Professional Documents

Culture Documents

ITC Group Company Profile

Uploaded by

Neel ThobhaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ITC Group Company Profile

Uploaded by

Neel ThobhaniCopyright:

Available Formats

1

COMPANY OVERVIEW: ITC GROUP

ITC is one of India's foremost private sector companies with a market capitalization of nearly US $ 15 billion and a turnover of over US $ 4.75 billion. ITC is rated among the World's Best Big Companies, Asia's 'Fab 50' and the World's Most Reputable Companies by Forbes magazine, among India's Most Respected Companies by Business World and among India's Most Valuable Companies by Business Today. ITC also ranks among India's top 10 `Most Valuable (Company) Brands', in a study conducted by Brand Finance and published by the Economic Times.ITC has a diversified presence in Cigarettes, Hotels, Paperboards & Specialty Papers, Packaging, Agri-Business, Packaged Foods & Confectionery, Information Technology, Branded Apparel, Greeting Cards, Safety Matches and other FMCG products. While ITC is an outstanding market leader in its traditional businesses of Cigarettes, Hotels, Paperboards, Packaging and Agri-Exports, it is rapidly gaining market share even in its nascent businesses of Packaged Foods & Confectionery, Branded Apparel and Greeting Cards. As one of India's most valuable and respected corporations, ITC is widely perceived to be dedicatedly nation-oriented. Chairman Y C Deveshwar calls this source of inspiration "a commitment beyond the market". In his own words: "ITC believes that its aspiration to create enduring value for the nation provides the motive force to sustain growing shareholder value. ITC practices this philosophy by not only driving each of its businesses towards international competitiveness but by also consciously contributing to enhancing the competitiveness of the larger value chain of which it is a part."ITC's diversified status originates from its corporate strategy aimed at creating multiple drivers of growth anchored on its time-tested core competencies: unmatched distribution reach, superior brandbuilding capabilities, effective supply chain management and acknowledged service skills in hoteliering. Over time, the strategic forays into new businesses are expected to garner a significant share of these emerging high-growth markets in India. ITC's Agri-Business is one of India's largest exporters of agricultural products. ITC is one of the country's biggest foreign exchange earners (US $ 2.8 billion in the last decade).The Company's 'e-Choupal' initiative is enabling Indian agriculture significantly enhance its competitiveness by empowering Indian farmers through the power of the Internet. This transformational strategy, which

has already become the subject matter of a case study at Harvard Business School, is expected to progressively create for ITC a huge rural distribution infrastructure, significantly enhancing the Company's marketing reach. ITC's wholly owned Information Technology subsidiary, ITC Infotech India Limited, is aggressively pursuing emerging opportunities in providing end-to-end IT solutions, including eenabled services and business process out sourcing. ITC's production facilities and hotels have won numerous national and international awards for quality, productivity, safety and environment management systems. ITC was the first company in India to voluntarily seek a corporate governance rating.

ITC employs over 21,000 people at more than 60 locations across India. The Company continuously endeavors to enhance its wealth generating capabilities in a globalizing environment to consistently reward more than 4,46,000 shareholders, fulfill the aspirations of its stakeholders and meet societal expectations. This overarching vision of the company is expressively captured in its corporate positioning statement: "Enduring Value. For the nation. For the Shareholder.

COMPANY PROFILE Name : ITC Limited Registered Address : Virginia House, 37, Jawaharlal Nehru Road, Kolkata West Bengal 700071 Chairman / Chair Person : Yogesh Chander Deveshwar Executive Director(s) : Pradeep Vasant Dhobale Nakul Anand Kurush Noshir Grant Year of Establishment : 1974 Industry Name : FMCG Factory/plant : Cigarette and Packing & Printing Factory : Basdeopur P.O., District Munger Munger 811202 India Annual Turnover : $ 3.5 billion Total Employees : 21,000 Banker: State Bank of India , ICICI Phone : 033-22889371/ 033-22886426 Fax : 033-22882358 Email : isc@itc.in. Internet : http://www.itcportal.com

