Professional Documents

Culture Documents

ACCT1A Sample Exam 3 Title

Uploaded by

Benson WencenslausOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT1A Sample Exam 3 Title

Uploaded by

Benson WencenslausCopyright:

Available Formats

ACCT1A

Sample Exam 3

Name: __________________________ Date: _____________ 1. The maturity date of a note receivable: A) Is the day of the credit sale. B) Is the day the note was signed. C) Is the day the note is due to be paid. D) Is the date of the first payment. E) Is the last day of the month. 2. The amount of bad debt expense can be estimated by: A) The percent of sales method. B) The percent of accounts receivable method. C) The aging of accounts receivable method. D) Only b and c. E) Bad debt expense can be estimated by any of the three methods listed above. 3. Dell reported net sales of $8,739 million and average accounts receivable of $864 million. Its accounts receivable turnover is: A) 0.90. B) 10.1. C) 36.1. D) 50.0. E) 3,686. 4. A promissory note: A) Is a short-term investment for the maker. B) Is a written promise to pay a specified amount of money at a certain date. C) Is a liability to the payee. D) Is another name for an installment receivable. E) Cannot be used in payment of an account receivable. 5. An accounting procedure that (1) estimates and reports bad debts expense from credit sales during the period of the sales, and (2) reports accounts receivable at the amount of cash to be collected is the: A) Allowance method of accounting for bad debts. B) Aging of notes receivable. C) Adjustment method for uncollectible debts. D) Direct write-off method of accounting for bad debts. E) Cash basis method of accounting for bad debts. 6. The accounts receivable turnover is calculated by: A) Dividing net sales by average accounts receivable. B) Dividing net sales by average accounts receivable and multiplying by 365. C) Dividing average accounts receivable by net sales. D) Dividing average accounts receivable by net sales and multiplying by 365. E) Dividing net income by average accounts receivable. 7. Electron borrowed $75,000 cash from TechCom by signing a promissory note. TechCom's entry to record the transaction should include a: A) Debit to Notes Receivable for $75,000. B) Debit to Accounts Receivable for $75,000. C) Credit to Notes Receivable for $75,000. D) Debit Notes Payable for $75,000. E) Credit to Sales for $75,000.

Page 1

ACCT1A

Sample Exam 3

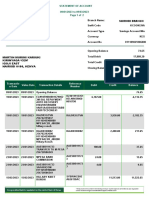

8. A company used the percent of sales method to determine its bad debts expense. At the end of the current year, the company's unadjusted trial balance reported the following selected amounts:

All sales are made on credit. Based on past experience, the company estimates 0.5% of credit sales to be uncollectible. What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared? A) $925 B) $1,225 C) $4,200 D) $4,500 E) $45,000 9. Western Company sold $700,000 of its accounts receivable and was charged a 3% factoring fee. How should Western Company record this transaction in the journal?

A) B) C) D) E)

Item A Item B Item C Item D Item E

Page 2

ACCT1A

Sample Exam 3

10. The materiality principle: A) States that an amount can be ignored if its effect on financial statements is unimportant to the user's business decisions. B) Requires use of the allowance method for bad debts. C) Requires use of the direct write-off method. D) States that bad debts not be written off. E) Requires that expenses be reported in the same period as the sales they helped produce. 11. A method of estimating bad debts expense that involves a detailed examination of outstanding accounts and their length of time past due is the: A) Direct write-off method. B) Aging of accounts receivable method. C) Percentage of sales method. D) Aging of investments method. E) Percent of accounts receivable method. 12. The matching principle requires: A) That expenses be ignored if their effect on the financial statements are less important than revenues to the financial statement user. B) The use of the direct write-off method for bad debts. C) The use of the allowance method of accounting for bad debts. D) That bad debts be disclosed in the financial statements. E) That bad debts not be written off. 13. Wallah Company agreed to accept $5,000 in cash along with an $8,000, 90-day, 13.5% note from customer Judith Klemper to settle her $13,000 past-due account. How should Wallah record this transaction?

