Professional Documents

Culture Documents

As Vodafone Cashes In, India Gov't Wrestles With The Tax Law

Uploaded by

Yvonne SmithCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

As Vodafone Cashes In, India Gov't Wrestles With The Tax Law

Uploaded by

Yvonne SmithCopyright:

Available Formats

Kenneth Rapoza - BRIC Breaker - Forbes

Page 1 of 8

Business Autos Energy Logistics & Transportation Media & Entertainment Pharma & Healthcare Retail SportsMoney Strategies & Solutions Wall Street Washington

hours ago

6 hours ago

Romney's Tax Returns are Remarkably... Unremarkable

KELLY PHILLIPS ERB Taxgirl

The Secret to Getting into Harvard Business School

DAN SCHAWBEL Personal Branding

Kenneth Rapoza

BRIC BREAKER

MY PROFILE MY HEADLINE GRABS MY RSS FEED

Jan.

24 2012 1:46 pm |

0 comments

As Vodafone Cashes In, India Govt Wrestles With The Tax Law

To Indias political class, the Indian Supreme Courts ruling in favor of a billion dollar tax windfall for UK telecom Vodafone was a lot like ripping a band-aid off a hairy arm. So painful was the sting of the case that Indias divisive and warring political parties finally agree on something: it hurts. Tax laws have to be changed, or more multinational deals will get done without a dime being paid to the Indian government. The fact that the $2.2 billion victor is a British multinational adds insult to injury. Indias never really been forgiven for kicking the British Empire out in 1947. Vodafones success was a high-five, the slap heard around the world. Indias Supreme Court also ordered the government to refund the company $500 million in taxes. Plus 4% interest on top of that. This is a hot potato politically in India, said Shan Nair, co-founder of Nair & Company, a consulting firm helping international businesses incorporate overseas. Eventually the law is going to change, probably within six months in my guess, and it is going to affect all foreign companies that have more than 50% of their assets in India. If that is you, and you sell the company, you will have to pay a capital gains tax on it. Thats not the case now, at least how the Supreme Court interpreted it. Its a big problem because you have Indian multinationals setting up shop off shore in Mauritius in Africa and claiming that a foreign group owns them, even though the bulk of the work and the management is all based in India. Mauritius is a favored off-shore country for India corporates and investment firms looking to avoid some of the countrys high taxes.

MY ACTIVITY FEED

Show all activity

KENNETH'S NEW POST 1 hour ago

As Vodafone Cashes In, India Gov't Wrestles With The Tax Law

KENNETH COMMENTED 3 hours ago

I have to say that although I did not live in MA when Romney ran the state as governor (was...

Posted to THE ONE SUCCESS STORY ROMNEY CAN'T DISCUSS

KENNETH COMMENTED

3 hours ago

All true. But life is so not black and white and you know that Joshen. Just as many Americans are...

Posted to OVER A MILLION PEOPLE SIGN PETITION AGAINST BRAZIL'S 'PANDORA DAM'

KENNETH CALLED OUT

3 hours ago

securityaffairs

Commented on EU OIL EMBARGO ON IRAN SEEN HAVING 'MINIMAL' IMPACT ON OIL MARKETS

I share the decision, but le me remind you that unfortunately the money folds all logic, while we decide for...

CONTRIBUTOR COMMENT Yesterday

http://blogs.forbes.com/kenrapoza/

1/24/2012

Kenneth Rapoza - BRIC Breaker - Forbes

Page 2 of 8

Ultimately, the Supreme Court ruled that the Indian tax authorities have no jurisdiction to tax Vodafones $11.2 billion acquisition of Indian cellphone company Hutchison Essar from Hong Kong based Hutchison Whampoa because it was structured as a transaction between two foreign entities. The government argued that Vodafone, through Whampoa, had acquired 67% in Essar and should pay taxes on the deal. The Vodafone battle was being watched closely by multinationals concerned that Indias top officials could bribe Supreme Court judges to see things there way, adding to the general uncertainty of doing business in the country. This ruling sends a positive signal to foreign companies that India is open for business and its top court is incorruptible, said Nair. The outcome bodes well for U.S. firms like AT&T (T) and General Electric (GE), which are threatened with similar taxes on transactions. Their window on escaping that tax loophole, however, is closing as ruling and opposition parties hammer out new regulations to protect its tax collecting powers. Foreign investors and even domestic firms appear genuinely delighted that the court has taken what they see as a fair legal decision rather than blindly siding with the government. Other countries have tried to tax the sale and purchase of assets in foreign M&A deals controlled by offshore entities. The verdict is clearly great news for Vodafone, which had to set aside $5 billion in case the court ruled against them. Vodafone Highlights from Nair & Co.

