Professional Documents

Culture Documents

Flexible Budgets and Performance Analysis: Key Terms and Concepts To Know

Uploaded by

Rachel YangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Flexible Budgets and Performance Analysis: Key Terms and Concepts To Know

Uploaded by

Rachel YangCopyright:

Available Formats

Revised Summer 2010

CHAPTER 8 FLEXIBLE BUDGETS AND PERFORMANCE ANALYSIS

Key Terms and Concepts to Know

Static or Planning Budgets Used for planning purposes Prepared at the beginning of the period Based on one projected level of activity Flexible Budgets Used for control purposes Prepared at the end of the period Flexed to accommodate actual level of production Uses cost (variable and fixed) and revenue formulas from static budget Activity Variance Difference between a revenue or cost item in the static budget and the same item in the flexible budget. Results from the difference between the level of activity assumed in the planning budget and the actual level of activity used in the flexible budget. Revenue Variance Difference between how much the revenue should have been at the actual level of activity and the actual revenue for the period. Favorable revenue variance occurs when the revenue is greater than expected at the actual level of activity for the period. Unfavorable revenue variance occurs when the revenue is less than expected at the actual level of activity for the period. Spending Variance Difference between how much an expense should have been at the actual level of activity and the actual amount of expense incurred. Favorable spending variance occurs when the cost is less than expected at the actual level of activity for the period. Unfavorable spending variance occurs when the cost is greater than expected at the actual level of activity for the period.

Page 1 of 15

Revised Summer 2010

Key Topics to Know

Actual Performance vs. Planning Budget

The planning or static budget is a best guess as to what the actual performance will be during the budget period. Needless to say, rarely does actual performance match the planning budget. The differences between the planning budget and actual performance are due to two basic causes: differences in activity level and differences in spending. To bridge the gap between planning budget and actual performance and to isolate each difference, a flexible budget is constructed based on the actual level of activity and the revenue and cost formulas from the planning budget. The revenue and cost formulas are developed as follows; o If the static budget expected to sell 100 units at a price of $30 per unit, then $30 would be the per-unit revenue formula for any number of units sold. o If the static budget expected total variable costs to be 100 units sold at a cost of $18 per unit, then $18 would be the per-unit variable cost formula for any number of units sold. o If the static budget expected total fixed costs to be $700, then $700 will be the budgeted fixed costs at any level of activity within the relevant range of activity. The differences between the static and flexible budgets are due to the difference between planned (static) activity and actual (flexible) activity. These differences are labeled activity variances. The differences between the flexible budget and the actual performance are due to differences in selling price per unit for revenue and spending per unit for expenses. These differences are labeled revenue and spending variances. Note that for overhead costs and selling and administrative expenses, spending variances result from both the cost per item and the number of items used.

Page 2 of 15

Revised Summer 2010

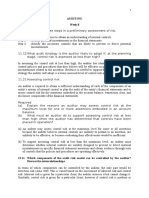

Example #1: The May 2009 income statement for Trajan Inc. is shown below: Units sold Sales Variable expenses Contribution margin Fixed expenses Operating income Required: a) Determine what the operating income should have been for the actual units sold. b) Reconcile the difference between static budget and actual operating income. Solution #1: Revenue and Cost Formula Units sold Sales Variable expenses Contribution margin Fixed expenses Operating income $30 $18 $700 in total Actual 110 $3,200 $1,920 $1,280 $680 $600 Flexible Budget 110 $3,300 1,980 1,320 700 $620 Static Budget 100 $3,000 $1,800 $1,200 $700 $500 Actual 110 $3,200 $1,920 $1,280 $680 $600 Static Budget 100 $3,000 $1,800 $1,200 $700 $500

Step 1: Revenue and cost formula = static budget / units sold for revenue and variable expenses and total static budget fixed costs Step 2: Create flexible budget based on actual units sold and the revenue and cost formula. Trajan should have had an operating income of $620. The static budget and actual operating income may be reconciled as follows: Static budget income + Increase due to 10 additional units sold = Flexible budget income - Decrease due to reductions in actual selling price per unit = Actual income

