Professional Documents

Culture Documents

Chemical Industry Investment in The Marcellus Shale Region Will Continue 2012

Uploaded by

陳政民Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chemical Industry Investment in The Marcellus Shale Region Will Continue 2012

Uploaded by

陳政民Copyright:

Available Formats

Chemical industry investment in the Marcellus Shale region will continue

Chemical industry investment in the Marcellus Shale region will continue

13 February 2012 00:00 [Source: ICB] With the huge sums of investment being targeted for the natural gas-rich area, there might as well be gold under the hills of the Appalachia region of the US Simply stated, chemical industry growth in the Marcellus Shale area of the US Appalachia region will be huge. The massive reserves of natural gas in North American shale are inspiring companies to increase their ethylene cracking capabilities. Global energy and chemical giant Royal Dutch Shell is set to announce the location of its new cracker before the spring, and in mid-January, capital investment company Renewable Manufacturing Gateway and Aither Chemicals - both based in the US - signed a deal to build a $750m (572m) petrochemical plant in the US that will use natural gas extracted from the Marcellus Shale deposit as feedstock. The three states Shell is eyeing for the cracker location are Pennsylvania, West Virginia and Ohio. Shell owns or leases the natural gas rights for about 700,000 gross acres in the Marcellus, mostly in Pennsylvania. As the US Gulf Coast is already well supplied with ample ethane from Texas and the midcontinent, "Marcellus ethane is the most competitive feedstock for petrochemicals in the US, so it makes sense to use it there, rather than add to its cost by transporting it across one-third of the country, then sending derivative products back up to the northeast," explained Iain Lo, vicepresident of new business development and ventures for Shell Chemicals, during an ICIS interview in the summer of 2011. World-scale crackers tend to take four to five years to build, cost roughly $1bn to construct, and when completed can generally produce about 2bn lbs (907,441 tonnes) of ethylene/year. "The Marcellus will be the largest source of gas supply, with many pipeline projects lined up through 2012," says Iain Reid, analyst at US-based equity research group Jefferies. "The play is still in its infancy." There are more than a dozen other major chemical companies interested in the area (see below) and by 2020, North America will have four or five new ethylene crackers or cracker-equivalents, said James Virosco, principal of US-based consultancy Nexant, in early January at a presentation of the Chemical Marketing & Economics Group in New York. Since the cost of a new greenfield cracker is so high, the extra capacity will be brought on "through restarts or debottlenecking," Virosco adds. According to a Wall Street Journal article on December 27, 2011, "the US chemical industry is the biggest potential winner from the shale boom." Historically, an oil to natural gas price ratio of 6:1 or higher increases the global competitiveness of Gulf Coast-based petrochemicals and derivatives such as plastic resins. "For the last several years this ratio has been above 7:1, but more recently the high ratio of oil to natural gas prices has been over 25:1, helping to spur capital investment in North America," says Cal Dooley, president and CEO of the American Chemistry Council. "Cheap natural gas has transformed the US chemicals landscape," notes Reid. Only a decade ago, the US was viewed as a high-cost, if not the highest cost, region for petrochemical production. In the past few years, however, the US has re-emerged as one of the lowest-cost geographies, "particularly for petrochemical producers with access to ethane," says Reid. This has enabled the US to go from being "a net importer of high density polyethylene (HDPE) and linear low density polyethylene (LLDPE) five years ago, to a major net exporter today," says Virosco. "An underappreciated point of the shale gas story is the substantial cost benefit to manufacturers, based on estimates of future natural gas prices as more shale gas is recovered," says Robert McCutcheon, a partner at global consultancy PwC. "Lower feedstock and energy costs could help US manufacturers reduce natural gas expenses by as much as $11.6bn/year through 2025," he notes. In December 2011, PwC released a major research paper on shale gas, and its potential to "spark a renaissance" in US manufacturing. INFRASTRUCTURE BUILDING It is not that the US is the only place in the world with shale gas. "What is unique is how quickly the US has been able to take advantage of it," says Reid. Most of this is down to the extensive natural gas pipeline infrastructure already in place in North America. "Similar infrastructure in Europe and China would likely take decades to build," points out Reid. The amount of natural gas being pulled, though, has overwhelmed the system. "Traditional sources of supply like Gulf of Mexico pipeline gas, Rocky Mountain gas and even liquefied natural gas (LNG) is being displaced by regional production, and the requisite new transmission and distribution capacity is coming online to serve local production," says Nelly Mikhaiel, natural gas/LNG consultant with Nexant.

