Professional Documents

Culture Documents

Deventci-R1, A-Lovech Block, North-West Bulgaria

Uploaded by

LeonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deventci-R1, A-Lovech Block, North-West Bulgaria

Uploaded by

LeonCopyright:

Available Formats

Deventci-R1, A-Lovech block, North-West Bulgaria

The second half of 2009 saw Liberty Energy enter into a Purchase and Sales agreement to acquire rights to a rich natural gas property situated in NorthWest Bulgaria, 130km from the capital city Sofia. Based within the A-Lovech exploration block which covers 1,830 square miles (or 1,171,200 acres) of the East European country, the property contains the deepest well drilled in Bulgaria for the past 30 years. Known as Deventci-R1, this primary well sits on a 15-20 sq km geological feature known as the West Koynare structure, reaching a total depth of 5,888 meters (19,313 ft.) into the Lower Triassic Alexandrovo formation. With bottom-hole pressure of around 11,500psi, this is the highest pressured gas reservoir to be identified in Bulgaria. The well encountered gas saturated reservoirs in the Dolni Dabnik member of the Middle Triassic Doirentsi formation, with further potential reservoirs in the Upper Triassic Rusinovdel and the Lower Jurassic Ozirovo formations. In total, this gas deposit has a capacity of around six billion cubic meters. Initial results indicate that the gas and natural gas condensate found at the site to be of exceptionally high quality with low sulphur content. Looking to the future, Liberty Energys agreement entitles the company to royalty interests on all future revenues and reserves located on the block, at no further cost to us. It is anticipated that the development will be tied in with the nearby Aglen field and first sales are expected in 2011, on completion of the pipeline. Following this transaction, Liberty Energy plans to continue searching assets in Bulgaria and surrounding European regions with a view to engaging in similar low risk opportunities.

Liberty Energy Corp. (OTCBB:LBYE.OB) In 2010 the Company announced it had concluded the assignment of overriding royalty rights (ORRI) to a proven multi billion cubic feet of natural gas property in North-West Bulgaria. The Company confirmed in 2011 that the New York Stock Exchange listed TransAtlantic Petroleum, with a market capitalization of circa $1billion, closed an agreement to buy Direct Petroleum Bulgaria EEOD (the current operators). TransAtlantic Worldwide Ltd., a subsidiary of TransAtlantic Petroleum, has now entered into a joint venture agreement with LNG Energy to begin exploratory drilling in Bulgaria's unconventional Etropole formation. The agreement, subject to certain conditions, including the issuance of the Etropole Concession by the Bulgarian government, calls for LNG to invest US$7.5 million to start drilling an exploratory well on the A-Lovech license in Bulgaria. Additionally, LNG has agreed to fund up to an additional US$12.5 million, of which US$7.5 million is to drill a second exploratory well, the Peshtene R-11.1 In return, LNG would acquire a 50% working interest in the Etropole Concession. If the concession is not granted, LNG would have no further obligations under the agreement.2 The Peshtene R-11 well has been expected to be drilled to 10,500 feet, to core and test the unconventional Etropole formation. The A-Lovech exploration license is 100% owned and operated by Direct Bulgaria, and covers approximately 565k acres in northwest Bulgaria, all of which is prospective for the Etropole formation1. The agreement with LNG covers the southern 405,000 acres of the license. Direct Bulgaria plans to file for a production concession over this southern portion, supported by the results of the Peshtene R-11 well. In the northern portion of the A-Lovech license, called the Koynare Area, Direct Bulgaria has applied for a production license following their evaluation of the Deventci-R1 discovery well. These concessions cover 160,000 acres (648 sq kms), which contain a conventional gas discovery in the Jurassic-aged Orzirovo formation which is also prospective for the Etropole. The discovery well, the Deventci-R1, is currently producing approx. 250 thousand cubic feet per day on a limited test basis, which is processed in a compressed natural gas facility adjacent to the well. The A-Lovech license is also estimated to contain over 300,000 acres prospective for Etropole shale (at a depth of approximately 3,800 meters), which was recently certified as a geologic discovery by the Bulgarian government. It is anticipated that coring the Etropole interval in the Deventici R-2 well will greatly enhance the technical understanding of the potential of this shale play. The third established prospective area is a deep gas field on the Aglen block license that produced approximately 9 Bcf before being abandoned in the late 1990s.2 "Having an ORRI entitles us to royalty interest on all future revenues and reserves located on the block. LNG will bring hands-on experience to the exploration of the Etropole formation for natural gas. The drilling of an Etropole test well will also increase the operators technical understanding of the play, and is the first step in efforts to unlock the long-term potential in the Etropole. Should the Etropole prove productive, this location lies less than 10 km from existing pipeline infrastructure, and production will benefit from regional natural gas prices that are currently around $10/Mcf. We excited by the news of a new partner in this proven multi billion cubic feet asset," commented Ian Spowart, CEO of Liberty Energy Corp.

