Professional Documents

Culture Documents

Assets Capitalization Routing Through CWIP or AuC With IO

Uploaded by

Ravindra JainOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assets Capitalization Routing Through CWIP or AuC With IO

Uploaded by

Ravindra JainCopyright:

Available Formats

Assets Capitalization routing through CWIP or AuC with IO

Google Search Results

You arrived here after searching for the following phrases: how to capitalise project made in ps module in sap Click a phrase to jump to the first occurrence, or return to the search results. Objective To capitalize fixed assets like Plant & machinery, buildings, Furniture & fixtures, IT assets etc. by routing through CWIP with a budget availability check To capitalize assets which are constructed internally. To capitalize all associated costs related to procurement of assets. To account for any exchange gain/loss. Process Flow This method is used for capitalizing assets that are constructed and / or procured like Plant and Machinery, Building, Land Development etc. under any project or otherwise. To be process flow for capitalizing the assets under this method: In CO-IO an internal order under IM Node is created for such activity with investment profile of Auto creation of AuC and budget is allocated to such IO from the IM Node based on individual capex sanctions. A CWIP Fixed asset for Capital Work-in-Progress (CWIP) type is also created automatically with following details: Description of Assets Location Sub-Location Business Area In MM Module a PO/SO (with account assignment type 0) is raised against the internal order which is detailed in the MM Module specific scenario. Commitment item will be generated against the internal order. In MM Module GR/Service acceptance is made which is detailed in the MM Module specific scenario. All values are posted to the specific AUC Account (which by nature is a P&L Account). In this

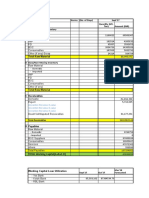

step AUC account will be debited with budget availability check from IO and GR/IR account will be credited. In MM Module, Invoice is posted and the difference if any from the GR is posted to the assigned AUC Account. Debit/Credit Notes stating foreign exchange interest gains or losses received from Corporate is posted against the internal order. However any gain/loss arising out of forward cover taken by Corporate shall not be capitalized. In case budget availability check fails, no posting can be made to the account. In case additional budget is required budget supplement can be provided to IO from Head Office. In the month end these internal orders are settled to Capital Workin-Progress (CWIP) asset which is already assigned in the settlement rule of the internal order. Whenever the asset is put to use for commercial purposes and a certificate obtained for the same, the Fixed asset master is created with the following information Asset Class Description of Assets Location Sub-Location Personnel number (In case of Household Assets provided to employees) Business Area Cost Centers Internal order Relevant Insurance data Depreciation data for the relevant depreciation areas Depreciation keys Settlement rule is modified in the internal order with recipient being the fixed asset(s) created above. In case of multiple assets, the fixed value for each asset or the ratio of distribution of the values needs to be indicated against each recipient. Any cost or expense which is identified as the integral part of asset can be capitalised also and can be maintained as sub-number in the original asset. Amount accumulated in CWIP is settled through line item settlement to the specific fixed asset(s) After the entire process as stated above is completed and IO does not have any commitment item and confirmation is obtained from the originator that the capitalization process is complete, the status of the IO is changed to COMP. This indicates that asset procurement process is complete. Any unutilized budget is not returned, but reported as a variance in the capex reportback. Expected Results CWIP Asset Master is created Accounting entries are posted at month-end to CWIP Balance in AUC accounts to be zeroised for each month for each business area, except for amounts appearing in certain AUC accounts, which shall be negated by an equivalent offsetting amount appearing in Transfer to Fixed Assets account Asset Master is created Final settlement is posted and capitalization of Asset takes place

Previous Entry: Assets Acquisition from other division or affiliated company Next Entry: 9 Steps for Funds Management BCS

You may be interested in

Activation of New Depreciation Area in Assets Accounting for IFRS SAP Assets Accounting Procurement Cycle Assets Acquisition from other division or affiliated company Message AA416 Retirement of old assets data not possible SAP Assets Master Time Dependent Data SAP Assets Accounting Depreciation SAP Assets Accounting End User Documents SAP Assets Accounting Configuration Document SAP Assets Accounting Concept Document

You might also like

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- BRS Confg in Sap PDFDocument25 pagesBRS Confg in Sap PDFSANTOSH VAISHYANo ratings yet

- Planning & Budgeting Using SAP Cost Center PlanningDocument12 pagesPlanning & Budgeting Using SAP Cost Center PlanningFaraz Ahmed QuddusiNo ratings yet

