Professional Documents

Culture Documents

Prospects Potentials of Mining Industry in Oman

Uploaded by

rajataimurOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prospects Potentials of Mining Industry in Oman

Uploaded by

rajataimurCopyright:

Available Formats

PROJECTPROFILE

(PRELEMINARY) ON

PROSPECTS&POTENTIALSOFMININGINDUSTRY INOMAN

Preparedby

KERALACLAYSANDCERAMICPRODUCTSLTD. PAPPINISSERY,KANNURDISTRICT

INTRODUCTION Availability of mineral bearing land is depleting in Kerala day by day and in recent days mining process in the state is not so easy and encouraging due to the so called environmental problems. Mineral reserve available in the land possessed by the company will last only for a few more years. For the existence of the company and its employees finding of new areas with mineral deposit is highly essential. Moreover, the expansion cum diversification programme of the company has necessitated finding out of other sources of mineral potentials in or outside the State or even outside the country. The rigorous search for alternate mineral resources by the company has led to the knowledge about the promising and abundant mineral wealth of the Sultanate of Oman. The company is very much enlightened to know that Sultanate of Oman is blessed with abundant quantity of commercially valuable industrial rocks and minerals. The promising and encouraging factor is that the industrial policy of Oman permits the entrance of foreign investors with private or joint venture participation in the mining industry of Oman. It is under these circumstances that the company is planning to enter in to the mining industry of Oman. With a determination to enter in to the mining industry of Oman the company initiated steps in this regard. As directed by the Government of Kerala, at the request of the company , a meeting was arranged at the Directorate of Mining and Geology, Thiruvananthapuram and had discussion with the Director of Mining and Geology on the subject. According to the decision of the meeting the company requested the Ambassador of Sultanate of Oman at New Delhi to give an appointment for discussion on the subject. In response to the request of the company the appointment with the Oman Ambassador was fixed at 11.00 AM on 17th September, 2010. Anticipating permission of Government a delegation of the company consisting of Sri. Anakai Balakrishnan, Managing Director, Sri. K.T.mohamed Basheer, AGM (Production) and Sri. P.K.Bharathan, Geologist proceeded to New Delhi and met the Ambassador and had discussion on the subject. The delegation received a warm welcome at the Embassy of Sultanate of Oman. H.E. Humaid Al-Maani himself met the delegation in person and participated throughout the discussion. The discussion was very fruitful and promising. He appreciated the desire of the company in entering in the mining industry of Oman. On the first instance the Ambassador

emphasized that entering of KCCPL in the mining industry of Oman on the label of a State Government company is not an easy task. He suggested that better way is to find out a suitable partner in Oman who is interested in the similar working field of the company and to formulate a joint venture company. Only on the label of a joint venture concern the company can step in to the mining field of Oman. In Sultanate of Oman, Government owned companies are not functioning in the mining field. Only private and joint venture companies are available in the mining field of Oman. Director General of Minerals (DGML), Ministry of Commerce and Industry is only supervising the mining industry. Companies, including few Indian private companies, who are interested on expansion of their industry, are available there. The Ambassador reiterated that before debating with industrialists of Oman the company has to make a visit to Oman to have an on the spot understanding and detailed know how about the situation of the mining industry and connected factors prevailing there. He assured that all necessary guidance and helps can be arranged by the embassy at the request of the company well in advance, preferably before one month. Attaining of permission for mining in Oman is not a difficult task. Moreover Government of Oman is going for a free trade agreement with India. The procedure will be made more transparent and easy when it is materialized. The ambassador said that the company can approach directly any private company in Oman for joint venture participation. During the visit to Oman the Embassy shall arrange meetings with the DGML, Director of Commerce and Industries and other concerned Department officials. Finally he reiterated that the company can enter the mining industry of Oman in joint venture participation with any Oman or other foreign/Indian private companies available in Oman and the Embassy shall provide all necessary guidance and helps in this regard. Omans infrastructure sector offers a lot of opportunities to the investors. To conclude, H.E. Humaid Al-Maani, Ambassador to Sultanate of Oman invited the company for a visit to Oman and to have on the spot identification of areas of mineral occurrence and areas of interest of the company in mining field. PREPARATION OF DETAILED PROJECT REPORT (DPR) According to the instructions from Government of Kerala vide Letter No. 4679/H2/2010/ID dated 06-7-2010 a Detailed Project Report (DPR) is to be prepared and submitted to Government for approval. A detailed project report can be prepared only on completion of the visit to Oman and detailed study on the mining scenario and industrial set up and other