ACCOUNTING POLICIES

Convention To prepare financial statements in accordance with applicable Accounting Standards in India. A summary of important accounting policies, which have been applied consistently, is set out below. The financial statements have also been prepared in accordance with relevant presentational requirements of the Companies Act, 1956. Basis of Accounting To prepare financial statements in accordance with the historical cost convention modified by revaluation of certain Fixed Assets as and when undertaken as detailed below. Fixed Assets To state Fixed Assets at cost of acquisition inclusive of inward freight, duties and taxes and incidental expenses related to acquisition. In respect of major projects involving construction, related pre-operational expenses form part of the value of assets capitalized. Expenses capitalized also include applicable borrowing costs. To adjust the original cost of imported Fixed Assets acquired through foreign currency loans at the end of each financial year by any change in liability arising out of expressing the outstanding foreign loan at the rate of exchange prevailing at the date of Balance Sheet. To capitalize software where it is expected to provide future enduring economic benefits. Capitalization costs include license fees and costs of implementation / system integration services. The costs are capitalized in the year in which the relevant software is implemented for use. To charge off as a revenue expenditure all up gradation /enhancements unless they bring similar significant additional benefits. Depreciation To calculate depreciation on Fixed Assets and Intangible Assets in a manner that amortizes the cost of the assets after commissioning, over their estimated useful lives or, where specified, lives based on the rates specified in Schedule XIV to the Companies Act, 1956, whichever is lower, by equal annual installments. Leasehold

properties are amortized over the period of the lease. To amortize capitalized software costs over a period of five years. Revaluation of Assets As and when Fixed Assets are revalued, to adjust the provision for depreciation on such revalued Fixed Assets, where applicable, in order to make allowance for consequent additional diminution in value on considerations of age, condition and unexpired useful life of such Fixed Assets; to transfer to Revaluation Reserve the difference between the

Written up value of the Fixed Assets revalued and depreciation adjustment and to charge Revaluation Reserve Account with annual depreciation on that portion of the value which is written up. Investments To state Current Investments at lower of cost and fair value; and Long Term Investments, including in Joint Ventures and Associates, at cost. Where applicable, provision is made where there is a permanent fall in valuation of Long Term Investments. Inventories To state inventories including work-in-progress at cost or below. The cost is calculated on weighted average method. Cost comprises expenditure incurred in the normal course of business in bringing such inventories to its location and includes, where applicable, appropriate overheads based on normal level of activity. Obsolete, slow moving and defective inventories are identified at the time of physical verification of inventories and, where necessary, provision is made for such inventories. Sales To state net sales after deducting taxes and duties from invoiced value of goods and services rendered. Investment Income

To account for Income from Investments on an accrual basis, inclusive of related tax deducted at source. Proposed Dividend To provide for Dividends (including income tax thereon) in the books of account as proposed by the Directors, pending approval at the Annual General Meeting. Employee Benefits To make regular monthly contributions to various Provident Funds which are in the nature of defined contribution scheme and such paid / payable amounts are charged against revenue. To administer such Funds through duly constituted and approved independent trusts with the exception of Provident Fund and Family Pension contributions in respect of Unionized Staff which are statutorily deposited with the Government. To administer through duly constituted and approved independent trusts, various Gratuity and Pension Funds which are in the nature of defined benefit scheme. To determine the liabilities towards such schemes and towards employee leave encashment by an independent actuarial valuation as per the requirements of Accounting Standard

CAPITAL COMPONENTS :

A firms Capital Components are Debt Borrowed money, either loans or bonds Common equity Ownership interest Preferred stock A hybrid security, a cross between debt and equity Capital structure is the mix of the three capital components generally expressed in percentages.

