Professional Documents

Culture Documents

Assignment 2

Uploaded by

Jayanth Appi KOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 2

Uploaded by

Jayanth Appi KCopyright:

Available Formats

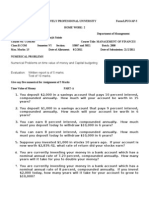

Module 3 & 4 Assignment 2

Date of Announcement 24.04.2012 Date of Submission 07.05.2012 3 marks 1. List out the components of cash flow stream. 2. What is sensitivity analysis? List out the merits and limitations of sensitivity analysis? 3. List out the techniques of stand alone risk analysis. 4. What is meant by scenario analysis? 5. List out the techniques of risk analysis. 6. What do you understand by risk of a project? 7. What are the three elements of cash flow stream? 8. What are the sources of risk? 7 marks 1. Discuss about the biases in cash flow estimation? 2. Discuss the different ways of managing the project related risks? 3. Explain and evaluate NPV and payback period method as appraisal criteria for projects. What decision rule is associated with these methods? 4. Explain the sensitivity analysis method. 5. What are the mistakes committed in financial analysis? 6. What is simulation analysis? What are the steps involved in simulation analysis? 7. Evaluate payback period as one of the evaluation criteria. 8. Evaluate the sensitivity analysis method of assessing risk regarding single investment.

10 marks 1. A limited company is considering investing in a project requiring a capital outlay of Rs. 2,00,000. Forecast for annual income after depreciation but before tax is as follows:

Year Rs.

1 1,00,000

2 1,00,000

3 80,000

4 80,000

5 40,000

Depreciation may be taken at 20% on original cost and taxation at 50% of net income. You are required to evaluate the project according to i) ii) Pay back method Discounted cash flow method taking cost of capital as 10%.

2. The cash flows of a project is given below: Year Cash flow 0 -8000 1 2000 2 -1000 3 10000 4 2000

Calculate IRR for this project. Also calculate the unrecovered investment balance at the end of each year.

3. A company is considering two mutually exclusive investments, project X andproject Y. The expected cash flows of these projects are as follows: Year 0 1 2 3 4 5 Project X -5000 -2500 300 2000 5000 6000 Project Y -2500 800 1000 2000 2000 1500

Which project should it choose if the cost of capital is 15percent? 45 percent? 4. Suppose a firm has a proposal requiring original investment of Rs. 2000 in a plant having economic life of 2 years. Cash flow and probabilities for 2 yrs are: 1 Year alternative 1 2 3 2nd year: if cash flows in 1st year are: Cash flow 800 1100 1500 Probability 0.3 0.4 0.3

Rs. 800 Alternative Cash flow 1 2 3 400 1000 1500 0.2 0.6 0.2 Probability

Rs, 1100 Cash flow 1300 1500 1600 0.3 0.4 0.3 Probability

Rs. 1500 Cash flow 1600 2000 2400 0.1 0.8 0.1 Probability

Cost of capital is at 10%. Plot decision tree and suggest whether the proposal is to be accepted.

5. Rana Home appliances Ltd. is considering the manufacture of a new dishwasher B-IO, for which the following information has been gathered. B-IO is expected to have a product life cycle of five years after which it will be withdrawn form the market. The sales from this products are expected to be as follows: Year Sales (in million) 1 800 2 950 3 1000 4 1200 5 1000

The capital equipment required for manufacturing B-IO costs Rs. 900 million and it will be depreciated at the rate of 25 percent per year as per the WDV method for tax purposes. The expected net salvage value after 5 years is Rs. 150 million. The working capital requirement for the project is expected to be 10% of the sales. Working capital level will be adjusted at the beginning of the year in relation to the sales for the year. At the end of five years, working capital is expected to be liquidated at par, barring an estimated loss of Rs. 5 million on account of bad debt, which of course, will be tax-deductible expense. The accountant of the firm has provided the following estimates for the cost of B-1O. Raw material cost : 45 percent of sales Variable management cost : 15percent of sales Fixed annual operating and maintenance costs: Rs. 3 million Variable selling expenses : 10percent of sales. The tax rate for the firm is 30 percent. a. Estimate the post-tax incremental cash flows for the project to manufacture B-1O. b. What is the NPV of the project if the cost of capital is 20 percent?

