Professional Documents

Culture Documents

Market Potential of Tata AIG Life Insurance

Uploaded by

ghanshyam1988Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Potential of Tata AIG Life Insurance

Uploaded by

ghanshyam1988Copyright:

Available Formats

1

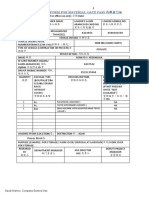

A SUMMER TRAINING PROJECT REPORT ON MARKET POTENTIAL OF TATA AIG LIFE INSURANCE

2011-12

UNDER GUIDENCE OF:

SUBMITTED BY:

Mr.Sanjeev Kumar ShivRaj

Singh MBA-IIIrd.Sem

SUBMITTED TO- Mr. Ajeet Verma ( Faculty Of Management ) CERTIFICATE

PREFACE

A comprehensive study of Financial Analysis is a supplement to the theoretical classroom knowledge. It helps to understand the subject more precisely and practical implications of various concepts.

This report tries to outline idea of professional world and helps in understanding the pragmatic aspect of management function. Own observations are significant towards the contribution in learning the subject. The report is therefore designed as a reference of organization functioning rather than copy down instrument.

The purpose of project is to make me familiar with day to day functioning of business. The present report is an effort in this direction.

My humble endeavor and motive in presenting the project report is to impart a balanced introduction and knowledge of Financial Analysis, which is an important integral part of financial management.

It is hoped that this project will serve as supportive document to research worker as efforts has been tired to make this report an informative, stimulating, and selfexplanatory.

ACKNOWLEDGEMENT

The extensive endeavor, bliss and euphoria that accompany the successful completion of any task would not be complete without the expression of gratitude to the people who made it possible. I take this opportunity to acknowledge all

those people whose guidance and encouragement has helped me in winding up this

project.

I am really grateful to Mr. Sunil Agarwal (DGM of Wimco) for guiding and

providing me with necessary help throughout the project. Without his critical and

timely suggestion, this project would never have been possible.

I wish to express my special thanks and regard to Mr P.S. CHAUHAN who

was my guide incharge of project work, who had me the necessary tips and

Supervision to carry out my project and to prepare the report.

Unfortunately, the list of expression of thank, no matter how extensive is

incomplete and inadequate. Last but not the least, I would like to extend my

heartiest gratitude to all those who had directly or indirectly responsible for the

successful completion of the project.

GHANSHYAM DAS

CONTENTS

INTRODUCTION OF INSURANCE

Insurance is a contract between two parties whereby one party called insurer undertakes in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event." Insurance may be described as a social device to reduce or eliminate risk of life and property. U n d e r t h e p l a n o f i n s u r a n c e , a l a r g e n u m b e r o f p e o p l e a s s o c i a t e t h e m s e l v e s b y s h a r i n g r i s k , a t t a c h e d t o individual. With the help of Insurance, large number of people exposed to a similar risk makes contributions to a common fund out of which the losses suffered by the unfortunate few, due to accidental events, are made good. Insurance is a tool by which fatalities of a small number are compensated out of funds collected from plenteous. Gradually as competition increased benefits given by industry to its customers increased by leaps and bounds. Insurance is a basic form of risk management which provides protection against possible loss to life or physical assets. Person who seeks protection against such loss is termed as insured, and company that promises to honor claim, in case such loss is actually incurred by insured, is termed as Insurer. In order to get insurance, insured is required to pay to insurance company a certain amount called premium. Premium is collected by insurance companies which acts as trustee to pool created through contributions made by persons seeking to protect themselves from common risk. Any loss to the insured in case of happening of an uncertain event is paid out of this pool. Insurance business is divided into four classes.

Life Insurance Fire Marine Miscellaneous Insurance. Insurance provides: Protection to investor. Accumulation of savings. Channeling these savings into sectors needing huge long term investment.

FUNCTION OF INSURANCE

Provide protection: The primary function of insurance is to provide protection against future risk, accidentsand uncertainty. Insurance cannot check the happening of the risk, but can certainly provide for the losses of risk. Insurance is actually a protection against economic loss, by sharing the risk with others. Collective bearing of risk: Insurance is an instrument to share the financial loss of few among many others. Insurance is a mean by which few losses are shared among larger number of people. All the insured contribute the premiums towards a fund and out of which the persons exposed to a particular risk is paid. Assessment of risk: Insurance determines the probable volume of risk by evaluating various factors that giverise to risk. Risk is the basis for determining the premium rate also. Provide certainty: Insurance is a device, which helps to change from uncertainty to certainty. Insurance is device whereby the uncertain risks may be made more certain. Small capital to cover larger risk: Insurance relieves the businessmen from security investments, by payingsmall amount of premium against larger risks and uncertainty. Contributes towards the development of industries: Insurance provides development opportunity to those larger industries having more risks in their setting up. Even the financial institutions may be prepared to give credit to sick industrial units which have insured their assets including plant and machinery. Means of savings and investment: Insurance serves as savings and investment, insurance is a compulsory way of savings and it restricts the unnecessary expenses by the insured's For the purpose of availing income-tax exemptions also, people invest in insurance.

The Future Of insurance industry

The insurance industry is today witness to a massive transformation from its earlier days. From a humble beginning made in 1956 since the nationalization of the industry and the birth of the life insurance corporation, the industry today sees a deluge of multinational insurers all charging in to set up shop here considering the existent vast unexploited potential.

Multinational partnership:

The winds of liberalization have initiated vast changes in the functioning of the industry today. Increasing number of multinational partnerships with private insurers have paved the way for a radial shift in insurance selling- through a number of new distribution channels besides bringing about more awareness on the need for insurance and also stressing on the important role technology can play.

With major trade barriers gone, the Indian insurance industry is slowly opening itself from a protected environment to e-business, incorporating newer technologies in insurance, thanks to competition, that will hopefully bring forth a marked improvement in customer service, insurance marketing, risk management, claim settlement, underwriting etc in comparison to its earlier days.

10

Faster decision-making:

Today, information dissemination is increasingly faster with the advent of information technology, which will largely help individuals gain access to every bit of information they would require, enabling faster decision-making. This is in start contrast with the pre-liberalization era wherein information sourcing was virtually non-existent except from the recruited agents of the insurance company.

Policy servicing, an area that has long remained neglected will now receive a major thrust with insurance companies redefining strategies to weed out sluggishness and provide the policyholder with prompt service. Online policy servicing too will soon become the norm thereby cutting down on the unnecessary delays.

Information explosion:

11

The oncoming technological revolution is all set to totally revamp the vary concept of knowledge management. Automating knowledge management will become the sole aim to increase productivity. Large database of raw information on individuals investment patterns can be fed into computers to enable faster segregation of information as per required categories.

Computerizing information can make a major difference to general insurance industry wherein motor claim losses particularly have been hitting the roof. With an organized system of data collection and storage, data analysis and claim management system, keeping track of the claim applicants behavioral patterns becomes easy.

Easier claims settlements:

Claims settlement that was hitherto a time consuming affair will see a marked difference in operations. With competition building and improved customer service becoming the new mantra, the time taken for claim settlement will reduce considerably. World over underwriting risks, claims management, risk surveys etc are far more simplified thanks to technology. Insurance companies are slowly realizing the mass difference information technology can make to business. Consider policy information being made available online. Tracking policy

12

details, the premiums to be paid, premiums paid so far, the bonus percentage, maturity date of the policy and several such details can be accessed at the mere click of a mouse soon.

Bank assurance:

Moreover, in addition to the single distribution channel of selling insurance policies through a large network of agents, bancassurance is gradually gaining prominence. Utilizing the extensive network of banks for selling insurance will over a period of time bring about an increase penetration in rural areas where in a large unexploited potential exists.