Page 3 of 15

$500 $120 $620 $20 $600

Revised Summer 2010

Example #2: Jansen Corporations data concerning the companys monthly revenues and costs appear below. Variable Cost Formula $15.00/unit $7.25/unit $0.45/unit $0.90/unit Fixed Cost Formula $20,000 $1,200 $10,000 $2,000

Revenue Costs of material Wages and salaries Utilities Rent Miscellaneous Required:

a) Prepare the companys planning budget assuming that 10,000 units were manufactured. b) Assume that 9,900 units were actually manufactured. Prepare the flexible budget for this level of activity. c) Prepare a flexible budget performance report for the company using the actual income statement information shown below. Revenue Costs of materials Salaries Utilities Rent Miscellaneous $149,200 73,200 19,500 5,800 10,000 12,000

Page 4 of 15

Revised Summer 2010

Solution #2: a) Planning Budget and b) Flexible Budget Revenue and Cost Formula Budgeted number of units sold Revenue Expenses: Cost of materials Salaries Utilities Rent Miscellaneous Total expenses Net Operating Income $15.00/unit $7.25/unit $20,000 $.45/unit+$1,200 $10,000 $.90/unit+$2,000 Planning Budget Income Statement 10,000 $150,000 72,500 20,000 5,700 10,000 11,000 $119,200 $30,800 Flexible Budget Income Statement 9,900 $148,500 71,775 20,000 5,655 10,000 10,910 $118,340 $30,160

b) Flexible budget Performance Report (1) Planning Budget Number of Units Revenues Expenses: Cost of materials Salaries Utilities Rent Miscellaneous Total Expense Net Operating Income 10,000 $15.00/unit $150,000 $7.25/unit $20,000 $.45/unit+ $1,200 $10,000 $.90/unit+ $2,000 72,500 20,000 5,700 10,000 11,000 119,200 $30,800 Activity Variance (2) - (1) (2) Flexible Budget Revenue and Spending Variances (3) - (2) (3) Actual Results

9,900 $1,500 U $148,500 725 F 0 45 F 0 90 F $860 F $640 U 71,775 20,000 5,655 10,000 10,910 118,340 $30,160

9,900 $700 F $149,200 1,425 U 500 F 145 U 0 1,090 U 2,160 1,460 U 73,200 19,500 5,800 10,000 12,000 120,500 $28,700

Page 5 of 15

Revised Summer 2010

Practice Problems

Practice Problem #1: A partially completed flexible overhead budget for Sunflowers Inc. is shown below: Cost Formula Variable overhead: Supplies Utilities Repairs Total variable overhead Fixed overhead: Depreciation Salaries Rent Total fixed overhead Total overhead Required: Fill in the missing data. Practice Problem #2: Johnson, Inc.s has provided the following information regarding Junes results. Revenue and Cost Formula $13.00/unit $3.25/unit $8,000 $600 + $0.50/unit $5,000 $800 + $0.80/unit Actual Results $28,000 7,000 7,600 1,550 5,000 2,500 Activity Level in Units 8,000 12,000 16,000 $108,000 60,000 24,000 $192,000 $15,000 96,000 44,000 $155,000 $347,000

Revenue Conversion costs Salaries Utilities Rent Miscellaneous Required:

a) Prepare the companys planning budget assuming that 2,000 units were manufactured. b) Assume that 2,100 units were actually manufactured. Prepare the flexible budget for this level of activity. c) Prepare a flexible budget performance report for the company.

Page 6 of 15

Revised Summer 2010

Sample True / False Questions

1. A static budget is a series of static budgets at different levels of activities. True False 2. Flexible budgeting relies on the assumption that unit variable costs will remain constant within the relevant range of activity. True False 3. Flexible budgets are widely used in production and service departments. True False 4. A flexible budget report will show both actual and budget cost based on the budgeted activity level achieved. True False 5. A static budget is an effective means to evaluate a manager's ability to control costs, regardless of the actual activity level. True False 6. A flexible budget is a budget that is designed to cover a range of activity. True False 7. Static budget is prepared at the end of the period. True False 8. Flexible budget is prepared at the end of the period. True False 9. A flexible budget performance report compares actual costs to what the costs should have been, given the planned level of activity for the period. True False 10. Flexible budget is used for control purposes. True False

