Professional Documents

Culture Documents

Best Buy Co., Inc. First Quarter Report 2012

Uploaded by

RiverheadLOCALOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Best Buy Co., Inc. First Quarter Report 2012

Uploaded by

RiverheadLOCALCopyright:

Available Formats

5/30/12

Earnings Disclosure - Investor Relations - Best Buy Co., Inc.

Earnings Disclosure

BestBuyReportsFiscalFirstQuarterResults

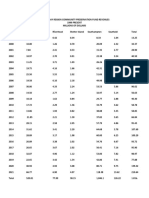

GAAPdilutedEPSof$0.47;adjusted(nonGAAP)dilutedEPSup11percentto$0.72 Companybuildinganewturnaroundplan Fullyearguidanceoutlookunchanged FISCALFIRSTQUARTERPERFORMANCESUMMARY(1) (U.S.dollarsandsquarefootageinmillions,exceptpershareandpersquarefootamounts) ThreeMonthsEnded May5,2012 April30,2011 Revenue Comparablestoresales%change(2) Grossprofitas%ofrevenue SG&Aas%ofrevenue Restructuringcharges Operatingincome Operatingincomeasa%ofrevenue DilutedEPSfromcontinuingoperations Adjusted(nonGAAP)Results(3) Operatingincome Operatingincomeasa%ofrevenue DilutedEPSfromcontinuingoperations KeyMetrics(4) TotalU.S.bigboxretailsquarefeet Revenuepersquarefoot(Domesticsegment) Adjustedoperatingincomepersquarefoot(Domesticsegment) Adjustedreturnoninvestedcapital(5) FiscalFirstQuarter2013Highlights Domesticsegmentonlinerevenuegrowthof20percent $11,610 (5.3%) 25.0% 21.7% $127 $262 2.3% $0.47 $389 3.4% $0.72 42.4 $854 $42 11.2% $11,369 (3.0%) 25.7% 21.6% $4 $460 4.0% $0.64 $464 4.1% $0.65 42.5 $854 $48 11.2% Change 2% N/A (70bps) 10bps N/A (43%) (170bps) (27%) (16%) (70bps) 11% 0% 0% (13%) 0bps

Domesticsegmentmobilephonescomparablestoresalesgrowthof13percent

Domesticsegmentconnectionsgrowthof11percent

DomesticsegmentServicesrevenueincreasedapproximately11percent,includingtheimpactofthe mindSHIFTacquisition

Domesticsegmentcomparablestoresalesgrowthintablets,mobilephones,eReadersandappliancesmorethan offsetbydeclinesinnotebooks,gaming,digitalimagingandtelevisions

www.investors.bestbuy.com/phoenix.zhtml?c=83192&p=earningsDisclosure_Print&erid=441231&vs=txt 1/12

5/30/12

Earnings Disclosure - Investor Relations - Best Buy Co., Inc.

Closed41(effectiveMay12,2012)ofthe50U.S.bigboxstoreclosuresplannedforfiscal2013

Asexpected,theInternationalsegmentoperatinglosswasdrivenprimarilybylowerrevenueinEuropeand ChinaandincreasedcompetitiveconditionsinEurope

MINNEAPOLIS,May22,2012BestBuyCo.,Inc.(NYSE:BBY)todayreportedGAAPnetearningsfromcontinuing operationsof$161million,or$0.47perdilutedshare,forthethreemonthsendedMay5,2012comparedtonetearnings fromcontinuingoperationsof$255million,or$0.64perdilutedsharefortheprioryearperiod.Excludingpreviously announcedrestructuringcharges,adjusted(nonGAAP)netearningsfromcontinuingoperationsforthefirstquarterwas $246million,or$0.72perdilutedshare,comparedtoadjustednetearningsfromcontinuingoperationsof$258million,or $0.65perdilutedshare,fortheprioryearperiod. "BestBuyisinaturnaround,andthestrategicprioritieswelaidoutatthebeginningoftheyeararejustthefirstphaseofthe changestocome,"saidMikeMikan,CEO(interim)ofBestBuy."Weknowwehavetobetteradapttothenewrealitiesofthe marketplace,andwearecreatingalongtermplandesignedtomakeBestBuymorerelevantwithcustomersandpositionthe companyforsustained,profitablereturnsintheyearsahead.Firstquarterresultswereinlinewithourexpectations,andwe arereaffirmingourpreviouslyprovidedannualguidanceforfiscal2013." Revenue ThreeMonthsendedMay5,2012 ($millions) Domestic International Total Revenue $8,822 2,788 $11,610 ChangeYOY 5.1% (6.3%) 2.1% Comp.StoreSales (3.7%) (10.5%) (5.3%) PriorYearPeriod Comp.StoreSales (3.8%) (0.2%) (3.0%)

Totalcompanyrevenuewas$11.6billionduringthefiscalfirstquarter,anincreaseof2.1percentcomparedtotheprioryear period,andincludedacomparablestoresalesdeclineof5.3percent.Asaresultofthecompany'sfiscalyearchange,thefirst quarteroffiscal2013includedFebruary2012,whichincludedafifth("extra")week.Excludingtheextraweek,totalcompany revenuedeclined4.3percentcomparedtotheprioryearperiod.AreasofcomparablestoresalesgrowthintheDomestic segmentincludedtabletsandmobilephoneswithintheComputing&MobilePhonesrevenuecategory,eReaderswithinthe ConsumerElectronicsrevenuecategoryandAppliances.Theseincreasesweremorethanoffsetbycomparablestoresales declinesprimarilyinnotebookswithintheComputingandMobilePhonesrevenuecategory,gamingwithinthe Entertainmentrevenuecategory,anddigitalimagingandtelevisionswithintheConsumerElectronicsrevenuecategory.The Domesticsegmentonlinechannelrevenuegrew20percentcomparedtotheprioryearperiod. Internationalsegmentcomparablestoresalesdeclined10.5percent.Asthecompanypreviouslydiscussed,firstquartersales wereexpectedtobelowerdrivenbydeclinesintheFiveStarbusinessstemmingfromtheexpirationofgovernment sponsoredprogramsandaslowdownintheChineseeconomy.Theimpactofthechangeintheseprogramswassimilarlyfelt byotherretailersinChina.Additionally,softnessinnotebooks,hometheaterandgamingresultedincomparablestore declinesinCanada,andthedifficultmacroenvironmentandchangesinnetworksubsidiesfortheprepayU.K.phonemarket ledtolowermobilephonesalesinourEuropebusiness. GrossProfit ThreeMonthsendedMay5,2012 ($millions) Domestic International GrossProfit $2,233 674 ChangeYOY 4% (13%) %ofRevenue 25.3% 24.2%

2/12

www.investors.bestbuy.com/phoenix.zhtml?c=83192&p=earningsDisclosure_Print&erid=441231&vs=txt

5/30/12

Earnings Disclosure - Investor Relations - Best Buy Co., Inc.

