Professional Documents

Culture Documents

TWO - 0189-Banking Law & Practice

Uploaded by

Shahzadi JaanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TWO - 0189-Banking Law & Practice

Uploaded by

Shahzadi JaanCopyright:

Available Formats

ALLAMA IQBAL OPEN UNIVERSITY, ISLAMABAD (Department of Business Administration)

BANKING LAW AND PRACTICE (189) CHECKLIST SEMESTER: SPRING 2012

This packet comprises the following material: 1. Text Book (one) 2. Course Outline 3. Assignment No. 1, 2 4. Assignment Forms ( 2 sets ) In this packet, if you find anything missing out of the above mentioned material, please contact at the address given below: The Deputy Registrar Services Block No. 28 Allama Iqbal Open University H-8, Islamabad. Nadia Rashid (Course Coordinator)

ALLAMA IQBAL OPEN UNIVERSITY, ISLAMABAD (Department of Business Administration) WARNING

1.

2. PLAGIARISM OR HIRING OF GHOST WRITER(S) FOR SOLVING THE ASSIGNMENT(S) WILL DEBAR THE STUDENT FROM AWARD OF DEGREE/CERTIFICATE, IF FOUND AT ANY STAGE. SUBMITTING ASSIGNMENTS BORROWED OR STOLEN FROM OTHER(S) AS ONES OWN WILL BE PENALIZED AS DEFINED IN AIOU PLAGIARISM POLICY.

Course: Banking Law and Practice (189) Level: BBA

ASSIGNMENT No. 1

Semester: Spring 2012 Marks: 100

Q. 1 Discuss in detail the functions and credit control measures of State bank of Pakistan and Reserve Bank of India. Also give comparison between both banks policies. (20) Q. 2 Discuss the rights and obligations of banker and customer to each other in detail. (20) Q. 3 What do you mean by accounts of special customers? How these accounts are opened by a bank? Discuss the procedure of opening such accounts in detail. (20) Q. 4 Discuss in detail the significance and use of deposits in banking system of Pakistan. (20) Q. 5 (a) (b) Mr. Hasan promises to pay Mr. Sajid Rs. 100,000 and all other sums which shall be due to him. Is it a promissory note? State reasons. (10) Differentiate between the features of bill of exchange and promissory note. (10)

ASSIGNMENT No. 2

Total Marks: 100

Q. 1 Discuss the different types of loans being offered by banks in Pakistan. Also describe the basic principles that must be observed by a bank while extending loan to a borrower. (20) Q. 2 How the State Bank of Pakistan control the bank credit in Pakistan? Discuss the various tools used by it for controlling the credit. (20) Q. 3 Critically evaluate the contemporary practices of Islamic banks in Pakistan. Also explain that how much it comply with Islamic Shariah. (20)

Q. 4 What do you mean by Letter of Credit? Discuss in detail the mechanism involved in making payments for overseas business through a letter of credit. (20) Q. 5 Write note on the following: (a) Foreign Exchange Regulation Act, 1947 (b) Banking Companies Ordinance, 1962 (20)

BANKING LAW AND PRACTICE COURSE OUTLINE (BBA-189)