Page 7 of 15

Revised Summer 2010

Sample Multiple Choice Questions

1. A static budget a) Should not be prepared in a company. b) Is useful in evaluating a manager's performance by comparing actual variable costs and planned variable costs. c) Shows planned results at the original budgeted activity level. d) Is changed only if the actual level of activity is different than originally budgeted. 2. What is the primary difference between a static budget and a flexible budget? a) The static budget contains only fixed costs, while the flexible budget contains only variable costs. b) The static budget is adjusted for different activity levels, while a flexible budget is prepared for a single level of activity. c) The static budget is prepared for a single level of activity, while a flexible budget is adjusted for different activity levels. d) The static budget is prepared for a single level of activity, while a flexible budget is adjusted for different activity levels. 3. The master budget of Company A shows that the planned activity level for next year is expected to be 50,000 machine hours. At this level of activity, the following manufacturing overhead costs are expected: Indirect labor Machine supplies Indirect materials Depreciation on factory building Total manufacturing overhead $300,000 80,000 70,000 50,000 $500,000

A flexible budget for a level of activity of 60,000 machine hours would show total manufacturing overhead costs of a) $420,000 b) $504,000 c) $540,000 d) $600,000

Page 8 of 15

Revised Summer 2010

4. Rickets Ltd. prepared a 2010 budget for 90,000 units of product. Actual production in 2010 was 100,000 units. The actual production in 2009 was 97,000 units. To be most useful, what amounts should a performance report for this company compare? a) The actual results for 100,000 units with the original budget for 90,000 units b) The actual results for 100,000 units with a new budget for 90,000 units. c) The actual results for 100,000 units with last year's actual results for 97,000 units d) It doesn't matter. All of these choices are equally useful. 5. Star Lite Manufacturing Company prepared a static budget of 50,000 direct labor hours, with estimated overhead costs of $250,000 for variable overhead and $60,000 for fixed overhead. Trepid then prepared a flexible budget at 38,000 labor hours. How much is total overhead costs at this level of activity? a) $190,000 b) $247,000 c) $250,000 d) $260,000 6. Universal Industries budgeted manufacturing costs for 25,000 units are: Fixed manufacturing costs $25,000 per month Variable manufacturing costs $300,000 The company produced 21,000 units during March. How much is the flexible budget for total manufacturing costs for March? a) $260,000 b) $252,000 c) $277,000 d) $325,000 7. True Masons budgeted costs for 30,000 linear feet of block are: Fixed manufacturing costs $12,000 per month Variable manufacturing costs $16.00 per linear True Masons installed 25,000 linear feet of block during March. What are the budgeted total manufacturing costs in March? a) $320,000 b) $360,000 c) $400,000 d) $412,000

Page 9 of 15

Revised Summer 2010

8. Wayman Company uses flexible budgets. At normal capacity of 10,000 units, budgeted manufacturing overhead is: $50,000 variable and $135,000 fixed. If Wayman had actual overhead costs of $187,500 for 11,000 units produced, what is the difference between actual and budgeted costs? a) $2,500 unfavorable b) $2,500 favorable c) $4,500 unfavorable d) $6,000 favorable 9. Ajax Company's planned activity level for next year is expected to be 100,000 machine hours. At this level of activity, the company budgeted the following manufacturing overhead costs: Variable Costs Indirect materials $200,000 Indirect labor 100,000 Supplies 60,000 Fixed Costs Depreciation $40,000 Taxes 15,000 Supervision 65,000

A flexible budget prepared at the 80,000 machine hours level of activity would show total manufacturing overhead costs of a) $288,000 b) $360,000 c) $384,000 d) $408,000 10. A companys static budget estimate of total overhead costs was $100,000 based on the assumption that 10,000 units would be produced and sold. The company estimates that 30% of its overhead is variable and the remainder is fixed. What would be the total overhead costs according to the flexible budget if 12,000 units were produced and sold? a) $96,000 b) $100,000 c) $106,000 d) $116,000 11. Which of the following statements is false? a) A flexible budget is used for control purpose and a static budget is used for planning purposes. b) A flexible budget is prepared at the end of the period and a static budget is prepared at the beginning of the period. c) A flexible budget is not useful for controlling variable costs. d) A static budget provides budgeted estimates for one level of activity.