ABOUT ME

I covered Brazil pre-Lula and post-Lula and spent the last five years covering all aspects of the country for Dow Jones, Wall Street Journal and Barron's. Meanwhile, for an undetermined amount of time, and with a little help from my friends, I will be parachuting into Russia, India and China. (I figure if Anderson Cooper can parachute, I can parachute.) See my profile Followers: Contributor Since: Location: 116 March 2011 New York, NY

MY PROFILE MY HEADLINE GRABS

MY RSS FEED EMAIL ME TIPS

WHAT I'M UP TO

About BRIC Breaker

BRIC Breaker covers the big emerging markets of Brazil, Russia, India and China. The focus is on politics, corporate and investment news, thoughts from senior level money managers and analysts, equity and fixed income investment ideas from mutual fund managers, and some celebrity and culture if relevant to the news cycle. The page is updated throughout the day, five to seven days a week.

The deal with Whampoa and Essar was struck in 2007 and structured between Vodafones Dutch subsidiary and a Cayman Islands-based company that held Hutchison Whampoas India assets.

Image via Wikipedia

Indias Supreme Court ruled that the deal is not subject to capital gains tax because the company was not domiciled in India. That means Vodafone had no reason to withhold tax and was thus repaid under court order. The government was unable to convince the court of the fact that the main asset being sold in the transaction was based in India. The court said that the offshore transaction is a bona fide structure and the fact that the selling partys Cayman Islands unit was in place for many years before the deal implied that the deal structure wasnt created just with the purpose of avoiding taxes. The verdict provides clarity for other foreign direct investors whose deals have similar structures to Vodafone and is a major boost for companies that are facing similar demands from Indias tax department. Some of the deals that are facing similar disputes include Idea Cellular-AT&T; GE-Genpact; Mitsui-Vedanta; SABmiller-Fosters and Sanofi-aventis-Shantha Biotech. British firm Cairn Energy has already agreed to pay taxes in India as well as the UK on selling its stake in Cairn India to Vedanta Resources. Depending upon the

Economic Growth From Coal www.americaspower.org Discover how coal helps American families, jobs & lowers costs. 5 Dividend Stock Picks www.Fabian.com Free Special Report on 5 hot Dividend Stocks You Should Own Now! Best Rehab in California malibuhorizon.com/Best_CA_Rehab CA Alcohol Drug Treatment Center Private Rehab Center in California High Yielding Stock Picks Fool.com 13 Dividend Paying Stocks from The Motley Fool. Learn to Invest Right!

http://blogs.forbes.com/kenrapoza/

1/24/2012

Kenneth Rapoza - BRIC Breaker - Forbes

Page 3 of 8

size of the stake sale, the tax liability could range between $850 million to over $1 billion.

Buzz Up!

StumbleUpon

Email this

Be the first to comment

Get the full story:

BUSINESS LAW

Jan.

23 2012 7:06 pm |

4 comments

The One Success Story Romney Cant Discuss

Politics is not without its bitter ironies, but none is greater in this presidential election campaign than the one plaguing Mitt Romney. Talk about a dilemma. The mans biggest success story in his political career is the one story his partys voters dont want to hear. On April 12, 2006, Mitt Romney passed the Massachusetts version of what would later become known as the dreaded ObamaCare. It will go down Image via Wikipedia as his crowning achievement as the states one-term Republican governor. For all he might say on the campaign trail, some of it true, the rest pandering to a base of antiObama, anti-government Republicans, Mitt Romney is mighty proud of signing Massachusetts Healthcare Reform into law on that day. Or at least he was. So much so, in fact, that he ordered the signing of that bill carved into stone in the Massachusetts State House tradition. Inside the golden domed State House on Beacon Hill is an oil painting of Romney with a copy of a bill decorated in a medical symbol beside a portrait of his wife Ann. Each governor gets an outgoing portrait of himself to hang in the State House and he chose to have an image of a notebook with a medical symbol on it to immortalize that policy. It was his biggest accomplishment, says Sarah Iselin, president of the Blue Cross Foundation of Massachusetts, a non-profit organization dedicated to healthcare and part of the Blue Cross Blue Shield insurance company. Ever since the days of Bill Clinton, Democrats have been trying to get universal healthcare coverage for all Americans. Hillary Clinton tried it and failed in the 90s. On a national level, Republicans have always been against it despite the fact that Americans actually like the idea of

