Professional Documents

Culture Documents

Regulatory Order: MBank

Uploaded by

Statesman JournalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Regulatory Order: MBank

Uploaded by

Statesman JournalCopyright:

Available Formats

FEDERAL DEPOSIT INSURANCE CORPORATION WASHINGTON, D.C.

OREGON DIVISION OF FINANCE AND CORPORATE SECURITIES SALEM, OREGON

IN THE MATTER OF MBANK GRESHAM, OREGON (INSURED STATE NONMEMBER BANK)

) ) ) ) ) ) ) )

ORDER TO CEASE AND DESIST FDIC-09-216b

MBank, Gresham, Oregon ("Bank"), having been advised of its right to a NOTICE OF CHARGES AND OF HEARING detailing the unsafe or unsound banking practices alleged to have been committed by the Bank and of its right to a hearing on the alleged charges under section 8(b)(1) of the Federal Deposit Insurance Act ("Act"), 12 U.S.C. 1818(b)(1), and Oregon Revised Statute, 706.580(2), and having waived those rights, entered into a STIPULATION AND CONSENT TO THE ISSUANCE OF AN ORDER TO CEASE AND DESIST ("CONSENT AGREEMENT") with counsel for the Federal Deposit Insurance Corporation ("FDIC"), and with counsel for the Oregon Division of Finance and Corporate Securities (DFCS), dated June 25, 2009, whereby solely for the purpose of this proceeding and without admitting or denying the alleged charges of unsafe or unsound banking practices and violations of law and/or regulations, the Bank consented to the issuance of an ORDER TO CEASE AND DESIST ("ORDER") by the FDIC and the DFCS.

-2-

The FDIC and the DFCS considered the matter and determined that they had reason to believe that the Bank had engaged in unsafe or unsound banking practices. The FDIC and the DFCS, therefore, accepted the CONSENT AGREEMENT and issued the following: ORDER TO CEASE AND DESIST IT IS HEREBY ORDERED, that the Bank, its institution-affiliated parties, as that term is defined in section 3(u) of the Act, 12 U.S.C. 1813(u), and its successors and assigns, cease and desist from the following unsafe and unsound banking practices, as more fully set forth in the Joint FDIC and DFCS Report of Visitation dated March 2, 2009: (a) operating with a board of directors which has failed to provide adequate

supervision over and direction to the active management of the Bank; (b) by the Bank; (c) (d) (e) (f) operating with an inadequate loan valuation reserve; operating with a large volume of poor quality loans; operating in such a manner as to produce operating losses; and operating with inadequate provisions for liquidity. operating with inadequate capital in relation to the kind and quality of assets held

IT IS FURTHER ORDERED, that the Bank, its institution-affiliated parties, and its successors and assigns, take affirmative action as follows: 1. The Bank shall have and retain qualified management. (a) Each member of management shall have qualifications and experience

commensurate with his or her duties and responsibilities at the Bank. Each member of

-3-

management shall be provided appropriate written authority from the Bank's Board to implement the provisions of this ORDER. (b) During the life of this ORDER, the Bank shall notify the Regional

Director of the FDICs San Francisco Regional Office (Regional Director) and the Administrator of the Oregon Division of Finance and Corporate Securities ("Administrator") in writing when it proposes to add any individual to the Bank's Board or employ any individual as a senior executive officer. The notification must be received at least 30 days before such addition or employment is intended to become effective and should include a description of the background and experience of the individual or individuals to be added or employed. 2. (a) Within 180 days from the effective date of this ORDER, the Bank shall

increase Tier 1 capital in such an amount as to equal or exceed 10.0 percent of the Banks adjusted Part 325 total assets. Thereafter, during the life of this ORDER, the Bank shall maintain Tier 1 capital in such an amount as to equal or exceed 10.0 percent of the Banks adjusted Part 325 total assets. (b) The level of Tier 1 capital to be maintained during the life of this ORDER

pursuant to Subparagraph 2(a) shall be in addition to a fully funded allowance for loan and lease losses, the adequacy of which shall be satisfactory to the Regional Director and the Administrator as determined at subsequent examinations and/or visitations. (c) For the purposes of this ORDER, the terms "Tier 1 capital" and "total

assets" shall have the meanings ascribed to them in Part 325 of the FDICs Rules and Regulations, 12 C.F.R. 325.2(v) and 325.2(x).

