Professional Documents

Culture Documents

I Tax Return

Uploaded by

Pronay ChakrabortyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

I Tax Return

Uploaded by

Pronay ChakrabortyCopyright:

Available Formats

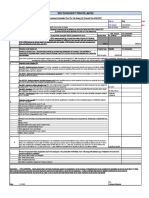

Personnel No. Personnel Area Pers. SubArea Org.

Unit

00364464 NW-I, ZO-Guwahati, R-IV Narsingpur ADB Narsingpur ADB

Name PAN No. Position Financial Year

Pronay Chakraborty ALXPC1927A Clerical - on prob. 01.04.2011 -31.03.2012

1.80C, 80CC Details:-01. Public Provident Fund 02. National Saving Certificate VIIIth issue 03.Subscription to notified mutual fund 04. Annuity Plan of LIC (New Jeevan Dhara,NJD- I, New Jeevan Akshay,NJA-I,NJA-II) 05. Postal Insurance Premium, Life Insurance, SBI Life/ICICI Prudential Premium 06. Sum paid as tuition fees (whether at the time of admission or thereafter) 07. Accrued interest on NSC VIII issue only 08. Repayment of loan installment on account of construction (paid not through Salary) 09. Stamp duty and Registration fee paid on house property 10. Term/Fixed Deposit for five years and above in Bank 11. Unit Linked Insurance Plan 1971 of UTI 12. Ded. in contribution to certain pension fund-max Rs.10,000/- (LIC,SBI Life,ICICI Prud) 13. Amt. Deposited with the National Housing Bank 14. Subscription to approved mutual fund (Infrastructure) 15. Post Office C. T. D. 16. Contribution to Superannuation Fund 17. Subscription to notified Central Government security (NSS) 18. Subscription to approved equity shares or debentures (Infrastructure) 19. Contribution to Recognized Provident Fund 20. Contribution to notified unit linked insurance plan of LIC Mutual Fund 21. Contribution to provident fund as per PF Act, 1925 22. Subscription to notified pension fund 23. Subsr to dpst schm of a pblc sectr com or any constituted athry in house constrc 24.Contract for a deferred annuity on life of specified persons 25. Section 80C - Senior Citizens Savings Scheme Rules 2004

Amount

16,000.00 0.00 0.00 0.00 10,687.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

2.Other Permissible Deductions:-01. Deduction in respect of medical insurance Premium (80D) Max.15,000/02. Ded in respect of maintenance incl. Med. treatment of handicapped dependent(80DD) a) Disabilty (Max. 50,000) b) Severe Disability (Max. 100,000) 03. Ded. in respect of treatment of specified decease on ailment prescribed(80DDB) a) Non Senior Citizen (Max. 40,000) b) Senior Citizen (Max. 60,000) 04. Repayment of interest on education loan (For self,spouse and dependent children) 05. Section 80G - Donation to PM's Rel.Fund or Don. to other insti./fund(100% Exem) 06. Deduction in case of an assessee with disability/Physical Blindness(80U) (a) With disability (Maximum Rs. 50,000) (b) With severe disability over 80%(Maximum of Rs. 100,000) 07. Medical Insurance Premium (Senior Citizen) 08. Medical Insurance Premium (Payment on behalf of parents) 09. Donation to CRY or other institution/fund (50% exemption) 10. Ded. in respect of rent paid(for those who are not getting HRA and Paying Rent) 11. Infrastructure Bond

Amount

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

3.Computation of Loss from House Property:-1.Rent Received 2.Less : Municipal Taxes 3.Interest on Housing Loan

Amount

0.00 0.00 0.00

4.Income from other sources:-01. Profit & Gains of business or profession 02. Long term Capital gains (Normal Rate) 03. Short term Capital gains 04. Income from Interest 05. Other Income(Income from lotteries,Speculations etc- IT-Deduction @30% slab) 06. TDS on Other Income 07. Other Income ( Normal Slab )

Amount

0.00 0.00 0.00 0.00 0.00 0.00 0.00

Date:18.04.2012 Time: 20:40:37 1

SIGNATURE ( Pronay Chakraborty )

Personnel No. Personnel Area Pers. SubArea Org. Unit

00364464 NW-I, ZO-Guwahati, R-IV Narsingpur ADB Narsingpur ADB

Name PAN No. Position Financial Year

Pronay Chakraborty ALXPC1927A Clerical - on prob. 01.04.2011 -31.03.2012

PERK VALUES FOR LOANS

Type of Loan 01. Housing Loan Perk 02. Add. Housing Loan Perk 03. Personal Loan Perk 04. Two wheeler Loan Perk 05. Car Loan Perk 06. Car Repair Loan Perk 07. Additional Car Loan Perk 08. Bicycle Loan Perk 09. Consumer Loan Perk 10. Dmnd Loan Agnst Sec Loan Perk 11. Others (Computer Loan , Etc.)