Improve customer service the ultimate aim:

The insurance industry, with competition hotting up is has woken up to ground realities and is in the process of implementing software solutions. Realizing the unlimited power information technology holds, insurance companies have realized the strategic deployment of technology for integrating office operation, and gaining customer confidence through improve d customer service is need of the hour. Financial burden from affecting the lives of our loved once. Yet, most of us never insure a part of us that is much more important.

13

Not only van a disabled person not work but he or she has to undergo extensive medical regimes while still incurring the daily costs of living and health insurance is not enough to circumvent the perils associated with permanent disability. A recent study conducted abroad found that although 96 percent of seriously ill people had medical insurance over a third of them lost everything that they owned and maintained owing to their disability.

After all, a disabled person still needs to eat and drink like the rest of normal human society. Given the fact that he or she is disabled now requires extra care from the family or paid professional help that eventually uses up the funds much beyond what they might have earned. People may be put off by the price of disability insurance but the only reason why the policy premiums are higher is because there is much greater chance of you actually needing the policy.

Most of the Indian insurance policies have an inbuilt disability clause. So the next time any agent tries to sell you a life insurance policy, do inquire more about the disability clauses.

Also, check out the definition disabled in the policy that the agent offers since you must be insured for your chosen occupation. At times, a disability may stop you from working at your current job but still kicks you perform other activities. Do verify if there is coverage offered for partial disability since it could be the moot point between over taxing yourself

14

worsening. Your condition and being able to achieve the needful by performing whatever amount of work seems prudent.

Also, look for a policy that holds a guarantee and is non cancelable. Guaranteed policies where the payment stays fixed. Non-cancelable policy stays in effect regardless of whatever the might happen and as long as premium is paid from time to time.

Finally, the last option is map to calculate the how much actual cover you may be having currently or might need in the times to come. An insurance cover of Rs. 1 lakh may have been adequate when you started and earned Rs. 3,000 per month. But it sure will be insufficient now that you have risen up in the world and your salary has risen to over Rs. 20,000 per month.

Keep your interests in your mind while choosing insurance policy and you will never regret it. After all, in the materialistically inclined times where we subsist, self-center ness is the only truly justifiable prerogative in life.

MEANING OF LIFE INSURANCE

15

Life insurance is a contract under which the insurer (Insurance Company) in Consideration of a premium paid undertakes to pay a fixed sum of money on The death of the insured or on the expiry of a specified period of time Whichever is earlier. In case of life insurance, the payment for life insurance policy is certain. The Event insured against is sure to happen only the time of its happening is not known. So life insurance is known as Life Assurance . The subject matter of insurance is life of human being. Life insurance provides risk coverage to the life of a person. On death of the person insurance offers protection against loss of income and compensate the titleholders of the policy.

ORIGIN OF LIFE INSURANCE

Almost 4,500 years ago, in the ancient land of Babylonia, traders used to bear risk of the caravan trade by giving loans that had to be later repaid with interest when the goods arrived safely. In 2100 BC, the Code of Hammurabi granted legal status to practice. That, perhaps, was how insurance made its beginning. Life insurance had its origins in ancient Rome, where citizens formed burial clubs that would meet the funeral expenses of its members as well as help survivors by making some payments. As European civilization progressed, it social institutions and welfare practices also got more and more refined. With the discovery of new lands, sea routs and the consequent growth in trade, medieval guilds took it upon themselves to protect their member traders from loss on account of fire, shipwrecks and the like. Since most of the trade took place by sea, there was also the fear of pirates. So these guilds even offered ransom for members held captive by pirates. Burial expenses and support in times of sickness and poverty were other services offered. Essentially, all these revolved around the concept of insurance or risk coverage. Thats how old these concepts are, really.

ROLE OF THE LIFE INSURANCE

16

Life insurance as an investment: Insurance products yield more than any other investment instruments and it also provides added incentives or bonus offered by insurance companies. Life insurance as risk cover: Insurance is all about risk cover and protection of life. Insurance provides a unique sense of security that no other form of invest can provide. Life insurance as tax planning: Insurance serves as an excellent tax saving mechanism.

INSURANCE & MYTH

Back to the 17th century. In 1963, astronomer Edmond Hally constructed the first mortality table to provide a link between the life insurance premium and the average life spans based on statistical laws of mortality and compound interest. In 1756, Joseph Dodson reworked the table, linking premium rate to age.

Enter companies

17

The first stock companies to get into the business of insurance were chartered in England in 1720. The year 1735 saw the birth of the first insurance company in the American colonies in Charleston, SC.

In 1759, the Presbyterian Synod of Philadelphia sponsored the first life insurance corporation in America for the benefit of ministers and their dependents.

However, it was after 1840 that the life insurance really took off in a big way. The trigger: reducing opposition from religious groups.

The growing years.

The 19th century saw huge developments in the field of insurance, with newer products being devised to meet the growing needs of urbanization and industrialization.

In 1835, the infamous New York fire drew peoples attention to the need to provide for sudden and large losses. Two years later, Massachusetts became the first state to require companies by law to maintain such reserves. The great Chicago fire of 1871 further emphasized how fires can cause huge losses in densely populated modern cities. The practice

18

of reinsurance, whether in the risks are spread amount several companies, was devised specifically for such situations.

With the advent of the automobile, public liability insurance, which first made its appearance in 1880s gained importance and acceptance.

In the 19th century, many societies were founded to insure the life and health of their members, with fraternal orders provided low cost, members only insurance.

Even today, such fraternal orders continue to provide insurance coverage to members as do most labour organizations. Many employers sponsors group insurance policies for their employees, providing not just life insurance, but sickness and accidents benefits and old age pensions. Employees contribute a certain percentage of premiums for these policies.

ORGANISATION STRUCTURE OF INSURANCE COMPANY

19

Board of Directors

Local board of Directors

company secretary

Chief general manager

Assistance general manager

Board of directors

20

The function of board of directors is to formulate the overall plan of action for the company in the best interests of the owners taking into account the interests of policyholders, staff, the public and the effect of

market competition. The board is responsible for the overall direction of the company and for selecting officers to manage it.

Local board of directors

Some companies have board of directors attached to local offices, they are non-executive and are appointed to promote the interests of the company locally and give advice on local affairs to the branch manager.

General manager

21

The chief general manager is the chief executive of company and is assisted by deputy and several assistants depending upon the size of the company.

The chief general is charged with the responsibility of implementing the policy laid down by the board. Each assistance general manager has given area of responsibility.

Company secretary

The responsibilities are those of administration of organization and ensuring the company complies with company and insurance laws.

Management services

The activities and costs of a large insurance company are so vast that separate departments have been set department of specialists to advice on any change in plan, which may be necessary in future.

Personnal

22

It is essential that any large organization be well staffed with the right kind of people, which is primarily the job of the personnel department.

Investments

The large funds of insurance company have to be effectively managed; the long term and shortterm investments of a company are looked into by the investment manager for security and income.

Geographical form

Head office

23

Head office administration

Regional Office

Regional Office

Regional Office

Main Branch

Main Branch

Main Branch

Sales Office

Sales Office

Sales Office

Head office

It is the main controlling office of the insurance company. The main burden of management and underwriting work is carried out in head office.

24

Regional offices

Some companies operate on party decentralized system where certain zonal or regional offices have underwriting authority for branches within their region.

Main-branches

They are responsible, for underwriting with their area and that of their sub-branches. They control the operations of sub-branches and report to regional offices.

25

Sub-branches

Sub-branches are the first level offices for an insurance company. The prime purpose of subbranch is to promote sales promotion in their respective areas.

