Professional Documents

Culture Documents

Vat 213

Uploaded by

Sridhar EluvakaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vat 213

Uploaded by

Sridhar EluvakaCopyright:

Available Formats

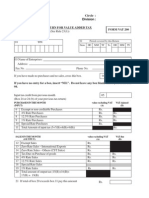

FORM VAT 213 RETURN FOR REPORTING UNDER / OVER DECLARATION OF INPUTS/OUTPUTS AND VALUE ADDED TAX [See

Rule 23(6)(a)] Date Month 01. Tax Office Address: _____________________________________ _____________________________________ _____________________________________ 02 TIN

Year

03. Name _______________________________________________________________________________________ Address _____________________________________________________________________________________ ____________________________________________________________________________________

04. Examination

of my records has shown that the correct amount of Value Added Tax in the return for tax period ______________ was not declared / over declared. Please find a true and correct summary of my monthly Return as below. The errors were due to ___________________________________________.

__________________________________________________________________________________________________

05. Input tax credit from previous month (Box 24 or 24 (b) of your previous tax return) PURCHASES IN THE MONTH (INPUT) 6 7 8 9 10 11 Exempt or non-creditable Purchases 4% Rate Purchases 12.5% Rate Purchases 1% Rate Purchases Special Rate Purchases Total Amount of input tax (5+7(B)+8(B)+9(B)) Value excluding VAT (A) Rs. Rs. Rs. Rs. Rs. Value Excluding VAT (A) Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs

Rs. VAT Claimed (B) Rs. Rs. Rs. Rs. VAT Due (B)

SALES IN THE MONTH (OUTPUT) 12 13 14 15 16 17 18 19 20 Exempt Sales Zero Rate Sales International Exports Zero Rate Sales Others (CST Sales) Tax Due on Purchase of goods 4% Rate Sales 12.5% Rate Sales Special Rate Sales (First Sales only) 1% Rate Sales Total amount of output tax (15(B)+16(B)+17(B)+ 19(B)

Rs. Rs. Rs. Rs. Rs. Rs.

21. Details of Under declaration/Over declaration of Input tax / Out put tax during the tax period. Input Tax Output Tax Input Tax Output Tax Tax Under / Adjustments if declared declared found to be found to be Over any (Box 11 of (Box 20 of correct correct declared ( Box 22 of VAT 200) VAT 200) (Box 11 of (Box 20 of VAT 213) VAT 213) VAT 213) (1) (2) (3) (4) (5) (6)

Total Amount Payable (7)

Total amount Creditable (8)

22. Payment Details:

Details

Payment Details:

Challan /Instrument No.

Date

Bank/Treasury

Branch Code

Amount

Total

22(a). Adjustment Details: Nature of Adjustment

Details

Amount

The amount in column (7) of Box 21 is payable in Box 22. The amount in column (8) of Box 21 exceeds total of box 20 and you have declared exports in box 13(A) and not adjusting the excess amount against tax liability if any under the CST Act, you can claim a refund in box 23 or carry a credit forward in box 24. If you have declared no exports in box 13(A) you must carry the credit forward in box 24, unless you have carried forward a tax credit for 24 consecutive months and not adjusting the excess amount against the tax liability if any under the CST Act. Refund 24(a) 23 Rs. Credit carried forward 24 Rs.

If you want to adjust the excess amount against the liability under the CST Act please fill in boxes 24(a) and 24(b). Tax due under the CST Act and adjusted against the excess amount in box 24.

24(a)

Rs.

24(b) Net credit carried forward

24(b) Rs.

Declaration: 25. Name..being (title)

of the above enterprise do hereby declare that the information given in this return is true and correct.

Signature & Stamp. Date of declaration ..

You might also like

- Monthly VAT return submissionDocument2 pagesMonthly VAT return submissionJayadeep VuppalaNo ratings yet

- Letter To VendorDocument3 pagesLetter To VendorJhalak AgarwalNo ratings yet

- NNNDocument4 pagesNNNJemely BagangNo ratings yet

- AY 2005-06 Saral Form 2DDocument2 pagesAY 2005-06 Saral Form 2DVinod VarmaNo ratings yet

- 145905Document1 page145905Tarun GodiyalNo ratings yet

- Monthly Return For Value Added Tax: 1% Rate PurchasesDocument3 pagesMonthly Return For Value Added Tax: 1% Rate PurchasesHasan Babu KothaNo ratings yet

- Monthly VAT Return Form Filing GuideDocument3 pagesMonthly VAT Return Form Filing GuideHasan Babu KothaNo ratings yet

- Saral: ITS-2D Form No. 2DDocument2 pagesSaral: ITS-2D Form No. 2DPrasanta KarmakarNo ratings yet

- Individual Income Tax ReturnDocument2 pagesIndividual Income Tax ReturnMNCOOhioNo ratings yet