Total

$2,907

(0%)

25.0%

Domesticsegmentgrossprofitdollarsincreased4percent,includingtheextraweek,andincludedaratedeclineof30basis pointscomparedtotheprioryearperiod.TheprimaryfactorsinfluencingthisDomesticsegmentratedeclinewerelower computerrepairrevenueandthecontinuingshiftfromonetimetransactionstoongoing"TechSupport"memberships, partiallyoffsetbyfavorabilityfromahighersalesmixofmobilephones. Internationalsegmentgrossprofitdollarsdeclined13percentandincludeda180basispointratedecline.Thisratedecline wasdueprimarilytoamorecompetitivepricingenvironmentandtheincreasedmixoflowermarginsmartphonesinour Europebusiness. Selling,GeneralandAdministrativeExpenses("SG&A") ThreeMonthsendedMay5,2012 ($millions) SG&A Domestic $1,811 International 707 Total $2,518 ChangeYOY 2% 4% 2% %ofRevenue 20.5% 25.4% 21.7%

TotalcompanySG&Aspendingincreased2percentcomparedtotheprioryearperiod.Excludingtheeffectoftheextraweek, totalcompanySG&Aspendingexperiencedaslightdecline. YearoveryearSG&AcomparisonsforbothDomesticandInternationalsegmentswereimpactedbytheabsenceoftheBest BuyMobileprofitsharepaymentasaresultofthepurchaseofCarphoneWarehouseplc's("CPW")shareoftheBestBuy Mobileprofitshareagreementinthefourthquarteroffiscal2012.Theseintercompanyprofitsharepaymentspreviously increasedDomesticsegmentSG&AexpensewhileloweringInternationalsegmentSG&Aandhadnoimpactonthe company'sconsolidatedoperatingincome. OperatingIncome ThreeMonthsendedMay5,2012 ($millions) Domestic International Total AdjustedoperatingincomeDomestic AdjustedoperatingincomeInternational Adjustedoperatingincome(2) OperatingIncome $295 (33) $262 $422 (33) $389 ChangeYOY (19%) n/a (43%) 14% n/a (16%) %ofRevenue 3.3% (1.2%) 2.3% 4.8% (1.2%) 3.4%

Operatingincomeof$262millionincluded$127millioninrestructuringchargesprimarilyrelatedtoemployeeseverance andfixedassetimpairments,asaresultofactionstakenduringthequartertoreduceheadcountandclosestores.Excluding thesecharges,adjustedoperatingincomeforthequarterdeclined16percentto$389milliondrivenbydeclinesinthe Internationalsegment. Pleaseseethetabletitled"ReconciliationofNonGAAPFinancialMeasures"attachedtothisreleaseformoredetail. ShareRepurchasesandDividends Thecompanyrepurchased$115million,or4.6millionshares,ofitscommonstockatanaveragepriceof$25.07pershare duringFebruary2012,thefirstmonthofthefiscalfirstquarter.Consistentwithpreviousguidance,thecompanycontinuesto expectrepurchasesofapproximately$750millionto$1.0billioninfiscal2013.OnMay10,2012,thecompanypaida quarterlydividendof$0.16percommonshareoutstanding,or$55millionintheaggregate.

www.investors.bestbuy.com/phoenix.zhtml?c=83192&p=earningsDisclosure_Print&erid=441231&vs=txt 3/12

5/30/12

Earnings Disclosure - Investor Relations - Best Buy Co., Inc.