The Weighted Average CalculationThe WACC A firms cost of capital is a weighted average of the costs of the three capital components where the weights reflect the $ amounts of each component in use Referred to in two ways k, the cost of capital WACC, for weighted average cost of capital Calculating the WACC Step 1: Develop a market-based capital structure Step 2: Adjust market returns on the underlying securities to reflect the costs of the three capital component Step 3: Combine in calculating the WACC

Capital Structure and CostBook Value Versus Market Value We can think of the WACC in terms of either book or market values of capital components For both structure and component costs Which is the correct focus? WACC used to evaluate next years capital projects Must be supported by capital raised next year Book values reflect capital raised and spent years ago Current market values represent our best estimate of next years capital market conditions Market values are the appropriate basis for WACC For capital structure For component costs

COMPUTATION OF COST OF CAPITAL

COST OF EQUITY : a) Dividend Based : - Constant - Growth - At a Constant Rate - At a Variable Rate b) Earning Based c) Realized Yield Method d) CAPM (Capital Asset Pricing Model)

Constant Dividend Model : - For Existing Equity Shares : Ke = D1 Po Where as, D1 = Expected Dividend Po = Current Market Price - For New Equity Shares: Ke = D1 Net Proceeds - Dividend Growth Model : - At Constant (fixed) rate

10

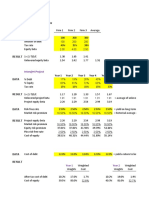

Ke = D1 + g Po Cost of Equity Year 2009 2010 2011

Div 3.7 10 4.45

BV 20.62 36.84 36.39

g 8.75 8.75 8.75

Ke 8.92 9.02 8.87

CAPM (Capital Asset Pricing Model)

Ke = Rf + b (Rm - Rf) Where as, Rf = Risk Free Return b = systematic risk of an equity share with respect to market Rm = Market Return

Cost of Equity by CAPM Year RF 2009 0.4484 2010 0.4596 2011 0.4325

B 0.74 0.74 0.74

RM 0.0679 0.0679 0.0679

Ke 0.16 0.16 0.16

11

COST OF DEBT (LOAN) :

Kd = Interest Rate (1-tax)

Calculation of Cost of Debt Year Interest Debt 2009 2010 2011 26.58 20.23 19.86 165.92 107.71 97.26

Int Rate (%) 16.02 18.78 20.42

Tax Rate 0.3 0.3 0.3

Kd 11.21 13.15 14.29

12

WEIGHTED AVERAGE COST OF CAPITAL : WACC = Ke. We + Kp. Wp + Kd . Wd

Calculation of WACC for 2011 Source Amount Equity Shares Retained Earnings Unsecured Loans Total 773.81 15,126.12 97.26 15997.19

Weight 0.05 0.95 0.01 WACC

Cost 8.87 8.87 14.29

Weighted cost 0.42 8.38 0.08 8.90

Calculation of WACC for 2010 Source Amount Equity Shares Retained Earnings Unsecured Loans Total

Weight

Cost 9.02 9.02 13.15 WACC

381.82 0.03 13628.17 0.97 107.71 0.01 14117.70

Weighted cost 0.24 8.71 0.10 9.05

Calculation of WACC for 2009 Source Amount Equity Shares Retained Earnings Unsecured Loans Total

Weight

Cost 8.93 8.93 11.21 WACC

377.44 0.03 13302.55 0.96 165.92 0.01 13845.91

Weighted cost 0.24 8.58 0.13 8.96

13

ANALYSIS & CONCLUSION

A calculation of a firm's cost of capital in which each category of capital is proportionately weighted. All capital sources - common stock, preferred stock, bonds and any other long-term debt - are included in a WACC calculation. All else equal, the WACC of a firm increases as the beta and rate of return on equity increases, as an increase in WACC notes a decrease in valuation and a higher risk. Broadly speaking, a companys assets are financed by either debt or equity. WACC is the average of the costs of these sources of financing, each of which is weighted by its respective use in the given situation. By taking a weighted average, we can see how much interest the company has to pay for every dollar it finances. A firm's WACC is the overall required return on the firm as a whole and, as such, it is often used internally by company directors to determine the economic feasibility of expansionary opportunities and mergers. It is the appropriate discount rate to use for cash flows with risk that is similar to that of the overall firm.