Regional system

Under this system the country was divided into regions office, it took over the underwriting policy drafting and claims work from the head office.

26

IMPORTANCE OF THE LIFE INSURANCE

Protection against untimely death: Life insurance provides protection to the dependents of the life insured and the family of the assured in case of h i s u n t i m e l y d ea t h . Th e d ep en d en t s o r f am i l y m em b er s ge t a f i x ed s u m o f mo n ey i n c a s e of d ea t h o f th e assured.

Saving for old age: After retirement the earning capacity of a person reduces. Life insurance enables a person to enjoy peace of mind and a sense of security in his/her old age.

Promotion of savings: Life insurance encourages people to save money compulsorily. When life policy is taken, the assured is to pay premiums regularly to keep the policy in force and he cannot get back the premiums, only surrender value can be returned to him. In case of surrender of policy, the policyholder gets the surrendered value only after the expiry of duration of the policy.

Initiates investments: Life Insurance Corporation encourages and mobilizes the public savings and canalizes the same in various i n v es t m en t s f o r t h e ec o n o mi c d ev e l o p m en t of th e c o un t r y . Li f e i n s u r a n c e i s an i mp or t a n t t o o l f o r th e mobilization and investment of small savings.

Credit worthiness: Life insurance policy can be used as a security to raise loans. It improves the credit worthiness of business.

Social Security: -

27

Life insurance is important for the society as a whole also. Life insurance enables a person to provide for education and marriage of children and for construction of house. It helps a person to make financial base for future.

Tax Benefit: Under the Income Tax Act, premium paid is allowed as a deduction from the total income under section 80C.

INSURANCE CYCLE

28

Policy Renewal/Change Options/Application:The Insurance Cycle begins each year with the insurance offer. Actuarial documents are published annually by the Risk Management Agency (RMA). The actuarial documents list the plan of insurance, crop, type, variety, and practice that may be insured in a state and county, and show the amounts of insurance, available insurance options, levels of coverage, price elections, applicable premium rates, and subsidy amounts. The Special Provisions of Insurance list program calendar dates, and general and special statements which may further define, limit, or modify coverage. Sales Closing/Cancellation/Termination Dates: -Insurance applications must be completed and signed no later than the sales closing date specified in the crop actuarial documents. Applications signed after the crop sales closing date may be rejected by the insurance provider. Insurance coverage is continuous and can be cancelled by either the insurance provider or the policyholder for the following crop year by providing a written notice to the other party no later than the cancellation date specified in the crop policy. For a policyholder insured the previous crop year, any changes he or she wishes to m a k e t o t h e p o l i c y c o v e r a g e m u s t b e m a d e o n o r b e f o r e t h e c r o p s a l e s c l o s i n g d a t e . T h e p o l i c y w i l l automatically renew for the subsequent crop year unless the policyholder cancels the policy in writing on or before the crop cancellation date. Insurance coverage may be terminated by the insurance provider for the following crop year for nonpayment of outstanding debt by providing a written notice to the policyholder no later than the termination date specified in the crop policy. The insurance provider may terminate coverage on a crop if no premium is earned for three consecutive years. Acceptance:Upon receipt of a properly completed and timely submitted insurance application, the insurance provider will accept and process the application, unless the applicant is determined to be ineligible under the contract or Federal statute or regulation. The insurance provider will issue a summary of coverage and the appropriate policy documents to the applicant. After the application is accepted, the policyholder may not cancel the policy for the initial crop year. Insurance Attaches: For annual crops, insurance attaches annually when planting begins on the insurance unit. The crop must be planted on or before the crops published final planting date unless late or prevented planting provisions apply. If prevented planting provisions apply, and the crop cannot be timely planted due to the causes specified in the crop provisions, such acreage may be eligible for a prevented planting payment. Acreage Reports:-

29

Th e p o l i c yh o l d er mu s t an n u a l l y r ep o r t f or ea c h i n s u r ed c r o p i n th e c ou n t y th e n u mb er o f i n s u r a b l e a n d uninsurable acres planted or prevented from being planted if prevented planting is available for the crop, the date the acreage was planted, share in the crop, the acreage location, farming practices used, and types or varieties planted to the insurance provider on or before the applicable acreage reporting date specified in the crop actuarial documents. Summary of Coverage:The insurance provider will process a properly completed and timely filed acreage report, and issue to the policyholder a summary of coverage that specifies the insured crop, the insured acres and amount of insurance o r gu a r a n t ee f o r ea c h i n s u r an c e u n i t . Th e p o l i c y h o l d er ma y m a k e c h a n ges t o t h e f i l ed a c r ea g e r ep o r t , i f permitted by the insurance provider. Premium Billing:The annual premium is earned and payable at the time insurance coverage begins. The insurance provider shall issue a premium billing based upon the information contained in the acreage report no earlier than the premium billing date specified in the crop actuarial documents. The premium billing will specify the amount of premium and any administrative fees that may be due. If the premium or administrative fees are not paid by the date specified in the actuarial documents or policy, the insurance provider may assess interest on the outstanding premium balance. Notice of Damage or Loss: A w r i t t en n o t i c e o f d am a g e o r l o s s f o r ea c h u n i t i s t o b e f i l ed b y t h e p o l i c y h o l d er wi t h i n 72 h o ur s o f th e policyholder's initial discovery of damage or loss but not later than 15 days after the calendar date for the end of the insurance period unless otherwise stated in the individual crop policy. The policyholder should refer to the individual crop provisions for additional requirements in the event of damage or loss. These notifications provide the opportunity for the insurance provider to inspect the crop and determine the extent of damage or potential production before the crop is harvested or otherwise disposed of. Inspection: Af t er t h e i n s u r an c e p ro v i d er r ec ei v es th e w r i t t en n o ti c e o f d am a g e o r l o s s , i t wi l l b e p ro c es s ed an d, i f necessary, a loss adjuster will be sent to inspect the damaged crop and gather pertinent information concerning the damage. If the policyholder wishes to destroy or not harvest the crop, the loss adjuster will gather the appropriate information, conduct an appraisal to establish the crop's remaining value and complete any forms needed. If the crop has been harvested or will not be harvested by the end of the insurance period, and the policyholder wishes to file a claim for indemnity, the loss adjuster will gather the

30

appropriate information and assist the policyholder in filing the claim for indemnity. It is the policyholder's responsibility to establish the time, location, cause, and amount of any loss. Indemnity Claim: -After the claim for indemnity is processed by the insurance provider, an indemnity check and a summary of i n d emn i t y p ay m en t w i l l b e i s s u ed s h o wi n g a n y d ed u c t i o n s t o th e am o un t of i n d em n i t y f o r o u t s t a n di n g premium, interest, or administrative fees. Contract Change Date:Changes to the insurance program may be made by RMA from one year to the next. The insurance provider wi l l n ot i f y t h e p o li c y h o l d er i n w r i t i n g o f an y ch a n g es t o th e p o l i c y, a c t u a r i a l do c u m en t s , o r t h e S p ec i a l P r o v i s i o n s o f In s u r a n c e p r i o r t o th e c a l en d a r d a t e f o r c o n t r a c t c h a n ges s p ec i f i ed i n t h e c r o p p o l i cy . Th e policyholder will have the opportunity to review the changes and, if he/she desires, continue the insurance coverage for the following crop year, change the policy coverage, or cancel the insurance coverage. Any changes to the policy coverage that the policyholder makes must be made no later than the crop sales closing date. If the policyholder wishes to cancel the policy, a written notice must be submitted to the insurance provider on or before the crop cancellation date.

WHAT DOES LIFE INSURANCE PROVIDE?