Fiscal2013AnnualGuidanceUnchanged Thecompanyismaintainingitsfiscal2013outlookofadjusted(nonGAAP)dilutedEPSintherangeof$3.50to$3.80, includingtheimpactofexpectedsharerepurchasesandexcludingfiscal2013restructuringcosts. Thecompany'sestimatesforpretaxrestructuringchargesinfiscal2013relatedtoitsstrategicimperativesoutlinedon March,29,2012isarangeof$300to$350million,includingstoreclosures,severance,assetimpairmentsandothercosts. Includingthesecharges,theGAAPdilutedEPSannualguidanceisexpectedintherangeof$2.85to$3.25.Pleasesee "ReconciliationofNonGAAPGuidance"attachedtothisreleaseformoredetail. ConferenceCall BestBuyisscheduledtoconductanearningsconferencecallat9:00a.m.EasternTime(8:00a.m.CentralTime)onMay22, 2012.AwebcastofthecallisexpectedtobeavailableonitsWebsiteathttp://www.investors.bestbuy.com/bothliveand afterthecall.Atelephonereplayisalsoavailablestartingatapproximately12:30pmEasternTime(11:30a.m.CentralTime) onMay22throughMay29.Thedialinnumberforthereplayis8004067325(domestic)or3035903030(international), andtheaccesscodeis4539171. (1)Thefirstquarteroffiscal2013included14weeks.Thefirstquarteroffiscal2012hasbeenrecasttoreflectthefiscalyear changeandincluded13weeks. (2)BestBuy'scomparablestoresalesiscomprisedofrevenueatstores,callcenters,andWebsitesoperatingforatleast14full monthsaswellasrevenuerelatedtoothercomparablesaleschannels.Relocated,remodeledandexpandedstoresare excludedfromthecomparablestoresalescalculationuntilatleast14fullmonthsafterreopening.Acquiredstoresare includedinthecomparablestoresalescalculationbeginningwiththefirstfullquarterfollowingthefirstanniversaryofthe dateoftheacquisition.Theportionofthecalculationofthecomparablestoresalespercentagechangeattributabletothe Internationalsegmentexcludestheeffectoffluctuationsinforeigncurrencyexchangerates.Themethodofcalculating comparablestoresalesvariesacrosstheretailindustry.Asaresult,BestBuy'smethodofcalculatingcomparablestoresales maynotbethesameasotherretailers'methods.Thecalculationofcomparablestoresalesexcludestheimpactoftheextra weekofrevenueinthefirstquarteroffiscal2013. (3)Thecompanydefinesadjustedoperatingincomefortheperiodspresentedasitsreportedoperatingincomeforthose periodscalculatedinaccordancewithaccountingprinciplesgenerallyacceptedintheU.S.("GAAP")adjustedtoexcludethe effectsofrestructuringcharges.Inaddition,thecompanydefinesadjustednetearningsandadjusteddilutedearningsper sharefortheperiodspresentedasitsreportednetearningsanddilutedearningspersharecalculatedinaccordancewith GAAPadjustedtoexcludetheeffectsofrestructuringcharges. ThesenonGAAPfinancialmeasuresprovideinvestorswithanunderstandingofthecompany'soperatingincome,net earningsanddilutedearningspershareadjustedtoexcludetheeffectoftheitemsdescribedabove.ThesenonGAAP financialmeasuresassistinvestorsinmakingareadycomparisonofthecompany'soperatingincome,netearningsand dilutedearningspershareforitsfiscalquarterendedMay5,2012,againstthecompany'sresultsfortherespectiveprioryear periodsandagainstthirdpartyestimatesofthecompany'sdilutedearningspershareforthoseperiodsthatmaynothave includedtheeffectofsuchitems.Additionally,managementusesthesenonGAAPfinancialmeasuresasaninternalmeasure toanalyzetrends,allocateresourcesandanalyzeunderlyingoperatingperformance.Pleasesee"ReconciliationofNonGAAP FinancialMeasures"attachedtothisreleaseformoredetail. (4)TotalU.S.bigboxretailsquarefeetisequaltothetotalretailsquarefootageofourU.S.BestBuybigboxstoresatfiscal quarterend.RevenuepersquarefootisequaltothesumofDomesticsegmenttrailingtwelvemonthsrevenuedividedbythe averagequarterlyretailsquarefootageforallU.S.stores,overthesameperiod.Adjustedoperatingincomepersquarefootis equaltothesumofDomesticsegmenttrailingtwelvemonthsadjustedoperatingincomedividedbytheaveragequarterly

www.investors.bestbuy.com/phoenix.zhtml?c=83192&p=earningsDisclosure_Print&erid=441231&vs=txt 4/12

5/30/12

Earnings Disclosure - Investor Relations - Best Buy Co., Inc.

retailsquarefootageforallU.S.stores,overthesameperiod. (5)Thecompanydefinesadjustedreturnoninvestedcapital("ROIC")asadjustednetoperatingprofitaftertaxesdividedby averageinvestedcapitalfortheperiodspresented(includingbothcontinuinganddiscontinuedoperations).Adjustednet operatingprofitaftertaxesisdefinedasouroperatingincomefortheperiodspresentedcalculatedinaccordancewithGAAP adjustedtoexcludetheeffectsof:(i)operatingleaseinterest;(ii)investmentincome;(iii)netearningsattributableto noncontrollinginterests;(iv)incometaxes;(v)allrestructuringchargesincostsofgoodssoldandoperatingexpenses, goodwillandtradenameimpairments,andcostsrelatedtothepurchaseofCPW'sshareoftheBestBuyMobileprofitshare agreement("BestBuyEuropetransactioncosts");and(vi)thenoncontrollinginterestimpactoftherestructuringcharges, BestBuyEuropetransactioncostsandthepurchaseofCPW'sshareoftheBestBuyMobileprofitshareagreement.Average investedcapitalisdefinedastheaverageofourtotalassetsforthetrailingfourquartersinrelationtotheperiodspresented adjustedto:(i)excludeexcesscashandcashequivalentandshortterminvestments;(ii)includecapitalizedoperatinglease obligationscalculatedusingamultipleofeighttimesrentalexpenses;(iii)excludeourtotalliabilities,lessouroutstanding debt;and(iv)excludeequityofnoncontrollinginterests. ThisnonGAAPfinancialmeasureprovidesinvestorswithanunderstandingofhoweffectivelythecompanyisinvestingits capitalanddeployingitsassets.ManagementusesthisnonGAAPfinancialmeasuretoassistinallocatingresources,and trendsinthemeasuremayfluctuateovertimeasmanagementbalanceslongterminitiativeswithpossibleshortterm impacts.OurROICcalculationutilizestotaloperationsinordertoprovideameasurethatincludestheresultsofandcapital investedinalloperations,includingthosebusinessesthatarenolongercontinuingoperations.Pleasesee"Reconciliationof NonGAAPFinancialMeasures"attachedtothisreleaseformoredetail. ForwardLookingandCautionaryStatements: ThisnewsreleasecontainsforwardlookingstatementswithinthemeaningofthePrivateSecuritiesLitigationReformActof 1995ascontainedinSection27AoftheSecuritiesActof1933andSection21EoftheSecuritiesExchangeActof1934that reflectmanagement'scurrentviewsandestimatesregardingfuturemarketconditions,companyperformanceandfinancial results,businessprospects,newstrategies,thecompetitiveenvironmentandotherevents.Youcanidentifythesestatements bythefactthattheyusewordssuchas"anticipate,""believe,""estimate,""expect,""intend,""project,""guidance,""plan," "outlook,"andotherwordsandtermsofsimilarmeaning.Thesestatementsinvolveanumberofrisksanduncertaintiesthat couldcauseactualresultstodiffermateriallyfromthepotentialresultsdiscussedintheforwardlookingstatements.Among thefactorsthatcouldcauseactualresultsandoutcomestodiffermateriallyfromthosecontainedinsuchforwardlooking statementsarethefollowing:generaleconomicconditions,changesinconsumerpreferences,creditmarketconstraints, acquisitionsanddevelopmentofnewbusinesses,divestitures,productavailability,salesvolumes,pricingactionsand promotionalactivitiesofcompetitors,profitmargins,weather,naturalormanmadedisasters,changesinlaworregulations, foreigncurrencyfluctuation,availabilityofsuitablerealestatelocations,thecompany'sabilitytoreacttoadisasterrecovery situation,theimpactoflabormarketsandnewproductintroductionsonoverallprofitability,failuretoachieveanticipated benefitsofannouncedtransactions,integrationchallengesrelatingtonewventuresandunanticipatedcostsassociatedwith previouslyannouncedorfuturerestructuringactivities.Afurtherlistanddescriptionoftheserisks,uncertaintiesandother matterscanbefoundinthecompany'sannualreportandotherreportsfiledfromtimetotimewiththeSecuritiesand ExchangeCommission,including,butnotlimitedto,BestBuy'sAnnualReportonForm10KfiledwiththeSEConMay1, 2012.BestBuycautionsthattheforegoinglistofimportantfactorsisnotcomplete,andanyforwardlookingstatementsspeak onlyasofthedatetheyaremade,andBestBuyassumesnoobligationtoupdateanyforwardlookingstatementthatitmay make. AboutBestBuyCo.,Inc. BestBuyCo.,Inc.(NYSE:BBY)isaleadingmultichannelglobalretaileranddeveloperoftechnologyproductsandservices. Everydayouremployees167,000strongarecommittedtohelpingdeliverthetechnologysolutionsthatenableeasyaccess

