Professional Documents

Culture Documents

Strategy Analyses and Recommendations For Dell

Uploaded by

MonicadadrahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strategy Analyses and Recommendations For Dell

Uploaded by

MonicadadrahCopyright:

Available Formats

Theyre all over the world, inspiring our most innovative thinking.

STRATEGYANALYSESAND RECOMMENDATIONSFOR DELL,INC. March6,2006

AUTHORS KHALIDALKELABI (OrganizationCapabilitiesandResources) JENNIFERLUND (Compet dscape) KATHRYNLYNCH (IndustryCharacteristicsandMacroForces) GREGSHORR (Present dStrategy) MATTHEWSMITH (OrganizationCharacteristics) 1

TABLEOFCONTENTS AUTHORS ........................................................................ ................................................................................ ...........1 TABLE OF CONTENTS ................................................. ................................................................................ ...........2 I. EXECUTIVE SUMMARY............................................... ................................................................................ .......3 II. KEY STRATEGY ISSUES................................................ ................................................................................ ....4 III. ORGANIZATION CHARACTERISTICS......................................... ................................................................5 IV. ORGANIZATI ON CAPABILITIES AND RESOURCES .................................................. ..............................8 V. INDUSTRY CHARACTERISTICS AND MACRO FORCES.... .....................................................................10 VI. COMP ETITIVE LANDSCAPE............................................................... ..........................................................13 VII. PRESENT POSITI ONING AND STRATEGY ............................................................. .................................16 VIII. ENVIRONMENT AND STRATEGY ASSESSMENT .. ...............................................................................1 9 IX. OPTIONS AND RECOMMENDED STRATEGY ......................................... .................................................22 IX.1. FOCUS ON INNOVATION .. ................................................................................ ................................................22 IX.2. DIVESTING ............. ................................................................................ .........................................................22 IX.3. EXPANSION INTO SERVICES....................................................................... ......................................................23 IX.4. REINVIGORATE DIFF ERENTIATION ADVANTAGE .......................................................... ..................................23 IX.5. RECOMMENDED STRATEGY ................ ................................................................................ ............................24 APPENDICES A C: ORGANIZATION CHARACTERISTICS .... ..................................................................28 A. ORGANIZA TIONAL PURPOSE AND DIRECTION ................................................... ..................................................28 B. ORGANIZATIONAL CHARACTER ISTICS.......................................................................... .......................................29 C. VALUE CHAIN ANALYSIS .............. ................................................................................ ......................................31 APPENDICES D F: ORGANIZATION CAPABILITI ES AND RESOURCES..............................................36 D. KEY COMPETEN CIES ASSESSMENT ................................................................ .....................................................36 E. TECHNOLOGY ASSESSMENT ............................................................................... ................................................39 F. FINANCIAL RATIO ANALYSIS . ................................................................................ .............................................43 APPENDICES G I: INDUSTRY CHARACT ERISTICS ....................................................................... ...........45 G. MACRO FORCES ANALYSIS ......................................... ................................................................................ ........45 H. INDUSTRY ANALYSIS ................................................ ................................................................................ ..........50 I. INDUSTRY LIFE CYCLE ............................................ ................................................................................ .............53 APPENDICES J L: COMPETITIVE LANDSCAPE........................... ..............................................................55 J. FIVE FORCES OF COMPETITION ................................................................. ...........................................................55 K. MAJOR COMPETITO RS ............................................................................. ............................................................57 L. COMPETITOR RES OURCES ......................................................................... ..........................................................59 APPENDICES M O: CUR

RENT POSITIONING AND STRATEGY................................................... ..........62 M. PRODUCT MARKET MATRIX .......................................... ................................................................................ .....62 N. PORTER S GENERIC STRATEGIES ......................................... ................................................................................ 65 O. MARKET ATTRACTIVENESS AND STRENGTH ....................................... ................................................................66 APPENDIX P: B IBLIOGRAPHY .................................................................... .......................................................69 2

I.EXECUTIVESUMMARY Dell has experienced tremendous growth over the past twenty year s. Throughout this period, Dell has continued to raise its standards of excellen ce. The values, mission and vision of the company facilitate the achievement of these illustrious goals. The purpose of this document is to evaluate the interna l and external environments and Dells position within this competitive landscape. Based upon this analysis, a recommended strategy will be outlined which will gu ide Dell back to its roots. The key competencies of Dell are customer focus, man ufacturing processes, supply chain management, customer selection, acquisition a nd retention, customer service and human capital management. Dells strategy has b een to match its core competencies with key industry success factors. The PC ind ustry is facing increasingly strong worldwide competition leading to reduced dif ferentiation among competitors and increased price sensitivity among consumers. Although Dell has seen considerable growth, the company is beginning to lose its competitive edge in critical business segments. Specifically, Dell needs to imp rove in the following areas: customer service, customization options, increased marketing presence and retail solutions tailored to the global environment. Dells ability to adapt in these business segments will ultimately determine its abili ty to maintain its predominant position. The recommended strategy for Dell is to reinvigorate its differentiation advantage. Ultimately, the company must get ba ck to basics. This requires the firm to realign its core competencies with the n eeds of a global marketplace. 3

II.KEYSTRATEGYISSUES Dell is facing multiple strategic issues which may impede on th e companys top position in the computer hardware market. This section addresses t he four key strategic issues that Dell should address in order to maintain its p rominent market position. First, Dell faces slow growth for its primary product: the personal computer (PC) in a saturated U.S. market. The majority of U.S. cor porate and education PCs will be replacement units affected by a technological u pgrade cycle within the next two years. Therefore, as Dell attempts to maintain its dominant position, the company should focus on product customization and sup erior relationships with suppliers. This strategy enabled Dells past success but had become diluted over the last five years. The company should continue to impr ove itself in these areas in order to remain the top computer hardware different iator. Second, the erosion of Dells brand value continues due to the perception o f declining customer service. Although the company prides itself on superior cus tomer service, recent surveys suggest that Dells results recently declined in thi s business segment. Dells executives are aware that quality customer service is a key element of the companys success and are reportedly working towards improveme nts. Third, Dells inability to serve all market needs due to the current strategy of limited vendors in its supply chain. Dell brings few products to market and leverages technology created by other companies effectively and efficiently. Del l also remains committed to chip supplier, Intel. Although this enables Dell to offer PCs at high value to consumers, it also limits the companys ability to supp ly diverse customers. The company should consider enabling itself to offer more customized products by increasing relationships with more diverse suppliers. 4

Finally, Dells market footprint extends primarily to mature markets in the U.S., Europe and Japan. The global market for PCs continues to growcreating additional opportunities for Dell. For Dell to compete in growing computer markets around t he world including Latin America, China and other countries in Asia the company should enhance its expertise in customizing its products. This would enable it t o expand its market niche of product differentiator outside of the U.S. III.ORGANIZATIONCHARACTERISTICS By MatthewSmith Dell, Inc. has experienced tremendous growth since Michael Dell founded the comp any with only $1,000 in his University of Texas dorm-room. Today, Dell has globa l revenues of nearly $50 billion and employs more than 55,000 individuals. Despi te this tremendous growth, the organization has remained committed to its core v alues. The Soul of Dell creates an ethical framework in which people are the commo n thread which links the organizations current position and future aspirations. T he organizations mission is to be the most successful computer company in the world at delivering the best customer experience in the markets we serve (Soul of Dell , 2006). The vision of the company is: to lead in all regions we serve. The founda tion of our success is the same in the United Kingdom and France, China and Japa n, Canada and other countries. Customers want technology products that are relev ant to them, offer great value and can be easily purchased and used. Thats what o ur team around the globe consistently delivers (Fiscal 2005 in Review, 2005). Con sidering variations in customer preferences throughout the world, this vision ma y not allow Dell the flexibility to meet varying customer needs throughout its g lobal marketplace. 5