A) B) C) D) E)

Item A Item B Item C Item D Item E

Page 3

ACCT1A

Sample Exam 3

14. On December 31 of the current year, a company's unadjusted trial balance included the following: Accounts Receivable, debit balance of $97,250; Allowance for Doubtful Accounts, credit balance of $951. What amount should be debited to Bad Debts Expense, assuming 6% of outstanding accounts receivable at the end of the current year will be uncollectible?: A) $ 951. B) $3,992. C) $4,884. D) $5,835. E) $6,786. 15. A company has net sales of $870,000 and average accounts receivable of $174,000. What is its accounts receivable turnover for the period? A) 0.20. B) 5.00 C) 20.0 D) 73.0 E) 1,825. 16. Acme Company has an agreement with a major credit card company which calls for cash to be received immediately upon deposit of Acme customers' credit card sales receipts. The credit card company receives 3.5% of card sales as its fee. If Acme has $2,000 in credit card sales, which of the following statements are true? A) Acme debits Cash $2,000. B) Acme debits Cash $1,930. C) Acme debits Accounts Receivable--Credit Card Co $2,000. D) Acme debits Accounts Receivable--Credit Card Co $1,930. E) Acme credits Sales $1,930 17. If the credit balance of the Allowance for Doubtful Accounts account exceeds the amount of a bad debt being written off, the entry to record the write-off against the allowance account results in: A) An increase in the expenses of the current period. B) A reduction in current assets. C) A reduction in equity. D) No effect on the expenses of the current period. E) A reduction in current liabilities. 18. The interest accrued on $3,600 at 7% for 60 days is: A) $ 36. B) $ 42. C) $252. D) $180. E) $420. 19. The account receivable turnover measures: A) How long it takes to sell accounts receivable to a factor. B) How often, on average receivables are received and collected during the period. C) The relation of cash sales to credit sales. D) How long it takes to sell merchandise inventory. E) All of the above. 20. The quality of receivables refers to: A) The creditworthiness of sellers. B) The speed of collection. C) The likelihood of collection without loss. D) Sales turnover. E) The interest rate.

Page 4

ACCT1A

Sample Exam 3

21. The amount due on the maturity date of a $6,000, 60-day 8%, note receivable is: A) $6,000. B) $6,480. C) $5,520. D) $6,080. E) $5,920. 22. The buyer who pays cash for an account receivable is called a: A) Payor. B) Pledgor. C) Factor. D) Payee. E) Pledgee. 23. Pledging receivables: A) Allows firms to raise cash. B) Allows a firm to retain ownership of its receivables. C) Does not transfer risk of bad debts to the lender. D) Should be disclosed in the financial statements. E) All of the above. 24. A promissory note received from a customer in exchange for an account receivable: A) Is a cash equivalent for the recipient. B) Is an account receivable for the recipient. C) Is a note receivable for the recipient. D) Is a short-term investment for the recipient. E) Is a note payable for the recipient.

Page 5

ACCT1A

Sample Exam 3

25. A company ages its accounts receivables to determine its end of period adjustment for bad debts. At the end of the current year, management estimated that $39,375 of the accounts receivable balance would be uncollectible. Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a credit balance of $3,285. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

A) B) C) D) E)

Item A Item B Item C Item D Item E

26. Ordinary repairs: A) Are expenditures to keep an asset in normal operating condition. B) Are necessary if an asset is to perform to expectations over its useful life. C) Are treated as expenses. D) Include cleaning, lubricating, and normal adjusting. E) All of the above. 27. Huffington Company traded in an old delivery truck for a new one. The old truck had a cost of $75,000 and accumulated depreciation of $60,000. The new truck had an invoice price of $125,000. Huffington was given a $12,000 trade-in allowance on the old truck, which meant they paid $113,000 in addition to the old truck to acquire the new truck. What is the recorded value of the new truck? A) $15,000 B) $75,000 C) $113,000 D) $125,000 E) $128,000