connected factors prevailing in Oman. The company proposes to entrust the preparation of DPR to an agency having ample experience in that field. As emphasized by the Honble Ambassador of Oman the company proposes to send a delegation to Oman in the near future. For this purpose the company proposes to formulate a team consisting of 3 officers of KCCPL. One representative of the agency who is preparing the DPR, one representative of the DMG and one representative of State Government. Required approval of the proposal for entry in to the mining field of Oman and permission to sent delegation to Oman is awaited from the State Government. The mining industry of Oman is open to foreign investment- 79 of the listed companies and funds are open to foreign investment, most up to 49%. 110 companies are open to GCC investors. All newly listed companies are now required to allow foreign investment. Oman based Bank Muscat will concentrate on the midsized corporates in South India to build a niche for business in the country. The Banks India operations are part of its effort to network with countries which traditionally have trade and investment ties with Oman. The Bangalore branch is the banks first branch outside Oman. The bank is planning to actively promote Indo-Oman projects in the private and public sector. Details of mineralized area that can be availed, partner of JV, percentage of investment, project cost, nature of implementation, profit factor, etc. can be ascertained only on finalization of the DPR. The service of Bank Muscat can be actively utilized in this regard.

THE MINING INDUSTRY OF OMAN Oman, the second largest country after Saudi Arabia in the GCC, holds huge reserves of industrial rocks and minerals. Natural gas and crude oil dominate Omans economy. Oil and gas output was supplemented by the production of chromite, gold, gypsum, sand and gravel, silver and dimension stone; the smelting and refining of copper and the manufacturing of cement. Some of Omans main mineral resources include chromite, dolomite, zinc, limestone, gypsum, silicon, copper, gold, cobalt and iron. The growing demand for Omans minerals has prompted many companies to float either subsidiaries or joint ventures for exploration and mining of the vast resources available in Oman. There is a lot of scope for local entrepreneurs to have joint ventures with foreign investors for excavating and exporting of minerals.

The Directorate general of Minerals (DGML), Ministry of Commerce and Industry has been conducting several significant studies and also drawn an inventory of commercially available industrial rocks and minerals in Oman with a view to encourage the business community to work for a vibrant mineral based industry. To cap it all, the Ministry has now brought out a 164 page book, Industrial Rocks and Minerals in Oman: Development Possibilities that spells out the various commercial applications that these minerals can be put to. The book has been authored by Dr. Hayat A Qidwai, a geological expert at the Directorate General of Minerals. For most industries, about seven or eight industrial rocks and minerals are required namely; limestone, dolomite, gypsum, salt, silica sand/ quartzite, kaolin and attapulgite. Fortunately Oman has all of them in commercial quantities and can be utilized for value added products like glass and ceramic items, chemicals, fertilizers, abrasives, fillers, fluxes, and refractory, construction and insulation items. There is a good potential for setting up large and small scale industrial units based on these locally available mineral resources. Various chemical industries based on salt, limestone, silica sand such as soda ash, caustic soda, sodium silicate, lime, calcium carbide and various glass products can be set up in addition to upgrading the low iron for steel production and other industries such as pottery, stoneware, thermal insulation, floor and wall tiles and refractories as noted by Dr. Qidwai in the book. The mineral sector has seen steady growth over recent years. Several Ministry of Commerce and Industry sponsored programmes have carried out detailed mineral and geological exploratory surveys and studies, indicating that attractive investment opportunities exist for a number of large-scale mining projects. The Sultanate works closely with various bodies involved in mineral exploration, including the environmentally concerned Japanese International Co-operation Agency (JICA). THE OMANI CHAMBER OF COMMERCE & INDUSTRIES (OCCI) The Omani Chamber of Commerce and Industries (OCCI) supports efforts to promote investment in the Sultanate, arranges Omani trade delegation visits abroad and hosts foreign trade delegation to the

Sultanate. It arranges lectures and workshops on opportunities, incentives and facilities available in Oman.

