Professional Documents

Culture Documents

Managerial Auditing Journal: Emerald Article: Customer Profitability Analysis:: An Activity-Based Costingapproach

Uploaded by

Innamuri Venkata SrikanthOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managerial Auditing Journal: Emerald Article: Customer Profitability Analysis:: An Activity-Based Costingapproach

Uploaded by

Innamuri Venkata SrikanthCopyright:

Available Formats

Managerial Auditing Journal

Emerald Article: Customer profitability analysis:: an activity-based costingapproach Malcolm Smith, Shane Dikolli

Article information:

To cite this document: Malcolm Smith, Shane Dikolli, (1995),"Customer profitability analysis:: an activity-based costingapproach", Managerial Auditing Journal, Vol. 10 Iss: 7 pp. 3 - 7 Permanent link to this document: http://dx.doi.org/10.1108/02686909510090276 Downloaded on: 25-03-2012 References: This document contains references to 7 other documents Citations: This document has been cited by 3 other documents To copy this document: permissions@emeraldinsight.com This document has been downloaded 7587 times.

Access to this document was granted through an Emerald subscription provided by VIGNANA JYOTHI INSTITUTE OF MANAGEMENT For Authors: If you would like to write for this, or any other Emerald publication, then please use our Emerald for Authors service. Information about how to choose which publication to write for and submission guidelines are available for all. Additional help for authors is available for Emerald subscribers. Please visit www.emeraldinsight.com/authors for more information. About Emerald www.emeraldinsight.com With over forty years' experience, Emerald Group Publishing is a leading independent publisher of global research with impact in business, society, public policy and education. In total, Emerald publishes over 275 journals and more than 130 book series, as well as an extensive range of online products and services. Emerald is both COUNTER 3 and TRANSFER compliant. The organization is a partner of the Committee on Publication Ethics (COPE) and also works with Portico and the LOCKSS initiative for digital archive preservation.

*Related content and download information correct at time of download.

Customer profitability analysis:

an activity-based costing approach

Malcolm Smith and Shane Dikolli A systematic approach is essential in attempting to develop an ABC analysis

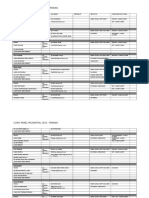

The impact of activity-based costing (ABC) on customer profitability analysis (CPA) has attracted relatively little attention in the management accounting literature. BellisJones[1], Howell and Soucy[2] and Smith[3] have examined the importance of customer profitability without exploring the potential usefulness of ABC in developing an accurate CPA. CPA is justifiable if the cost-benefit of compiling the information is favourable and the outcome of any subsequent strategic decision leads to income increases. Strategic decisions may range from changing the delivery terms of a customers contract to terminating business dealings with an unprofitable customer. Smith[3] observes that strategic consideration of customer-related costs can lead to a cost-effective change in the way customers needs are satisfied. Figure 1 encapsulates the range of possible customer expense categories and identifies four key factors which impact on customer profitability. Further embellishment of this figure for each of the key factors allows the development of characteristics which distinguish profitable from unprofitable customers. A consideration of discounts, commissions and sales support allows the impact of purchasing patterns to be specified, as shown in Table I. Discount and commission data, sorted by customer, is likely to be readily available in most computerized accounting systems. However, the determination of field service and sales support costs for each customer will necessitate some form of ABC. For example, the average length of time spent taking a customers order might be measured and then applied as a weighting factor to the number of telephone calls made. Large switchboard systems are capable of providing such statistics

Managerial Auditing Journal, Vol. 10 No. 7, 1995, pp. 3-7 MCB University Press Limited, 0268-6902

automatically. Time and information management systems can be added to smaller telephone systems to collect statistics relating to the frequency of calls to customers telephone numbers. Sales representatives planning sheets or an associated computerized system could provide statistics regarding the number and distance of customer visits. Alternatively, an estimated number of calls per customer, weighted according to the distance of the visit, might be used as a basis of allocation of sales-support costs. Ultimately, significant purchasing pattern dollars revealed in a customer profitability analysis should focus managements attention towards attempting to modify a customers purchasing behaviour. A consideration of distribution costs and frequency and special delivery requirements allows a further distinction to be made, as shown in Table II. Even with ABC, the split of the distribution cost between customers on a common delivery run is difficult. Assuming each delivery consumes the same amount of time, the most logical allocation of distribution cost is an even split between all customers to reflect capacityconsuming packaging or, more commonly, significant distances from the distribution point. The number of customer deliveries should be extractable from the sales ordering system and will be a useful input to the process of allocating distribution and shipping frequency costs to customers. Resource costs associated with shipping frequency might be split between standard and non-standard shipping activities, the latter requiring some form of manual monitoring. However, such a process will be worthwhile if it highlights those customers who place abnormal resource-consuming demands on the organization. The impact of differential ordering and debt-handling procedures on the cost of the accounting function further specifies the characteristics typical of the unprofitable customer, as shown in Table III.