Page 10 of 15

Revised Summer 2010

12. A flexible budget a) Is prepared when management cannot agree on objectives for the company. b) Projects budget data for various levels of activity. c) Is only useful in controlling fixed costs. d) Cannot be used for evaluation purposes because budgeted data are adjusted to reflect actual results. 13. What budgeted amounts appear on the flexible budget? a) Original budgeted amounts at the static budget activity level b) Actual costs for the budgeted activity level c) Budgeted amounts for the actual activity level achieved d) Actual costs for the estimated activity level 14. In the Glexo Company, indirect labor is budgeted for $36,000 and factory supervision is budgeted for $12,000 at normal capacity of 80,000 direct labor hours. If 90,000 direct labor hours are worked, flexible budget total for these costs is a) $48,000 b) $54,000 c) $52,500 d) $49,500 15. The comparison of differences between actual and planned results a) Is done by the external auditors. b) Appears on the company's external financial statements. c) Is usually done orally in departmental meetings. d) Appears on periodic budget reports.

Page 11 of 15

Revised Summer 2010

Solutions to Practice Problems

Practice Problem #1: Cost Formula Variable overhead: Supplies $9.00 Utilities $5.00 Repairs $2.00 Total variable overhead Fixed overhead: Depreciation Salaries Rent Total fixed overhead Total overhead Activity Level in Units 8,000 12,000 16,000 $72,000 40,000 16,000 $128,000 $15,000 96,000 44,000 $155,000 $283,000 $108,000 60,000 24,000 $192,000 $15,000 96,000 44,000 $155,000 $347,000 $144,000 80,000 32,000 $256,000 $15,000 96,000 44,000 $155,000 $411,000

Variable overhead cost formula = variable overhead cost / activity level Fixed overhead costs do not change as the level of activity changes.

Page 12 of 15

Revised Summer 2010

Practice Problem #2: a) Planning Budget and b) Flexible Budget Revenue and Cost Formula $13.00/unit $3.25/unit $8,000 $.50/unit+$600 $5,000 $.80/unit+$800

Budgeted number of units sold Revenue Expenses: Conversion costs Salaries Utilities Rent Miscellaneous Total expenses Net Operating Income

Planning Budget Income Statement 2,000 $26,000 6,500 8,000 1,600 5,000 2,400 $23,500 $2,500

Flexible Budget Income Statement 2,100 $27,300 6,825 8,000 1,650 5,000 2,480 $23,955 $3,345

c) Flexible budget Performance Report (1) Planning Budget Number of Units Revenues Expenses: Cost of materials Salaries Utilities Rent Miscellaneous Total Expense Net Operating Income $13.00/unit $3.25/unit $8,000 $.50/unit+ $600 $5,000 $.80/unit+ $800 2,000 $26,000 6,500 8,000 1,600 5,000 2,400 $23,500 $2,500 Activity Variance (2) - (1) $1,300 F 325 U 0 50 U 0 80 U $455 U $845 F (2) Flexible Budget 2,100 $27,300 6,825 8,000 1,650 5,000 2,480 $23,955 $3,345

Revenue and Spending Variances (3) - (2) $700 F 175 U 400 F 150 F 0 20 U $305 F $1,005 F

(3) Actual Results 2,100 $28,000 7,000 7,600 1,550 5,000 2,500 23,650 $4,350

Page 13 of 15

Revised Summer 2010

Solutions to True / False Problems

1. 2. 3. 4. 5. False because a static budget is based on one level of activity. True True False because a flexible budget report will show both actual and budget cost based on the actual activity level achieved. False because a static budget is suitable for planning but is inappropriate for evaluating how well costs are controlled. If the actual level of activity differs from what was planned, it would be misleading to compare actual costs to the static budget. True False because the static budget is prepared at the beginning of the period. True False because a flexible budget performance report compares actual costs to what the costs should have been, given the actual level of activity for the period. True

6. 7. 8. 9.

