Professional Documents

Culture Documents

Home Work Ch. 1

Uploaded by

score08Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Home Work Ch. 1

Uploaded by

score08Copyright:

Available Formats

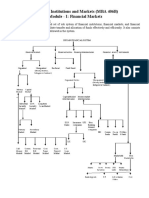

Hivan Ron-Anguiano Ch. 1 2.

What is the difference between the claim of a debt holder of General Motors and an equity holder of General Motors? -debt holder requires a fixed dollar payment. An equity holder claims ownership and is paid on earnings if any after the debt holders are paid. 3. What is the basic principle in determining the price of a financial asset? -The basic principle is that the price of any financial assets equal to the present value of its expected cash flow, even if the cash flow is not know with certainty. 8. Explain the difference between each of the following: a. money market and capital market : money markets deal with short term debt instruments and capital markets deal with longer maturity financial assets. b. primary market and secondary market: primary markets are dealing with financial claims that are newly issued while secondary markets deal with seasoned financial instruments. c. domestic market and foreign market : domestic market is where issuers domiciled in a country issue securities and where those securities are subsequently traded. The foreign market in any county is where the securities of issuers not domiciled in the country are sold and traded. d. National market and Euromarkets: Internal market aka national market is composed of the domestic market and foreign market. The Euromarkets aka external market aka offshore market aka international market allows trading of securities with two distinguishing features: 1. At issuance securities are offered simultaneously to investors in a number of countries. 2. They are issued outside the jurisdiction of any single country. 9.Indicate whether each of the following instruments trades I the money market or the capital market. a. money market- Financial instrument with 4 month maturity b. capital market-US Treasury issues securities with 10 year maturity c. capital market- MFST issues common stock d. money market- Alaska (state) issues financial instruments with 8 month maturity

15. What is meant by the institutionalization of capital markets: -The shifting of the financial markets from dominance by retail investors to intuitional investor is referred to as the institutionalization of financial markets. 16. What are the two basic types of derivatives? -Future/Forward contracts and options contracts b. Derivative markets are nothing more than legalized gambling casinos and serve no economic function. Comment on this statement. Derivatives serve an important function of the global financial marketplace, providing end-users with opportunities to better manage financial risks associated with their business transactions. Without derivative instruments and the market in which they trade in, the financial systems throughout the world would not be as integrated as they are today. 17. What is the economic rationale for the widespread use of disclosure regulation. - The standard justification for disclosure rules is that mangers o the issuing firm have more information about the financial health and future of the firm than investors who own or are considering the purchase of the firms securities. Managers have uneven information or more than regular investors and this creates what is known as agency problems. The managers are acting for their own benefits and not the investors. 18. What is meant by market failure? -A market is said to fail if it cannot, by itself, maintain all the requirements for a competitive situation.

You might also like

- Whiskey FinalDocument13 pagesWhiskey FinalElijahRosejuneGumapacAmoyNo ratings yet

- Financial Markets (Chapter 7)Document3 pagesFinancial Markets (Chapter 7)Kyla Dayawon100% (1)

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- Chapter 1 (Role of Financial Markets and Institutions)Document25 pagesChapter 1 (Role of Financial Markets and Institutions)Momenul Islam Mridha Murad100% (2)

- Financial MarketsDocument49 pagesFinancial MarketsNew OldNo ratings yet

- The Game of KevukDocument8 pagesThe Game of KevukTselin NyaiNo ratings yet

- International Financial MarketDocument36 pagesInternational Financial MarketSmitaNo ratings yet

- Fin 4303 Chapter 8 ContentDocument10 pagesFin 4303 Chapter 8 Contentsxsy8124100% (1)

- Inbound Email Configuration For Offline ApprovalsDocument10 pagesInbound Email Configuration For Offline Approvalssarin.kane8423100% (1)

- Contemporary Financial Management 14th Edition Moyer Solutions ManualDocument35 pagesContemporary Financial Management 14th Edition Moyer Solutions Manualexedentzigzag.96ewc96% (23)