- Vendor Ageing Analysis Through Report PainterDocument18 pagesVendor Ageing Analysis Through Report PainterGayatri Panda0% (1)

- J1IG ISDN Process v1Document7 pagesJ1IG ISDN Process v1KAMALJEET SINGH100% (1)

- Sap FM 001Document35 pagesSap FM 001RakeshNo ratings yet

- Month End Closing-Foreign CurrencyRevaluation.Document5 pagesMonth End Closing-Foreign CurrencyRevaluation.Kancheti Bhanu PrasadNo ratings yet

- Multiple Valuation Approaches Transfer Prices PDFDocument9 pagesMultiple Valuation Approaches Transfer Prices PDFmaheshNo ratings yet

- Asset Under Construction Through MM - SAP BlogsDocument27 pagesAsset Under Construction Through MM - SAP BlogsgirijadeviNo ratings yet

- Financial Statement VersionDocument19 pagesFinancial Statement VersionEmegteiNo ratings yet

- Procedure For Revalue The Fixed AssetsDocument5 pagesProcedure For Revalue The Fixed AssetsjsphdvdNo ratings yet

- Budget On Asset Purchase - SAP Blogs PDFDocument19 pagesBudget On Asset Purchase - SAP Blogs PDFRangabashyamNo ratings yet

- Specify Account Assignment Types For Account Assignment ObjeDocument3 pagesSpecify Account Assignment Types For Account Assignment ObjeharishNo ratings yet

- TDS Provision EntryDocument5 pagesTDS Provision EntryvijayshedgeNo ratings yet

- Manual Bank Reconciliation Using Excel UploadDocument25 pagesManual Bank Reconciliation Using Excel UploadGavin MonteiroNo ratings yet

- Foreign Currency Valuation Process in SapDocument4 pagesForeign Currency Valuation Process in Sappepeillo75No ratings yet

- Interpretation Algorithms SAP DocumentationDocument4 pagesInterpretation Algorithms SAP Documentationsrinivas100% (1)

- Sap Functionality For Accounting of Prepaid ExpensesDocument3 pagesSap Functionality For Accounting of Prepaid ExpensesVanshika Narang100% (1)

- SAP Controlling - Internal OrderDocument40 pagesSAP Controlling - Internal OrderpavankalluriNo ratings yet

- TCS Configuration PDFDocument20 pagesTCS Configuration PDFrishisap2No ratings yet

- Narayan Jyotiraditya Bala Banik Configuration Steps: Main Customizing ActivitiesDocument20 pagesNarayan Jyotiraditya Bala Banik Configuration Steps: Main Customizing ActivitiesJyotiraditya BanerjeeNo ratings yet

- GST JV S4 Configuration&ProcessDocument6 pagesGST JV S4 Configuration&Processpraveer100% (1)

- Asset Under ConstructionDocument18 pagesAsset Under ConstructionSandhya AbhishekNo ratings yet

- Common Errors at The Time of Executing J1inchlnDocument4 pagesCommon Errors at The Time of Executing J1inchlnPavan KocherlakotaNo ratings yet

- SAP FSCM Dispute Management Case Study Dow CorningDocument29 pagesSAP FSCM Dispute Management Case Study Dow Corningvenky3105No ratings yet

- Make To OrderDocument2 pagesMake To OrderPriyanko Chatterjee100% (1)

- Assets Under Construction in SAP FICODocument1 pageAssets Under Construction in SAP FICOankitonwayNo ratings yet

- FIFO Basis in SAPDocument8 pagesFIFO Basis in SAPAjay KumarNo ratings yet

- Multiple Partial Payments From An Invoice Through Automatic Payment ProgramDocument26 pagesMultiple Partial Payments From An Invoice Through Automatic Payment ProgramnasuuNo ratings yet

- Project DocumentationDocument82 pagesProject DocumentationMani Bhargavi KommareddyNo ratings yet

- Foreign Currency Valuation EXPLAINED With ExampleDocument52 pagesForeign Currency Valuation EXPLAINED With ExampleSuraj MohapatraNo ratings yet

- House Bank Configuration StepsDocument9 pagesHouse Bank Configuration StepsaarifnslgroupNo ratings yet

- IT Depreciation India ConfigDocument10 pagesIT Depreciation India Configunfriendly.gy2268No ratings yet

- Sap Fi /co Tickets: How Is Integration Testing Done?Document1 pageSap Fi /co Tickets: How Is Integration Testing Done?Alex LindeNo ratings yet