investment

Oman Centre for Investment Promotion and Export Development (OCIPED) is a government establishment formed by Royal Decree No. 59/96 dated 26th June 1996. The centre aims at increasing the contribution of the private sector to the investments required for the development plans and promoting the export of Omani Products to foreign countries to improve the balance of trade of the Sultanate. FOREIGN INVESTMENT IN OMAN Can a foreigner own majority shares in an Omani company? Foreign ownership is allowed up to 100 per cent with the approval of the Ministerial Cabinet, however, in accordance with the commitment provided to the World Trade Organization, approvals are granted for foreign ownership up to 70 per cent in most of the sectors on automatic basis. As per the Foreign Capital Investment Law ministry grant license to applicants if the paid up capital of the company is at least RO 150000 (US $ 390000). Is a foreign company allowed to open branch and representative office in Oman? Foreign companies engaged in trade, industry and service sectors may open commercial representative offices in Oman. Companies conducting business through special contracts or agreements with the government are allowed to establish a branch in Oman. In practice contracts awarded by the government, Petroleum Development Oman LLC (PDO) and Oman LNG LLC (LNG) enable foreign companies to establish branches in Oman by registering with the Ministry of Commerce and Industry. Investment incentives Investment incentives include provision of plots for nominal lease charges in specified areas and reduced utility charges and exemption from tax. Tax exemption from corporate tax and customs duties are granted to entities engaged in manufacturing, mining, agriculture, fishing, fish farming, fish processing, aquaculture, animal breeding, tourism, export of manufactured and processed products and public utilities. The exemptions are granted for five years from the date of production or

services first rendered and a five year extension may also be granted subject to certain conditions. Does Oman have a One-Stop-Shop? In the Ministry of Commerce and Industry a One-Stop-Shop (OSS) for assisting the domestic and foreign investors in obtaining all required clearances quickly and from one window has been established. OSS enables investors and businessmen to set up companies in Oman while minimizing paper work, saving costs and time. All applications and governmental processes involved in company registration and approval requests will be possible online through the official eGovernment Services portal, making it a single- entry access point for OSS services for appropriate entities. What are the tax rates in Oman? Companies are taxed at a single rate of 12 per cent of the taxable income exceeding RO 30000 irrespective of the percentage of foreign ownership. Branches of foreign companies are taxed at a single rate according to the entire amount of branchs taxable income. The tax rate varies from five per cent to 30 per cent. Foreign companies that do not have a permanent establishment in Oman are subject to a flat tax of 10 per cent of gross income of the following type of income: Royalties, management fees, rent for equipment, transfer of technical know-how and R&D fees. Is there any restriction on repatriation? Oman is a free economy and does not restrict the remittance abroad of equity, debt, capital, interest, dividends, profits and personal savings. What are the criteria for getting residential and investors visa? All the visitors must hold a valid passport. The holders of Israeli passport and those who have obtained any entry visa to Israel are not permitted to enter Sultanate. Prospective visitors to Oman should obtain a visa issued from the Directorate General of Immigration (Royal Oman Police) by contacting one of the following authorities: 1. The Omani Embassies and Consulates abroad

2. The Department of Immigration and Passport at Al Buraimi or the Sultanates Commercial Office in Dubai for those entering through border crossing Wajajah, Hafit and Hatta at the UAE border. A two weeks entry visa will be issued for businessmen without a sponsor. Issuance of the visa takes one week from the date of submission. Transit visas for twenty four hours are issued at Seb International Airport. The ordinary visit visa requires an Omani sponsor. Duration of this visa is three months and is taken one month to obtain. Investor visa is granted to a foreigner who intends to invest his money in Oman and pursuant to a certification in this respect from the authority concerned. This visa can be used within six months from the date of issuance. It is a multiple entry visa valid for staying in the country for two years from the date it is inserted in the passport. The period is renewable. Advantage of investing in the Sultanate A wide selection of shares. Open to foreign investment- 79 of the listed companies and funds are open to foreign investment, most up to 49%. 110 companies are open to GCC investors. All newly listed companies are now required to allow foreign investment. Oman based Bank Muscat will concentrate on the midsized corporates in South India to build a niche for business in the country. The Banks India operations are part of its effort to network with countries which traditionally have trade and investment ties with Oman. The Bangalore branch is the banks first branch outside Oman. The bank is planning to actively promote Indo-Oman projects in the private and public sector. It will also cater to the substantially NRI community in Oman which predominantly belongs to South India.