- People vs. Chingh - GR No. 178323 - DigestDocument1 pagePeople vs. Chingh - GR No. 178323 - DigestAbigail TolabingNo ratings yet

- Enterprise Risk ManagementDocument59 pagesEnterprise Risk Managementdarshani sandamaliNo ratings yet

- Case Study of Asahi Glass CompanyDocument22 pagesCase Study of Asahi Glass CompanyJohan ManurungNo ratings yet

- Final Exam Financial MarketsDocument9 pagesFinal Exam Financial MarketsLorielyn Mae SalcedoNo ratings yet

- Stock Market Investing for Beginners: The Best Book on Stock Investments To Help You Make Money In Less Than 1 Hour a DayFrom EverandStock Market Investing for Beginners: The Best Book on Stock Investments To Help You Make Money In Less Than 1 Hour a DayNo ratings yet

- Notes On Financial SystemsDocument62 pagesNotes On Financial SystemsamitNo ratings yet

- 12 - Chapter 5 PDFDocument49 pages12 - Chapter 5 PDFShipra Chaudhary100% (1)

- CH 4 Financial MarketsDocument12 pagesCH 4 Financial MarketsYonatan MazengiaNo ratings yet

- Chap 3 Financial MarketsDocument63 pagesChap 3 Financial MarketsHoàng Lâm NguyễnNo ratings yet

- Capital Market ReformsDocument11 pagesCapital Market ReformsVijith VijyanNo ratings yet

- Financial Institutions and Markets (MBA 406B) Module - I: Financial MarketsDocument62 pagesFinancial Institutions and Markets (MBA 406B) Module - I: Financial MarketsMothish Chowdary GenieNo ratings yet

- International Financial System: 2.1.1. Role of Financial MarketDocument54 pagesInternational Financial System: 2.1.1. Role of Financial MarketADHITHYA SATHEESANNo ratings yet

- Chapter 1 HWDocument5 pagesChapter 1 HWValerie Bodden Kluge100% (1)

- Mgt-205: Financial Markets and InstitutionsDocument78 pagesMgt-205: Financial Markets and InstitutionsBishal ShresthaNo ratings yet

- FMI All ModulesDocument81 pagesFMI All ModulesSandeepMishraNo ratings yet

- Chapter 8 AnswerDocument5 pagesChapter 8 AnswerKlea OrosaNo ratings yet

- Investment and Risk Management Chapter 2 Concepts in ReviewDocument6 pagesInvestment and Risk Management Chapter 2 Concepts in ReviewAnn Connie PerezNo ratings yet

- Chapter 2: Overview of The Financial SystemDocument43 pagesChapter 2: Overview of The Financial Systememre kutayNo ratings yet

- Bba Notes 6Document53 pagesBba Notes 6RAJATNo ratings yet

- PMS EXAM CHP 2Document9 pagesPMS EXAM CHP 2Rachaita AdhikaryNo ratings yet

- EurobondDocument11 pagesEurobondMahirNo ratings yet

- The Financial Market EnvironmentDocument50 pagesThe Financial Market EnvironmentLorrie Jean De GuzmanNo ratings yet

- CH 11 The Capital Market & 12 The Securities MarketDocument59 pagesCH 11 The Capital Market & 12 The Securities MarketJenny RanilloNo ratings yet

- Finmark Semis AssignmentDocument10 pagesFinmark Semis AssignmentPeachy CamNo ratings yet

- Financial EnvironmentDocument4 pagesFinancial EnvironmentUmair AzizNo ratings yet

- FINMA 2105 - Chapter 2Document13 pagesFINMA 2105 - Chapter 2John Lloyd Gonzales AlvarezNo ratings yet

- 12th Commerce Lesson 6Document16 pages12th Commerce Lesson 6sonaiya software solutionsNo ratings yet

- Capital N Money MarketDocument22 pagesCapital N Money MarketColin Castor FdesNo ratings yet

