Professional Documents

Culture Documents

ING Direct Case Study Anaysis

Uploaded by

Abby Leigh GrabitzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ING Direct Case Study Anaysis

Uploaded by

Abby Leigh GrabitzCopyright:

Available Formats

Introduction ING Group evolved from the joining of Nationale-Nederlanden (insurance) and NMB Postbank (banking) in 1990.

ING Direct, a separate entity within ING Group, was launched in 1997 and took on the banking values and strategy that was previously embodied by Postbank. Their strategy of focusing on simple low-risk products in mature banking markets using direct banking channels (i.e. telephone, internet, ATMs) is the key in keeping their costs low while providing the high returns without restrictions or fees for their customers. Importantly, ING Direct avoided cannibalizing customers from the parent ING Group by only entering markets that the parent company did not operate in already. The success of ING Direct stems from not only from their diverse resources and capabilities, but also from how they dealt with the competitive market in each country they entered and globally. However, as this case study explains, the uniqueness of ING Directs strategy and culture may not be sustainable as the company grows. The following analysis highlights key issues/problems that ING Direct is facing, how the competitive market and the companys resources/capabilities affect these issues, a brief look at the companys financial situation, and finally, some recommendations to begin to remedy or overcome these issues.

Case Analysis Examination of the Issues/Problems for ING Direct As ING Direct grows, a number of problems can be identified along with the reasons for them. The four main issues for ING Direct in this case are: Uncertain stability and robustness/feasibility of the ING Direct concept with such aggressive growth.

Increasing competition. Problems with new product development countering their simplistic model and being less appealing and/or profitable as the basic savings account. Overall, these issues stem from numerous factors in ING Directs current situation. One

of the main causes is that their level of growth has surpassed their highest expectation. While seemingly a good thing, this has led to a build-up of large company tension, or in other words as the company becomes larger/more successful, it gets more and more difficult to keep the small company culture, causing the issues listed above to be more pressing. Additionally, customers have more access (via the internet) to the rates of multiple firms and are thus more aware of their banking options. The issue of increasing competition stems in part from the fact that the traditional retail banks (that previously just ignored ING Direct) are realizing that they are missing out on some of the profits ING Direct is earning. New trends in banking have also swung the market towards the entrance of supermarket brands and services for account aggregation. Together, along with an increase in consolidation in the banking industry, these factors have made the competitive environment more intense for ING Direct and cause these issues to arise.

Five Forces Breakdown The Five Forces model is a powerful tool used to identify the current factors in the external/competitive market that affect a company. For ING Direct, the Five Forces can be broken down into specific factors in the market (see Appendix A). Although the power of suppliers and the threat of powerful new entrants are relatively low, the power of buyers, substitutes, and rivalry are all considered to be quite high. These things taken together along with the level of growth in the market imply that the current market is very competitive. This

analysis supports the current increase in market competition (one of the issues/problems for ING Direct). However, it should be noted that there are several key resources/capabilities that help ING Direct counteract the increased competition.

Key Resources/Capabilities Although understanding the competitive market is important, it is not a stand-alone analysis. A Resource Based View (RBV) is also extremely useful in identifying why the competitive market may affect the company differently than expected. This case highlights many different key resources and capabilities that help to keep ING Direct ahead of the competition (see Appendix B). These unique resources and capabilities have proven to be difficult to imitate, are controlled by the company (rather than by one employee, suppliers, or buyers), depreciate slowly, and better than that offered by the current competition.

Financial Analysis A brief financial commentary for ING Direct can be found in Appendix C.