The organization, which is exceedingly results driven, has set one major goal th rough 2007. That goal, which was increased by $20 billion, is to reach $80 billi on in revenue by the end of 2007. Despite a recent decline in PC sales, the revi sed goal was established to reflect increases in service and storage revenues. I n addition, the organization believes it stands to benefit from increased sales in emerging markets. Dell is a flat organization which operates on open communic ation and demands results. Employees at every level are given the freedom to pur sue and develop new and more efficient ways of completing tasks without prior ap proval from upper management. If successful, new strategies are shared and initi ated across the organization. Likewise, open communication creates a results driven organization. The organization believes that each emplo yee should know exactly where he/she stands with regards to meeting organization al goals. To facilitate this, employees are rated every six months by their peer s. These surveys are instrumental for accountability. Those employees that earn excellent ratings on their surveys are rewarded with high appraisals. Conversely, those that receive poor ratings expe ct substandard appraisals. Dells culture is a meritocracy in which leadership rew ards achievement. As noted, Dell leadership relies heavily upon surveys to evalu ate, reward, retain and promote high performers. The organization feels that thi s method provides an honest, open assessment of employee accomplishment and pote ntial. This assessment, which is based upon open communication and honesty, crea tes a culture that is competitive, hard working and loyal to the organization. D ell utilizes key strategic partnerships to maintain efficiencies in its operatio ns. Dell currently partners with Intel for 100% of its chips. While this single source partnership has allowed Dell to contain its costs and maintain consistent supplies, it has also limited the customer choice. Many analysts believe an add itional partnership with AMD would provide Dell 6

significant price and performance advantages. Dell also partners with Costco, Sa ms Club, QVC Inc. and Target in an effort to broaden its customer base. Additiona l production partnerships include Lexmark, Fuji Xerox, Kodak, Samsung and EMC. R ather than spend significant dollars on R&D, Dell relies heavily upon the techno logical developments of its partners and competitors to recreate successful tech nologies. Dells value chain is considered to be the gold-standard of the industry . The organizations model relies heavily on technology and its employees to achieve its success. With regards to inbound logistics, the organization maintains just-intime inventories through shared EDI systems. The organizations ability to maintai n four day inventory levels are among the most cost effective of any company. Th e organization also looks to its employees to maintain efficiencies. As noted, D ells culture encourages its employees to develop more efficient ways of doing bus iness. Within operations, employee developed initiatives have saved the organization billions of dollars and quadrupled productivity over the last 4 yea rs. Dells direct-selling business model revolutionized the computer industry. The organization has maintained a massive marketing budget to push its customized PC s. Although most orders are placed via Dells website, customers may also place cu stomized orders by phone, fax or through limited retail locations. Those orders, which now include printers and consumer electronics, are then shipped within on e week for significantly less cost than its competitors. Over the last decade, f ew competitors have matched Dells legendary customer service. Although customer s ervice is considered to be a differentiator in the computer industry, recent sur veys have shown a decline by Dell. This decline has resulted in the similar decl ine in the brands inferred value. Increased outsourcing is a suspected reason for the firms decline in this business segment. 7

IV.ORGANIZATIONCAPABILITIESANDRESOURCES By Khalid Alkelabi The heart of Dells business strategy and its direct selling model is customer foc us. Dell developed a core competency in making its customers the center of its b usiness and deployed its resources and capabilities to enhance the ability to se rve them. The customer centricity in Dells strategy has empowered it to develop m ore competencies: manufacturing processes, supply chain management, human capita l management, customer selection and customer service. In order to hit the marke t in a timely manner with new products that are based on new technologies, Dell had to constantly improve its supply chain. Furthermore, manufacturing processes had to be improved to compliment the efficiencies created by the supply chain. To manage this complicated infrastructure, Dell had to recruit, train and retain a capable workforce that can grow as the company grows; thus, a healthy environ ment that endorses honesty, accountability and learning was created over time. T his efficient and logical approach helped enhance core competencies: Dell became more efficient in recognizing, acquiring and retaining customers by fulfilling their needs efficiently, delivering value and servicing them effectively. These core competencies enabled Dell to manage its profitability and performance effic iently in a mature industry (Appendix I). Dell was able to utilize its internal resources and capabilities and leverage its core competencies to match the indus trys key success factor (Appendix H.6). In addition, Dells infrastructure, human c apital, global presence and capabilities will greatly help its international growth and contribute further t o its differentiation strategy. Dells technology infrastructure is efficient and capable of supporting expansion into new markets, growing sales and delivering v alue to customers. Global manufacturing facilities supported by innovative proce sses will also support such strategies. 8

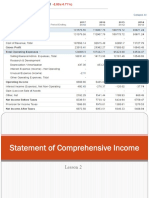

Dells differentiation stems from process innovation. The company is very successf ul in leveraging and harnessing the value of its suppliers and partners technology innovation. This allows Dell to minimize R&D spending and improve the cost stru cture, a strategy that is rarely matched by competitors. The company is also gai ning knowledge in the retail industry by partnering with major retailers such as Costco. This is vital for the success of any strategic initiative aiming for a retail presence in global emerging markets such as China and India. Dells financi als indicate a stellar operational performance evident by above the average inve ntory, assets and receivables turnovers. The company was able to achieve a high financial performance at the operational level by utilizing its state of the art IT infrastructure, supply chain and inventory management systems. Further, the companys stock represents an attractive investment due to the companys utilization of assets and focus on capital return. This is evident when comparing Dells high return on investment, asses and invest ed capital (ROE, ROA and ROIC) to the industry and market (Appendix F). experien cing average profit margins. Profitability ratios indicate that Dell is This is contributed to hyper competition in the PC industry; competitors are running on thinner margins in order to gain market sha re. The capital structure that Dell adopts focuses on financing growth and opera tions from retained earnings, the company doesnt pay dividends or acquire debt. T he companys financial policy in this regard emulates an IT start-up company, even though its a mature company in a mature industry. Its highly unlikely that Dell w ill continue this policy in the near future as investors press for dividends and the stock price falls, as is happening already. Further, acquiring debt might be necessary to finance growth and establishing retail pres ence into global emerging markets. This will not have a negative affect on Dell since it possesses the necessary financial leverage. 9

V.INDUSTRYCHARACTERISTICSANDMACROFORCES ByKathrynLynch The current environment for the computer hardware industry is shaped by several macro forces. Primarily, Dell and its competitors are influenced by economic, de mographic, technological and national forces. Government, social, physical and national for ces peripherally affect the computer hardware industry to varying degrees. The c ommoditization of the personal computera vital tool for business and consumer cus tomersis a key driver for the economics of this industry. Corporate spending acco unts for 80% of all technology spending, and economic conditions decreasing busi ness capital expenditures has a negative and direct impact on the computer hardw are industry. While this industry is mature in the U.S., leading to decreased gr owth expectations, computer spending by other countries around the world will li kely fill this void. Specifically, the computer hardware industry is predicted t o grow exponentially in Latin America and non-Japanese Asia over the next severa l years. Demographic forces also influence the characteristics of the computer h ardware industry. Geographic areas discussed above indicate where computers are well below their penetration levelscreating the prospect of new markets. Although 2003 U.S. census data on computer and internet usage at home correlates closely with income and educational level, the commoditization of computer hardware ind ustry enables it to be accessible to lower income level consumers. Consumer race and age also influences computer usage, according to the 2003 U.S. Census Burea u. Computer hardware companies should target less educated consumers, Hispanics, Blacks and people older than 65 years to achieve additional areas of market grow th. 10