10.

Page 14 of 15

Revised Summer 2010

Solutions to Multiple Choice Questions

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. C D C B C C D B D C C B C C D

Page 15 of 15

You might also like

- Superdry Assignment 2-FINALDocument31 pagesSuperdry Assignment 2-FINALHuong Khanh LeNo ratings yet

- Quick QuizDocument6 pagesQuick QuizLeng ChhunNo ratings yet

- Consolidated BS - Date of AcquisitionDocument2 pagesConsolidated BS - Date of AcquisitionKharen Valdez0% (1)

- Chapter 6 HomeworkDocument10 pagesChapter 6 HomeworkAshy Lee0% (1)

- Hca14 PPT CH07Document39 pagesHca14 PPT CH07Kamlesh ShuklaNo ratings yet

- AGS CUP 6 Auditing Elimination RoundDocument17 pagesAGS CUP 6 Auditing Elimination RoundKenneth RobledoNo ratings yet

- Advanced AuditingDocument358 pagesAdvanced AuditingAnuj MauryaNo ratings yet

- FULL DISCLOSURE Test BankDocument11 pagesFULL DISCLOSURE Test Bankzee abadillaNo ratings yet

- Auditing TheoryDocument11 pagesAuditing Theoryfnyeko100% (1)

- Handout 7 - Process CostingDocument32 pagesHandout 7 - Process CostingDonovan Leong 도노반No ratings yet

- Quiz On Auditing For 1 To 2Document10 pagesQuiz On Auditing For 1 To 2Vanjo MuñozNo ratings yet

- ABC and Standard CostingDocument16 pagesABC and Standard CostingCarlo QuinlogNo ratings yet

- MidtermExam Fin3 (Prac)Document10 pagesMidtermExam Fin3 (Prac)Raymond PacaldoNo ratings yet

- Chapter On CVP 2015 - Acc 2Document16 pagesChapter On CVP 2015 - Acc 2nur aqilah ridzuanNo ratings yet

- Module 1 PDFDocument11 pagesModule 1 PDFAangela Del Rosario CorpuzNo ratings yet

- Far 102 - Cash and Cash EquivalentsDocument4 pagesFar 102 - Cash and Cash EquivalentsKeanna Denise GonzalesNo ratings yet

- Chapter 4 ModifiedDocument30 pagesChapter 4 ModifiedSonu Avinash SinghNo ratings yet

- Auditing and Assurance: Specialized Industries - Midterm ExaminationDocument14 pagesAuditing and Assurance: Specialized Industries - Midterm ExaminationHannah SyNo ratings yet

- Audit EvidenceDocument23 pagesAudit EvidenceAmna MirzaNo ratings yet

- Auditing 1 Final ExamDocument8 pagesAuditing 1 Final ExamEdemson NavalesNo ratings yet

- Business Combination-Acquisition of Net AssetsDocument2 pagesBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanNo ratings yet

- A Mining Company Is Considering To Open A New Coal MineDocument4 pagesA Mining Company Is Considering To Open A New Coal MineD Y Patil Institute of MCA and MBANo ratings yet

- 401 Practice FinalDocument93 pages401 Practice FinalAsmir Ermina BegicNo ratings yet

- Purchases FinalDocument10 pagesPurchases FinalMary Joe VesagasNo ratings yet

- The Following Information Will Be Used For Question Nos. 8 and 9Document5 pagesThe Following Information Will Be Used For Question Nos. 8 and 9jenieNo ratings yet

- Cost2 1 PDF FreeDocument9 pagesCost2 1 PDF FreeIT GAMING100% (1)

- ROMERO BSMA1E Standard Costing ExerciseDocument4 pagesROMERO BSMA1E Standard Costing ExerciseAliah Romero100% (1)

- Exercises For Accounting For Merchandise StoresDocument4 pagesExercises For Accounting For Merchandise StoresAnne Dorene ChuaNo ratings yet

- Midterm Examination II TheoryDocument43 pagesMidterm Examination II TheorySaeym SegoviaNo ratings yet