Page 6

ACCT1A

Sample Exam 3

28. Many companies use accelerated depreciation in computing taxable income because: A) It is required by the tax rules. B) It is required by financial reporting rules. C) It postpones tax payments until later years, and the company can use the resources now to earn additional income before payment is due. D) Using it causes a company to use higher income in the early years of the asset's useful life. E) The results are identical to straight-line depreciation. 29. A company used straight-line depreciation for an item of equipment that cost $12,000, had a salvage value of $2,000, and had a five-year useful life. After depreciating the asset for three complete years, the salvage value was reduced to $1,200 and its total useful life was increased from 5 years to 6 years. Determine the amount of depreciation to be charged against the machine during each of the remaining years of its useful life: A) $1,000. B) $1,800. C) $1,467. D) $1,600. E) $2,160. 30. A method that allocates an equal portion of the total depreciable cost for a plant asset to each unit produced is called: A) Accelerated depreciation. B) Declining-balance depreciation. C) Straight-line depreciation. D) Units-of-production depreciation. E) Modified accelerated cost recovery system (MACRS) depreciation. 31. Natural resources: A) Include standing timber, mineral deposits, and oil and gas fields. B) Are also called wasting assets. C) Are long-term assets. D) Are depleted. E) All of the above. 32. Assume Fairytale Brownies sold a wrapping/packaging machine for cash of $172,000. If Accumulated depreciation on the sale date was $58,311 and a gain of $6,721 was recognized on the sale. What was the original cost of the asset? A) $223,590. B) $216,869. C) $165,279. D) $65,032. E) $113,689. 33. Plant assets are: A) Tangible assets used in the operation of a business that have a useful life of more than one accounting period. B) Current assets. C) Held for sale. D) Intangible assets used in the operations of a business that have a useful life of more than one accounting period. E) Tangible assets used in the operation of business that have a useful life of less than one accounting period. 34. The relevant factor(s) in computing depreciation include: A) Cost. B) Salvage value. C) Useful life. D) Depreciation method. E) All of the above.

Page 7

ACCT1A

Sample Exam 3

35. Revenue expenditures: A) Are additional costs of plant assets that do not materially increase the asset's life or its productive capabilities. B) Are known as balance sheet expenditures. C) Extend the asset's useful life. D) Substantially benefit future periods. E) Are debited to asset accounts. 36. The total cost of an asset less its accumulated depreciation is called: A) Historical cost. B) Book value. C) Present value. D) Current (market) value. E) Replacement cost. 37. The formula for computing annual straight-line depreciation is: A) Depreciable cost divided by useful life in units. B) Cost plus salvage value divided by the useful life in years. C) Cost less salvage value divided by the useful life in years. D) Cost divided by useful life in years. E) Cost divided by useful life in units. 38. A change in an accounting estimate is: A) Reflected in past financial statements. B) Reflected in future financial statements and also requires modification of past statements. C) A change in a calculated amount that is part of financial statements that results from new information or subsequent developments and from better insight or improved judgement. D) Not allowed under current accounting rules. E) Considered an error in the financial statements. 39. A leasehold: A) Is a short-term rental agreement. B) Is the same as a patent. C) Are the rights granted to the lessee by the lessor of a lease. D) Is recorded as rent expense. E) Is an investment asset. 40. Another name for a capital expenditure is: A) Revenue expenditure. B) Asset expenditure. C) Long-term expenditure. D) Contributed capital expenditure. E) Balance sheet expenditure. 41. The useful life of a plant asset is: A) The length of time it is productively used in a company's operations. B) Never related to its physical life. C) Its productive life, but not to exceed one year. D) Determined by the FASB. E) Determined by law. 42. Salvage value is: A) Also called residual value. B) Also called scrap value. C) An estimate of the asset's value at the end of its benefit period. D) A factor relevant to determining depreciation. E) All of the above.

Page 8

ACCT1A

Sample Exam 3

43. A company purchased property for a building site. The costs associated with the property were:

What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building? A) $175,800 to Land; $18,800 to Building. B) $190,000 to Land; $3,800 to Building. C) $190,800 to Land; $1,000 to Building. D) $192,800 to Land; $0 to Building. E) $193,800 to Land; $0 to Building. 44. A company purchased a rope braiding machine for $190,000. The machine has a useful life of 8 years and a residual value of $10,000. It is estimated that the machine could produce 750,000 units of climbing rope over its useful life. In the first year, 105,000 units were produced. In the second year, production increased to 109,000 units. Using the units-of-production method, what is the amount of depreciation that should be recorded for the second year? A) $25,200. B) $26,160. C) $26,660. D) $27,613. E) $53,160. 45. Plant assets include: A) Land. B) Land improvements. C) Buildings. D) Machinery and equipment. E) All of the above. 46. Which of the following costs should be recorded as the cost of a given machine? 1. Purchase price 2. Costs to assemble the machine 3. Costs to test the machine 4. Costs of a worker injured while the machine was being tested A) All of these items make up the cost of the machine. B) Items 1, 2 and 3. C) Items 2, 3 and 4. D) Items 3, 4 and 1. E) Items 1 and 2.