www.investors.bestbuy.com/phoenix.zhtml?c=83192&p=earningsDisclosure_Print&erid=441231&vs=txt 5/12

5/30/12

Earnings Disclosure - Investor Relations - Best Buy Co., Inc.

topeople,knowledge,ideasandfun.Wearekeenlyawareofourroleandimpactontheworld,andwearecommittedto developingandimplementingbusinessstrategiesthatbringsustainabletechnologysolutionstoourconsumersand communities.ForadditionalinformationaboutBestBuy,visitwww.investors.bestbuy.com. InvestorContacts: BillSeymour,VicePresident,InvestorRelations (612)2916122orbill.seymour@bestbuy.com AdamHauser,Director,InvestorRelations (612)2914446oradam.hauser@bestbuy.com MollieO'Brien,Director,InvestorRelations (612)2917735ormollie.obrien@bestbuy.com MediaContacts: SusanBusch,SeniorDirector,PublicRelations (612)2916114orsusan.busch@bestbuy.com BESTBUYCO.,INC. CONSOLIDATEDSTATEMENTSOFEARNINGS ($inmillions,exceptpershareamounts) (Unauditedandsubjecttoreclassification) ThreeMonthsEnded May5,2012 April30,2011 Revenue Costofgoodssold Grossprofit Grossprofit% Selling,generalandadministrativeexpenses SG&A% Restructuringcharges Operatingincome Operatingincome% Otherincome(expense): Investmentincomeandother Interestexpense Earningsfromcontinuingoperationsbeforeincometax expenseandequityinlossofaffiliates Incometaxexpense Effectivetaxrate Equityinlossofaffiliates Netearningsfromcontinuingoperations Lossfromdiscontinuedoperations,netoftax Netearningsincludingnoncontrollinginterest Netearningsfromcontinuingoperationsattributableto noncontrollinginterests Netlossfromdiscontinuedoperationsattributableto noncontrollinginterests NetearningsattributabletoBestBuyCo.,Inc. Basicearnings(loss)pershareattributabletoBestBuyCo.,Inc. Continuingoperations Discontinuedoperations $11,610 8,703 2,907 25.0% 2,518 21.7% 127 262 2.3% 6 (33) 235 72 30.6% (2) 161 (9) 152 6 $158 $0.47 $(0.01) $11,369 8,448 2,921 25.7% 2,457 21.6% 4 460 4.0% 17 (28) 449 155 34.6% (1) 293 (54) 239 (38) 11 $212 $0.65 $(0.11)

6/12

www.investors.bestbuy.com/phoenix.zhtml?c=83192&p=earningsDisclosure_Print&erid=441231&vs=txt

5/30/12

Earnings Disclosure - Investor Relations - Best Buy Co., Inc.

Basicearningspershare Dilutedearnings(loss)pershareattributabletoBestBuyCo.,Inc.(1) Continuingoperations Discontinuedoperations Dilutedearningspershare DividendsdeclaredperBestBuyCo.,Inc.commonshare

$0.46 $0.47 $(0.01) $0.46 $0.16

$0.54 $0.64 $(0.11) $0.53 $0.15 391.1 400.7

WeightedaverageBestBuyCo.,Inc.commonsharesoutstanding(inmillions) Basic 342.2 Diluted 342.8

(1)Thecalculationofdilutedearningspershareassumestheconversionofthecompany'spreviouslyoutstanding convertibledebenturesduein2022into8.8millionsharescommonstockinthethreemonthsendedApril30,2011,and addsbacktherelatedaftertaxinterestexpenseof$1.4millionforthethreemonthsendedApril30,2011. BESTBUYCO.,INC. CONDENSEDCONSOLIDATEDBALANCESHEETS ($inmillions) (Unauditedandsubjecttoreclassification) May5,2012 ASSETS Currentassets Cashandcashequivalents Shortterminvestments Receivables Merchandiseinventories Othercurrentassets Totalcurrentassets Netproperty&equipment Goodwill Tradenames Customerrelationships Equityandotherinvestments Otherassets TOTALASSETS LIABILITIES&EQUITY Currentliabilities Accountspayable Accruedliabilities Shorttermdebt Currentportionoflongtermdebt Totalcurrentliabilities April30,2011

$1,386 1,846 6,065 1,019 10,316 3,407 1,335 130 224 128 471 $16,011

$2,793 20 1,713 6,508 1,135 12,169 3,797 2,506 136 194 316 454 $19,572

$5,731 2,913 306 43 8,993 1,025 1,678 4,315

$6,102 2,876 39 442 9,459 1,179 1,704 7,230 $19,572

Longtermliabilities Longtermdebt Equity TOTALLIABILITIES&EQUITY $16,011

BESTBUYCO.,INC. CONDENSEDCONSOLIDATEDSTATEMENTSOFCASHFLOWS ($inmillions) (Unauditedandsubjecttoreclassification) ThreeMonthsEnded May5,2012 April30,2011 OPERATINGACTIVITIES

www.investors.bestbuy.com/phoenix.zhtml?c=83192&p=earningsDisclosure_Print&erid=441231&vs=txt 7/12

5/30/12

Earnings Disclosure - Investor Relations - Best Buy Co., Inc.

