Professional Documents

Culture Documents

AG KC Finance Indian Banking Going Green

Uploaded by

Shantanu KrishnaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AG KC Finance Indian Banking Going Green

Uploaded by

Shantanu KrishnaCopyright:

Available Formats

2010

Indian Banks Going Green

Project Mart

1|Page

ResearchNData | Project Mart Indian Banks Going Green

Table of Contents

Table of Contents.................................................................................................................i Executive Summary............................................................................................................ 1 Introduction........................................................................................................................ 2 Global Scenario................................................................................................................... 3 Indian Scenario................................................................................................................... 4 Internal Initiatives............................................................................................................... 5 External Initiatives.............................................................................................................. 6 Key Players......................................................................................................................... 7 1. ICICI bank ................................................................................................................... 7 3. Punjab national bank................................................................................................... 9 4. Bank of Baroda.......................................................................................................... 10 5. YES Bank...................................................................................................................10 Role of Government and RBI.............................................................................................11 Impact on industrial growth in India..................................................................................12 Drivers.............................................................................................................................. 13 Barriers.............................................................................................................................14 Key Opportunities.............................................................................................................15 Key Success Factors..........................................................................................................16 Employees ....................................................................................................................17 Customers.....................................................................................................................17 Other stakeholders........................................................................................................ 17 Trends..............................................................................................................................18 ICICI Banks path breaking initiative...............................................................................19 SMERA rating................................................................................................................. 19 Financial Aspects involved with Green Banking.................................................................20 Cases on Indian Banks Going Green..................................................................................21 Case1-Induslnd Bank ...................................21 Case 2-AGB....................................................................................................................22 i|Page

Project Mart Indian Banks Going Green

References........................................................................................................................ 23

ii | P a g e

Project Mart Indian Banks Going Green

Executive Summary

Green banking as a term covers several different areas, but in general refers to how environmentally friendly your bank is, and how committed to green policies they are. As green initiatives sweep across the globe, more and more banks are taking note and taking action. The report is divided into three major parts. The first part gives an overview of the Green Banking scenario across the globe and in particular the Indian scenario. Various global banks having offices and branches in India and also Indian banks have realized the importance of the banking sector going green and so has the government which has guided and instructed banks in India on becoming environment friendly in their conduct of business. Various initiatives internal and external have been taken by the banks in India. Internal like paper free banking, e-statement, green offices etc. and external like supporting those industries which have already become green and those which are making serious attempts to grow green are being given priority by banks in their lending operations. The second part of the report elaborates on the key players who have adopted green banking in India and abroad, what role the government plays in supporting the Green Revolution among bankers and what the impacts of this are on the industrial growth in India. ICICI, Standard Chartered Bank, Punjab National Bank, Bank of Baroda, YES bank are the major banks that have been working towards going environment friendly. The Government of India has advised that Ozone Depleting Substances (ODS) are required to be phased out as per schedule prescribed therein. The RBI has advised that finance should not be extended for setting up of new units consuming/ producing ODS. Green Banking if implemented sincerely will act as an obstacle for the polluting industries that give a pass by to the other institutional regulatory mechanisms. The third section talks about the key drivers, barriers, success factors and opportunities in the Green Banking context, particularly in India. Various trends in the industry like SMERA rating have been elaborated upon in this section. The report also presents case studies on two banks who have adopted and succeeded in their greening efforts. IndusInd Bank having a comprehensive plan to reduce its carbon footprint has taken up what has been called Green Banking Project. The goal of the Green Banking Project is to promote sustainable business practices to offset the effects of climate change through energy and resource conservation, while protecting the environment for future generations. The Aryavart Gramin Bank devised an innovative scheme to make available finance for Solar Home Lighting Systems (SHS) mainly to provide ambient light at homes to improve living standard, education, health and welfare of the people residing in rural, semi urban and even in urban areas beset with frequent power cuts.

1|Page

Project Mart Indian Banks Going Green

Introduction

Green is slowly and steadily becoming the symbolic colour of eco-consciousness in the world. "Green" as a marketing communications platform is gaining a lot of attention. Every brand will have to become green to some extent because the response to climate change is critical to the survival of future generations. Taking the environment and climate change into consideration in what we do is important. So too is extending that sentiment to some of the more unlikely facets of our daily lives. Banking and finances is probably one of the areas you might not think you can do anything about, but there's a surprising amount that you can do to ensure that your money and finances are being managed in a green, ethical way. As green initiatives sweep across the globe, more and more financial institutions are taking note and taking action. The approach to green banking or sustainable banking as it is also known varies from organization to organization. As more consumers look at whether their lifestyle is sustainable, different areas of their lives come under scrutiny. This can include how their money is managed, which is where green banking can come in. Green banking is a very general term which can cover a multitude of areas from a bank being environmentally friendly to how their money is invested. Green banking as a term covers several different areas, but in general refers to how environmentally friendly your bank is, and how committed to green policies they are. A key aspect to green banking is the commitment that your bank will put your money into ethical, good natured sections of investment. In the past, it's been unclear where the money you put into a bank actually goes and less than reputable destinations, such as those that fund the purchasing of weapons and war related activities could well have received funds from your bank without you knowing it. Using a green bank gives you the reassurance of knowing where your money is - and isn't - going to when you go to deposit your cash. Most banks usually include green and ethical commitments in their manifestos - but there is a lot of difference in these commitments from bank to bank. Roughly, banks started devoting attention to this matter only halfway into the1990s.The first bank to set this precedent was the Co-Operative bank, whose lead has set an example to the rest of the banking world. Within the banking sector, environmental concerns were long considered to be more related to the social sciences, the subject having an image associated with idealistic nonconformist social

Green Banking in general refers to how environmentall y friendly your bank is and how committed to green policies it is.

2|Page

Project Mart Indian Banks Going Green

reformers. By now, many banks are actively involved, however, and are attempting to get the better of one anothers green activities.

