Professional Documents

Culture Documents

Introduction to Credit Derivatives

Uploaded by

cfafrmcaiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction to Credit Derivatives

Uploaded by

cfafrmcaiaCopyright:

Available Formats

Chapter 29 Introduction to Credit Derivatives Credit Derivatives Financial instruments designed to transfer credit exposure of an underlying asset or issuer

er between two or more parties o Individually negotiated, may take the form of options, swaps, forwards, or credit-linked notes o Payoffs linked to (derived from) the credit characteristics of the referenced asset/issuer Ex: Hedge exposure to interest rate spread between risky and riskless assets Ex: Target specific exposures to enhance portfolio returns o Appeal to financial managers who invest in high-yield bonds, bank loans, or other creditdependent assets o Prior to credit derivatives, the only way to manage credit exposure was to buy/sell underlying assets Inefficient (transaction costs, tax issues) Permit the transfer of credit risk exposure from one party to another (a) Compare and contrast the three types of credit risk Three Sources of Credit Risk 1. Default Risk o Can be complete or partial o Failure of any payment/coupon/interest is a default o Significant risk for high-yield bonds, particularly during periods of economic stress 2. Downgrade Risk o Risk that a national rating agency will lower its credit rating for an issuer based on perceived earning capacity o Formal review by an independent agency o Rating migration can be positive or negative o Note that in migration tables, higher-rated debt tends to migrate downward more high-yield debt has higher default, but also more positive migration comparatively 3. Credit Spread Risk o Risk that the spread over a reference riskless asset will increase for an outstanding debt obligation o Financial markets reaction o Credit risk increases during recessions/slowdowns in the economy (spreads up) Revenues/earnings decline broadly across industries This reduces interest coverage ratios o Company-specific risks can also have an impact (obsolete products, deteriorating client base) (b) Describe two methods of measuring credit risk Measuring Credit Risk Two standards ways to measure credit risk: 1. Credit Rating assigned by NRSROs (S&P, Moodys, Fitch) 2. Credit Risk Premium Difference between yield on credit-risky asset and comparable US Treasury security Non-US Treasury fixed income market is often referred to as the spread product market (c) Describe three traditional methods of managing credit risk Traditional Methods of Managing Credit Risk 1. Underwriting Standards Steps that underwriters will go through in analysis: Consider financial position, revenue growth, earnings potential, interest coverage, leverage, ratios Review the competitive pressures/industry (competition, growth potential, new products) Set a cap on amount willing to lend and determine the amount of the loan

2. 3.

Diversification Build a loan portfolio consisting of commercial loans across several different industries Asset Sales Sell loans to reduce their exposure to different clients/industries Difficult to do in practice (drawback) Loans portfolios tend to be highly customized and sell at a discount

(d) Understand the diversification potential of credit risky investments Credit Risky Investments Four fixed-income instruments are examined that are located at the upper-end of the credit risk scale o High-yield bonds (junk bonds) o Leveraged loans o Distressed debt o Emerging market bonds Risk/Return payoff is below, as measured by the Sharpe Ration o Emerging market and high-yield debt greater SR than stocks and bonds o Distressed debt slightly worse than stocks and bonds o Leveraged loans performed very poorly (driven by 2007-2009 crisis) Leveraged Loans -0.97 Emerging Market 0.55 High Yield 0.42 Distressed Debt 0.24 Treasury Bonds 0.33 US Stocks 0.30

Sharpe Ratio

Correlation with Other Securities (Diversification Potential) Credit-risky investments have low-medium correlation with US stocks They have very low correlation with US Treasuries o Negative for distressed debt and leveraged loans Very strong potential to provide diversification in general to traditional stock/bond portfolios Important note: o Credit-risky investments have negative skew and large positive kurtosis (large, negative fat tails) o High downside exposure for credit-risky investments Leveraged Loans 1.00 0.29 0.71 0.64 -0.18 0.42 Emerging Market 1.00 0.48 0.45 0.11 0.36 High Yield Distressed Debt Treasury Bonds US Stocks

Leveraged Loans Emerging Market High Yield Distressed Debt Treasury Bonds US Stocks

1.00 0.76 0.12 0.69

1.00 -0.26 0.31

1.00 0.07

1.00

(e) Describe the high yield debt market High-Yield Debt Bonds with large credit risk premiums compared to similar risk-free bonds (usually rated below BBB) Significant credit risk For 1993-2008, Monthly Data: E(r) = 0.56%, SD = 1.97%, negatively skewed (-0.69), high kurtosis (4.02) o High downside pressure apparent in the form of defaults, downgrades, and increased credit spreads

(f) Describe the leveraged bank loan market Leveraged Loan Market Market of bank loans made to companies with credit ratings below investment grade o Or with loans prices at L + 150 bps or more Corporate bank loans are floating rate instruments, tied to LIBOR Loans are subjected to risk of prepayment (borrower paying off early or re-financing: call risk) o In addition to risk of default, downgrade, and increased credit spreads Includes syndicated loans to fairly large or mid-sized firms Two types of corporate loans: o (1) Revolvers or Revolving Credits legally committed lines of credit o (2) Term Loans amortizing loans Leveraged Loans Notes Historical distribution of monthly returns (1993-2008): E(r) = 0.05%, SD = 0.81%, negative skew (-1.58), high kurtosis (6.71) o Low average return due to 2008 return of -34% Most consistent returns of all credit-risky investments (0%-2% returns 86% of the time) Significant growth in market from 1996-2008 due to institutional investors o Due to a number of factors 1. Bank loan market and high yield market have started to converge Less difference between commercial banks and investment banks 2. Insurance companies are getting more involved in the bank loan business Commercial banks, brokerage firms, and insurance companies becoming more integrated 3. Bank loans are now accepted as a form of investment by institutional investors Offer high spreads and a good match against liabilities (longer than 2-4 yrs) 4. Capital markets for bank loans have become more efficient Can repackage loans and sell them to investors (rather than hold on BS) (g) Compare and contrast revolvers with term loans Revolvers versus Term Loans Revolvers are legally committed lines of credit o Usually serve as additional backing for commercial paper loans of fiscally sound companies Term loans are fully funded commitments with fixed amortized schedules o Usually provided to firms with lower credit ratings o Re-priced periodically, based on floating rates Lower market risk (interest-rate risk), credit risk plays a greater role in return (h) Describe the emerging markets debt market Emerging Markets Two types of risks with investing in sovereign debt of a foreign country 1. Credit risk inability to make debt payments when due 2. Political risk willingness to make payments for political reasons Higher when foreign economy is in a downturn (lower tax revenues) Historical monthly returns: E(r) = 0.90%, SD = 4.05%, negatively skewed (-2.24), high kurtosis (13.65) o Fatter tails than any of the other credit-risky investments o Downside bias explained mostly by three events: Asian currency crisis/contagion (October 1997) Russian government default on bonds (August 1998) Global market meltdown (2007-2009)