- What Is The Correct Amount of Inventory?: SolutionDocument3 pagesWhat Is The Correct Amount of Inventory?: SolutionSofia LaoNo ratings yet

- Quiz BeeDocument15 pagesQuiz Beejoshua100% (1)

- Accounting For LaborDocument43 pagesAccounting For LaborAmy Spencer100% (1)

- AC11 - CHAPTER 3 Subsequent To Date of AcquisitionDocument76 pagesAC11 - CHAPTER 3 Subsequent To Date of Acquisitionanon_467190796100% (1)

- Analysis of Investments in Associates of An SME1Document3 pagesAnalysis of Investments in Associates of An SME1Jan ryanNo ratings yet

- Cuartero - Unit 3 - Accounting Changes and Error CorrectionDocument10 pagesCuartero - Unit 3 - Accounting Changes and Error CorrectionAim RubiaNo ratings yet

- Exercise Workbook For Student 8: SAP B1 On Cloud - AISDocument38 pagesExercise Workbook For Student 8: SAP B1 On Cloud - AISMarcos Jose AveNo ratings yet

- ADVACCDocument3 pagesADVACCCianne AlcantaraNo ratings yet

- SYNTHESISDocument8 pagesSYNTHESISMark Stanley PangoniloNo ratings yet

- Accounting Changes-QUESTIONNAIRESDocument7 pagesAccounting Changes-QUESTIONNAIRESJennifer ArcadioNo ratings yet

- Cash ReviewerDocument35 pagesCash ReviewerAprile AnonuevoNo ratings yet

- 1.1 Assignment1 Internal Audit and The Audit Committee and Types of AuditDocument4 pages1.1 Assignment1 Internal Audit and The Audit Committee and Types of AuditXexiannaNo ratings yet

- L6 AbcDocument24 pagesL6 AbcDouglas Leong Jian-HaoNo ratings yet

- Audit of CashDocument1 pageAudit of CashXandae MempinNo ratings yet

- Chapter Review Guide QuestionsDocument1 pageChapter Review Guide QuestionsRick RanteNo ratings yet

- PPE HandoutsDocument12 pagesPPE HandoutsChristine Joy PamaNo ratings yet

- Hansen Aise Im Ch16Document55 pagesHansen Aise Im Ch16Daniel NababanNo ratings yet

- MB2 2013 Ap Set ADocument6 pagesMB2 2013 Ap Set AMary Queen Ramos-UmoquitNo ratings yet

- Jamolod - Unit 1 - General Features of Financial StatementDocument8 pagesJamolod - Unit 1 - General Features of Financial StatementJatha JamolodNo ratings yet

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoieNo ratings yet

- Nfjpia Nmbe Far 2017 AnsDocument9 pagesNfjpia Nmbe Far 2017 AnsSamieeNo ratings yet

- Accounting ReviewerDocument22 pagesAccounting ReviewerAira TantoyNo ratings yet

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- Objectives, Roles, and Scope of Management AccountingDocument4 pagesObjectives, Roles, and Scope of Management AccountingElla TuratoNo ratings yet

- Ch07 Audit Planning Assessment of Control Risk1Document26 pagesCh07 Audit Planning Assessment of Control Risk1Mary GarciaNo ratings yet

- Business Analysis?: Research DisciplineDocument19 pagesBusiness Analysis?: Research Disciplinemyril shyane loocNo ratings yet

- Applied Auditing Review Course Pre-Board - FinalDocument13 pagesApplied Auditing Review Course Pre-Board - FinalROMAR A. PIGANo ratings yet

- Management Advisory ServicesDocument11 pagesManagement Advisory ServicesAnonymous 7m9SLrNo ratings yet

- Psa 530: Audit Sampling and Other Selective TestingDocument49 pagesPsa 530: Audit Sampling and Other Selective TestingJeric IsraelNo ratings yet

- Mas 2605Document6 pagesMas 2605John Philip CastroNo ratings yet

- CosmanDocument2 pagesCosmanRose Ann Juleth LicayanNo ratings yet

- Week 8Document3 pagesWeek 8Anonymous J0pEMcy5vY100% (1)

