Professional Documents

Culture Documents

Gratuity Forms

Uploaded by

Deeptodip SenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gratuity Forms

Uploaded by

Deeptodip SenCopyright:

Available Formats

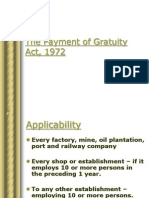

PAYMENT OF GRATUITY ACT, 1972 & PAYMENT OF GRATUITY(CENTRAL) RULES, 1972

Type & S.N Nature Of o Document 1 2 3 4 Form A Form B Form C Form D Relevant Clause Rule 3 (1) Rule 3 (2) Rule 3 (3) Rule 5 (1) Schedule Of Submission/ Maintenance Within 30 days from which the rules become applicable Within 30 days of any change in the particulars of the establishment like name, address or nature of business Atleast 60 days before the intended closure of the business

Description Of the Form Notice Of Opening Notice Of Change Notice Of Closure Notice for excluding husband from family Notice of withdrawal of notice for excluding husband from family

Submitting Authority Concerned controlling authority of the area Concerned controlling authority of the area Concerned controlling authority of the area

Remarks

To be submitted by the employee to the employer in triplicate. The employer after receipt forwards a copy to the concerned controlling authority of the area. To be submitted by the employee withdrawing the notice in form D to the employer in triplicate. The employer after receipt forwards a copy to the concerned controlling authority of the area. To be submitted by the employee to the employer in duplicate. The employer within 30 days of the receipt of nomination , verify with the service particulars and after attestation return back a copy to the employee. To be submitted by the employee within 90 days of acquiring a family to the employer

Form E

Rule 5 (2)

Form F

Nomination

Rule 6 (1)

Form G

Fresh Nomination

Rule 6 (3)

Form H

Modification Of Nomination Application for gratuity by an employee Application for gratuity by a nominee Application for gratuity by a legal heir

Rule 6 (4)

To be submitted by the employee to the employer , in cases including where a nominee predeceases an employee To be submitted by the employee, eligible for payment of gratuity to the employer , within 30 days from which the gratuity becomes payable. To be submitted by the nominee of an employee to the employer within 30 days from the date of gratuity payable to him/her. For this purpose an application in plain paper may also be accepted To be submitted by the legal heir of an employee, eligible for payment of gratuity , to the employer, within 1 year from the date of gratuity payable to him/her On verification of claims made for payment of gratuity, the employer , within 15 days of receipt of an application , issue a notice to the applicant employee , his nominee or legal heir, specifying the amount of gratuity payable and fixing a date of payment not later than the 30th day of receipt of the application.

Form I

Rule 7 (1)

10

Form J

Rule 7 (2)

11

Form K

Rule 7 (3)

12

Form L

Notice for payment of gratuity

Rule 8 (1)

13

Form M

Notice rejecting payment of gratuity Rule 8 (1)

On verification of claims made for payment of gratuity, if the claim is found inadmissible, the employer may issue a notice to the applicant employee, his nominee or legal heir , specifying the reasons why the claim is found inadmissible In cases wherein the employer refuses to accept a claim application or issues a notice specifying a amount of gratuity which is considered less by the applicant or fails to issue a notice under rule 8, the claimant employee/ his nominee/ legal heir may within 90 days of occurrence of cause for application, apply in form N to the concerned controlling authority of the area for issuing a direction On receipt of form N , the concerned controlling authority of the area may call upon the applicant and the employer to appear before him on a specified date, time and place. The controlling authority may , at any stage of proceedings, issue summons to the applicant or the employer to produce evidences, documents etc. The controlling authority to record the particulars of each case in form Q on subsequent verification of the genuineness of the claims made, the controlling authority to issue a notice , specifying to the employer , the amount of gratuity payable and directing the employer for payment of gratuity within 30 days of receipt of notice. The controlling authority on receipt of the decision of the appellate authority, modify his direction for payment of gratuity and issue a notice to the employer, specifying the modified amount of gratuity and directing payment within 15 days of receipt of notice by the employer. In situations wherein, the employer fails to pay the gratuity due under the act in accordance with the notice of the controlling authority , the employee/his nominee/legal heir may apply to the controlling authority in duplicate for recovery The employer to display an abstract of the act and rules framed thereunder in English and a language understood by the majority of employees at a conspicuous place or near the main entrance of the establishment