Page 9

ACCT1A

Sample Exam 3

47. The New Deal is a used-car dealership which owns the following four assets. Identify those which are considered plant assets. 1. Cars and vans which they plan to sell to customers 2. A van which is used to provide courtesy rides to customers who are having their cars serviced at the dealership. 3. A show room used to display some of the more high-end vehicles for sale 4. A building and land which was purchased as an investment which are not used in the company's operations. A) All are plant assets. B) Items 1 and 2 are plant assets. C) Items 3 and 4 are plant assets. D) Items 1, 3 and 4 are plant assets. E) Items 2 and 3 are plant assets. 48. Plant assets are: A) Current assets. B) Used in operations. C) Natural resources. D) Long-term investments. E) Intangible. 49. When originally purchased, a vehicle had an estimated useful life of 8 years. The vehicle cost $23,000 and its estimated salvage value is $1,500. After 4 years of straight-line depreciation, the asset's total estimated useful life was revised from 8 years to 6 years and there was no change in the estimated salvage value. The depreciation expense in year 5 equals: A) $ 5,375.00. B) $ 2,687.50. C) $ 5,543.75. D) $10,750.00. E) $ 2,856.25. 50. Obsolescence: A) Occurs when an asset is at the end of its useful life. B) Refers to a plant asset that is no longer useful in producing goods and services. C) Refers to the insufficient capacity of a company's plant assets to meet the company's productive demands. D) Occurs when an asset's salvage value is less than its replacement cost. E) Does not affect plant assets. 51. FUTA taxes are: A) Social Security taxes. B) Medicare taxes. C) Employee income taxes. D) Unemployment taxes. E) Employee deductions. 52. Uncertainties such as natural disasters: A) Are not contingent liabilities because they are future events not arising out of past transactions or events. B) Are contingent liabilities because they are future events arising from past transactions or events. C) Should be disclosed because of their usefulness to financial statements. D) Are estimated liabilities because the amounts are uncertain. E) Arise out of transactions such as debt guarantees.

Page 10

ACCT1A

Sample Exam 3

53. Obligations not expected to be paid within the longer of one year or the company's operating cycle are reported as: A) Current assets. B) Current liabilities. C) Long-term liabilities. D) Operating cycle liabilities. E) Bills. 54. Known liabilities: A) Include accounts payable, notes payable, and payroll. B) Are obligations set by agreements, contracts, or laws. C) Are measurable. D) Are definitely determinable. E) All of the above. 55. A company had fixed interest expense of $6,000, its income before interest expense and any income taxes is $18,000, and its net income is $8,400. The company's times interest earned ratio equals: A) 0.33. B) 0.71. C) 1.40. D) 3.00. E) 12,000. 56. An employee earnings report: A) Is the W-2. B) Is the W-4. C) Is the cumulative record of an employee's hours worked, gross earnings, deductions, and net pay. D) Shows the pay period dates, hours worked, gross pay, deductions, and net pay of each employee for every pay period. E) Is used to compute the federal income taxes withheld from each employee's gross pay. 57. Unearned revenues are: A) Also called deferred revenues. B) Amounts received in advance from customers for future delivery of products or services. C) Also called collections in advance. D) Also called prepayments. E) All of the above. 58. The wage bracket withholding table is used to: A) Compute social security withholding. B) Compute Medicare withholding. C) Compute federal income tax withholding. D) Prepare the W-4. E) All of the above. 59. Gross pay is: A) Take-home pay. B) Total compensation earned by an employee before any deductions. C) Salaries after taxes are deducted. D) Deductions withheld by an employer. E) The amount of the paycheck. 60. Contingent liabilities must be recorded if: A) The future event is probable and the amount owed can be reasonably estimated. B) The future event is remote. C) The future event is reasonably possible. D) The amount owed cannot be reasonably estimated. E) All of the above.

