Professional Documents

Culture Documents

Fs Analysis

Uploaded by

Peter John Castillo JuanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fs Analysis

Uploaded by

Peter John Castillo JuanCopyright:

Available Formats

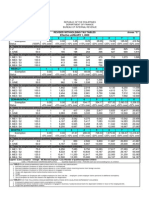

BANK OF THE PHILIPPINE ISLANDS CONSOLIDATED STATEMENTS OF FINANCIAL PERFORMANCE-HORIZONTAL ANALYSIS

For the Years 2009 and 2010

(In Millions)

ASSETS TOTAL CASH AND SHORT TERM INVESTMENTS TOTAL RECEIVABLES TOTAL CURRENT ASSETS NET PROPERTY PLANT AND EQUIPMENT Deferred Tax Assets, Long Term Deferred Charges, Long Term Other Long-Term Assets TOTAL ASSETS

2009 130,831 44,143.0 195,055 12,570.0 4,872.0 344.0 15,753.0 724,420

2010 179,418 56,029.0 254,520 13,077.0 5,023.0 820.0 17,106.0 878,146

Increase(Decrease) Amount 48,587 11,886.0 59,465.0 507.0 151.0 476.0 1,353.0 153,726.0

(%) 37.14 26.93 30.49 4.03 3.10 138.37 8.59 21.22

LIABILITIES & EQUITY TOTAL CURRENT LIABILITIES Long-Term Debt Minority Interest Pension & Other Post-Retirement Benefits Other Non-Current Liabilities TOTAL LIABILITIES Common Stock Additional Paid in Capital Retained Earnings Comprehensive Income and Other TOTAL COMMON EQUITY TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 606,326 37,009.0 967.0 817.0 12,503.0 656,655 32,467.0 1,412.0 34,375.0 -1,456.0 66,798.0 67,765.0 724,420 752,210 29,868.0 1,244.0 -13,793.0 795,871 35,562.0 8,317.0 36,643.0 509.0 81,031.0 82,275.0 878,146

145,884.0 (7,141.0) 277.0 (817.0) 1,290.0 139,216.0 3,095.0 6,905.0 2,268.0 1,965.0 14,233.0 14,510.0 153,726.0

24.06 (19.30) 28.65 (100.00) 10.32 21.20 9.53 489.02 6.60 (134.96) 21.31 21.41 21.22

SHORT TERM SOLVENCY ANALYSIS

As shown in the balance sheet, the percentage increase in total current asset (30.49%) was higher that the percentage increase in current liabilities (24.06%). It can be observed that cash and cash equivalents increased significantly. However, data also shows that the total receivables increase much higher than percentage increase of revenues. This indicates slower collection of receivables to cash. The changes mentioned resulted to the appreciation in the short term solvency position of the company as of the end of year 2010 compared with year 2009. The overall short-term condition of the company as regards to its current assets and current liabilities can be viewed as favorable to the firm.

The bank should maintain and continue to improve its credit standing in order to avoid running out of funds, sustain its credibility, attract investors and established tighter relationship to its shareholders.

LONG TERM FINANCIAL POSITION ANALYSIS

The book value of net property, plant and equipment slightly increased because of the depreciation (6.25%) provision for the year which has a higher rate than the gross property, plant and equipment (5.14%). Total liabilities increased by 21.20% whereas shareholders equity increased by 21.41% thus the companys capital structure shifted slightly away from borrowing and toward capital provided by profitable operations. These changes can be viewed favorably because they indicate strengthening of the long term financial positions by the year end 2010. Overall long term condition of the bank also shows favorable standing for the firm. BPI should concentrate on increasing its shareholders equity while decreasing its total liabilities, particularly long-term liabilities, for it can be tied up to high interest rates in the long run which the bank should avoid.

MARIANO MARCOS STATE UNIVERSITY

COLLEGE OF BUSINESS, ECONOMICS AND ACCOUNTANCY CITY OF BATAC

FINANCIAL STATEMENT ANALYSIS OF BANK OF THE PHILIPPINE ISLANDS

Submitted by Autriz, Janice Cariaga, Thomas Emerson Doroni, Revianne Juan, Peter John Madamba, Meliza Mariano, Reimar Martinez, Hazel Anne Opelac, Diana Ross Silvestre, Jazinda

Submitted to Dr. Leah Ballesteros

You might also like

- 2015 BIR Withholding Tax TableDocument1 page2015 BIR Withholding Tax TableJonasAblangNo ratings yet

- Internal Audit Checklist ExampleDocument7 pagesInternal Audit Checklist ExampleISO 9001 Checklist91% (34)

- This Document Is EmptyDocument1 pageThis Document Is EmptyPeter John Castillo JuanNo ratings yet

- This Document Is EmptyDocument1 pageThis Document Is EmptyPeter John Castillo JuanNo ratings yet

- ThereDocument1 pageTherePeter John Castillo JuanNo ratings yet

- Chronicles of The Japanese Invasion in IlocosDocument8 pagesChronicles of The Japanese Invasion in IlocosPeter John Castillo JuanNo ratings yet