Figure 1. Expense categories impacting on customer

profitability

Purchasing patterns Delivery policy Customer profitability Accounting procedures Inventory holding

Table II. Delivery policy and customer profitability

Expense Distribution expenses Shipping frequencies Freight fleet requirements Characteristics of Characteristics of profitable customers unprofitable customers Located close by, Located long distance, standard packaging, unique capacitybarcode reading consuming packaging Infrequent large-lot deliveries No special requirements Daily deliveries with additional deliveries on demand Require purchase or conversion of custommade delivery trucks

While the value of sales credits per customer is easily determined, the consumption of resources associated with administering the number of sales credits can only be determined only with analysis and measurement of occurrences of the activity driver. The activity costs of processing customer remittances can logically be allocated to customers on the basis of the number of remittances received, but those customers who pay late might be assigned a weighting factor to reflect a greater consumption of organizational resources (for example, through follow-up telephone calls) than by ontime customers. A further weighting factor might also be applied to customers who receive settlement discounts on accounts greater than, say, seven days. Order entry and processing would similarly be allocated to customers based on the number of invoice line items, with customers with standing orders or complex orders assigned an appropriate weighting factor. Despite the

apparent arbitrariness of such weighting factors, the final analysis resulting from their implementation may provide a number of opportunities with which to alter the management of customer accounting activities. Inventory-support and holding requirements, too, are often customer-specific with a direct impact on their relative profitability, as shown in Table IV. Customers requiring immediate deliveries will necessitate the organization holding greater inventory levels. The increased costs of storing inventory can be assigned to such customers using weighting factors. Determination of such weighting factors per customer requires an accumulation of statistics relating to required delivery promptness. These statistics may necessitate manual collection, or could be modelled from computerized systems to reveal the average number of days between a customers order and the corresponding delivery date. Decisions can be made to change the characteristics of a customer from profitable to unprofitable, but the success of such decisions depends on the accuracy of the information provided in the CPA. While ABC can improve the accuracy of such information, conventional ABC systems have limitations that need to be addressed. Not all ABC systems will analyse cost drivers in the area of customer-related costs, despite the likelihood of their not being volume-dependent. More sophisticated ABC systems may manage customer-related costs effectively, but this depends largely on the objectives of the ABC system and/or the nature of the production process. Where the primary objective of the ABC system is to determine product profitability, then the cost drivers selected will probably be quite different from those selected for customer-related resource consumption analysis. Delivery costs, for example, might be assigned accurately to customers based on distance travelled to the

Table I. Purchasing patterns and customer profitability

Expense Cost of volume discounts Characteristics of profitable customers Nil to low discounts Characteristics of unprofitable customers Large discounts

Size of agents Low commissions commissions Cost of field service to maintain products Cost of sales support

High commissions

Infrequent, successful Lengthy delays in order-getting obtaining daily orders telephone calls by telephone Few visits Frequent calls, assistance with administrative operations, help with in-store displays

Table III. Accounting procedures and customer profitability

Expense Sales credits Characteristics of Characteristics of profitable customers unprofitable customers Collates any sales credits and claims monthly Discounts, if any, apply to cash sales Pays on time Initiates separate sales credits for each item of product returned Receives discounts on accounts greater than seven days Pays late