Summary and Recommendations ING Directs current strategy of focusing on simple products and low cost operations has proven to be successful. From inception in 1997, ING Direct has expanded into 7 countries in 6 years, with over 4 million customers globally. Analysis of their resources and capabilities has shown that their unique strategy give them an edge over their competition. In order to prevent their increased competition in the market from taking customers and limiting their profits, one recommendation is that ING Direct should focus on reducing their cost/asset ratio down to 30 basis points in their current markets. Additionally, ING Direct can only enter into 15

countries maximum without cannibalizing customers from the parent company. Thus, it is recommended that the company still strive to enter into the additional 8 countries utilizing their proof of concept pilots. Doing so will help to maintain their current growth rate. The simplicity of their product portfolio should be maintained, but more market research should be done to selectively identify other cross-selling products that would also be successful. For example, they should invest in their valuable cross-selling database in order to keep current customers by offering additional products as well as using similar products to bring in more customers. Lastly, it is very important for ING Direct to acknowledge that their current company culture may need to be slightly altered in order to function efficiently as the firm continues to grow. It is important for the head office to get feedback about how each business unit (country) is dealing with this growth to help identify specific resources/capabilities at the business unit level that can be updated in other countries. This may identify ways to maintain ING Directs small company atmosphere while giving each business unit a voice. It was also mentioned that they are considering consolidating the data centers, but this is not recommended, as it would cause them to lose the local feel of each unit. Because their strategy hinges on the availability of an efficient electronic payment infrastructure, they should strive to incorporate technological advance into how they operate. Each of the issues for ING Direct is linked to their ability to the issue of maintaining their current strategy during massive growth. By following the aforementioned recommendations, ING will be able to further identify other strategic advantages they might have in the ever-changing banking industry.

Appendix A: Five Forces Breakdown for ING Direct Threat of New Entrants: LOW High barriers to entry High expenditure High volumes necessary for low cost operations High level of money spend on advertising Large time investment necessary to increase brand awareness Substitutes: HIGH Money market mutual funds money in the mattress no investment in any financial institutions Investment in CDs or Savings Bonds Paying off debt

Rivarly: HIGH Traditional banks (i.e. Citibank, HSBC) recognizing ING Direct as a profit threat Direct/Internet banking operations (i.e. Cahoot, Smile) of traditional banks Direct-only banks (i.e. Egg Wingspan) Supermarket brands Consolidation in the market

Power of Suppliers: LOW Out-sourcing third party firms (for brokerage) lots to choose from in the market Other institutions (for current accounts) no control over customers using ING Direct IT software providers (to maintain IT infrastructure) can also be done internally, no influence on company

Power of Buyers: HIGH Individuals with current accounts at other banks Very price/interest rate sensitive and can easily switch to another financial institution (no major barriers) Have sticky deposits that once invested they often stay in one place Have easy access to interest rates

Appendix B: Resources and Capabilities for ING Direct

Resources and Capabilities

Brand image Knowledge carried over from Postbank Customer/Prospect database for cross-selling other products (linked to low customer acquisition costs) Alliances with local players (i.e. 3rd party brokerage firms) Marketing and advertising ING Direct cafes (only enough of them to generate maximum PR) Solid IT infrastructure in each business unit (provide local information and promote sharing of best practices) Focus on simple products (8 key product classes) Utilize current markets as pilots for new market entry (proof of concept) Feeds off of the overall banking infrastructure (i.e. customers still use current accounts at other institutions) Consistent customer service Unique organization of the company (fleet of companies approach with decisions made by the Direct council CEOs of each business unit (country) and the head office)

Appendix C: Financial Commentary for ING Direct Exhibit 3 in the case shows that Net profit for ING Direct is currently negative, although this is expected to change in 2004. This is not entirely surprising as their current break-even target after entering a country is year 4 of operations (typically only 1 or 2 years for other banking institutions). In the 6 years of operation, ING Direct has expanded into 7 countries, which means that many of these business units will have not yet reached their break-even point. Thus, it is important for the company to push each business unit toward their break-even point (and later profits). Additionally, the case specifically mentioned that 50% of the direct costs are from marketing (mainly from advertising). This is important as it shows where a large portion of ING Direct spending is occurring and could be slimmed. For example, some advertising just focusing on ING at large can be used for both ING Direct and the parent ING Group, leading to savings for both. Similar advertising may also be available for use in other countries, again cutting costs (although this should be done carefully as both language and cultural barriers are often present). This is not to say dramatic cuts should be made in advertising as it is one of the major resources/capabilities that ING Direct has over their direct banking competition.