Copyright: Daniel Foster

http://www.icis.com/Articles/Article.aspx?liArticleID=9531152&PrinterFriendly=true[2012/2/14 04:21:13]

Chemical industry investment in the Marcellus Shale region will continue

For example, US-based pipeline operator Kinder Morgan placed its 350m cubic feet/day Tennessee 300 pipeline into service in November 2011, increasing capacity on the Tennessee Gas Pipeline. The expansion included the installation of about 127 miles of pipeline, including through Pennsylvania and New Jersey. About two dozen infrastructure expansion projects are under way, chasing start-up between now and 2015, estimates Mikhaiel: Transco's Atlantic Access project, the NJ-NY Expansion, and Dominion's Marcellus Northeast project are only a few. "The biggest problem is actually delivering the gas to the doorstep of premium, large markets, such as New York City, which from a regulatory standpoint, is understandably difficult and may take some time," notes Mikhaiel.

INCENTIVES TO GROW While President Obama's promotion of shale gas development during his State of the Union Address in late January is a good sign, much of the energy and petrochemical community is fuming at the president's steadfast position to end oil and gas industry tax breaks - something the American Petroleum Insititute warns will "slow down the production of energy." However, Mikhaiel says: "Marcellus host states are cognizant of the fact that Marcellus is bringing in a lot of money, but there's obviously some concern that an onerous fiscal regime could frighten investors." Surveying the states' attitude towards taxes yields a mixed bag, however. "Marcellus shale gas in Pennsylvania is not subject to a severance tax, which is an incentive in and of itself," adds Mikhaiel. Severance taxes are usually levied to cover costs created by drilling activity, including infrastructure wear and tear, and the prevention and repair of environmental damage. There have been calls to impose such a tax, but Pennsylvania legislators cannot agree on the tax's scope. As of September 2011, there were about 100 Marcellus Shale-related bills before the Pennsylvania General Assembly. "Of these, 15 bills would impose a severance tax or local impact fee," says Mikhaiel. "However, Governor Tom Corbett is adamantly opposed to a severance tax on shale gas and will not sign a bill calling for such a provision," adds Mikhaiel. West Virginia has a severance tax, and it is levied on value, at 5%. But in mid-January, the West Virginia House of Delegates went ahead with tax-incentive legislation for the construction of an ethane cracker in West Virginia. The bill would give a 25-year tax break if passed by the Senate. "The hope is this legislation will put West Virginia in a better position to be chosen for a cracker facility location," said Speaker Rick Thompson, introducing the bill at the request of Governor Earl Ray Tomblin. "A $2bn investment like this doesn't come along every day. We wanted to get the bill moving quickly so the governor has the tools he needs to try to make that happen," Thompson added. Ohio's severance tax on natural gas is levied on volume: $0.025/thousand cubic feet, but the governor is said to have taken the matter under consideration, and Ohio might increase its severance tax.

http://www.icis.com/Articles/Article.aspx?liArticleID=9531152&PrinterFriendly=true[2012/2/14 04:21:13]

Chemical industry investment in the Marcellus Shale region will continue

"Clearly, greater investments in US manufacturing plants and higher levels of employment can be a boon to the US manufacturing sector. To achieve these positive results, however, manufacturers will likely need to become active stakeholders in the shale gas industry," notes McCutcheon. "While domestic energy companies will face many of these issues more directly, manufacturers will benefit only if shale gas is extracted profitably and safely," he adds.

TRIGGERING A BUILDING BOOM

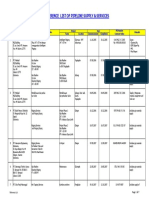

Several major chemical companies have announced new investments in the Marcellus region.

Shell Chemicals plans to build an ethylene cracker in Ohio, West Virginia or Pennsylvania. Dow Chemical plans to build three petrochemical facilities and restart another idled during the recession. Eastman Chemical restarted a small ethylene cracker in July 2011 that had been shuttered in recent years. Bayer is in talks over building ethane crackers at its industrial parks in West Virginia. Westlake Chemical tentatively plans to use shale-based feedstocks for expansion in Kentucky in 2014. Canada's NOVA Chemicals has signed agreements with Norway's Statoil and US-based Caiman Energy for ethane sourced from the region. US Steel has invested $95m in an Ohio facility to meet construction demands, including drilling rigs, in the region. Other companies, including Occidental Chemical, Chevron Phillips Chemical, and LyondellBasell, are considering expanding operations in the US because of the abundance of shale gas in the nation.

Additional reporting by Joe Kamalick in Washington, D.C. Keep up to date with the latest news and developments in the shale gas industry ICIS Copyright Reed Business Information 2012

Author: Ivan Lerner +1 713 525 2653

For the latest chemical news, data and analysis that directly impacts your business sign up for a free trial to ICIS news - the breaking online news service for the global chemical industry. Get the facts and analysis behind the headlines from our market leading weekly magazine: sign up to a free trial to ICIS Chemical Business.