UNIT 1 INTRODUCTION TO BANKING IN THE WORLD AND PAKISTAN Evolution of Banking, Early Growth, Modern Banking, Development of Modern Banking, Types of banks, Development of Banking in America, Banking during Muslim Rule in India, The Emergence of Public Banks in India, Joint Stock Bank, Exchange Banks, The Imperial Bank of India, The Reserve Bank of India, PostWorld War Indian Banking, Banking in Pakistan UNIT 2 TYPES OF DEPOSITS/ACCOUNTS AND BANKER-CUSTOMER RELATIONSHIP Deposits, Nature of deposits (Accounts) such as Current, Term Deposits, Term Deposits in Joint Names, Saving Deposits, Call, Short Notice Deposits and Pak Rupee Non-Resident Accounts, Foreign Currency Accounts, Importance and Mobilization of Deposits in Banking System Banker, Functions Of The Banker, Customer, Qualifications of Customer, Rights and Obligations of Customer Towards The Banker, General Relationship, Other Relationships, Special Features of Relationship, Right to Lien, Right of Set off, Bankers Duty of Secrecy, Termination of Relationship UNIT 3 ACCOUNTS OF GENERAL AND SPECIAL CUSTOMERS Accounts of General Customers: Introduction and Preliminary Investigation, Specimen Signature, Married Women, Pardanashin Women, Minor Accounts, Individual Accounts, Joint Accounts Accounts of Special Customers: Partnership Firms, Joint Stock Companies, Accounts of Clubs, Societies, and Associations, Agents Accounts, Trust Account, Executors and Administrators Account, Account of Local Bodies UNIT 4 CHEQUES, PROMISSORY NOTE, AND BILL OF EXCHANGE Cheques: Definition, Types of Cheques, The Requisites of a Cheque, Parties to a Cheque; Promissory Note; Bill of Exchange: Parties to a Bill of Exchange, Types of Bills; Bankers Draft, Pay Order, Telegraph Transfers, Mail Transfers, Travellers Cheques etc UNIT 5 CREDIT OPERATIONS IN BANKS Principles and Forms of Lending: Principles of Lending; Forms of Lending- Cash Finance, Overdraft; Loans- Bridge and Participation Loans, Purchase and Discounting of Bills Securities for Advances: Classification of Securities, Bankers Lien, Charge, Contract of Pledge, Hypothecation, Guarantees, Indemnity

UNIT 6 CONTROL OF BANK CREDIT IN PAKISTAN Bank Rate, Open Market Operation, Variable Reserve Requirements, Selective Credit Control, National Credit Consultative Council, Small Loans Scheme, Agricultural Finance, Industrial Finance, Export Finance, Export Finance Scheme UNIT 7 DEVELOPMENT OF ISLAMIC BANKING IN PAKISTAN Main features of the Islamic Economic system System of Interest Free Banking and Implementation in Pakistan Modes of Non-Interest Financing (i) Financing by Lending: (a) Qard-e-Hasna (b) Loans with service charges (ii) Trade Related Modes: (a) Purchase of Trade bills (b) Purchase and sale of goods on Mark up basis (c) Financing for the development of a property on the basis of "development charge:. (d) Purchase of goods/immovable property under buy-back agreements (e) Hire purchase (f) Leasing (iii) Investment Type modes: (a) Musharika (b) Participating Term and Modaraba certificates (c) Equity participation (d) Rent Sharing UNIT 8 AN INTRODUCTION TO FOREIGN EXCHANGE Why Foreign Exchange? Foreign Exchange Control in Pakistan, Mechanism of Foreign Exchange, Letters of Credit (L/C): Definition, Classes of Letters of Credit- Documentary Letters of Credit, Revocable and Irrevocable Letters of Credit, Revolving Letters of Credit, Red Clause Credit, Green Clause Credit, Transferable and Assignable Credit, Back to Back Credit, Deferred Payment Credit, Acceptance Terms Credit, Advantages of Letter of Credit, Rights and Liabilities of Opening Banker and Negotiating Banker, Negotiation of documents, Remittance Against Imports, Forward Exchange Contract, Forward Cover Against Exports UNIT 9 AN INTRODUCTION TO BANKING LAWS IN PAKISTAN Negotiable Instruments Act, 1881 State Bank of Pakistan Act, 1956 Banking Companies Ordinance, 1962 Banks (Nationalization) Act, 1974 Foreign Exchange Regulation Act, 1947 BOOK RECOMMENDED: Practice and Law of Banking in Pakistan, By Dr. Asrar H. Siddiqi =====

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Abinaya Tex Industry OverviewDocument24 pagesAbinaya Tex Industry Overviewselvi abrahamNo ratings yet

- Yamal NCND IMFPA DE JP54 - 17 DICIEMBRE CONTRATODocument15 pagesYamal NCND IMFPA DE JP54 - 17 DICIEMBRE CONTRATOyuzmely67% (3)

- ManualDocument499 pagesManualsdgsg100% (1)

- Mock Exam A - Afternoon Session (With Solutions) PDFDocument65 pagesMock Exam A - Afternoon Session (With Solutions) PDFJainn SNo ratings yet

