Professional Documents

Culture Documents

1

Uploaded by

Prasad PimparkarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1

Uploaded by

Prasad PimparkarCopyright:

Available Formats

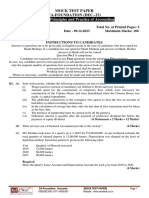

1]Sen & Co. of Calcutta consign goods costing Rs.

25,000 to their agent, Mustak of Mysore, on which they pay fright, insurance and charges Rs. 1,500, drawing on him a bill of exchange at 90 days for Rs. 20,000. They discount the bill at Mercantile Bank being charged Rs. 200 therefor. After two months they received from their agent and Account Sales informing that the entire consignment has been sold for Rs. 35,000. That expenses amounting to Rs. 700 have been incurred and showing as deduction the agreed commission of 2 per cent on the amount realized. A draft on the syndicate Bank was enclosed for the balance due. Show important ledger account in the books of both parties. 2] The Kolkata Motors Ltd. Consigned to their agent in Patna to Motor cars costing Rs. 48,000 each for sales. Commission was payable ordinary 8% and del- credere commission 2%. The agent was to bear all expenses in Patna which amounted to Rs, 6,500. The agent sold one car at Rs. 65,000.and remitted Rs. 52,000 on account. The second car was sold for Rs. 71,500 but out of this a sum of Rs. 13,000 became bad debt. Open the necessary accounts in the books of both consignor and consignee 3] On 15 January, 2004 Jamshed & Co. of Mumbai sent to Mukharjee Co. of Kolkata 400 bicycle at an invoice price of Rs. 100 per bicycle to be sold on commission. Freight and insurance were Rs. 600. Account sale was received from consignee as follows: 15th March 100 bicycles were sold at Rs. 145 on which 15% commission and Rs. 375 for expenses were deducted. 10th April 150 bicycles were sold at Rs. 140 on which 5% commission and Rs. 290 for expenses were deducted. 4] Karanth sold goods on behalf of Vijay sales on consignment basis. On January 1, 2008, he had with him a stock of RTs. 20,000 on consignment Karanth had instruction to sell the goods at cost plus 25% and was entitled to commission of 4% on sales, i9n addition to 1% Del credere commission on total sales for guaranteeing collection of all the sales proceeds. During the year ended 31st December, 2008, cash sales were Rs. 1,20,000, credit sales Rs. 1,05,000 and Karanths expenses relating to the consignment Rs. 3000 being salaries and insurance. Bad debts were Rs. 3,000 and goods sent on consignment Rs. 2, 00,000. From the above, prepare Consignment Account and consignees account in the books of Vijay sales and important Ledger accounts in the books of Karanth . 5] Nanak of Calcutta consigned 100 Prestige Cookers to Rajat of Jalpaiguri costing Rs 90 per cooker,but invoiced at a price so as to show 20% profit on such invoice price. Nanak spent Rs 800 as freight and insurance. Rajat was entitled to a commission of 10% on gross sales. Rajat sold 75 cookers @ 150 each and spent Rs 150 as dock dues

and Rs 200 as miscellaneous expenses.Show Consignment A/c and Consignees A/c in the books of Consigner, and Consigners A/c in the books of Consignee.

You might also like

- The Complete Guide to Real Estate Investing How to Buy, Sell, and Rent Properties for ProfitFrom EverandThe Complete Guide to Real Estate Investing How to Buy, Sell, and Rent Properties for ProfitNo ratings yet

- Consignment ProblemsDocument2 pagesConsignment ProblemsPruthvi Kashyap G0% (1)

- Consignment AccountsDocument6 pagesConsignment AccountsMadhura Khapekar30% (10)

- Consignment QuestionsDocument7 pagesConsignment QuestionsHimanshu LatwalNo ratings yet

- QN Bank 2 Sem B ComDocument23 pagesQN Bank 2 Sem B Commohanraokp2279100% (1)

- ConsignmentDocument2 pagesConsignmentKanniha SuryavanshiNo ratings yet

- Tuhi NirankarDocument3 pagesTuhi NirankarasifahemdNo ratings yet

- Financial Account: Consignment AccountsDocument1 pageFinancial Account: Consignment AccountsSaloniNo ratings yet

- Problems On Joint VentureDocument8 pagesProblems On Joint VentureKrishna Prince M MNo ratings yet

- Unit Test AcDocument2 pagesUnit Test AcRamnarayan DarakNo ratings yet

- Class 11th TestDocument7 pagesClass 11th TestMayank GoelNo ratings yet

- Consignment Class WorkDocument4 pagesConsignment Class WorkHarsh GossainNo ratings yet

- Consignment QuestionDocument2 pagesConsignment QuestionADITYA JAGTAPNo ratings yet

- Accounting Long Questions II YearDocument10 pagesAccounting Long Questions II Yeararshad aliNo ratings yet

- Venture of Joint Nature Class NotesDocument22 pagesVenture of Joint Nature Class NotesDbNo ratings yet

