Professional Documents

Culture Documents

Types of Banks

Uploaded by

stealth53Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Types of Banks

Uploaded by

stealth53Copyright:

Available Formats

Types of Banks Commercial banks can be majorly divided into these : 1.Public sector banks 2.

private sector banks 3.Foreign banks

Public sector banks Public sector banks are the banks where the government holds the major stake and it issues its share to public i.e. the bank goes public. All these banks report to the RBI. These banks also could be termed as government owned banks. The prime motive of the bank is public welfare and not maximizing its profits. Currently the target of the banks is to reach out to as many people as it can , so that the services could help the people in the villages. If we consider the statistics in financial year 2011, 21 public sector banks and five associate banks of State Bank of India collectively brought basic banking facilities to 26,630 villages, this being 118 per cent of the target of 23,629 villages. The targets were set by the Government in association with the Reserve Bank of India in order to reach the benefits of banking services to the common man. When we talk about public sector banks they can be classified as follows: 1.SBI group 2.Nationalized banks 3.Regional rural banks 4.local area banks

SBI group State Bank of India (SBI) is government-owned and is the largest bank in India The State Bank of India is the oldest and largest bank in India,with more than $250 billion (USD) in assets. It is the second-largest bank in the world in number of branches. it opened its 10,000th branch in 2008. The bank has 84 international branches located in 32 countries and approximately 25,000 ATMs. Additionally, SBI has controlling or complete interest in a number of affiliate banks,resulting in the availability of banking services at more than 14,600 branches and nearly 45,000 ATMs. SBI provides various domestic, international and NRI products and services, through its vast network in India and overseas. SERVICES The products include gold deposits (by weight), savings accounts with overdraft privileges, and an extraordinary number of passbook savings accounts. Investment Banking Consumer Banking Commercial Banking Retail Banking Private Banking Asset Management Pensions Mortgages Credit Cards SBI also provides new age services like E-pay: where in you can pay the bills online and other payments like phone recharges etc.This helps people avoid the usage of cheques. Internet Banking: the banking has become hassle free as a person can access his/her account from anywhere and it provides various facilities like transfer of funds etc.Statements could also be viewed. The service such as E-rail also uses the internet to book railway tickets.Also one might notice sbi has the largest ATM network which is an achievement with respect to the technology used.

The other services are the usual which comprise of the locker facility .personal banking which is reasonably new in the field of banking in india. Here are few numbers that one could relate with the SBIs business . Revenue $29.728 billion Operating income $5.507 billion Profit $2.668 billion Total assets $322.077 billion Total equity $19.048 billion

Real Time Gross Settlement System (RTGS)& National Electronic Fund Transfer system (NEFT) Bank offers Real Time Gross Settlement System (RTGS) & National Electronic Fund Transfer system (NEFT) which enables an efficient, secure, economical and reliable system of transfer of funds from bank to bank as well as from remitters account in a particular bank to the beneficiarys account in another bank across the country.

1.RTGS: An electronic payment system in which payment instructions between banks are processed and settled individually and continuously, on a real time basis, throughout the day. Available for transaction value of Rs.2.00 lacs and above.

2.NEFT : Another electronic payment system in which payment instructions between banks are processed and settled on deferred net settlement (DNS) basis at fixed times during the day. There is no minimum or maximum stipulated transaction value for using this facility.

CENTRALISATION AND DECENTRALIZATION Organizational setup where the authority to make important an decision is retained by the managers at the top of the hierarchy.This is centralization and it is followed as the bank cannot run the risk of taking a undesirable decision.Hence the decision is escalated to the higher level of management. Decentralizing on the other hand may be stated as follows. The important decisions about organizational resources taken to initiate new projects which are delegated to managers at all levels in hierarchy. The basic idea behind this is to prevent the wastage of time by taking quick decisions without waiting for approvals from the higher authorities in case of smaller issues . If the bank needs to purchase any kind of equipment like computers or software branch managers are required to take permission from the high authority So in terms of decision making centralization is high and low decentralization, managers have some power to take decision but it is very limited.

CHANGES As it is known that SBI has a large customer base ,in order to keep up to with the current trends the computerization came into picture this definitely adds to one of the pros that SBI has.According to indiastat.com SBI is fully computerized. SBI initially planned to convert only 3,300 of its branches, it was so successful that it expanded the project to include all of the more than 14,600 SBI and affiliate bank branches. Also one of the known problems that the bank faced is that of the attitude of the staff towards the customers.In order to come over this problem the bank has introduced a program called parivartan which means change. These changes are in order change the current scenario and to introduce themselves as a customer friendly bank who greets them with a smile and resolves every issue faced by the customers.

State Bank Group aims to respond faster to market demands, enable real-time information access and assign the right people to the right positions at the right time.

TECHNOLOGY On Implementation of mySAP ERP help State Bank Group drive advancement and innovation in areas of human capital management and enterprise resource planning such as e- learning, virtual classrooms, career development and successing planning, competency assessment, performance management and property management After these set of changes SBI hopes that it would result in increase its market share and customers would have a better experience with respect to attending their grievances .