14

Form N

Application for direction

Rule 10 (1)

15

Form O

Notice for appearance before the controlling authority Summons Particulars of application under Section 7 Notice for payment of Gratuity

Rule 11 (1)

16 17

Form P Form Q

Rule 14 Rule 16(1)

18

Form R

Rule 17

19

Form S

Notice for payment of Gratuity as determined by appellate authority

Rule 18(8)

20

Form T

Application for recovery of gratuity

Rule 19

21

Form U

Display of abstract of the act and rules

Rule 20

You might also like

- GratuityDocument14 pagesGratuityNavin SharmaNo ratings yet

- Rules 1972Document30 pagesRules 1972venkateshbedhreNo ratings yet

- Gratuity & PF-Shweta, Pratibha & RohanDocument48 pagesGratuity & PF-Shweta, Pratibha & RohanBhagyashree SondagarNo ratings yet

- Procedure of Contract Labour Act 1970Document4 pagesProcedure of Contract Labour Act 1970Shravan KumarNo ratings yet

- Payment of Gratuity Act1972Document29 pagesPayment of Gratuity Act1972Rafunsel PresentationNo ratings yet

- TN Gratuity RulesDocument42 pagesTN Gratuity RulesKAVIYANo ratings yet

- Payment of Gratuity RulesDocument82 pagesPayment of Gratuity RulesjyotikunaljhaNo ratings yet

- The Kerala Payment of Gratuity Rules, 1973Document10 pagesThe Kerala Payment of Gratuity Rules, 1973ritwikprakash1799No ratings yet

- Payment of Gratuity Punjab RulesDocument7 pagesPayment of Gratuity Punjab RulesSakshi VermaNo ratings yet

- The Payment of Gratuity Act, 1972Document21 pagesThe Payment of Gratuity Act, 1972Ravi NarayanaNo ratings yet

- Applications For RevocationDocument5 pagesApplications For Revocationaanismu1893No ratings yet

- The Payment of Gratuity Act, 1972: Prepared & Presented by Debraj Subedi BPT09002 MBA (PT), TUDocument26 pagesThe Payment of Gratuity Act, 1972: Prepared & Presented by Debraj Subedi BPT09002 MBA (PT), TUmugds_hansNo ratings yet

- Steps Against Personal Guarantor Under The IBCDocument5 pagesSteps Against Personal Guarantor Under The IBCEkansh AroraNo ratings yet

- Labour Law Compliance ChecklistDocument159 pagesLabour Law Compliance ChecklistBharat Joshi100% (1)

- Payment of Wages Act, 1936: FactoriesDocument46 pagesPayment of Wages Act, 1936: FactoriesViraja GuruNo ratings yet

- Show FileDocument22 pagesShow Filesaumya.bsphcl.prosixNo ratings yet

- Meaning of RetrenchmentDocument7 pagesMeaning of RetrenchmentRicha GargNo ratings yet

- Citizen CharterDocument6 pagesCitizen CharterpenusilaNo ratings yet

- Demands & Recovery Under GST: Faqs: Input Tax CreditDocument12 pagesDemands & Recovery Under GST: Faqs: Input Tax Creditpooja rajputNo ratings yet

- RetrenchmentDocument11 pagesRetrenchmentAbhi P Prabha0% (1)

- (Singapore) Employment Agencies Act (Chapter 92, Section 29) Employment Agency RulesDocument22 pages(Singapore) Employment Agencies Act (Chapter 92, Section 29) Employment Agency RulesJerome AsisNo ratings yet

- Process Late RequestDocument5 pagesProcess Late RequestSNo ratings yet

- Chinta Mukti: .Ctor OrationDocument7 pagesChinta Mukti: .Ctor OrationRudradeep DuttaNo ratings yet

- Shiza Ali 458 Evening BDocument12 pagesShiza Ali 458 Evening BWasif MunirNo ratings yet

- Standard Employment ContractDocument3 pagesStandard Employment ContractGC CruzadoNo ratings yet

- Labor Case DigestsDocument8 pagesLabor Case DigestsAbigail Moffait SarandiNo ratings yet