6. Consider a set of five projects: Project 1 2 3 4 5 Cash outflow 50000 100000 120000 150000 200000 Estimated annual cash inflow 18000 50000 30000 40000 30000 Project life 10 4 8 16 25

Rank the five projects on the dimensions of NPV, IRR and BCR. The discount rate is 10%. 7. A company is considering two mutually exclusive investments, project A and project B. The expected cash flows of these projects are as follows: Project A Investment outlays Cash flows 1 2 3 4 5 400000 Rs 40000 120000 160000 240000 160000 Project B 450000 Rs 120000 160000 200000 120000 80000

The company has a target of return on capital of 10% and on this basis you are required to compare the profitability of the projects and state which alternative you consider financially more profitable.

You might also like

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Project Financial Appraisal - NumericalsDocument5 pagesProject Financial Appraisal - NumericalsAbhishek KarekarNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- Question of Capital BudgetingDocument7 pagesQuestion of Capital Budgeting29_ramesh170100% (2)

- Docslide - Us Assignment 2 55844503ab61cDocument4 pagesDocslide - Us Assignment 2 55844503ab61cAhmedNo ratings yet

- MBA-I Sem - II Subject: Financial Management (202) : Assignment Submission: 5 Nov 2016Document3 pagesMBA-I Sem - II Subject: Financial Management (202) : Assignment Submission: 5 Nov 2016ISLAMICLECTURESNo ratings yet

- CF - PWS - 5Document3 pagesCF - PWS - 5cyclo tronNo ratings yet

- Corporate Valuation NumericalsDocument47 pagesCorporate Valuation Numericalspasler9929No ratings yet

- AssignmentDocument3 pagesAssignmentChourasia HarishNo ratings yet

- 05 Exercises On Capital BudgetingDocument4 pages05 Exercises On Capital BudgetingAnshuman AggarwalNo ratings yet

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- Ba 4202 FM Important QuestionsDocument6 pagesBa 4202 FM Important QuestionsRishi vardhiniNo ratings yet

- CapbudgetingproblemsDocument3 pagesCapbudgetingproblemsVishal PaithankarNo ratings yet

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaNo ratings yet

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda0% (1)

- Financial Management 532635578Document30 pagesFinancial Management 532635578viaan1990No ratings yet

- Capital Budgeting SumsDocument6 pagesCapital Budgeting SumsDeep DebnathNo ratings yet

- Project Appraisal & Finance ProblemsDocument3 pagesProject Appraisal & Finance ProblemsBhargav Tej PNo ratings yet

- PracticeQuestions-Qbank-Part I-FM-IIDocument7 pagesPracticeQuestions-Qbank-Part I-FM-IISonakshi BhatiaNo ratings yet

- Module 3 - Capital Budgeting - 3A - Questions 2022-23Document10 pagesModule 3 - Capital Budgeting - 3A - Questions 2022-23Manya GargNo ratings yet

- Tute5 Capital BudgetingDocument1 pageTute5 Capital Budgetingvivek patelNo ratings yet

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- Capital Budgeting Illustrative NumericalsDocument6 pagesCapital Budgeting Illustrative NumericalsPriyanka Dargad100% (1)

- Importanat Questions - Doc (FM)Document5 pagesImportanat Questions - Doc (FM)Ishika Singh ChNo ratings yet

- MB0045 - Financial Management - 4 Credits (Book ID: B1134) : Master of Business Administration Semester IIDocument4 pagesMB0045 - Financial Management - 4 Credits (Book ID: B1134) : Master of Business Administration Semester IIAryan MehtaNo ratings yet

- AFM Capital Budgeting AssignmentDocument5 pagesAFM Capital Budgeting Assignmentmahendrabpatel100% (1)