requires tracing of the distances travelled by each product to each customer. The nature of such a task, particularly in an environment with a diverse product range, would be extremely onerous. An alternative, but less accurate, way of allocating the cost would be to use a capacity or volume-based measure. This may be feasible from a cost-benefit standpoint. By contrast, in environments where custom-made products dictate the nature of the production process, the activity drivers from both a product-profitability and a customer-profitability perspective are likely to be similar because the custom-made product is delivered to a customer and the associated distance travelled will be the same for either the customer or the product as the cost object. In mass-manufacturing environments, it would seem more likely, then, that the activity drivers selected for a customer profitability analysis would differ from the activity drivers selected for a product profitability analysis. Johnson[4] suggests that activity-based concepts are being oversold and that focus on total customer satisfaction is of paramount importance. He argues that if customers really want frequent deliveries in small-lot sizes, and an alternative supplier can meet the customer needs, then activity analysis might be misleading the supplier. This assumes that the supplier is prepared to decline the customers business and allow a competitor to supply that customer. Using ABC in a customer profitability analysis, the supplier may indeed accept that the customer is unprofitable and be willing to meet the customers needs. Kaplan[5] discusses three types of potentially unprofitable customer who might be retained: (1) new and growing customers, who promise profitable business in the future and may provide a stepping stone for penetrating lucrative new markets; (2) customers providing qualitative rather than financial benefits, including customers at the edge in the development of new markets who provide valuable insights into likely trend movements in consumer demand; (3) customers providing increased capability because of their status as recognized leaders in their markets or fields of expertise. Thus, where a CPA reveals that a particular customer is unprofitable, it does not necessarily follow that this customer should be eliminated. Nor does it follow that the customer must be persuaded to accept terms and conditions that will reduce the customers level of satisfaction. Negotiations with a customer might well reveal that less frequent deliveries would actually benefit the customer (i.e. less workload for the receiving officer,

Settlement discounts Debtor collection support Order processing

Maintains regular bulk orders

Requires immediate crisis deliveries resulting from stockouts, but whose order details are so complex that multiple queries result before the transaction can be completed

customer premises; but where product profitability is the ultimate objective, it is simpler to assign delivery costs based on the volume or weight of the product delivered to customers, irrespective of where the product was delivered. For example, to allocate accurately delivery costs of $10,000 over a total distance travelled to customers of 2,000 kilometres, it is necessary to trace the distances travelled to each customer and assign costs at the rate of $5 per kilometre. In many cases the individual distances could reasonably be estimated without too much difficulty. From a product-profitability perspective, allocating accurately the $10,000 over different products

Table IV. Inventory holding and customer profitability

Expense Inventory support Distribution support Holding requirements Characteristics of profitable customers Predictable delivery and inventory requests Collects sales orders Characteristics of unprofitable customers Requires delivery on demand at irregular times Requires free delivery to a remote or long-distance location Will take business elsewhere if required inventory is not held

Compatible with your JIT scheduling

fewer purchase orders, fewer transaction input entries, less paperwork) without causing costly stockpiles. Clearly, there is scope for negotiating with customers to influence their behaviour (so that they act in ways which are more profitable for the firm) without compromising the customers level of satisfaction. Some aspects of improved negotiation might include: q non-cash incentives from sunk-cost investments for example, sponsoring a season of a major cultural event primarily yields advertising benefits; however, seats in the accompanying corporate boxes might also yield enticing customer incentives. Similarly, a companys accumulated frequent-flyer points may perhaps be spent on customers, new or existing; q restructure of delivery runs to create a more timely but less frequent service for the customer; q capacity maximization on delivery runs that are required for profitable customers by offering a more frequent service for the potentially unprofitable customer with unpredictable demands; q purchase of equipment on behalf of customers which they can use rent-free, in lieu of discounts and/or agents commissions. The cash saved on reduced discounts/commissions potentially should exceed the cost of the asset. Additionally, ownership is retained and a stronger bond is forged with the customer, thereby generating greater negotiating power in future; q free short-term financial advice which will create efficiencies for the customer, leading to reduced internal workload and consumption of resources; q new products at no cost in return for reduced discounts, to serve a dual purpose: improving customer profitability while providing a useful vehicle for the promotion of new products; q a trade-off between quantity discounts and settlement discounts that minimizes the costs of cash overdraft and maximizes long-run production scheduling. The overriding consideration with a CPA is that management will at least be armed with information about unprofitable customers and can focus attention on developing those innovations/strategies that might reduce the lack of profits of a particular customer, without reducing that customers satisfaction. Alternatively, provided a shift of thinking is possible, management can restructure the manufacturing process that will ultimately lead to a shift in the results of a customers profitability. The role of the mechanics of ABC in developing a CPA should not be underestimated. With ABC, general ledger amounts are dissected, making the assignment of costs to