Netearningsincludingnoncontrollinginterests Adjustmentstoreconcilenetearningstototalcashprovidedby operatingactivities: Depreciationandamortizationofdefinitelivedintangibleassets Other,net Changesinoperatingassetsandliabilities,netofacquiredassets andliabilities: Receivables Merchandiseinventories Accountspayable Otherassetsandliabilities Totalcashprovidedbyoperatingactivities INVESTINGACTIVITIES Additionstopropertyandequipment Other,net Totalcashusedininvestingactivities FINANCINGACTIVITIES Repurchaseofcommonstock (Repayments)borrowingsofdebt,net Other,net Totalcash(usedin)providedbyfinancingactivities EFFECTOFEXCHANGERATECHANGESONCASH ADJUSTMENTFORCHANGEINFISCALYEAR INCREASEINCASHANDCASHEQUIVALENTS CASHANDCASHEQUIVALENTSATBEGINNINGOFPERIOD CASHANDCASHEQUIVALENTSATENDOFPERIOD

$152

$239

237 88

237 (60)

623 765 (1,153) (333) 379 (141) 47 (94) (132) (195) 22 (305) 5 202 187 1,199 $1,386

616 926 (561) (54) 1,343 (172) 29 (143) (260) 461 36 237 18 235 1,690 1,103 $2,793

BESTBUYCO.,INC. SEGMENTINFORMATION ($inmillions) (Unauditedandsubjecttoreclassification) DomesticSegmentPerformanceSummary ThreeMonthsEnded May5,2012 April30,2011 Revenue Grossprofit SG&A Restructuringcharges Operatingincome KeyMetrics: Comparablestoresales%change(1) Grossprofitas%ofrevenue SG&Aas%ofrevenue Operatingincomeas%ofrevenue Adjusted(nonGAAP)Results(2) Operatingincome Operatingincomeas%ofrevenue InternationalSegmentPerformanceSummary ThreeMonthsEnded Revenue May5,2012 $2,788 April30,2011 $2,977 (6%)

8/12

Change 5% 4% 2% N/A (19%) N/A (30bps) (70bps) (110bps) 14% 40bps

$8,822 $2,233 $1,811 $127 $295 (3.7%) 25.3% 20.5% 3.3% $422 4.8%

$8,392 $2,147 $1,776 $5 $366 (3.8%) 25.6% 21.2% 4.4% $371 4.4%

www.investors.bestbuy.com/phoenix.zhtml?c=83192&p=earningsDisclosure_Print&erid=441231&vs=txt

5/30/12

Earnings Disclosure - Investor Relations - Best Buy Co., Inc.

Grossprofit SG&A Restructuringcharges Operating(loss)income KeyMetrics: Comparablestoresales%change(1) Grossprofitas%ofrevenue SG&Aas%ofrevenue Operating(loss)incomeas%ofrevenue Adjusted(nonGAAP)Results(2) Operating(loss)income Operating(loss)incomeas%ofrevenue

$674 $707 $0 ($33) (10.5%) 24.2% 25.4% (1.2%) ($33) (1.2%)

$774 $681 ($1) $94 (0.2%) 26.0% 22.9% 3.2% $93 3.1%

(13%) 4% N/A N/A N/A (180bps) 250bps N/A N/A N/A

(1)BestBuy'scomparablestoresalesiscomprisedofrevenueatstores,callcenters,andWebsitesoperatingforatleast14 fullmonthsaswellasrevenuerelatedtoothercomparablesaleschannels.Relocated,remodeledandexpandedstoresare excludedfromthecomparablestoresalescalculationuntilatleast14fullmonthsafterreopening.Acquiredstoresare includedinthecomparablestoresalescalculationbeginningwiththefirstfullquarterfollowingthefirstanniversaryof thedateoftheacquisition.Theportionofthecalculationofthecomparablestoresalespercentagechangeattributableto theInternationalsegmentexcludestheeffectoffluctuationsinforeigncurrencyexchangerates.Themethodofcalculating comparablestoresalesvariesacrosstheretailindustry.Asaresult,BestBuy'smethodofcalculatingcomparablestore salesmaynotbethesameasotherretailers'methods.Thecalculationofcomparablestoresalesexcludestheimpactofthe extraweekofrevenueinthefirstquarteroffiscal2013. (2)Excludestheimpactofpreviouslyannouncedrestructuringcharges.Pleaseseetabletitled"ReconciliationofNon GAAPFinancialMeasures"atthebackofthisrelease. BESTBUYCO.,INC. REVENUECATEGORYSUMMARY (Unauditedandsubjecttoreclassification) DomesticSegmentSummary RevenueMixSummary ThreeMonthsEnded May5,2012 April30,2011 34% 35% 43% 40% 9% 13% 6% 5% 7% 6% 1% 1% 100% 100% ComparableStoreSales ThreeMonthsEnded May5,2012 April30,2011 (5.4%) (5.6%) 3.6% (1.1%) (27.8%) (12.1%) 8.9% 4.2% (2.3%) 3.9% n/a n/a (3.7%) (3.8%)

ConsumerElectronics ComputingandMobilePhones Entertainment Appliances Services(1) Other Total InternationalSegmentSummary

ConsumerElectronics ComputingandMobilePhones Entertainment Appliances Services(1) Other Total

RevenueMixSummary ThreeMonthsEnded May5,2012 April30,2011 17% 18% 62% 59% 4% 4% 9% 10% 8% 9% <1% <1% 100% 100%

ComparableStoreSales ThreeMonthsEnded May5,2012 April30,2011 (17.7%) (8.6%) (5.7%) 3.0% (18.9%) (10.2%) (26.2%) 12.8% 1.1% (6.0%) n/a n/a (10.5%) (0.2%)

(1)The"Services"revenuecategoryconsistsprimarilyofservicecontracts,extendedwarranties,computerrelatedservices, productrepairanddeliveryandinstallationforhometheater,mobileaudioandappliances. BESTBUYCO.,INC. RECONCILIATIONOFNONGAAPFINANCIALMEASURES

www.investors.bestbuy.com/phoenix.zhtml?c=83192&p=earningsDisclosure_Print&erid=441231&vs=txt 9/12

5/30/12

Earnings Disclosure - Investor Relations - Best Buy Co., Inc.

