Professional Documents

Culture Documents

Go Fin 268 02 pg630

Uploaded by

R.p. VenkatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Go Fin 268 02 pg630

Uploaded by

R.p. VenkatCopyright:

Available Formats

7. RETIREMENT & PENSION 7.

19 Tamil Nadu Government Employees' Special Provident Fund-cum-Gratuity Scheme (1984) - Payment of interest on the employees' subscription beyond 148th instalment - Revised orders

Finance (Pension) Department G.O. (Ms) No. 268 1. 2. 3. 4. ORDER According to rule 5 of the Tamil Nadu Government Employee's Special Provident Fundcum-Gratuity Scheme Rules (1984), the rate of interest shall be treated on par with the rate of interest applicable to General Provident Fund (Tamil Nadu) subscription. The recovery of subscription under the said scheme was commenced from the month of April, 1984 and the recovery of subscription accumulated to Rs.5,021/- at the end of July, 1996. The rate of interest towards General Provident Fund subscription was raised from time to time since 1984 and the rate of interest for the year 1996-97 towards General Provident Fund subscription was 12% per annum. 2. In the Government order first read above, orders have been issued allowing 12% per annum instead of 9% per annum on the second stage of interest calculation by issuing the following orders:Those employees subscribing to the scheme and retire before 148th installment shall receive gross amount as per the table of repayment. 3.Those who have already subscribed 148 installments at the end of month of July 1996 shall be paid the principal amount Rs.5,021/- plus the interest thereon at 12% per annum compounded annually plus the Government contribution of Rs.5,000/- (now enhanced to Rs.10,000/-). The Heads of Offices/ Heads of Departments shall work out the interest and sanction the payment under the scheme. 4. In the Government order second and third read above, orders have been issued reducing the rate of interest payable on the principal amount of Rs.5,021/- under the Tamil Nadu Government Employees Special Provident Fund-cum-Gratuity Scheme (1984) from 12% per annum to 11% per annum compounded annually with effect from 1.8.2000 and from 11% per annum to 9.5% per annum compounded annually with effect from 1.8.2001 respectively consequent on the reduction on the rate of interest towards General Provident Fund subscription made by the Government employees from 12% per annum to 11% per annum with effect from 1.4.2000 and from 11% annum to 9.5% per annum with effect from 1.4.2001. In the G.O. fourth read above, orders have been issued reducing the rate of interest from 9.5% per annum to 9% per annum towards the General Provident Fund subscription made by the Government employees with effect from 1.4.2002. 5. The Government have decided to reduce the interest from 9.5% per annum to 9% compounded annually with effect from 1.8.2002 payable on the amount of Rs.5,021/- standing at the credit of the State Government at the end of July, 1996 under the Government Employees Special Provident fund-cum-Gratuity Scheme (1984). Accordingly, the Government direct that the rate of interest payable on the principal amount of Rs.5,021/- shall be reduced to 9% per annum compounded annually with effect from 1.8.2002. 6. An illustration for the calculation of interest is annexed to this order. (By order of the Governor) SECRETARY TO GOVERNMENT G.O. G.O. G.O. G.O. (Ms) (Ms) (Ms) (Ms) Dated:31.07.2002 Read : No.62 Finance (Pension) Department dated:11.2.1997. No.473 Finance (Pension) Department dated:17.10.2000. No.334 Finance (Pension) Department dated:5.9.2001. No.151 Finance (Allowance) Department dated:6.5.2002.