- Application of Statistics in Civil EngineeringDocument1 pageApplication of Statistics in Civil EngineeringPeter John Castillo JuanNo ratings yet

- Globe Telecom Corporate Governane ManualDocument15 pagesGlobe Telecom Corporate Governane ManualPeter John Castillo JuanNo ratings yet

- An Act To Ordain and Institute The Civil Code of The PhilippinesDocument13 pagesAn Act To Ordain and Institute The Civil Code of The PhilippinesPeter John Castillo JuanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- FIN 2200 Sample Midterm F12 With SolutionsDocument13 pagesFIN 2200 Sample Midterm F12 With SolutionsSupri awasthiNo ratings yet

- Question Bank Test 1 With AnswersDocument9 pagesQuestion Bank Test 1 With AnswersUlugbek BayboboevNo ratings yet

- CPT Economics MCQDocument57 pagesCPT Economics MCQharsha143sai100% (1)

- Responses For MGMT 2023Document2 pagesResponses For MGMT 2023Wes GibbsNo ratings yet

- Year End Adjustments - Accruals & Prepayments: Woods, Chapter 28 Thomas, Chapter 13Document58 pagesYear End Adjustments - Accruals & Prepayments: Woods, Chapter 28 Thomas, Chapter 13Hendry Heng Wei XiangNo ratings yet

- Capital Structure - SumsDocument3 pagesCapital Structure - Sumsmeet daftaryNo ratings yet

- What Is Accumulated Depreciation?: Contra Asset AccountDocument2 pagesWhat Is Accumulated Depreciation?: Contra Asset AccountBella AyabNo ratings yet

- 300+ TOP Financial Accounting MCQs and Answers PDF 2021Document17 pages300+ TOP Financial Accounting MCQs and Answers PDF 2021Bhagat DeepakNo ratings yet

- Acct-111e - Quiz CompDocument18 pagesAcct-111e - Quiz CompJap Keren LirazanNo ratings yet

- The General'S Favorite Fishing Hole Statement of Comprehensive Income April 30, 2017Document7 pagesThe General'S Favorite Fishing Hole Statement of Comprehensive Income April 30, 2017Jessamae MacasojotNo ratings yet

- CH 3Document10 pagesCH 3Mohammed mostafaNo ratings yet

- Multiple Choice Questions Presentation of FSDocument4 pagesMultiple Choice Questions Presentation of FSUy Uy ChoiceNo ratings yet

- Far 5Document9 pagesFar 5Sonu NayakNo ratings yet

- Differential AnalysisDocument9 pagesDifferential AnalysisGilner PomarNo ratings yet

- 12471depreciation 2Document2 pages12471depreciation 2Simra SalmanNo ratings yet

- Chapter 17 Notes INVESTMENTSDocument14 pagesChapter 17 Notes INVESTMENTSBusiness Administration DepartmentNo ratings yet

- KPMG Course of Accounting Professional: An Integrated Learning Program For Upcoming Finance ProfessionalsDocument114 pagesKPMG Course of Accounting Professional: An Integrated Learning Program For Upcoming Finance ProfessionalsKrishna ShahNo ratings yet

- Module 8 AssignmentDocument4 pagesModule 8 AssignmentRosario CabarrubiasNo ratings yet

- Solution:: Purchases, Cash Basis P 2,850,000Document2 pagesSolution:: Purchases, Cash Basis P 2,850,000Jen Deloy50% (2)

- Nature of Financial Accounting InformationDocument7 pagesNature of Financial Accounting Informationajeng.saraswatiNo ratings yet

- Corporate Finance Case 2 ამხოსნაDocument3 pagesCorporate Finance Case 2 ამხოსნაIrakli SaliaNo ratings yet

- Moody's Ratio Definitions PDFDocument3 pagesMoody's Ratio Definitions PDFdildildildilNo ratings yet

- Sample Questions 5-6Document8 pagesSample Questions 5-6jangrapa100% (1)

- How Can A Seller-Lessee Use A Sale-Leaseback To Generate A Current Gain?Document5 pagesHow Can A Seller-Lessee Use A Sale-Leaseback To Generate A Current Gain?jakeNo ratings yet

- Relevant CostingDocument3 pagesRelevant CostingMaria DyNo ratings yet

- Accounting Assignment 2Document4 pagesAccounting Assignment 2Laddie LMNo ratings yet

- Midterm Quizzes Compilation - Docx-1Document91 pagesMidterm Quizzes Compilation - Docx-1Yess poooNo ratings yet

- Colgate Ratio Analysis WSM 2020 SolvedDocument17 pagesColgate Ratio Analysis WSM 2020 Solvedabi habudinNo ratings yet

- Dividend PolicyDocument15 pagesDividend PolicyRahul AgrawalNo ratings yet

- Welcome To The Financial Information System (FIS) An IntroductionDocument23 pagesWelcome To The Financial Information System (FIS) An IntroductionMuneer SainulabdeenNo ratings yet