customers easier. In particular, the associated on-costs of employing sales staff and motor vehicles would be analysed in detail and be readily available. This would embrace vehicle operating costs (depreciation, petrol, licensing, insurance and vehicle signage) as well as superannuation, fringe benefits and payroll tax, holiday and long-service leave entitlements, workers compensation insurance, mobile telephone and training costs. Several of these items might conveniently be omitted from a non-ABC customer profitability analysis because of the complex analysis required to divide the general ledger amounts between the activities of different salespersons. Resource to activity allocations (e.g. gas, water, electricity) provide a more accurate representation of resource consumption by customers. A non-ABC alternative is likely to cause customer-cost distortions in such translations. Additionally, activity drivers will assist in the assignment of activity costs to customers, where otherwise arbitrary allocation methods would be employed. Thus, distribution costs might be assigned on a zone basis depending on the delivery destination activity, rather than being spread across all customers in an arbitrary fashion. A systematic approach is essential in attempting to develop an activity-based costing CPA. Lewis[6] outlines a simple ABC system for recognizing marketing costs by product line. He also indicates how these ideas can be easily transferred into a profitability analysis statement by territory. It follows that Lewiss ideas could be extended further to a full CPA, or at least provide a useful starting-point for developing a CPA. For more sophisticated models, Turney and Stratton[7] present an activity-based model using micro and macro activities which lead to assignment of cost to final products. This two-tiered activity structure could apply just as well to an assignment of cost to customers as it does to final products. The primary advantage of this type of model is that dual objectives may be satisfied, as follows: q customer costing objective depicting the profitability of a customer using the cost of macro activities; q performance improvement objective isolating detailed areas for potential improvement by focusing on micro activities. The two-tiered activity model reduces many of the difficulties associated with conventional ABC systems where the activity drivers to the final cost object are so aggregated that the level of accuracy is potentially compromised. Detailed analysis of customers, and associated servicecost differences, may be justified if the cost of obtaining

and maintaining information is not excessive, or if the information so generated is useful in the making of strategic decisions. Analysis of the revenue streams generated by customers, relative to their service costs, may lead to some customers being eliminated from the business or, at least, a change of emphasis in the way in which resources are allocated between customers. In each case incremental costs and price elasticities of demand must be examined and a customer loyalty profile established to determine sensitivity to prices or to the levels of service provided. How will our internal costs change in response to variations in the level of service provided? A fundamental analysis of customers, and the effect of variations in service on internal cost structures, will provide the information to support strategic decisions relating to the customer base. A more accurate ABC model, tracking resource consumption by customers, is likely to cause fewer customer-cost distortions than are non-ABC alternatives. The need for a strategic approach is evident. We must not be tempted to pigeon-hole TQM, ABC or CPA and

examine each in a blinkered fashion. They must be employed simultaneously so that all aspects of customer focus can be considered, with projected costs and revenues appropriately quantified.

References 1. Bellis-Jones, R., Customer profitability analysis, Management Accounting (UK), February 1989, pp. 26-8. 2. Howell, R.A. and Soucy, S.R., Customer profitability: as critical as product profitability, Management Accounting (US), October 1990, pp. 43-7. 3. Smith, M., Customer profitability analysis revisited, Management Accounting (UK), October 1993, pp. 26-8. 4. Johnson, H.T., Its time to stop overselling activity-based concepts, Management Accounting (US), September 1992, pp. 26-35. 5. Kaplan, R.S., In defense of activity-based cost management, Management Accounting (US), November 1992, pp. 58-63. 6. Lewis, R.J., Activity-based costing for marketing, Management Accounting (US), November 1991, pp. 33-8. 7. Turney, P.B. and Stratton, A.J., Using ABC to support continuous improvement, Management Accounting (US), September 1992, pp. 46-50.

Malcolm Smith is Associate Professor of Accounting in the School of Economics and Commerce, Murdoch University, Murdoch, Western Australia and Shane Dikolli is Lecturer in Accounting in the School of Accounting, Curtin University of Technology, Perth, Western Australia.

You might also like

- Business To Business Marketing 3Document10 pagesBusiness To Business Marketing 3Innamuri Venkata SrikanthNo ratings yet

- Marketing ResearchDocument22 pagesMarketing ResearchInnamuri Venkata SrikanthNo ratings yet

- ComptrDocument1 pageComptrInnamuri Venkata SrikanthNo ratings yet

- Increase Sales, Hire Best CandidatesDocument3 pagesIncrease Sales, Hire Best CandidatessrishillNo ratings yet

- A Project Report On "Corporate Social Responsibility and Multinational Oil Corporations"Document32 pagesA Project Report On "Corporate Social Responsibility and Multinational Oil Corporations"Innamuri Venkata SrikanthNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- RFID Receiver Antenna Project For 13.56 MHZ BandDocument5 pagesRFID Receiver Antenna Project For 13.56 MHZ BandJay KhandharNo ratings yet