($inmillions,exceptpershareamounts) (Unauditedandsubjecttoreclassification) ThefollowinginformationprovidesreconciliationsofnonGAAPfinancialmeasuresfromcontinuingoperationstothemost comparablefinancialmeasurescalculatedandpresentedinaccordancewithaccountingprinciplesgenerallyacceptedinthe U.S.("GAAP").ThecompanyhasprovidednonGAAPfinancialmeasures,whicharenotcalculatedorpresentedin accordancewithGAAP,asinformationsupplementalandinadditiontothefinancialmeasurespresentedinthe accompanyingnewsreleasethatarecalculatedandpresentedinaccordancewithGAAP.SuchnonGAAPfinancialmeasures shouldnotbeconsideredsuperiorto,asasubstitutefor,orasanalternativeto,andshouldbeconsideredinconjunction with,theGAAPfinancialmeasurespresentedinthenewsrelease.ThenonGAAPfinancialmeasuresintheaccompanying newsreleasemaydifferfromsimilarmeasuresusedbyothercompanies. Thefollowingtablesreconcileoperatingincome,netearningsanddilutedearningspersharefortheperiodspresentedfor continuingoperations(GAAPfinancialmeasures)toadjustedoperatingincome,adjustednetearningsandadjusted dilutedearningspershareforcontinuingoperations(nonGAAPfinancialmeasures)fortheperiodspresented. ThreeMonthsEnded May5,2012 $ %ofRev. Domestic Operatingincome Restructuringcharges Adjustedoperatingincome International Operating(loss)income Restructuringcharges Adjustedoperating(loss)income Consolidated Operatingincome Restructuringcharges Adjustedoperatingincome Netearnings Aftertaximpactof: Restructuringcharges Adjustednetearnings DilutedEPS Pershareimpactof: Restructuringcharges AdjusteddilutedEPS ($33) 0 ($33) $262 127 $389 $161 85 $246 $0.47 0.25 $0.72 (1.2%) n/a (1.2%) 2.3% 1.1% 3.4% $94 (1) $93 $460 4 $464 $255 3 $258 $0.64 0.01 $0.65 3.2% (0.0%) 3.1% 4.0% 0.0% 4.1% $295 127 $422 3.3% 1.4% 4.8% ThreeMonthsEnded April30,2011 $ %ofRev. $366 5 $371 4.4% 0.1% 4.4%

BESTBUYCO.,INC. RECONCILIATIONOFNONGAAPFINANCIALMEASURES ($inmillions) (Unauditedandsubjecttoreclassification) ThefollowinginformationprovidesareconciliationofanonGAAPfinancialmeasuretothemostcomparablefinancial measurecalculatedandpresentedinaccordancewithGAAP.ThecompanyhasprovidedthenonGAAPfinancialmeasure, whichisnotcalculatedorpresentedinaccordancewithGAAP,asinformationsupplementalandinadditiontothefinancial measurethatiscalculatedandpresentedinaccordancewithGAAP.SuchnonGAAPfinancialmeasureshouldnotbe consideredsuperiorto,asasubstitutefor,orasanalternativeto,andshouldbeconsideredinconjunctionwith,theGAAP financialmeasure.ThenonGAAPfinancialmeasureintheaccompanyingnewsreleasemaydifferfromsimilarmeasures usedbyothercompanies. ThefollowingtableincludesthecalculationofadjustedROICfortotaloperations,whichincludesbothcontinuingand discontinuedoperations(nonGAAPfinancialmeasures),alongwithareconciliationtothecalculationofreturnontotal assets("ROA")(GAAPfinancialmeasure)fortheperiodspresented. CalculationofReturnonInvestedCapital(1) May5,2012 (2) April30,2011(2)

www.investors.bestbuy.com/phoenix.zhtml?c=83192&p=earningsDisclosure_Print&erid=441231&vs=txt 10/12

5/30/12

Earnings Disclosure - Investor Relations - Best Buy Co., Inc.

NetOperatingProfitAfterTaxes(NOPAT) Operatingincomecontinuingoperations Operatingincomediscontinuedoperations Totaloperatingincome Add:Operatingleaseinterest(3) Add:Investmentincome Less:Netearningsattributabletononcontrollinginterest(NCI) Less:Incometaxes(4) NOPAT Add:Restructuringchargesandimpairments(5) Add:NCIimpactofBBYMprofitsharebuyoutandrestructuringcharges AdjustedNOPAT AverageInvestedCapital Totalassets Less:ExcessCash(6) Add:Capitalizedoperatingleaseobligations(7) Totalliabilities Exclude:Debt(8) Less:Noncontrollinginterests Averageinvestedcapital AdjustedReturnoninvestedcapital(ROIC) CalculationofReturnonAssets(1)

$782 (364) 418 599 36 (1,221) (966) $(1,134) 1,664 1,202 $1,732 $18,170 (1,254) 9,588 (12,662) 2,268 (671) $15,439 11.2% May5,2012 (2)

$2,405 (271) 2,134 587 51 (90) (1,069) $1,613 224 $1,837 $19,082 (978) 9,388 (12,142) 1,770 (674) $16,446 11.2% April30,2011(2) $1,385 19,082 7.3%

Netearningsincludingnoncontrollinginterests(9) Totalassets Returnonassets(ROA)

$(156) 18,170 (0.9%)