Page 11

ACCT1A

Sample Exam 3

61. Payroll expenses for employers may involve: A) Liabilities to individual employees. B) Liabilities to federal and state governments. C) Liabilities to insurance companies. D) Liabilities to labor unions. E) All of the above. 62. A payroll register includes: A) Pay period dates. B) Hours worked. C) Gross pay and net pay. D) Deductions. E) All of the above. 63. Fixed costs: A) Create risk. B) Can be an advantage when a company is growing. C) Include interest expense. D) Do not fluctuate with changes in sales. E) All of the above. 64. An employee earned $47,000 during the year working for an employer. The FICA tax for social security is 6.2% and the FICA tax for Medicare is 1.45%. The employee's share of FICA taxes is: A) $ 681.50. B) $2,914.00. C) $3,595.50. D) $7,191.00. E) Zero, since the employee's pay exceeds the FICA limit. 65. Employer payroll taxes: A) Are an added expense beyond the wages and salaries earned by employees. B) Represent the federal taxes withheld from employees. C) Represent the social security taxes withheld from employees. D) Are paid by the employee. E) All of the above. 66. A company sold $12,000 worth of trampolines with an extended warranty. It estimates that 2% of these sales will result in warranty work. The company should: A) Consider the warranty expense a remote liability since the rate is only 2%. B) Recognize warranty expense at the time the warranty work is performed. C) Recognize warranty expense and liability in the year of the sale. D) Consider the warranty expense a contingent liability. E) Recognize warranty liability when the company purchases the trampolines. 67. A company sells leaf blowers for $170 each. Each unit has a 3 year warranty that covers replacement of defective parts. It is estimated that 4% of all leaf blowers sold will be returned under the warranty at an average cost of $30 each. During October, the company sold 400,000 leaf blowers. 800 leaf blowers were serviced under the warranty during October at a total cost of $25,000. The balance in the Estimated Warranty Liability account on October 1 was $12,500. What is the company's warranty expense for the month of October? A) $24,000. B) $25,000. C) $37,500. D) $467,500. E) $480,000.

Page 12

ACCT1A

Sample Exam 3

68. Employers' responsibilities for payroll include: A) Providing each employee with an annual report of his or her wages subject to FICA and federal income taxes along with the amount of these taxes withheld. B) Filing Form 941, the Employer's Quarterly Federal Tax Return. C) Filing Form 940, the Annual Federal Unemployment Tax Return. D) Individual earnings records for each employee. E) All of the above. 69. The current FUTA tax rate is 0.8%, and the SUTA tax rate is 5.4%. Both taxes are applied to the first $7,000 of an employee's pay. Assume that an employee earned $8,900. What is the amount of total unemployment taxes the employer must pay on this employee's wages? A) $322.00. B) $434.00. C) $480.60. D) $551.80. E) Zero, since the employee's wages exceed the maximum of $7,000. 70. FICA taxes include: A) Social Security taxes. B) Charitable giving. C) Employee income taxes. D) Unemployment taxes. E) All of the above. 71. Obligations due to be paid within one year or the company's operating cycle, whichever is longer, are: A) Current assets. B) Current liabilities. C) Earned revenues. D) Operating cycle liabilities. E) Bills. 72. Sales taxes payable: A) Is an estimated liability. B) Is a contingent liability. C) Is a current liability for retailers. D) Is a business expense. E) Is a long-term liability. 73. If a company uses a special payroll bank account: A) The company does not need to issue paychecks. B) The company draws one check for the entire payroll on the regular bank account and deposits it in the payroll bank account. C) The company must use a federal depository bank for the payroll. D) There is no need for a payroll register. E) There is no need to issue W-2's. 74. The amount of federal income taxes withheld from an employee's paycheck is determined by: A) The employee's annual earnings rate and number of withholding allowances. B) The employer's merit rating. C) The amount of social security taxes. D) Multiplying the gross pay by 6.2%. E) All of the above. 75. The times interest earned computation is: A) (Net income + Interest expense + Income taxes)/Interest expense. B) (Net income + Interest expense - Income taxes)/Interest expense. C) (Net income - Interest expense - Income taxes)/Interest expense. D) (Net income - Interest expense + Income taxes)/Interest expense. E) Interest expense/(Net income + Interest expense + Income taxes expense).