Global Scenario

In the early 1990s, The United Nations Environment Program started a Finance Initiative to catalyze the banking industrys awareness of environmental issues. This global partnership between UNEP and the financial sector has grown to include over 160 institutions, including banks, insurers and fund managers. Companies work with UNEP to understand the impacts of environmental and social considerations on financial performance. In 2003, western financial institutions got together independently to introduce the Equator Principles. These voluntary guidelines were developed to address the environmental and social issues that arise in financing projects. They direct banks to deny loans for projects if the borrower is unable or unwilling to comply with the principles, or with the banks own internal environmental and social policies, whichever are stronger. Through efforts such as these, the greening of many banks, particularly in the west, has slowly but steadily gained ground. For financial institutions in the Asia-Pacific region, the concept of green banking is still new. The Development Bank of the Philippines (DBP), an ADFIAP member, is an early leader in green banking in Asia, having started implementing an environmental management system in 1997. In 2004, DBP attained ISO 14001 certification after a thorough audit of its operational controls, policies, programs, monitoring and measurement systems, and corrective and preventive actions in areas such as waste management and building maintenance. HSBC, one of the worlds biggest banks, in December 2004 became the first major bank in the world to publicly commit to going carbon neutral. It achieved this goal one year later, through a combination of reducing its direct emissions, buying green electricity, and offsetting its remaining emissions through the purchase of carbon offset credits. These credits have been purchased from wind and biogas energy production sites in India, Australia, Germany and New Zealand. According to the 2004 HSBC corporate social responsibility report, while the British banks direct contribution to climate change is relatively small, they believe it is important to start making a difference close to home. The trend in green banking has been gaining importance ever since. Banks across the globe have discovered that it makes good business sense to embrace the concept of green banking, and to take into account the environmental impact of their operations.

3|Page

Project Mart Indian Banks Going Green

Indian Scenario

India is home to one of the fastest-growing economies in the world, and is currently the fourth-largest in greenhouse gas (GHG) emissions. According to a report filed this year (2010) by The Indian Network for Climate Change Assessment (INCCA), a nation-wide network comprising 127 research institutions working on science and impacts of climate change, Indias ranking as of 2007 in aggregate GHG emissions in the world is 5th, behind USA, China, EU and Russia. The net Greenhouse Gas (GHG) emissions from India are reported to be 1727.71 million tons of CO2 equivalent in 2007.Therefore necessary actions in specific sectors are required to reduce GHG emission intensity and India has announced a voluntary plan to reduce carbon emission intensity by 20-25% by 2020. Also, due to soaring energy consumption, by 2031 India would need to add over 40,000 MW of electric generating capacity every year to address growing infrastructure needs. The banking sector has the very high opportunity to see with 400 million Indians transacting at an average 4-6 times a month. It occupies the space of primary lender cum custodian to individuals at large and invests in large scale projects for infrastructural and other long term growth projects. India has developed a National Action Plan on Climate Change which outlines a number of steps to simultaneously advance Indias development and climate change adaptation and mitigation. Last year the Indian Government approved a national trading scheme for carbon credits and energy-efficiency certificates that it claims could be worth more than 750 billion rupees by 2015. This provides significant opportunity for the banking sector. Even in the absence of certainty around climate regulations and policy, there are sufficient commercial drivers for banks to be proactive in facilitating the transition to a low carbon economy by dedicating greater amounts of finance for renewable and clean energy projects. Banks in India can carefully evaluate which areas need development and would be most complementary to their organizational structure and ideology. Budget allocations may be set aside and cost-benefit analysis completed. Cost implications will only exist as long as banks view climate change initiatives as a cost centre. As soon as banks can capitalize on the inherent opportunities which are now available the concern over costs will diminish. The Government of India, via the Bureau of Energy Efficiency (BEE), plans to launch a partial risk guarantee fund to provide commercial banks with partial coverage of risk exposure against loans made for energy efficiency projects. The organization (BEE) also plans to set up a new public sector firm to be called Energy Efficiency Services to boost investments in energy efficiency projects. Fear that Equator Principles early movers risk losing business is 4|Page

Project Mart Indian Banks Going Green

preventing Indian banks from signing to them but if environmental risks are not managed, banks face risk of project suspension or closure.

Internal Initiatives

The green economy is roaring to life, and today the focus is on how bankers can keep pace with it not just from the standpoint of providing banking services to other industries but participating in greening itself. Apart from lending, banks have also started looking within their organizations to manage the environmental impact of their operations. Banks occupy huge amounts of office space, devour large amounts of paper, have transport facilities, and consume energy and water. They have started tracking their resource use efficiency. They monitor water, paper, and energy consumption as well as carbon dioxide emissions. Following the national trend in businesses across the country, banks are turning to more eco-friendly solutions. How they implement these new methods for reducing, reusing and recycling cover the gamut from simple office efficiency methods to online banking to significant technology changes. Green Banking has taken many forms worldwide from e-statements to reducing carbon emissions from servers in banks. Office efficiency methods include retrofitting branch offices with low-wattage illumination, energy-efficient heating and cooling systems, and light sensors for conference rooms. Recycling bins are becoming the norm for banks as they look for common sense, low-cost solutions to recycling efforts. Employees are encouraged to power down their workstations at the end of the day to eliminate unnecessary energy consumption. By implementing more energy-efficient operational procedures in bank functions, such as trust administration, online document management can significantly reduce the banks overall paper output. In addition, banks are promoting online banking to reduce the amount of paper that customers print and the volume of mail they generate. The benefits derived from the convenience of banking from the home or the office also helps customers reduce their carbon footprint by eliminating the need to drive to and from the branch office. Many banks offer free online banking, bill pay and paperless statements. This not only helps the environment, but improves the banks efficiency and profitability as well. Paperless statements can be electronically generated for a lower cost than printing, stuffing, and mailing monthly statements - and its much more environmentally friendly. Most banks promote e-statements and online banking as a part of cost saving campaigns. This takes it a step further and gives a feel good factor to the customer by encouraging him to do the right thing and save the planet. Changes in technology purchases that fully support a paperless office environment enable banks to significantly reduce paper output by offering solutions in workflow and document management. Banks are able to cut back on

5|Page

Project Mart Indian Banks Going Green

the time and energy spent on manual paper-based processes with workflow management systems and collaboration tools. Workflow management solutions allow documents to be scanned into a system and kept indefinitely for retrieval at any time. Also, technology software choices can not only help reduce errors and improve version control, but eliminate the costs of producing, storing, and shipping paper documents.Another initiative by major banks internal to reduce their carbon footprints are provision of credit cards and debit cards that can be recycled, or are made from recycled materials. An internal movement towards environment-friendly operations becomes necessary. At banks like ICICI, ideas are generated by employees through contests. Ideas include dateless diaries, visiting cards on recycled paper, sapling plantations and green walkathons.