The proceed accruing from Life Insurance Policy can be utilized for

Final expenses resulting from death Guaranteed maintenance of life style Replacement of income Mortgage or liquidation payments Cost of education Estate or other taxes Continuity or security of interest

31

NEED FOR LIFE INSURANCE

The need for life insurance comes from the need to safeguard our family. If you care for your familys needs you will definitely consider insurance. Factors such as fewer number of earning members, stress, pollution, increased competition, higher ambition etc. are some of the reason why insurance has gained importance and where insurance plays a successful role. Insurance provides a sense of security to the income earner as also to the family. Buying insurance frees the individual from unnecessary financial burden that can otherwise make him spend sleepless night. The individual has a sense of consolation that he has something to fall back on.

From the very beginning of your life, to the retirement age insurance can take care of all your needs. The child needs good education to mount him into a good citizen. After his schooling he need to go for higher studies, to gain a professional edge over the others a necessity in this age where cut throat competition in the rule. His career needs have to be fulfilled. Insurance is a must also because of the uncertain future adversities of life. Accidents, illness, disability etc. are facts of life, which can be extremely devastating. Other than the hospitalization, medication bills these may run up its the aftermath of the incidence, the physical well being of the individual that has to be taken into consideration. Will the individual in the position to earn as before? A pertinent question. But what if he is not? Disability can be taken care of by insurance. Your family will not have to go through the grind due of your present inability.

32

Insurance has become a necessity today. It provides timely financial as also rewards with bonuses. Insurance is desired to safeguard oneself and one's family against possible losses on account of risks and perils. It provides financial compensation for the losses suffered due to the happening of any unforeseen events. By taking life insurance a person can have peace of mind and need not worry about the financial consequences in case of any untimely death. Certain Insurance contracts are also made compulsory by legislation. For example, Motor Vehicles Act 1988 stipulates that a person driving a vehicle in a public place should hold a valid insurance policy covering "Act" risks. Another example of compulsory insurance pertains to the Environmental Protection Act, wherein a person using or carrying hazardous substances (as defined in the Act) must hold a valid public liability (Act) policy.

WHO PROVIDE INSURANCE

33

In India, prior to liberalization Insurance protection was made available through Public sector Insurance Companies, namely, Life Insurance Corporation of India (LIC) and the four subsidiaries of General Insurance Corporation of India (GIC). By the passing of the IRDA Bill, the Insurance sector has been opened up for private companies to carry on Insurance business. There are several private Life Insurance Companies in India namely

LIC. HDFC Standard life insurance. ICICI Prudential life insurance. SBI life insurance. Allianz Bajaj life insurance. Met life insurance. Max New York life insurance. ING Vysa life insurance. Aviva life insurance. Birla Sun life insurance. OM kotak Mahindra life insurance. TATA AIG life insurance.

WHAT IS THE PROCESS TO OBTAIN INSURANCE

The simplest procedure to obtain insurance is:

34

1. Approach the Insurance Companies directly or through Insurance agents of the concerned companies or through Intermediaries. 2. Complete a proposal from giving full details. 3. Submit Date of Birth Certificate and other relevant documents.

Insurance contracts are based on good faith i.e. the details furnished by the proposer are accepted in good faith and this will form the basis of the contract.

What are the other alternatives to Insurance?

One alternative to Insurance is to provide self-Insurance i.e. the individual has to create a fund to meet risk exigencies. Specified trusts have also tried to provide insurance by a scheme of self-insurance. However, these are not very popular. The postal department provides Insurance coverage to all working people. There are many financial instruments, which advocate savings and provide future returns at specific intervals such as the provident fund and pension plans. However, none of these provide for life coverage.

Which type of policy is best suitable?

35

The type of policy that suits you best depends on many factors, including your income, assets and liabilities, your familys expenses, number of dependent members and your insurance objectives.

Life insurance policies are broadly categorized in the: -

Whole life policies: - Cover the insured for life. The insurance does not receive the money while he is alive; the nominee receives the sum assured plus bonus upon death of the insured. A whole life policy offers the highest bonus and cost less.

Endowment policies: - Cover the insured for specific period. The insured receives the money on survival of the term and is not covered thereafter. These are more expensive than whole life policies.

It is broadly classified into two types with bonus and without bonus. With bonus policies offer more than the sum assured on survival of the term, where as without bonus policies offer only the sum assured.

With bonus policies are further classified into 3 broad types:

36

Endowment with profit - The nominee receives the money immediately on the death of the insured. On survival the insured receives the money only at the end of the term. Money back policies: The nominee receives money immediately on the death of the insured. On survival the insured receives money at regular intervals during the term. These policies cost more than endowment with profit policies. Annuities / Childrens policies: The nominee receives a guaranteed amount of money at a predetermined and not immediately on death of the insured. On survival the insured receives money at the same pre-determined to me. These policies are best suited for planning childrens future education marriage cost. Pension schemes These policies are providing benefit to the insured only upon retirement. If the insured dies during the term of the policy, his nominee would receive the benefits either as a lump sum or as a pension every month.

37

Riders and Their Work:

A rider on the insurance contract provides additional protection against risk. You can buy a basic insurance policy and add riders to the policy to include extra protection such as additional accident cover, disability cover, critical illness cover, hospitalization benefits, etc.

However you need to pay additional charge (premium) towards rider coverage but these additional charges are normally lower than individual policies that provide the same benefits. If the event that has been insured against through riders coverage occurs, you or your beneficiaries will be paid riders benefits in addition to the basics benefits under the insurance contract. Riders: An addition to Policy Riders are options that allow you to enhance your life cover, qualitatively and quantitatively. They are optional and available in the variety of combinations. Premiums on riders are far lower than premiums on the base policy because insurers do not have to factor in the set cost of the risk cover, particularly the actuarial and underwriting expenses. In the other words, riders provide low cost pure risk cover. They have to be however what along with the base policy; you cannot keep adding riders through the tenure of a policy. Riders, if selected policy based on your insurance needs, can add great value to your life cover.

38

Pension policies: -

Pension policies are personal investment specially designed to help you earn a regular income even after you stopped working. Through this plan, you build a fund till you retire which provide your financial securities on your retirement. The decision to buy a pension product depends on the responsibilities and future financial needs of an individual. Typically a pension needs 75 to 80 per cent of the expenses during working life in his post retirement days to insure a comfortable life post retirement. Investing in the pension fund from a life insurance company helps save regularly for retirement. A key advantage of investing in pensions over certain other savings in that there is a tax rebate premiums paid up to Rs 10,000 per year irrespective of the income levels.

Pension Plans: life cover: -

The key objective of the pension product which to save and build a corpus for post retirement needs. Pension products in India are available with and without a life cover. Ideally pension products shouldnt have and in build life cover so that the entire premium can go towards building the saving element. It is, however, important to make sure a plan to mitigate loss of regular income due to death of the income provider he set up to provide and income to the spouse and children in the event of premature death.

39

GLOSSARY OF INSURANCE

Actual Cash Value An amount equivalent to the fair market value of the stolen or damaged property immediately preceding the loss. For real property, this amount can be based on a determination of the fair market value of the property before and after the loss. For vehicles, this amount can be determined by local area private party sales and dealer quotations for comparable vehicles. Admitted Company An insurance company authorized to do business in California. Agent A licensed person or organization authorized to sell insurance by or on behalf of an insurance company. Aircraft Insurance Coverage for the insured in the event that the insured's negligent acts and/or omissions result in losses in connection with the use, ownership, or maintenance of aircraft. Automobile Insurance Coverage on the risks associated with driving or owning an automobile. It can include collision, liability, comprehensive, medical, and uninsured motorist coverages. Binder A temporary or preliminary agreement which provides coverage until a policy can be written or delivered. Bodily Injury Any physical injury to a person. The purpose of liability insurance is to cover bodily injury to a third party resulting from the negligent or unintentional acts of an insured.