LNG Energy reports Bulgarian well reaches TD with gas shows

Published Jan 10, 2012

LNG Energy Ltd. report that the Peshtene R-11 well in Bulgaria has been successfully drilled to its total depth of 3,190 meters under the farm-in agreement with TransAtlantic Worldwide Ltd., a wholly owned subsidiary of TransAtlantic Petroleum Ltd. The Peshtene R-11 well (Peshten), located on the A-Lovech exploration license, targeted the Middle Jurassic age Etropole formation. Peshtene was successfully drilled in a total of 56 days to a depth of 3190 meters, including 354 meters of Etropole argillite. Numerous gas shows were recorded in the argillite, consisting of methane, ethane and propane (C1, C2, and C3). Over 289 metres of the Jurassic age Etropole and Ozirovo whole core has been taken from the well. The Ozirovo formation produces nearby in the Chiren Gas Field and in TransAtlantic's Deventci R1 discovery well 36 kilometers to the east.. Petrophysical analysis of the Etropole formation indicates net pay of 114 meters, with an average porosity of 6% and water saturation of 48%. Comprehensive core analysis by Core Laboratories is expected to be completed in the first quarter of 2012. The core data from the Etropole argillite and Ozirovo carbonate will be evaluated for reservoir rock properties, geochemical analysis, and rock mechanics. The results of the core and well log analysis will help to design and plan the future completion procedure for the well. Peshtene is scheduled to be completed and tested in Q2, 2012. Based on the data recovered to date, TransAtlantic's subsidiary, Direct Petroleum Bulgaria EOOD ("Direct Bulgaria"), has applied to the government of Bulgaria for a Production Concession (the "Stefanetz Concession"). The Stefanetz Concession is expected to cover an area up to 1,600 square kilometers (395,000 acres) for a term of up to 35 years. "We are excited with the very positive gas shows and data obtained in the Peshtene." commented Dave Afseth, President and CEO of LNG. "We look forward to reviewing the results of the core analyses that will enable us to design and implement an appropriate stimulation to flow test both the Peshtene and Starogard wells."

TransAtlantic Petroleum Ltd Announces Definitive Agreement to Sell Vikin

Friday, 16 Mar 2012

TransAtlantic Petroleum Ltd announced that on March 15, 2012, TransAtlantic signed a stock purchase agreement to sell its oilfield services business, which is substantially comprised of its wholly owned subsidiaries Viking International Limited (Viking International) and Viking Geophysical Services, Ltd. (Viking Geophysical and, together with Viking International, Viking), to Dalea Partners, LP (Dalea, an affiliate of N. Malone Mitchell, 3rd, the Company's Chairman and Chief Executive Officer) for an aggregate purchase price of $164.0 million, consisting of $152.5 million in cash, subject to a net working capital adjustment, and a $11.5 million promissory note from Dalea. The promissory note will be payable five years from the date of issuance or earlier upon the occurrence of certain specified events. Prior to closing, Dalea expects to assign the stock purchase agreement to a joint venture owned by Dalea and funds advised by Abraaj Investment Management Limited. Contractually, the effective date of the sale of Viking will be April 1, 2012, regardless of when the actual closing occurs. The closing is anticipated to occur during the second quarter of 2012. The purchase price for Viking will be increased by the amount (if any) that the net working capital of Viking is greater than zero and will be decreased by the amount (if any) that the net working capital of Viking is less than zero.