- Application & Condition - Lease of Residential - Bid - KangDocument4 pagesApplication & Condition - Lease of Residential - Bid - KangGenelia SgNo ratings yet

- RetrenchmentDocument12 pagesRetrenchmentshilpakpr75% (8)

- Reasons of RejectionDocument5 pagesReasons of RejectionImdadul AhmedNo ratings yet

- The Payment of Gratuity Act, 1972Document10 pagesThe Payment of Gratuity Act, 1972shaileshv88No ratings yet

- Position Paper SampleDocument18 pagesPosition Paper SampleKenneth FrancoNo ratings yet

- Payment of Gratuity ActDocument36 pagesPayment of Gratuity ActAkhilaSridhar 21No ratings yet

- Employment Contract: A. Employer DetailsDocument3 pagesEmployment Contract: A. Employer Detailsルーシー ドウランNo ratings yet

- Position Paper of ComplainantDocument9 pagesPosition Paper of ComplainantMaris Kionisala100% (2)

- The Payment of Gratuity Act 1972Document36 pagesThe Payment of Gratuity Act 1972Prema LathaNo ratings yet

- EmploymentDocument10 pagesEmploymentMark Angelo S. EnriquezNo ratings yet

- Labour LawsDocument18 pagesLabour LawssachinNo ratings yet

- A Brief Check List of Labour Laws: Composed by P.B.S. KumarDocument17 pagesA Brief Check List of Labour Laws: Composed by P.B.S. KumarJames MelwynNo ratings yet

- Almodiel VS NLRC: GR No. 100641, June 14, 1993 FactsDocument27 pagesAlmodiel VS NLRC: GR No. 100641, June 14, 1993 Factsbdjn bdjnNo ratings yet

- Labour Laws NewDocument12 pagesLabour Laws Newtushar khomaneNo ratings yet

- Employment Contract 4Document3 pagesEmployment Contract 4Abd Zuber100% (1)

- Industrial Employment Standing Orders Act 1946 114Document29 pagesIndustrial Employment Standing Orders Act 1946 114searchshriNo ratings yet

- Sample of The Standard Employment Contract (Please Use Your Company's Letterhead)Document3 pagesSample of The Standard Employment Contract (Please Use Your Company's Letterhead)Abd ZuberNo ratings yet

- Sample of The Standard Employment Contract (Please Use Your Company's Letterhead)Document3 pagesSample of The Standard Employment Contract (Please Use Your Company's Letterhead)Abd ZuberNo ratings yet

- Labour Compliances COLPALDocument17 pagesLabour Compliances COLPALAshu TanejaNo ratings yet

- Payment of Wages Act 1936Document12 pagesPayment of Wages Act 1936Rinu VargheseNo ratings yet

- The Bangladesh Labor Code: Chapter-II (Appointment and Condition of Employment)Document30 pagesThe Bangladesh Labor Code: Chapter-II (Appointment and Condition of Employment)Tarikul IslamNo ratings yet

- MECDocument3 pagesMECcherrybd0% (1)

- Lab2 100-101 JulianDocument5 pagesLab2 100-101 JulianDanica Faye JulianNo ratings yet

- Employment LawDocument3 pagesEmployment LawMary NjihiaNo ratings yet

- Abstract of The Karnataka PAYMENT of WAGES ACT 1963 & RulesDocument3 pagesAbstract of The Karnataka PAYMENT of WAGES ACT 1963 & RulesShabir Tramboo100% (1)

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word DocumentasherfahamanNo ratings yet

- Abstract of The Minimum Wages Act, 1948Document4 pagesAbstract of The Minimum Wages Act, 1948Shabir TrambooNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Labor Contract Law of the People's Republic of China (2007)From EverandLabor Contract Law of the People's Republic of China (2007)No ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Judicial RolsDocument29 pagesJudicial Rolsu23627019No ratings yet

- Murder of Jamal Khashoggi: An International Law PerspectiveDocument21 pagesMurder of Jamal Khashoggi: An International Law PerspectiveKeyan MotolNo ratings yet

- Urbano V ChavezDocument6 pagesUrbano V ChavezHavie GraceNo ratings yet

- 1.-Abs-Cbn Broadcasting v. CA, 301 Scra 572 (1999)Document20 pages1.-Abs-Cbn Broadcasting v. CA, 301 Scra 572 (1999)Christine Rose Bonilla LikiganNo ratings yet