40

Boiler and Machinery Insurance Covers losses resulting from the malfunction of boilers and machinery. This coverage is usually excluded from property insurance creating the need for this separate product. Broker A licensed person or organization paid by you to look for insurance on your behalf. Burglary Coverage against loss as a result of forced entry into premises. Cancellation The termination of insurance coverage during the policy period. Flat cancellation is the cancellation of a policy as of its effective date, without any premium charge. Claim Notice to an insurer that under the terms of a policy, a loss may be covered. Claimant The first or third party. That is any person who asserts right of recovery. Collision (Auto) Reimburses you for damage to your automobile sustained in a collision with another car or with any other object, movable or fixed, (for example, you accidentally backed into another object while pulling out from a parking stall and causing damage to the bumper and fender of your covered automobile).

41

Collision Deductive Waiver This coverage waves your collision deductible if you are hit by an negligent uninsured motorist. Common Carrier Liability Coverage for transportation firms that must carry any customer's goods so long as the customer is willing to pay. Examples include trucking companies, bus lines, and airlines. Comprehensive (Auto) Provides coverage for any direct and accidental loss of, or damage to, your covered automobile and its normal equipment, to include but not limited to fire, theft or malicious mischief. Comprehensive Glass Insurance Coverage on an "all risks" basis for glass breakage, subject to exclusions of war and fire. Credit Life Insurance Insurance issued to a creditor (lender) to cover the life of a debtor (borrower) for an outstanding loan. Decline The company refuses to accept the request for insurance coverage.

Deductible The amount of the loss which the insured is responsible to pay before benefits from the insurance company are payable. You may choose a higher deductible to lower your premium.

42

Depreciation A decrease in value due to age, wear and tear, etc.

Disability Insurance Health insurance that provides income payments to the insured wage earner when income is interrupted or terminated because of illness, sickness, or accident. Endorsement Amendment to the policy used to add or delete coverage. Also referred to as a "rider." Exclusion Certain causes and conditions, listed in the policy, which are not covered. Expiration Date The date on which the policy ends. Face Amount The dollar amount to be paid to the beneficiary when the insured dies. It does not include other amounts that may be paid from insurance purchased with dividends or any policy riders. Financial Guarantee Insurance A surety bond, insurance policy or, when issued by an insurer, an indemnity contract and any guaranty similar to the foregoing types, under which loss is payable upon proof of occurrence of financial loss to an insured claimant, oblige, or indemnitee.

43

Fire Insurance Coverage for loss of or damage to a building and/or contents due to fire.

Good Driver Discount To be eligible for the Good Drivers Discount all operators of the insured vehicles must have been licensed for three or more year, have no more than a one (1) point charge on their driving record and has not been determined "at fault" in an accident resulting in bodily injury or death to any person. Grace Period A period (usually 31 days) after the premium due date, during which an overdue premium may be paid without penalty. The policy remains in force throughout this period. Guaranteed Insurability An option that permits the policy holder to buy additional stated amounts of life insurance at stated times in the future without evidence of insurability. Health Insurance A policy that will pay specifies sums for medical expenses or treatments. Health policies can offer many options and vary in their approaches to coverage. Homeowner Insurance An elective combination of coverages for the risks of owning a home. Can include losses due to fire, burglary, vandalism, earthquake, and other perils.

44

Incontestable Clause A policy provision in which the company agrees not to contest the validity of the contract after it has been in force for a certain period of time, usually two years. Insured The policyholder - the person(s) protected in case of a loss or claim. Insurer The insurance company. Legal Insurance Prepaid legal insurance coverage plan sold on a group basis. Liability (Auto) Coverage for a policyholder's legal liability resulting from injuries to other persons or damage to their property as a result of an auto accident. Liability Insurance Coverage for all sums that the insured becomes legally obligated to pay because of bodily injury or property damage, and sometimes other wrongs, to which an insurance policy applies. Life Insurance A policy that will pay a specified sum to beneficiaries upon the death of the insured. Limit Maximum amount a policy will pay either overall or under a particular coverage.

45

Loan Value The amount which can be borrowed at a specified rate of interest from the issuing company by the policyholder, using the value of the policy as collateral. In the event the policyholder dies with the debt partially or fully unpaid, then the amount borrowed plus any interest is deducted from the amount payable.

Marine Insurance Coverage for goods in transit and the vehicles of transportation on waterways, land, and air.

Material Misrepresentation The policyholder / applicant make a false statement of any material (important) fact on his/her application. For instance, the policyholder provides false information regarding the location where the vehicle is garaged. Medical Payments Will pay reasonable expenses incurred for necessary medical and /or funeral services because of bodily injury caused by accident and sustained by you or any other person while occupying a covered automobile. Miscellaneous Insurance Includes insurance against loss from damage done, directly or indirectly by lightning, windstorm, tornado, earthquake or insurance under an open policy indemnifying the producer of any motion picture, television, theatrical, sport, or similar production, event, or exhibition against loss by reason of the interruption, postponement, or cancellation of such production, event, or exhibition due to death, accidental injury, or sickness preventing performers, directors, or other principals from commencing or continuing their respective performance or duties; and any insurance not included in any other classes and which is a proper subject of insurance (California Insurance Code, Section 120).

46

Misquote An incorrect estimate of the insurance premium. Mortgage Insurance Life insurance that pays the balance of a mortgage if the mortgagor (insured) dies. Peril The cause of a possible loss. For example, fire, theft, or hail. Policy The written contract of insurance. Policy Limit The maximum amount a policy will pay, either overall or under a particular coverage. Premium The amount of money an insurance company charges for insurance coverage.

Premium Financing A a policyholder contracts with a lender to pay the insurance premium on his/her behalf. The policyholder agrees to repay the lender for the cost of the premium, plus interest and fees. Pro-Rata Cancellation When the policy is terminated midterm by the insurance company, the earned premium is calculated only for the period coverage was provided. For example: an annual policy with premium of $1,000 is canceled after 40 days of coverage at the company's election. The earned premium would be calculated as follows: 40/365 days X $1,000=.110 X $1,000=$110.

47

Property Damage Damage to another person's property. The purpose of liability insurance is to cover property damage to a third party resulting from the negligent or intentional acts of an insured. Quote An estimate of the cost of insurance, based on information supplied to the insurance company by the applicant.

Replacement Cost The cost to repair or replace an insured item. Some insurance only pays the actual cash or market value of the item at the time of the loss, not what it would cost to fix or replace it. If you have personal property replacement cost coverage, your insurance will pay the full cost to repair an item or buy a new one once the repairs or purchases have been made.

Replacement Value The full cost to repair or replace the damaged property with no deduction for depreciation, subject to policy limits and contract provisions. Reinstatement The restoring of a lapsed policy to full force and effect. The reinstatement may be effective after the cancellation date, creating a lapse of coverage. Some companies require evidence of insurability and payment of past due premiums plus interest. Rider Usually known as an endorsement, a rider is an amendment to the policy used to add or delete coverage.

48

Short-Rate Cancellation When the policy is terminated prior to the expiration date at the policyholder's request. Earned premium charged would be more than the pro-rata earned premium. Generally, the return premium would be approximately 90 percent of the pro-rata return premium. However, the company may also establish its own short-rate schedule. Solicitor A licensed employee of a fire and casualty agent or broker who may act for the agent or broker in some circumstances.