Technological forces have the most significant influence on the computer hardwar e industry. The phenomenon called the upgrade cycle is one of the most influential macro forces on the computer industry. The upgrade cycle drives waves of new pu rchases among business and consumer customers as technological change transpires . Some industry analysts assess that 50% of computer hardware product profits ar e created during the first 3 6 months of sales. In 2006, Microsoft is set to rel ease the Vista operating system which is likely to catalyze an upgrade cycle among business and consumer customers. Customers increasingly choose a single vendor to meet all of their computer needs and technology upgrades. For a computer hard ware company to remain competitive, all customers needs must be efficiently satis fied. We recommend that Dell focus on turn-key technology solutions in order to ma intain its superior differentiator status within the industry. National forces a re increasingly important in a computer companys ability to maintain its competit ive edge, both in terms of the manufacturing process and improving sales. Comput er companies are increasingly shifting their manufacturing operations outside of the U.S. to take advantage of a growing business and consumer market for their products as well as cheaper operating costs. Government, social and physical for ces influence the computer hardware industry, however, these macro forces are si gnificantly less important than those discussed in prior paragraphs. Governments throughout the world represent an opportunity for computer hardware companies, including Dell, as they aim to develop and deliver more services to their citize ns. Social forces, including holiday, back-to-school sales and a summer business slowdown in Europe also drives sales in this industry. The physical environment has very little impact on the computer industry since all computer parts are ar tificially manufactured. However, adverse 11

weather can negatively impact the competitive edge of a company such as Dell, wh ich relies on just in time inventory methods as well as direct sales to its custom ers. The electronic computer manufacturing industry is mature in Japan, the U.S. and Europe. Growth opportunities remain among certain target populations within those areas and significant areas of market expansion are likely to occur in La tin America, Asia, and the Middle East. However, computer hardware companies are likely to continue the trend towards consolidation for the foreseeable future. Mergers and acquisitions have characterized this industry over the last few year s including Lenovo Groups purchase of IBMs PC division in 2005 and HPs 2002 acquisi tion of Compaq. Pricing in the computer manufacturing industry is extremely comp etitive. IT reflects the rapid pace of technological change and decreasing PC co sts. Since 2000, the prices of chips and disk drives declined and the standardiz ation of primary components of PCs led to a decline in PC prices. Direct sellers , including Dell, have traditionally been able to under-price indirect sellers i n the industry including Compaq and HP. However, most PC vendors now offer a des ktop model for less than $500 and a laptop for $700. Key success factors for com panies in this industry continue to evolve as the industry matures. Specifically , they include: Competitive prices Superior relationships with suppliers Product customization for business and consumer customers Quality customer service Exce llent cost structure Dells business model incorporates many of these key factors; the company is worki ng to improve customer service and product customization. 12

There are also significant opportunities for computer hardware manufacturers inc luding expansion into peripheral markets and products such as printers. Dell ent ered this market in 2003. However, threats to the computer hardware industry are strongprimarily, stiff competition among top industry players such as HP. The computer and peripherals industry is firmly entrenched in the maturity stage of the life cycle. Companies in this stage, including Dell, experience stable sales, slight growth, and decr easing production costs. In order to remain at the forefront of the competition, computer hardware companies should focus on process innovationan arena where Del l has succeeded. Specifically, Dell adopted a customer-focused approach with a c losely managed supply chain and cash-flow process. Dells low-cost, direct sales m odel shaped its position in the industry and other companies have struggled to c opy this innovation. As Dell and other computer hardware companies continue to m aneuver the challenges of the mature life cycle stage, they will need to remain focused on process innovation and creating business and consumer customer value to maintain its status as industry leader. VI.COMPETITIVELANDSCAPE ByJenniferLund Understanding the external environment is key to successfully competing in the c omputer hardware industry. Porters Five Forces of Competition provide a framework for Dell to outline the bargaining power of suppliers and customers, the threat of new entrants, the threat of substitutes and the intensity of competition. In this industry, the bargaining power of suppliers is high due to the limited num ber of suppliers for key components. For instance, Intel sells 90% of the microp rocessors used in PCs and Microsoft provides 85-90% of the operating systems. In addition, 80% of the worlds laptops are assembled in Taiwan. Likewise, the barga ining power 13

of customers is also high due to the fact that PCs are now commodities. Nearly a ll PCs contain the same components or the same type of components. However, cust omers power remains limited because consumers may be willing to pay a premium to computer companies that are able to provide technological solutions. Alternative ly, the threat of new entrants is low. The 1990s saw a significant level of grow th, but the early 2000s have shown signs of contraction within the industry. The threat of substitutes is also low since the only available substitute for a Win dows-based PC is an Apple Macintosh. Finally, the intensity of competition is hi gh since there are relatively few competitors in the market. However, they all o ffer the same basic products and must compete on price. Next, Dell must analyze its competitors to determine the best way for it to successfully compete in the computer hardware industry. Dells main competitors include: HP, IBM and Sun Micro systems (Sun). In the PC market, Dell competes primarily against HP. It held the #2 spot (behind Dell) as of the 3rd quarter of 2005. HP is also doing well in A sia-Pacific, growing its market share by 250 basis points in the same quarter. H owever, HP appears to be focusing less on its PC division, enabling Dell to incr ease its own market share. IBM recently sold its PC division to Lenovo, but rema ins a strong competitor in the server market. In addition, its 2002 purchase of PwCs consulting division provided it with an established services organization. T he combination of IBMs server line and its consulting arm allow it to provide ser vices that Dell cannot. Sun competes predominantly in the server market. It held the #3 spot in the Unix server market in the 2nd quarter of 2005. It recently a dded personnel to improve its services offerings and created alliances with Elec tronic Data Systems Corp and Computer Services Corp. Sun also 14

added the Galaxy server line to regain market share but its continuing financial weaknesses may allow Dell to take server market share. Dell and its competitors were analyzed in terms of their sales, liquidity, asset management, profitabili ty and operations. IBM and HP have far outpaced Dell and Sun in terms of sales. For instance, IBM earned $92 billion compared to Dells $49 billion in 2005. The c urrent ratio reveals Sun as the most liquid competitor. Its current ratio of 1.5 1 surpassed that of HP (1.38), IBM (1.31) and Dell (1.20). Although this implies that Sun is more capable of repaying short-term assets than any of its main com petitors, this analysis reflects information available prior to Suns 2005 acquisi tion of Storagetek. Asset turnover measures the firms ability to use its assets t o create sales. With a ratio of 2.12, Dell outpaces its competition. For every d ollar of total assets, it earned $2.12 in sales. Alternatively, HP has a ratio o f 1.12, IBMs totaled 0.90 and Suns equaled 0.78. Four profitability measures were evaluated: gross profit margin, net profit margin, return on equity and return o n assets. IBM and Sun earned the highest gross profit margins in 2005 with 42.7% and 41.5%, respectively. This implies that IBM and Sun are better at controllin g input costs than HP and Dell. IBMs large consulting division generates greater sales with fewer inputs resulting in higher profitability. However, Dells gross p rofit margin trended upward over the past three years indicating that Dell has e ither increased its prices or improved its control of input costs. Net profit ma rgin paints a different picture. Sun actually earned a negative net profit margin despite its high gross profit margin. The other three competitors earned steady margins over the past three years. However, IBM still posted the highest marks (8.8% in 2005 and 2004 and 8.5% in 2003). 15