Page 13

ACCT1A

Sample Exam 3

Answer Key

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. C E B B A A A D A A B C D C B B D B B C D C E C A E D C D D E A A E A B C C C E A E E B E B E B A B D A C E D C E C

Page 14

ACCT1A

Sample Exam 3

59. 60. 61. 62. 63. 64. 65. 66. 67. 68. 69. 70. 71. 72. 73. 74. 75.

B A E E E C A C E E B A B C B A A

Page 15

You might also like

- Chapter 01 Intermediate AccountingDocument10 pagesChapter 01 Intermediate AccountingKelvin Kenneth ValmonteNo ratings yet

- AFAR - CUP 2019 ANSWERSDocument9 pagesAFAR - CUP 2019 ANSWERSTakuriNo ratings yet

- Module 2.ABMDocument1 pageModule 2.ABMLeizl A. VillapandoNo ratings yet

- Ex-08 - Comprehensive Review 2.0Document14 pagesEx-08 - Comprehensive Review 2.0Jedidiah Smith0% (1)

- Accounting Exam 1Document4 pagesAccounting Exam 1Tra. SmNo ratings yet

- Top 61 Accounting Interview QuestionsDocument3 pagesTop 61 Accounting Interview QuestionsSachin KumarNo ratings yet

- Theory of Accounts Quiz 1Document3 pagesTheory of Accounts Quiz 1Cris Tarrazona Casiple100% (1)

- Final Exam - 2020Document10 pagesFinal Exam - 2020mshan lee100% (1)

- Motor Yacht Accounting ProceduresDocument3 pagesMotor Yacht Accounting Proceduresroberto.stepicNo ratings yet

- Acct 220 Final Exam (Umuc)Document9 pagesAcct 220 Final Exam (Umuc)OmarNiemczykNo ratings yet

- Theory of AccountsDocument11 pagesTheory of AccountsMarc Eric Redondo50% (2)

- Manufacturing AccountingDocument9 pagesManufacturing AccountingKui MangusNo ratings yet

- Research ProposalDocument14 pagesResearch ProposalMuhammad Ali100% (1)

- Accounting Exam SolnDocument17 pagesAccounting Exam SolnAsmara NoorNo ratings yet

- AccountingDocument14 pagesAccountingasdefence0% (1)

- ACCT504 Case Study 1 The Complete Accounting Cycle-13Document12 pagesACCT504 Case Study 1 The Complete Accounting Cycle-13Mohammad Islam100% (1)

- Bookkeeping Problem Accounting CycleDocument2 pagesBookkeeping Problem Accounting CycleMa Christina EncinasNo ratings yet

- Week 3. Assignment 2 - Journat Entries and Adjustments and Preparing StatmentsDocument3 pagesWeek 3. Assignment 2 - Journat Entries and Adjustments and Preparing Statmentsayush guptaNo ratings yet

- Conceptual Framework for Financial ReportingDocument11 pagesConceptual Framework for Financial ReportingAnne NavarroNo ratings yet

- Exercises of Financial AccountingDocument25 pagesExercises of Financial AccountingSai AlviorNo ratings yet

- CPA TestDocument22 pagesCPA Testdani13_335942No ratings yet

- Accounting As An Information SystemDocument14 pagesAccounting As An Information SystemAimee SagastumeNo ratings yet

- Exercises: Set B: Date Ref. Debit Credit BalanceDocument6 pagesExercises: Set B: Date Ref. Debit Credit BalanceSameh SalahNo ratings yet

- Cpa ReviewDocument31 pagesCpa ReviewlordaiztrandNo ratings yet

- Accounting ExamDocument1 pageAccounting ExamRGDayananNo ratings yet

- Accounting Web TestDocument5 pagesAccounting Web TestZhou Tian Yang100% (1)

- Inc and Bal SheetDocument13 pagesInc and Bal SheetSanjay MehrotraNo ratings yet

- ACC 403 Homework CH 10 and 11Document5 pagesACC 403 Homework CH 10 and 11leelee0302100% (1)

- Auditing - Hook Chapter 8 SolutionsDocument35 pagesAuditing - Hook Chapter 8 SolutionsZenni T XinNo ratings yet