External Initiatives

The banking sector generally perceives itself as environmentally neutral. However, the regulatory landscape that large commercial and community banks often find themselves walking through is constantly changing and looks more like a minefield. Although banks themselves do not largely impact the environment much through their own internal operations like a large scale manufacturer or developer might, the external impact on the environment can be substantial. That is because banks like any other business may be potentially liable for environmental damage that their operations or fiduciary involvement may cause. Some financial institutions that previously found nothing wrong with underwriting millions for certain sectors like mining, illegal logging and other commercial operations that rapidly deplete the ozone layer, denude forests, deplete water resources, or pollute the rivers, have now started paying attention. Along with governments, financial institutions like banks have realized that protecting the environment should also be their business. In banks cases, the concern is on derived environmental liability through debt and equity transactions. Real sustainable banking does not imply that banks should write off clients that are currently not operating as sustainable as they might, but that they assist these clients along the difficult road to more sustainable business practices. At the same time, banks will have to support clients with sustainable investment ambitions, usually ones that are still ahead of their time, with specific financial instruments to help them meet their objectives. Banks are promoting their online banking services as Green Banking because by banking online, customers will reduce the amount of paperwork they consume, the volume of mail they generate, and the amount of driving to-and-from branch offices. Each of which will benefit the environment and in most cases will increase a bank's efficiency and profitability. But there is more to the concept of green banking. Banks are also becoming more environment-friendly by taking the following initiatives: Mortgage deals based on how ecologically sound/energy efficient your home is. Green mortgages allow home buyers to add as much as an additional 15% of the price of their house into their loan for upgrades including energy-efficient windows, solar panels, or water

6|Page

Project Mart Indian Banks Going Green

heaters. The savings in their monthly energy bills can offset the higher monthly mortgage payments and save money in the long run. Credit cards allow users to raise money for environmental causes every time they use their plastic. A green credit card also allows cardholders to earn rewards or points which can be redeemed for contributions to eco-friendly charitable organizations. These cards offer an excellent incentive for bank customers to use their green card for their expensive purchases. Set aside funds that are used to finance renewable energy schemes such as small hydroelectric projects and wind farms. Various deals such as discounts and lower-rate borrowing when people buy certain green energy saving products or services, such as public transport tickets, are playing a major role today.

Key Players

1. ICICI bank

ICICI Bank's Technology Finance Group (TFG) implements programmes for multilateral agencies in areas of collaborative research and development (R&D), energy, environment and healthcare. TFG's initiatives include efforts to attract and channel private financing into cleaner technologies, to create public-private partnerships to mitigate greenhouse gas emissions through energy efficiency and to promote sustainable development. TFG assisted in the introduction of codes of environmental management (ISO 14000) to the country. TFG supported the first passenger electric car in India (Reva), currently being exported to the UK and 17 other countries. It also supported the introduction of municipal shared savings concept through the energy service company (ESCO) route, which help save expenditure for street lighting and water pumping. Another significant initiative was the introduction of green rating of buildings through setting up of CII's Green Business Centre (GBC). The GBC now has 350 million square feet of floor space registered for green rating that will save energy, water and emissions. TFG has also partnered with the Indian Army to assist 25 resource conservation and biodiversity protection projects in different geographies of the country. Through Go Green', ICICI Bank has significantly reduced consumption of energy and paper by encouraging paperless transactions and communication, using CFL lighting and regulating AC temperatures across all our offices and branches. ICICI Bank offers discounts in processing fees for customers opting for energy-efficient vehicles. Processing fees are reduced for those who purchase homes in Leadership in Energy and Environmental Design' certified buildings. Chlorophyll' is ICICI Bank's monthly internal newsletter launched in September 2009 covering perspectives of senior management, initiatives within the ICICI Group, updates on global environmental developments and tips to help employees contribute towards environmental conservation. ICICI Bank has pledged its support to the World Wildlife Federation-led Earth Hour by switching of all lights in its premises, branches and ATMs for one hour. ICICI Bank also

7|Page

Project Mart Indian Banks Going Green

celebrated World Environment Day on June 5, 2009, an occasion when branch staff and customers took the green pledge, planted and distributed saplings and conducted other events.

2. Standard chartered bank

The bank has developed a wide variety of tools that show staff how they can protect the environment.. These include Your Office Environment, and My Environment. Standard Chartered Bank has an Environment Coordinator network, comprising at least one member of staff in each market, responsible for driving the commitment to protect the environment through exciting and innovative action. The banks approach to raising their customers awareness focuses on increasing energy efficiency and reducing resource consumption, and is driven by their Consumer Banking business. This year Consumer Banking made significant steps in embedding environmental considerations into their core business operations: The introduction and promotion of e-statements across Bangladesh, Indonesia, Pakistan, Thailand and the UAE has led to a 20 per cent reduction in the number of customers requiring printed statements. This equates to an annual saving of $3.9 million and the preservation of 447 trees. Staff in India, Hong Kong, Singapore, Malaysia, UAE have worked to reduce the amount of paper required for application forms and terms and conditions associated with credit cards, current accounts, savings accounts and personal loans. They have reduced the number of fields that customers must complete and introduced plainer language. Paper use for application forms has fallen by 20-25 per cent, while a 30-35 per cent reduction in the paper required for terms and conditions has been recorded A full energy audit of bank branches was carried out this year, and $3.3 million was allocated to improve efficiency, including measures such as the introduction of energy efficient lighting and air conditioning. Partnerships: The bank has been a member of the Corporate Leaders Group on Climate Change since 2004.