- Case Partition SaleDocument6 pagesCase Partition SaleIqram MeonNo ratings yet

- Phil. American Life Ins. Co. vs. Auditor GeneralDocument22 pagesPhil. American Life Ins. Co. vs. Auditor GeneralXtine CampuPotNo ratings yet

- Cordova V CordovaDocument2 pagesCordova V CordovaPatatas SayoteNo ratings yet

- Joint Affidavit of Two Disinterested Persons: Re: One and The Same PersonDocument1 pageJoint Affidavit of Two Disinterested Persons: Re: One and The Same PersonAnthony ElmaNo ratings yet

- United States v. Bramley, 1st Cir. (2017)Document17 pagesUnited States v. Bramley, 1st Cir. (2017)Scribd Government DocsNo ratings yet

- G.R. No. 224162 - JANET LIM NAPOLES, PETITIONER, VS. SANDIGANBAYAN (THIRD DIVISION), RESPONDENT - RESOLUTION - Supreme Court E-LibraryDocument3 pagesG.R. No. 224162 - JANET LIM NAPOLES, PETITIONER, VS. SANDIGANBAYAN (THIRD DIVISION), RESPONDENT - RESOLUTION - Supreme Court E-LibrarygrelvanelliNo ratings yet

- Crimes Against Personal Liberty and SecurityDocument9 pagesCrimes Against Personal Liberty and SecurityFrei Richelieu Bravo EchaveNo ratings yet

- Oblicon Case DigestDocument13 pagesOblicon Case DigestGillian AlexisNo ratings yet

- San Miguel Corporation Employees Union v. Bersamira, June 13, 1990Document2 pagesSan Miguel Corporation Employees Union v. Bersamira, June 13, 1990Heart NuqueNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument7 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledLR FNo ratings yet

- Redskins TTAB CancellationDocument177 pagesRedskins TTAB CancellationThrotexNo ratings yet

- AdvanceMe Inc v. RapidPay LLC - Document No. 327Document3 pagesAdvanceMe Inc v. RapidPay LLC - Document No. 327Justia.comNo ratings yet

- Ampatuan Jr. Vs de LimaDocument1 pageAmpatuan Jr. Vs de LimaPrincessAngelicaMorado0% (1)

- City of Angeles Vs CA DIGESTDocument2 pagesCity of Angeles Vs CA DIGESTJay Ribs100% (1)

- Spec Pro DigestDocument6 pagesSpec Pro Digestdaryl canozaNo ratings yet

- Veoh Networks, Inc. v. UMG Recordings, Inc. Et Al - Document No. 20Document3 pagesVeoh Networks, Inc. v. UMG Recordings, Inc. Et Al - Document No. 20Justia.comNo ratings yet

- 3.fernando V. CA 510 SCRA 351 PDFDocument9 pages3.fernando V. CA 510 SCRA 351 PDFaspiringlawyer1234No ratings yet

- Montebon vs. COMELEC Case DigestDocument2 pagesMontebon vs. COMELEC Case DigestOnnie Lee100% (1)

- Alcantara V Director-DigestDocument2 pagesAlcantara V Director-DigestJanine OlivaNo ratings yet

- General DefencesDocument69 pagesGeneral DefenceskeerthivhashanNo ratings yet

- The Law School, University of Kashmir 7Th SemesterDocument23 pagesThe Law School, University of Kashmir 7Th SemesterFaezan100% (1)

- 307 Solar Team Entertainment v. People - RevisedDocument3 pages307 Solar Team Entertainment v. People - RevisedMiguel ManagoNo ratings yet

- PAD 170 NotesDocument9 pagesPAD 170 NotesAdrieana Danvers0% (1)

- CLC - People Vs Bon GR No. 166401 Oct 30, 2006Document3 pagesCLC - People Vs Bon GR No. 166401 Oct 30, 2006Devonee WoopNo ratings yet

- Astm D756.1956Document8 pagesAstm D756.1956Hafid ScooteristNo ratings yet

- Evi Chap 1Document26 pagesEvi Chap 1sherlynn100% (1)