Return on equity shifts the focus from IBM to Dell. In 2005, Dells ROE totaled 46 .9%, IBMs was 26.4%, HP equaled 6.5% and Sun earned -1.6%. Return on assets prese nts a similar view of the companies. Dell is once again in the lead with 13.1%, compared to IBMs 7.9%, HPs 3.1% and Suns -0.8% in 2005. Dell is obviously the best at turning its assets into net sales. The final category analyzed was operations more specifically, inventory turnover. For manufacturing companies, this is a c ritical measure of success. Too much inventory can lead to companies holding obs olete inventory, while too little may mean that customers will turn to competito rs. As expected, Dell outperformed its competitors. In 2005, it turned its inven tory over 107 times! In contrast, IBMs ratio was 28 times. Dell is not as large i n terms of total sales or as liquid as some of its competitors, but it has prove n to be the most effective in terms of cost and asset management. VII.PRESENTPOSIT IONINGANDSTRATEGY ByGregShorr Dell competes in several international and domestic markets and currently produc es a wide variety of products. In each of these markets, Dell has succeeded due to its broad differentiation approach. This approach, detailed in Appendix N, is based on the strength of its direct sales business model, manufacturing prowess, brand stren gth and customer service. The ability to differentiate has allowed Dell to stand out within mature markets and maintain a higher than average margins for its pr oducts. Although Dell s products cover a wide swath of the industry, there are s everal product lines and markets that the company does not currently serve. The company should consider three options: 16

Adding a PC and server product line based on AMD microprocessors Developing a sh owroom style storefront in developing markets Expanding consulting services to i nclude business services Dell s addition of a product line based on AMD microprocessors would enable the company to service the entire market of PC users. Dell s exclusive use of Intel processors has limited the company s ability to match the high end products that its competitors are offering. This leaves Dell continuing to serve the low-end portion of the market and out of the very profitable high-end portion of the mar ket. In addition, as AMD gains market share on Intel, Dell will encounter pressu re on its own market share. Dell currently is the largest worldwide provider of PCs based on the strength of its U.S. business. In international markets, Dell i s currently second or third, but has struggled to gain market share with its dir ect sales business model. Issues in developing countries include lack of credit cards and buying habits that involve touching and seeing before purchasing. With out gaining market share in these large markets, Dell could surrender its top positi on to competitors such as Lenovo, who are already entrenched in these markets. D eveloping a showroom style storefront would enable Dell to compete effectively a gainst its competitors in these countries. The showroom allows Dell to maintain its competitive advantages while simultaneously meeting the societal needs of the developing mar kets. It will be a place for Dell to exhibit its product and conduct sales for l ater delivery. Dell will retain its ability to customize its products and mainta in its build-to-order efficiencies. Dell s efficiency has made the firm a player in business infrastructure services. However, the company is viewed as a leader in providing value, not necessarily complete or creative solutions. By moving i nto business consulting, Dell may be able to develop more extensive relationship s with companies. These relationships could help grow Dell s core business throu gh 17

better understanding of client s needs and stronger ties to Dell, rather than to their current consulting partner: HP, IBM, et al. This process will effectively open an additional sales channel to Dell, but it is a risky endeavor. Diversifi cation into consulting may pull the company too far from its core Before branchi ng into the development of business competency of sales and production. consulting, Dell should examine the impact on the other portions of its product portfolio. Due to its varied product portfolio, Dell cannot be cast into one par ticular quadrant of either the Boston Consulting Group Growth-Share matrix or th e McKinsey 9-cell. Each business group must be looked at separately in order to accurately portray its b usiness prospects. Dell s sole cash cow is its PC business. This market continue s to grow and as the market share leader, Dell is poised to reap the benefits of this growth. In order to ensure that this product remains a cash cow, Dell must continue to determine what products the industry wants, and consistently be a b est-in-class deliverer of value to its consumers. One of Dell s stars is its ser ver business. Dells market share has grown at a rate of over 25% and it recently surpassed Sun as the #3 provider of servers. To keep this product line a star, D ell needs to continue its growth in the low end server market, It also needs to simultaneously develop its higher end server product line to meet the needs of t he entire server market. Dell s one visible question mark is its services busine ss. Although this division is one of the fastest growing segments at Dell, its s mall market share leaves this segment vulnerable to competitors and other market forces. In order to turn this business into a star, Dell needs to increase mark et share. Dell must develop its creative infrastructure and than advertise its creativity throughout the market. By changing its market perception, Dell will b egin to draw clients that it previously would not have drawn, and thus increase market share. 18

Dell s peripheral business spans the range of cash cows to question marks. Dell must continue to feed its question marks through advertising and developing soli d product reputations. This should be done by following the outline laid out by the PC division, where Dell has used outstanding quality and value to become the market leader. VIII.ENVIRONMENTANDSTRATEGYASSESSMENT The computer industry can be ch aracterized as mature in the U.S., Japan, and Europe but there is continued room for growth in Latin America, the Middle East, and the rest of Asia. Further, bu siness and consumer customers globally are subject to a technology upgrade cycle, whereby the short product lifecycle of computer products drives repeat purchases . Pricing is fiercely competitive in the computer hardware industry. Further, me rgers characterize a significant trend and are likely to remain a defining facto r in the near-term. These deals are enabling computer hardware providers to offe r better services to their customers. Two of Dells largest competitors, HP and IB M, offer full-service products (i.e. hardware, software and consulting services) . As discussed in Appendix J, computer hardware consumers increasingly prefer an d are willing to pay a premium to vendors that are able to provide all of their IT needs: hardware, software, and the knowledge to package the items to meet the customers requirements. In addition, the technology in this industry is rapidly changing and Dell does not conduct its own research and development. This is not necessarily a problem. However, Dell does risk being considerably outpaced by i ts competitors. The computer hardware industry offers extensive opportunities fo r growth. For instance, 80% of sales over the next four years will take place in developing countries. Dell has the opportunity and the ability to earn a high p ercentage of those sales if it develops a successful strategy for entering the m arket. 19

Dells organizational structure is a vital part of the companys success. Little hie rarchy exists within the company. From the factory floor to the executive office , communication is emphasized and all employees are empowered to make decisions to improve job and business performance. Upper management approval is not requir ed for the implementation of new ideas. Dells flat corporate structure is likely to enable the company to remain at the tope of its industry. Employee empowermen t facilitates process innovationone of the main competitive characteristics of ma turing industries. Similarly, Dells fast, consistent, reliable and responsive bus iness model enables it to execute its direct sales model more effectively than a ny other company in the industry. As Dell expands into growing markets, however, the company will have to adapt its organizational structure to growing global e nvironments. Dell will need to maintain focus on its place in the industry as a product differentiator, bringing superior value to customers. Although strategic partnerships (such as with Intel) have been key to the companys success, it need s to continue to be selective about these relationships and to continually evalu ate whether they remain appropriate in the current environment. The key macro fo rce for the computer industry is technological change. The extremely short produ ct life cycle for computers, influenced by the upgrade cycle, has both positive and negative effects on companies within the industry. It challenges companies t o maintain superior inventory management and supplier relationships: areas where Dell excels. Technological change also drives waves of additional computer purchases within a mature market . Another trend impacting the computer industry is the rise of a single vendor a s a provider for all IT needs. This simplifies technology choices for customers and makes one vendor accountable and Dell does not offer this capability current ly. 20