http://blogs.forbes.com/kenrapoza/

1/24/2012

Kenneth Rapoza - BRIC Breaker - Forbes

Page 4 of 8

affordable, universal health insurance by a margin of 2-to-1, according to an ABC News/Washington Post poll. President Barack Obama, when he was running for the presidency in 2008, promised some form of universal health insurance during his tenure. He modeled much of the Affordable Care Act on Massachusetts Healthcare Reform. Republicans hated it, gave it a media friendly nickname, ObamaCare, and told everyone that Obama was coming after their aging momma. Now, in the election campaign of 2012, with ObamaCares future still unknown as Republican challengers vow to overturn it if elected, everyone is going after Romney. Herein lies the Republican who made possible ObamaCare the presidents most controversial policy, at least by media standards. I have been around politicians for a long time and I can say that the fact Romney cannot talk about the biggest policy success in Massachusetts in the last 25 years has to be one of the biggest ironies Ive seen in a while, says Michael Widmer, president of the non-partisan Massachusetts Taxpayer Foundation. Three years after Massachusetts enacted its groundbreaking health care reform law, Chapter 58 of the Acts of 2006, the number of residents with health insurance has increased by more than 432,000, roughly the population of Boston, giving the state the lowest rate of uninsured residents in the country. An analysis by the Massachusetts Taxpayers Foundation in 2009 showed that the cost of this achievement has been relatively modest and well within early projections of how much the state would have to spend to implement reform. In short, universal care, mandates and fees on business to help pay for it has not made companies close shop, or caused residents to buy into a program they cannot really afford. In terms of government expenditure, based on actual and projected spending data for the first four years of health care reform, the Foundation concluded that state budget spending on health reform has grown from a base of $1.04 billion in fiscal year 2006 to a projected $1.75 billion in fiscal year 2010, a gross increase of $707 million. After the federal government reimburses part of that for its portion of Medicaid costs in the plan, the total comes down to around $353 million for the state. For some people, thats a kick in the bucket for the common good. We are doing another study on this right now and it looks like the state pays maybe $100 million a year out of its budget to keep universal coverage, said Widmer. Id say thats not a big problem for a government with a $30 billion budget.

Buzz Up!

StumbleUpon

Email this

4 Total Comments.

Get the full story:

BUSINESS PHARMA AND HEALTH WASHINGTON

Jan.

23 2012 3:04 pm |

0 comments

For China, Its Slowdown Shmoedown

Chinas economy is no longer humming along at the double digit rate it once was, and could conceivably sputter along in the high-7s and 8% range in 2012. But if commodity demand is any indicator, the China

http://blogs.forbes.com/kenrapoza/

1/24/2012

Kenneth Rapoza - BRIC Breaker - Forbes

Page 5 of 8

dragon is still hungry for raw materials. The Chinese economy isnt done growing just yet. While Chinas economy is undeniably slowing, this is one kind of slowdown the global economy needs. For the most part, the country is importing more commodities than it did in 2010, but in percentage terms volume growth is not as big as it was when comparing 2010 imports to 2009 imports. Nevertheless, Chinas December trade data showed solid commodity demand above and beyond what markets had been expecting, Barclays Capital said in a report on Monday. Demand for commodities across the board was 8.7% higher. In base metals, copper imports actually set a new record of 406,937 metric tons. While we believe the strength of imports into the end of 2011 was driven by consumer demand following the end of destocking, we also believe a portion of these imports went into trader and exchange stockbuilding. Chinese copper imports fell over 2011 as whole, but it was a year of two halves: a weak first half due to destocking but a strong rebound in the second half due to a recovery in buying and attractive lower prices, Barclays analysts wrote in a report for clients on Monday titled Feeding the Dragon. December trade data for precious metals showed a continuation of recent trends. Silver and platinum imports declined, while palladium imports continued to rise, tracking Chinas underlying auto market trends. On the energy side of commodities, crude oil imports broke a record last month, too. China imported 5.067 million barrels of oil a day in 2011. Oil demand also averaged a record high of 9.231 million barrels a day, up 6.4% from 2010. All in all, despite a relatively weak year for China, with credit constraints and inflationary pressures, Chinas underlying demand provides a strong support to commodities this year. Barclays analysts said that they were maintaining their view that should global growth surprise to the upside by a small extent, credit conditions improve and China decides to start buying more commodities to restock for which signs are emerging already Chinese oil demand can be key source of upside surprise relative to consensus estimates this year. China demand for commodities remains robust, but not as robust as the year before when compared to the previous 12 months. Chinas government is still managing to hold onto a soft landing of the economy, as fixed investment slows, the housing market corrects significantly, and the countrys biggest trading partners in Europe head for a recession. China Energy Commodity Trade Data Crude Oil Imports (000 b/d) 2011: 60,800 2010: 57,667

http://blogs.forbes.com/kenrapoza/

1/24/2012

Kenneth Rapoza - BRIC Breaker - Forbes

Page 6 of 8

Coal Imports (000 tons) 2011: 182,395 2010: 164,833 LNG Imports (tons) 2011: 12,212,646 2010: 9,355,842