N.NARAYANAN

630

7. RETIREMENT & PENSION

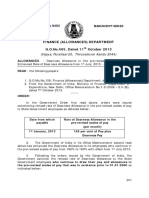

ILLUSTRATION A Government employee is due to retire on superannuation on 31st January, 2003 Subscription paid for 148 instalments at Rs.20/- per month Total Rs. 2960 Rs. 5021 interest allowed upto 31.7.96 as per the table of repayment Rs. 2061 From 1.8.96 onwards the principal amount for calculation of interest will be Rs.5021/Interest for the period from 1.8.96 to 31.7.97 on Rs.5021=Rs.5021 x 12/100=Rs.602.52 rounded to nearest rupee 603 Total at the end of 31.7.97=Rs.5021+603 = 5624 From 1.8.97 onwards the principal amount will be Rs.5624 Interest for the period from 1.8.97 to 31.7.98 on Rs.5624=Rs.5624 x 12/100=Rs.674.88 rounded to nearest rupee 675 Total at the end of 31.7.98=Rs.5624+675 = 6299 From 1.8.98 onwards the principal amount will be Rs.6299 Interest for the period from 1.8.98 to 31.7.99 on Rs.6299=Rs.6299 x 12/100=Rs.755.88 rounded to nearest rupee 756 Total at the end of 31.7.99=Rs.6299+756 = 7055 From 1.8.99 onwards the principal amount will be Rs.7055 Interest for the period from 1.8.99 to 31.7.00 on Rs.7055=Rs.7055 x 12/100=Rs.846.88 rounded to nearest rupee 847 Total at the end of 31.7.2000=Rs.7055+847 = 7902 From 1.8.2000 onwards the principal amount will be Rs.7902 Interest for the period from 1.8.2000 to 31.7.2001 on Rs.7902=Rs.7902 x 11/100=Rs.869.22 rounded to nearest rupee 869 Total at the end of 31.7.2001=Rs.7902+869 = 8771 From 1.8.2001 onwards the principal amount will be Rs.8771 Interest for the period from 1.8.2001 to 31.7.2002 on Rs.8771=Rs.8771 x 9.5/100=Rs.833.25 rounded to nearest rupee 833 Total at the end of 31.7.2002=Rs.8771+833 = 9604 From 1.8.2002 onwards the principal amount will be Rs.9604 Interest for the period from 1.8.2002 to 31.1.2003 on Rs.9604=Rs.9604 x 9/100x6/12 (for six months) =Rs.422.18 rounded to nearest rupee 432 Total at the end of 31.1.2003=Rs.9604+432 = 10036 So total interest to be allowed is (Rs.10036-2960) 7076 The retiring employee will get an aggregate amount as given below: Principal Interest Government Contribution Total amount to be paid = Rs.2960 = Rs.7076 = Rs.10000 Rs.20036

631

You might also like

- Tamil Nadu Govt Employee Pension Interest RateDocument2 pagesTamil Nadu Govt Employee Pension Interest RateMani BaluNo ratings yet

- Fin-E-268-2002 SPF Rs20Document5 pagesFin-E-268-2002 SPF Rs20The PrincipalNo ratings yet

- GO (P) No 1142-98-Fin Dated 25-03-1998Document6 pagesGO (P) No 1142-98-Fin Dated 25-03-1998Saravanan SubramaniNo ratings yet

- Gover Rnment of Andhra PradeshDocument15 pagesGover Rnment of Andhra PradeshChoppa RamachandraiahNo ratings yet

- Pension Rules 2009trDocument12 pagesPension Rules 2009trjaydeep_chakrabort_2No ratings yet

- YDocument4 pagesYBernadette RajNo ratings yet

- GIS-Revised Rates of Intrest 2010Document18 pagesGIS-Revised Rates of Intrest 2010SEKHARNo ratings yet

- SPF 1984Document4 pagesSPF 1984sakthijack100% (2)

- TN Govt introduces new pension schemeDocument14 pagesTN Govt introduces new pension schemeGuna SeelanNo ratings yet

- Final Payment Sanctioned for Retired AssistantDocument5 pagesFinal Payment Sanctioned for Retired Assistantsakthijack67% (3)

- AP Govt Revises Interest Rate for Employee Insurance SchemeDocument6 pagesAP Govt Revises Interest Rate for Employee Insurance SchemeSivareddy50% (2)

- Fin - e - 197 - 2021 FBFDocument3 pagesFin - e - 197 - 2021 FBFsubramaniam vNo ratings yet

- Gis Tabels 2014 15Document24 pagesGis Tabels 2014 15seprwglNo ratings yet

- Apgli Revised Slab RatesDocument5 pagesApgli Revised Slab RatesSREEKANTHBABUNo ratings yet

- 05032016fin - MS36 - 1Document5 pages05032016fin - MS36 - 1Santtosh Kummar AgathamudiNo ratings yet

- 15.P. Go - 504 - SPF - 2000Document3 pages15.P. Go - 504 - SPF - 2000Nesa Raj0% (1)

- 2019fin MS19Document4 pages2019fin MS19ShanmukhamNo ratings yet

- FD 03 SRP 2020 Dtd-23-03-2020 PDFDocument4 pagesFD 03 SRP 2020 Dtd-23-03-2020 PDFLokesh G NNo ratings yet

- TN govt increases DA to 295Document3 pagesTN govt increases DA to 295NAZIR AHAMEDNo ratings yet

- Tamil Nadu Government OrderDocument3 pagesTamil Nadu Government OrderChandru ArcNo ratings yet

- 1.06.2021 - Consolidation of PensionDocument7 pages1.06.2021 - Consolidation of PensionChalla RamanamurtyNo ratings yet

- CFCP e 22 2008Document2 pagesCFCP e 22 2008mlocal652No ratings yet

- FINANCE (Allowances) DEPARTMENT G.O.Ms - No.151, Dated 20 May 2019Document3 pagesFINANCE (Allowances) DEPARTMENT G.O.Ms - No.151, Dated 20 May 2019Ram RajNo ratings yet