UPDATE 1-Abraaj to buy TransAtlantic's oilfield services ops Tue Feb 28, 2012 TransAtlantic says deal valued at $164 mln

* Abraaj teams up with CEO, shareholder Malone Mitchell * TransAtlantic to use proceeds to pay down debt DUBAI, Feb 28 (Reuters) - Abraaj Capital, the Dubai-based private equity firm, has teamed with the top shareholder of TransAtlantic Petroleum Ltd to buy the Canadian energy company's oilfield services business in a deal valued at around $164 million. Abraaj, which recently bought private equity firm Aureos, joined with TransAtlantic's top shareholder and Chief Executive Malone Mitchell for the deal, it said in a statement on Tuesday. The private equity firm said it signed a non-binding letter of intent alongwith Dalea Partners -- an affiliate of Mitchell -- to acquire the business. TransAtlantic, which holds interests in oil and gas properties in Turkey, Bulgaria and Romania, has been exploring strategic alternatives for its oilfield services business since last year.

In a separate bourse statement, TransAtlantic said it intends to use net proceeds from the sale to pay down outstanding debt, adding it was engaged in an exclusivity period with the prospective buyers to negotiate definitive agreements. TransAtlantic's oilfield services business is mainly comprised of wholly-owned subsidiaries Viking International Limited and Viking Geophysical Services Ltd. In May 2011, TransAtlantic named Mitchell as its chief executive and set plans in motion to explore strategic alternatives for its oilfield services business. Abraaj, founded in 2002 by Group Chief Executive Arif Naqvi, has raised $7 billion since its inception. It owns stakes in Orascom Construction, budget carrier Air Arabia , supermarket chain Spinneys and education group GEMS. Funds managed by the group have stakes in 35 companies across the Middle East region. Last week, the PE firm agreed to buy UK-based specialist fund manager Aureos Capital, creating an entity with $7.5 billion in assets and a wider focus on emerging markets.

Networking Reasearch

BanFracNow Research

You might also like

- Shale Gas & Oil ShaleDocument17 pagesShale Gas & Oil ShaleNorfolkingNo ratings yet

- Global Trends 2030: Alternative WorldsDocument160 pagesGlobal Trends 2030: Alternative WorldsOffice of the Director of National Intelligence97% (29)

- Fractional Distillation of Crude OilDocument6 pagesFractional Distillation of Crude OilDavid Ngo83% (6)

- Fire and Safety in Edible Oil Industries To Be AdoptedDocument68 pagesFire and Safety in Edible Oil Industries To Be AdoptedRushiram Reddy60% (5)

- Operation Manual LVDH - 100-Cu - El: Owners Manual Page 1 of 26Document26 pagesOperation Manual LVDH - 100-Cu - El: Owners Manual Page 1 of 26anshulkhajuria60% (10)

- Lecture 02A - DesaltingDocument30 pagesLecture 02A - DesaltingJorge Enciso AcuñaNo ratings yet

- Offshore Production FacilitiesDocument8 pagesOffshore Production FacilitiesPercival Wulfric BrianNo ratings yet

- Skeptical Inquirer 27-03Document72 pagesSkeptical Inquirer 27-03NatanAntonioliNo ratings yet

- DECC Report On Facts of On-Shore Frack 2010Document12 pagesDECC Report On Facts of On-Shore Frack 2010api-277737848100% (1)

- KIS2012 Oil Gas Exploration Minister For EnergyDocument25 pagesKIS2012 Oil Gas Exploration Minister For EnergyPrince AliNo ratings yet

- Shale Gas and FrackingDocument28 pagesShale Gas and Frackinglgu02190No ratings yet

- Israel Oil and Gas OverviewDocument6 pagesIsrael Oil and Gas OverviewEbenezer Amoah-KyeiNo ratings yet

- Aldorf Presentation 5th World LNG August 31Document29 pagesAldorf Presentation 5th World LNG August 31stavros7No ratings yet

- Power in Nigeria:: The Decade of GasDocument8 pagesPower in Nigeria:: The Decade of GasIsmail AdebiyiNo ratings yet

- Small Scale Vegetable Oil ExtractionDocument108 pagesSmall Scale Vegetable Oil ExtractionUmesh100% (2)

- SLFA-60 6000 SeriesDocument4 pagesSLFA-60 6000 SeriesFarid MurzoneNo ratings yet