- Structure of Financial SystemDocument21 pagesStructure of Financial Systemkhalid hossainNo ratings yet

- FM201 Financial Market MidtermModuleDocument26 pagesFM201 Financial Market MidtermModuleeysjenNo ratings yet

- Financial Markets. An OverviewDocument3 pagesFinancial Markets. An OverviewEmmanuelle RojasNo ratings yet

- IRM Chapter 2 Concept ReviewsDocument6 pagesIRM Chapter 2 Concept ReviewsJustine Belle FryorNo ratings yet

- Structure of Financial SystemDocument18 pagesStructure of Financial SystemTarequr RahmanNo ratings yet

- EGEE3313 Economics OF Financial MarketsDocument11 pagesEGEE3313 Economics OF Financial MarketsNg WcNo ratings yet

- Presentation On Indian Debt MarketDocument55 pagesPresentation On Indian Debt Marketpriya_12345632369100% (9)

- FInancial Management: FInancial Market EnvironmentDocument47 pagesFInancial Management: FInancial Market EnvironmentHeinz Reimann Daguinsin OraisNo ratings yet

- Compilation of Reports From Group 1 6Document104 pagesCompilation of Reports From Group 1 6Kearn CercadoNo ratings yet

- Tonic 1 - Nguyễn Hà Diệp ChiDocument4 pagesTonic 1 - Nguyễn Hà Diệp Chichichichi3007No ratings yet

- Element OneDocument17 pagesElement OneSena MulugetaNo ratings yet

- Global Finance ReportDocument4 pagesGlobal Finance ReportLORIDELLE ABONALESNo ratings yet

- AN INTRODUCTION TO INTERNATIONAL FINANCIAL, MONETARY AND BANKING SYSTEM - ShortDocument6 pagesAN INTRODUCTION TO INTERNATIONAL FINANCIAL, MONETARY AND BANKING SYSTEM - ShortNavidEhsanNo ratings yet

- ReviewerDocument10 pagesReviewerGeli aceNo ratings yet

- Financial Market and Institutions Lecture-1, 2, 3Document4 pagesFinancial Market and Institutions Lecture-1, 2, 3Tyler vanPersieNo ratings yet

- 16-F-324-Eurocurrency Markets & Syndicated Credits PDFDocument22 pages16-F-324-Eurocurrency Markets & Syndicated Credits PDFDhaval ShahNo ratings yet

- GR12 Business Finance Module 3-4Document8 pagesGR12 Business Finance Module 3-4Jean Diane JoveloNo ratings yet

- The Financial Market Environment: All Rights ReservedDocument30 pagesThe Financial Market Environment: All Rights ReservedSajjad RavinNo ratings yet

- Financial System and MarketsDocument32 pagesFinancial System and Marketsmohamedsafwan0480No ratings yet

- International Corporate Finance 1st Edition Robin Test BankDocument30 pagesInternational Corporate Finance 1st Edition Robin Test BankNatalieRojaswskrf100% (16)

- FMDocument7 pagesFMA.K.S.PNo ratings yet

- Capital Market Lec NoticeDocument30 pagesCapital Market Lec NoticeZabibu SadickNo ratings yet

- FINMARKDocument18 pagesFINMARKIvan AnaboNo ratings yet

- Chapter 2 Capital MarketsDocument9 pagesChapter 2 Capital MarketsFarah Nader Gooda100% (1)

- PPT-W1Document35 pagesPPT-W1Wetty OktaviaNo ratings yet

- Unit 1 Answers From The QuestionsDocument15 pagesUnit 1 Answers From The QuestionsPenny TratiaNo ratings yet

- DSSB ClerkDocument4 pagesDSSB Clerkjfeb40563No ratings yet

- NYS OPRHP Letter Re IccDocument3 pagesNYS OPRHP Letter Re IccDaily FreemanNo ratings yet

- GROUP 2 Mental Health Program and PoliciesDocument12 pagesGROUP 2 Mental Health Program and PoliciesCantos FlorenceNo ratings yet