- Adobe Scan 20 Oct 2022Document4 pagesAdobe Scan 20 Oct 2022Xyz YzxNo ratings yet

- Journal N LedgerDocument4 pagesJournal N LedgerFarah BulsaraNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034.: First Semester - Nov 2005Document4 pagesLoyola College (Autonomous), Chennai - 600 034.: First Semester - Nov 2005Charles VinothNo ratings yet

- FA-III Question BankDocument13 pagesFA-III Question BankmeenasarathaNo ratings yet

- ConsignmentDocument3 pagesConsignmentBABITA AJAY DHAKATENo ratings yet

- Issue of DebenturesDocument15 pagesIssue of DebenturesKrish BhargavaNo ratings yet

- Basics of AccountingDocument3 pagesBasics of AccountingAjesh Mukundan PNo ratings yet

- Unit-I: DepreciationDocument4 pagesUnit-I: DepreciationEswari GkNo ratings yet

- Consignemnt Bcom MaterialDocument2 pagesConsignemnt Bcom MaterialSNEHA SAJNANINo ratings yet

- AccountsDocument2 pagesAccountsசெந்தில் மணிNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: Questions Accounting For DepartmentsDocument153 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questions Accounting For Departmentsshankar k.c.No ratings yet

- Examinations: Elements of AccountancyDocument4 pagesExaminations: Elements of AccountancyChandan Kumar Banerjee0% (2)

- Exercises On Accounting EquationDocument4 pagesExercises On Accounting EquationNeelu AggrawalNo ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- AccountDocument67 pagesAccountchamalix100% (1)

- Final Account With AnswersDocument23 pagesFinal Account With Answerskunjap0% (1)

- CAF-6 Mock Paper by SkansDocument6 pagesCAF-6 Mock Paper by SkansMehak AliNo ratings yet

- Hire PurchaseDocument3 pagesHire PurchaseQuestionscastle FriendNo ratings yet

- Journal With GST1Document1 pageJournal With GST1PearlNo ratings yet

- Isc Accounts 5 MB: (Three HoursDocument7 pagesIsc Accounts 5 MB: (Three HoursShivam SinghNo ratings yet

- IPCC MTP2 AccountingDocument7 pagesIPCC MTP2 AccountingBalaji SiddhuNo ratings yet

- BK Paper 45 MarksR3 PrelimDocument5 pagesBK Paper 45 MarksR3 Prelimpsawant770% (1)

- 31 Introduction To AccountingDocument3 pages31 Introduction To Accountings_hirenNo ratings yet

- Fa IiiDocument76 pagesFa Iiirishav agarwalNo ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper2Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper2mansoorbariNo ratings yet

- Concept of Installment SystemDocument5 pagesConcept of Installment Systemshambhuling ShettyNo ratings yet

- Thakur Academy 12 CommerceDocument2 pagesThakur Academy 12 CommerceRonalNo ratings yet

- 438Document6 pages438Rehan AshrafNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: BC 1502 - Financial AccountingDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: BC 1502 - Financial AccountingIPloboNo ratings yet

- Accounting AnswersDocument5 pagesAccounting AnswersallhomeworktutorsNo ratings yet

- 54940bosmtpsr2 Inter p1 QDocument6 pages54940bosmtpsr2 Inter p1 QAryan GurjarNo ratings yet

- CA Inter MTP 2 M'19 PDFDocument149 pagesCA Inter MTP 2 M'19 PDFSunitha SuniNo ratings yet

- 8 Consignment FTDocument8 pages8 Consignment FTShweta BhadauriaNo ratings yet

- Class 11 Accounts SP 1Document6 pagesClass 11 Accounts SP 1UdyamGNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- Sardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksDocument3 pagesSardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksRiteshHPatelNo ratings yet

- PAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadDocument164 pagesPAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadTajammal CheemaNo ratings yet

- Qus. MTP Accounts - 09.12.23Document5 pagesQus. MTP Accounts - 09.12.23karann021003No ratings yet

- Q1 Classify The Following Accovints and Give Short Explanation Also. (1) Dhanesh Shah's AccountDocument3 pagesQ1 Classify The Following Accovints and Give Short Explanation Also. (1) Dhanesh Shah's Accountapi-232747878No ratings yet

- Debentures Questions 1Document3 pagesDebentures Questions 1Ishant GargNo ratings yet

- Trial Balance As On 31 March, 2003: Particulars Debit (RS.)Document3 pagesTrial Balance As On 31 March, 2003: Particulars Debit (RS.)Jesse LucasNo ratings yet

- Model Question Financial Accounting - IIDocument3 pagesModel Question Financial Accounting - IIEswari Gk100% (1)

- Logistics-II Mid (Accounts)Document3 pagesLogistics-II Mid (Accounts)David Raju GollapudiNo ratings yet

- 09.D. Gauthier - The Initial Bargaining Position (p.194)Document360 pages09.D. Gauthier - The Initial Bargaining Position (p.194)Iss Criss100% (1)