Following analysis can be concluded for ITC ltd. from the above report : ITC is very less levered with the debt of 0.02 The cost of Equity is almost same as overall cost of capital The Cash EPS > basic EPS for all the years which reveals generation of cash profit by ITC throughout the years Also EPS has been consistently increasing and showing good growth of companys performance

14

ANNEXURE - 1

Balance Sheet of ITC Mar '11 12 mths Sources Of Funds Total Share Capital Equity Share Capital Share Application Money Preference Share Capital Reserves Revaluation Reserves Networth Secured Loans Unsecured Loans Total Debt Total Liabilities 773.81 773.81 0.00 0.00 15,126.12 53.34 15,953.27 1.94 97.26 99.20 16,052.47 Mar '11 12 mths Application Of Funds Gross Block 12,765.82 Less: Accum. Depreciation 4,420.75 Net Block 8,345.07 Capital Work in Progress 1,333.40 Investments 5,554.66 Inventories 5,267.53 Sundry Debtors 907.62 Cash and Bank Balance 98.77 Total Current Assets 6,273.92 Loans and Advances 2,173.89 Fixed Deposits 2,144.47 Total CA, Loans & 10,592.28

------------------- in Rs. Cr. ------------------Mar '10 12 mths 381.82 381.82 0.00 0.00 13,628.17 54.39 14,064.38 0.00 107.71 107.71 14,172.09 Mar '10 12 mths Mar '09 12 mths 377.44 377.44 0.00 0.00 13,302.55 55.09 13,735.08 11.63 165.92 177.55 13,912.63 Mar '09 12 mths Mar '08 12 mths 376.86 376.86 0.00 0.00 11,624.69 56.12 12,057.67 5.57 208.86 214.43 12,272.10 Mar '08 12 mths Mar '07 12 mths 376.22 376.22 0.00 0.00 10,003.78 57.08 10,437.08 60.78 140.10 200.88 10,637.96 Mar '07 12 mths

11,967.86 3,825.46 8,142.40 1,008.99 5,726.87 4,549.07 858.80 120.16 5,528.03 1,929.16 1,006.12 8,463.31

10,558.65 3,286.74 7,271.91 1,214.06 2,837.75 4,599.72 668.67 68.73 5,337.12 2,150.21 963.66 8,450.99

8,959.70 2,790.87 6,168.83 1,126.82 2,934.55 4,050.52 736.93 153.34 4,940.79 1,949.29 416.91 7,306.99

7,134.31 2,389.54 4,744.77 1,130.20 3,067.77 3,354.03 636.69 103.54 4,094.26 1,390.19 796.62 6,281.07

15

Advances Deffered Credit Current Liabilities Provisions Total CL & Provisions Net Current Assets Miscellaneous Expenses Total Assets Contingent Liabilities Book Value (Rs)