(1)ThecalculationsofReturnonInvestedCapitalandReturnonAssetsusetotaloperations,whichincludesbothcontinuing anddiscontinuedoperations. (2)Incomestatementaccountsrepresenttheactivityforthe12monthsendedasofeachofthebalancesheetdates.Balance sheetaccountsrepresenttheaverageaccountbalancesforthe4quartersendedasofeachofthebalancesheetdates. (3)Operatingleaseinterestrepresentstheaddbacktooperatingincomedrivenbyourcapitalizedleaseobligationsand representsfiftypercentofourannualrentalexpensewhichisthemultipleusedfortheretailsectorbyoneofthenationally recognizedcreditratingagenciesthatratesourcreditworthiness,andweconsiderittobeanappropriatemultipleforour leaseportfolio. (4)Incometaxesarecalculatedusingablendedstatutoryrateattheenterpriselevelbasedonstatutoryratesfromthe countrieswedobusinessin. (5)Includesallrestructuringchargesincostsofgoodssoldandoperatingexpenses,goodwillandtradenameimpairments, andtheBestBuyEuropetransactioncosts. (6)Cashandcashequivalentsandshortterminvestmentsarecappedatthegreaterof1%ofrevenueoractualamountson hand.Thecashandcashequivalentsandshortterminvestmentsinexcessofthecaparesubtractedfromourcalculationof averageinvestedcapitaltoshowtheirexclusionfromtotalassets. (7)Themultipleofeighttimesannualrentalexpenseinthecalculationofourcapitalizedoperatingleaseobligationsisthe multipleusedfortheretailsectorbyoneofthenationallyrecognizedcreditratingagenciesthatratesourcreditworthiness, andweconsiderittobeanappropriatemultipleforourleaseportfolio. (8)Debtincludesshorttermdebt,currentportionoflongtermdebtandlongtermdebtandisaddedbacktoour calculationofaverageinvestedcapitaltoshowitsexclusionfromtotalliabilities. (9)NetearningsincludingnoncontrollinginterestsforthetwelvemonthsendedMay5,2012includethe$1.3billion purchaseofCPW'sshareoftheBestBuyMobileprofitshareagreement,a$1.2billionnoncashimpairmentchargeto reflectthewriteoffofBestBuyEuropegoodwilland$214millioninrestructuringcharges. BESTBUYCO.,INC. RECONCILIATIONOFNONGAAPGUIDANCE (Unauditedandsubjecttoreclassification) ThefollowinginformationprovidesreconciliationsofnonGAAPfinancialmeasurestothemostcomparablefinancial measurescalculatedandpresentedinaccordancewithGAAP.ThecompanyhasprovidednonGAAPfinancialmeasures, whicharenotcalculatedorpresentedinaccordancewithGAAP,asinformationsupplementalandinadditiontothe financialmeasurespresentedintheaccompanyingnewsreleasethatarecalculatedandpresentedinaccordancewith

www.investors.bestbuy.com/phoenix.zhtml?c=83192&p=earningsDisclosure_Print&erid=441231&vs=txt 11/12

5/30/12

Earnings Disclosure - Investor Relations - Best Buy Co., Inc.

GAAP.SuchnonGAAPfinancialmeasuresshouldnotbeconsideredsuperiorto,asasubstitutefor,orasanalternativeto, andshouldbeconsideredinconjunctionwith,theGAAPfinancialmeasurespresentedinthenewsrelease.ThenonGAAP financialmeasuresintheaccompanyingnewsreleasemaydifferfromsimilarmeasuresusedbyothercompanies. ThefollowingtablereconcilesEPSguidancefortheperiodpresented(GAAPfinancialmeasures)toadjusteddilutedEPS guidance(nonGAAPfinancialmeasures)fortheperiodpresented. TwelveMonthsEnding Feb2,2013 ReconciliationofAdjustedDilutedEPS DilutedEPSguidance Restructuringcharges AdjusteddilutedEPSguidance BestBuyReportsFY13Q1Results

HUG#1613743

$2.85$3.25 $0.65$0.55 $3.50$3.80

www.investors.bestbuy.com/phoenix.zhtml?c=83192&p=earningsDisclosure_Print&erid=441231&vs=txt

12/12

You might also like

- RXR/GGV Qualified & Eligible Documents (Final 09.26.22)Document23 pagesRXR/GGV Qualified & Eligible Documents (Final 09.26.22)RiverheadLOCALNo ratings yet

- Riverhead Town Proposed Battery Energy Storage CodeDocument10 pagesRiverhead Town Proposed Battery Energy Storage CodeRiverheadLOCALNo ratings yet

- AKRF Public Outreach Report AttachmentsDocument126 pagesAKRF Public Outreach Report AttachmentsRiverheadLOCALNo ratings yet

- Peconic Bay Region Community Preservation Fund Revenues 1999-2021Document1 pagePeconic Bay Region Community Preservation Fund Revenues 1999-2021RiverheadLOCALNo ratings yet

- Riverhead Budget Presentation March 22, 2022Document14 pagesRiverhead Budget Presentation March 22, 2022RiverheadLOCALNo ratings yet

- Yvette AguiarDocument10 pagesYvette AguiarRiverheadLOCALNo ratings yet

- N.Y. Downtown Revitalization Initiative Round Five GuidebookDocument38 pagesN.Y. Downtown Revitalization Initiative Round Five GuidebookRiverheadLOCALNo ratings yet

- Draft Scope Riverhead Logistics CenterDocument20 pagesDraft Scope Riverhead Logistics CenterRiverheadLOCALNo ratings yet

- 5-10-2022 Budget Hearing Presentation UpdatedDocument12 pages5-10-2022 Budget Hearing Presentation UpdatedRiverheadLOCALNo ratings yet

- 2022 - 03 - 16 - EPCAL Resolution & Letter AgreementDocument9 pages2022 - 03 - 16 - EPCAL Resolution & Letter AgreementRiverheadLOCALNo ratings yet

- Riverhead Town Board Comprehensive Plan Status Discussion Feb. 17, 2022Document30 pagesRiverhead Town Board Comprehensive Plan Status Discussion Feb. 17, 2022RiverheadLOCALNo ratings yet

- Riverhead Comprehensive Plan Update Public Outreach Compendium Feb 16, 2022Document7 pagesRiverhead Comprehensive Plan Update Public Outreach Compendium Feb 16, 2022RiverheadLOCALNo ratings yet

- Catherine KentDocument7 pagesCatherine KentRiverheadLOCALNo ratings yet

- Pediatric Covid-19 Hospitalization ReportDocument15 pagesPediatric Covid-19 Hospitalization ReportKevin TamponeNo ratings yet

- Juan Micieli-MartinezDocument3 pagesJuan Micieli-MartinezRiverheadLOCALNo ratings yet

- Robert E. KernDocument3 pagesRobert E. KernRiverheadLOCALNo ratings yet

- Evelyn Hobson-Womack Campaign Finance DisclosureDocument3 pagesEvelyn Hobson-Womack Campaign Finance DisclosureRiverheadLOCALNo ratings yet

- Kenneth RothwellDocument5 pagesKenneth RothwellRiverheadLOCALNo ratings yet

- 2021 General Election - Suffolk County Sample Ballot BookletDocument154 pages2021 General Election - Suffolk County Sample Ballot BookletRiverheadLOCALNo ratings yet