-4-

3.

(a)

Within 30 days from the effective date of this ORDER, the Bank shall

develop a written plan, approved by its Board and acceptable to the Regional Director and the Administrator, for systematically reducing the amount of loans or other extensions of credit advanced, directly or indirectly, to or for the benefit of, any borrowers in the Non-OwnerOccupied Commercial Real Estate and Construction/Land Development Concentrations. (b) Within 30 days from the effective date of this ORDER, the Bank shall

develop and adopt robust risk management practices that adhere to the joint interagency Guidance on Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices dated December 12, 2006. 4. The Bank shall not pay cash dividends without the prior written consent of the

Regional Director and the Administrator. 5. Within 30 days of the effective date of this ORDER, the Bank shall submit to the

Regional Director and the Administrator a written plan for reducing its reliance on brokered deposits. The plan should contain details as to the current composition of brokered deposits by maturity and explain the means by which such deposits will be paid or rolled over. The plan shall be in a form and manner acceptable to the Regional Director and the Administrator as determined at subsequent examinations and/or visitations. 6. Within 30 days of the end of the first quarter following the effective date of this

ORDER, and within 30 days of the end of each quarter thereafter, the Bank shall furnish written progress reports to the Regional Director and the Administrator detailing the form and manner of any actions taken to secure compliance with this ORDER and the results thereof. Such reports

-5-

may be discontinued when the corrections required by this ORDER have been accomplished and the Regional Director and the Administrator have released the Bank in writing from making further reports. 7. Following the effective date of this ORDER, the Bank shall send to its

shareholder(s) or otherwise furnish a description of this ORDER in conjunction with the Bank's next shareholder communication and also in conjunction with its notice or proxy statement preceding the Bank's next shareholder meeting. The description shall fully describe the ORDER in all material respects. The description and any accompanying communication, statement, or notice shall be sent to the FDIC, Accounting and Securities Section, Washington, D.C. 20429, at least 15 days prior to dissemination to shareholders. Any changes requested to be made by the FDIC shall be made prior to dissemination of the description, communication, notice, or statement. This ORDER will become effective upon its issuance by the FDIC and the DFCS. The provisions of this ORDER shall remain effective and enforceable except to the extent that, and until such time as, any provisions of this ORDER shall have been modified, terminated, suspended, or set aside by the FDIC and the DFCS. Pursuant to delegated authority. Dated at San Francisco, California, this 1st day of July, 2009. /s/ J. George Doerr Deputy Regional Director Risk Management Division of Supervision and Consumer Protection San Francisco Region Federal Deposit Insurance Corporation /s/ David C. Tatman Administrator Oregon Division of Finance and Corporate Securities

You might also like

- Letter To Judge Hernandez From Rural Oregon LawmakersDocument4 pagesLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalNo ratings yet

- Roads and Trails of Cascade HeadDocument1 pageRoads and Trails of Cascade HeadStatesman JournalNo ratings yet

- Cedar Creek Vegitation Burn SeverityDocument1 pageCedar Creek Vegitation Burn SeverityStatesman JournalNo ratings yet

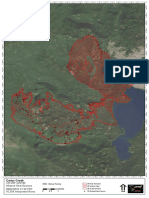

- Cedar Creek Fire Aug. 16Document1 pageCedar Creek Fire Aug. 16Statesman JournalNo ratings yet

- Social-Emotional & Behavioral Health Supports: Timeline Additional StaffDocument1 pageSocial-Emotional & Behavioral Health Supports: Timeline Additional StaffStatesman JournalNo ratings yet