0.00 5,668.10 4,104.84 9,772.94 819.34 0.00 16,052.47 251.78 20.55

0.00 4,619.54 4,549.94 9,169.48 -706.17 0.00 14,172.09 258.73 36.69

0.00 4,121.59 1,740.49 5,862.08 2,588.91 0.00 13,912.63 261.36 36.24

0.00 3,619.76 1,645.33 5,265.09 2,041.90 0.00 12,272.10 308.08 31.85

0.00 3,113.01 1,472.84 4,585.85 1,695.22 0.00 10,637.96 129.56 27.59

16

ANNEXURE 2

Profit & Loss account of ITC Mar '11 12 mths Income Sales Turnover Excise Duty Net Sales Other Income Stock Adjustments Total Income Expenditure Raw Materials Power & Fuel Cost Employee Cost Other Manufacturing Expenses Selling and Admin Expenses Miscellaneous Expenses Preoperative Exp Capitalised Total Expenses 30,633.57 9,512.74 21,120.83 775.76 308.42 22,205.01 8,601.13 421.68 1,178.46 560.57 2,408.03 1,120.89 -60.54 14,230.22 Mar '11 12 mths Operating Profit PBDIT Interest PBDT Depreciation Other Written Off Profit Before Tax Extra-ordinary items PBT (Post Extra-ord 7,199.03 7,974.79 78.11 7,896.68 655.99 0.00 7,240.69 35.21 7,275.90

------------------- in Rs. Cr. ------------------Mar '10 12 mths 26,399.63 7,832.18 18,567.45 545.05 -447.54 18,664.96 7,140.69 387.34 1,014.87 413.79 2,093.87 1,008.91 -71.88 11,987.59 Mar '10 12 mths 6,132.32 6,677.37 90.28 6,587.09 608.71 0.00 5,978.38 48.65 6,027.03 Mar '09 12 mths 23,247.84 8,262.03 14,985.81 426.21 630.30 16,042.32 6,864.96 394.12 903.37 402.88 1,684.41 516.90 -72.55 10,694.09 Mar '09 12 mths 4,922.02 5,348.23 47.65 5,300.58 549.41 0.00 4,751.17 81.52 4,832.69 Mar '08 12 mths 21,467.38 7,435.18 14,032.20 516.50 32.46 14,581.16 6,307.79 309.90 745.00 73.52 1,609.33 682.72 -112.75 9,615.51 Mar '08 12 mths 4,449.15 4,965.65 24.61 4,941.04 438.46 0.00 4,502.58 117.41 4,619.99 Mar '07 12 mths 19,519.99 7,206.16 12,313.83 276.22 322.96 12,913.01 5,807.48 253.00 630.15 65.32 1,299.17 601.28 -42.52 8,613.88 Mar '07 12 mths 4,022.91 4,299.13 16.04 4,283.09 362.92 0.00 3,920.17 61.94 3,982.11

17

Items) Tax 2,287.69 Reported Net Profit 4,987.61 Total Value Addition 5,629.09 Preference Dividend 0.00 Equity Dividend 3,443.47 Corporate Dividend Tax 558.62 Per share data (annualised) Shares in issue (lakhs) 77,381.44 Earning Per Share (Rs) 6.45 Equity Dividend (%) 445.00 Book Value (Rs) 20.55

1,965.43 4,061.00 4,846.90 0.00 3,818.18 634.15 38,181.77 10.64 1,000.00 36.69

1,565.13 3,263.59 3,829.13 0.00 1,396.53 237.34 37,744.00 8.65 370.00 36.24

1,480.97 3,120.10 3,307.72 0.00 1,319.01 224.17 37,686.10 8.28 350.00 31.85

1,263.07 2,699.97 2,806.40 0.00 1,166.29 198.21 37,622.23 7.18 310.00 27.59

18

ANNEXURE 3

Ratios

Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07 Per share ratios Adjusted EPS (Rs) Adjusted cash EPS (Rs) Reported EPS (Rs) Reported cash EPS (Rs) Dividend per share Operating profit per share (Rs) 6.24 7.08 6.45 7.29 4.45 9.30 10.38 11.98 10.64 12.23 10.00 16.06 36.69 36.84 48.63 34.73 8.43 9.89 8.65 10.10 3.70 13.04 36.24 36.39 39.70 34.27 7.87 9.03 8.28 9.44 3.50 11.76 31.85 32.00 37.23 29.88 7.08 8.04 7.18 8.14 3.10 10.64 27.59 27.74 32.73 25.62

Book value (excl rev res) per share (Rs) 20.55 Book value (incl rev res) per share (Rs.) 20.62 Net operating income per share (Rs) Free reserves per share (Rs) 27.29 19.07

19

BIBLIOGRAPHY 1. 2. 3. 4. 5. 6. http://www.cmie.com/ http://money.rediff.com http://www.moneycontrol.com/ http://www.itcportal.com/ Book : Financial Management by I M Pandey Class Notes

Thank you!...