- League of Women Voters of NYS 2021 Voters Guide: Ballot PropositionsDocument2 pagesLeague of Women Voters of NYS 2021 Voters Guide: Ballot PropositionsRiverheadLOCAL67% (3)

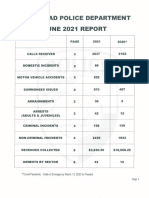

- Riverhead Town Police Report, January 2021Document6 pagesRiverhead Town Police Report, January 2021RiverheadLOCALNo ratings yet

- Riverhead Town Police Monthly Report July 2021Document6 pagesRiverhead Town Police Monthly Report July 2021RiverheadLOCALNo ratings yet

- Old Steeple Church Time CapsuleDocument4 pagesOld Steeple Church Time CapsuleRiverheadLOCALNo ratings yet

- Riverhead Town Police Monthly Report, June 2021Document6 pagesRiverhead Town Police Monthly Report, June 2021RiverheadLOCALNo ratings yet

- Riverhead Town Police Report, August 2021Document6 pagesRiverhead Town Police Report, August 2021RiverheadLOCALNo ratings yet

- Navy Environmental Concerns Survey For CalvertonDocument3 pagesNavy Environmental Concerns Survey For CalvertonRiverheadLOCALNo ratings yet

- Riverhead Town Police Report, March 2021Document6 pagesRiverhead Town Police Report, March 2021RiverheadLOCALNo ratings yet

- Aguiar-Kent Campaign Finance Report 32-Day Pre GeneralDocument2 pagesAguiar-Kent Campaign Finance Report 32-Day Pre GeneralRiverheadLOCALNo ratings yet

- NYSED Health and Safety Guide For The 2021 2022 School YearDocument21 pagesNYSED Health and Safety Guide For The 2021 2022 School YearNewsChannel 9100% (2)

- "The Case of The DIsappering Landfill, or To Mine or Not To Mine" by Carl E. Fritz JR., PEDocument10 pages"The Case of The DIsappering Landfill, or To Mine or Not To Mine" by Carl E. Fritz JR., PERiverheadLOCALNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Todd Hitt Court FilingDocument33 pagesTodd Hitt Court FilingJon BanisterNo ratings yet

- The Complete Guide To Mining StocksDocument24 pagesThe Complete Guide To Mining StocksisheanesuNo ratings yet

- Audit Program For EquityDocument12 pagesAudit Program For EquityIra Jean DaganzoNo ratings yet

- Chap 013Document36 pagesChap 013ismat arteeNo ratings yet

- DoubleDragon Final Domestic ProspectusDocument528 pagesDoubleDragon Final Domestic ProspectusKeith GarridoNo ratings yet

- Tan vs. Sec (206 Scra 740)Document4 pagesTan vs. Sec (206 Scra 740)Rivera Meriem Grace MendezNo ratings yet

- Introduction To Accounting - Kartiks Case StudyDocument3 pagesIntroduction To Accounting - Kartiks Case Studynudetarzan1985No ratings yet

- Accounting Chapter 9Document7 pagesAccounting Chapter 9Angelica Faye DuroNo ratings yet

- 177 Pascual vs. OrozcoDocument3 pages177 Pascual vs. OrozcoLoren Bea TulalianNo ratings yet

- C Law Unit II - Securities Exchange Board of India (SEBI ACT)Document5 pagesC Law Unit II - Securities Exchange Board of India (SEBI ACT)Mr. funNo ratings yet

- Thompson Corporations Outline: General PrinciplesDocument32 pagesThompson Corporations Outline: General PrinciplesthebhurdNo ratings yet

- EMH Markets Fully Reflect InfoDocument2 pagesEMH Markets Fully Reflect InfoJoshua JiangNo ratings yet

- An Analysis of Hedging Strategies using Index FuturesDocument73 pagesAn Analysis of Hedging Strategies using Index FuturesGowtham ShettyNo ratings yet

- Corporation Reviewer 2Document166 pagesCorporation Reviewer 2meiji15No ratings yet

- Bruce Berkowitz On WFC 90sDocument4 pagesBruce Berkowitz On WFC 90sVu Latticework PoetNo ratings yet

- Law On Sales ReviewerDocument4 pagesLaw On Sales ReviewerresNo ratings yet

- Investment Banking PrelimDocument13 pagesInvestment Banking PrelimKristina SisonNo ratings yet

- Stock Exchange Index MethodologyDocument13 pagesStock Exchange Index MethodologyBoy satyaNo ratings yet

- 'BOOTS Pension Fund Management TO CHECKDocument2 pages'BOOTS Pension Fund Management TO CHECKMatsatka VitaNo ratings yet

- Santa Claus RallyDocument7 pagesSanta Claus Rallytanner3052No ratings yet

- F-2019 PSC Annual Report With FS SR - PSE3Document251 pagesF-2019 PSC Annual Report With FS SR - PSE3Peter ParkerNo ratings yet

- Chapter 4 Financial InvestmentDocument53 pagesChapter 4 Financial InvestmentAngelica Joy ManaoisNo ratings yet

- Left v. Tesla 18-05463Document27 pagesLeft v. Tesla 18-05463Fred LamertNo ratings yet

- 6sub Alll in One Walang PE Pati EappDocument136 pages6sub Alll in One Walang PE Pati EappJeff Dela RosaNo ratings yet

- Ai Trading ApplicationDocument28 pagesAi Trading ApplicationAbhijeet PradhanNo ratings yet

- Chapter 11 Risk and Return in Capital Markets Key ConceptsDocument14 pagesChapter 11 Risk and Return in Capital Markets Key ConceptsshuNo ratings yet

- Blaine Kitchenware IncDocument4 pagesBlaine Kitchenware IncChrisNo ratings yet

- CA - Zam Dec-2017Document102 pagesCA - Zam Dec-2017Dixie CheeloNo ratings yet

- LAW-resa-corporation Flashcards Study GuideDocument27 pagesLAW-resa-corporation Flashcards Study Guiderose annNo ratings yet

- MBA-2 Sem-III: Management of Financial ServicesDocument17 pagesMBA-2 Sem-III: Management of Financial ServicesDivyang VyasNo ratings yet