Professional Documents

Culture Documents

Sa103s 2011

Uploaded by

iurm28Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sa103s 2011

Uploaded by

iurm28Copyright:

Available Formats

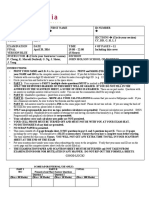

Self-employment (short)

Tax year 6 April 2010 to 5 April 2011

Your name

Your Unique Taxpayer Reference (UTR)

Read page SESN 1 of the notes to check if you should use this page or the Self-employment (full) page.

Business details

1

Description of business

If you are a foster carer or shared lives carer, put X in the box read page SESN 2 of the notes

If your business started after 5 April 2010, enter the start date DD MM YYYY

Postcode of your business address

6

If your business ceased before 6 April 2011, enter the final date of trading

If your business name, description, address or postcode have changed in the last 12 months, put X in the box and give details in the Any other information box of your tax return

Date your books or accounts are made up to read page SESN 3 of the notes

Business income if your annual business turnover was below 70,000

8

Your turnover the takings, fees, sales or money earned by your business

Any other business income not included in box 8 excluding Business Start-up Allowance

0 0

0 0

Allowable business expenses

If your annual turnover was below 70,000 you may just put your total expenses in box 19, rather than filling in the whole section.

10

Costs of goods bought for resale or goods used

15

Accountancy, legal and other professional fees

11

0 0

16

0 0

Car, van and travel expenses after private use proportion

Interest and bank and credit card etc. financial charges

17

0 0

12

0 0

Phone, fax, stationery and other office costs

Wages, salaries and other staff costs

18

0 0

13

0 0

Other allowable business expenses client entertaining costs are not an allowable expense

Rent, rates, power and insurance costs

14

0 0

19

0 0

Repairs and renewals of property and equipment

Total allowable expenses total of boxes 10 to 18

SA103S 2011

0 0

0 0

HMRC 12/10

Tax return: Self-employment (short): Page SES 1

Net profit or loss

20

Net profit if your business income is more than your expenses (if box 8 + box 9 minus box 19 is positive)

21

Or, net loss if your expenses exceed your business income (if box 19 minus (box 8 + box 9) is positive)

0 0

0 0

Tax allowances for vehicles and equipment (capital allowances)

There are 'capital' tax allowances for vehicles and equipment used in your business (you should not have included the cost of these in your business expenses). Read pages SESN 4 to SESN 8 of the notes and use the example and Working Sheets to work out your capital allowances.

22

Annual Investment Allowance

24

Other capital allowances

23

0 0

25

0 0

Allowance for small balance of unrelieved expenditure

0 0

Total balancing charges where you have disposed of items for more than their value

0 0

Calculating your taxable profits

Your taxable profit may not be the same as your net profit. Read page SESN 9 of the notes to see if you need to make any adjustments and fill in the boxes which apply to arrive at your taxable profit for the year.

26

Goods and/or services for your own use read page SESN 8 of the notes

28

Loss brought forward from earlier years set off against this years profits up to the amount in box 27

27

0 0

29

0 0

Net business profit for tax purposes (if box 20 + box 25 + box 26 minus (boxes 21 to 24) is positive)

Any other business income not included in boxes 8 or 9 for example, Business Start-up Allowance

0 0

0 0

Total taxable profits or net business loss

30

Total taxable profits from this business (if box 27 + box 29 minus box 28 is positive)

31

Net business loss for tax purposes (if boxes 21 to 24 minus (box 20 + box 25 + box 26) is positive)

0 0

0 0

Losses, Class 4 NICs and CIS deductions

If you have made a loss for tax purposes (box 31), read page SESN 9 of the notes and fill in boxes 32 to 34 as appropriate.