You might also like

- Capital BudgetingDocument83 pagesCapital BudgetingKaran SharmaNo ratings yet

- Financial Modeling & Analysis Course, Ottawa - The Vair CompaniesDocument4 pagesFinancial Modeling & Analysis Course, Ottawa - The Vair CompaniesThe Vair CompaniesNo ratings yet

- Performance ApppraidDocument81 pagesPerformance ApppraidManisha LatiyanNo ratings yet

- Assignment Ratio AnalysisDocument7 pagesAssignment Ratio AnalysisMrinal Kanti DasNo ratings yet

- Analysis Report On Macquarie GroupDocument55 pagesAnalysis Report On Macquarie GroupBruce BartonNo ratings yet

- IveyMBA Permanent Employment Report PDFDocument10 pagesIveyMBA Permanent Employment Report PDFUmesh T NNo ratings yet

- EY IFRS Training ProgramDocument8 pagesEY IFRS Training ProgramHenry Harvin EducationNo ratings yet

- Measuring and Managing Investment RiskDocument41 pagesMeasuring and Managing Investment RiskAryan PandeyNo ratings yet

- Asset Management PresentationDocument27 pagesAsset Management PresentationSamer KahilNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisGaurav PoddarNo ratings yet

- Financial ModellingDocument3 pagesFinancial ModellingSakshi Lodha100% (1)

- Financial Model Excel ValuationDocument1 pageFinancial Model Excel ValuationMohnish ManchandaNo ratings yet

- Mis Application in FinanceDocument28 pagesMis Application in Financeprakash_malickal100% (6)

- Nestle Strategic Plan Final Project 4M1 Group. (Major - Marekting)Document50 pagesNestle Strategic Plan Final Project 4M1 Group. (Major - Marekting)mohaNo ratings yet

- CFI Interview QuestionsDocument5 pagesCFI Interview QuestionsSagar KansalNo ratings yet

- Cash Flow Analysis, Target Cost, Variable CostDocument29 pagesCash Flow Analysis, Target Cost, Variable CostitsmenatoyNo ratings yet

- Financial Accounting CycleDocument55 pagesFinancial Accounting CycleAbhishek VermaNo ratings yet

- Peer Company AnalysisDocument91 pagesPeer Company AnalysisPankaj GauravNo ratings yet

- SynopsisDocument7 pagesSynopsisAnchalNo ratings yet

- F 3 Financial StrategyDocument3 pagesF 3 Financial StrategyOlalekan PopoolaNo ratings yet

- Assignment 3 - Financial Case StudyDocument1 pageAssignment 3 - Financial Case StudySenura SeneviratneNo ratings yet

- Depreciation and Amortization SchedulesDocument36 pagesDepreciation and Amortization SchedulestejaasNo ratings yet

- Asg 1 Role of Finance ManagerDocument2 pagesAsg 1 Role of Finance ManagerRokov N ZhasaNo ratings yet

- The Forrester Wave™ - Master Data Management, Q2 2023Document16 pagesThe Forrester Wave™ - Master Data Management, Q2 2023dwight duglingNo ratings yet

- Cost of CapitalDocument8 pagesCost of CapitalAreeb BaqaiNo ratings yet

- Comparable Companies: Inter@rt ProjectDocument9 pagesComparable Companies: Inter@rt ProjectVincenzo AlterioNo ratings yet

- Advanced Finacial ModellingDocument1 pageAdvanced Finacial ModellingLifeis BeautyfulNo ratings yet

- Cash Flow Accounts Final Project (2Document21 pagesCash Flow Accounts Final Project (2KandaroliNo ratings yet