Dells vision is to lead in all regions we serve. Dell bases its foundation for succ ess on the strategy, regardless of location. In other words, Dell assumes that w hat works in the U.S. will work in Africa, Asia or Europe. In Dells primary marke t, the U.S., the company uses a direct sales strategy, meaning that it sells its products directly to the customer either online or over the phone, thereby elim inating the cost of the middle man. This strategy proved immensely profitable in D ells early years. In fact, it was so successful that it actually changed the way its competitors did business. However, Dells reliance on its direct sales model m ay not be as beneficial in emerging markets. This is primarily due to the fact t hat consumers in these markets may be distrustful of buying items online or do n ot have the proper means of payment (i.e. credit cards) to make online purchases . In the PC market, Dell pursues three market segments: consumers, governments a nd businesses. In the U.S. market, the government provides 51.8% of Dells revenue s. It controls the corporate and government markets within the U.S. and is curre ntly working to obtain that same power in the global PC market. Dell does not ho ld the same position in any of its other markets, but is working towards gaining dominance in other markets. It has recently begun shifting its focus from low-e nd servers to higher-end cluster servers. In addition to PCs and servers, Dell has entered the peripherals market printers, digital cameras, monitors, storage, et c. At present, this segment presents the biggest question mark in Dells product p ortfolio. In addition, Dell relies entirely on Intel chips. Originally, this str ategy benefited Dell through the advantage of incentives and discounts that came from buying in mass quantities and from only needing to maintain one production line. However, Intels lead in processing power has slowly lost ground to AMDs mor e powerful chips. Dell needs to reevaluate its current strategy of relying entir ely on Intel if it wants to maintain its position in the PC market. 21

IX.OPTIONSANDRECOMMENDEDSTRATEGY IX.1.Focusoninnovation While many of its competitor working feverishly to develop the next generation of technology, Dell has been waiting. To date, the firm s strategy has been to recreate technology. In many c ases, companies that do their own R&D are able to stay ahead of the industry thr ough the development of new products. Putting more emphasis on R&D has some pote ntial benefits. Through increased R&D spending, Dell may be the first to introdu ce products to market and establish first mover advantage. Dell s recognizable b rand-name would allow it to expand into new products and potentially create insu rmountable barriers to entry for its competition. However, an increased emphasis on R&D would distance the company from its core competencies. Increasing R&D ch anges its focus from mass customization of mature products to smaller batches an d product introduction and growth. Additionally, it would force the company from its direct sales model, as new products require multiple distribution channels to ensure they are available to customers as quickly as possible. Currently Dell s strength is the sales of mature products through mass production, bringing qu ality and price without the cost of R&D. IX.2.Divesting As is the nature of many l arger companies, Dell is competing in several different product markets. Divesti ng products or services that the company is not competing near the top of the ma rket will increase internal focus. Divesting of these assets or divisions could occur through identifying a competitor and selling the business, or by spinning a division into its own company. The key benefit of this strategy is the improve d focus on core business. Stripping away these segments would enable Dell to bec ome more streamlined. Specifically, it would require all 22

segments to work for similar customer bases. Establishing a singular customer fo cus to each employee allows Dell to leaps in product creativity and adds more th an value to its brand. As a complete solutions provider, Dell is uniquely positi oned to meet a full range of customer needs. Divesting portions of their busines s, especially in its growing infrastructure segment, could potentially limit gro wth. Removing components from Dell s network will mean that as business grows, D ell would utilize external resources to satisfy customer s requests, limiting th e effectiveness of Dell s competitive advantage. A single Dell branded solution is more likely to position Dell as a differentiated service company. IX.3.Expansi onintoservices This strategy encourages Dell to move into business consulting. This is a new business segment for Dell and would open a potentially new revenue str eam. Given the firm s internal success at manufacturing and value-chain efficien cies, Dell would have a respected reputation as a consultant. While application of these theories may be difficult at other firms, Dell s expertise and proven t rack record would provide differentiation in a crowded market. Movement into the services business places Dell against largely entrenched competitors. These com petitors have levels of expertise that Dell cannot currently match, placing it a t a competitive disadvantage. While Dells specific knowledge would help it enter the market, its ability to service the complete market would be limited. Likewis e, a limited market would not allow a stable revenue stream, making this busines s segment questionable. Ultimately, a move towards business consulting would dis tance the company from its core competencies. This move would limit focus from c ore businesses and distract the company from its position of excellence. IX.4.Rei nvigorateDifferentiationAdvantage This strategy encourages Dell to return to its co re competencies and calls for the company to get back to basics. It pushes the com pany to improve upon those competencies 23

which helped differentiate it from the beginning. Specifically, improvements wil l include the enhancement of customer service, the addition of suppliers, new ma rketing campaigns, the modification of retail sales and the expansion of turn-ke y solutions. This strategy seeks to widen Dell s competitive advantage through t he further refinement of its existing core competencies. Advantages of this stra tegy are considerable. Dell has long established itself as a pioneer and expert in value-chain management. The improvements this strategy develops are located w ithin the companys existing value-chain. Furthermore, Dells culture and structure is specifically aligned to focus on improvements in these areas. Most significantly , the suggested strategy does not force the firm reinvent itself. Because improv ements are limited to existing business segments, Dell will not be required to p roduce or develop new product lines. The negative aspects of this strategy are w orthy of mention. By solely improving upon existing competencies, the company ru ns the risk of becoming stagnant. The proposed strategy does not encourage the a ddition of new products or services, potentially keeping the company out of new and profitable markets. Stagnation in the technology industry represents a signi ficant risk and may cause degradation in the firms signaling criteria. This may r educe the companys premium price and ultimately decrease profitability. IX.5.Recom mendedStrategy It is recommended that the final alternative, in which Dell reinvig orates its differentiation strategy, be implemented. With this strategy, existin g organizational resources and wherewithal can be leveraged to develop a clear d ifferentiation advantage. This strategy does not make unnecessary or drastic ope rational changes which have the potential to disrupt the successful corporate cu lture and structure. Rather, the recommended strategy identifies and improves se veral existing competencies which have made the company so successful. 24

Dell considers customer service and support to be a key differentiator. The comp any, which prides itself on this segment of business, has consistently ranked #1 in the industry. Not surprisingly, this segment represents a significant and ex panding revenue stream for the firm. However, Dells lead in customer service and support has declined in recent years. Declining training and the outsourcing of customer service and support has damaged its reputation. To rectify this problem , Dell must improve its customer service representatives selection process, ensur ing they are easily understood and well trained. By improving this segment of bu siness Dell can once again clearly differentiate itself from rivals HP and IBM. Dells hugely successful direct sales model has allowed its products to be customi zed by customers. However, Dell maintains a single source relationship with chip maker Intel which limits consumer choice. Those that prefer to have PCs powered with AMD chips are currently unable to do so. To strengthen Dells customization position, the firm must offer increased configuration choices through the establ ishment of additional supplier relationships. There is however, one significant caveat. Dell must pursue relationships with only those suppliers that are able t o integrate seamlessly with Dells supply-chain. This strategy will allow Dell to offer additional choices for its customers while maintaining production efficien cies. This strategy also recommends that Dell revitalize its marketing efforts t o target underserved markets within the U.S. while expanding its marketing abroa d into emerging and growing international markets. As noted, the first tactic is domestic. Recent surveys show that a high percentage of U.S. homes have PCs. Ho wever, there is a stark discrepancy in computer use among ethnicities. Whites an d Asians are much more likely to use and own computers than their Black or Hispa nic counterparts. This high ownership among Whites and Asians makes it difficult for Dell to grow in this demographic segment. However, the low ownersh ip among 25