32

Loss from this tax year set off against other income for 201011

35

If you are exempt from paying Class 4 NICs, put 'X' in the box read page SESN 10 of the notes

33

0 0

36

Loss to be carried back to previous year(s) and set off against income (or capital gains)

34

0 0

If you have been given a 201011 Class 4 NICs deferment certificate, put 'X' in the box read page SESN 10 of the notes

Total loss to carry forward after all other set-offs including unused losses brought forward

37

0 0

Deductions on payment and deduction statements from contractors construction industry subcontractors only

SA103S 2011 Tax return: Self-employment (short): Page SES 2

0 0

You might also like

- Sa 103 FDocument6 pagesSa 103 FcoolmanzNo ratings yet

- WWW - Hmrc.gov - Uk Worksheets SA103S-NotesDocument10 pagesWWW - Hmrc.gov - Uk Worksheets SA103S-NoteskpotyiNo ratings yet

- Self-Employment (Short) : Tax Year 6 April 2019 To 5 April 2020 (2019-20)Document2 pagesSelf-Employment (Short) : Tax Year 6 April 2019 To 5 April 2020 (2019-20)Lucca HeartNo ratings yet

- Tax return for 2013 tax yearDocument16 pagesTax return for 2013 tax yearmwf1806No ratings yet

- Tax Return 2012 Guide EnclosedDocument16 pagesTax Return 2012 Guide EnclosedNatalia Ciocirlan100% (1)

- Form12 PDFDocument16 pagesForm12 PDFAsder DareNo ratings yet

- Application For VAT Registration UKDocument4 pagesApplication For VAT Registration UKKeyconsulting UKNo ratings yet

- Self-Employment (Short) : Tax Year 6 April 2021 To 5 April 2022 (2021-22)Document2 pagesSelf-Employment (Short) : Tax Year 6 April 2021 To 5 April 2022 (2021-22)Mary IlasNo ratings yet

- Sa 110Document2 pagesSa 110coolmanzNo ratings yet

- Module 4: Business Taxation, Corporation TaxDocument16 pagesModule 4: Business Taxation, Corporation TaxIftime IonelaNo ratings yet

- How To Calculate Your Taxable Profits: Helpsheet 222Document14 pagesHow To Calculate Your Taxable Profits: Helpsheet 222subtle69No ratings yet

- Tax relief for employment expensesDocument4 pagesTax relief for employment expensesKen Smith0% (1)

- Sa103s NotesDocument12 pagesSa103s NotesRupesh GangwarNo ratings yet

- Corporation Tax 1Document4 pagesCorporation Tax 1Sanjida KhanNo ratings yet

- Self-employment tax return guideDocument6 pagesSelf-employment tax return guidePéter KolozsNo ratings yet

- File ITR-1 Form for Individuals with Income from Salary and InterestDocument6 pagesFile ITR-1 Form for Individuals with Income from Salary and InterestManjunath YvNo ratings yet

- Value Added Tax (VAT) Number Registration / ApplicationDocument4 pagesValue Added Tax (VAT) Number Registration / ApplicationLedger Domains LLCNo ratings yet

- MIRA 303 BPT Interim Payment (English) FillableDocument2 pagesMIRA 303 BPT Interim Payment (English) FillableEman MahrynNo ratings yet

- Worksheet 1: Reconciliation Statement: Income Add Backs: Amounts Not Shown in The AccountsDocument2 pagesWorksheet 1: Reconciliation Statement: Income Add Backs: Amounts Not Shown in The AccountsLeena NagpalNo ratings yet

- Learn XtraDocument12 pagesLearn XtraKent WhiteNo ratings yet

- Form 46G: Return of Third Party Information For The Year 2010Document4 pagesForm 46G: Return of Third Party Information For The Year 2010billyhorganNo ratings yet

- Chapter 7Document15 pagesChapter 7Jaren Ann DeangNo ratings yet

- 2012 ISA PackDocument12 pages2012 ISA Packinfo328750% (2)

- Claim For Repayment of Tax Deducted From Savings and InvestmentsDocument4 pagesClaim For Repayment of Tax Deducted From Savings and InvestmentsxzmangeshNo ratings yet

- VAT On Merchandise Purchased and SoldDocument5 pagesVAT On Merchandise Purchased and SoldBernadette Solis100% (1)

- UK Accounting Standards GuideDocument16 pagesUK Accounting Standards GuideKusum KusumNo ratings yet

- Form 11: Tax Return and Self-Assessment For The Year 2014Document32 pagesForm 11: Tax Return and Self-Assessment For The Year 2014garyjenkins82No ratings yet

- VAT Other Aspects - January 2024Document5 pagesVAT Other Aspects - January 2024Charisma CharlesNo ratings yet