- Adidas Group Equity Valuation Thesis - João Francisco Menezes - 152114017-1 PDFDocument43 pagesAdidas Group Equity Valuation Thesis - João Francisco Menezes - 152114017-1 PDFNancy NanNo ratings yet

- IB Interview Guide, Module 4: Accounting and the Three Financial StatementsDocument149 pagesIB Interview Guide, Module 4: Accounting and the Three Financial StatementsArthur M100% (1)

- SAPM Full NotesDocument305 pagesSAPM Full NotesDeeKsha BishnoiNo ratings yet

- Ch5 - Financial Statement AnalysisDocument39 pagesCh5 - Financial Statement AnalysisLaura TurbatuNo ratings yet

- IBA Marketing Management Course OutlineDocument12 pagesIBA Marketing Management Course OutlineSauban AhmedNo ratings yet

- Valuation of BusinessDocument44 pagesValuation of Businessnaren75No ratings yet

- Complete Revision Notes Auditing 1Document90 pagesComplete Revision Notes Auditing 1Marwin AceNo ratings yet

- RC Equity Research Report Essentials CFA InstituteDocument3 pagesRC Equity Research Report Essentials CFA InstitutetheakjNo ratings yet

- CA Final Financial Reporting NotesDocument14 pagesCA Final Financial Reporting NotesB GANAPATHYNo ratings yet

- MCS Case StudyDocument17 pagesMCS Case StudyPratik Tambe0% (1)

- Apple Model EDUCBADocument5 pagesApple Model EDUCBAAakashNo ratings yet

- Ratio Problems 2Document7 pagesRatio Problems 2Vivek Mathi100% (1)

- Excel Advanced Skills For Financial ModellingDocument10 pagesExcel Advanced Skills For Financial ModellingChaurasia TanuNo ratings yet

- Budgeting Case StudyDocument1 pageBudgeting Case Studykisschotu100% (1)

- Workshop Financial Modelling-ShareDocument58 pagesWorkshop Financial Modelling-ShareIdham Idham Idham100% (1)

- Equity ResearchDocument4 pagesEquity ResearchDevangi KothariNo ratings yet

- Equity TrainingDocument224 pagesEquity TrainingSang Huynh100% (3)

- Chapter 02 Investment AppraisalDocument3 pagesChapter 02 Investment AppraisalMarzuka Akter KhanNo ratings yet

- Ch20 InvestmentAppraisalDocument32 pagesCh20 InvestmentAppraisalsohail merchantNo ratings yet

- Chapter 7 SolutionsDocument8 pagesChapter 7 SolutionsAustin LeeNo ratings yet

- Eusprig 2015 CoralityDocument20 pagesEusprig 2015 CoralityserpepeNo ratings yet

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesFrom EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- Cost Of Capital A Complete Guide - 2020 EditionFrom EverandCost Of Capital A Complete Guide - 2020 EditionRating: 4 out of 5 stars4/5 (1)

- Project On Mm-On Lux SoapDocument22 pagesProject On Mm-On Lux SoapAshutosh SrivastavaNo ratings yet

- Inspirational Management Quotes by Jack WelchDocument6 pagesInspirational Management Quotes by Jack WelchNeel ThobhaniNo ratings yet

- CH 1 GlobDocument3 pagesCH 1 GlobNeel ThobhaniNo ratings yet

- Knowledge-Management MIS Presentation FinalDocument22 pagesKnowledge-Management MIS Presentation FinalNeel ThobhaniNo ratings yet

- Chapter 9Document27 pagesChapter 9Jayanthi Heeranandani100% (1)

- Credit Creation and Money SupplyDocument27 pagesCredit Creation and Money SupplyPrasad LadNo ratings yet

- Release of BMC Service Desk Express Version 10Document32 pagesRelease of BMC Service Desk Express Version 10Wan ShitongNo ratings yet