You might also like

- Mining Sector - KSA PDFDocument8 pagesMining Sector - KSA PDFLjubomir JocicNo ratings yet

- South Sudan Mining Brochure PDFDocument2 pagesSouth Sudan Mining Brochure PDFAnyak2014No ratings yet

- Mineral Mining IndustryDocument9 pagesMineral Mining Industrypankaj455No ratings yet

- Request For Information (Rfi) : Works - Construction of Showroom and BuildingDocument1 pageRequest For Information (Rfi) : Works - Construction of Showroom and BuildingImran SikandarNo ratings yet

- AC MaintenanceDocument10 pagesAC Maintenancemechmohsin4745No ratings yet

- Oman CompanyDocument7 pagesOman CompanyReetikaNo ratings yet

- Mineral Deposits in NigeriaDocument3 pagesMineral Deposits in NigeriaBode Eniafe BankoleNo ratings yet

- Doing Business in Oman - World Bank Report 2020Document64 pagesDoing Business in Oman - World Bank Report 2020PMO Oman ProjectsNo ratings yet

- Muscat Hills H.rock CuttingDocument2 pagesMuscat Hills H.rock CuttingSajjad HussainNo ratings yet

- Volume III (Boq)Document20 pagesVolume III (Boq)Imran SikandarNo ratings yet

- Martabe ProjectDocument7 pagesMartabe ProjectFerry H. SitohangNo ratings yet

- 177-Article Text-337-1-10-20201026Document12 pages177-Article Text-337-1-10-20201026Julian I SwandiNo ratings yet

- Marble Industry AFG AISA 2012Document62 pagesMarble Industry AFG AISA 2012rasselahsanNo ratings yet

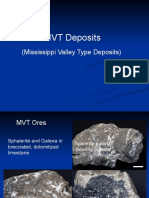

- MVT DepositsDocument20 pagesMVT DepositsHenry Gonzales YanaNo ratings yet

- Oil Discovered in The Volta BasinDocument2 pagesOil Discovered in The Volta BasinAlfred Richie BennettNo ratings yet

- Indian GraphiteDocument12 pagesIndian Graphitearmandoarmando1100% (1)

- The Sme Guide For Reporting Exploration Results, Mineral Resources, and Mineral Reserves (The 2007 SME Guide)Document47 pagesThe Sme Guide For Reporting Exploration Results, Mineral Resources, and Mineral Reserves (The 2007 SME Guide)Zuhry DizzyNo ratings yet

- Major Lead Zinc DepositDocument20 pagesMajor Lead Zinc Depositzeeshan269No ratings yet

- Maputo Development CorridorDocument18 pagesMaputo Development CorridorRaimundo Paulo Langa100% (1)

- HSSG BrochureDocument17 pagesHSSG BrochureMuhammed RafeekNo ratings yet

- David HumphreyDocument7 pagesDavid HumphreyMarcoFranchinottiNo ratings yet

- Stages of Mineral ExplorationDocument8 pagesStages of Mineral ExplorationJoseph Mofat100% (1)

- Mineral Resources and Location in NigeriaDocument8 pagesMineral Resources and Location in NigeriaShelze ConsultingNo ratings yet

- Industrial Analysis On Gold IndustryDocument53 pagesIndustrial Analysis On Gold IndustrySKULL SACHINNo ratings yet

- Sirohi District PPT. DSRDocument26 pagesSirohi District PPT. DSRSumit Kumar100% (1)

- Knowledge Management in GeologyDocument1 pageKnowledge Management in GeologyMompoloki KgotlhaneNo ratings yet

- ChromiteDocument16 pagesChromitebvhanji100% (2)

- Mediam Rock CuttingDocument2 pagesMediam Rock CuttingSajjad HussainNo ratings yet

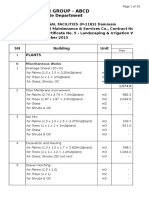

- Progress Billing Landscaping WorksDocument20 pagesProgress Billing Landscaping Worksarchie_728No ratings yet

- Malaysia Steel Works (KL) BHD and The Malaysia Smelting Corporation Berhad.Document5 pagesMalaysia Steel Works (KL) BHD and The Malaysia Smelting Corporation Berhad.Wasim SabriNo ratings yet

- Deposit Synthesis - Vms.galleyDocument21 pagesDeposit Synthesis - Vms.galleytpeabdelmoumenNo ratings yet