- Amelia David Chelsea Cruz Ellaine Garcia Rica Mae Magdato Shephiela Mae Enriquez Jamaica Bartolay Jerie Mae de Castro Meryl Manabat Riejel Duran Alexis ConcensinoDocument9 pagesAmelia David Chelsea Cruz Ellaine Garcia Rica Mae Magdato Shephiela Mae Enriquez Jamaica Bartolay Jerie Mae de Castro Meryl Manabat Riejel Duran Alexis ConcensinoRadleigh MercadejasNo ratings yet

- Chap 0023Document26 pagesChap 0023yousef olabiNo ratings yet

- Bagabag National High School Instructional Modules in FABM 1Document2 pagesBagabag National High School Instructional Modules in FABM 1marissa casareno almueteNo ratings yet

- What Is Ecocroticism - GlotfeltyDocument3 pagesWhat Is Ecocroticism - GlotfeltyUmut AlıntaşNo ratings yet

- Tata Contact UsDocument9 pagesTata Contact UsS K SinghNo ratings yet

- History One Marks Questions With AnswerDocument49 pagesHistory One Marks Questions With AnsweryasvanthmNo ratings yet

- English File Intermediate. Workbook With Key (Christina Latham-Koenig, Clive Oxenden Etc.) (Z-Library)Document2 pagesEnglish File Intermediate. Workbook With Key (Christina Latham-Koenig, Clive Oxenden Etc.) (Z-Library)dzinedvisionNo ratings yet

- Elizabeth Stevens ResumeDocument3 pagesElizabeth Stevens Resumeapi-296217953No ratings yet

- Management Decision Case: Restoration HardwaDocument3 pagesManagement Decision Case: Restoration HardwaRishha Devi Ravindran100% (5)

- NeoLiberalism and The Counter-EnlightenmentDocument26 pagesNeoLiberalism and The Counter-EnlightenmentvanathelNo ratings yet

- Luovutuskirja Ajoneuvon Vesikulkuneuvon Omistusoikeuden Siirrosta B124eDocument2 pagesLuovutuskirja Ajoneuvon Vesikulkuneuvon Omistusoikeuden Siirrosta B124eAirsoftNo ratings yet

- NMML Occasional Paper: The Anticolonial Ethics of Lala Har Dayal'sDocument22 pagesNMML Occasional Paper: The Anticolonial Ethics of Lala Har Dayal'sСаша ПаповићNo ratings yet

- Module - No. 7 CGP G12. - Name of AuthorsDocument77 pagesModule - No. 7 CGP G12. - Name of AuthorsJericson San Jose100% (1)

- Khilafat Movement 1919-1924Document17 pagesKhilafat Movement 1919-1924Grane FrameNo ratings yet

- Litonjua JR Vs Litonjua SRDocument17 pagesLitonjua JR Vs Litonjua SRRubyNo ratings yet

- Barnacus: City in Peril: BackgroundDocument11 pagesBarnacus: City in Peril: BackgroundEtienne LNo ratings yet

- Car Sale AGreement BIlal ShahDocument3 pagesCar Sale AGreement BIlal ShahYasir KhanNo ratings yet

- Journal Jul Dec14 Art4Document16 pagesJournal Jul Dec14 Art4paromita bhattacharjeeNo ratings yet

- Ebook Accounting Information For Business Decisions 4Th Australian Edition PDF Full Chapter PDFDocument67 pagesEbook Accounting Information For Business Decisions 4Th Australian Edition PDF Full Chapter PDFgina.letlow138100% (27)

- Professionals and Practitioners in Counselling: 1. Roles, Functions, and Competencies of CounselorsDocument70 pagesProfessionals and Practitioners in Counselling: 1. Roles, Functions, and Competencies of CounselorsShyra PapaNo ratings yet

- TriboSys 3203 3204Document1 pageTriboSys 3203 3204Hayden LeeNo ratings yet