Blacks and Hispanics represents an area of growth. To strengthen Dells visibility with Blacks and Hispanics, it is recommended that Dell modifies its marketing f ocus. Dell must develop marketing campaigns to position its PCs as commodities t hat are necessary for everyday life. The second marketing enhancement will be ce ntered in emerging markets where Dells direct sales model has several inherent li mitations. For obvious reasons, the model does not work well in markets which cu stomers do not have access to the internet or credit-cards. In these markets it makes sense for Dell to expand its use of retail locations or showrooms. To achi eve success within emerging markets Dell must combine its direct sales model wit h its learned experience from its retail partnerships. This tactic calls for Del l to develop showrooms in which displays are available for customers to test and use products before they place an order. Once a customer has decided to purchas e an item, they may use an in-store phone or internet connection to place their order. As in the traditional Dell model, customers may customize their product d uring this process. This tactic allows Dell to bring its product to customers in emerging markets while still maintaining its direct sales business model. Turnkey IT solutions include the planning, implementation and maintenance of IT cust omer services. opportunities. Simply stated, it provides Dells customers with one -stop shopping As noted in Appendix O, this business segment represents a tremendous opportunity for revenue growth. While Dell does offer limited turn-key or manage d lifecycle services, the firm is not considered to be a major player in the mar ket currently representing less than 1% of the total market. The aim of this str ategy is to increase market-share through further enhancement of turn-key IT sol utions. To strengthen Dells position within the market, the company must improve its focus on specific customer needs. Dell must improve its existing services to provide reliable and predictable solutions around this segment of business. 26

Specifically, it is critical that the company design and deliver services which offer superior quality and efficiency, while sustaining customization for indivi dual customer needs. The subsequent exhibit shows the gap between buyer intended value and perceived value. The difficulty for Dell stems from the lack of real differentiation between intended value and perceived value of buyers. Competitor s adoption of Dell s business model, combined with the recent decline in Dell s c ustomer service has reduced Dell s competitive advantages, forcing customers to make decisions solely based on price. Potential opportunities for Dell to reverse this trend can be found in advertisi ng, service reputation and retail locations in emerging markets. Because Dells pr oducts are highly customized and purchased infrequently, it is important for the company to optimi ze its signaling criteria. The preceding recommended strategy differentiates the organization through the initiation of tactics which fortify the link between intended and perceived buye r value. 27

APPENDICESAC:ORGANIZATIONCHARACTERISTICS By MatthewSmith

A.OrganizationalPurposeandDirection A.1.OrganizationalValues Dell considers its organ tional values to be the Soul of Dell (Soul of Dell, 2006). Specifically, this Soul i s a statement of the corporations philosophy which defines its current position a nd future aspirations. It also serves as a guide for the firms actions around the world. Dell is committed to achieving financial success through ethical busines s practices which benefit its customers, shareholders, employees and the citizen s of its global markets. A.2.OrganizationalMission The organizations mission stateme nt is as follows: Dell s mission is to be the most successful computer company in the world at delivering the best customer experience in the markets we serve (Fr equently, 2006). A.3.OrganizationalVision While not specifically stated, it has bee n surmised that Dells vision is to lead in all regions we serve. The foundation of our success is the same in the United Kingdom and France, China and Japan, Cana da and other countries. Customers want technology products that are relevant to them, offer great value and can be easily purchased and used. Thats what our team around the globe consistently delivers (Fiscal 2005 in Review, 2005). Dells visio n is quite focused and assumes customer needs to be somewhat homogenous througho ut the world. A.4.OrganizationalGoals The primary organizational goal of Dell is to achieve $80 billion in revenue by the end of fiscal 2007. Despite having missed Q3 expectations in 2005, the organization raised its original revenue goal from $60 to $80 billion. This goal was revised to reflect high levels of revenue, 28

operating profits and cash from operations in recent years (Fiscal 2005 in Revie w, 2005). While this amended goal may seem to paint a promising picture for Dells future, it may be misleading. Desktop PC sales account for 37% of Dells revenue. Contrary to the PC market in general, Dells growth in the PC market has slowed o ver the last 18 months. Although Dell shipped a record 9.2 million units in that quarter, increased its service revenues by 36% and its storage revenue by 35%, its desktop sales declined by 2% (Dell Appears, 2005). Dell must regain its reve nue in this business segment if it is to reach its $80 billion goal. Secondary g oals for the firm include increasing its lagging PC sales while continuing to ex pand in emerging markets such as India and China. B.OrganizationalCharacteristics B .1.OrganizationalStructure Dell is best described as a flat organization. From the factory floor to senior leadership very little hierarchy exists to slow down the decision process. Employees are encouraged to pursue the most efficient ways to complete their jobs and are permitted to implement these new efficiencies witho ut prior approval by upper management. This open-communication has made junior e mployees realize their ideas are welcome and respected. Once proven to be succes sful, it is not uncommon for these ideas to be implemented across the organizati on. B.2.OrganizationalCulture Dell Inc. was founded 21 years ago as a computer star t-up company by Michael Dell. While the company has grown to more than 55,000 em ployees in 80 countries, Dell has done its best to maintain a small-company atmo sphere. communication and honesty. Dell preserves its culture through open Tell Dell surveys encourage rank-and-file employees to anonymously evaluate managers and senior leadership. The firm believes this type of honesty helps bring about accountability and change. Past appraisals have br ought about improvements 29

in work/life balance, corporate objectives, and job satisfaction ratings. volunt arily with over 90% of the workforce taking part in the survey. Participation is Overall Dells culture is described as a meritocracy which rewards those employees who work hard to meet organizational goals (Culture, 2006) and is critical of t hose who do not. Employees have seen first hand the profitability achieved by th e firms stock in the 1990s. While todays employees may not realize the same wealth from surging stock options as those in the 1990s, by-and- large the culture wor ks to retain and reward those employees who remain very competitive, hard workin g and loyal to the organization. B.3.CharacteristicsofLeadership Michael Dell starte d his computer company, which would later become Dell, Inc., in his University o f Texas dorm-room with just $1000. In 2004 Dell stepped down to become the organ izations Chairman of the Board and allowed Kevin Rollins to succeed as CEO. As no ted, leadership has worked hard to maintain accountability within this relativel y flat organization. Management is made acutely aware and held accountable when it fails to maximize organizational goals. People know how they are doing, how th e company is doing, what the problems are and know that the worst state for a le ader to be in is denial (There s Something About Dell, 2005). One way in which De ll evaluates its management is through the 360-degree appraisal process (Theres Som ething About Dell, 2005). Every six months employees are given the chance to rat e the performance of every manager. This appraisal includes every manager up to the CEO. Annual appraisals and promotions for management are based upon their im provement on their Tell Dell score. B.4.KeyStrategicPartnerships Dell has maintained a long-term single source partnership with the Intel Corporation to provide the c hips necessary to produce its PCs. As Intels largest customer, Dell is virtually 30

guaranteed its requests for Intels chips. This has helped Dell maintain productio n capacity even in times of chip shortages. Furthermore, the partnership with In tel has helped Dell contain the cost of its low-end, standard-based desktops and servers. This partnership may also have produced negative results for Dell. By not partnering with chip producer AMD in at least one of its lines, Dell may be at risk of losing both a price and perfor mance advantage. Chips from AMD are viewed by many analysts to be superior to th ose produced by Intel (Scannell, 2006). As Dell enters into new business segment s, such as home electronics, it has increased its partnerships with retailers an d suppliers. Dell has recently expanded its retail partners to include Costco Wh olesale Corp., Sams Club, QVC Inc. and Target in an attempt to boost its lagging consumer sales in PCs, consumer electronics and printers. In printers, Dell has p artnered with Lexmark, Fuji Xerox, Kodak and Samsung. Dell has also initiated se veral partnerships with top players in consumer electronics to minimize initial costs within this new business segment. Lastly, Dell has developed a partnership with EMC for its data storage solutions. C.ValueChainAnalysis 31