You might also like

- Meeting 7: Team Presentation I: BNP Paribas Fortis: The James' Banking ExperienceDocument3 pagesMeeting 7: Team Presentation I: BNP Paribas Fortis: The James' Banking ExperienceKAVIN K100% (1)

- World Class ManufacturingDocument6 pagesWorld Class ManufacturingAdlin Kaushal Dsouza 19008No ratings yet

- Wealth FrontDocument4 pagesWealth FrontSiddharth JastiNo ratings yet

- Dell Case StudyDocument4 pagesDell Case StudyDamian Arias100% (3)

- Assignment No. 3: Scenario/Case On BiddingDocument5 pagesAssignment No. 3: Scenario/Case On BiddingKristia Jolina Buendia AldeNo ratings yet

- Midland Case Instructions 1Document3 pagesMidland Case Instructions 1Bibhuti AnandNo ratings yet

- Nike Case AnalysisDocument11 pagesNike Case AnalysisastrdppNo ratings yet

- Financial Model Case Study for Roads PPP ProjectDocument17 pagesFinancial Model Case Study for Roads PPP ProjectAadarsh Sinha0% (1)

- Walmart vs Amazon: Free Shipping Wars to Erode Prime MarginsDocument4 pagesWalmart vs Amazon: Free Shipping Wars to Erode Prime MarginsMervyn TangNo ratings yet

- Marriott CaseDocument1 pageMarriott CasejenniferNo ratings yet

- VodafoneDocument15 pagesVodafoneloveshbhNo ratings yet

- Dupont Strength and WeaknessDocument3 pagesDupont Strength and WeaknessAastha GargNo ratings yet

- Problems - Non Current LiabilitiesDocument1 pageProblems - Non Current LiabilitieshukaNo ratings yet

- Running Head: The Body Shop CaseDocument19 pagesRunning Head: The Body Shop CaseDominique Meagan LeeNo ratings yet

- Capital One CaseDocument5 pagesCapital One CasePrateek MongaNo ratings yet

- Polanyi - The Livelihood of ManDocument158 pagesPolanyi - The Livelihood of ManAlexander Polishchuk67% (3)

- Amazon Case StudyDocument7 pagesAmazon Case StudyHusain BootwalaNo ratings yet

- Case Analysis of ARTDocument9 pagesCase Analysis of ARTHitesh Diyora0% (2)

- SearsDocument1 pageSearsMohamed GhalwashNo ratings yet

- By-Shantanu Mishra, Ashish Sabharwal, Gaurav Gupta, Abhijeet PandeDocument10 pagesBy-Shantanu Mishra, Ashish Sabharwal, Gaurav Gupta, Abhijeet Pandeabhijeet pandeNo ratings yet

- Case Analysis-Ing DirectDocument3 pagesCase Analysis-Ing DirectTathagat ChatterjeeNo ratings yet

- Matching DellDocument10 pagesMatching DellOng Wei KiongNo ratings yet

- Caso HuaweiDocument4 pagesCaso HuaweiAle GarlandNo ratings yet

- Ing Direct Case StudyDocument27 pagesIng Direct Case StudySreerag GangadharanNo ratings yet

- Cash Conversion CycleDocument7 pagesCash Conversion Cyclebarakkat72No ratings yet

- The Effect of Global Crisis Into Euro Region: A Case Study of Greek CrisisDocument6 pagesThe Effect of Global Crisis Into Euro Region: A Case Study of Greek CrisisujjwalenigmaNo ratings yet

- Milking Money Out of ParmalatDocument12 pagesMilking Money Out of Parmalatmariana francoNo ratings yet

- Business Analysis BMWDocument7 pagesBusiness Analysis BMWPooja SheoranNo ratings yet

- Amazon's Acquisition of Whole Foods: A Strategic Move for Data and Private Label Brands (38 charactersDocument4 pagesAmazon's Acquisition of Whole Foods: A Strategic Move for Data and Private Label Brands (38 charactersGemaAkbarRamadhaniNo ratings yet