Links posted in this story: Chevron Phillips Chemical, Dow Chemical Company, Eastman Chemical Company, Ethylene, Polyethylene high density, Polyethylene low density, Nova Chemicals Corporation, Occidental Petroleum Corporation, Royal Dutch Shell Plc 2012 Reed Business Information Limited. All Rights Reserved.

http://www.icis.com/Articles/Article.aspx?liArticleID=9531152&PrinterFriendly=true[2012/2/14 04:21:13]

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sweet Crude MayDocument72 pagesSweet Crude MayGreatNo ratings yet

- CBM Vs ShaleDocument2 pagesCBM Vs ShaleKarlina DewiNo ratings yet

- 7-Gullfaks IOR ScreeningDocument31 pages7-Gullfaks IOR ScreeningMuhammad Umair Zahid Abbasi100% (1)

- Crude Oil Assay Database - Crude Oil Data Source References - KnovelDocument3 pagesCrude Oil Assay Database - Crude Oil Data Source References - KnovelValeanu Ermil100% (1)

- 01 - 01 - SK10 - JXNipponDocument1 page01 - 01 - SK10 - JXNipponredevils86No ratings yet

- JPMorgan Global LNG Feb 2012Document248 pagesJPMorgan Global LNG Feb 2012rasjlpNo ratings yet

- Gie SSLNG 2020 A0 Full 1009 PDFDocument1 pageGie SSLNG 2020 A0 Full 1009 PDFSara VaccaNo ratings yet

- Petroskills Course Schedule 2017Document9 pagesPetroskills Course Schedule 2017Connor SailorNo ratings yet

- Refinery ProcessDocument30 pagesRefinery Processasif rahimNo ratings yet

- Australian Coal Bed Methane:: Principles and Development ChallengesDocument30 pagesAustralian Coal Bed Methane:: Principles and Development Challengesupesddn2010No ratings yet

- List of MLPsDocument6 pagesList of MLPscordolisNo ratings yet

- Company Directory - Nigeria - Oil & EnergyDocument5 pagesCompany Directory - Nigeria - Oil & EnergyOlubunmi Omoniyi100% (1)

- The Oil Industry of PakistanDocument21 pagesThe Oil Industry of Pakistanmhuf89No ratings yet

- Attachment 05 - BFD, ELD and P&I Diagrams-PearlDocument77 pagesAttachment 05 - BFD, ELD and P&I Diagrams-Pearlum er100% (1)

- Books Final32Document5 pagesBooks Final32shuvo134No ratings yet

- Laporan mingguan-LUTHFIDocument6 pagesLaporan mingguan-LUTHFIluthfiNo ratings yet

- An Overview of The World LNG Market and Canada's Potential For Exports of LNGDocument44 pagesAn Overview of The World LNG Market and Canada's Potential For Exports of LNGJoel Lim Min SheuNo ratings yet

- Farrel Pipeline Services-1Document7 pagesFarrel Pipeline Services-1robyharyudha100% (1)

- Price List Bit FTP - 16.04.2018Document1 pagePrice List Bit FTP - 16.04.2018karunamoorthi_p2209No ratings yet

- Deepwater Drilling and Well Control Course OutlineDocument2 pagesDeepwater Drilling and Well Control Course Outlinemahdi_esmNo ratings yet

- Grassroot Refinery Economics PDFDocument45 pagesGrassroot Refinery Economics PDFKokil JainNo ratings yet

- Hydrocarbon Processing: Deep Water FLNGDocument1 pageHydrocarbon Processing: Deep Water FLNGnirmal_subudhiNo ratings yet

- HP Top Project AwardsDocument9 pagesHP Top Project AwardsSterlingNo ratings yet

- Daily Drilling Report: Bha Tally Bit Record Mud Report Mud Pump Drilling InformationDocument25 pagesDaily Drilling Report: Bha Tally Bit Record Mud Report Mud Pump Drilling InformationHamed NazariNo ratings yet

- Presentation 1Document9 pagesPresentation 1Manish KumarNo ratings yet

- Cygnus Energy LNG News Weekly 21st January 2023 - CompressedDocument15 pagesCygnus Energy LNG News Weekly 21st January 2023 - CompressedAvadhut PalkarNo ratings yet

- EP India 09-10 PDFDocument132 pagesEP India 09-10 PDFdbircs1981No ratings yet

- AG & GULF PLATTS 18 April 2024 FULLDocument30 pagesAG & GULF PLATTS 18 April 2024 FULLliuheng1012No ratings yet

- The European Natural Gas Network: North SeaDocument1 pageThe European Natural Gas Network: North SeaFloriNaNo ratings yet

- STR 052 04 JR2 GA20 ModelDocument1 pageSTR 052 04 JR2 GA20 ModelSigit PurnomoNo ratings yet