C.1.InboundLogistics Dells direct-to-consumer sales model has revolutionized the val ue chain within the computer industry. This model, which relies heavily upon web -based technologies such as Electronic Data Interchange (EDI) and just-in-time i nventories, has clearly been one of the distinguishing factors in Dells success. Dell encourages its suppliers to use its website to track orders and inventories . This real-time information sharing allows Dells chip and component manufacturer s to better see Dells sales. The goal of the information sharing is to create a v irtual corporation where suppliers can watch their products purchased as parts o n Dells computers. By using this technology, suppliers are able to more efficient ly meet inventory requirements and maintain low costs. C.2.Operations Dell has pos itioned itself as the #1 seller of personal computers by maintaining an efficien t and streamlined operating strategy. Dells servers, storage systems, mobile and desktop computers are built-to-order in six manufacturing facilities around the world. Web-based systems control customer orders and inventory levels. Dell maintains inventory le vels of only four days, even as it serves more customers with more products in m ore markets every day (Fiscal 2005 in Review, 2005). As noted, Dells culture encou rages its employees to find ways to cut costs. Within the last 4 years, Dell has increased its productivity by 400% and saved more than $1.9 billion by removing unnecessary costs within its operations (Fiscal 2005 in Review, 2005). This eff iciency has allowed Dell to sell its made-to-order units for 10% to 20% less tha n its rivals. C.3.OutboundLogistics Dells direct-to-consumer business model enables its customers to purchase its products via its website, by fax/phone or at limit ed retail locations. Internet customers are able to 32

customize their purchases on their own Dell Homepage. Dell notes that customers wh ich utilize its website spend more and make purchases faster than those using th e fax/phone method of order. Once the order is placed, Dell prides itself on a 7 -day shipping schedule. This delivery schedule is typically better than those of fered by the companys competitors. C.4.MarketingandSales Dells marketing efforts have a ubiquitous presence across the web, television and print. Few competitors can match the marketing budget of the $50 billion firm. Internet sales currently mak e up over 50% of the firms total sales. In hopes of increasing its consumer base the organization has offered its products at discount chains Wal-Mart, Target, Q VC Inc. and Costco. Although Dell built its reputation as a low-priced computer seller, the firm has shown signs of distancing itself from its discount-price im age by expanding its product mix to include high-end PCs, televisions, MP3 playe rs and other electronics. C.5.Service Over half of Dells sales are made on its webs ite, limiting the level of direct sales interaction between its employees and cu stomers. However, once the purchase is made consumers often interact with customer service/support representatives. As cost differences become slimmer, exceptional service is one way in which computer com panies differentiate and attract new and returning customers. Revenues from enha nced services/support are significant for the firm and have grown nearly 40 perce nt for three consecutive years (Fiscal 2005 in Review, 2005). Although the firm h as long prided itself on offering the best customer service in the industry, rec ent surveys have shown declining results in this segment of the business. Consum er Reports ranked Dell behind Apple, IBM and Toshiba for its customer support wi th laptops (Computers, Desktops, & Laptops, 2006, p. 232). Despite the decline, Dell has still managed to rate higher than its competitors HP and Compaq. In rec ent years customer 33

service/support has been moved to lower wage nations. Top executives have acknow ledged the problem and are reportedly working toward improvements. C.6.FirmInfrast ructure Dell was founded in and maintains its worldwide corporate headquarters in Round Rock, Texas. To increase its global presence the firm has expanded its in frastructure to include corporate offices and manufacturing facilities in the UK , Japan, Singapore, Ireland, Brazil, China, Malaysia and other U.S. locations. T he firms infrastructure also includes several overseas call centers in India. Although the company partners with retailers, it does not have any official retail locations as part of its infrastructure. Most of the firms infrastructure is virtual or web-based. This allows the company to sidestep retail overhead costs while maintaining customer visibility. C.7.HumanResources Dell employs over 55,000 individuals. The o rganization is dedicated to creating a diverse workforce to meet the objectives of the organization and its customers. Dell-sponsored groups were formed to prom ote a sense of community among employee participants, support business goals, ai d in their personal and professional development, support business goals and pro vide a resource for organically recruiting and retaining the best and brightest talent in the industry. The organization works diligently to create a corporate environment based on meritocracy, personal achievement and equal access to all a vailable opportunities. C.8.TechnologyDevelopment Dell defines itself as a global di versified technology provider (Form 10-Q, 2005). Although it would seem that Dell spends a tremendous amount on its R&D this is not the case. Dell brings very fe w new products to market. Instead, Dell has a focused strategy which leverages t he work of partners and other firms to recreate the work others have done very we ll 34

(Fiscal 2005 in Review, 2005). Dells global teams meet regularly with customers t o gain feedback on which new technologies will have the greatest impact. This fe edback is then shared with partners such as Oracle, Intel, EMC and Red Hat to sh are in R&D costs. This strategy is in stark contrast to IBM which spends billion s of dollars annually on R&D. The savings that Dell realizes from R&D allows it to deliver cookie-cutter servers and desktops at value. However, many analysts b elieve the firms inability to adopt more state-of-the-art technologies has preven ted Dell from establishing a successful strategy for high-end products (Scannell , 2006). C.9.Procurement As previously stated, Dell has remained extremely loyal t o chip maker Intel. As the largest producer of personal computers, Dell is also the largest customer of Intel chips. Intel claims to be able to ship materials i nto Dells production facilities every two hours based on realtime customer orders . This real-time supplier allows Dell and its suppliers to forecast and manage t he most efficient levels of inventory. Dell s decision to remain solely committed to Intel chips have certainly helped contain the cost of low-end, standard-base d desktops and servers. But competitors and analysts alike believe the company m ay be losing both a price and performance advantage by not incorporating rival A MD chips in at least one of its lines (Scannell, 2006, p. 4). Despite these claim s, Dell officials say that have no plans to use AMD chips in the near future. As noted, suppliers are directly linked to Dells website and are therefore able to see its inventory levels. Purchasing orders for production facilities are initia ted when customers place orders thereby depleting inventory levels on the shared website. This form of purchasing allows both Dell and its suppliers to properly forecast, thereby maintaining low levels of inventory and capital investment. 35

APPENDICESDF:ORGANIZATIONCAPABILITIESANDRESOURCES ByKhalidAlkelabi

D.KeyCompetenciesAssessment D.1.KeyCompetencies 1. Customer focus Dell understands how to serve its customers and it knows them well. The build to order business model that Dell adopts across its product lines (servers, desktops, notebooks, PDAs an d consumer electronics) accommodates the changing needs of its customers. This m odel allows Dell to offer the latest technologies for an affordable price in a s hort period of time; and that is exactly what customers want from companies in t his industry. As an example, Dell manages the changing needs of key customers by managing product life cycles and technology shifts (Gandossy, 2005). 2. Manufac turing processes Dells direct selling business model was the first to be applied on a mass scale in the personal computer industry. The model was further empower ed by the boom of the Internet in 1994. Dell developed numerous efficiencies and proficiencies over the last decade and applied the model to multiple product li nes where standardization of production and technology accessibility were possib le (Hoffman, 2005). 3. Supply chain management The direct selling business model applied by Dell is powered by a state of the art supply chain management (SCM) system. Dell is one of few global companies that realized a competitive advantage from its SCM system; it allowed Dell to move beyond a simp le value chain mechanism into a more sophisticated value webs organism. This had a great impact on Dells just-in-time (JIT) manufacturing and JIT inventory manag ement systems. (Gunasekara, 2005). 36