Sprinkler Insurance Coverage for property damage caused by untimely discharge from an automatic sprinkler system. Surcharge An extra charge applied by the insurer. For automobile insurance, a surcharge is usually for accidents or moving violations. Surrender To terminate or cancel a life insurance policy before the maturity date. In the case of a cash value policy, the policyholder may exercise one of the non-forfeiture options at the time of surrender. Team and Vehicle Insurance Includes insurance against loss through damage or legal liability for damage, to property caused by the use of teams or vehicles other than ships, boats, or railroad rolling stock, whether by accident or collision or by explosion of engine, tank, boiler, pipe, or tire of the vehicle, and insurance against the theft of the whole or part of such vehicle (California Insurance Code, Section 115).

Title Insurance

49

Coverage for losses if a land title is not free and clear of defects that were unknown when the title insurance was written. Underwriting The process of selecting applicants for insurance and classifying them according to their degrees of insurability so that the appropriate premium rates may be charged. The process includes rejection of unacceptable risks. Uninsured Motorist Bodily Injury Will pay you and your passengers for bodily injury cause by a negligent uninsured motorist, a hitand-run driver, or by a driver whose insurer is insolvent. Uninsured Motorist Property Damage Will pay for damages to your automobile, set up to a limit, when caused by a negligent uninsured motorist. Waiting Period A period of time set forth in a policy which must pass before some or all coverages begin.

Workers Compensation Insurance Coverage providing four types of benefits (medical care, death, disability, and rehabilitation) for employee job-related injuries or diseases as a matter of right (without regard to fault). Insurance Terms Used in the Area of Sureties and Bonds Arrestee - A person in custody whose release may be secured by posting bail.

Bailee - A person or concern having possession of property committed in trust from the owner.

50

Bid Bond - A guarantee that the contractor will enter into a contract, if it is awarded to him, and furnish such contract bond (sometimes called "performance bond") as is required by terms thereof. Court Bonds - All bonds and undertakings required of litigants to enable them to pursue certain remedies of the courts. Effective Date - The date on which an insurance policy or bond goes into effect, and from which protection is furnished. Fidelity Bond - An obligation of the insurance company against financial loss caused by the dishonest acts of employees. Judicial Bond - A bond required in civil and criminal court actions. Named Schedule Bond - A fidelity bond providing coverage for persons listed or scheduled on the bond. Obligee - Broadly, anyone in whose favor an obligation runs. Frequently used in surety bonds, this refers to the person, firm or corporation protected by the bond. Obligor - Commonly called "principal," one bound by an obligation. Under a bond, strictly speaking, both the principal and the surety are obligers.

Power of Attorney - Authority given one person or corporation to act for and obligate another, to the extent laid down in the instrument creating the power. Principal - A person or organization whose obligation are guaranteed by a bond.

51

Surety - An arrangement whereby one party becomes answerable to a third party for the acts of a second party. Customarily an insurance company, the party in a surety ship arrangement who holds himself responsible to one person for the acts of another. Surety Bond - A bond which the surety agrees to answer to the oblige for the non-performance of the principal (also known as the obligor). .

WHAT ARE THE OTHER BENEFITS OF TAKING INSURANCE

52

1. Tax Relief: Under Section 80C of Income Tax Act, a portion of premiums paid for life insurance policies are deducted from tax liability. Similarly, exemption is available for Health Insurance Policy premiums. a. Money paid as claim including Bonus under a life policy is exempted from payment of Income Tax. However annuities received under certain pension plans are taxable. 2. Encourages Savings: An insurance scheme encourages thrift among individuals. It inculcates the habit of saving compulsorily, unlike other saving instruments, wherein the saved money can be easily withdrawn. 3. The beneficiaries to an insurance claim amount are protected from the claims of creditors by affecting a valid assignment. 4. For a policy taken under the MWP Act 1874, (Married Women's Property Act), a trust is created for wife and children as beneficiaries. 5. Life Policies are accepted as a security for a loan. They can also be surrendered for meeting unexpected emergencies. 6. Based on the concept of sharing of losses, the society will benefit as catastrophic losses are spread globally.

53

INTRODUCTION TO INDIAN INSURANCE INDUSTRY

In India, insurance has a deep-rooted history. It finds mention in the writings of Manu ( Manusmrithi ), Yagnavalkya ( Dharmasastra ) and Kautilya ( Arthasastra ). The writings talk in terms of pooling of resources that could be re-distributed in times of calamities such as fire, floods, epidemics and famine. This was probably a pre-cursor to modern day insurance. Ancient Indian history has preserved the earliest traces of insurance in the form of marine trade loans and carriers contracts. Insurance in India has evolved over time heavily drawing from other countries, England in particular. 1818 saw the advent of life insurance business in India with the establishment of the Oriental Life Insurance Company in Calcutta. This Company however failed in 1834. In 1829, the Madras Equitable had begun transacting life insurance business in the Madras Presidency. 1870 saw the enactment of the British Insurance Act and in the last three decades of the nineteenth century, the Bombay Mutual (1871), Oriental (1874) and Empire of India (1897) were started in the Bombay Residency. This era, however, was dominated by foreign insurance offices which did good business in India, namely Albert Life Assurance, Royal Insurance, Liverpool and London Globe Insurance and the Indian offices were up for hard competition from the foreign companies. In 1914, the Government of India started publishing returns of Insurance Companies in India. The Indian Life Assurance Companies Act, 1912 was the first statutory measure to regulate life business. In 1928, the Indian Insurance Companies Act was enacted to enable the Government to collect statistical information about both life and non-life business transacted in India by Indian and foreign insurers including provident insurance societies. In 1938, with a view to protecting the interest of the Insurance public, the earlier legislation was consolidated and amended by the Insurance Act, 1938 with comprehensive provisions for effective control over the activities of insurers. The Insurance Amendment Act of 1950 abolished Principal Agencies. However, there were a large number of insurance companies and the level of competition was high. There were also allegations of unfair trade practices. The Government of India, therefore, decided to nationalize insurance business. An Ordinance was issued on 19th January, 1956 nationalizing the Life Insurance sector and Life Insurance Corporation came into existence in the same year. The LIC absorbed 154 Indian, 16 non-Indian insurers as also 75 provident societies245 Indian and foreign insurers in all. The LIC had monopoly till the late 90s when the Insurance sector was reopened to the private sector. The history of general insurance dates back to the Industrial Revolution in the west and the consequent growth of sea-faring trade and commerce in the 17th century. It came to India as a legacy of British occupation. General Insurance in India has its roots in the establishment of Triton Insurance Company Ltd., in the year 1850 in Calcutta by the British. In 1907, the Indian Mercantile Insurance Ltd, was set up. This was the first company to transact all classes of general insurance business. 1957 saw the formation of the General Insurance Council, a wing of the Insurance Associaton of