(i) Describe the distressed debt market Distressed Debt Debt that is impaired in some way o Already in default due to a missed PMT on a bond coupon or interest on a loan o Bonds of a company undergoing CH11 bankruptcy reorganization o Bonds of a company with good growth potential but CF problems o Debt of a company with very low credit ratings (high prob of default) Returns characteristics: o Greatest return dispersion compared to other credit-risky investments (-33% to 19%) High yield has dispersion of [-9%, 7%] and leveraged loans has [-5%, 5%] o Not surprisingly, the monthly standard deviation is high at 6.24% (annualized: 28.29%) Higher than volatility of US stocks Highest to Lowest Performing Credit-Risky Instruments from 1993-2008 1. Emerging market bonds 2. US stocks 3. High-yield bonds and distressed 4. US Treasury bonds 5. Leveraged loans (j) List four advantages that credit derivatives provide Credit Derivatives Products Credit options Credit-linked notes Total return swaps Credit default swaps (CDS) Four Advantages of Credit Derivatives to Investors 1. Isolation of credit risk o Manage credit risk more efficiently than buying/selling credit-risky assets 2. Transfer of credit risk o More efficient way of increasing/decreasing credit exposure 3. Liquidity o Can provide liquidity to the market when there is credit stress 4. More rigorous and transparent pricing o Provided by buying/selling the underlying credit collateral (k) Understand credit put options and credit call options Binary Options Operate based on two states (yes/no, default/no default, etc.) Option pays out money to the option holder if a certain event happens (otherwise no payout, loss of premium) o Default or a ratings downgrade, for example o European pays out only at maturity if default occurs, American exercised as soon as default occurs

Example: Late 1990s: International Corporation of Thailand had issued bonds with Face Value = $500M o Bond indenture allowed investors to sell bonds back to issuer at face value if credit rating of Thai govt debt fell below investment grades (put option for investors) o Also a provision that provided investors an extra 50 bp of coupon income if the credit ratings fell by two units and another 25 bp for each subsequent decline in ratings given that they stayed above investment grade (call option to the investor) Therefore: { { (l) Explain why an investor would purchase a credit linked note (CLN) Credit-Linked Note A bond with an embedded credit option o Generally issued with reference to a corporation or a basket of credit risks o If no default of underlying reference credit, then holder of CLN receives coupon PMTs and face at maturity o If default, then note holder will receive either a lower coupon PMT or a partial repayment of the principal value Holder does not want default of reference asset/basket Motivation for Investors to Purchase a CLN They receive a higher yield in exchange for providing the CLN issuer with some credit insurance o If credit event takes place, the holder of the note gives up some fraction of the coupon or principal value o If no credit event takes place, the holder of the CLN collects an insurance premium in the form of a higher yield CLNs appeal to investors who want to take on some credit risk but do not want to (or are not able to) directly buy credit derivatives (such as swaps and options) These are on-balance-sheet debt instruments and can be tailored to achieve specific credit risk profiles (m) Compare and contrast the cash flows of a total return credit swap for the swap buyer with those for the swap seller Total Return Credit Swap Derivative instrument that swaps the total return on a referenced asset (all CFs + capital gains/losses) in exchange for a guaranteed interest rate (such as LIBOR) plus a spread o The exchange is for a CF that is not related to the creditworthiness of the underlying asset Credit protection buyer gives up the return on the underlying in return for certain payments from the credit protection seller o Credit protection buyer (to get the guaranteed rate of L + spread) is the swap seller o Credit protection seller is taking the total return and is the swap buyer Cash Flows for a total return credit swap for the swap buyer and the swap seller are as follows: o Credit protection seller receives total return on a credit-risky asset without having to buy it with its own money Economic exposure of reference asset is transferred to credit protection seller (swap buyer) o Credit protection buyer receives a periodic PMT (LIBOR + spread) from credit protection seller Credit protection buyer (swap seller) maintains physical ownership of underlying asset

Diagram: Total Return Credit Swap

(n) Compare and contrast a total return credit swap with a credit default swap (CDS) Total Return Credit Swap Agreement between two parties where the credit protection buyer makes PMTs to protection seller based on the total return of the reference asset o In return, protection seller makes periodic PMTs in return based on LIBOR + spread Credit Default Swap (CDS) Agreement between two parties, where the credit protection buyer makes period PMTs to a credit protection seller in the form of a fixed coupon for the specified life of the swap agreement o In return, the credit protection seller provides protection against a set of predetermined events with respect to the reference entity (such as bankruptcy or debt restructuring) If a credit event occurs, the protection seller makes a payment to the protection buyer in exchange for physical security of the bond (or the difference between par and MV of debt obligation) o Upon exchange the swap contract is closed Buying a CDS allows the credit risk to be transferred to the CDS seller for a specified period of time Diagram of a CDS:

Difference between a Total Return Credit Swap and a CDS Main difference is in terms of payments o In a CDS, a PMT is made by protection seller to protection buyer when a specified event occurs o In a TRCS, PMTs are made by the credit protection seller regardless of whether an event occurs A CDS is similar to a binary put option because its primary objective is to hedge the credit exposure of a credit risky asset o It serves as a simple form of credit insurance where protection buyer pays a periodic fee to the seller in exchange for a contingent payment in case a specified credit event occurs

(o) List five types of terms negotiated by parties to a CDS Five Types of Terms Negotiated by Parties to a CDS 1. CDS Spread o Premium paid by protection buyer, typically quarterly o Quoted in bps on notional value on annual basis Annual cost for protection against default of a company 2. Contract size and maturity o No standard is imposed by the ISDA most CDSs are between $20M and $100M with a tenor of 3-5 years 3. Trigger events o Determines when the protection seller should make a PMT to protection buyer o ISDA stipulates six trigger events: (1) Bankruptcy (2) Failure to pay (3) Restructuring (4) Obligation acceleration (5) Obligation default (6) Repudiation/Moratorium 4. Settlement o Whether settlement is made by cash payment or physical settlement Cash PMT compensating protection buyer for lost value of underlying asset Physical Settlement buying at par value the distressed impaired bond from protection buyer o Physical settlements occur more frequently Getting a reliable price for a distressed asset is not easy, making cash PMT settlements more difficult to complete 5. Delivery o Specifies the type of assets that could be delivered by the protection buyer for physical settlement Protection buyer may consider the cheapest to deliver asset Direct obligation of the referenced entity (bond or bank loan) Obligation of a subsidiary of the reference entity (if reference entity owns more than 50% of subsidiary) referred to as qualifying affiliate guarantees Obligation of a third party that the reference entity may have guaranteed, referred to as a qualifying guarantee (p) List six kind of trigger events provided by the International Swaps and Derivatives Association (ISDA) Six Trigger Events 1. Bankruptcy a companys inability to pay its debt 2. Failure to pay not in bankruptcy, but is already unable to meet its debt obligations 3. Restructuring any type of debt restructuring that adversely affects the credit protection buyer 4. Obligation acceleration acceleration of repayment of loan due to deterioration of borrowers credit quality 5. Repudiation/Moratorium refusal to pay debt when it is due or an absolute denial of the debt obligations o Most often associated with sovereign or emerging market debt Example The US govt takeover of Fannie Mae and Freddie Mac in September 2008 was a credit event that triggered $1.4T of outstanding CDSs o Protection buyers cashed in their protection under the CDS and delivered Fannie/Freddie bonds to the protection sellers