- Budgetary Control and Responsibility AccountingDocument56 pagesBudgetary Control and Responsibility AccountingNickNo ratings yet

- Iv Report%2Document64 pagesIv Report%2yashNo ratings yet

- Chapter 5 Derivatives Markets - 2023Document35 pagesChapter 5 Derivatives Markets - 202305 Phạm Hồng Diệp12.11No ratings yet

- Management Consulting Firms - Finding The Right Growth StrategyDocument140 pagesManagement Consulting Firms - Finding The Right Growth Strategyer_manikaur2221No ratings yet

- Services Marketing - Question Paper Set-2 (Semester III) PDFDocument3 pagesServices Marketing - Question Paper Set-2 (Semester III) PDFVikas SinghNo ratings yet

- BSTX Reviewer (Midterm)Document7 pagesBSTX Reviewer (Midterm)alaine daphneNo ratings yet

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document3 pagesHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971MadhuNo ratings yet

- List of Accounting Standards (AS 1 - 32) of ICAIDocument6 pagesList of Accounting Standards (AS 1 - 32) of ICAIMr. Rain Man100% (1)

- A Study On Financial Statement Analysis of HDFC BankDocument11 pagesA Study On Financial Statement Analysis of HDFC BankOne's JourneyNo ratings yet

- 54R-07 - AACE InternationalDocument17 pages54R-07 - AACE InternationalFirasAlnaimiNo ratings yet

- Take Home Midterms Mix 30Document6 pagesTake Home Midterms Mix 30rizzelNo ratings yet

- FAM 1,2 UnitsDocument23 pagesFAM 1,2 Units2111CS010082 - KASINENI BHANU GAYATHRINo ratings yet

- The Book of Jargon - Project FinanceDocument108 pagesThe Book of Jargon - Project FinanceLukas PodolskengNo ratings yet

- SBL Revision Notes PDFDocument175 pagesSBL Revision Notes PDFAliRazaSattar100% (3)

- Assessment Test Week 6 (ECO 2) - Google FormsDocument3 pagesAssessment Test Week 6 (ECO 2) - Google FormsNeil Jasper CorozaNo ratings yet

- UNIT-1 Time Value of MoneyDocument16 pagesUNIT-1 Time Value of MoneyRitesh KumarNo ratings yet

- MA1-Pre Exam (R)Document2 pagesMA1-Pre Exam (R)BRos THivNo ratings yet

- Max Final ProjectDocument76 pagesMax Final ProjectAvinash JosephNo ratings yet

- GCG MC 2017-03, Implementing Rules and Guidelines of EO No 36, S 2017Document13 pagesGCG MC 2017-03, Implementing Rules and Guidelines of EO No 36, S 2017bongricoNo ratings yet

- How To Start Investing in Philippine Stock MarketDocument53 pagesHow To Start Investing in Philippine Stock MarketAlbert Aromin100% (1)

- Study Questions of Marketing ManagementDocument6 pagesStudy Questions of Marketing ManagementAbir HasanNo ratings yet

- BA 230.final Paper - CMBDocument8 pagesBA 230.final Paper - CMBChristian Paul BonguezNo ratings yet

- Transkrip Akademik Academic Transcript Sementara: Mimosa PudicaDocument2 pagesTranskrip Akademik Academic Transcript Sementara: Mimosa Pudicaanon_639661161No ratings yet

- Compilation of Raw Data - LBOBGDT Group 9Document165 pagesCompilation of Raw Data - LBOBGDT Group 9Romm SamsonNo ratings yet

- Contract Costing 4 Problems and SolutionDocument9 pagesContract Costing 4 Problems and Solutioncnagadeepa60% (5)

- AISM Rules BookDocument7 pagesAISM Rules Bookstyle doseNo ratings yet

- Operations Securities Settlement AnalystDocument2 pagesOperations Securities Settlement AnalystPranit AutiNo ratings yet

- Frequently Asked Questions in ManagementDocument230 pagesFrequently Asked Questions in ManagementsiddharthzalaNo ratings yet

- De La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsDocument27 pagesDe La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsAmber QuiñonesNo ratings yet