Perquisite value 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Date:18.04.2012 Time: 20:40:37 2

SIGNATURE ( Pronay Chakraborty )

From: Mr./Ms : Pronay Chakraborty Designation : Clerical - on prob. STATE BANK OF INDIA, Dept. : Narsingpur ADB PAN : ALXPC1927A PFINDEX NO : 3644642 To, STATE BANK OF INDIA, , , . Dear Sir, FINANCIAL YEAR 01.04.2011- 31.03.2012 VALUATION OF PERQUISITES 1. 2. I understand that Income Tax Rules for valuation of perquisites (Rule 3 duly amended till date) is applicable for the Current FinancialYear 01.04.2011 - 31.03.2012. In the event of any such perquisites as concessional/interest free loans etc are held by the Courts/IncomeTax Department,as taxable, I undertake to pay the demands made by the tax authorities, including interest, penalty, on the Bank as well as on me in my individual capacity as an assessee for current as well as previous financial years. This authority for recovery from me extends, inter-alia to my salary, terminal benefits, including pension in the event of my retirement/cessation of service. By declaring the information on-line I undertake to abide by all the rules relating to my Income, Investment and Tax liability. I am submitting the satisfactory proof of Investments made by me. I understand the investments/Interest on educational loans of children/ Lettable value of house/houses and the interest/investment under Sec-80G declared in the investment declaration form will be accounted for by the system and will be reflected in my form 16 and cannot be changed at a later date. I am wholly and solely responsible for it.

3. 4. 5. 6.

7.

Date:18.04.2012 Time: 20:40:37 3

SIGNATURE ( Pronay Chakraborty )

You might also like

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionnikunjrnanavatiNo ratings yet

- pcc-2011 TaxDocument19 pagespcc-2011 TaxHeena NigamNo ratings yet

- Life Insurance Premium CertificateDocument1 pageLife Insurance Premium CertificateNirantar SenNo ratings yet

- Premium Paid Certificate: Date: 25-MAR-2011Document2 pagesPremium Paid Certificate: Date: 25-MAR-2011sivasivaniNo ratings yet

- NMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationDocument10 pagesNMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationAnkit SharmaNo ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- MockDocument18 pagesMockSmarty ShivamNo ratings yet

- Chapter 12 TaxdeductionsDocument16 pagesChapter 12 TaxdeductionsRiya SharmaNo ratings yet

- Income Tax Guide FY 2023-24Document11 pagesIncome Tax Guide FY 2023-24akshay yadavNo ratings yet

- IT Declaration Form Revised SalaryDocument1 pageIT Declaration Form Revised SalaryMANUBHOPALNo ratings yet

- Details of Investment Declaration For The Financial Year 2014-2015Document1 pageDetails of Investment Declaration For The Financial Year 2014-2015Abhinav AgnihotriNo ratings yet

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionVinayak DhotreNo ratings yet

- R TSSDocument28 pagesR TSSAndri RodriguezNo ratings yet

- Schedule of Bonds Discount AmortizationDocument11 pagesSchedule of Bonds Discount AmortizationOndhotara AkasheNo ratings yet

- TDS (Tax Deducted at Source) : ST STDocument6 pagesTDS (Tax Deducted at Source) : ST STRuchiRangariNo ratings yet

- Luther Employment Law in MyanmarDocument158 pagesLuther Employment Law in Myanmarzar niNo ratings yet

- Circular / Office OrderDocument10 pagesCircular / Office OrderrockyrrNo ratings yet

- BASHIR Salary Slip (50129700 May, 2017)Document1 pageBASHIR Salary Slip (50129700 May, 2017)Abidullah KhanNo ratings yet