(q) List four types of risks associated with credit derivatives Four Types of Risks Associated with Credit Derivatives 1. Operational risk o Risk that traders or portfolio managers would not use credit swaps in a responsible way Credit swaps do not appear on an investors BS, so an investor may not be fully aware of the total credit risk to which he is exposed 2. Counterparty risk o CDSs are private transactions that are individually negotiated Therefore, they are illiquid investments with a limited secondary market o In normal markets, counterparty credit risk is small However, in extremely stressed markets the risk can be significant 3. Liquidity risk o Credit derivatives are traded OTC as customized contracts between two parties (therefore illiquid) No credit derivatives are traded on exchanges 4. Pricing risk o Derivatives are priced using complex mathematical models that rely on certain assumptions regarding economic parameters Pricing is sensitive to underlying assumptions, and there is risk that the pricing is not accurate if the assumptions are incorrect or if assumptions are not met

Chapter 30 Collateralized Debt Obligations (a) Explain factors impacting the growth (or contraction) in the collateralized debt obligation market Collateralized Debt Obligations (CDOs) A form of asset-backed security that is backed by a portfolio of bonds and loans Born from two other types of asset-backed securities CBOs and CLOs o CBOs debt instruments backed by a portfolio of senior or subordinated bonds of different issuers o CLOs debt instruments backed by a portfolio of leveraged loans The term is often used to refer to any type of CBO or CLO structure o A simple CDO is a SPV or trust that purchases loans from banks, insurance companies, or other sellers and repackages them into new highly rated securities that are then sold to investors These new securities are backed by a pool of bonds and loans contained in the trust First CDO created in 1987 market experienced significant growth, peaked in 2006 collapsed in 2008 Powerful tool for investors, banks, asset managers, and brokerage houses o CDOs transfer credit risk by creating a pool of different credit-risky assets and selling investmentgrade notes that participate in the pool Great diversification potential (low correlation with US stocks and Treasury bonds) Benefits of CDOs Contributing to Growth of the Market Offer easy access to a diversified pool of credit-risky assets o Much more efficient than constructing a credit-risky portfolio Investors can select among different classes of credit-risky assets (such as distressed debt) Offer different tranches, providing the exact level of credit exposure desired Allow banks to manager the credit risks of their BS of loans Provide asset managers management fees for managing the CDO structures Brokerage firms collect underwriting fees for selling CDO tranches (b) Compare and contrast the structure of: (1) balance sheet CDOs with arbitrage CDOs, (2) cash funded CDOs with synthetic CDOs, (3) cash flow CDO with market value CDOs, and (4) funded with unfunded CDOs Diagram of the CDO Market that provides an overview of notes in this LOS:

CDOs can be divided into two types: balance sheet CDOs and arbitrage CDOs. Balance Sheet CDOs Primary source is banks and insurance companies, which use these structures to manages assets on their BS Main form is the collateralized loan obligation (CLO) Main goal is to manage balance sheet risk o Reduce credit risk to a particular client or industry (transfer the risk to a CDO) o Reduce regulatory capital charges by selling a portion of a loan/bond portfolio to a CDO o Providing an infusion of capital for the bank/insurance company Arbitrage CDOs Main suppliers are money managers Contain bonds, mortgages, commercial loans, and investment in other CDO structures CBO form Main goal is to make a profit o Designed to capture a spread between the higher-yielding securities that the CDO earns on its portfolio and the yield it pays on the securities issued to the CDO investors Money management firms earn fees on the amount of assets under management

Both arbitrage CDOs and balance sheet CDOs can be either cash funded or synthetically constructed through the use of derivatives. Cash-Funded CDO CDO trust purchases and maintains physical ownership of a portfolio of securities o Such as high-yield bonds, ABS, and bank loans CDO issues securities to investors and uses the proceeds to purchase underlying assets of the CDO portfolio Synthetic CDO CDO gains exposure using credit derivatives (such as total return swaps or CDSs) o No physical ownership of underlying securities CDO sells credit protection on a referenced basket of assets o In return receives income in the form of CDS PMTS from protection buyer, which are then passed on to investors Key Differences between Cash-Funded and Synthetic BS CDOs 1. Ownership of assets o Cash-funded involve actual sale/transfer of loans/assets to CDO trust (ownership to CDO trust) o Synthetic involves transferring total return profile (risk profile) of a basket of loans using credit derivatives (ownership of assets is not transferred) 2. Proceeds from the sales of CDO securities o Cash-funded: sales of CDO securities are used to buy the collateral CFs generated from collateral are used to pay returns on CDO securities o Synthetic: sale of CDO securities are typically invested in US Treasuries Interest earned on Treasuries are used to fund swap payments to the bank 3. Leverage o Cash-funded no leverage o Synthetic can use leverage, which would enhance returns 4. Transferring assets o Cash-funded the structure may have to get the commercial borrowers consent before transferring loans to the CDO trust (may result in increased financial and time costs) o Synthetic not necessary, so the structure is les troublesome in terms of transferring assets

Under the arbitrage CDO structure, there are two subcategories: cash flow and market value CDOs. Cash Flow CDO CDO issues securities and uses the proceeds to purchase a portfolio of credit risky assets Portfolio is managed to wind down and pay off the CDOs liabilities using interest and principal PMTs from the underlying CDO portfolio o Managers focus on the underlying portfolios credit quality Must liquidate with a minimum of default to redeem liabilities issued by the CDO o Tenor of CDOs liabilities coincide with the maturity of underlying CDO assets (typically) Market Value CDO Managers actively trade the underlying portfolio and pay off the CDOs liabilities through the trading and sale of the underlying assets o Managers are more concerned with the underlying volatility of the portfolios MV Under the synthetic CDO structure, there are two subcategories: funded and unfunded CDOs. Funded CDO CDO manager collects proceeds from investors and places them in low-risk securities (Treasury notes) o CDO receives periodic fees from its CDSs, as well as interest from Treasury notes in the portfolio This income is passed on to investors o If credit event occurs under one of the CDSs, the CDO makes a credit protection PMT by selling some of low-risk securities (Treasury notes) Unfunded CDO Investors do not pay for the CDO tranche o They assume the role of credit protection seller (receive PMTs from the CDO) o If the underlying referenced credit portfolio suffers losses above a specified level, they pay the CDO issuer This synthetic CDO is merely an intermediary that brings together credit protection buyers and sellers o Receives a management fee for this service