- Mozambique Offshore: Rovuma Offshore Gas Discoveries 2010 and 2011Document12 pagesMozambique Offshore: Rovuma Offshore Gas Discoveries 2010 and 2011tsar mitchelNo ratings yet

- Oil Gas Teaser TemplateDocument3 pagesOil Gas Teaser TemplateMike RobertsNo ratings yet

- SPX Twin Screw Pumps PDFDocument8 pagesSPX Twin Screw Pumps PDFarunkumar17No ratings yet

- North American LNG TerminalsDocument6 pagesNorth American LNG TerminalsHimSelfNo ratings yet

- Pipline Cleaning ServicesDocument4 pagesPipline Cleaning Servicesbagus adhitiawarman100% (1)

- Bongkot Field 20 Year AnniversaryDocument8 pagesBongkot Field 20 Year AnniversaryAnonymous ntK705RtNo ratings yet

- East Africa Gas Finds and ProspectivityDocument20 pagesEast Africa Gas Finds and Prospectivitytsar mitchelNo ratings yet

- Amg-Talihina Natural Gas Development Proposal All DocsDocument10 pagesAmg-Talihina Natural Gas Development Proposal All Docsapi-289653586No ratings yet

- 1 2 Gerald PeereboomDocument7 pages1 2 Gerald PeereboomihllhmNo ratings yet

- Energie Mines 10-AngDocument112 pagesEnergie Mines 10-AngHocine NesratNo ratings yet

- Cygnus Energy LNG News Weekly 01th October 2021Document22 pagesCygnus Energy LNG News Weekly 01th October 2021Sandesh Tukaram GhandatNo ratings yet

- IA For The Goliat Offshore Oil Field DevelopmentDocument13 pagesIA For The Goliat Offshore Oil Field DevelopmentcesarNo ratings yet

- Interim Management Statement: HighlightsDocument19 pagesInterim Management Statement: Highlightsmikejimmy111No ratings yet

- Givot EnvoiDocument0 pagesGivot Envoithennm1No ratings yet

- Energy and Resources Projects Are The Main Focus of Our Investment StrategyDocument7 pagesEnergy and Resources Projects Are The Main Focus of Our Investment StrategyKarthik Krishna Rupesh VanamaNo ratings yet

- Lecture - 1Document62 pagesLecture - 1Sourav PoddarNo ratings yet

- Enegie Mine Ang-8Document172 pagesEnegie Mine Ang-8Rachid Hassi Rmel100% (1)

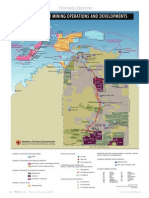

- MINES AUSTRALASIA SEG-Newsletter-80-2010-January-ESDocument27 pagesMINES AUSTRALASIA SEG-Newsletter-80-2010-January-ESAnonymous C0lBgO24iNo ratings yet

- N Territory Petroleum Leases PDFDocument4 pagesN Territory Petroleum Leases PDFnik_ramli7391No ratings yet

- DSD Gorgon Fact SheetDocument2 pagesDSD Gorgon Fact SheetringboltNo ratings yet

- 2011 Celtic Sea Drilling UpdateDocument2 pages2011 Celtic Sea Drilling UpdatekevenNo ratings yet

- Lundin Eia Report Block 10a SeismicDocument168 pagesLundin Eia Report Block 10a SeismicEzzadin BabanNo ratings yet

- Kenya Offshore (L5, L7, L11a, L11B & L12)Document4 pagesKenya Offshore (L5, L7, L11a, L11B & L12)tsar mitchelNo ratings yet

- Offshore Tech-DuyungPSC MakoGasFieldDocument5 pagesOffshore Tech-DuyungPSC MakoGasFieldredevils86No ratings yet

- First Croatian Geothermal Power Plant: MARIJA 1, 4.71 MW Example of Cascade Use of Geothermal EnergyDocument13 pagesFirst Croatian Geothermal Power Plant: MARIJA 1, 4.71 MW Example of Cascade Use of Geothermal EnergyNestorov IvanNo ratings yet