- AP PRC 10 EXOL Leave Rules .. Ex-Gratia .. To Some DeseasDocument7 pagesAP PRC 10 EXOL Leave Rules .. Ex-Gratia .. To Some DeseasSEKHARNo ratings yet

- Sri Lanka PAYE Income Tax TablesDocument14 pagesSri Lanka PAYE Income Tax Tableskahatadeniya0% (1)

- G.O. 313 of 2018 PDFDocument3 pagesG.O. 313 of 2018 PDFKulandaivelu Advocate OfficeNo ratings yet

- FINANCE (Allowances) DEPARTMENT G.O.Ms - No.313, Dated 18 September 2018Document3 pagesFINANCE (Allowances) DEPARTMENT G.O.Ms - No.313, Dated 18 September 2018panneerselvam panneerNo ratings yet

- Provision of Property Loans Through Banks-Instructions For AccountingDocument5 pagesProvision of Property Loans Through Banks-Instructions For AccountingPrabath WijewardanaNo ratings yet

- Loan & AdvancesDocument31 pagesLoan & Advancesmacbook28487No ratings yet

- Telangana Govt increases DA by 3.544Document6 pagesTelangana Govt increases DA by 3.544Shiva RamNo ratings yet

- Government of West B Ngal FI Ance Department Audit BranchDocument3 pagesGovernment of West B Ngal FI Ance Department Audit BranchsudipNo ratings yet

- Appendix Chapter IIDocument57 pagesAppendix Chapter IItridibmtNo ratings yet

- Da KeralaDocument4 pagesDa KeralaVishwas ShindeNo ratings yet

- Pen GO248Document8 pagesPen GO248Upendra KumarNo ratings yet

- D A To Pensioners'Document2 pagesD A To Pensioners'Onkar OakNo ratings yet

- BENEFITSDocument9 pagesBENEFITSSaurav TomarNo ratings yet

- Surender Leave in 2009-10Document2 pagesSurender Leave in 2009-10dayakarNo ratings yet

- Minimum Pension PRC 2010 ... GO100Document246 pagesMinimum Pension PRC 2010 ... GO100SEKHAR100% (5)

- Surender LeaveDocument2 pagesSurender Leavemrrhmn4uNo ratings yet

- IR GoDocument4 pagesIR Govenkatasubramaniyan100% (4)

- Finance (Allowances) Department G.O.No.405, Dated 11 October 2013Document4 pagesFinance (Allowances) Department G.O.No.405, Dated 11 October 2013Papu KuttyNo ratings yet

- GO (P) No 560-96-Fin Dated 06-09-1996 PDFDocument4 pagesGO (P) No 560-96-Fin Dated 06-09-1996 PDFSaravanan SubramaniNo ratings yet

- Fin e 327 2019Document4 pagesFin e 327 2019Gunalan GunaNo ratings yet

- G.O.Ms - No.58 - dt.11.06.2021 - Family Pension To CPS EmployeesDocument5 pagesG.O.Ms - No.58 - dt.11.06.2021 - Family Pension To CPS Employeesdto nagarkurnoolNo ratings yet

- Prorata Pension DetailsDocument6 pagesProrata Pension Detailsshaunak_srNo ratings yet

- Fin e 8 2023 PDFDocument3 pagesFin e 8 2023 PDFSelva KumarNo ratings yet

- Andhra Pradesh Government Pension Order SummaryDocument252 pagesAndhra Pradesh Government Pension Order SummaryDRAVIDA SANKSHEMA SANGHAM100% (1)

- Gono261addl HraDocument3 pagesGono261addl Hraapi-215249734100% (1)

- 26.01.2016 Eps Will Apply Only Epf MembersDocument2 pages26.01.2016 Eps Will Apply Only Epf Membersd kumarNo ratings yet

- Microsoft Word - 2019FIN - MS36Document6 pagesMicrosoft Word - 2019FIN - MS36nagalaxmi manchalaNo ratings yet

- GPF Interest Rate 8Document2 pagesGPF Interest Rate 8vanjinathan_aNo ratings yet

- Pensatoryallowance Vide Go Ms 176 dt.15-12-2015 PDFDocument4 pagesPensatoryallowance Vide Go Ms 176 dt.15-12-2015 PDFSRIDHARNo ratings yet

- Telangana Pension DR HikeDocument4 pagesTelangana Pension DR Hikeindhra sena reddyNo ratings yet

- Cps ClarificationDocument4 pagesCps ClarificationgcrajasekaranNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- Setting up, operating and maintaining Self-Managed Superannuation FundsFrom EverandSetting up, operating and maintaining Self-Managed Superannuation FundsNo ratings yet