(c) Explain how special purpose vehicles work in the CDO market Special Purpose Vehicle (SPV) Legal entity set up to accomplish a specific transaction (such as a CDO structure) o Usually established as a Delaware or Massachusetts business trust (or special purpose corp) SPV for a balance sheet CDO is most often established as a CLO trust o Sponsor of this trust is a selling bank SPV for an arbitrage CDO is a CBO o Sponsor of this trust is a money manager SPVs are not affected by any financial difficulties encountered by the trust sponsor (bankruptcy remote) o Assets in the CDO trust will not be affected if the sponsor goes bankrupt SPV owns the collateral placed in the trust and issues notes and equity against it o Interest paid from CFs generated o Principal paid off at the end of the SPVs life (usually from sale of SPV assets) Notes are usually issue privately to institutional investors CDOs can be issued in different tranches with different credit ratings (typically senior, mezzanine, and equity) which have a different priority on CFs o Largest tranche is the super senior (up to 85%), then next largest is senior, etc. o Most subordinated is the equity tranche (first loss tranche) o All tranches but equity tranche are rated as investment grade by a NRSRO Distribution of CFs are in a waterfall structure

Diagram: Structure of the CDO and the Waterfall

(d) Describe the structure of a cash funded balance sheet CDO Cash Funded Balance Sheet CDO Seller of assets of a balance sheet CDO is typically a bank that wants to remove part of its loan portfolio from its balance sheet (forms a CLO SPV) o Seller of assets (originating bank) receives money from financial markets and lends the money to commercial loaners in return for secured loan obligations o Bank then pools together loans and sells them to the CLO trust in return for cash o CLO trust issues debt securities that represent a claim on the pool of the commercial loans in the trust Sold to outside investors (pension funds, endowments, high-net-worth individuals) o CLO trust uses cash from the sale of debt securities to pay the bank for purchase of commercial loans Note that there is an actual sale and transfer of the banks loan portfolio to the CLO trust Overseers of the CLO Trust Assets in a CLO trust are typically managed by a professional money manager Trust also has a trustee who protects the CLO investors interests The CLO trust may also purchase credit enhancement from an insurance company that guarantees timely PMT of interest and principal on the CLO notes (enhancement would be investment grade) (e) Calculate the net gain (or loss) of a synthetic balance sheet CDO using a total return swap to the bank sponsoring a credit loan obligation trust (CLO trust) Synthetic Balance Sheet CDO Example: A bank borrows $400M (from capital markets) at LIOBOR to form a commercial loan portfolio o From loan portfolio the bank receives L + 250 bps plus appreciation/depreciation of loans Bank wants to reduce its exposure to loans on its BS and establishes an SPV trust for a balance sheet CLO o Transfers the total return profile of the loans using a 4-yr total return swap Swap transaction: o CLO trust pays bank L + 100 bp on $400M notional Covers funding costs and provides an additional 100 bp o Bank pays CLO trust total return on loan portfolio [L + 250 bps plus appreciation/depreciation] CLO trust issues $100M of notes with 4-year maturity and uses proceeds from sale of note to purchase 4-yr Treasury notes that pay 6% annually o CLO trust records notes on its BS as a liability o CLO securities receive an investment-grade rating (backed by default-free US Treasury securities) o CLO investors receive the return on the CLO trusts assets and swap agreements: 6% interest earned on the Treasury notes Net income of 150 bp on the swap agreement Any depreciation/appreciation of the value of the loan portfolio

For the bank, the total gain/loss is 100 bp which is due to receiving L + 100 bp on swap from CLO trust minus the interest of LIBOR paid to the capital markets. The rest nets out (see page 176 for breakdown). Therefore, based on the notional, the bank receives $4M annually on this deal. For the CLO investors, they invest $100M and, in return receive $6M (150 bp on $400M) + 6% on Treasuries + increase/decrease in the value of the portfolio. See Figure 10 on page 176.

(f) Explain why synthetic CDOs using credit default swaps (CDSs) are often called correlation products Synthetic CDOs Most now use CDSs, rather than total return swaps (which used to be predominate) o Bank makes periodic PMTs to CDO trust CDO trust pays if any of the loans default based on CDS agreement Synthetic CDOs using CDSs are often called correlation products because the CDS agreement generally references the default of more than one loan or debtor o CDO investors purchase correlation risk (being exposed to several debtors at the same time joint default risk) o CDO manager tries to structure CDS in such a way that all default do not occur simultaneously (g) Identify key benefits to banks from CLOs Key Benefits to Banks from CLOs 1. Reducing risk-based/regulatory capital o Most important reason for a bank for form a CLO trust o Regulatory capital charge is the highest percentage of capital requirements in Basel (8%) Example: If a bank has a $300M portfolio and sells it to a CDO trust, then it frees up $24M to use elsewhere o When the equity tranche of a CDO trust cant be sold to investors, the sponsoring company may have to retain an equity position in the CDO trust (maintain capital in amount of equity tranche) Expanding on previous example, if equity tranche is $10M, then regulatory freed is $14M 2. Increasing loan capacity o Not only frees up regulatory capital, but selling its loan portfolio generates funds to make more loans or buy other assets that can strengthen the banks balance sheet 3. Improving ROE and ROA measures o Bank can use extra cash to pay down some its debt liabilities (reduce capital base and increase high-yield assets

4.

5.

6.

Reducing capital concentration o If a bank is at its credit exposure limit to some industry/group, selling loans can free up capacity to make more loans in a profitable industry o Reduced concentration helps banks manage exposures Preserving customer relations o Banks serve as a portfolio manager for the CLO trust in most cases Clients may not even know their loans have been sold and the banks relationship with the client is not marred Competitive positioning o Many institutional investors want to invest in bank loans to reap high yields CLO trusts help facilitate this A great way for a bank to position itself competitively is to sell loans to a CLO trust

Credit Enhancements for CLO Trusts (which most employ) Ensure an investment-grade rating o However, they come at a cost coupon rate lower than it would be if there were no provisions 1. Subordination o Internal credit enhancement o Most common o Exist because of tranche structure of a CLO trust Equity tranche provides credit enhancement for every class above it 2. Overcollateralization o Internal credit enhancement o The level of overcollateralization for the senior tranche = Example: Collateral = $100M, Senior = $80M, Subordinated = $20M Overcollateralization = $100M/$80M = 125% Spread Enhancement o Internal credit enhancement o Excess spread may exist because assets of CLO trust may be of lower credit quality than CLO securities If there are no portfolio losses to cover, the excess spread accrues to the equity tranche of the CLO trust Cash Collateral (Reserve Account) o Excess cash is kept in highly rates securities (such as US Treasuries or high-grade commercial paper) o Not the most efficient way to provide credit support for debt holders (rate of return is too low) External Credit Enhancement o Provided by a third party o Provide insurance against defaults in the portfolio Standard insurance contract Put option CDS

3.

4.

5.