- Navigator 5Document11 pagesNavigator 5Westshore ShipbrokersNo ratings yet

- Cygnus Energy LNG News Weekly 12th Feb 2021Document19 pagesCygnus Energy LNG News Weekly 12th Feb 2021Sandesh Tukaram GhandatNo ratings yet

- GLOBALATOMIC SPU Oct2019Document8 pagesGLOBALATOMIC SPU Oct2019mushava nyokaNo ratings yet

- Kayelekera Mine Malawi, Southern Africa: in Production Ramp-UpDocument4 pagesKayelekera Mine Malawi, Southern Africa: in Production Ramp-UpRanken KumwendaNo ratings yet

- Cygnus Energy LNG News Weekly 09th April 2021Document16 pagesCygnus Energy LNG News Weekly 09th April 2021Sandesh Tukaram GhandatNo ratings yet

- Northern Australia Portfolio: Project OverviewDocument2 pagesNorthern Australia Portfolio: Project Overviewgraceenggint8799No ratings yet

- Cost-Competitive and Self-Supporting Geothermal Energy, CO2-EOR and CO2 Storage Concept Case Study of The E6 Structure in The Baltic SeaDocument8 pagesCost-Competitive and Self-Supporting Geothermal Energy, CO2-EOR and CO2 Storage Concept Case Study of The E6 Structure in The Baltic Seabin guoNo ratings yet

- Ichthys LNG Fact SheetDocument6 pagesIchthys LNG Fact Sheetvadimbla100% (1)

- 5 Big Project in Africa in 2020-2025Document2 pages5 Big Project in Africa in 2020-2025Amit B MakNo ratings yet

- 02-07-02 (Lalala1)Document9 pages02-07-02 (Lalala1)Precious BalgunaNo ratings yet

- Extraction Oil & Gas Company ProfileDocument2 pagesExtraction Oil & Gas Company ProfileAnonymous 8HTodWqnNo ratings yet

- Asian Oil and Gas-January-February 2013Document24 pagesAsian Oil and Gas-January-February 2013jedi_pandaNo ratings yet

- TAG Oil Reports 100% Increase in Production Revenue & Strong Year-End Financial ResultsDocument6 pagesTAG Oil Reports 100% Increase in Production Revenue & Strong Year-End Financial ResultsmpgervetNo ratings yet

- PR Eni Indonesia Geng-NorthDocument2 pagesPR Eni Indonesia Geng-NorthDangolNo ratings yet

- Inpex - Ichthys Project Fact Sheet - September 2012 FinalDocument6 pagesInpex - Ichthys Project Fact Sheet - September 2012 FinalmicahtanNo ratings yet

- Five Exploration Blocks Farm-In Opportunities in Chad - FLYERDocument4 pagesFive Exploration Blocks Farm-In Opportunities in Chad - FLYERChukwunoso NwonyeNo ratings yet

- BROWNLEE Offshore Exploration ActivitiesDocument2 pagesBROWNLEE Offshore Exploration Activitiesapi-26782788No ratings yet

- Blake FieldDocument6 pagesBlake FieldNicolas SosaNo ratings yet

- 3 Utskot SchlumbergerDocument21 pages3 Utskot SchlumbergerLeandro FagundesNo ratings yet

- A Small List of Operating Oil and Gas Fields in Myanmar by Production LevelDocument6 pagesA Small List of Operating Oil and Gas Fields in Myanmar by Production LevelNickAronNo ratings yet

- Cygnus Energy LNG News Weekly 26th March 2021Document14 pagesCygnus Energy LNG News Weekly 26th March 2021Sandesh Tukaram GhandatNo ratings yet

- South Korea: BackgroundDocument9 pagesSouth Korea: BackgroundAmit Kumar GolchhaNo ratings yet

- The Gorgon LNG ProjectDocument10 pagesThe Gorgon LNG ProjectthawdarNo ratings yet

- NAP RIO JV Resource SummaryDocument6 pagesNAP RIO JV Resource SummaryReginaLeaderPostNo ratings yet

- Shale Gas - : Revolution or Evolution of Global Gas Market?Document69 pagesShale Gas - : Revolution or Evolution of Global Gas Market?Navarino LiveNo ratings yet