8|Page

Project Mart Indian Banks Going Green

It is a member of the United Nations Environmental Program. The bank is a member of The Climate Group and a founding signatory to The Climate Principles.

3. Punjab national bank

The bank feels that besides creating awareness about pollution which is responsible for global warming there is a need for taking steps for reducing pollution by banking system as a whole. To stabilize emission of green house gases in the atmosphere at a level that would prevent dangerous changes in the climate, an international agreement, popularly known as Kyoto Protocol was signed in the year 1997 which permits meeting the national targets through a combination of domestic climate change activities and the use of the Kyoto Flexible Mechanism namely Emission Trading System (ETS), Joint Implementation (JI) and Clean Development Mechanism (CDM). The projects under CDM generate Certified Emission Reductions (CERs) or carbon credits, which can be sold to developed countries. India is one of the leading generators of CERs through CDM and as such has a large scope in carbon trading. Since the CDM projects have to pass through a long process, Punjab National Bank has entered into a Memorandum of Understanding with two reputed consultants. Further, in order to tap the potential available under this area, Bank has put in place comprehensive guidelines for financing Carbon Credit. Bank has in place guidelines for providing finance to units producing clean energy such as, solar energy, wind energy and hydel energy on merits of each case which help in containing Green House Gases (GHGs) emissions leading to clean environment.

9|Page

Project Mart Indian Banks Going Green

4. Bank of Baroda

Bank of Baroda has adopted environment friendly systems and technologies in the design of the new Data Center (Green Initiative), which includes: Energy efficient electrical and HVAC design Environment friendly construction material Chiller based HVAC Temperature monitoring Intelligent building management software High efficiency Precision air-conditioning units

The Bank's ultimate objective is to reorient itself as a highly technology enabled Bank and Bank of first choice for its customers in order to emerge as a leader in the global market place on every single parameter including technology and environment friendly conduct of business.

5. YES Bank

A carbon footprint is "the measure of the impact of human activities on the environment in terms of the amount of greenhouse gases produced, which is measured in units of carbon dioxide". YES BANK is a first Indian signatory to the Carbon Disclosure Project and has 10 | P a g e

Project Mart Indian Banks Going Green

documented its Carbon Footprint. It is also the first Indian Bank from the private sector to become signatory to UNEP Statement by Financial Institutions on the Environment and Sustainable Development. YES BANK also advocates a proactive response to climate change from its peers in the banking community, industries and society as well.

Role of Government and RBI

All the international initiatives towards integrating environmental concerns into business operation of banks are voluntary in nature and are meant to promote a common good of a better ecosystem. Voluntary commitment has its own shortcoming in a competitive market. Unless the market for green money will increase, the lenders will always have an incentive to delay their social commitment and prioritize the commercial interest in the short run. So demand for green money is a precondition of green banking if it will be voluntary. India is on a higher growth trajectory for last one and half decade and the industrial sector plays the most important role in Indias growth story. However, Indian industry faces the challenges of controlling environmental impact of their business i.e. reducing pollution and emission of their clients. Though government has been trying to address the issue by framing environmental legislations and encouraging industry to follow environmental technologies and practices, they would not be enough given the poor track records of enforcement, public awareness and inability to derive competitive advantage by producing eco-friendly products. A Government legislation that makes banks accountable for the misdeeds of their clients will help promote green banking. The government could encourage green banking by adopting differentiation in interest rates, even further by tax incentives for banks offering green finance products. The Dutch government is, for example, indeed doing so by such means as the green tax ruling (a tax incentive for the investment in green funds and projects). In the Netherlands, the government introduced Green Fund Plan in 1995 and successfully changed its economic structure by nurturing green finance. For example, the government offers a 1.2 percent capital gains tax exemption for banks providing money for green industries. A fund can be 11 | P a g e

Project Mart Indian Banks Going Green

created from the additional money charge and it can be used for financing projects that emit less carbon. This way, the borrowers of higher carbon emitting projects would replace those with lower carbon emitting projects. In December 2007, The Reserve Bank of India (RBI) sent a circular and asked banks to take effective steps to further the cause of sustainable development, taking into consideration the effects on climate change and global warming. Sustainable efforts by financial institutions assume urgency and banks can play a meaningful role for the cause of clean environment. The central bank also asked banks to place on record information on their efforts toward corporate social responsibility and sustainable development along with their annual accounts. There are no specific legislative drivers to encourage better performance in terms of sustainable lending or project finance. However, several voluntary standards and sets of principles exist and are gaining steam in the business marketplace. Examples include the Equator Principles, World Bank IFC Guidelines, Global Reporting Initiative (GRI) Finance Sector Guidelines and even Securities and Exchange Commission federal reporting requirements. Leading international finance and local banking institutions have signed on to many of these guidelines, which are rapidly becoming the norm in the banking industry.

Banks in India were advised to implement suitable and appropriate plan of action toward helping the cause of sustainable development with particular reference to IFC Principles on Project Finance (the Equator Principles). Banks and financial institutions should keep themselves abreast of the developments on an ongoing basis and modify their strategies in light of such developments. The Government of India has advised that Ozone Depleting Substances (ODS) are required to be phased out as per schedule prescribed therein. In view of the obligations, the RBI has advised that finance should not be extended for setting up of new units consuming/ producing ODS.