- Advanced Financial ManagementDocument2 pagesAdvanced Financial ManagementjashmathewwNo ratings yet

- Accounting Journal ResearchDocument27 pagesAccounting Journal ResearchAgustinus Yogi IndriawanNo ratings yet

- ACC 304 Week 2 Quiz 01 - Chapter 8Document6 pagesACC 304 Week 2 Quiz 01 - Chapter 8LereeNo ratings yet

- Exam 1 Practice AccountingDocument7 pagesExam 1 Practice Accountings430230No ratings yet

- Adjusting Accounts for Financial StatementsDocument60 pagesAdjusting Accounts for Financial Statementssamas7480No ratings yet

- Financial Accounting I Final Practice Exam 1Document14 pagesFinancial Accounting I Final Practice Exam 1misterwaterr100% (1)

- ACC 304 Week 3 Quiz 02 Chapter 09Document6 pagesACC 304 Week 3 Quiz 02 Chapter 09LereeNo ratings yet

- The Financial Accounting Cycle PDFDocument219 pagesThe Financial Accounting Cycle PDFQuadjo Opoku Sarkodie100% (1)

- FFFFDocument284 pagesFFFFDeepika JouNo ratings yet

- MACRS DepreciationDocument3 pagesMACRS DepreciationRanaAbdulAzizNo ratings yet

- Cash Flow Notes StudentsDocument15 pagesCash Flow Notes StudentsKennethNo ratings yet

- FI504 Case Study 1 - The Complete Accounting Cycle RevisedDocument16 pagesFI504 Case Study 1 - The Complete Accounting Cycle RevisedBrittini Beyondcompare BridgesNo ratings yet

- Itm696 - CH9,10,11Document31 pagesItm696 - CH9,10,11bkleafs100% (1)

- May 2016 Professional Examination Financial Accounting (1.1) Examiner'S Report, Questions and Marking SchemeDocument24 pagesMay 2016 Professional Examination Financial Accounting (1.1) Examiner'S Report, Questions and Marking SchemeMartn Carldazo DrogbaNo ratings yet

- (ToA) Cash & Cash EquivalentsDocument1 page(ToA) Cash & Cash Equivalentslooter198No ratings yet

- Adjustments (Accounting)Document18 pagesAdjustments (Accounting)MarKhun GabotNo ratings yet

- Some ExercisesDocument3 pagesSome ExercisesMinh Tâm NguyễnNo ratings yet

- Accounting Problems and Standard SolutionsDocument3 pagesAccounting Problems and Standard SolutionsIris Mnemosyne100% (1)

- Accounting For Overheads ACCAPartD F2 QN03Document7 pagesAccounting For Overheads ACCAPartD F2 QN03Ankit Agrawal100% (1)

- What Is AccountingDocument23 pagesWhat Is AccountingKartik KrisnianNo ratings yet

- Basic AccountingDocument8 pagesBasic Accountingpurple ailurophileNo ratings yet

- Adjusting Entries PDFDocument16 pagesAdjusting Entries PDFabdul majid khawajaNo ratings yet

- Relic Spotter Inc. CaseDocument9 pagesRelic Spotter Inc. CaseC DonisNo ratings yet

- AccountingDocument7 pagesAccountingGifford NaleNo ratings yet

- Introduction To Financial Accounting SystemDocument59 pagesIntroduction To Financial Accounting SystemElvanNo ratings yet

- Accounting Theory Perspectives and MethodologiesDocument17 pagesAccounting Theory Perspectives and MethodologiesSiti Hajar PratiwiNo ratings yet

- Cash FlowDocument6 pagesCash FlowLara Lewis AchillesNo ratings yet

- Accounting For Income Tax-NotesDocument4 pagesAccounting For Income Tax-NotesMaureen Derial PantaNo ratings yet

- Accounting Principles SEC FASB StandardsDocument9 pagesAccounting Principles SEC FASB StandardsJerry WideNo ratings yet

- Inventory MCQDocument6 pagesInventory MCQsan0z100% (2)

- A Manual ONDocument20 pagesA Manual ONSpecs F Work75% (4)

- The International Monetary System Chapter 11Document23 pagesThe International Monetary System Chapter 11Ashi GargNo ratings yet