- Out and About in OmanDocument11 pagesOut and About in OmanbooksarabiaNo ratings yet

- Geology and Mineral Investment Opportunities in South Sudan: Dr. Andu Ezbon Adde MAY 2013Document39 pagesGeology and Mineral Investment Opportunities in South Sudan: Dr. Andu Ezbon Adde MAY 2013Jalo Max100% (1)

- BOTSWANADocument32 pagesBOTSWANAAvinash_Negi_7301No ratings yet

- Tender 77-2013 UpdatedDocument2 pagesTender 77-2013 UpdatedBRGRNo ratings yet

- Contract Summary-UpdatedDocument6 pagesContract Summary-UpdatedCristy EvangelistaNo ratings yet

- Introduction To Sedimentary PetrologyDocument53 pagesIntroduction To Sedimentary Petrologyakshat5552No ratings yet

- Mineral Industry in Egypt, Vol 2, No. 1, NR20110100004 - 62185880Document19 pagesMineral Industry in Egypt, Vol 2, No. 1, NR20110100004 - 62185880Alshymaa Dda50% (2)

- Construction Week Middle East - April 21 2018Document44 pagesConstruction Week Middle East - April 21 2018ReadNo ratings yet

- Technical Report On The Sekondian Group, GhanaDocument26 pagesTechnical Report On The Sekondian Group, GhanaFrimpong Benedict100% (1)

- THIN SECTION AND PETROGRAPHY ExperimentDocument17 pagesTHIN SECTION AND PETROGRAPHY Experimentfaizuanismail100% (1)

- NIKM Business Proposal OK Rev2Document9 pagesNIKM Business Proposal OK Rev2Gunawan Tabrani100% (1)

- Greenfield Exploration Targets in MozambiqueDocument16 pagesGreenfield Exploration Targets in Mozambiquea10000816No ratings yet

- Memorandum of UnderstandingDocument1 pageMemorandum of UnderstandingPhoebe Grace LopezNo ratings yet

- Granite Industry of Rajasthan, India - LitosonlineDocument3 pagesGranite Industry of Rajasthan, India - LitosonlineNikhil ToshniwalNo ratings yet

- Mining and ResourcesDocument32 pagesMining and ResourcesNicolas Tapia100% (2)

- Geology of Rakhine BasinDocument25 pagesGeology of Rakhine BasinYTF Rystad100% (1)

- Chrome Ore Beneficiation Challenges & LISTODocument8 pagesChrome Ore Beneficiation Challenges & LISTOAlfredo V. Campa100% (1)

- Seismic Refraction Tomography and MASW Survey For Geotechnical Evaluation of Soil For The Teaching Hospital Project..Document15 pagesSeismic Refraction Tomography and MASW Survey For Geotechnical Evaluation of Soil For The Teaching Hospital Project..diego lozanoNo ratings yet

- PPP Prospectus 8 12 19 1Document18 pagesPPP Prospectus 8 12 19 1Honey Tiwari100% (1)

- Comeg Report Write Up2Document49 pagesComeg Report Write Up2Samaiye Olugbenga OmokehindeNo ratings yet

- CMC Business PlanDocument32 pagesCMC Business PlanRobert ShisokaNo ratings yet

- Caine EtAl 1996 GeologyDocument5 pagesCaine EtAl 1996 GeologyIhyaRidhaNo ratings yet

- Company ProfileDocument6 pagesCompany ProfileFaidzil ChabibNo ratings yet

- 2.MineralIndustryinOman ICV PaperDocument12 pages2.MineralIndustryinOman ICV PaperDINIL DSNo ratings yet

- Mining Companies Ye MenDocument18 pagesMining Companies Ye MenEbrahim Rashad AlzobiryNo ratings yet

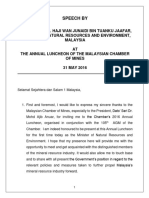

- Minister Speech-Luncheon MCOMDocument7 pagesMinister Speech-Luncheon MCOMhanan hayatiNo ratings yet

- Malaysia 2012 Mineral YearbookDocument8 pagesMalaysia 2012 Mineral YearbookAli ZarehNo ratings yet

- ArmeniaDocument12 pagesArmeniaHamed PiriNo ratings yet

- Training and RecruitmentDocument42 pagesTraining and RecruitmentTechno EntertainerNo ratings yet

