Professional Documents

Culture Documents

Leve 400 Course Outline Financial Accounting

Uploaded by

Ablorh Mensah AbrahamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Leve 400 Course Outline Financial Accounting

Uploaded by

Ablorh Mensah AbrahamCopyright:

Available Formats

FINANCIAL ACCOUNTING LEVEL 400 SECOND SEMESTER COURSE OUTLINE Week 1

1. The Regulatory and Financial Reporting Framework b. Apply the Companies Code 1963, Act 179 to limited liability companies in Ghana b. The International Accounting Standards Board (IASB) i The role of The International Accounting Standards Board (IASB) ii The standard setting process c. The framework for the preparation and presentation of financial statements i Objective of financial statements ii Qualitative characteristics of financial statements iii Elements of financial statements iv Recognition and measurement of elements of financial statements v Fair value basis of measurement vi Concepts of capital and capital maintenance

Week 2 -5 d. Prepare and present the financial statements of limited companies in conformity with legal requirements, approved accounting standards and generally accepted accounting principles

Week 6 IA

Week 7 - 9 2. Preparation of consolidated financial statements Group accounting- introduction Describe the concept of a group and objective and usefulness of consolidated financial statement Describe the circumstances and reasoning for subsidiaries to be excluded from consolidated financial statements Preparation of a consolidated balance sheet for a simple group dealing with pre and post acquisition profits, minority interest and consolidated goodwill. Prepare a consolidated profit a and loss account for a simple group including scenario where acquisitions occur during the year and situation where there are minority interest.

Week 9-11 3. Group accounting- Intra group transaction adjustments Explanation of why intra-group transactions should be eliminated on consolidation Account for the effect in the profit and loss account and balance sheet) of intra group trading and other transactions including:Unrealised profit in stock

4. Application of International Financial Reporting Standards a. Identify and recommend accounting treatments for items in financial statements 1. Revenue recognition 2. Impairment of assets 3. Inventories. 4. Property, plant and equipment. 5. Revenue.

Week 12 IA

Week 13 Revision FORM OF EXAMINATION The examination will be a three-hour paper consisting of 4 questions. Marks have been allocated based on the efforts required to answer each question LECTURING The methods: The following methods and forms of study are used in the course:

lectures (3 hours a week) teacher's consultations individual assignment group assignment

Reading Materials Frankwood Volume2 Ghanas Companies Code ACCA Manual Financial Reporting IFRS Financial Reporting ICA Manual Accounting Theory and Practice by MWE Glautier and B Underdown Lecturers materials

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Aqua Bounty - Case AnswersDocument6 pagesAqua Bounty - Case AnswersAblorh Mensah Abraham50% (4)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Enterprise Risk SubmissionDocument4 pagesEnterprise Risk SubmissionAblorh Mensah Abraham50% (4)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 31Document6 pagesChapter 31LorraineMartinNo ratings yet

- Boss Ats StrategyDocument39 pagesBoss Ats StrategyDocksey100% (1)

- AA025 PYQ 2015 - 2014 (ANS) by SectionDocument4 pagesAA025 PYQ 2015 - 2014 (ANS) by Sectionnurauniatiqah49No ratings yet

- B. Module 16 Presentation (Compatibility Mode)Document3 pagesB. Module 16 Presentation (Compatibility Mode)Ablorh Mensah AbrahamNo ratings yet

- Course Evaluation 4 - Amended 1page PDFDocument1 pageCourse Evaluation 4 - Amended 1page PDFAblorh Mensah AbrahamNo ratings yet

- Course Evaluation 4 - Amended 1page PDFDocument1 pageCourse Evaluation 4 - Amended 1page PDFAblorh Mensah AbrahamNo ratings yet

- Public Notice Amendment PDDocument1 pagePublic Notice Amendment PDAblorh Mensah AbrahamNo ratings yet

- Work EthicsDocument3 pagesWork EthicsAblorh Mensah AbrahamNo ratings yet

- Sharing The Experience: Presented by Abraham Ablorh MensahDocument12 pagesSharing The Experience: Presented by Abraham Ablorh MensahAblorh Mensah AbrahamNo ratings yet

- HR Outsourcing CompanyDocument2 pagesHR Outsourcing CompanyAblorh Mensah AbrahamNo ratings yet

- Are Washed in The BloodDocument1 pageAre Washed in The BloodAblorh Mensah AbrahamNo ratings yet

- Classifying CostDocument5 pagesClassifying CostAblorh Mensah AbrahamNo ratings yet

- Shinhan Financial Group - Case SubmissionDocument7 pagesShinhan Financial Group - Case SubmissionAblorh Mensah AbrahamNo ratings yet

- I Fly AwayDocument1 pageI Fly AwayAblorh Mensah AbrahamNo ratings yet

- Ppa e Bulletin Jan Feb 2013Document8 pagesPpa e Bulletin Jan Feb 2013Ablorh Mensah AbrahamNo ratings yet

- All To Jesus I Surrender Key of CDocument1 pageAll To Jesus I Surrender Key of CBishal RaiNo ratings yet