- Group & Individual AssignmentDocument4 pagesGroup & Individual AssignmentKinetibebNo ratings yet

- Question Sheet: (Net Profit Before Depreciation and After Tax)Document11 pagesQuestion Sheet: (Net Profit Before Depreciation and After Tax)Vinay SemwalNo ratings yet

- IV PMBD Pmb1dDocument6 pagesIV PMBD Pmb1dShanmugam AnnamalaiNo ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- Decision Analisis EconomicoDocument15 pagesDecision Analisis EconomicoYasin Naman M.No ratings yet

- Finances em 2Document3 pagesFinances em 2Craaft NishiNo ratings yet

- CAP II Group II June 2022Document97 pagesCAP II Group II June 2022aneupane465No ratings yet

- Og FMDocument5 pagesOg FMSiva KumarNo ratings yet

- MB0045Document3 pagesMB0045Wael AlsawafiriNo ratings yet

- Finance RTP Cap-II June 2016Document37 pagesFinance RTP Cap-II June 2016Artha sarokarNo ratings yet

- Paper - 2: Strategic Financial Management Questions and Answers Questions International Capital BudgetingDocument33 pagesPaper - 2: Strategic Financial Management Questions and Answers Questions International Capital BudgetingAyushNo ratings yet

- Financial Management (MBOF 912 D) 1Document5 pagesFinancial Management (MBOF 912 D) 1Siva KumarNo ratings yet

- Time Value and Capital BudgetingDocument9 pagesTime Value and Capital BudgetingaskdgasNo ratings yet

- Financial ManagementDocument9 pagesFinancial ManagementRajyalakshmi MNo ratings yet

- Activity - Capital Investment AnalysisDocument5 pagesActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENo ratings yet

- Finance Question Papers Pune UniversityDocument12 pagesFinance Question Papers Pune UniversityJincy GeevargheseNo ratings yet

- Tutorial 2 - Principles of Capital BudgetingDocument3 pagesTutorial 2 - Principles of Capital Budgetingbrahim.safa2018No ratings yet

- Instructions To CandidatesDocument3 pagesInstructions To CandidatesSchoTestNo ratings yet

- Advanced Financial Management: Thursday 10 June 2010Document10 pagesAdvanced Financial Management: Thursday 10 June 2010Waleed MinhasNo ratings yet

- CBE - Corporate Finance - SPJG - FinalDocument16 pagesCBE - Corporate Finance - SPJG - FinalNguyễn QuyênNo ratings yet

- Use of Statistical Tables PermittedDocument2 pagesUse of Statistical Tables PermittedPAVAN KUMARNo ratings yet

- Capital BudgetingDocument47 pagesCapital BudgetingShaheer AliNo ratings yet

- Accounting Papers of Ibp Part TwoDocument64 pagesAccounting Papers of Ibp Part TwoTehreem Ali50% (2)

- Tutorial 3 For FM-IDocument5 pagesTutorial 3 For FM-IarishthegreatNo ratings yet

- HW 2Document3 pagesHW 2Love MittalNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1Bigbi Kumar100% (1)

- R35 Capital Budgeting Q BankDocument15 pagesR35 Capital Budgeting Q BankAhmedNo ratings yet

- HW3MGT517Document3 pagesHW3MGT517Jaya PaudwalNo ratings yet

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Titan IndustriesDocument4 pagesTitan IndustriesJayanth Appi KNo ratings yet

- PipeDocument7 pagesPipeJayanth Appi KNo ratings yet

- Book 1Document4 pagesBook 1Jayanth Appi KNo ratings yet

- Performance Management in FMCGDocument15 pagesPerformance Management in FMCGJayanth Appi KNo ratings yet

- Alufix Slab Formwork Tim PDFDocument18 pagesAlufix Slab Formwork Tim PDFMae FalcunitinNo ratings yet

- Ericsson For Sale From Powerstorm 4SA03071242Document8 pagesEricsson For Sale From Powerstorm 4SA03071242wd3esaNo ratings yet