54

India. The General Insurance Council framed a code of conduct for ensuring fair conduct and sound business practices. In 1968, the Insurance Act was amended to regulate investments and set minimum solvency margins. The Tariff Advisory Committee was also set up then. In 1972 with the passing of the General Insurance Business (Nationalisation) Act, general insurance business was nationalized with effect from 1st January, 1973. 107 insurers were amalgamated and grouped into four companies, namely National Insurance Company Ltd., the New India Assurance Company Ltd., the Oriental Insurance Company Ltd and the United India Insurance Company Ltd. The General Insurance Corporation of India was incorporated as a company in 1971 and it commence business on January 1sst 1973. This millennium has seen insurance come a full circle in a journey extending to nearly 200 years. The process of re-opening of the sector had begun in the early 1990s and the last decade and more has seen it been opened up substantially. In 1993, the Government set up a committee under the chairmanship of RN Malhotra, former Governor of RBI, to propose recommendations for reforms in the insurance sector. The objective was to complement the reforms initiated in the financial sector. The committee submitted its report in 1994 wherein , among other things, it recommended that the private sector be permitted to enter the insurance industry. They stated that foreign companies be allowed to enter by floating Indian companies, preferably a joint venture with Indian partners. Following the recommendations of the Malhotra Committee report, in 1999, the Insurance Regulatory and Development Authority (IRDA) was constituted as an autonomous body to regulate and develop the insurance industry. The IRDA was incorporated as a statutory body in April, 2000. The key objectives of the IRDA include promotion of competition so as to enhance customer satisfaction through increased consumer choice and lower premiums, while ensuring the financial security of the insurance market. The IRDA opened up the market in August 2000 with the invitation for application for registrations. Foreign companies were allowed ownership of up to 26%. The Authority has the power to frame regulations under Section 114A of the Insurance Act, 1938 and has from 2000 onwards framed various regulations ranging from registration of companies for carrying on insurance business to protection of policyholders interests. In December, 2000, the subsidiaries of the General Insurance Corporation of India were restructured as independent companies and at the same time GIC was converted into a national re-insurer. Parliament passed a bill de-linking the four subsidiaries from GIC in July, 2002.

INTRODUCTION TO TATA AIG

55

TATA AIG INSURANCE COMPANY:Tata Enterprises with 82 companies, spread over seven sectors and with an annual turnover exceeding US $8.8 billion, employs more than 262,000 people. Tata Group has shown over years that it is a value driven company and has pioneering contributions in various fields including insurance, aviation, iron and steel. In terms of capital market performance as many as 40 listed Tata companies account for nearly 5% of the total market capitalization of all listed companies. The Group has had a long association with India's insurance sector having been the largest insurance company in India prior to the nationalization of insurance. TATA GROUP IN INSURANCE: Tata AIG General Insurance Company Ltd, and Tata AIG Life Insurance Company Ltd., (collectively "Tata AIG") are joint venture companies between the Tata group India's most trusted industrial house and American I n t er n a t i on a l G r o u p , In c . ( A I G) , t h e l e a d i n g U . S . b a s ed i n t er n a t i o n a l i n s u r an c e an d f i n a n c i a l s er v i c es organization. The Late Sir Dorab Tata, was the founder Chairman of New India Assurance Co. Ltd., a group company incorporated way back in 1919. Government of India took over the management of this company as a part of nationalization of general insurance companies in 1972. Not deterred by the move, Tata group have ventured into risk management services having tied up with AIG group, back in 1977, with the incorporation of Tata AIG Risk Management Services Pvt. Ltd. The Tata Group is one of India's largest and most respected business conglomerates, with revenues in 2006-07 of $28.8 billion (Rs129,994 crore), the equivalent of about3.2 per cent of the country's GDP, and a market capitalization of $72.2 billion as on December 6, 2007. Tata companies together employ some 289,500 people.

INTRODUCTION TO AIG

American International Group, Inc. (AIG), is a major American insurance corporation based at the American International Building in New York City. The British headquarters are located on Fenchurch Street in London,

56

continental Europe operations are based in La Defense, Paris, and its Asian HQ is in Hong Kong. According to the 2008 Forbes Global 2000 list, AIG was the 18th-largest company in the world.

Company Background: AIGs history dates back to 1919, when Cornelius Vander Starr established an i n s u r a n c e a gen c y i n Sh a n gh a i , Ch i n a . S t a r r w a s th e f i r s t Wes t e r n er i n Sh a n gh ai t o s el l i n s u r an c e t o t h e Chinese. In 1962, Starr gave management of the company's less than successful U.S. holdings to Maurice. \ " Ha n k \ " G r e en b er g , wh o s h i f t ed t h e c o mp an y' s U . S . f o cu s f r om p er s o n a l i n s u r an c e t o h i g h . 1 9 6 9 . American International Group, Inc is the leading U.S. based international insurance and financial services organization and the largest underwriter of commercial and industrial insurance in the United States. Its member companies write a wide range of commercial and personal insurance products through a variety of distribution channels in over 130 countries and jurisdictions throughout the world. AIG's Life Insurance operations comprise of the most extensive worldwide network of any life insurer. AIG's global businesses also include financial services and asset management, including aircraft leasing, financial products, trading and market making, consumer finance, savings products. THE JOINT VENTURE: Tata AIG Life Insurance Co. Ltd. is capitalized at Rs. 185 crores of which 74 per cent has been brought in by Tata Sons and the American partner brings in the balance 26 per cent. Mr. George O men has been named managing director of Tata AIG Life. Tata-AIG plans to provide broad array of life insurance plans to cover to b o th i n di vi d u a l s an d gr o u p s . Th e c o m p a n y h ea d q u a r t e r e d i n Mu m b a i , wi t h b r a n c h o p er a t i o n s i n De l h i , Chennai, Hyderabad, Bangalore Calcutta, Pune and Chandigarh.

ABOUT TATA-AIG: Tata AIG Insurance Solutions is one of the leading insurance companies that provide both life insurance as well as general insurance. This pioneer company is a joint collaboration between the American International G r o up , I n c . ( AI G ) an d Ta t a G r o u p . Th ey o wn t h e c o mp an y i n t h e r a t i o o f 2 6 : 7 4 . I t i s a l ea d i n g f i n a n c i a l institution that has carved a niche for itself all over the world. Tata AIG Insurance provides facilities to both corporate and individuals. Starting its operations on April 1, 2001, it seeks to serve different categories of people. It acquired its license for carrying out

57

operations in India on February 12, 2001. Tata AIG Insurance S o l u t i o n s i s o n e o f th e mo s t p r es t i gi o u s o r gan i z a t i on s i n t h e bu s i n es s wo r l d . I t em p l o ys th o u s an d s of employees and offers various opportunities to people to build a prospective career. As a leading name in the financial world, it identifies the potential and experience of the individual. This insurance company identifies the clients needs and works accordingly. It stresses on innovative aspect and opening of new markets. It believes in new economy and latest Internet technology. Tata AIG Insurance offers a number of products for the General Insurance holders. General insurance products include: Individual insurance Small business insurance Corporate insurance

Ta t a A I G I n s u r an c e of f er s f l ex i b l e l i f e i n s ur a n c e t o t h e i n d i v i du a l s , bu s i n es s o r g a n i z a t i o n an d o t h er association. For the corporate, there are various insurance products like group pensions, employee benefits ,work place solutions and credit life. For the individuals, Tata AIG Insurance offers various products for adults, children and for retirement planning.

TATA AIG AND AMERICA

It may not be very high-decibel at present by the Indian insurance industry is undergoing a transformation. Not much had changed in the insurance sector since its beginnings in the early-19 th century. But a strong gust of wind in the late-1990s finally saw change blowing over this sector.

With private players venturing into insurance with a handful of blue-rib and foreign coalitions, the insurance scene in the Indian subcontinent has changed rapidly. Whats more, the sharper competition even has monoliths Life Insurance Corporation of India (LIC) and New India Assurance Company Ltd. (NIA), the strongest subsidiary of General Insurance Corporation of India (GIC), on their toes.

58

According to IRDA figures, private players in the insurance sector in India have already garnered over a 20 per cent market share in the last four years. Thats an achievement when compared to the growth rates of countries like South Korea and Thailand where the private sector took around 15 years to gain a 15 per cent share of the market. India has 14 private players in life insurance and 12 players in the general insurance sector.

Private players are introducing world-class insurance products and services in the Indian market. IRDA, the insurance regulator, has played a key role in regulating and discipline the market, besides helping to fun the insurance business prudently as well as helping insurers to build a very strong base. The government of India has been encouraging more insurance companies to invest in the country, as the opening up of the insurance industry will create more employment.