- BASHIR Salary Slip (50129700 May, 2017)Document1 pageBASHIR Salary Slip (50129700 May, 2017)Abidullah KhanNo ratings yet

- Income Tax Ready Reckoner 2011-12Document28 pagesIncome Tax Ready Reckoner 2011-12kpksscribdNo ratings yet

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYNo ratings yet

- Investment Declaration Form (Hemarus)Document4 pagesInvestment Declaration Form (Hemarus)Shashi NaganurNo ratings yet

- LNVJWLAP-04230167450 UnlockedDocument2 pagesLNVJWLAP-04230167450 Unlockedpulapa umamaheswara raoNo ratings yet

- Imposto D Renda em Inglês Tax Return - BrancoDocument5 pagesImposto D Renda em Inglês Tax Return - BrancoAbimaelNo ratings yet

- Tax Certificate - 008857356 - 161253Document1 pageTax Certificate - 008857356 - 161253gaurav sharmaNo ratings yet

- ULIPRPR XXXXXXX8009 19022021 4680 UnlockedDocument1 pageULIPRPR XXXXXXX8009 19022021 4680 Unlockedmanish sharmaNo ratings yet

- Sri B Satish Pension ReformsDocument91 pagesSri B Satish Pension ReformsyajurvedNo ratings yet

- Assignment of Economic and Business Legislature: Submitted To-Submitted byDocument7 pagesAssignment of Economic and Business Legislature: Submitted To-Submitted byMohit SahniNo ratings yet

- Taxation Direct and IndirectDocument6 pagesTaxation Direct and Indirectdivyakashyapbharat1No ratings yet

- IDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1Document3 pagesIDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1ragupathi.arumugaNo ratings yet

- FCL - 2024-01-10T134409.841Document2 pagesFCL - 2024-01-10T134409.841BINOD KUMARNo ratings yet

- New Direct Tax CodeDocument8 pagesNew Direct Tax CodeGurgaon88No ratings yet

- 1 .Income Tax On Salaries - (01.06.2015)Document57 pages1 .Income Tax On Salaries - (01.06.2015)yvNo ratings yet

- Deductions U/S 80C TO 80U: By: Sumit BediDocument69 pagesDeductions U/S 80C TO 80U: By: Sumit BediKittu NemaniNo ratings yet

- Tax Assessment-Part ADocument20 pagesTax Assessment-Part Ajoseph lupashaNo ratings yet

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- Sanction Letter: Shop No 7 11 C Prince Plaza Sneha Nagar, Indore Indore, Madhya Pradesh, 452001Document7 pagesSanction Letter: Shop No 7 11 C Prince Plaza Sneha Nagar, Indore Indore, Madhya Pradesh, 452001NISHA BANSALNo ratings yet

- Income Tax, IndiaDocument11 pagesIncome Tax, Indiahimanshu_mathur88No ratings yet

- Employment Income TaxDocument20 pagesEmployment Income TaxBizu AtnafuNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof Submissiongopikiran6No ratings yet

- IT Assignment - MDocument8 pagesIT Assignment - Mrushabh pareetNo ratings yet

- S.NO. Particulars Amount: Documents Compulsorily)Document1 pageS.NO. Particulars Amount: Documents Compulsorily)cmlr shopNo ratings yet

- Lnvjwlap 042301674501Document2 pagesLnvjwlap 042301674501pulapa umamaheswara raoNo ratings yet

- IT Proof SubmissionDocument2 pagesIT Proof SubmissiongreateyogeshNo ratings yet

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- Direct Taxes CodeDocument5 pagesDirect Taxes CodeSonia KapoorNo ratings yet

- Final Indirect Tax ProjectDocument39 pagesFinal Indirect Tax Projectssg1015No ratings yet

- Fixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeDocument4 pagesFixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeoooohlalaNo ratings yet

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887No ratings yet

- The Financial Kaleidoscope - Feb 2021 (Eng)Document9 pagesThe Financial Kaleidoscope - Feb 2021 (Eng)MdNo ratings yet

- Compilation Notes To Start WithDocument7 pagesCompilation Notes To Start WithSumant ChilkotiNo ratings yet

- Electricity BillDocument1 pageElectricity Billkapurmohnish0% (2)