Buzz Up!

StumbleUpon

Email this

Be the first to comment

Get the full story:

COMMODITIES CURRENCIES INVESTING

Jan.

23 2012 2:11 pm |

2 comments

EU Oil Embargo On Iran Seen Having Minimal Impact On Oil Markets

The European Union agreed to an unsurprising Iranian oil embargo Monday. The impact on the energy market will likely be minimal, says Richard Soultanian, director of energy consulting firm NUS Consulting in Park Ridge, New Jersey.

EU slaps embargo on Iranian oil. Impact on oil markets minimal, energy consulant forecasts.

Soultanian said last week that an EU embargo would be handed down on Monday, following similar sanctions from Washington. The Obama Administration applying the pressure on Asian countries now, the main recipients of Iranian crude outside of Europe. Results so far have been mixed. U.S. Treasury Secretary Timothy Geithner tried convincing the Chinese government this month to follow Washingtons lead, but Beijing said that it will continue to import Iranian oil. India said the same thing, adding that it will only fall in line with Obama if the United Nations issues the embargo, too. Moreover, the biggest importers of Iranian oil in Europe are Greece, Italy and Spain, all borderline bankrupt. The embargo will likely give those countries leverage to lock in cheaper rates for Iranian oil over the next six months before they have to look elsewhere, if the embargo remains in effect. The implementation of the sanctions has gotten off to a mixed start, Soultanian says. The likely impact to Iran and the oil markets will be minimal. At present it appears that the most likely consequence of (the) sanctions is the provision of additional leverage to Irans customers to negotiate deeper discounts in order to continue the relationship, he said. Iran produces approximately four million barrels of oil per day and exports a little more than half of that production, primarily to China, Europe, India, Japan, South Korea and Turkey. Japan said it will reduce its Iranian oil imports, but will not ban them altogether because the country is still rebuilding from last years natural disasters. Looking

http://blogs.forbes.com/kenrapoza/

1/24/2012

Kenneth Rapoza - BRIC Breaker - Forbes

Page 7 of 8

elsewhere for oil, possibly at higher prices, could impede the countrys recovery. Meanwhile, Turkey and South Korea have not formulated any official position at this time. All of the 27 European Union member states agreed to the sanctions on Monday morning after two failed meetings between EU ambassadors last week. In addition to the oil embargo, European governments also agreed to freeze assets of the Iranian central bank abroad in an effort to starve the Iranian government of funds for its nuclear program. Brussels and Washington both agree that Iran will eventually use its nuclear capabilities to build weaponry. The Iranian programs are proceeding apace and represent a strategic threat, an unnamed EU diplomat was quoted saying in The Guardian on Monday. The aim is to have a big impact on the Iranian financial system, targeting the economic lifeline of the regime. See: Turkey Eyes Saudi Oil Amid Iran SanctionsTodays Zaman South Korea Seeking Exemption From Iran Oil Embargo Agence France Presse EU To Embargo Iranian Crude As Tensions MountFox Business News

Buzz Up!

StumbleUpon

Email this

2 Called-out Comments, 2 Total Comments.

Get the full story:

BUSINESS ENERGY

Jan.

23 2012 1:29 pm |

0 comments

Top Value Picks In The BRICs For Week Of Jan. 23

Emerging markets remain a very hard sell for retail and institutional investors as 2012 is now underway. Sales teams have their work cut out for them in trying to convince investors to build positions in equities. Last week, HSBC Chief Strategist Philip Poole told clients that there was The weekly ValuEngine/BRIC Breaker Picks in the some steep value in some of BRICs returns this week after a brief hiatus. Petrobras is off the list. Vale is on it. And Baidu is still a buy. the big emerging markets. That makes for good buying opportunities for investors with horizons longer than a year, and willing to give up 20% or more in losses. The MSCI Emerging Markets index exchange traded fund (EEM) lost over 20% last year. This year its up over 9%. Risk assets continue to be a roller coaster ride. For those who meet the height requirements, the stock forecasters at ValuEngine have 15 ADRs of BRIC companies that according their methodology are priced to