- 04 Membrane Structure NotesDocument22 pages04 Membrane Structure NotesWesley ChinNo ratings yet

- Course: Introduction To Geomatics (GLS411) Group Practical (2-3 Persons in A Group) Practical #3: Principle and Operation of A LevelDocument3 pagesCourse: Introduction To Geomatics (GLS411) Group Practical (2-3 Persons in A Group) Practical #3: Principle and Operation of A LevelalyafarzanaNo ratings yet

- Introduction of ProtozoaDocument31 pagesIntroduction of ProtozoaEINSTEIN2D100% (2)

- Chapter 10 Translation ExposureDocument14 pagesChapter 10 Translation ExposurehazelNo ratings yet

- Most Probable Number (MPN) Test: Principle, Procedure, ResultsDocument4 pagesMost Probable Number (MPN) Test: Principle, Procedure, ResultsHammad KingNo ratings yet

- Sweat Equity SharesDocument8 pagesSweat Equity SharesPratik RankaNo ratings yet

- Invoice ApprovalDocument54 pagesInvoice ApprovalHamada Asmr AladhamNo ratings yet

- 2008 Kershaw CatalogDocument38 pages2008 Kershaw CatalogDANILA MARECHEKNo ratings yet

- YhhjjDocument52 pagesYhhjjSam CunananNo ratings yet

- 04 Task Performance 1Document2 pages04 Task Performance 1mart arvyNo ratings yet

- Report On Monitoring and Evaluation-Ilagan CityDocument5 pagesReport On Monitoring and Evaluation-Ilagan CityRonnie Francisco TejanoNo ratings yet

- OracleCarrierManifestingPartnerIntegration PDFDocument40 pagesOracleCarrierManifestingPartnerIntegration PDFvishal_vishnu11No ratings yet

- Market EquilibriumDocument36 pagesMarket EquilibriumLiraOhNo ratings yet

- 8D & 7QC ToolsDocument117 pages8D & 7QC ToolsAshok Kumar100% (1)

- Southern California International Gateway Final Environmental Impact ReportDocument40 pagesSouthern California International Gateway Final Environmental Impact ReportLong Beach PostNo ratings yet

- Mahindra First Choice Wheels LTD: 4-Wheeler Inspection ReportDocument5 pagesMahindra First Choice Wheels LTD: 4-Wheeler Inspection ReportRavi LoveNo ratings yet

- MotorsDocument116 pagesMotorsAmália EirezNo ratings yet

- 50 Law-Firms Details by Vaibhav SharmaDocument17 pages50 Law-Firms Details by Vaibhav SharmaApoorva NandiniNo ratings yet

- Dash8 200 300 Electrical PDFDocument35 pagesDash8 200 300 Electrical PDFCarina Ramo LakaNo ratings yet

- 4BT3 9-G2 PDFDocument5 pages4BT3 9-G2 PDFNv Thái100% (1)

- IFSSO Newsletter Jul-Sep 2010Document2 pagesIFSSO Newsletter Jul-Sep 2010rjotaduranNo ratings yet

- Heat Pyqs NsejsDocument3 pagesHeat Pyqs NsejsPocketMonTuberNo ratings yet

- Ibragimova Lesson 4Document3 pagesIbragimova Lesson 4Dilnaz IbragimovaNo ratings yet

- Manual TV Hyundai HYLED3239iNTMDocument40 pagesManual TV Hyundai HYLED3239iNTMReinaldo TorresNo ratings yet

- Small Business and Entrepreneurship ProjectDocument38 pagesSmall Business and Entrepreneurship ProjectMădălina Elena FotacheNo ratings yet

- Vertical Cutoff WallsDocument18 pagesVertical Cutoff WallsMark LaiNo ratings yet

- Rate If Iodine and PropanoneDocument3 pagesRate If Iodine and Propanoneshareef1No ratings yet

- Papalia Welcome Asl 1 Guidelines 1 1Document14 pagesPapalia Welcome Asl 1 Guidelines 1 1api-403316973No ratings yet