- Vocabulary, Opposites and Word Buildingy, Opposites and Word BuildingDocument5 pagesVocabulary, Opposites and Word Buildingy, Opposites and Word BuildingImam Bux MallahNo ratings yet

- Trafalgar Square: World Council For Corporate GovernanceDocument2 pagesTrafalgar Square: World Council For Corporate GovernanceJohn Adam St Gang: Crown Control100% (1)

- Octane Service StationDocument3 pagesOctane Service StationAkanksha Vaish0% (2)

- Agreement Surat Jual BeliDocument5 pagesAgreement Surat Jual BeliIndiNo ratings yet

- TF100-19E 145-155 Series CouplingsDocument8 pagesTF100-19E 145-155 Series CouplingsFaiz AmiruddinNo ratings yet

- First Amended Complaint Stardock v. Paul Reiche and Fred FordDocument98 pagesFirst Amended Complaint Stardock v. Paul Reiche and Fred FordPolygondotcomNo ratings yet

- Ch. 1-Fundamentals of Accounting IDocument20 pagesCh. 1-Fundamentals of Accounting IDèřæ Ô MáNo ratings yet

- KUSHAQ Accessories Brochure 08-12-22Document8 pagesKUSHAQ Accessories Brochure 08-12-22ŠKODA Teynampet Gurudev MotorsNo ratings yet

- Youth Empowerment Grants ApplicationDocument5 pagesYouth Empowerment Grants ApplicationKishan TalawattaNo ratings yet

- Travelling in The EUDocument2 pagesTravelling in The EUJacNo ratings yet

- Monzo Warns Job Candidates Not To Use ChatGPT During Application Process - HR Software - HR Grapevine - NewsDocument1 pageMonzo Warns Job Candidates Not To Use ChatGPT During Application Process - HR Software - HR Grapevine - NewsMaxNo ratings yet

- 011 CIR V General FoodsDocument2 pages011 CIR V General FoodsJacob Dalisay100% (3)

- Ravi Shankar Jha and Vijay Kumar Shukla, JJ.: Equiv Alent Citation: 2017 (2) MPLJ373Document16 pagesRavi Shankar Jha and Vijay Kumar Shukla, JJ.: Equiv Alent Citation: 2017 (2) MPLJ373Utkarsh KhandelwalNo ratings yet

- Evangelical Christianity Notes - Abdal Hakim MuradDocument3 pagesEvangelical Christianity Notes - Abdal Hakim MuradDawudIsrael1No ratings yet

- Filipinas Synthetic Fiber Corporation vs. CA, Cta, and CirDocument1 pageFilipinas Synthetic Fiber Corporation vs. CA, Cta, and CirmwaikeNo ratings yet

- Cbydp ResolutionDocument2 pagesCbydp ResolutionJan Alleana Mayo FernandezNo ratings yet

- The Qatar Crisis: Middle East Freezes Out Qatar: What You Need To KnowDocument7 pagesThe Qatar Crisis: Middle East Freezes Out Qatar: What You Need To KnowMukund KakkarNo ratings yet

- Voltaire - Wikipedia, The Free EncyclopediaDocument16 pagesVoltaire - Wikipedia, The Free EncyclopediaRAMIZKHAN124No ratings yet

- F An Economic Analysis of Financial Structure: (Ch.8 in The Text)Document12 pagesF An Economic Analysis of Financial Structure: (Ch.8 in The Text)Ra'fat JalladNo ratings yet

- Audit Fraud MemoDocument16 pagesAudit Fraud MemoManish AggarwalNo ratings yet

- 2017-2018 WTW ResourceGuide US Brochure EN PDFDocument12 pages2017-2018 WTW ResourceGuide US Brochure EN PDFErickNo ratings yet

- Ky Establishing Investment Funds in The Cayman Islands RevisedDocument30 pagesKy Establishing Investment Funds in The Cayman Islands RevisedChris W ChanNo ratings yet

- Ib Assignment FinalDocument7 pagesIb Assignment FinalGaurav MandalNo ratings yet

- Chapter 15 Self Study SolutionsDocument22 pagesChapter 15 Self Study SolutionsTifani Titah100% (1)

- Agreement Between Builders Developers and Members of SocietyDocument10 pagesAgreement Between Builders Developers and Members of SocietyDeepak BhanushaliNo ratings yet

- Cambodian Architecture Assignment PDFDocument27 pagesCambodian Architecture Assignment PDFAngelo NepomucenoNo ratings yet

- G.R. No. 111713 January 27, 1997 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, HENRY ORTIZ, Accused-AppellantDocument69 pagesG.R. No. 111713 January 27, 1997 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, HENRY ORTIZ, Accused-AppellantJan Wilcel PeñaflorNo ratings yet

- Direct Shear Test ReprtDocument4 pagesDirect Shear Test ReprtShivaraj SubramaniamNo ratings yet

- Virudhunagar Employment OfficeDocument1 pageVirudhunagar Employment OfficeChakkaravarthi Kudumbanar100% (1)