(h) Compare and contrast cash flow arbitrage CDOs to market value arbitrage CDOs Arbitrage CDOs Buy bonds in the open market, place them in a CDO trust, sell new securities as CBO/CLOs to investors o If can sell at lower yields than the yield received on bonds in the trust, then earn an arbitrage profit Cash Flow Arbitrage CDOs Repayment on the CDO securities depends on the CFs from the underlying portfolio of bonds o CDO trust holds the bonds and receives interest and principal PMTs o them o CDO trust securities are sold to match the payment schedule of the bonds held as collateral As collateral pays down, the CDO trust pays down its securities o Most are actively managed (increase return to CDO investors and reduce risk of losses to default) o The CFs on which these CDOs depend themselves depend on two factors: The default rate of the bonds held in the CDO trust The recovery rate of the underlying bonds after they default o The MV of the underlying bonds does not affect the returns earned by the investors Market Value Arbitrage CDOs Return earned by investors is linked to the MV of the underlying collateral Used when the maturity of assets used as collateral is not exactly the same as maturity of CDO securities o This is the case most of the time CFs come from interest PMTs from collateral bonds and from resale of these bonds to make principal PMTs on the CDO securities Total rate of return is the performance measure Comparison between Cash Flow Arbitrage and Market Value Arbitrage CDOs Both are affected by default and recovery rates of bonds in the CDO trust o Default rates increase MV of pool of bonds held by CDO decreases and return on equity tranche decreases Note that the drop in yield on the equity tranche is greater for market value arbitrage CDOs o This is because the trust collateral cant recover the lost value since high-yield bonds need to be sold to fund the redemptions on the CDO securities Example: A CDO trust has two tranches: o Tranche A has $100M in CDO securities o Tranche B has $50M in securities, subordinated Underlying the CDO trust is $150M in high-yield bonds that pay L + 4% o Senior tranche receives: Principal + (L + 1%) o Subordinated tranche receives whatever is left after tranche A is paid Assume L = 5%, recovery rate for defaulted high-yield debt is 40% Case 1: PMT to tranche B for a (1) CF arbitrage CDO and a (2) MV arbitrage CDO where no default occurs With no defaults, the payoff to the subordinated tranche will be the same for each. Underlying $150M(1 + .05 + .04) = $163.5M Senior $100M(1 + .05 + .01) = $106M Subordinated $163.5M $106M = $57.5M Case 2: PMT to the CF arbitrage CDO if there is a 1% default rate: Underlying $150M(1 + .05 + .04)(.99) + $150M(.01)(.40) = $162.465M Senior $100M(1 + .05 + .01) = $106M Subordinated $163.5M $106M = $56.465M

Case 3: PMT to the CF market value CDO if there is a 1% drop in portfolio value Underlying $150M(1 + .05 + .04) $150M(0.01) = $162.0M Senior $100M(1 + .05 + .01) = $106M Subordinated $163.5M $106M = $56M (i) Describe synthetic arbitrage CDOs Synthetic Arbitrage CDO Use a credit default swap or a total return credit swap to transfer risk but not legal ownership of assets Structure is similar to a synthetic balance sheet CLO o CDO trust enters into a swap agreement on a referenced pool of credit-risky securities CLO trust pays the sponsoring money manager L + spread CLO trust receives the total return on fixed income portfolio These instruments are used to exploit a disparity between the yield on the underlying securities and the lower cost of servicing the CDO securities (require less administrative oversight than cash-funded structures) Can also be used to provide access to relatively rare high-yield assets not available in cash markets Can use leverage Key difference from a cash flow CDO: o Swap PMTs in the synthetic arbitrage CDO are made on a periodic basis (quarterly) o Underlying collateral must be marked to market every quarter to determine total return Security holders are exposed to market risk (j) Calculate the profits from an arbitrage CDO trust Example: Money manager establishes an arbitrage CDO trust to invest in high-yield bonds o 3-year life o Tranche A: Face Value of $400M, Coupon = 8%, Rated AAA o Tranche B: Face Value of $50M, Coupon = 8.5%, Rated BBB o Tranche C: Face Value of $50M, Coupon = 9%, Not Rated Money manager has a portfolio of high-yield bonds: o Face Value of $500M, Coupon = 9%, Market Value of $450M, Rated BB Money manager sells bonds to the CDO trust for a fee of 20 bp o Amount is based on $450M market value, therefore fee = $0.9M Money manager charges an annual management fee of 50 bp o Amount is based on $500M face value, therefore annual fee = $2.5M Trustee is assigned to oversee the indenture clauses of the CDO securities and charges $0.25M For the difference in the selling price of CDO notes ($500M) and the purchase price of high-yield bonds ($450M), the CDO trust buys $50M 3-year Treasury notes with annual coupon of 5% Cash Flows for the CDO: Inflows o 9% on $500M high-yield bonds = $45M o 5% on $50M US Treasuries = $2.5M Outflows o 8% on $400M tranche A = $32M o 8.5% on $50M tranche B = $4.25M o 9% on $50M tranche C = $4.5M o Annual management fee = $2.5M o Annual trustee fee = $0.25M Inflows = $47.5M, Outflows = $43.5M, Net Annual CDO Trust Income = $4M

Therefore, there are three ways to make a profit from an arbitrage CDO: 1. Money manager earns a transaction fee for selling its high-yield portfolio to the CDO trust ($0.9M) 2. Money manager earns the spread between the collateral income and payouts on CDO notes ($4M/year) o The money manager is an equity investor in the CDO trust 3. CDO sponsor (manager of the CDO trust) earns a management fee of $2.5M per year

(k) Describe three phases of most arbitrage CDOs Three Phases in Most Arbitrage CDOs 1. Ramp-up Period o CDO trust uses proceeds from the CDO note sale to purchase the initial collateral of assets 2. Revolving Period o Manager of the CDO trust actively manages the collateral pool of assets for the CDO Buy/Sell securities and reinvest any excess proceeds 3. Amortization Period o CDO manager stops reinvesting excess cash and starts winding down the CDO by repaying the CDO debt securities as the CDO collateral matures

Chapter 31 Risks and New Developments in CDOs (a) Describe the nature of new developments in CDOs: (1) distressed debt CDOs, (2) hedge fund CDOs, (3) collateralized commodity obligations, (4) private equity CDOs, (5) single tranche CDOs, and (6) CDO squared Distressed Debt CDOs CDOs that use distressed debt as their primary collateral o Usually consists of a pool of different kinds of distressed securities Some in default, some that are not, and some that are not even distressed Those not distressed would be below investment grade Spread more than 10% over US Treasury rate Cash flow crisis, default, or bankruptcy In determining CFs, the CDO manager uses historical default rates and recovery rates Credit enhancements are employed so that managers are able to offer CDO securities rated higher than the underlying securities in the pool o Allows investors to gain exposure to distressed debt market but can limit risk exposure to their desired level/tolerance Primary suppliers of distressed assets are banks o Although banks will have incurred losses, it can stop the deterioration on their BSs Any additional losses will be felt by the CDO trust and the holders of the equity tranches o Reduces their nonperforming assets ratio freeing up regulatory capital to be used for other needs Hedge Fund CDOs Structured securities that are backed by a pool of HFs Generally referred to as collateralized fund obligations (CFOs) and constructed basically the same way as a CDO HFs Fund of funds (Advisors construct/manage) SPV (Trustee manages) Tranches Investors First two structures appeared in 2002 (Man Group: $550M structure, Diversified Strategies CFO: $250M) Structure of the Diversified Strategies CFO: o CFO issued five tranches of structured notes, each with 5-year bullet maturities o CFO bonds have a trustee (JP Morgan Chase) and the DSF II FoF has an advisor (Investment Management Services) o First four investment-grade tranches are tied to LIBOR and receive semiannual coupon PMTs o Equity tranche represents 26.5% of SPVs capital structure, receives a max annual coupon of 5% Large equity contribution is the primary reason it is rated investment grade CFO has to meet diversification, allocation, and liquidity requirements to meet investment grade by S&P o Diversity: Concentration with a single manager and a minimum number of strategies are restricted o Allocation: Maximum allocation by strategy is specified o Liquidity: Must maintain at least a certain percentage (e.g. 20%) in separate managed accounts to allow for liquidity at any time (unlike HF investments that can only be liquidated at specific times) Collateralized Commodity Obligations A CDO linked to commodity prices, with tranches rated by S&P o Barclays started launched the first one in 2005, which serves as example in notes Structurally it is similar to a synthetic arbitrage CDO, except that underlying assets are a pool of commodities trigger swaps (CTSs) o Synthetic arbitrage CDO has underlying credit-risky assets that are referenced using a swap o CTSs are similar to a CDS a payment is triggered if the price of a referenced commodity falls below a pre-set level during the observation period, leading to the PMT from one party to another Payments of principal and coupons of the CCO depend on the prices of several commodities over a short averaging period immediately before the five-year maturity of the CCO Portfolio construction rules to obtain an investment-grade rating for senior tranches (Barclays): o Loss profiles of CTSs are determined using historical observations o Diversified basket of commodities (16 for Barclays) used industrial metals, precious metals, etc.