- Marketing Report InsightsDocument20 pagesMarketing Report Insightsmewtoki33% (3)

- Purchases and CreditorsDocument3 pagesPurchases and Creditorsyadav jiNo ratings yet

- Learning To Lead Leading To Learn Lesson - Katie AndersonDocument360 pagesLearning To Lead Leading To Learn Lesson - Katie Andersonabc100% (1)

- Human Resource Management in McDonaldDocument7 pagesHuman Resource Management in McDonaldPrateik PrabhuNo ratings yet

- PFRS 8 Segment ReportingDocument3 pagesPFRS 8 Segment ReportingAllaine ElfaNo ratings yet

- The Procurement Alignment FrameworkDocument8 pagesThe Procurement Alignment FrameworkZhe TianNo ratings yet

- What It Takes To Be An EntrepreneurDocument3 pagesWhat It Takes To Be An EntrepreneurJose FrancisNo ratings yet

- Rate of Return Analysis (Online Version)Document35 pagesRate of Return Analysis (Online Version)samiyaNo ratings yet

- CV Resume for Quality Assurance ChemistDocument3 pagesCV Resume for Quality Assurance Chemistnvvsganesh1984No ratings yet

- Calf Fattening FeasibilityDocument19 pagesCalf Fattening FeasibilityMuammad Sanwal100% (2)

- ZapposDocument3 pagesZapposMehak AroraNo ratings yet

- Basics of EntrepreneurshipDocument51 pagesBasics of EntrepreneurshipGanesh Kumar100% (1)

- USLS Solution Rights-StockholdersDocument3 pagesUSLS Solution Rights-StockholdersMarian Augelio PolancoNo ratings yet

- PT041000 Relatedresources Trade Secret Case Law Report 2013cDocument78 pagesPT041000 Relatedresources Trade Secret Case Law Report 2013cGulshatRaissovaNo ratings yet

- Income Taxation Provisions in the PhilippinesDocument11 pagesIncome Taxation Provisions in the Philippinesroselleyap20No ratings yet

- 1.1 History of The Organization & Its ObjectivesDocument42 pages1.1 History of The Organization & Its ObjectivesJaiHanumankiNo ratings yet

- VF Brands - Case Write Up - Group8Document6 pagesVF Brands - Case Write Up - Group8maheshNo ratings yet

- CHURCHILL MINING PLC 2011 AGMDocument25 pagesCHURCHILL MINING PLC 2011 AGMmarianafransiscaNo ratings yet

- Anbu Employee Welfare Measure Project PPT PresentationDocument12 pagesAnbu Employee Welfare Measure Project PPT PresentationVasanth KumarNo ratings yet

- Beeah - Annual Report 2010 (LR) - 0Document40 pagesBeeah - Annual Report 2010 (LR) - 0hareb_dNo ratings yet

- Pub 100427Document5 pagesPub 100427Engr Nabeel AhmadNo ratings yet

- Mamta Lohia Agarwal - CVDocument2 pagesMamta Lohia Agarwal - CVJunaid OmerNo ratings yet

- BIM Execution Plan ExampleDocument20 pagesBIM Execution Plan ExampleDarell IvanderNo ratings yet

- General Banking Laws of 2000 (RA 8791) : Banks Shall Be Classified IntoDocument9 pagesGeneral Banking Laws of 2000 (RA 8791) : Banks Shall Be Classified IntoJoy DalesNo ratings yet

- MRP (Material Requirement Planning) - ADocument30 pagesMRP (Material Requirement Planning) - Amks210No ratings yet

- SHO1 Asset AcquisitionMerger-ConsoldationDocument5 pagesSHO1 Asset AcquisitionMerger-ConsoldationDessa JardinelNo ratings yet

- The Traffic and Transport System and Effects On Accessibility, The Environment and SafetyDocument9 pagesThe Traffic and Transport System and Effects On Accessibility, The Environment and SafetyLevend KalaçNo ratings yet