Impact on industrial growth in India

One of the major economic elements influencing overall industrial activity and economic growth is the financial institutions such as banking sector. Therefore banks need to go green and play a lead in environment protection by adapting their lending structures accordingly which would force industries to go for mandated investment for environmental management, use of appropriate technologies and management systems. Banks which provides facilities like mobile banking and internet banking help cut down the carbon footprint of the customers by eliminating the need for physical statements or travel to branches. It is also encouraging customers to use more environment-friendly vehicles by offering a 50 per cent waiver on processing fee on car models which use alternative modes of energy. The vehicles identified include LPG models of Maruti800, Omni and Versa, Hyundai's Santro Eco,

12 | P a g e

Project Mart Indian Banks Going Green

Honda's Civic Hybrid, Reva electric cars, and the CNG versions of Tata Indica and Mahindra Logan. ICICI Home Finance is trying to woo consumers by with reduced processing fees on purchasing homes in Leadership in Energy and Environmental Design certified buildings. Green Banking if implemented sincerely will act as an obstacle for the polluting industries that give a pass by to the other institutional regulatory mechanisms. There has not been much initiative in this regard by the banks and other financial institutions in India though they play an active role in Indias emerging economy. More and more investments and credits made available by the banks adopting Green banking will lead to the growth of industries which have lesser or negligible carbon footprints.

Drivers

The trend towards green banking is still largely driven by and directed toward consumer behavior. An increase in online bill-pay and the use of paperless statements translates not only into less paper to be processed, handled and discarded but it also can lead to reduced staffing needs which can mean significant savings for the bank. In the past few months, several major banks have introduced incentives to encourage their customers to reduce paper by moving to online banking. These incentives vary from rewards cards to contests to cash rebates and may help to speed up the online banking adoption rate. The value proposition for corporations to go green includes many of the same issues as that for individual consumers but on a much larger scope and with additional concerns. . Corporations may share a desire to reduce carbon footprint and enhance security by eliminating paper waste, but they are also extremely concerned with eliminating or decreasing errors due to manual processing and with creating a profitable bottom line. For these reasons and more, corporations are actively pursuing green programs, many companies are taking active steps to reduce waste, implement sustainability measures and increase profitability by going green. Over the past several years, we have seen more and more conventional banks adopting more socially responsible or green language for their products or policies. Examples are 13 | P a g e

Project Mart Indian Banks Going Green

Deutsche Bank with its Banking on Green product line, and Bank of Americas Brighter Planet Visa debit and credit card. Increasing criticism of the business practices of large banks has also accelerated these apparently green innovations. While these usually fail to receive enough attention, an environmental risk associated with a client can become a financial risk for the bank. As an example of this, the continuity of a client can become endangered due to changing government policy or the shifting preferences of consumers or industrial clients, either of which result from attempts to achieve sustainability. Furthermore, banks can sometimes even be held directly accountable for the environmental damages caused by the activities of a client. Also these banks may face reputation risks which can arise by investing in activities which are sufficiently disapproved of by society. In cases where clients are interested not only in financial rewards but also in ecological and social rewards, an interesting market develops. The market for funds that invest exclusively in companies demonstrating progressive environmental care, for example, is growing dramatically. Also available are funds specializing in solar energy, wind energy and environmental technology. As the banking industry tightens its belt, green banks are emerging both as a result of the eco-friendly movement and as a key driver for reducing overall costs. In addition, creating a strong socially responsible image in the community seems to be another benefit emerging for these green banks.

Barriers

Few institutions have swathed themselves in green as enthusiastically as the world's biggest financial corporations. While not traditionally associated with antipollution or renewableenergy issues, a number of banks have made impressive promises about investing in green businesses and reducing their own greenhouse gas emissions. But a close look at corporate environmental reports and sustainability reports reveal that, despite the rhetoric, certain financial giants and banks struggle with the first step itself which is diminishing the carbon emissions from their buildings due to lighting, air conditioners etc. and the jets on which their employees travel. Brisk business in the banking sector has lead to more employees in well-lit offices, working on more computers around the clock. This demands more electricity created often, by burning CO2 -spewing coal or natural gas. More deals lead to more air travel, another key source of emissions linked to global warming. Lack of awareness or shunning away by individuals who transact with the bank, the bank employees, the bank management or

14 | P a g e

Project Mart Indian Banks Going Green

corporations, from responsibilities towards the environment as a whole is another major barrier to green banking in India. Banks that do not have correct policies in place to screen and assess environmentally damaging projects are generally face obstacles in going green. Most of the times environmental safeguards are sacrificed for short-term gains or profits and projects which may be smaller are dropped which is also a barrier to sustainable banking.

Key Opportunities

Environmental awareness has been put firmly on the global agenda by banks, creating numerous investment opportunities in the area of clean energy, water management and green production processes. State Bank of India (SBI), India's largest commercial bank, took the lead in setting high sustainability standards and decided to install windmills of 15 MW capacity in three States 4.5 MW in Tamil Nadu, 9 MW in Maharashtra and 1.5 MW in Gujarat, state SBI sources. The 15-mw project, supplied by Suzlon Energy, consists of 10 units of Suzlon's S-82 and 1.5mw wind turbine generators. These generators were earlier installed across Gujarat, Maharashtra and Tamil Nadu. The path breaking project forms an important part of SBI's strategy to reduce its carbon footprint and sensitize clients on the need for adopting efficient processes. The electricity generated from the wind turbines will power various SBI facilities and operations across the three states. The project was completed by Suzlon in record time - going from concept to commissioning in just four months, covering equipment supply, construction, project commissioning, power evacuation, and comprehensive operations and maintenance services. ICICI has partnered with the Indian government, World Bank and UNAID to support SME projects in the area of green research and clean technology. It is also working with the Indian Army on water management, energy conservation and alternative energy projects. The bank has also partnered with TATA Power to raise awareness on energy conservation at schools through the TATA Power Club. For waste management, they have partnered with Jindal Urban Infrastructure Limited to sponsor an integrated MSW processing plant in Delhi. With a base of around 35,000 employees, ICICI Bank will increase its focus on clean technology in the current fiscal. Standard chartered bank launched a paper reduction campaign in India which was a huge success and Consumer Banking project of the bank plans to launch this paper reduction campaign in 15 countries and is very optimistic about covering the core regions by 2011. Markets to be covered by the paper reduction campaign:

15 | P a g e

Project Mart Indian Banks Going Green

Asia Bangladesh China Hong Kong India Korea Pakistan Taiwan

Africa Ghana Kenya Nigeria Indonesia Malaysia Thailand Singapore

Middle-East UAE

Citibank has recently stepped up its green banking efforts. As part of the group-wide plan, Citigroup's markets and banking group expects to invest in and to finance more than $30bn in clean energy and alternative technology during the next 10 years, with current commitments already approaching $7.5bn. Since the company began its environmental sustainability initiatives, it focused on greener energy consumption practices and facilities. In its 10th Global Citizenship Report, it declares new targets covering waste- and waterrelated goals including a 20% reduction of water usage and 40% reduction of landfill waste by 2015.