- Tax Collected at Source (TCS) : ServicesDocument22 pagesTax Collected at Source (TCS) : ServiceskodukulasubramanyamNo ratings yet

- IT Depreciation - User ManualDocument20 pagesIT Depreciation - User Manualunfriendly.gy2268100% (1)

- 3 Way Match:: SAP Tolerance Limits Work Only For MIRO TransactionDocument18 pages3 Way Match:: SAP Tolerance Limits Work Only For MIRO TransactionGB TrainingNo ratings yet

- Basic Cash Management ConfigurationDocument2 pagesBasic Cash Management ConfigurationManuel RobalinhoNo ratings yet

- Withholding TaxDocument18 pagesWithholding Taxraju aws100% (1)

- SAP S4HANA FICO & TRM Month End & Period End Closing ActivityDocument3 pagesSAP S4HANA FICO & TRM Month End & Period End Closing ActivityNadiaNo ratings yet

- 1FOrder To Cash Cycle SAP FI-SD IntegrationDocument7 pages1FOrder To Cash Cycle SAP FI-SD IntegrationKunjunni MashNo ratings yet

- FI To MM IntegrationDocument8 pagesFI To MM IntegrationsurendraNo ratings yet

- SAP FICO Training Content by Mr. Upendar Reddy, ICWAIDocument4 pagesSAP FICO Training Content by Mr. Upendar Reddy, ICWAIupendarhere0% (1)

- SAP FICO Consultants - SAP FICO Real Time Q - S Submitted by Ravi DeepuDocument3 pagesSAP FICO Consultants - SAP FICO Real Time Q - S Submitted by Ravi DeepuNethaji GurramNo ratings yet

- FF63 Create Memo RecordDocument3 pagesFF63 Create Memo RecordloanltkNo ratings yet

- Integration Step by Step Notes: Sap Mm-FiDocument32 pagesIntegration Step by Step Notes: Sap Mm-Fisrinivas100% (1)

- Clearing and Posting Specific To Ledger GroupsDocument5 pagesClearing and Posting Specific To Ledger GroupsNaveen SgNo ratings yet

- GL in ObycDocument5 pagesGL in Obychitarth135No ratings yet

- SAP Asset Tax DepreciationDocument2 pagesSAP Asset Tax DepreciationThatra K ChariNo ratings yet

- Uploading Plans & Forecasts To SAP v1.0Document3 pagesUploading Plans & Forecasts To SAP v1.0FurqanNo ratings yet

- (App) Configuration PDFDocument17 pages(App) Configuration PDFUJ21100% (1)

- SAP - GL Account PostingDocument8 pagesSAP - GL Account PostingRT1234No ratings yet

- Isd Process V1Document3 pagesIsd Process V1Anand PrakashNo ratings yet

- FF7B Liquidity ForecastDocument11 pagesFF7B Liquidity ForecastloanltkNo ratings yet

- 3 Planning Layout Planner ProfileDocument17 pages3 Planning Layout Planner ProfileNarayan Adapa100% (2)

- Import Process GST PDFDocument2 pagesImport Process GST PDFhoneyNo ratings yet

- Cost Center1Document47 pagesCost Center1hossainmz0% (1)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- 541 MovementDocument1 page541 MovementRavindra JainNo ratings yet

- 941 MovementDocument1 page941 MovementRavindra JainNo ratings yet

- Inventory Norms (No. of Days) Sept'17 Amount (INR) Quantity (Mt. Ton)Document3 pagesInventory Norms (No. of Days) Sept'17 Amount (INR) Quantity (Mt. Ton)Ravindra JainNo ratings yet

- Sms UssdDocument3 pagesSms UssdAmit PaulNo ratings yet

- Practice Manual AmaDocument9 pagesPractice Manual AmaRavindra JainNo ratings yet

- Central Excise FormsDocument7 pagesCentral Excise FormsRavindra JainNo ratings yet

- Tds Rates A y 2013 14Document2 pagesTds Rates A y 2013 14Ravindra JainNo ratings yet

- How One Can Create Huf (Hindu Undivided Family)Document7 pagesHow One Can Create Huf (Hindu Undivided Family)Ravindra JainNo ratings yet

- User Instructions: Installation Operation Maintenance NAF Duball DL Pocket ValveDocument12 pagesUser Instructions: Installation Operation Maintenance NAF Duball DL Pocket ValveMauricio Contreras R.No ratings yet