- Clair OilfieldDocument3 pagesClair OilfieldJabir JammyNo ratings yet

- Moving Natural Gas Stranded Reserves To Market in PolandDocument7 pagesMoving Natural Gas Stranded Reserves To Market in PolandMarcelo Varejão CasarinNo ratings yet

- Natural GasDocument4 pagesNatural Gassumitjena180No ratings yet

- AbstractAltaEWTProductionGeosciences2018 11 06 - FINALDocument5 pagesAbstractAltaEWTProductionGeosciences2018 11 06 - FINALJeffGreenNo ratings yet

- Petroleum Exploration and Exploitation in NorwayFrom EverandPetroleum Exploration and Exploitation in NorwayRating: 5 out of 5 stars5/5 (1)

- The World Is Swimming in ShaleDocument730 pagesThe World Is Swimming in ShaleLeonNo ratings yet

- Tight-Gas Horizontal Well Fracturing in The North SeaDocument4 pagesTight-Gas Horizontal Well Fracturing in The North SeaLeonNo ratings yet

- CorpoInvestor Privileges in EU-US Trade Deal Threaten Public Interest and Democracyrate Bill of RightsDocument10 pagesCorpoInvestor Privileges in EU-US Trade Deal Threaten Public Interest and Democracyrate Bill of RightsLeonNo ratings yet

- Shale World InfographDocument1 pageShale World InfographLeonNo ratings yet

- Multistage Fracturing and Completion For Subsea Openhole SidetrackDocument2 pagesMultistage Fracturing and Completion For Subsea Openhole SidetrackLeonNo ratings yet

- Where The Shale Gas Revolution Came FromDocument13 pagesWhere The Shale Gas Revolution Came FromLeon100% (1)

- Frac Rig Up North SeaDocument2 pagesFrac Rig Up North SeaLeonNo ratings yet

- FlexSTIM Offshore Modular Stimulation SystemDocument2 pagesFlexSTIM Offshore Modular Stimulation SystemLeonNo ratings yet

- Is Natural Gas A Climate Change Solution For CanadaDocument58 pagesIs Natural Gas A Climate Change Solution For CanadaLeonNo ratings yet

- Defining Shale Gas Life Cycle: A Framework For Identifying and Mitigating Environmental ImpactsDocument12 pagesDefining Shale Gas Life Cycle: A Framework For Identifying and Mitigating Environmental ImpactsLeonNo ratings yet

- Promised Land ScriptDocument135 pagesPromised Land ScriptLachlan MarkayNo ratings yet

- Howarth Et Al. - National Climate AssessmentDocument8 pagesHowarth Et Al. - National Climate AssessmentLeonNo ratings yet

- Study of The Potential Impacts of Hydraulic Fracturing On Drinking Water Resources: Progress Report by The U.S. Environmental Protection Agency, December 2012Document278 pagesStudy of The Potential Impacts of Hydraulic Fracturing On Drinking Water Resources: Progress Report by The U.S. Environmental Protection Agency, December 2012Randall WestNo ratings yet

- HF Progress Report Exec Summary20121214Document4 pagesHF Progress Report Exec Summary20121214LeonNo ratings yet

- Hallowich BriefDocument48 pagesHallowich BriefLeonNo ratings yet

- Shale Gas in Bulgaria The Czech Republic and Romania NetDocument30 pagesShale Gas in Bulgaria The Czech Republic and Romania NetLeonNo ratings yet

- OGIQ - Top 10 RefineriesDocument1 pageOGIQ - Top 10 RefineriesLeonNo ratings yet

- California Releases Draft Hydraulic Fracturing StandardsDocument9 pagesCalifornia Releases Draft Hydraulic Fracturing StandardsLeonNo ratings yet

- Statistical Review of World Energy Full Report 2012 PDFDocument48 pagesStatistical Review of World Energy Full Report 2012 PDFAddy RikkaNo ratings yet

- ContentDocument7 pagesContentLeonNo ratings yet

- Thaigovernmentannouncedstepstoendthedogmeattrade 121211054716 Phpapp02Document4 pagesThaigovernmentannouncedstepstoendthedogmeattrade 121211054716 Phpapp02LeonNo ratings yet

- Statement Regarding Chimera Energy Corp.Document1 pageStatement Regarding Chimera Energy Corp.LeonNo ratings yet