Key Success Factors

The success factors of the Indian Green Banking initiatives can be categorized on the basis of the initiatives that each party involved have taken in the banking scenario. The three categories are employees, customers and all the other external stakeholders involved in the scenario. Employe es

Other Stakeholder s

Custome rs

16 | P a g e

Project Mart Indian Banks Going Green

Bank s

Employees

Carrying out operations in an environmental friendly manner like reduced use of papers in transactions. A case in point is the use of dateless diaries so that they do not become redundant in a year. Buildings and facilities that are environment friendly with lesser and efficient consumption of electricity Implementing employee performance measures that take their contribution to environment into account. This may also involve conducting audits on the manners in which each employee utilizes resources at work Educating employee of the initiatives by the organization, peers in the industry and also communicating to them the ways of making a contribution themselves

Customers

Provide waivers and easy financing to projects with green initiatives and which would make positive impacts to the environment Providing encouragement to businesses which are not environment friendly and assist them in becoming one Encouraging customers to make a transition from traditional banking to paperless banking by proving them with mechanisms that are more simpler and yet secure

Other stakeholders

Collaborations with other international agencies that encourage environment friendly activities. Examples include the Equator Principles, World Bank IFC Guidelines, among others

17 | P a g e

Project Mart Indian Banks Going Green

Being party to government and central bank initiatives and directives that would result in an positive effect to the environment Adhering to international norms like the Kyoto protocol, UNEP statement etc. Being a customer themselves of organizations that are ready to sell their carbon credits. Many banks have taken up the responsibility to be carbon positive and one way of doing that is buying carbon credits from external agencies.

Trends

Funding for renewable energy projects is expected to become easier in India as Banks and private equity investors begin to look at clean energy projects as viable businesses propositions to invest in. There aree numerous investors who are keen on getting into the renewable sector if a viable business proposition is proposed. As such, it is hoped the ease of funding will follow such viable business offers. Green leaders award winners in the banking industry, HSBC, ICICI and HDFC says that they are not only keen on investing in renewable energy projects but would also cut down their own carbon emissions via different initiatives. ICICI Bank, Indias largest private sector lender, confirmed that it had been into renewable energy development for years and would continue offering funding for other projects. A recent study by PricewaterhouseCoopers commissioned by the Indian Banks' Association (IBA) and The Climate Group confirmed that India's leading banks are recognizing and seizing opportunities in an emerging low-carbon economy. Various banks are starting to invest in low-carbon technologies and develop new products and services that will address the risks and opportunities of climate change. For instance, in coal technologies, ICICI Bank introduced innovative concepts like deep beneficiation of coal (coal washeries) and coal bed methane. It also assisted a company develop a product that provides an eco-friendly air-conditioning alternative to conventional air conditioners. Energy efficiency is another key focus of banks, with an estimated market worth more than $15 billion by 2015 in India. IDBI Bank, for instance, has an exclusive team working on clean development mechanism (CDM) advisory services. It also implemented a refinance scheme for energy saving projects for micro, small and medium enterprises sector. Yes Bank too, is incorporating community development initiatives such as clean and green drives, energy efficiency practices, through its "Yes Community" initiatives. The new Green Home Loan Scheme from SBI will support environmentally-friendly residential projects and offer various concessions. These loans will be sanctioned for projects rated by the Indian Green Building Council (IGBC) and offer several financial benefits - a 5 per cent concession in margin, 0.25 per cent concession in interest rate and processing fee waiver.

18 | P a g e

Project Mart Indian Banks Going Green

ICICI Banks path breaking initiative

In an effort to promote e-statements and go the green banking way, ICICI Bank has come up with an interesting promotion in collaboration with The Bombay Natural History Society. As part of the campaign, a website called Go Green has been launched. On this website, customers of ICICI Bank can sign up for receiving their bank statements by email in lieu of which ICICI Bank will plant a tree in lieu of the savings they make by not having to send you printed paper through the mail. Not only does the customer receive a Go Green certificate from ICICI Bank and BNHS, but the customer's name is also featured on the Roll of Honour on the site - a nice way to publicly acknowledge the customer's initiative. It is an attractive site which also includes some interesting tree facts thrown in for good measure.

SMERA rating

Reduction in GHGs emission and energy conservation is the new mantra to reduce the adverse effect of global warming. Considering the rapid climatic changes experienced globally in the recent past, various Government initiatives are underway to reduce the carbon emission in the atmosphere. One such initiative "Green Rating" was launched by the SME Rating Agency of India Ltd-(SMERA) in April 2010. Union Finance Minister Pranab Mukherjee presented the first Green Rating Certificate to M/s Ultimate Alloys - Coimbatore. SMERAs-Green Rating is an independent, third party comprehensive measure of units sensitivity towards environment and the affirmative action adopted by the unit to reduce energy consumption and emission. The rating methodology would include submission of data by the applicant followed by the site visit and interaction with management. The final rating assessment is undertaken by a committee comprising of external experts and on its finalization, the rating will be disseminated to the applicant.