- Csa z1600 Emergency and Continuity Management Program - Ron MeyersDocument23 pagesCsa z1600 Emergency and Continuity Management Program - Ron MeyersDidu DaduNo ratings yet

- Market Research Final PPT - OrangeDocument14 pagesMarket Research Final PPT - OrangePrateek JainNo ratings yet

- Group Assignment Cafes Monte Bianco Final V2Document13 pagesGroup Assignment Cafes Monte Bianco Final V2Linh Chi Trịnh T.No ratings yet

- IBM Network and Service Management Solutions Help SBB Keep Trains On ScheduleDocument2 pagesIBM Network and Service Management Solutions Help SBB Keep Trains On ScheduleIBMTransportationNo ratings yet

- Costing for FDLC JDE and brightERP ProjectsDocument4 pagesCosting for FDLC JDE and brightERP ProjectsanoopNo ratings yet

- HTTP WWW - Valueresearchonline.com Funds DefaultDocument2 pagesHTTP WWW - Valueresearchonline.com Funds DefaultAnanth PuthucodeNo ratings yet

- Legal Opinion Johnsan Blue Industrial Suspension AmendmentDocument2 pagesLegal Opinion Johnsan Blue Industrial Suspension AmendmentRudiver Jungco JrNo ratings yet

- HTTP WWW - Aiqsystems.com HitandRunTradingDocument5 pagesHTTP WWW - Aiqsystems.com HitandRunTradingpderby1No ratings yet

- Shooting StarDocument2 pagesShooting Starlaba primeNo ratings yet

- Bank Panin Dubai Syariah GCG Report 2018Document117 pagesBank Panin Dubai Syariah GCG Report 2018kwon jielNo ratings yet

- Rsik ManagementDocument221 pagesRsik ManagementNirmal ShresthaNo ratings yet

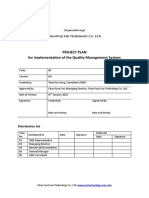

- 01 - Project - Plan - EN For CPS Co - LTDDocument8 pages01 - Project - Plan - EN For CPS Co - LTDThant AungNo ratings yet

- Lean Fundamentals Training: Gain A World Recognised AccreditationDocument4 pagesLean Fundamentals Training: Gain A World Recognised AccreditationAhmed ElhajNo ratings yet

- Food Bill 21-07-23Document2 pagesFood Bill 21-07-23ankit goenkaNo ratings yet

- Bus Part B1P ReadingBank U2Document2 pagesBus Part B1P ReadingBank U2Linh ĐanNo ratings yet

- A Rib A Supplier EnablementDocument2 pagesA Rib A Supplier Enablementeternal_rhymes6972No ratings yet

- Nbaa BylawsDocument49 pagesNbaa BylawsAmaniNo ratings yet

- Dragon Fruit Jam Marketing PlanDocument31 pagesDragon Fruit Jam Marketing PlanLara Rinoa LarrozaNo ratings yet

- ListDocument6 pagesListImamNo ratings yet

- CMA TOPIC4 Differential Analysis (Chapter 14) PDFDocument3 pagesCMA TOPIC4 Differential Analysis (Chapter 14) PDF靳雪娇No ratings yet

- Forensic Accounting Notes - Lesson 1 2Document11 pagesForensic Accounting Notes - Lesson 1 2wambualucas74No ratings yet

- Bahan Lain KokokrunchDocument7 pagesBahan Lain KokokrunchsurianimerhalimNo ratings yet

- Haystack Syndrome (Eliyahu M. Goldratt) (Z-Library)Document270 pagesHaystack Syndrome (Eliyahu M. Goldratt) (Z-Library)jmulder1100% (3)

- Go-to-Market & Scale - 2020-01-09 - Emin, Patrick, TessaDocument58 pagesGo-to-Market & Scale - 2020-01-09 - Emin, Patrick, TessaFounderinstituteNo ratings yet

- Ra 7042 Foreign Investment ActDocument2 pagesRa 7042 Foreign Investment ActMark Hiro NakagawaNo ratings yet

- Elizade Acc 101 Revision Lecture NotesDocument18 pagesElizade Acc 101 Revision Lecture NotesTijani OladipupoNo ratings yet