- Formalities For Registration Under J&K Vat Act, 2005Document4 pagesFormalities For Registration Under J&K Vat Act, 2005zakirkhiljiNo ratings yet

- Book Profit Calculation: Inclusions To Net ProfitDocument1 pageBook Profit Calculation: Inclusions To Net ProfitChandrika DasNo ratings yet

- How To Complete A Tax Return If You Received SEISS Grants: TH THDocument3 pagesHow To Complete A Tax Return If You Received SEISS Grants: TH THTony WhNo ratings yet

- Taxation in NL VATDocument2 pagesTaxation in NL VAToktavijan avgustNo ratings yet

- VATPT For PicpaDocument73 pagesVATPT For PicpaJoy Superales SalaoNo ratings yet

- Methods of payment optionsDocument2 pagesMethods of payment optionsJill GeorgeNo ratings yet

- SUGAM ITR-4S Presumptive Business Income Tax ReturnDocument11 pagesSUGAM ITR-4S Presumptive Business Income Tax ReturncachandhiranNo ratings yet

- Tax Calculation Summary Notes: 6 April 2015 To 5 April 2016Document46 pagesTax Calculation Summary Notes: 6 April 2015 To 5 April 2016coolmanzNo ratings yet

- Frequently Asked QuestionsDocument40 pagesFrequently Asked Questionsroy rebosuraNo ratings yet

- AQ2016 IDRX FA2016 Reference MaterialDocument31 pagesAQ2016 IDRX FA2016 Reference Materialmarla_ffonteNo ratings yet

- PAYE2012 DemoDocument110 pagesPAYE2012 DemoNorvee ReyesNo ratings yet

- Tax Relief For Expenses of Employment: Year To 5 April 2 0Document4 pagesTax Relief For Expenses of Employment: Year To 5 April 2 0Saniya KhanNo ratings yet

- 3.2 Business Profit TaxDocument53 pages3.2 Business Profit TaxBizu AtnafuNo ratings yet

- Request for a Business NumberDocument5 pagesRequest for a Business Numberrouzbeh1797No ratings yet

- HS227Document6 pagesHS2271lalaNo ratings yet

- SA105-2018 (UK Property (SA105) - BlankisitDocument2 pagesSA105-2018 (UK Property (SA105) - BlankisitMal WilliamsonNo ratings yet

- ct600 Guide 2011Document24 pagesct600 Guide 2011Deepak SaldanhaNo ratings yet

- For BIR Use Only Annual Income Tax ReturnDocument7 pagesFor BIR Use Only Annual Income Tax ReturndignaNo ratings yet

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986No ratings yet

- The Regular Income TaxDocument4 pagesThe Regular Income TaxJean Diane JoveloNo ratings yet

- Itemized Deductions Schedule ADocument2 pagesItemized Deductions Schedule Aljens09No ratings yet

- VAT On Sale of Goods and PropertiesDocument55 pagesVAT On Sale of Goods and PropertiesNEstanda100% (1)

- Goods and Services Tax (GST) : Complete Option 1 OR 2 OR 3 (Indicate One Choice With An X)Document2 pagesGoods and Services Tax (GST) : Complete Option 1 OR 2 OR 3 (Indicate One Choice With An X)rajkrishna03No ratings yet

- Comprehensive Guide For Income Tax Returns FY 20-21Document34 pagesComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- Aprelim - Purely Business IncomeDocument37 pagesAprelim - Purely Business IncomeAshley VasquezNo ratings yet

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- TaxaoneDocument20 pagesTaxaonedianne ballonNo ratings yet

- The Following Information Is Required For Tax Auditaddress Where Books of AccountsDocument3 pagesThe Following Information Is Required For Tax Auditaddress Where Books of AccountsJasmeet DhamijaNo ratings yet

- Business Cessation Form IR315Document2 pagesBusiness Cessation Form IR315Charlotte's WangNo ratings yet

- SlideshowDocument37 pagesSlideshowBhavesh AgrawalNo ratings yet

- UntitledDocument21 pagesUntitleddhirajpironNo ratings yet

- Material Costing and ControlDocument54 pagesMaterial Costing and ControlFADIASATTNo ratings yet