19 | P a g e

Project Mart Indian Banks Going Green

Financial Aspects involved with Green Banking

The bottom-line benefits of sustainability performance in the banking industry are evident in the market place. Some key benefits of such an approach include: Improved Financial Performance Reduced Operating Costs Enhanced Brand Image and Reputation Increased Loan Originations and Customer Loyalty Increased Ability to Attract and Retain Employees. Operational efficiency

By switching to electronic bills, statements, and payments, every year the average household can save 6.6 pounds of paper. Paperless initiatives like e-statements and egreetings helped ICICI Bank save 30,000 trees from being felled in 2009-10, besides cutting down spending on stationery by Rs 7.36 crore. ICICI Group companies have saved around 30,000 trees and 16 crore litres of water through green initiatives, the bank said in a statement. Cost savings of Rs 380 mn from have been achieved through 3.6 mn reams of paper saved. In a single office, HSBC expects to save $140,000 annually through energy-saving initiatives. It introduced a technology that cut its energy demand by 1.07 million kilowatt hours and carbon dioxide emissions by 1,050 tonnes every year. It has also been able to reduce by a third its water and energy consumption in its operations in China and India.

20 | P a g e

Project Mart Indian Banks Going Green

Cases on Indian Banks Going Green Case1-Induslnd Bank

IndusInd Bank, a fast growing, new-generation private-sector Bank was incorporated in 1994. It caters to the needs of both Consumer & Corporate clients and has a robust technology platform supporting multichannel delivery capabilities. The Bank enjoys a patronage of 2 million customers and has a network of 186 branches, 412 ATMs spread across 151 geographical locations in 28 states and union territories as on November 30, 2009. It also has representative offices in Dubai and London. IndusInd Bank having a comprehensive plan to reduce its carbon footprint has taken up what has been called Green Banking Project. The goal of the Green Banking Project is to promote sustainable business practices to offset the effects of climate change through energy and resource conservation, while protecting the environment for future generations. Some of the initiatives being undertaken under this plan are solar-powered ATMs, thin computing, e-archiving, e-learning, e-waste management, paperless fax, energy conservation, CNG cars and also supporting finance programs with incentives to go green. In December 2009, IndusInd Bank inaugurated Mumbai's first solar-powered ATM as part of its project campaign titled "Hum aur Hariyali". IndusInds new Solar ATM replaces the use of conventional energy for eight hours per day with eco-friendly and renewable solar energy. With the commencement of the Green Banking Initiative in the Bank, one of the key deliverables was enabling the ATM and signages with Solar energy. IndusInds new Solar ATM at Opera house is a first of its kind in India and a revolutionary concept in Green Banking. Autonics Solar UPS replaces the conventional use of fossil fuel in the form of diesel generators with eco friendly and renewable solar energy. The system operates on real time and has two levels of operation- Timer Based (switch to solar UPS on timer operation) and Trigger based (in case of power failure the system will switch to UPS). The system will also have alarms or alerts to indicate when the battery is low and a signal indicating the start of the Generator and the ability to start the generator using AMF or similar devices. The Solar ATM at Opera House uses photovoltaic cells mounted on the roof of the building. These cells convert sunlight into electricity and this clean and renewable form of energy is used to power the ATM. The Solar UPS generate approx 5926.4 watts, or 6 units of power. The energy saved will be 1980 KW hrs per annum and will result in the reduction ofCO2 by 1942 Kgs per year. In terms of costs, the Savings will be approximately be Rs.60.00/day in case of a commercial 21 | P a g e

Project Mart Indian Banks Going Green

user with grid power supply and Rs.120.00 in case of solar energy substituting diesel generator. This will translate to Rs.20100.00 savings per annum using grid or Rs.40,200.00 for diesel generators.

Case 2-AGB

Aryavart Gramin Bank, a Regional Rural Bank, was constituted on 3rd October 2006 after amalgamation of three Regional Rural Banks (RRBs) namely Avadh Gramin Bank, Barabanki Gramin Bank and Farrukhabad Gramin Bank. The said three RRBs were sponsored by Bank of India and had locational proximity. Like the parental bodies, the amalgamated entity functions under Regional Rural Banks Act 1976 and is sponsored by Bank of India. In order to expand and sustain clean energy through clean development mechanism (CDM) and to avail benefit of carbon credits, the Bank has signed a Memorandum of Understanding with a U.S.A. based corporation to work together for mutually beneficial purpose of sourcing and selling Voluntary Emission Reduction (VER) Carbon Credits. Scope of the Project will include all lending for solar products by the Bank during the project term of Six years. The Bank will use the proceeds from the credits for market development activities with the goal of expanding and sustaining the local market for clean energy, inter alia establishing service centres, providing partial employment to rural youth by imparting training and providing toolkit for maintenance and repair of Solar Home Lighting Systems financed by the bank. In 2006 The Aryavart Gramin Bank in the northern Indian state of Uttar Pradesh faced severe power shortages in rural areas and needed reliable back up power to run its computerized branches. The bank installed PV systems that charged the batteries which in turn operated the computers. They also devised an innovative scheme to make available finance for Solar Home Lighting Systems (SHS) with a slogan Ghar Ghar Me Ujala (Light in every house) mainly to provide ambient light at home to improve living standard, education, health and welfare of the people residing in rural, semi urban and even in urban areas beset with frequent power cuts. Another important facet of the scheme is the system devised for maintenance of SHSs. A local youth is trained by the Company/ Dealer to maintain the systems. He is provided with a toolkit. An honorarium of Rs 10,000/- per year is paid by the Bank to these Business Facilitators. Thus, it is providing partial employment to rural youth who would otherwise migrate to cities for semi-skilled / unskilled jobs.

22 | P a g e

Project Mart Indian Banks Going Green

The Solar Home Lighting System consists of a Solar Panel of 35 watts, a low maintenance battery, a charge controller and 2 luminaries (9 watts CFLs backed by a reflector enhancing the light output). The lights work for minimum 5 hours a day and the system has autonomy of 3 days i.e. one sunny and two non-sunny days. Besides two CFLs, the SHS also supports a mobile charger (a necessity in villages), a small DC fan and a Black and White T.V. bringing the whole world in the courtyard of a farmer. The price of SHS offered by the Company is so competitive that the farmers are not required to run after subsidy. The equated monthly installment (with interest) of Rs 245/- per month for a loan of Rs. 11,000/- per SHS repayable in 60 months is found to be cheaper by villagers, who spend roughly Rs. 280/- per month on Kerosene. The Bank organized many Credit Camps exclusively for SHS to popularize the scheme and to provide finance for installing the Solar Home Lighting Systems to the Banks existing good clients.