- Section24-Prior Year Salary OverpaymentsDocument8 pagesSection24-Prior Year Salary OverpaymentsP45 TesterNo ratings yet

- Guide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11Document6 pagesGuide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11amitbabuNo ratings yet

- All About GST Annual ReturnsDocument9 pagesAll About GST Annual ReturnsinfoNo ratings yet

- 1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Document12 pages1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Ganesh ChavanNo ratings yet

- Bir Form 1601-CDocument4 pagesBir Form 1601-Csanto tomas proper barangay100% (1)

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Pawan Yadav0% (2)

- GST User ManuelDocument195 pagesGST User Manuelsakthi raoNo ratings yet

- Step-by-Step Guide to Claim GST RefundDocument34 pagesStep-by-Step Guide to Claim GST Refunddhruv MahajanNo ratings yet

- Central Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2020-21Document12 pagesCentral Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2020-21ajayNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelNo ratings yet

- Form VAT ReturnDocument3 pagesForm VAT ReturnYf WoonNo ratings yet

- Declaration under section 197A(1) of the Income Tax ActDocument2 pagesDeclaration under section 197A(1) of the Income Tax Actkinnari bhutaNo ratings yet

- Payroll EnrollmentDocument1 pagePayroll Enrollmentaliciaalfoldi1992No ratings yet

- FORM 202: Popular EnterpriseDocument4 pagesFORM 202: Popular Enterprisesam3461No ratings yet

- Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document1 pageMonthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Kristine CabalteraNo ratings yet

- FTP FTP - Bir.gov - PH Webadmin Forms 2551mDocument1 pageFTP FTP - Bir.gov - PH Webadmin Forms 2551mPeter John M. LainezNo ratings yet

- Goods and Services TaxDocument79 pagesGoods and Services TaxhatimNo ratings yet

- Quarterly Value-Added Tax Return: 333-337 Quezon Ave., Quezon City, Metro ManilaDocument5 pagesQuarterly Value-Added Tax Return: 333-337 Quezon Ave., Quezon City, Metro ManilaJacinto TanNo ratings yet

- 1Document4 pages1shivapannaleNo ratings yet

- Protest Letter Tax AssessmentDocument2 pagesProtest Letter Tax AssessmentConsciousness Vivid100% (1)

- Sample Protest LetterDocument2 pagesSample Protest LetterLyceum WebinarNo ratings yet

- 2551MDocument3 pages2551MButch Pogi100% (2)

- File GSTR-3B and pay GST onlineDocument23 pagesFile GSTR-3B and pay GST onlineBala VinayagamNo ratings yet

- Tax Audit Checklist GuideDocument3 pagesTax Audit Checklist Guidehemanth0% (1)

- Return of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasDocument2 pagesReturn of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasAngela ArleneNo ratings yet

- Crs FormDocument6 pagesCrs Form- EmslieNo ratings yet

- Guide On GSTR 1 Filing On GST PortalDocument53 pagesGuide On GSTR 1 Filing On GST PortalCA Naveen Kumar BalanNo ratings yet

- TR 64Document1 pageTR 64Narender SeshadriNo ratings yet

- Self CertificationDocument6 pagesSelf CertificationGuocheng MaNo ratings yet

- Central Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2017-18Document7 pagesCentral Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2017-18Vijaykumar ChalwadiNo ratings yet

- Central Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2017-18Document7 pagesCentral Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2017-18Priya mishraNo ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- Refund of IGST On Export of Goods PDFDocument7 pagesRefund of IGST On Export of Goods PDFCA Rahul ModiNo ratings yet

- Form2FandInstructions 06062006Document11 pagesForm2FandInstructions 06062006Mnaoj PatelNo ratings yet

- AMT NOL Calculation WorksheetDocument2 pagesAMT NOL Calculation WorksheetcaixinranNo ratings yet

- Hvac Invoice TemplateDocument2 pagesHvac Invoice TemplateMonang RidwanNo ratings yet

- Professional (Regular and COS/Job Order) Percentage Tax Expanded Withholding Tax Without Sworn Declaration 3% 10% With Sworn DeclarationDocument5 pagesProfessional (Regular and COS/Job Order) Percentage Tax Expanded Withholding Tax Without Sworn Declaration 3% 10% With Sworn Declarationblessa elaurzaNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- Mvat f231Document5 pagesMvat f231pgotaphoeNo ratings yet

- 1702 NewDocument11 pages1702 NewDIVINE WAGTINGANNo ratings yet

- i1040-CM (2018)Document4 pagesi1040-CM (2018)Laurence Arcon BanalNo ratings yet

- TDS Payment ChallanDocument3 pagesTDS Payment ChallanmejarirajeshNo ratings yet