- Merck & CO Tree PlanDocument36 pagesMerck & CO Tree PlanddNo ratings yet

- A Case Study On International Expansion: When Amazon Went To ChinaDocument3 pagesA Case Study On International Expansion: When Amazon Went To ChinaitsarNo ratings yet

- Amazon Case StudyDocument30 pagesAmazon Case Studymu ji100% (1)

- Deluxe Corporation Case StudyDocument3 pagesDeluxe Corporation Case StudyHEM BANSALNo ratings yet

- Tencent CaseDocument8 pagesTencent CaseChiro Sun0% (1)

- BSC How To PlayDocument10 pagesBSC How To Playjhuaranccac100% (1)

- Flipkart Myntra MergerDocument4 pagesFlipkart Myntra MergersatishgwNo ratings yet

- Whtsapp DealDocument3 pagesWhtsapp DealvishalbiNo ratings yet

- SearsvswalmartDocument7 pagesSearsvswalmartXie KeyangNo ratings yet

- NTT Docomo Case StudyDocument4 pagesNTT Docomo Case StudyLy Nguyen LeNo ratings yet

- The Goldman Sachs IPO (A) - ATSCDocument9 pagesThe Goldman Sachs IPO (A) - ATSCANKIT PUNIANo ratings yet

- Initiation For Increasing Brand ValueDocument4 pagesInitiation For Increasing Brand ValueKrishNo ratings yet

- Group assignments covering Managerial Economics, Marketing, Financial Accounting and moreDocument12 pagesGroup assignments covering Managerial Economics, Marketing, Financial Accounting and moregaurab_khetan789No ratings yet

- Discussion QuestionsDocument3 pagesDiscussion Questionsmehar noor100% (1)

- DuPont's Capital Structure Decision in 1983Document19 pagesDuPont's Capital Structure Decision in 1983Chuan LiuNo ratings yet

- Entering Lnternational MarketsDocument173 pagesEntering Lnternational MarketsNitin SharmaNo ratings yet

- The Cost of Capital For Swan MotorsDocument2 pagesThe Cost of Capital For Swan Motorsanhnguyen2501No ratings yet

- Case Analysis..Go GlobalDocument4 pagesCase Analysis..Go Globalशशांक पाण्डे0% (1)

- Barings CaseDocument3 pagesBarings CaseAnonymous LC5kFdtcNo ratings yet

- FMDocument8 pagesFMRishi SuriNo ratings yet

- GAP Case Study SolutionsDocument2 pagesGAP Case Study SolutionsAditya HonguntiNo ratings yet

- Marriot Corporation - Cost of CapitalDocument3 pagesMarriot Corporation - Cost of CapitalInderpreet Singh Saini100% (17)

- Bancolombia EosDocument10 pagesBancolombia Eosamishaa13No ratings yet

- USTDocument4 pagesUSTJames JeffersonNo ratings yet

- Threadless Marketing Case Study - Digital to Physical ShiftDocument4 pagesThreadless Marketing Case Study - Digital to Physical Shiftdjdazed75% (4)

- Dabur IndiaDocument37 pagesDabur IndiaBandaru NarendrababuNo ratings yet

- Summary 6 AlibabaDocument2 pagesSummary 6 AlibabaFatur MulyaNo ratings yet

- Critical Analysis of ING DirectDocument27 pagesCritical Analysis of ING DirectTom Jacob100% (7)

- Strategy s03 Ingusa Af 102213Document2 pagesStrategy s03 Ingusa Af 102213Alex FerraNo ratings yet

- Capital OneDocument5 pagesCapital OneSoham PradhanNo ratings yet

- MarketingDocument7 pagesMarketingRamya KanthamneniNo ratings yet

- Marketing Action PlanDocument2 pagesMarketing Action PlanAmbashe Dek100% (2)

- Ing Case Study: Module Name: Module Code: Module TutorsDocument25 pagesIng Case Study: Module Name: Module Code: Module Tutorsarchit_khandelwalNo ratings yet