- Prigrim Progress Character ListDocument5 pagesPrigrim Progress Character ListAblorh Mensah Abraham100% (1)

- Chapter 6 - The Political and Economic EnvironmentDocument3 pagesChapter 6 - The Political and Economic EnvironmentAblorh Mensah AbrahamNo ratings yet

- The Ga Chieftancy CoupDocument2 pagesThe Ga Chieftancy CoupAblorh Mensah AbrahamNo ratings yet

- 2 - Working With TemperamentsDocument42 pages2 - Working With TemperamentsAblorh Mensah AbrahamNo ratings yet

- The Manager Agricultural Development Bank XXXXXXX AccraDocument1 pageThe Manager Agricultural Development Bank XXXXXXX AccraAblorh Mensah AbrahamNo ratings yet

- The Wooden BowlDocument7 pagesThe Wooden BowlAblorh Mensah AbrahamNo ratings yet

- Paid in FullDocument1 pagePaid in FullAblorh Mensah AbrahamNo ratings yet

- of GoldDocument22 pagesof GoldPooja Soni100% (5)

- Introduction To Accounting and Business: Discussion QuestionsDocument46 pagesIntroduction To Accounting and Business: Discussion QuestionsCyyyNo ratings yet

- Corporate Banking CAIIBDocument59 pagesCorporate Banking CAIIBvenkatesh pkNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 11Document35 pagesMultinational Business Finance 12th Edition Slides Chapter 11Alli TobbaNo ratings yet

- Finance Exam 2 Cheat Sheet: by ViaDocument2 pagesFinance Exam 2 Cheat Sheet: by ViaKimondo KingNo ratings yet

- QUIZ 2-Mid.-Problems On Statement of Cash FlowsDocument2 pagesQUIZ 2-Mid.-Problems On Statement of Cash FlowsMonica GeronaNo ratings yet

- Project On Mutual FundsDocument75 pagesProject On Mutual FundsParag MoreNo ratings yet

- PAM Entering OCO Orders in Interactive Brokers (IB) APPDocument13 pagesPAM Entering OCO Orders in Interactive Brokers (IB) APPMamoon20No ratings yet

- Report 1Document29 pagesReport 1Riya ThakurNo ratings yet

- Projecting Financials & ValuationsDocument88 pagesProjecting Financials & ValuationsPratik ModyNo ratings yet

- Conflict Encountered by Manila Bulletin Publishing Corporation With Swot and RecommDocument2 pagesConflict Encountered by Manila Bulletin Publishing Corporation With Swot and RecommJoshua DaarolNo ratings yet

- Rahul PDFDocument73 pagesRahul PDFrahul mehtaNo ratings yet

- Tutorial 2 Discount Rate WACC AfterDocument12 pagesTutorial 2 Discount Rate WACC AfteroussemNo ratings yet

- PerpetualDocument4 pagesPerpetualJayvee BelarminoNo ratings yet

- Pert. Ke 3. Analisa Kinerja KeuanganDocument25 pagesPert. Ke 3. Analisa Kinerja KeuanganYULIANTONo ratings yet

- Group Case AssignmentDocument34 pagesGroup Case AssignmentNaomi Alberg-BlijdNo ratings yet

- Bosinp 8 CP 7Document84 pagesBosinp 8 CP 7Dhruv TayalNo ratings yet

- Introduction To Forwards & Futures: NotesDocument8 pagesIntroduction To Forwards & Futures: Notesamit pNo ratings yet

- Essay - Stock Prices Fluctuate Due To Covid CasesDocument10 pagesEssay - Stock Prices Fluctuate Due To Covid CasesJames Patrick ONo ratings yet

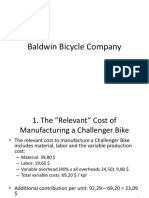

- Baldwin Bicycle Company EngDocument8 pagesBaldwin Bicycle Company EngChayan Kothari IDD,Biochem, IT-BHU, Varanasi (INDIA)No ratings yet

- Chipotle Stock PriceDocument5 pagesChipotle Stock PriceKashémNo ratings yet

- HP Analyst ReportDocument11 pagesHP Analyst Reportjoycechan879827No ratings yet

- Survey of Accounting 7th Edition Warren Solutions ManualDocument35 pagesSurvey of Accounting 7th Edition Warren Solutions Manualandrefloresxudd100% (25)

- Ifrs 1 First-Time Adoption On International Financial Reporting StandardDocument9 pagesIfrs 1 First-Time Adoption On International Financial Reporting StandardAsad MehmoodNo ratings yet

- Hull White PDFDocument64 pagesHull White PDFstehbar9570No ratings yet

- Chapter 6. Exchange Rate DeterminationDocument22 pagesChapter 6. Exchange Rate DeterminationTuấn LêNo ratings yet

- Cfa Level2 Fra Intercorporate Investments v2 PDFDocument43 pagesCfa Level2 Fra Intercorporate Investments v2 PDFDevesh Garg100% (1)