References

ICICI bank http://www.icicibank.com Aryavart Gramin Bank http://www.aryavart-rrb.com SBI http://www.statebankofindia.com Punjab National Bank http://www.pnbindia.in Standard Chartered Bank http://www.standardchartered.co.in Bank of Baroda http://www.bankofbaroda.com YES Bank http://www.yesbank.in SME Rating Agency of India Ltd. http://www.smera.in/SmeraPress.aspx UK Energy Saving http://www.uk-energysaving.com/green_banking.html One Source article- Banks are going green http://onesource.thomsonreuters.com/new sletter/article.asp?q=25 Human Capital Review http://www.humancapitalreview.org/conte nt/default.asp?Article_ID=672 Bloomberg Business Week http://www.businessweek.com/magazine/c ontent/07_25/c4039011.htm Bureau of Energy Efficiency http://www.bee-india.nic.in/ UNEP http://www.unep.org/greeneconomy/

23 | P a g e

Project Mart Indian Banks Going Green

24 | P a g e

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Power and Propulsion PDFDocument13 pagesPower and Propulsion PDFahmedalgaloNo ratings yet

- Thermal Analysis of Polymers - 2008 - Menczel - FrontmatterDocument8 pagesThermal Analysis of Polymers - 2008 - Menczel - FrontmatterBABLI GUPTANo ratings yet

- Las Mapeh 9 q2 w6 HealthDocument8 pagesLas Mapeh 9 q2 w6 HealthJemalyn Hibaya Lasaca100% (1)

- Report On RoboticsDocument40 pagesReport On Roboticsangelcrystl4774No ratings yet

- Approved Reading List Editions 2019ff As of 01 19 2023 2Document9 pagesApproved Reading List Editions 2019ff As of 01 19 2023 2nikolNo ratings yet

- Honda XL700VA9 Parts Catalogue Final PDFDocument78 pagesHonda XL700VA9 Parts Catalogue Final PDFangeloNo ratings yet

- Wheatley Hp600 Quintuplex Plunger PumpDocument2 pagesWheatley Hp600 Quintuplex Plunger Pumpmetasoniko2014No ratings yet

- Kingspan 30 GSNDocument1 pageKingspan 30 GSNNoella AguiarNo ratings yet

- RB in Poultry Feed - 3Document17 pagesRB in Poultry Feed - 3Vishwanath HebbiNo ratings yet

- Part 7 Mean Field TheoryDocument40 pagesPart 7 Mean Field TheoryOmegaUserNo ratings yet

- Sediments and Sedimentary Rock-Week 4Document61 pagesSediments and Sedimentary Rock-Week 4qomaruzzaman5740No ratings yet

- 10 To 11-ClassDocument111 pages10 To 11-ClassVikaas SagerNo ratings yet

- Annals of The New York Academy of Sciences - 2023 - Hess - Accelerating Action To Reduce Anemia Review of Causes and RiskDocument13 pagesAnnals of The New York Academy of Sciences - 2023 - Hess - Accelerating Action To Reduce Anemia Review of Causes and RiskIdmNo ratings yet

- Paradise Lost Epic Poem by John MiltonDocument9 pagesParadise Lost Epic Poem by John MiltonSotero PoreNo ratings yet

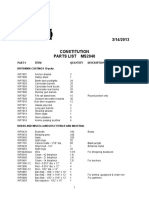

- MS2040 Constitution Parts ListDocument6 pagesMS2040 Constitution Parts ListTemptationNo ratings yet

- Fate NumeneraDocument24 pagesFate Numeneraimaginaari100% (1)

- MECH0018.1 Assignment 2 QP Fall 2021Document17 pagesMECH0018.1 Assignment 2 QP Fall 2021saleem razaNo ratings yet

- Draf Model LC 2024 Non TransferableDocument3 pagesDraf Model LC 2024 Non TransferablepresidenciaNo ratings yet

- Art Lab For Little Kids - Susan Schwake PDFDocument146 pagesArt Lab For Little Kids - Susan Schwake PDFEmma Alfonzo67% (3)

- Therelek - Heat Treatment ServicesDocument8 pagesTherelek - Heat Treatment ServicesTherelek EngineersNo ratings yet

- Acute and Chronic Gastrointestinal BleedingDocument7 pagesAcute and Chronic Gastrointestinal BleedingMarwan M.100% (1)

- Cambridge IGCSE: MATHEMATICS 0580/41Document20 pagesCambridge IGCSE: MATHEMATICS 0580/41TatiannahNo ratings yet

- XVI - Magneticpropertiesofmanganese ContainingsolidsolutionsofbismuthorthoniobateBiNiO4Document7 pagesXVI - Magneticpropertiesofmanganese ContainingsolidsolutionsofbismuthorthoniobateBiNiO4Chukwuebuka UgochukwuNo ratings yet

- TMJDocument38 pagesTMJAnonymous 6kAmeZzINo ratings yet

- MHFU Hunter RankDocument5 pagesMHFU Hunter RankGustin PrayogoNo ratings yet

- Interactions of Microplastic Debris Throughout The Marine Ecosystem Final Tracked-Galloway, TS Cole, M Lewis, CDocument22 pagesInteractions of Microplastic Debris Throughout The Marine Ecosystem Final Tracked-Galloway, TS Cole, M Lewis, CTrydawNo ratings yet

- TP260SR Tier 3 TC002-1037Document1 pageTP260SR Tier 3 TC002-1037Jorge GalarceNo ratings yet

- Full Site PDFDocument23 pagesFull Site PDFpursuwNo ratings yet

- CHEM333 Syllabus 2020 2021Document4 pagesCHEM333 Syllabus 2020 2021lina kwikNo ratings yet

- Web Based Bus Tracking SystemDocument4 pagesWeb Based Bus Tracking SystemKrishna EelaNo ratings yet