- 3D New Silk Road or Building The World's Greatest MarketDocument7 pages3D New Silk Road or Building The World's Greatest MarketLeonNo ratings yet

- GEAS Nov2012 FrackingDocument15 pagesGEAS Nov2012 FrackingLeonNo ratings yet

- Chimera Energy Corp SCAMDocument1 pageChimera Energy Corp SCAMLeonNo ratings yet

- Growing Greenhouse Gas Emissions Due To Meat ProductionDocument10 pagesGrowing Greenhouse Gas Emissions Due To Meat ProductionLeonNo ratings yet

- Oil Firms Issue Guidelines For Quakes Caused by FrackingDocument4 pagesOil Firms Issue Guidelines For Quakes Caused by FrackingLeonNo ratings yet

- Siegel@Fracking Harms Environment, Planet's ClimateDocument8 pagesSiegel@Fracking Harms Environment, Planet's ClimateLeonNo ratings yet

- Shale Gas Lobby - FinalDocument19 pagesShale Gas Lobby - FinalLeonNo ratings yet

- Gold Prices During and After RecessionDocument8 pagesGold Prices During and After RecessionShakinah ShirinNo ratings yet

- KLM TechnologyDocument12 pagesKLM TechnologyBari Ipung GunturNo ratings yet

- 2 - Petroleum and Petrochemical IndustryDocument20 pages2 - Petroleum and Petrochemical IndustryVenus Abigail GutierrezNo ratings yet

- Abbreviations Abbreviations Abbreviations AbbreviationsDocument4 pagesAbbreviations Abbreviations Abbreviations Abbreviationsகரிகாலன் பிரசாந்த் குணசேகரன்No ratings yet

- Introduction To Engineering (E1001) : EnergyDocument22 pagesIntroduction To Engineering (E1001) : EnergyYu KakizawaNo ratings yet

- Rationale of The Study (Revised)Document3 pagesRationale of The Study (Revised)anvillemarie100% (1)

- Vapor Pressure of Petroleum Products (Reid Method) : Standard Test Method ForDocument11 pagesVapor Pressure of Petroleum Products (Reid Method) : Standard Test Method ForLuis Ernesto Marin JaimesNo ratings yet

- Reservoir Characterization by Analysis of Light Hydrocarbon ShowsDocument6 pagesReservoir Characterization by Analysis of Light Hydrocarbon ShowsAna Carolina Lazcano DuranNo ratings yet

- H55.633642 en List of Lubricants Prolonged Intervals 2Document7 pagesH55.633642 en List of Lubricants Prolonged Intervals 2andreNo ratings yet

- Palm Oil Based Surfactant Products For Petroleum IndustryDocument26 pagesPalm Oil Based Surfactant Products For Petroleum IndustryDewi Farra PrasasyaNo ratings yet

- Base Stock Study ComparisonDocument43 pagesBase Stock Study ComparisonChristian CotteNo ratings yet

- Engineering Progress: Disposal SystemsDocument1 pageEngineering Progress: Disposal SystemsGhasem BashiriNo ratings yet

- LinamarDocument1 pageLinamarGenieNo ratings yet

- Spe 184818 MSDocument18 pagesSpe 184818 MSSSNo ratings yet

- Esver STS Unit 3Document7 pagesEsver STS Unit 3Al Jane Amisola EsverNo ratings yet

- Extraction of Biodiesel From Cotton Seed Oil Final SynopsisDocument24 pagesExtraction of Biodiesel From Cotton Seed Oil Final SynopsisIsha MeshramNo ratings yet

- Challenges in The Oil & Gas Industry, Overview & Outlook: Maxwell AKERELEDocument22 pagesChallenges in The Oil & Gas Industry, Overview & Outlook: Maxwell AKERELEWesam Salah AlooloNo ratings yet

- HOEC Investor Presentation 20 April 2017 Final ExecutiveDocument27 pagesHOEC Investor Presentation 20 April 2017 Final Executivedeba01234No ratings yet

- Seal BrochureDocument29 pagesSeal BrochureAziz AbdullahNo ratings yet

- Pascal Konneh CV 2013Document4 pagesPascal Konneh CV 2013Zhoudq DqNo ratings yet