Commodities cant be included in the CTS basket if their one-year MA is greater than 150% of their five-year MA Reduces the likelihood of selling protection against commodity spikes o Each price trigger must differ by at least 5% from triggers in the same commodity Reduces likelihood of multiple triggers occurring simultaneously in one commodity Trigger events in the CTS can be positive or negative o Positive results when commodity prices increase over the five-year period and the CCO note holders are rewarded o Negative results when commodity prices decrease and CCO note holders receive less than par on their notes o

Private Equity CDOs Structured securities that are backed by investments in private equity o First one sponsored by JP Morgan and Prime Edge in 2001 raised EUR 150M by investing in 35 European PE fund managers o CDO trust issued three tranches (A: EUR 72M/AA/12 yr, B: EUR 33M/BBB/12 yr, C: EUR 45M) CDO securities rated investment grade by S&P (equity tranche not rated) First stand-alone credit rating for a PE vehicle Single-Tranche CDOs Sells only one tranche of securities provide a very targeted structure of credit risk Like a standard synthetic CDO, it uses a credit default swap o Main difference is that only a specific portion of the portfolio risk is transferred to investors o In a standard synthetic CDO, the entire portfolio risk is transferred Allow for a great deal of customization to investors o Maturity of CDO note, collateral composition, average credit rating, etc. The most finely tuned structures often referred to as bespoke CDOs or CDOs on demand Present investors with two main advantages: o Investors have more control over the terms of a single-tranche CDO than one with several tranches o All CFs go to investors (no waterfall structure) CDO Squared Structure that invests primarily in notes of other CDOs o Underlying pool of CDO squared contains notes from another CDO (CDO of CDOs) Can be cash backed or synthetically constructed o Cash CDO squared is backed by a portfolio of tranches of existing cash CDOs o Synthetic CDO squared consists of a portfolio of CDSs that reference tranches of other CDOs Master trust is created that invests in the tranches of other CDOs (secondary CDOs) o Different tranches in secondary CDOs can be invested in (equity to most senior) o Some CDO squared trusts specialize in purchasing equity tranches, some in highly rated tranches Master CDO issues its own tranched securities to investors Secondary CDO portfolio will contain some overlap of securities o Overlapping securities increase the default correlations to the master CDO o Overlapping credits may result in a master CDO that is concentrated in certain credits Two key rationales for CDO-squared transactions: o Greater diversification 4-10 secondary CDOs (a single, typical CDO includes 50-100 corporate and ABS credits) o Higher spread particularly if they invest in the lower-rated and equity tranches of the secondary CDOs Key difference between CDO and CDO squared: o In a regular CDO the number of defaults in underlying portfolio determines tranche losses o In CDO2, location of defaults determines whether investors suffer losses (more concentration, i.e. all losses from just one CDO, will impact the master CDO and cause more losses than evenly spread out defaults across underlying CDOs)

(b) Identify key risks associated with CDOs Risks Associated with CDO Trusts 1. Default risk of the underlying collateral o Greatest risk associated with an investment in a CDO structure o Risk is greater for lower-level tranches 2. Financial engineering risk o Led to a large number of CDO write-downs in recent credit crisis o Issue began with providing mortgages to subprime borrowers, then the cascade post-securitization and re-packaging as CDOs 3. Downgrade risk o Risk that the credit ratings of the CDO trust securities (not underlying collateral) are reduced o Credit downgrade might not result in default, but it does reduce the MV of CDO tranches Most significant for market value CdOs o Credit ratings can be both upgraded and downgraded 4. CDO default rates o Increased drastically in 2007-2008 (particular for those backed by subprime mortgages) o Downgrades of $351B in 2008 o Once a CDO tranche becomes impaired, recovery rates decline significantly o The lower the recovery rate the larger cushions need to be against losses 5. Differences in periodicity o Frequency of PMTs on the underlying collateral may not coincide with the frequency of PMTs on the trust securities If collateral assets pay interest more often than trust securities, then negative carry Trust will have to hold interest received in low-interest bearing accounts If collateral assets pay interest less often than trust securities, then interest deficiency Trust will have to find an alternate way of funding interest PMTs on securities as they come due Issue can be resolved using a swap agreement with an outside party 6. Difference in payment rates o Arises when the dates that the payments on the collateral are received are different from the dates when payments on the trust securities must be made Mismatch in PMT dates can be resolved using swaps with an outside counterparty 7. Basis risk o When the index used to determine interest PMTs on the CDO trust collateral is different from the index used to calculate the interest to be paid on the CDO trust securities Example: one being based on LIBOR (bank loans) and other assets on US CD rate 8. Spread compression o Risk arises when credit spreads narrow and result in reduced interest rate PMTs from the collateral Arbitrage CDOs based on high-yield bonds and commercial loans particularly susceptible 9. Yield curve risk o Any changes in the yield curve (shifts, twists) will affect CDO trust portfolios that have assets of different maturities o If rates drop, the spread between CDO trust assets and CDO securities will decrease Example of Risks Associated with CDOs Merrill Lynch from Late 2007 to Early 2008 ML recorded a $14B after-tax loss after changing its business strategy with respect to CDOs o Went from a transaction fee business that served as an intermediary in CDO market (serving as an underwriter/packager/seller) to being a CDO investor (during 2006) Motivated by lower yields on MBSs and CDO bonds they bought DCO securities from clients Underestimated the probability of default of subprime mortgages CDO issuers and buyers believed that underlying RE values would always be able to cover obligations on the loans Value of MBSs fell, depressing value of securities