The Indian insurance industry has seen it all, from being an open competitive market to being nationalized and back to being a liberalized market. The entry of private players in 2001 changed the dynamics of the industry and set new parameters for success. The per capita spend on insurance in India, according to one estimate, is nine dollars as compared with $2.500 in the US and $50 to 100 in Southeast Asia. Industry watchers believe the rise in the number of nuclear families will provide an impetus for growth. However, this needs to be supported with parallel developments in the industry.

59

Tracing the developments in the Indian insurance sector reveals a 360-degree turn witnessed over a period of almost two centuries. The business of life insurance in India in this existing from started in 1818 with the establishment of the Oriental Life Insurance Company in Kolkata. The general insurance business in the country, on the other hand, can trace its roots to Triton Insurance Company Ltd. The first general insurance company established in 1850 in Kolkata by the British.

In 1993, the Malhotra Committee headed by former finance secretary and RBI governor R.N. Malhotra was formed to evaluate the Indian insurance industry and recommend its future direction. The committee was set up with the objective of complementing the reforms initiated in the financial sector. The reforms were aimed at creating a more efficient and competitive financial system suitable for the requirements of the economy keeping in mind the structural changes that were underway and recognizing that insurance was an integral part of the overall financial system.

Tata AIG Life: Rapid Strides

Tata AIG Life Insurance Company Ltd., one of Indias leading private sector life insurance companies with its headquarters in Mumbai, has been growing from strength to strength since its inception in 2001. Tata AIG Life Insurance Company Ltd., and Tata AIG General Insurance Company Ltd., (collectively called Tata AIG) is joint venture companies formed by the coming together of the Tata group and American International Group Inc., (AIG). Tata AIG offers both life and general insurance. It represents the trust and integrity of Tata group combined with the international expertise and financial strength of AIG, Inc. The Tata group holds 74 per cent stake in the two insurance ventures while AIG hold the balance 26 per cent stake.

60

The insurance sector in the country has been opened to private players. The insurance business is not new in India, but the Indian insurance industry post-liberalization is still in its nascent stage. Though the private sector has been operating in the insurance industry for barely four years, it has made tremendous progress.

Tata AIG Life provides insurance solutions to individuals and corporate. The company was licensed to operate in India on February 12, 2001 and started operations on April 1, 2001. Today it offers a broad array of life insurance coverage to both individuals and groups with various types of add-ons and options available on basic life products to give consumers flexibility and choice. The non-life insurance arm, Tata AIG General Insurance Company, which started its operation in India on January 22, 2001, offers the complete range of insurance for automobile, home, personal accident, travel, energy marine, property and casualty, as well as several specialized financial lines.

The Trustworthiness of Tatas

The Tata group, Indias most recognized business group founded by Jamsetji Tata, began with a textile mill in central India in the 1780s. It is Indias bet-known industrial group with an estimated turnover of around US $ 14.25 billion (equivalent to 2.6 per cent of Indias GDP). Known for its adherence to business ethics, it is Indias most respected private business group. With more than 2,20,000 employees across Indias largest employer in the private sector.

61

The Tata groups early years were inspired by the spirit of nationalism. In fact, the group pioneered the several firsts in Indian industry: Indias first private sector steel industry, first private sector power utility, first luxury hotel chain and first international airlines, among others. In most recent times, the Tata groups pioneering spirit continues to be showcased by companies like Tata Consultancy Services (TCS), currently Asias largest software and services company, and Tata Motors, the first carmaker in a developing country to design and produce a car from the ground up. By combining ethical values with business acumen, globalization with national interest and core business with emerging ones, the Tata group aims to the largest and most respected global brand from India while fulfilling its long-standing commitment to providing the quality of life of its stakeholders. The fundamental part of insurance is trust. The Tata name symbolizes trust and the financial strength of Tata AIG, making Tata AIG the trust worthiest and customer focused insurance company, which looks at the long-term needs of the customers.

AIG: Financial Strength

American international group, Inc (AIG) is the worlds leading insurance and financial services organization with operations in about 130 countries and jurisdiction. AIG members companies serve commercial, institutional and individual customers through the most extensive worldwide property, casualty and life insurance network of any insurer.

62

In the US, AIG is the largest underwriter of commercial and industrial insurance and is one of the top three-life insurers. AIGs global businesses also include financial services, retirement savings and asset management. Its financial services businesses include aircraft leasing, financial products and trading.

AIGs growing global consumer finance business is led in the US by American General Finance. AIGs also has one of the largest US retirement savings businesses through AIG Sun America and AIG VALIC and is a leader in asset management for the individual and institutional market with specialized investment management capabilities in equities, fixed income, alternatives investments and real estate. AIGs common stock listed in the NYSE as well as stock exchange in London, Paris, Switzerland and Tokyo.

The life insurance industry in India has been facing fierce competition with around 14 players already in the market. Several other private players are expected to set up shop soon. With growing FDI inflow, there are a number of emerging players who are poised to make the market even more competitive in the near future. The countrys insurance market is vast, thanks to the lack of development and low penetration level, especially in rural area.

63

Building Marketing Muscle

Some of the new private insurance players are mainly focusing on banc assurance. Tata AIG Life being a multi channel and multi products company, there are several ways of reaching the customers through various channels banc assurance is a very important part of its distribution network and contributes considerably to Tata AIG Lifes growth.

It has currently five partners and are open to establishing additional tie-up. It is looking for other distribution channels like agencies, corporate agencies, brokerage houses, and rural and direct marketing channels, which will drive its growth.

Tata AIG Life has a total of 46 branch offices spread across 25 cities across the country. It has over 30,000 individual advisors and close to 200 distribution partners. Its unique selling proposition is to anticipate future insurance and saving needs and provide innovative products to fulfill these needs.

64

Tata AIG Lifes key individual life product: -

MahaLife (the only limited payment whole life product in the market offering a pay-out of a guaranteed 5 % of the sum assured every year after the premium paying term till age 100).

Nirvana (a unique pension product with both life cover and guaranteed additions),

HealthFirst (a comprehensive hospitalization plan recovering critical illness and surgeries),

65

Invest Assure (a fully flexible unit linked insurance plan).

SubhLife (a flexible endowment product and an ideal savings instrument with the dual benefit of systematic savings and life saver ).

Money Saver (the only moneyback plan which returns a guaranteed amount of 10 % of the sum assured every three years).

Star Kid (a child endowment policy with a guaranteed addition of 50 % of the premium).

Life Plus (a special term plan that not only covers you but also returns all your premium payments if you outlive the policy).

In fact, Tata AIG Life was the first private insurance company to offer group superannuation and gratuity. It is also the only private insurance company to offer traditional and unit linked comprehensive superannuation and gratuity scheme.

66

The Fact of Policies

MahaLife: Tata AIG Lifes MahaLife policy presents a safe investment to your child through life. The best part is that you only pay premium for the first 12 years after which your child gets an income as well as insurance cover for the rest of his life. This policy can also be bought as a retirement scheme. The star benefit of Maha Life is the guaranteed 5 % coupon (on the sum assured) every year for the rest of the insureds life from the thirteenth year of the policy. This is in addition to the sum assured that you get at the end of the policy. Apart from this, you also get non-guaranteed cash dividend from the sixth year onwards depending on the performance of the company.

SubhLife: It offers the flexibility of choosing the term of the policy from 10, 15, 20, 25 to 30 years. It also offers the flexibility of choosing the premium paying term. For example, if you make 25 years investment, you can spread the payment of premium over 3, 5, 7, 10 or even 25 years.