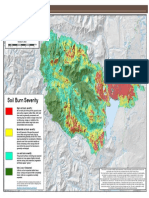

- Cedar Creek Fire Soil Burn SeverityDocument1 pageCedar Creek Fire Soil Burn SeverityStatesman JournalNo ratings yet

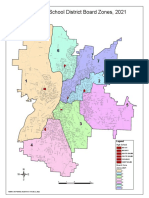

- School Board Zones Map 2021Document1 pageSchool Board Zones Map 2021Statesman JournalNo ratings yet

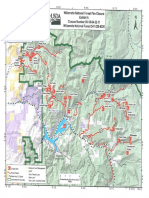

- Mount Hood National Forest Map of Closed and Open RoadsDocument1 pageMount Hood National Forest Map of Closed and Open RoadsStatesman JournalNo ratings yet

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Document4 pagesComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalNo ratings yet

- Cedar Creek Fire Sept. 3Document1 pageCedar Creek Fire Sept. 3Statesman JournalNo ratings yet

- Matthieu Lake Map and CampsitesDocument1 pageMatthieu Lake Map and CampsitesStatesman JournalNo ratings yet

- Windigo Fire ClosureDocument1 pageWindigo Fire ClosureStatesman JournalNo ratings yet

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDocument1 pageProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalNo ratings yet

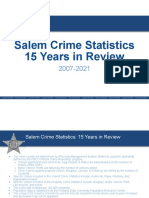

- Salem Police 15-Year Crime Trends 2007 - 2021Document10 pagesSalem Police 15-Year Crime Trends 2007 - 2021Statesman JournalNo ratings yet

- Revised Closure of The Beachie/Lionshead FiresDocument4 pagesRevised Closure of The Beachie/Lionshead FiresStatesman JournalNo ratings yet

- Oregon Annual Report Card 2020-21Document71 pagesOregon Annual Report Card 2020-21Statesman JournalNo ratings yet

- LGBTQ Proclaimation 2022Document1 pageLGBTQ Proclaimation 2022Statesman JournalNo ratings yet

- Salem Police 15-Year Crime Trends 2007 - 2015Document10 pagesSalem Police 15-Year Crime Trends 2007 - 2015Statesman JournalNo ratings yet

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalNo ratings yet

- WSD Retention Campaign Resolution - 2022Document1 pageWSD Retention Campaign Resolution - 2022Statesman JournalNo ratings yet

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDocument1 pageSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalNo ratings yet

- BG 7-Governing StyleDocument2 pagesBG 7-Governing StyleStatesman JournalNo ratings yet

- Salem Police Intelligence Support Unit 15-Year Crime TrendsDocument11 pagesSalem Police Intelligence Support Unit 15-Year Crime TrendsStatesman JournalNo ratings yet

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalNo ratings yet

- Failed Tax Abatement ProposalDocument8 pagesFailed Tax Abatement ProposalStatesman JournalNo ratings yet

- SIA Report 2022 - 21Document10 pagesSIA Report 2022 - 21Statesman JournalNo ratings yet

- Salem-Keizer Discipline Data Dec. 2021Document13 pagesSalem-Keizer Discipline Data Dec. 2021Statesman JournalNo ratings yet

- SB Presentation SIA 2020-21 Annual Report 11-9-21Document11 pagesSB Presentation SIA 2020-21 Annual Report 11-9-21Statesman JournalNo ratings yet

- Zone Alternates 2Document2 pagesZone Alternates 2Statesman JournalNo ratings yet

- Crib Midget Day Care Emergency Order of SuspensionDocument6 pagesCrib Midget Day Care Emergency Order of SuspensionStatesman JournalNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cape Vincent Area Events January 2019Document5 pagesCape Vincent Area Events January 2019NewzjunkyNo ratings yet

- PerforationsDocument5 pagesPerforationsMariusNONo ratings yet

- Gpat 2014 SolvedDocument12 pagesGpat 2014 Solvedjhansi100% (1)

