowtoformanllcNo ratings yet

- New York Articles of IncorporationDocument2 pagesNew York Articles of IncorporationRocketLawyer100% (1)

- New Mexico LLC Articles of OrganizationDocument4 pagesNew Mexico LLC Articles of OrganizationRocketLawyer100% (1)

- Massachusetts Articles of OrganizationDocument3 pagesMassachusetts Articles of OrganizationhowtoformanllcNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- SALE DEED GaneshDocument9 pagesSALE DEED GaneshAnil kumarNo ratings yet

- Educational Theory 2009 59, 4 Arts & Humanities Full TextDocument23 pagesEducational Theory 2009 59, 4 Arts & Humanities Full TextBianca DoyleNo ratings yet

- Alojado V SiongcoDocument2 pagesAlojado V SiongcoAndrea GatchalianNo ratings yet

- Cisco Routers For The Desperate Router Management The Easy WayDocument145 pagesCisco Routers For The Desperate Router Management The Easy WaytsgopiNo ratings yet

- Deed Assignment Receivables SaleDocument3 pagesDeed Assignment Receivables Saleneil_nailNo ratings yet

- Legal Notice For Transfer of PlotDocument3 pagesLegal Notice For Transfer of Plotazamkhan13No ratings yet

- FontsDocument1 pageFontsapi-250968630No ratings yet

- Distinction Between Real Rights and Personal RightsDocument1 pageDistinction Between Real Rights and Personal RightsMzingisi TuswaNo ratings yet

- IEC 255-3 (1989-05) RelayDocument24 pagesIEC 255-3 (1989-05) RelayjamaluddinNo ratings yet

- SCR Auto FinalDocument154 pagesSCR Auto FinalNikka AnastacioNo ratings yet

- The Slave in The Window: Paul J. Du PlessisDocument12 pagesThe Slave in The Window: Paul J. Du PlessisDumitru-Neamtu AnaNo ratings yet

- Chandrima Das v. Chairman, Railway BoardDocument22 pagesChandrima Das v. Chairman, Railway BoardSm699632No ratings yet

- Assignment 1 - Business Law and Regulations 2Document5 pagesAssignment 1 - Business Law and Regulations 2Jimbo ManalastasNo ratings yet

- Notice of Deed AcceptanceDocument1 pageNotice of Deed Acceptancehalcino89% (9)

- Esp6 - q2 - Mod6 - Pamamaraan NG Paggalang Sa Suhestiyon NG IbaDocument27 pagesEsp6 - q2 - Mod6 - Pamamaraan NG Paggalang Sa Suhestiyon NG IbaPhenny MendozaNo ratings yet

- Transfer of Property ActDocument3 pagesTransfer of Property ActRaihan Uddin lNo ratings yet

- Summary of December Finance CommitteeDocument43 pagesSummary of December Finance CommitteeAthertonPOANo ratings yet

- 3734 Shibnath Construction Raju Saha ShopDocument15 pages3734 Shibnath Construction Raju Saha ShoprajsharmarealtorsNo ratings yet

- Understand The Rules of Intestacy UpdatedDocument2 pagesUnderstand The Rules of Intestacy UpdatedwestintaNo ratings yet

- RCBC Vs Royal Cargo DigestDocument2 pagesRCBC Vs Royal Cargo DigestJeremae Ann CeriacoNo ratings yet

- Deed of MortgageDocument4 pagesDeed of Mortgagejimmy_andangNo ratings yet

- Land Titles and Deeds GuideDocument3 pagesLand Titles and Deeds GuideReah CrezzNo ratings yet

- CARPER LAD Form No. 48 Checklist of Required Docs For DAR-LBP PPUDocument4 pagesCARPER LAD Form No. 48 Checklist of Required Docs For DAR-LBP PPULaura CarrNo ratings yet

- De La Cruz V Asian ConsumerDocument3 pagesDe La Cruz V Asian ConsumerHector Mayel Macapagal100% (1)

- Gym FitnessDocument7 pagesGym FitnessMarijune LetargoNo ratings yet

- Your Will ExplainedDocument21 pagesYour Will Explainedsterling2001No ratings yet

- Sexy School Teacher Part01 - (420wap)Document24 pagesSexy School Teacher Part01 - (420wap)Timothy Peters50% (4)

- WIPODocument5 pagesWIPOScribdTranslationsNo ratings yet

- Ownership & PossessionDocument10 pagesOwnership & PossessionNeeraj Yadav100% (1)

- RERA Registration in IndiaDocument7 pagesRERA Registration in Indiaharsha sanilNo ratings yet