- 1 112mn0424 Block CavingDocument17 pages1 112mn0424 Block CavingVineet Kumar Singh100% (1)

- Liberation, Separation, ExtractionDocument100 pagesLiberation, Separation, Extractiongaol_bird009No ratings yet

- Mine Safety Audit ReportDocument66 pagesMine Safety Audit ReportShuhaib MD100% (1)

- Development of The Argo MineDocument7 pagesDevelopment of The Argo MineCraig ThomasNo ratings yet

- 5) Plug CementingDocument35 pages5) Plug Cementingeng20072007No ratings yet

- Company Profile: Toward A Sustainable GrowthDocument20 pagesCompany Profile: Toward A Sustainable GrowthBuyung RiyartoNo ratings yet

- Earth Science PPT 5Document32 pagesEarth Science PPT 5Ghieonn VillamorNo ratings yet

- 03 10133MR Nous West Ivory Granite Mine FSRDocument167 pages03 10133MR Nous West Ivory Granite Mine FSRYared AlazarNo ratings yet

- Case Study Sustainable MiningDocument15 pagesCase Study Sustainable MiningShiv Prasad SawNo ratings yet

- Global ResourcesDocument23 pagesGlobal Resourcescooldude99344No ratings yet

- PirometalurgiDocument2 pagesPirometalurgieltonNo ratings yet

- Flora and Fauna Literature 1Document66 pagesFlora and Fauna Literature 1dorieNo ratings yet

- Study of Merrill-Crowe Processing. Part II - Regression Analysis of Plant Operating DataDocument8 pagesStudy of Merrill-Crowe Processing. Part II - Regression Analysis of Plant Operating DataChristy Alexandra Solano GavelánNo ratings yet

- CRI - 2014 - LFS - Q - Variables NamesDocument19 pagesCRI - 2014 - LFS - Q - Variables Namessavan anvekarNo ratings yet

- Benchmarking Final ReportDocument91 pagesBenchmarking Final ReportFrancisco Javier Zepeda Iribarren100% (1)

- Buyers Guide 19 127130 PDFDocument277 pagesBuyers Guide 19 127130 PDFAnton Frian Yohanes ReynaldoNo ratings yet

- Literature Review: Aluminum Alloy Al-MgDocument14 pagesLiterature Review: Aluminum Alloy Al-MgGhulam IsaqNo ratings yet

- Land PollutionDocument4 pagesLand PollutionRajesh SahuNo ratings yet

- India Start PackageDocument66 pagesIndia Start PackageAnotherCrazyEnglishmanNo ratings yet

- Gold Kacha Flyer 2012Document2 pagesGold Kacha Flyer 2012gustavus1No ratings yet

- JORC Online Learning Brochure DigitalDocument4 pagesJORC Online Learning Brochure Digitalwidadi.apNo ratings yet

- Tesis - Anaiisis of Dozer Pushing in IPCC SystemDocument62 pagesTesis - Anaiisis of Dozer Pushing in IPCC SystemCarlos A. Espinoza MNo ratings yet

- Decision? Should Animus LTD Operate in The Mining Industry Only or Expand To Heavy MachineryDocument2 pagesDecision? Should Animus LTD Operate in The Mining Industry Only or Expand To Heavy MachineryHuỳnh Trúc PhươngNo ratings yet

- Granite Industry of Rajasthan, India - LitosonlineDocument3 pagesGranite Industry of Rajasthan, India - LitosonlineNikhil ToshniwalNo ratings yet

- Sip - Shubhankar AnandDocument77 pagesSip - Shubhankar AnandShubhankar AnandNo ratings yet

- 7942 Labugal - NatresDocument28 pages7942 Labugal - NatresbalunosarronNo ratings yet

- Minerals: Geometallurgical Characterisation With Portable FTIR: Application To Sediment-Hosted Cu-Co OresDocument20 pagesMinerals: Geometallurgical Characterisation With Portable FTIR: Application To Sediment-Hosted Cu-Co OresCESAR FUENTES VERANo ratings yet

- Indonesia Mining 2014Document21 pagesIndonesia Mining 2014FraserNo ratings yet

- A Draft of The Kerala Scientific Mining Policy 2014Document9 pagesA Draft of The Kerala Scientific Mining Policy 2014Dr.Thrivikramji.K.P.No ratings yet