- How To File Indian Income Tax Updated ReturnDocument6 pagesHow To File Indian Income Tax Updated ReturnpragativistaarNo ratings yet

- 2550Mv 2Document7 pages2550Mv 2nelsonNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Bolton, Timothy - The Empire of Cnut The Great Conquest and The Consolidation of Power in Northern Europe in The Early Eleventh Century (Reup 6.21.10) PDFDocument368 pagesBolton, Timothy - The Empire of Cnut The Great Conquest and The Consolidation of Power in Northern Europe in The Early Eleventh Century (Reup 6.21.10) PDFSolNo ratings yet

- Ptu Question PapersDocument2 pagesPtu Question PapersChandan Kumar BanerjeeNo ratings yet

- Dvash-Banks v. U.S. Dep't of StateDocument2 pagesDvash-Banks v. U.S. Dep't of StateJohn Froy TabingoNo ratings yet

- ADocument109 pagesALefa Doctormann RalethohlaneNo ratings yet

- UPCAT Application Form GuideDocument2 pagesUPCAT Application Form GuideJM TSR0% (1)

- Caterpillar Cat 301.8C Mini Hydraulic Excavator (Prefix JBB) Service Repair Manual (JBB00001 and Up) PDFDocument22 pagesCaterpillar Cat 301.8C Mini Hydraulic Excavator (Prefix JBB) Service Repair Manual (JBB00001 and Up) PDFfkdmma33% (3)

- Durable Power of Attorney Form For Health CareDocument3 pagesDurable Power of Attorney Form For Health CareEmily GaoNo ratings yet

- Canadian Administrative Law MapDocument15 pagesCanadian Administrative Law MapLeegalease100% (1)

- 15 09 Project-TimelineDocument14 pages15 09 Project-TimelineAULIA ANNANo ratings yet

- Anti-Communist Myths DebunkedDocument168 pagesAnti-Communist Myths DebunkedSouthern Futurist100% (1)

- The Workmen's Compensation ActDocument23 pagesThe Workmen's Compensation ActMonika ShindeyNo ratings yet

- New Key Figures For BPMon & Analytics - New Controlling & SAP TM Content & Changes Key Figures - SAP BlogsDocument8 pagesNew Key Figures For BPMon & Analytics - New Controlling & SAP TM Content & Changes Key Figures - SAP BlogsSrinivas MsrNo ratings yet

- Compromise AgreementDocument2 pagesCompromise AgreementPevi Mae JalipaNo ratings yet

- Wee vs. de CastroDocument3 pagesWee vs. de CastroJoseph MacalintalNo ratings yet

- Concept of Islam and Muslim UmmahDocument8 pagesConcept of Islam and Muslim Ummahapi-370090967% (3)

- FABM2 - Lesson 1Document27 pagesFABM2 - Lesson 1wendell john mediana100% (1)

- QSPOT571423: Create Booking Within 24 HoursDocument2 pagesQSPOT571423: Create Booking Within 24 HoursNaimesh TrivediNo ratings yet

- 1982 SAMAHAN ConstitutionDocument11 pages1982 SAMAHAN ConstitutionSAMAHAN Central BoardNo ratings yet

- Reverse Percentages PDFDocument6 pagesReverse Percentages PDFChido DzirutweNo ratings yet

- ISLAWDocument18 pagesISLAWengg100% (6)

- Quotation for 15KW solar system installationDocument3 pagesQuotation for 15KW solar system installationfatima naveedNo ratings yet

- Taiwan's Quanta Computer, Inc. manufacturer of notebooks and electronicsDocument16 pagesTaiwan's Quanta Computer, Inc. manufacturer of notebooks and electronicsNUTHI SIVA SANTHANNo ratings yet

- Lc-2-5-Term ResultDocument44 pagesLc-2-5-Term Resultnaveen balwanNo ratings yet

- WR CSM 20 NameList 24032021 EngliDocument68 pagesWR CSM 20 NameList 24032021 EnglivijaygnluNo ratings yet

- Doosan Generator WarrantyDocument2 pagesDoosan Generator WarrantyFrank HigueraNo ratings yet

- Final TESFU Research AccountingDocument57 pagesFinal TESFU Research AccountingtesfayeNo ratings yet

- Lacson Vs Roque DigestDocument1 pageLacson Vs Roque DigestJestherin Baliton50% (2)

- Order Dated - 18-08-2020Document5 pagesOrder Dated - 18-08-2020Gaurav LavaniaNo ratings yet

- Full Download Sociology Your Compass For A New World Canadian 5th Edition Brym Solutions ManualDocument19 pagesFull Download Sociology Your Compass For A New World Canadian 5th Edition Brym Solutions Manualcherlysulc100% (25)

- Islamic Mangement Vs Conventional ManagementDocument18 pagesIslamic Mangement Vs Conventional Managementlick100% (1)