- How Children Learn LanguageDocument28 pagesHow Children Learn LanguageHuỳnh Lê Quang ĐệNo ratings yet

- 04 Refrigerated CargoDocument33 pages04 Refrigerated Cargosaurabh1906100% (1)

- Stomach CancerDocument19 pagesStomach CancerChristofer MadrigalNo ratings yet

- Boiler BlowdownDocument2 pagesBoiler BlowdownbaratheonNo ratings yet

- Work Procedure For CCB Installation of Raised Floor 2Document13 pagesWork Procedure For CCB Installation of Raised Floor 2ResearcherNo ratings yet

- How Time Management Impacts Working Students' Academic AchievementDocument13 pagesHow Time Management Impacts Working Students' Academic AchievementJames RayNo ratings yet

- EDC MS 6.4 System DescriptionDocument10 pagesEDC MS 6.4 System Descriptionmarsh2002No ratings yet

- ADA Concept GuideDocument10 pagesADA Concept GuidemoalpohoNo ratings yet

- Deutz-Fahr Workshop Manual for AGROTRON MK3 ModelsDocument50 pagesDeutz-Fahr Workshop Manual for AGROTRON MK3 Modelstukasai100% (1)

- DSI-DYWIDAG Geotechnics Rock Bolts enDocument6 pagesDSI-DYWIDAG Geotechnics Rock Bolts enTomás Nunes da SilvaNo ratings yet

- A7V Variable Displacement PumpDocument22 pagesA7V Variable Displacement PumpEduardo CramerNo ratings yet

- Wildseed Dinner MenuDocument1 pageWildseed Dinner MenuCaleb PershanNo ratings yet

- 5 Ethiopian - National - Healthcare - Quality - and - Safety - Strategy - Final - Draft-July122021Document86 pages5 Ethiopian - National - Healthcare - Quality - and - Safety - Strategy - Final - Draft-July122021Kemal MahmoudNo ratings yet

- Tunnels: Rock TunnellingDocument4 pagesTunnels: Rock TunnellingAndrés García CaseroNo ratings yet

- Environmental Clearance CertificateDocument4 pagesEnvironmental Clearance CertificateAra Jane T. PiniliNo ratings yet

- Mindray UMEC 12 Specifications FDADocument11 pagesMindray UMEC 12 Specifications FDAAlejandra Baas GuzmánNo ratings yet

- ABO BLOOD GROUP Part 1Document104 pagesABO BLOOD GROUP Part 1Taladua Cayla Grace O.No ratings yet

- Oxygen Therapy ProtocolDocument4 pagesOxygen Therapy ProtocolTeri Martin-Allen100% (1)

- Ransburg 76652 01 - 04Document24 pagesRansburg 76652 01 - 04enticoNo ratings yet

- 7220 Instrucciones de Intalacion PDFDocument2 pages7220 Instrucciones de Intalacion PDFAttackDenied123No ratings yet

- Do We Still Need Formocresol in Pediatric DentistryDocument3 pagesDo We Still Need Formocresol in Pediatric DentistryAlexanderDetorakisNo ratings yet

- Distance Protection SchemesDocument10 pagesDistance Protection SchemesdebasishNo ratings yet

- PERDEV Module 3 (Week 5 and 6)Document8 pagesPERDEV Module 3 (Week 5 and 6)Christy ParinasanNo ratings yet

- AZIZ Ur RehmanDocument3 pagesAZIZ Ur Rehmantop writerNo ratings yet

- Cognitive and Psychopathological Aspects of Ehlers DanlosDocument5 pagesCognitive and Psychopathological Aspects of Ehlers DanlosKarel GuevaraNo ratings yet

- Typhoid FeverDocument9 pagesTyphoid FeverAli Al.JuffairiNo ratings yet

- Aquatic Ecology and LimnologyDocument96 pagesAquatic Ecology and LimnologySale AlebachewNo ratings yet