http://blogs.forbes.com/kenrapoza/

1/24/2012

Kenneth Rapoza - BRIC Breaker - Forbes

Page 8 of 8

perfection. That includes long time Forbes BRIC Breaker/ValuEngine pick Ambe (ABV), Brazils top beverage company. But new to the list is Brazilian mining major Vale (VALE), trading at a steep discount of under 6x. Meanwhile, Chinas highly volatile solar panel makers are looking cheap, though maybe for good reason, and Chinas main search engine, Baidu (BIDU), is still a buy. Heres the rest of the list, along with current price to earnings ratios based on trailing 12 month earnings. Company Ambev (ABV) Baidu (BIDU) BrasilFoods (BRFS) China Mobile (CHL) CTrip.com (CTRP) Cosan Ltda. (CZZ) Eletrobras (EBR) Infosys (INFY) LDK Solar (LDK) Mechel (MTL) Renesola (SOL) Suntech Power (STP) Tata Motors (TTM) Vale (VALE) Telefonica Brasil (VIV) Wipro Ltd (WIT) Country Rating* P/E Brazil 4 24.67x China 4 47.98x Brazil 4 19.25x China 4 10.32x China 4 23.53x Brazil 5 4.47x Brazil 5 5.36x India 4 18.21x China 5 7.17x Russia 5 7.01x China 4 2.12x China 4 41.30x India 5 10.75x Brazil 4 5.35x Brazil 4 16.54x India 4 24.63x

*A rating of four indicates a buy. Five is a strong buy. Although ValuEngines buy list for the BRICs is much larger, the BRIC Breaker blog only considers high volume stocks trading at least 600,000 shares a day. Price to earnings ratio is based on trailing 12 month earnings.

Buzz Up!

StumbleUpon

Email this

Be the first to comment

Get the full story:

INTERNATIONAL INVESTING STOCKS

See Older Posts

http://blogs.forbes.com/kenrapoza/

1/24/2012

You might also like

- India Releases Final Version of MCA XBRL Validation ToolDocument1 pageIndia Releases Final Version of MCA XBRL Validation ToolYvonne SmithNo ratings yet

- Indian Government Enacts New Company LawDocument1 pageIndian Government Enacts New Company LawYvonne SmithNo ratings yet

- UK Budget 2013 - Corporate Tax Rate To Reduce As Per Schedule, Increase in VAT Thresholds, Changes To NICsDocument3 pagesUK Budget 2013 - Corporate Tax Rate To Reduce As Per Schedule, Increase in VAT Thresholds, Changes To NICsYvonne SmithNo ratings yet

- Terminating Jobs Overseas?Document1 pageTerminating Jobs Overseas?Yvonne SmithNo ratings yet

- Denmark Declares Increased Taxation For Employer-Provided Free ResidenceDocument1 pageDenmark Declares Increased Taxation For Employer-Provided Free ResidenceYvonne SmithNo ratings yet

- IndiaJournal: Shan Nair Bags 2008 Outstanding 50 Asian Americans in Business AwardDocument1 pageIndiaJournal: Shan Nair Bags 2008 Outstanding 50 Asian Americans in Business AwardYvonne SmithNo ratings yet

- South Korea To Hike Tax Rate For Foreigner WorkersDocument1 pageSouth Korea To Hike Tax Rate For Foreigner WorkersYvonne SmithNo ratings yet

- Nair I Did NotDocument1 pageNair I Did NotYvonne SmithNo ratings yet

- Outsourcing To A Vendor: Risky or Rewarding?Document1 pageOutsourcing To A Vendor: Risky or Rewarding?Yvonne SmithNo ratings yet

- NRI Achievers MagazineDocument9 pagesNRI Achievers MagazineYvonne SmithNo ratings yet

- Publication BrochureAugust2010Document2 pagesPublication BrochureAugust2010Yvonne SmithNo ratings yet

- Publication - PG 11 Summit Post Event Full ArticleDocument3 pagesPublication - PG 11 Summit Post Event Full ArticleYvonne SmithNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Downward Economic RollercoasterDocument3 pagesDownward Economic RollercoasterYvonne Smith100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Indian Americans Honored For Contributions To The BusinessDocument1 pageIndian Americans Honored For Contributions To The BusinessYvonne SmithNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 1680881686289Document10 pages1680881686289v9991 v9991No ratings yet