- Tomato ProductsDocument5 pagesTomato ProductsDan Man100% (1)

- Fidelity Investments 10Document1 pageFidelity Investments 10Jack Carroll (Attorney Jack B. Carroll)No ratings yet

- Gaining valuable experience through internships abroadDocument1 pageGaining valuable experience through internships abroadTuyết HoaNo ratings yet

- Lesson 4 - Consumption and Savings PDFDocument15 pagesLesson 4 - Consumption and Savings PDFJoshua CabinasNo ratings yet

- Labsii 202 Bara 2009Document82 pagesLabsii 202 Bara 2009siraj liki100% (5)

- Curriculum Vitae: Deepak Kumar MittalDocument3 pagesCurriculum Vitae: Deepak Kumar MittalThe Cultural CommitteeNo ratings yet

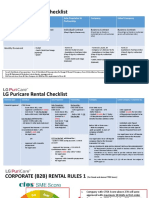

- B2B Rental Sale Checklist - LGEP - 5 - ReviewedDocument5 pagesB2B Rental Sale Checklist - LGEP - 5 - Reviewedsunlife zeoilenNo ratings yet

- Chapter 4 Sent To SVDocument15 pagesChapter 4 Sent To SVHung DuyNo ratings yet

- Revisiting Economics As A Social ScienceDocument6 pagesRevisiting Economics As A Social ScienceJowjie TVNo ratings yet

- Interior Styling - NOTESDocument54 pagesInterior Styling - NOTESAthira NairNo ratings yet

- Verify Servant/Tenant DetailsDocument1 pageVerify Servant/Tenant DetailsRavi ShekharNo ratings yet

- Koperasi Pulau PinangDocument1 pageKoperasi Pulau PinangMazlina ZainNo ratings yet

- Comparing Velocity of Money and Treasury Bill Rate in PakistanDocument18 pagesComparing Velocity of Money and Treasury Bill Rate in PakistanSyed Ashar ShahidNo ratings yet

- Material Management ERP-SAPDocument50 pagesMaterial Management ERP-SAPNuman Rox100% (1)

- E.F. Schumacher: Idea of Development By:-Piyush RajDocument6 pagesE.F. Schumacher: Idea of Development By:-Piyush RajPiyush rajNo ratings yet

- A Level Economics Paper 1 QPDocument36 pagesA Level Economics Paper 1 QPYusuf SaleemNo ratings yet

- Cost Allocation Joint by ProductsDocument31 pagesCost Allocation Joint by ProductsFanie Saphira100% (1)

- Module 2ME ExercisesDocument12 pagesModule 2ME ExercisesAJ SianNo ratings yet

- ABC costing quiz questionsDocument8 pagesABC costing quiz questionsSuchita GaonkarNo ratings yet

- Scadentar ImprumutDocument5 pagesScadentar ImprumutMihaela MaryNo ratings yet

- XBRL Financial Statements Duly Authenticated As Per Section 134 (Including BoardDocument196 pagesXBRL Financial Statements Duly Authenticated As Per Section 134 (Including BoardDSddsNo ratings yet

- Case Study of Delhi MetroDocument14 pagesCase Study of Delhi MetroMaria FernandesNo ratings yet

- Introduction To Economics - ppt1Document13 pagesIntroduction To Economics - ppt1Akshay HemanthNo ratings yet

- Cost PlanningDocument19 pagesCost Planningabil_rye92% (38)

- Email Campaign Strategy and TimelineDocument4 pagesEmail Campaign Strategy and TimelineHoney YuNo ratings yet

- Tybcom Economics Sem V (Prelims-Heramb)Document2 pagesTybcom Economics Sem V (Prelims-Heramb)A BPNo ratings yet

- LK PT Sakti BandungDocument20 pagesLK PT Sakti BandungLusi dwi ApriliaNo ratings yet

- MPSC Group B Indian Economy Important Questions 674b875dDocument5 pagesMPSC Group B Indian Economy Important Questions 674b875dVijay ChaudhariNo ratings yet