4. Customer selection, acquisition and retention Supported by its sophisticated IT and customer relationship management (CRM) systems, Dell efficiently targets corporate clients with low service costs and predictable buying behavior that is tied to their budgets. To retain these clients the company creates customized c orporate portals for each client, a model pioneered by Dell. This has resulted i n significant contributions to Dells revenue streams; a great portion of Dells sal es is generated by orders from business, corporate and government clients (Byrne s, 2003). 5. Customer service Dell offers a comprehensive set of tools to its bu siness clients and end consumers. From customer care programs to technical suppo rt, Dell offers multilayered services supported by Internet enabled knowledge ma nagement solutions, corporate support portals and Intranets, and global call cen ters. Dell also offers extended service and support plans across its product lin es for additional fees. Furthermore, Dell is beginning to offer complete service packages for corporate clients comprising of hardware/software solutions that a re deployed, serviced and maintained by Dells IT professional personnel. 6. Human capital management The industry that Dell operates in suffers from the limited selection pool of talented managers, IT professionals and engineers. Unlike the majority of its competitors, Dell has constantly attracted and retained the tale nts it needed. HR policies that define fast learning, problem solving, team buil ding and goal driven as the major characteristics of a successful executive hire are proving to be effective selection tools. Furthermore, the corporate culture at Dell has no tolerance for political conflicts, lies or inefficiencies; hones ty and results are all that matters (Salter, 1999). 37

D.2.OrganizationalSkills Dells core competencies are largely based on business proce sses, IT infrastructures and people. It is fairly easy for a competitor to copy and learn Dells business model or even reproduce their core competencies. Yet no competitor succeeded in doing so for one very important reason: execution. Dell has become the example of fast, consistent, reliable and responsive execution. T he successful marriage between Dells infrastructure (DNA) and its people created an organization that possesses a wealth of skills applied through extremely effi cient execution (Theres something, 2005). D.3.OrganizationalLearning Dells set of cor e competencies and the skills it gained from them are sustained, developed, and empowered by a corporate culture that encourages learning from mistakes and oper ating under ambiguity. The organization as a whole is an example of free knowled ge traffic: high visibility at every level. Dell went through a long iterative a pproach to integrate knowledge management into its IT infrastructure. The end re sult is a huge flow of information that circles Dells value webs. Through this IT enabled knowledge system, Dell benefits from suppliers wealth of knowledge: thei r technologies, production systems and inventory management systems. It also gat hers information about customers and learns a great deal about their Dell accomp lishes this by allowing the behavior, purchasing patterns, needs and trends. suppliers to integrate their systems with its systems; thus suppliers access cus tomers orders and provide information about availability, product details and tec hnology (Kersten, 1999). Furthermore, HR policies at Dell encourage the hiring o f skilled people that are willing to learn and share knowledge with their teams. Executives at every level share these values consistently; the corporate cultur es emphasis on accountability and results requires free sharing of knowledge and open communications. This was not easy to hardwire into Dells culture: from 38

1993 to 1995, many executives left their positions because they did not think th e environment was safe for them anymore; thus, change management was at its peak (Govindarajan, 2002). For the long run, Dells successful creation of a true lear ning organization has enabled it to grow at an exceptional rate. Unlike others i n the industry, this approach did not help Dell cope with growth; it actually ma de it what it is today. E.TechnologyAssessment E.1.ManufacturingTechnology Dell, as al major PC suppliers, does not manufacture any of its products. It assembles the components of the products in manufacturing assembly facilities around the world. The automation of the assembly process is key to Dells success. Each assembly lin e in an assembly facility can produce up to 4 different product models. To accom plish this, Dells engineers standardize products in a way that allows minor modif ications to produce different models (Hoffman, 2005). Original Equipment Manufac turers (OEMs), suppliers and third party manufacturers provide Dell with all the hardware and software it needs to produce desktops, servers, notebooks, LCDs, PDAs and printers. Although the companys supply chain consists of more than a hundred major suppliers, it prefers to lower the number for each component to 1, 2 or f ew supplier(s). Dell claims that this allows it to standardize its products, cre ate valuable relationships, integrate its IT systems with the supplier, receive favorable dis counts and reduce the complexity of the supply chain. It also claims that it onl y commits large, innovative and stable suppliers. For example, Intel is the only provider of PC and PDA processors; Microsoft is the only supplier of operating systems; LG for LCDs; Lexmark for printers; Western Digital and Samsung for hard drives. (See figure 1). 39

Figure 1 Dell s information & physical flow (Kraemer, 2001) To realize cost savings and operational efficiencies, Dell constantly tries to m inimize the number of touches a single component goes through in the supply chain until it reaches the inbound logistics at an assembly facility. The less touches a single component goes through the faster it arrives and the less it costs. In most new assembly facilities, the inbound logistics are performed in the facili ty itself, not at a separate facility. This allows Dell to better utilize its as sets and increase its inventory turnover. Inventories sit idle at an assembling facility for less than 4 hours on average. Dell is so successful in managing its supply chain and inventories that, unlike all competitors, it has major manufac turing facilities in the U.S. even though most suppliers are located overseas. I n 1999 Dell started to assemble all product lines at the facilities it owns inst ead of subcontractors and contracted manufacturers in hopes of better quality an d reduced costs (Hoffman, 2005). Suppliers, OEMs, and logistics partners have dir ect access to Dells transactional systems to fulfill orders, move components to a nd from Dell and deliver products to customers. 40

This helps Dell control costs and, as a first in the industry, it enables Dell t o modify products prices in real-time through its online ordering systems. Dell r elies on a formal business process improvement (BPI) program, similar to General Electrics Six Sigma, to continuously improve operational and production processe s. Managers, employees and engineers are heavily involved in this program and ar e cross-trained to enrich their knowledge about it. This program has been respon sible, since the early 90s, for many changes in inbound logistics, assembly lines improvements and standardizing product manufacturing (Fugate, 2004). E.2.Informa tionTechnology Managing Dells sophisticated value webs, build-to-order supply chain , e-commerce and internal resources is a true story of simultaneous IT horror an d success. Dell arrived to its current state of IT infrastructure utopia after mul tiple failures to implement an Enterprise Resource Planning (ERP) system. The pr oblem that faced Dell in the past was to find a solution that integrates enterpr ise wide IT systems, but ERP systems in the mid to late 90s failed to deliver suc h a comprehensive and flexible system that can accommodate Dells business model ( Slater, 1999). The current IT infrastructure that Dell implemented is a unique h ybrid of ERP, SCM, CRM and e-commerce systems provided by a subsidiary of Fujits u Limited (Glovia, 2001), JD Edwards (recently acquired by Oracle), Oracle datab ases and Microsoft operating systems. To support its IT infrastructure, Dell dep loyed a network of data centers to enable a variety of systems that manages logi stics, sales, manufacturing and other operations. Data centers are located in th e regions that Dell operates in globally. Each data center has its own staff of IT professional to develop, manage and maintain them. 41