- Final Project Report by Himanshu Yadav Student of Fostiima Business SchoolDocument55 pagesFinal Project Report by Himanshu Yadav Student of Fostiima Business Schoolak88901No ratings yet

- 4 Qi Imbalances and 5 Elements: A New System For Diagnosis and TreatmentDocument5 pages4 Qi Imbalances and 5 Elements: A New System For Diagnosis and Treatmentpixey55100% (1)

- Structure of An Atom Revision PaperDocument5 pagesStructure of An Atom Revision PaperZoe Kim ChinguwaNo ratings yet

- D904 - D906 - D914 - D916 - D924 - D926 - 8718458 - 04092008 - v02 - enDocument218 pagesD904 - D906 - D914 - D916 - D924 - D926 - 8718458 - 04092008 - v02 - enАлексей89% (18)

- Installation Manual of FirmwareDocument6 pagesInstallation Manual of FirmwareOmar Stalin Lucio RonNo ratings yet

- Basic Elements of The Communication ProcessDocument13 pagesBasic Elements of The Communication ProcessMech JTubao67% (3)

- Marketing Research Completed RevisedDocument70 pagesMarketing Research Completed RevisedJodel DagoroNo ratings yet

- A Visual Rhetoric StudyDocument32 pagesA Visual Rhetoric StudylpettenkoferNo ratings yet

- Business English IDocument8 pagesBusiness English ILarbi Ben TamaNo ratings yet

- Markov Decision Processes For Path Planning in Unpredictable EnvironmentDocument8 pagesMarkov Decision Processes For Path Planning in Unpredictable EnvironmentVartolomeiDumitruNo ratings yet

- CATL 34189-20AH Low Temperature Cell SpecificationDocument17 pagesCATL 34189-20AH Low Temperature Cell Specificationxueziying741No ratings yet

- Arch Plan-Agner Boco (For Blue Print) - p1Document1 pageArch Plan-Agner Boco (For Blue Print) - p1Jay CeeNo ratings yet

- SIDPAC Standard Data Channels: Ch. No. Symbols Description UnitsDocument2 pagesSIDPAC Standard Data Channels: Ch. No. Symbols Description UnitsRGFENo ratings yet

- Kumleben Commission ReportDocument232 pagesKumleben Commission ReportJulian Rademeyer100% (2)

- Content and Context Analysis of Selected Primary SourccesDocument3 pagesContent and Context Analysis of Selected Primary SourccesToshi CodmNo ratings yet

- Body LanguageDocument17 pagesBody LanguageAR PiZaNo ratings yet

- Chem 152 Lab ReportDocument21 pagesChem 152 Lab Reportapi-643022375No ratings yet

- Durham E-ThesesDocument203 pagesDurham E-ThesesH Man SharifNo ratings yet

- D1 001 Prof Rudi STAR - DM in Indonesia - From Theory To The Real WorldDocument37 pagesD1 001 Prof Rudi STAR - DM in Indonesia - From Theory To The Real WorldNovietha Lia FarizymelinNo ratings yet

- Future Scope and ConclusionDocument13 pagesFuture Scope and ConclusionGourab PalNo ratings yet

- Tele-Medicine: Presented by Shyam.s.s I Year M.SC NursingDocument12 pagesTele-Medicine: Presented by Shyam.s.s I Year M.SC NursingShyamNo ratings yet

- New Life in Christ - Vol05 - Engl - Teacher GuideDocument29 pagesNew Life in Christ - Vol05 - Engl - Teacher GuideOliver Angus100% (1)

- Unit 6 Selected and Short AnswersDocument19 pagesUnit 6 Selected and Short Answersbebepic355No ratings yet

- Competency #14 Ay 2022-2023 Social StudiesDocument22 pagesCompetency #14 Ay 2022-2023 Social StudiesCharis RebanalNo ratings yet

- NewspaperDocument2 pagesNewspaperbro nabsNo ratings yet

- DBL10 - Sapporo X Schematics Document: Compal ConfidentialDocument50 pagesDBL10 - Sapporo X Schematics Document: Compal ConfidentialEvgeniy BaranovskiyNo ratings yet

- B2 UNIT 6 Test StandardDocument6 pagesB2 UNIT 6 Test StandardКоваленко КатяNo ratings yet

- Dry Docking QuotationDocument4 pagesDry Docking Quotationboen jayme100% (1)

- Jim 1000 RC 3Document33 pagesJim 1000 RC 3singingblueeNo ratings yet