- Transistor Amplifier Operating ParametersDocument21 pagesTransistor Amplifier Operating ParametersReddyvari VenugopalNo ratings yet

- Principles of CHN New UpdatedDocument4 pagesPrinciples of CHN New Updatediheart musicNo ratings yet

- CPS Layoffs BreakdownDocument21 pagesCPS Layoffs BreakdownjroneillNo ratings yet

- Berger Paints (India) Limited 21 QuarterUpdateDocument7 pagesBerger Paints (India) Limited 21 QuarterUpdatevikasaggarwal01No ratings yet

- EVS XT2+ Tech Ref Software Manual v10.03 PDFDocument80 pagesEVS XT2+ Tech Ref Software Manual v10.03 PDFgibonulNo ratings yet

- NetworkingDocument1 pageNetworkingSherly YuvitaNo ratings yet

- New Microwave Lab ManualDocument35 pagesNew Microwave Lab ManualRadhikaNo ratings yet

- Gatk Pipeline Presentation: From Fastq Data To High Confident VariantsDocument8 pagesGatk Pipeline Presentation: From Fastq Data To High Confident VariantsSampreeth ReddyNo ratings yet

- Seismic Design Guide (2010)Document102 pagesSeismic Design Guide (2010)ingcarlosgonzalezNo ratings yet

- Clinnic Panel Penag 2014Document8 pagesClinnic Panel Penag 2014Cikgu Mohd NoorNo ratings yet

- Picco Tac 1095 N Hydrocarbon ResinDocument2 pagesPicco Tac 1095 N Hydrocarbon ResindevanandamqaNo ratings yet

- Informed Consent: Ghaiath M. A. HusseinDocument26 pagesInformed Consent: Ghaiath M. A. HusseinDocAxi Maximo Jr AxibalNo ratings yet

- Bibliography PresocraticsDocument10 pagesBibliography Presocraticsalraun66No ratings yet

- Otis Brochure Gen2life 191001-BELGIUM SmallDocument20 pagesOtis Brochure Gen2life 191001-BELGIUM SmallveersainikNo ratings yet

- Linear Programming Models: Graphical and Computer MethodsDocument91 pagesLinear Programming Models: Graphical and Computer MethodsFaith Reyna TanNo ratings yet

- Ragavendhar Seeks Entry Software JobDocument2 pagesRagavendhar Seeks Entry Software JobfferferfNo ratings yet

- July 4th G11 AssignmentDocument5 pagesJuly 4th G11 Assignmentmargo.nicole.schwartzNo ratings yet

- LP IV Lab Zdvzmanual Sem II fbsccAY 2019-20z 20-ConvxvzzertedDocument96 pagesLP IV Lab Zdvzmanual Sem II fbsccAY 2019-20z 20-ConvxvzzertedVikas GuptaNo ratings yet

- Human Resource Management (MGT 4320) : Kulliyyah of Economics and Management SciencesDocument9 pagesHuman Resource Management (MGT 4320) : Kulliyyah of Economics and Management SciencesAbuzafar AbdullahNo ratings yet

- Description MicroscopeDocument4 pagesDescription MicroscopeRanma SaotomeNo ratings yet

- Biology GCE 2010 June Paper 1 Mark SchemeDocument10 pagesBiology GCE 2010 June Paper 1 Mark SchemeRicky MartinNo ratings yet

- RRR Media Kit April 2018Document12 pagesRRR Media Kit April 2018SilasNo ratings yet

- All Types of Switch CommandsDocument11 pagesAll Types of Switch CommandsKunal SahooNo ratings yet

- STR File Varun 3Document61 pagesSTR File Varun 3Varun mendirattaNo ratings yet

- Introduction To Managerial Accounting Canadian 5th Edition Brewer Solutions ManualDocument25 pagesIntroduction To Managerial Accounting Canadian 5th Edition Brewer Solutions ManualMaryJohnsonsmni100% (57)

- Njhs Application EssayDocument4 pagesNjhs Application Essaycjawrknbf100% (2)

- Safety Data Sheet for Instant AdhesiveDocument6 pagesSafety Data Sheet for Instant AdhesiveDiego S. FreitasNo ratings yet

- The Ideal Structure of ZZ (Alwis)Document8 pagesThe Ideal Structure of ZZ (Alwis)yacp16761No ratings yet

- Philosophy of Disciple Making PaperDocument5 pagesPhilosophy of Disciple Making Paperapi-665038631No ratings yet