The current concerns of SBI are to fulfil the following: 1.The delivery of new product capabilities to all customers, including those in rural areas 2. The unification of processes across the bank to realize operational efficiencies and improve customer service 3. Provision of a single customer view of all accounts 4. The ability to merge the affiliate banks into SBI 5. Support for all SBI existing products 6. Reduced customer wait times in branches 7. Reversal of the customer attrition trend

Nationalized banks

There are 20 nationalized banks in In 1969, the Government arranged the nationalization of 14 scheduled commercial banks in order to expand the branch network, followed by six more in 1980. A merger reduced the number from 20 to 19. Nationalized banks are wholly owned by the Government. although some of them have made public issues. In contrast to the state bank group, nationalized banks are centrally governed, i.e., by their respective head offices. Thus, there is only one board for each nationalized bank and meetings are less frequent

Regional rural banks Regional Rural Banks (RRBs): In 1975, the state bank group and nationalized banks were required to sponsor and set up RRBs in partnership with individual states to provide low-cost financing and credit facilities to the rural masses. The example here is AP grameen vikas bank which is sponsored by SBI . Government of India :50% Government of Andhra Pradesh :15% State Bank of India :35% The basic objectives of this bank are as follows: 1.Commitment for rural development 2.deployment of technology, with an emphasis on employment of rural youth.

3.augmentation of agricultural production.

Similarly we have other set of banks with the same objectives namely; Nagarjuna grameena bank, Manjira grameena bank etc.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Application Procedures and RequirementsDocument5 pagesApplication Procedures and Requirementssui1981No ratings yet

- Abid RehmatDocument5 pagesAbid RehmatSheikh Aabid RehmatNo ratings yet

- 4 Differences Between Japanese and German Approaches To WorkDocument3 pages4 Differences Between Japanese and German Approaches To WorkParmpreet KaurNo ratings yet

- Reflection PaperDocument2 pagesReflection PaperJoceter DangiNo ratings yet

- Banking Statistics: 2.1.1. Statistics Based On Statutory ReturnsDocument63 pagesBanking Statistics: 2.1.1. Statistics Based On Statutory ReturnsKirubaker PrabuNo ratings yet

- BLANKING VAM TOP ® 2.875in. 7.8lb-ft API Drift 2.229in.Document1 pageBLANKING VAM TOP ® 2.875in. 7.8lb-ft API Drift 2.229in.BaurzhanNo ratings yet

- Bar Frauds & FormsDocument41 pagesBar Frauds & FormsOm Singh100% (6)

- Search Engine MarketingDocument6 pagesSearch Engine MarketingSachinShingoteNo ratings yet

- Search Engine Optimization: Abhilash Patel Ranklab Interactive, Recovery Brands, LLC @mistabhilashDocument31 pagesSearch Engine Optimization: Abhilash Patel Ranklab Interactive, Recovery Brands, LLC @mistabhilashapi-62303070No ratings yet

- 300 - PEI - Jun 2019 - DigiDocument24 pages300 - PEI - Jun 2019 - Digimick ryanNo ratings yet

- Ebenezer Sathe: ProfileDocument2 pagesEbenezer Sathe: ProfileRaj ShNo ratings yet

- Sub ContractingDocument19 pagesSub ContractingPRABESH GAJUREL0% (1)

- Pakistan Ordnance FactoriesDocument1 pagePakistan Ordnance FactoriesBDO3 3J SolutionsNo ratings yet

- IRR of RA 9295 2014 Amendments - Domestic Shipping Development ActDocument42 pagesIRR of RA 9295 2014 Amendments - Domestic Shipping Development ActIrene Balmes-LomibaoNo ratings yet

- Resume Formats: Choose The Best... !!Document10 pagesResume Formats: Choose The Best... !!Anonymous LMJCoKqNo ratings yet

- Greentech International Success Story 3Document2 pagesGreentech International Success Story 3Arif HidayatNo ratings yet

- Philippines As An Emerging Market: Mentor - Dr. Shalini TiwariDocument10 pagesPhilippines As An Emerging Market: Mentor - Dr. Shalini TiwariRahul ChauhanNo ratings yet

- MillWorker EnglishDocument10 pagesMillWorker EnglishRajveer SinghNo ratings yet

- Linda Meza Kolbe ReportDocument8 pagesLinda Meza Kolbe ReportLinda MezaNo ratings yet

- NEW TRC Volunteer Application FormDocument4 pagesNEW TRC Volunteer Application FormMark J ThompsonNo ratings yet

- Daftar Pustaka: WWW - Bkkbn.go - IdDocument4 pagesDaftar Pustaka: WWW - Bkkbn.go - IdOca DocaNo ratings yet

- BWI 6th Synthesis Report v3.2 FINAL enDocument5 pagesBWI 6th Synthesis Report v3.2 FINAL enJulio Best Setiyawan100% (1)

- Home First Finance CompanyDocument12 pagesHome First Finance CompanyJ BNo ratings yet

- Cta 2D CV 09396 D 2019apr08 Ass PDFDocument205 pagesCta 2D CV 09396 D 2019apr08 Ass PDFMosquite AquinoNo ratings yet

- Beekley v. Jessop Precision - ComplaintDocument104 pagesBeekley v. Jessop Precision - ComplaintSarah BursteinNo ratings yet

- Blaine Kitchenware CalculationDocument11 pagesBlaine Kitchenware CalculationAjeeth71% (7)

- S B Construction, BirbhumDocument2 pagesS B Construction, BirbhumSENCPWD, MALDA100% (1)

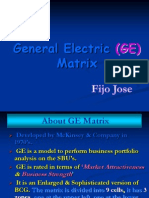

- GE MatrixDocument26 pagesGE MatrixFijo JoseNo ratings yet

- Paypal Resolution PackageDocument46 pagesPaypal Resolution PackageTavon LewisNo ratings yet

- Tax Alert - Revised Commercial Code of Ethiopia - FinalDocument1 pageTax Alert - Revised Commercial Code of Ethiopia - FinalBooruuNo ratings yet