By not monitoring risks or hedging its CDO investments, ML exposed itself to significant risks In July 2008, ML sold $30.6B of its CDO securities for 22 cents on the dollar to a distressed debt manager In total, ML wrote down approximately $27B of CDO securities

(c) Discuss the implications of the weighted average rating factor (WARF) and weighted average spread (WAS) over the London Interbank Offered Rate (LIBOR) for the CDO manager Weighted Average Rating Factor (WARF) Measures the average credit rating of the collateral in a CDO trust o Higher credit rating is associated with a lower WARF Weighted Average Spread over LIBOR (WAS) Average interest in excess of LIBOR earned by the CDO pool Notes on WARF and WAS Active CDO managers have to deal with a trade-off between the two o Increasing WARF (lower creditworthiness of pool of assets) will result in higher WAS o Reducing WARF (increasing creditworthiness) will reduce the WAS During a relatively strong US economy (like in 2005), active CDO managers considered second lien loans as a means of increasing their WAS over LIBOR Drawback was that the second lien loans are subprime, significantly increasing WARF This can also result in competing objectives among the CDO tranches o Super senior and senior tranche holders want to maintain collateral of good quality Maintain low WARF o On the other hand, equity tranche holders have an incentive to raise the WARF to boost the WAS so that they can acquire any extra or arbitrage income spread Senior tranche CDO holders should be vigilant that the CDO manager is not increasing the WARF to boost the WAS

You might also like

- Structured Finance and Insurance: The ART of Managing Capital and RiskFrom EverandStructured Finance and Insurance: The ART of Managing Capital and RiskRating: 3 out of 5 stars3/5 (1)

- CAIA Level 2Document82 pagesCAIA Level 2sandyag321100% (1)

- CAIA Chapters 102108Document2 pagesCAIA Chapters 102108morganstearnsNo ratings yet

- CaiaDocument2 pagesCaiaOsiris316No ratings yet

- September 2008 Caia Level I Sample Questions: Chartered Alternative Investment AnalystDocument27 pagesSeptember 2008 Caia Level I Sample Questions: Chartered Alternative Investment AnalystRavi Gupta100% (1)

- Chartered Alternative Investment Analyst Association Level 2 Study Guide March 2010Document80 pagesChartered Alternative Investment Analyst Association Level 2 Study Guide March 2010http://besthedgefund.blogspot.com100% (1)

- CAIA Level I An Introduction To Core Topics in Alternative InvestmentsDocument119 pagesCAIA Level I An Introduction To Core Topics in Alternative InvestmentsBianci0% (1)

- Caia Next Decade Alternative Investments 2020Document32 pagesCaia Next Decade Alternative Investments 2020Mainumby ConstantinoNo ratings yet

- L2B2 CompleteDocument130 pagesL2B2 Completeleonnox100% (1)

- CAIA - Level II - Study GuideDocument117 pagesCAIA - Level II - Study GuideJeffrey Baker0% (1)

- Leadership Risk: A Guide for Private Equity and Strategic InvestorsFrom EverandLeadership Risk: A Guide for Private Equity and Strategic InvestorsNo ratings yet

- CAIA Sample Questions & Exercises: LosebubDocument3 pagesCAIA Sample Questions & Exercises: LosebubData SoongNo ratings yet

- Get Your Team Up To Speed: Benefits IncludeDocument2 pagesGet Your Team Up To Speed: Benefits IncludeAmol ShikariNo ratings yet

- March 2018 Level I Study Guide Final 0Document83 pagesMarch 2018 Level I Study Guide Final 0csmphbNo ratings yet

- CAIA Sample Questions & ExercisesDocument99 pagesCAIA Sample Questions & ExercisesErik Spangberg83% (6)

- CAIA Prerequisite Diagnostic Review (PDR) and Answer Key Form ADocument29 pagesCAIA Prerequisite Diagnostic Review (PDR) and Answer Key Form Aminsusung9368100% (1)

- Asset-backed Securitization and the Financial Crisis: The Product and Market Functions of Asset-backed Securitization: Retrospect and ProspectFrom EverandAsset-backed Securitization and the Financial Crisis: The Product and Market Functions of Asset-backed Securitization: Retrospect and ProspectNo ratings yet

- CAIA Level II Essay Questions Asset Allocation OptimizationDocument31 pagesCAIA Level II Essay Questions Asset Allocation Optimizationmirela2g100% (2)

- EMPEA Emerging Markets Mezzanine Report May 2014 WEBDocument32 pagesEMPEA Emerging Markets Mezzanine Report May 2014 WEBJurgenNo ratings yet

- Private Credit Solutions:: A Closer Look at The Opportunity in Emerging MarketsDocument48 pagesPrivate Credit Solutions:: A Closer Look at The Opportunity in Emerging MarketsAljon Del Rosario100% (1)

- SERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKFrom EverandSERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKNo ratings yet

- SS 01 Quiz 2 PDFDocument60 pagesSS 01 Quiz 2 PDFYellow CarterNo ratings yet

- Scribd-Caia Level 1Document3 pagesScribd-Caia Level 1Data Soong0% (3)

- Private Equity Fund Of Funds A Complete Guide - 2020 EditionFrom EverandPrivate Equity Fund Of Funds A Complete Guide - 2020 EditionNo ratings yet

- CAIA Prerequisite Diagnostic Review and Answer Key Form BDocument30 pagesCAIA Prerequisite Diagnostic Review and Answer Key Form Bminsusung9368100% (1)

- CAIA HandbookDocument36 pagesCAIA Handbookreciprocations50% (2)

- A Primer On Structured FinanceDocument21 pagesA Primer On Structured FinanceBilyana PetrovaNo ratings yet

- March 2008 CAIA Level II Sample Questions: Chartered Alternative Investment AnalystDocument35 pagesMarch 2008 CAIA Level II Sample Questions: Chartered Alternative Investment AnalystAnubhav Srivastava100% (1)

- Final Full March 2017 Lii Workbook10 16Document253 pagesFinal Full March 2017 Lii Workbook10 16Marko100% (1)

- The Complete Direct Investing Handbook: A Guide for Family Offices, Qualified Purchasers, and Accredited InvestorsFrom EverandThe Complete Direct Investing Handbook: A Guide for Family Offices, Qualified Purchasers, and Accredited InvestorsNo ratings yet

- Pere 50Document15 pagesPere 50Ravin JagooNo ratings yet

- Investment Banking Explained, Second Edition: An Insider's Guide to the Industry: An Insider's Guide to the IndustryFrom EverandInvestment Banking Explained, Second Edition: An Insider's Guide to the Industry: An Insider's Guide to the IndustryNo ratings yet

- A Boost For Your Career in Finance: Benefits IncludeDocument2 pagesA Boost For Your Career in Finance: Benefits IncludeSarthak ShuklaNo ratings yet

- Study Guide Level I - Sept - 2022 - With - Cover (TOC)Document78 pagesStudy Guide Level I - Sept - 2022 - With - Cover (TOC)RenaNo ratings yet