- Cooper CaseDocument5 pagesCooper Caseankur_joshi_14No ratings yet

- Wall Street Playboys-Triangle Investing-Stocks, Real Estate and Crypto CurrenciesDocument139 pagesWall Street Playboys-Triangle Investing-Stocks, Real Estate and Crypto Currenciesboo100% (5)

- Calculating taxes for pediatricians in the PhilippinesDocument6 pagesCalculating taxes for pediatricians in the PhilippinesCalvin Carl D. Delos ReyesNo ratings yet

- Shareholdersx27 Equity Prac 1 PDF FreeDocument10 pagesShareholdersx27 Equity Prac 1 PDF FreeIllion IllionNo ratings yet

- Project Taxation (Ouano)Document16 pagesProject Taxation (Ouano)GuiltyCrownNo ratings yet

- Project WHEELS INDIADocument63 pagesProject WHEELS INDIAPriya MahiNo ratings yet

- Dec 2005 - Qns Mod BDocument12 pagesDec 2005 - Qns Mod BHubbak Khan100% (1)

- Fairchem Organics LimitedDocument16 pagesFairchem Organics Limitedsaipavan999No ratings yet

- Abybp 032012B 274Document19 pagesAbybp 032012B 274Raj KumarNo ratings yet

- CAPITALIZED-COSTgradient Rev 1Document13 pagesCAPITALIZED-COSTgradient Rev 1niaz kilam100% (2)

- CAPE Accounting Unit 1 2011 P2Document7 pagesCAPE Accounting Unit 1 2011 P2Sachin BahadoorsinghNo ratings yet

- Handouts 5-6 - Review - Exercises and SolutionsDocument6 pagesHandouts 5-6 - Review - Exercises and Solutions6kb4nm24vjNo ratings yet

- Cir Vs Leal, 392 Scra 9 (2002)Document2 pagesCir Vs Leal, 392 Scra 9 (2002)katentom-1No ratings yet

- Unit 01 Introduction To Business FinanceDocument10 pagesUnit 01 Introduction To Business FinanceRuthira Nair AB KrishenanNo ratings yet

- Financial Analysis of PNB Met LifeDocument92 pagesFinancial Analysis of PNB Met LifeKomal chawlaNo ratings yet

- Philippine Tax DeductionsDocument6 pagesPhilippine Tax DeductionsRylleMatthanCorderoNo ratings yet

- GST and The Indian Textile IndustryDocument28 pagesGST and The Indian Textile IndustryCorey PageNo ratings yet

- Corporate Finance Project Report ON: Oil and Natural Gas Corporation LTD (Ongc)Document13 pagesCorporate Finance Project Report ON: Oil and Natural Gas Corporation LTD (Ongc)Sachin PanwarNo ratings yet

- Carlos Superdrug Corp Vs DSWD, GR No. 166494, June 29, 2007Document3 pagesCarlos Superdrug Corp Vs DSWD, GR No. 166494, June 29, 2007Diane DistritoNo ratings yet

- Chapter16 PDFDocument50 pagesChapter16 PDFBabuM ACC FIN ECONo ratings yet

- Meaning and Definition of Audit ReportDocument50 pagesMeaning and Definition of Audit ReportomkintanviNo ratings yet

- Solution Manual For Financial AccountingDocument53 pagesSolution Manual For Financial AccountingPhương ĐinhNo ratings yet

- Bessrawl Corporation Is A U S Based Company That Prepares Its ConsolidatedDocument1 pageBessrawl Corporation Is A U S Based Company That Prepares Its ConsolidatedFreelance WorkerNo ratings yet

- Foreign Direct Investment in BangladeshDocument21 pagesForeign Direct Investment in Bangladeshsauvik84in100% (5)

- Composition of Gross Estate: Inter-Vivos (During The Lifetime) Transfer TaxDocument6 pagesComposition of Gross Estate: Inter-Vivos (During The Lifetime) Transfer TaxKatie PxNo ratings yet

- Ims Ship Management PVT - LTD: (Vikas Anton Sajan Roustabout Sagar Bhushan CETDocument2 pagesIms Ship Management PVT - LTD: (Vikas Anton Sajan Roustabout Sagar Bhushan CETlucasNo ratings yet

- QuizDocument2 pagesQuizTeodorico PelenioNo ratings yet

- Duties and Powers of The Comptroller and Auditor-General Comptroller and Auditor-General To Compile Accounts of Union and StatesDocument7 pagesDuties and Powers of The Comptroller and Auditor-General Comptroller and Auditor-General To Compile Accounts of Union and StatesN Ashok KumarNo ratings yet

- ITC Limited Valuation RangeDocument73 pagesITC Limited Valuation RangeSumangalNo ratings yet

- ch6 AnswersDocument72 pagesch6 AnswersMohamed SamirNo ratings yet