- ICICI Bank Moratorium FAQsDocument8 pagesICICI Bank Moratorium FAQsCNBCTV18 DigitalNo ratings yet

- TT06 - QuesDocument3 pagesTT06 - QuesLe Tuong MinhNo ratings yet

- Blank Letter Bank LetterDocument8 pagesBlank Letter Bank LetterBINGE TV EXCLUSIVENo ratings yet

- Indian Accounting Standards OverviewDocument12 pagesIndian Accounting Standards OverviewREHANRAJNo ratings yet

- SMChap 021Document56 pagesSMChap 021testbank91% (11)

- Acct 2020 Excel Budget Problem Student TemplateDocument12 pagesAcct 2020 Excel Budget Problem Student Templateapi-249190933No ratings yet

- Martin Murimi KariukiDocument2 pagesMartin Murimi KariukiKameneja LeeNo ratings yet

- Name: Ahmad Nawaz Name: Ahmad Nawaz Name: Ahmad Nawaz Name: Ahmad NawazDocument1 pageName: Ahmad Nawaz Name: Ahmad Nawaz Name: Ahmad Nawaz Name: Ahmad NawazRanja JeNo ratings yet

- Quote Driven MarketDocument2 pagesQuote Driven Marketkurdiausha29No ratings yet

- DSCR Tutorial: Understanding the Debt Service Coverage RatioDocument2 pagesDSCR Tutorial: Understanding the Debt Service Coverage RatioArun Pasi100% (1)

- Pledge-Contract Act: Simar MakkarDocument8 pagesPledge-Contract Act: Simar MakkarPearl LalwaniNo ratings yet

- Profitability Analysis On Ultratech Cement: By, M.Praneeth Reddy 22397089Document19 pagesProfitability Analysis On Ultratech Cement: By, M.Praneeth Reddy 22397089PradeepNo ratings yet

- Week 7Document3 pagesWeek 7yogeshgharpureNo ratings yet

- Money Growth Inflation GuideDocument2 pagesMoney Growth Inflation GuideQuy Nguyen QuangNo ratings yet

- How To Calculate NPV (With Downloadable Calculator)Document7 pagesHow To Calculate NPV (With Downloadable Calculator)Richard Obeng KorantengNo ratings yet

- Successful Forex Trading Secrets RevealedDocument37 pagesSuccessful Forex Trading Secrets RevealedAndrei Rotaru83% (6)

- Mod 04 - Trade A - RDocument2 pagesMod 04 - Trade A - RMARY GRACE VARGAS0% (1)

- Banc One Case Study PDF FreeDocument10 pagesBanc One Case Study PDF FreeFathima KamalNo ratings yet

- 2021 - Q2 - PT Merdeka Copper Gold TBK - 30 Jun 2021 AuditedDocument119 pages2021 - Q2 - PT Merdeka Copper Gold TBK - 30 Jun 2021 AuditedJun HarismonNo ratings yet

- A-Z Accounting Terms and MeaningsDocument23 pagesA-Z Accounting Terms and MeaningsRomilie Mae BalagtasNo ratings yet

- Pakistan Stock Exchange Limited: Internet Trading Subscribers ListDocument3 pagesPakistan Stock Exchange Limited: Internet Trading Subscribers ListMuhammad AhmedNo ratings yet

- BSF II, Macro OutlineDocument5 pagesBSF II, Macro OutlineJeff SmithNo ratings yet

- MT 309 Equity Shares: Benefits and RisksDocument2 pagesMT 309 Equity Shares: Benefits and Riskspiyush chauhanNo ratings yet

- Nism Series XV - Research Analyst Certification ExamDocument17 pagesNism Series XV - Research Analyst Certification ExamRohit ShetNo ratings yet

- Financial Statements: Statement of Profit or Loss and Other Comprehensive Income DR CRDocument8 pagesFinancial Statements: Statement of Profit or Loss and Other Comprehensive Income DR CRTawanda Tatenda HerbertNo ratings yet

- FINALREPORTBANKNEW Converted 95201213Document58 pagesFINALREPORTBANKNEW Converted 95201213dinjoNo ratings yet

- PFRS 9Document1 pagePFRS 9Ella MaeNo ratings yet

- Straumann enDocument26 pagesStraumann enyeochunhongNo ratings yet