- Case Study-Chinese Negotiation Training On Sales PriceDocument2 pagesCase Study-Chinese Negotiation Training On Sales PriceTilak Salian100% (1)

- Orange - Inselmancoaching Tips On How To Grow A Successful Chiropractor PracticeDocument36 pagesOrange - Inselmancoaching Tips On How To Grow A Successful Chiropractor PracticekabshielNo ratings yet

- Consumer Behaviour FMCGDocument14 pagesConsumer Behaviour FMCGAnwar Masiha Quereshi100% (1)

- M1a PDFDocument80 pagesM1a PDFTabish KhanNo ratings yet

- 5 MicroDocument2 pages5 MicroRegina TagumNo ratings yet

- Athena Chhattisgarh Power - Vedanta To Buy Athena Chhattisgarh Power For Rs 564 Crore - The Economic TimesDocument2 pagesAthena Chhattisgarh Power - Vedanta To Buy Athena Chhattisgarh Power For Rs 564 Crore - The Economic TimesstarNo ratings yet

- Interest Rates and Options StrategiesDocument13 pagesInterest Rates and Options StrategiesAnonymous 9qJCv5mC0No ratings yet

- Financial Statement Analysis and Security Valuation Solutions Chapter 6Document6 pagesFinancial Statement Analysis and Security Valuation Solutions Chapter 6Mia Greene100% (1)

- FAR.2906 - PPE-Depreciation and DerecognitionDocument4 pagesFAR.2906 - PPE-Depreciation and DerecognitionCV CVNo ratings yet

- Godiva Case StudyDocument15 pagesGodiva Case StudySaiman Santillan AkyolNo ratings yet

- FXStreet - Trade The News Series Inflation TheoryDocument37 pagesFXStreet - Trade The News Series Inflation TheoryalypatyNo ratings yet

- Segmenting The Business Market and Estimating Segment DemandDocument24 pagesSegmenting The Business Market and Estimating Segment Demandlilian04No ratings yet

- Depreciation Provisions and Reserves Class 11 NotesDocument48 pagesDepreciation Provisions and Reserves Class 11 Notesjainayan8190No ratings yet

- Mba 3 Sem Corporate Financial Management Group B Financial Management Paper 1 Summer 2018Document3 pagesMba 3 Sem Corporate Financial Management Group B Financial Management Paper 1 Summer 2018pranali nagleNo ratings yet

- Exercise ProblemsDocument6 pagesExercise ProblemsDianna Rose Vico100% (1)

- p2 - Guerrero Ch13Document40 pagesp2 - Guerrero Ch13JerichoPedragosa88% (17)

- Wal-Mart's Global Expansion Risks and StrategiesDocument8 pagesWal-Mart's Global Expansion Risks and StrategiesChunxiao QiuNo ratings yet

- Manacc Online QuizDocument3 pagesManacc Online QuizJoshuaTagayunaNo ratings yet

- GPDocument20 pagesGPron_bdNo ratings yet

- Price Schedule For Goods Offered From Within The PhilippinesDocument2 pagesPrice Schedule For Goods Offered From Within The PhilippinesTj GasolineNo ratings yet

- B.S Studies Pack BookDocument225 pagesB.S Studies Pack Bookjungleman marandaNo ratings yet

- Writ of Acquisition: X Orbon Binbrow XDocument5 pagesWrit of Acquisition: X Orbon Binbrow XAnonymous ZpsGbeZQWNo ratings yet

- Globalization, exchange rates, and international credit markets explainedDocument6 pagesGlobalization, exchange rates, and international credit markets explainednoordonNo ratings yet

- 28 Comm 308 Final Exam (Winter 2016)Document11 pages28 Comm 308 Final Exam (Winter 2016)TejaNo ratings yet

- Fyqs-Dx190715a Quotation Sheet (Fuyu)Document1 pageFyqs-Dx190715a Quotation Sheet (Fuyu)Ronald SalloNo ratings yet

- Case Study HelpDocument4 pagesCase Study HelpHennrocksNo ratings yet

- HE3032 Tutorial 12Document31 pagesHE3032 Tutorial 12knpkgrd4h7No ratings yet

- Grade 11 Accounting SyllabusDocument6 pagesGrade 11 Accounting SyllabusAlynRain QuipitNo ratings yet