- Muthoot Finance NCD Application Form Dec 2011 - Jan 2012Document8 pagesMuthoot Finance NCD Application Form Dec 2011 - Jan 2012Prajna CapitalNo ratings yet

- Auto Income Tax Calculator: Calculate Your Tax in Just 5 MinutesDocument6 pagesAuto Income Tax Calculator: Calculate Your Tax in Just 5 MinutesashutoshbinduNo ratings yet

- Theorem Tax Plan 2012-13Document1 pageTheorem Tax Plan 2012-13Ashwini PadhyNo ratings yet

- Muthoot Finance NCD Application Form Mar 2012Document8 pagesMuthoot Finance NCD Application Form Mar 2012Prajna CapitalNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Dividend PolicyDocument24 pagesDividend PolicySandhyadarshan Dash100% (1)

- Corporation Law ReviewerDocument14 pagesCorporation Law ReviewerRichard Allan Lim100% (1)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961digi timeNo ratings yet

- Liberalization of IndiaDocument18 pagesLiberalization of IndiaManjeet SinghNo ratings yet

- Taxation of CorporationsDocument78 pagesTaxation of CorporationsGlory Mhay67% (12)

- Credit Rating in BangladeshDocument74 pagesCredit Rating in BangladeshHussainul Islam SajibNo ratings yet

- Blakes Go Guides Small Business and TaxDocument66 pagesBlakes Go Guides Small Business and TaxRaj KumarNo ratings yet

- JFK Killed Just Days After Shutting Down RothschildDocument12 pagesJFK Killed Just Days After Shutting Down RothschildDomenico Bevilacqua100% (1)

- Regional Rural Banks Previous Papers - Gurgaon Gramin BankDocument35 pagesRegional Rural Banks Previous Papers - Gurgaon Gramin BankShiv Ram Krishna100% (2)

- Sur IPP PF SummaryDocument1 pageSur IPP PF Summarytkgoon6349No ratings yet

- Financial Reporting QuestionDocument5 pagesFinancial Reporting QuestionAVNEET SinghNo ratings yet

- Week One Lectures PDFDocument10 pagesWeek One Lectures PDFPradeep RaoNo ratings yet

- Metropolis Investment NoteDocument10 pagesMetropolis Investment NoteYash BNo ratings yet

- Chapter 14 - Answer PDFDocument18 pagesChapter 14 - Answer PDFAldrin ZlmdNo ratings yet

- MasDocument13 pagesMasHiroshi Wakato50% (2)

- Business Organizations OutlineDocument29 pagesBusiness Organizations OutlineMissy Meyer100% (1)

- SALWA Business PlanDocument62 pagesSALWA Business Planسلوئ اءزواني عبدالله سحىمىNo ratings yet

- Debtors Turnover RatioDocument7 pagesDebtors Turnover RatiorachitdedhiaNo ratings yet

- User Manual For Single Master Form-FirmsDocument103 pagesUser Manual For Single Master Form-FirmsUmaMaheshwariMohanNo ratings yet

- Accounting For Income Taxes: About This Chapter!Document9 pagesAccounting For Income Taxes: About This Chapter!sabithpaulNo ratings yet

- Q1 Module 1 To 5Document16 pagesQ1 Module 1 To 5Rajiv WarrierNo ratings yet

- Cash Flow Statement On KMBDocument86 pagesCash Flow Statement On KMBVeeresh PeddipathiNo ratings yet

- Case Study DiversificationDocument10 pagesCase Study DiversificationSebinKJosephNo ratings yet

- Sample Interview QuestionsDocument4 pagesSample Interview QuestionsDeepakNo ratings yet

- Investor Presentation PDFDocument28 pagesInvestor Presentation PDFshub56jainNo ratings yet

- Chapter 9 Answer SheetDocument10 pagesChapter 9 Answer SheetJoan Gayle BalisiNo ratings yet

- Multiple Choice ProblemsDocument11 pagesMultiple Choice ProblemsKatsuhiko TangNo ratings yet

- Fiscal Space: Special ReportDocument19 pagesFiscal Space: Special ReportNgô Túc HòaNo ratings yet

- Basis of Difference Balance of Trade (BOT)Document3 pagesBasis of Difference Balance of Trade (BOT)johann_747No ratings yet