- Alternative Investment Strategies and Risk Management: Improve Your Investment Portfolio’S Risk–Reward RatioFrom EverandAlternative Investment Strategies and Risk Management: Improve Your Investment Portfolio’S Risk–Reward RatioRating: 5 out of 5 stars5/5 (2)

- Financial Valuation Workbook: Step-by-Step Exercises and Tests to Help You Master Financial ValuationFrom EverandFinancial Valuation Workbook: Step-by-Step Exercises and Tests to Help You Master Financial ValuationRating: 3 out of 5 stars3/5 (1)

- Investing in Junk Bonds: Inside the High Yield Debt MarketFrom EverandInvesting in Junk Bonds: Inside the High Yield Debt MarketRating: 3 out of 5 stars3/5 (1)

- Alternative Investments: Instruments, Performance, Benchmarks, and StrategiesFrom EverandAlternative Investments: Instruments, Performance, Benchmarks, and StrategiesRating: 5 out of 5 stars5/5 (1)

- Getting a Job in Private Equity: Behind the Scenes Insight into How Private Equity Funds HireFrom EverandGetting a Job in Private Equity: Behind the Scenes Insight into How Private Equity Funds HireNo ratings yet

- High-Profit IPO Strategies: Finding Breakout IPOs for Investors and TradersFrom EverandHigh-Profit IPO Strategies: Finding Breakout IPOs for Investors and TradersNo ratings yet

- WEF Alternative Investments 2020 An Introduction To AIDocument44 pagesWEF Alternative Investments 2020 An Introduction To AIVishal MehtaNo ratings yet

- Alternative Investment Strategies A Complete Guide - 2020 EditionFrom EverandAlternative Investment Strategies A Complete Guide - 2020 EditionNo ratings yet

- CAIA Programme OverviewDocument27 pagesCAIA Programme OverviewAlex ChanNo ratings yet

- Asian Financial Statement Analysis: Detecting Financial IrregularitiesFrom EverandAsian Financial Statement Analysis: Detecting Financial IrregularitiesNo ratings yet

- Modeling Structured Finance Cash Flows with Microsoft Excel: A Step-by-Step GuideFrom EverandModeling Structured Finance Cash Flows with Microsoft Excel: A Step-by-Step GuideRating: 4 out of 5 stars4/5 (1)

- Private Equity Funds Performance EvaluationDocument5 pagesPrivate Equity Funds Performance Evaluationgnachev_4100% (1)

- Hull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 25: Credit Derivatives Multiple Choice Test BankDocument4 pagesHull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 25: Credit Derivatives Multiple Choice Test BankKevin Molly KamrathNo ratings yet

- Beating The Bear - Lessons From The 1929 Crash Applied To Today's WorldDocument224 pagesBeating The Bear - Lessons From The 1929 Crash Applied To Today's Worldkjkl3469No ratings yet

- Sovereign Risk and Natural Disasters in Emerging MarketsDocument17 pagesSovereign Risk and Natural Disasters in Emerging MarketsAgnes DizonNo ratings yet

- Update March 08Document25 pagesUpdate March 08api-27370939100% (2)

- Basel 2 - DeloitteDocument29 pagesBasel 2 - DeloitteSENTHIL KUMARNo ratings yet

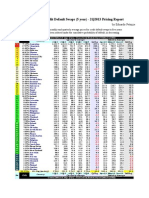

- Sovereign Credit Default Swaps (5 Year) - 2Q2013 Pricing ReportDocument1 pageSovereign Credit Default Swaps (5 Year) - 2Q2013 Pricing ReportEduardo PetazzeNo ratings yet

- Arm - MF - Final - Sample (From 2016)Document27 pagesArm - MF - Final - Sample (From 2016)甜瓜No ratings yet

- Introduction to Credit DerivativesDocument21 pagesIntroduction to Credit Derivativescfafrmcaia100% (1)

- Trade Capture Report MessagesDocument25 pagesTrade Capture Report Messagesjatipatel5719No ratings yet

- SSRN Id4509578Document125 pagesSSRN Id4509578Mauricio MartinsNo ratings yet

- Chapter 09 PPT - Holthausen & Zmijewski 2019Document103 pagesChapter 09 PPT - Holthausen & Zmijewski 2019royNo ratings yet

- The Financial Crisis of 2007 - Roles of CDOs, CDSs and Subprime MortgagesDocument25 pagesThe Financial Crisis of 2007 - Roles of CDOs, CDSs and Subprime MortgagesSertaç Yay100% (1)

- Capital Structure ArbitrageDocument241 pagesCapital Structure Arbitragepakhom100% (1)

- Interest SwapsDocument6 pagesInterest SwapsamiNo ratings yet

- Foreign Exchange: Practical Asset Pricing and Macroeconomic TheoryDocument246 pagesForeign Exchange: Practical Asset Pricing and Macroeconomic Theoryamitwns2011No ratings yet

- Structured Credit and Equity Product PDFDocument480 pagesStructured Credit and Equity Product PDFRach3ch100% (1)

- Vision IAS Mains 2020 Test 15 English Solution PDFDocument20 pagesVision IAS Mains 2020 Test 15 English Solution PDFSrinivas JupalliNo ratings yet

- Razor Financial PrincipalsDocument373 pagesRazor Financial PrincipalsoptimisteveNo ratings yet

- Inside Job The Documentary That Cost 20 000 000 000 000 To ProduceDocument30 pagesInside Job The Documentary That Cost 20 000 000 000 000 To ProducePedro José ZapataNo ratings yet

- Accounting Textbook Solutions - 63Document19 pagesAccounting Textbook Solutions - 63acc-expertNo ratings yet

- Bruce Greenwald InterviewDocument9 pagesBruce Greenwald Interviewkirit0No ratings yet

- (HVB Group) Trading The DAX in CDS Format and Playing Equity Versus DebtDocument26 pages(HVB Group) Trading The DAX in CDS Format and Playing Equity Versus DebtanuragNo ratings yet

- Goldman Sachs Abacus 2007 Ac1 An Outline of The Financial CrisisDocument14 pagesGoldman Sachs Abacus 2007 Ac1 An Outline of The Financial CrisisAkanksha BehlNo ratings yet

- Treasury Module III: Understanding Credit DerivativesDocument14 pagesTreasury Module III: Understanding Credit Derivativessantucan1No ratings yet

- Glossary Ec SimplifiedDocument181 pagesGlossary Ec SimplifiedReynald Satria Dwiky IrawanNo ratings yet

- Vic Bulzacchelli CVDocument2 pagesVic Bulzacchelli CVVic BulzacchelliNo ratings yet

- BIS Quarterly Review: International Banking and Financial Market DevelopmentsDocument78 pagesBIS Quarterly Review: International Banking and Financial Market DevelopmentsgafsdNo ratings yet

- Hibbert Etal Liquidity Premium Literature Review Sept 09Document28 pagesHibbert Etal Liquidity Premium Literature Review Sept 09richard_flavellNo ratings yet

- OTC Derivatives ModuleDocument7 pagesOTC Derivatives ModulehareshNo ratings yet

- Chap 001Document40 pagesChap 001AhmedNo ratings yet