- Philippine corporate law case digest summariesDocument42 pagesPhilippine corporate law case digest summariesAlarm GuardiansNo ratings yet

- FST Jun-13 Esi ChallanDocument1 pageFST Jun-13 Esi ChallanK Srinivasa RaoNo ratings yet

- Exide Battery Claim Form - Google SearchDocument6 pagesExide Battery Claim Form - Google SearchPradip Kumar DasNo ratings yet

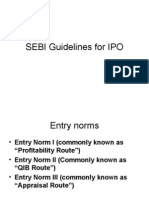

- SEBI IPO Guidelines SummaryDocument12 pagesSEBI IPO Guidelines SummaryAbhishek KhemkaNo ratings yet

- Inca Product Brochures PDFDocument72 pagesInca Product Brochures PDFJoel WalgraeveNo ratings yet

- Accounting Adjustments Chapter 3Document4 pagesAccounting Adjustments Chapter 3Alyssa LexNo ratings yet

- Roljack (Company Profile)Document20 pagesRoljack (Company Profile)nathan kleinNo ratings yet

- Agency, Trust and Partnership Green NotesDocument50 pagesAgency, Trust and Partnership Green NotesNewCovenantChurch96% (26)

- Notice: Initiation of Antidumping Duty Investigation: Circular Welded Austenitic Stainless Pressure Pipe From The Peoples Republic of ChinaDocument6 pagesNotice: Initiation of Antidumping Duty Investigation: Circular Welded Austenitic Stainless Pressure Pipe From The Peoples Republic of ChinaJustia.comNo ratings yet

- HersheyDocument9 pagesHersheyPew DUckNo ratings yet

- Revised Proposal For Submission27.05Document8 pagesRevised Proposal For Submission27.05MKamranDanishNo ratings yet

- Global Electric Power Steering (EPS) Market Analysis and Forecast (2013 - 2018)Document15 pagesGlobal Electric Power Steering (EPS) Market Analysis and Forecast (2013 - 2018)Sanjay MatthewsNo ratings yet

- Distribution DecisionsDocument21 pagesDistribution DecisionsMujNo ratings yet

- Credit Appraisal and Risk Rating at PNBDocument48 pagesCredit Appraisal and Risk Rating at PNBAbhay Thakur100% (2)

- Capitalist and Socialist Economic Systems - GeeksforGeeksDocument8 pagesCapitalist and Socialist Economic Systems - GeeksforGeeksVI OrchidNo ratings yet

- Beta Saham 20210101 enDocument14 pagesBeta Saham 20210101 enWawan A BehakiNo ratings yet

- Maria Mies - Dynamics of Sexual Division of Labour and Capital AccumulationDocument10 pagesMaria Mies - Dynamics of Sexual Division of Labour and Capital Accumulationzii08088No ratings yet

- Economics QuizDocument13 pagesEconomics QuizBhushan SawantNo ratings yet

- BI in FMCGDocument30 pagesBI in FMCGrajatdeshwal100% (1)

- BS 5837 (2012) - Trees in Relation To Design, Demolition and ConstructionDocument4 pagesBS 5837 (2012) - Trees in Relation To Design, Demolition and ConstructionCarolina ZegarraNo ratings yet

- Form TR 20 Gaz TAbill 2018 2Document2 pagesForm TR 20 Gaz TAbill 2018 2abc100% (1)

- Real Estate in India: Challenges and Prospects: Increasing Demand of The New ProjectsDocument2 pagesReal Estate in India: Challenges and Prospects: Increasing Demand of The New ProjectsSheher Bano KazmiNo ratings yet

- 32 Resolution (20% DEVELOPMENT FUND 2020)Document3 pages32 Resolution (20% DEVELOPMENT FUND 2020)anabel100% (2)

- Rigged PDFDocument263 pagesRigged PDFScott KlairNo ratings yet

- Jara Strategy 031210Document2 pagesJara Strategy 031210shrideeppatelNo ratings yet

- Forex Card RatesDocument2 pagesForex Card RatesKrishnan JayaramanNo ratings yet

- Cecchetti 6e Chapter 23Document50 pagesCecchetti 6e Chapter 23Karthik LakshminarayanNo ratings yet

- Unit 4 1 - Lesson 4 - Incidence of Subsidies 1Document12 pagesUnit 4 1 - Lesson 4 - Incidence of Subsidies 1api-260512563No ratings yet

- AccountingDocument6 pagesAccountingGourav SaxenaNo ratings yet