Professional Documents

Culture Documents

Mktg2203 Assignment

Uploaded by

Dongyu BiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mktg2203 Assignment

Uploaded by

Dongyu BiCopyright:

Available Formats

Introduction

Since its inception in 1974, Super Cheap Auto now comes to be one of the biggest retailers in Australia and New Zealand, it comprises over 260 store locations across Australia and New Zealand (Super Cheap Auto Group Limited, 2010). The product portfolio in the Super Cheap Auto business comprises over 10,000 different items such as Batteries, Oils, filters and Car care available in each store (Roth, 2011). Ensuring an expansive product range for automotive maintenance and accessories, tools and outdoor equipment, Super Cheap Auto has become an industry leader in aftermarket automotive accessories (Roth, 2011). The two biggest competitor of Super Cheap Auto are auto barn and Repco (Roth, 2011). Although Super Cheap Auto faces a really competitive environment, it maintain the leader of the retailer shop according to the super cheap (Supercheap Auto, 2011).

Situation analysis

Market analysis

Super Cheap Auto is competing as a retailer in the automotive aftermarket industry which is a significant subsector of the automotive industry. Trends in the automotive industry translate with a time delay to the aftermarket sector which indicates that the increase in the sales of new cars in Australia from 2009 to 2010 will induce an increase demand for accessories in the short term, parts and servicing in the longer term. The Global demand for automotive aftermarket products is projected to increase five percent per year through 2007 to $144 billion ().The Australian aftermarket industry for replacement parts and accessories is estimated to be worth between $5-6 billion. The retail segment accounts for about $1.6 billion of total sales per year (). Although not directly involved in manufacturing, the automotive retail segment is still a significant to the automotive sector by selling, distributing and servicing both imported and Australian-manufactured motor vehicles.

Economic environment

Economic forces are those factors that affect how much people and organisations can spend and how they choose to spend it. The instruction of the essay requires us to describe the influence by macro-environmental economic forces on the organisation and the market (ELLIOTT, thiele, & WALLER, 2010). The macroenvironmental economic environment include the factors interest rates, economic growth, consumer confidence, income levels, savings levels, the availability of credit, unemployment levels and exchange rates which outside of the industry and are not directly controllable by the organisation (ELLIOTT, thiele, & WALLER, 2010). Economic forces and conditions can change quickly and dramatically, and markets can find themselves facing a very different economic environment within a short period of time (William M. Pride, 2010). For example, as the global economic crisis began to undermine business investment, the average consumption decrease dramatically per person. Australia has a stable and competitive economy which has recorded 17 consecutive years of economic growth since 1992 averaging 3.3 per cent a year (Roth, 2011). However, the economy headed into a severe slowdown during the financial crisis. The customer lost the confidence, and cut back on spending, specifically on the commodities. Personally, the economic conditions in Australia present opportunities and risks for Super Cheap Auto. The limited budget will force consumers to seek specialist and super cheap necessities, which is good opportunity for super cheap to build up the quality and cheap brand. Although the outlook for retail trading remains uncertain during the financial crisis, we've managed to achieve excellent results to date and are positive about the future (ELLIOTT, thiele, & WALLER, 2010).

Political environmenti

Political forces are the influence of politics on marketing decisions, which include political stability, government policy, trade agreements, and taxation arrangements (ELLIOTT, thiele, & WALLER, 2010). SCA is one of the biggest retailers which sell the parts of the auto in Australia. Political effect on the super cheap is distinctive because it own about 30 super retail markets and around 260 stores across Australia and New Zealand (Supercheap Auto, 2011). The businesses of super cheap cross the board, which means Super Cheap Auto, imports the products from other country such as China and resells in Australia and New Zealand. Political system varies greatly between countries (Roth, 2011). Super Cheap Auto needs to understand the

political system of its target country such as Australia and New Zealand and the importing country of products. The target countries such as Australia and New Zealand mainly capitalist, but highly regulated; whereas the political environment in importing country of Super Cheap Auto such as China is totally different, its mainly communist in nature. The target countries such as Australia and New Zealand are really close from the geographical position and culture. They build up the bilateral trade agreements in the 1983 (Bilateral and regional trade relationships, 2008). This is relevant for Super Cheap Auto as its competitive advantage comes from the similar taste in two target countries. Government policy is another big issue for the retailers especially for the Super Cheap Auto. The import duty and sales tax will be considered as the cost of selling (ELLIOTT, thiele, & WALLER, 2010). Australia is an open economy, which encourage the import and export. However import barriers are still available today such as import duty, anti dumping and so on.

Legal environment

The laws in force in different countries can be vastly different. Intellectual property laws are really important in the Australia, which is legally protected by copyright, patent and trademark legislation (ELLIOTT, thiele, & WALLER, 2010). Super Cheap Auto, as one of the biggest retailer, which is not affected by the IP much. Trade Practices Act is a big issue for the Super Cheap Auto (Bilateral and regional trade relationships, 2008). Some countries restrict trade practices through laws and regulations. Tariffs, quotas, embargos and bans on foreign ownership are three public trade barriers through government regulations (ELLIOTT, thiele, & WALLER, 2010). Tariffs: Duties charged on imports that effectively increase the price of imports relative to domestically made products. Quotas: Annual limits on the amount of particular types of goods that can be imported. Embargos: Bans or restrictions on imports from a particular country.

The World Trade Organisation has worked for many years to promote free trade; the reduced trade barrier is the international tendency. This is good new or opportunity for the development of Super Cheap Auto. WTO (World Trade Organisation) has worked for many years to eliminate the restrictions on the free trade, and the international trade barriers are reduction continually (ELLIOTT, thiele, & WALLER, 2010). Finally, its a competing advantage that Super Cheap Autos target countries New Zealand and Australia have build up the trade agreement (Bilateral and regional trade relationships, 2008). In addition, China to be the manufacture part of the Super Cheap Auto need to be understand especially on the government regulation and policy.

Social and cultural environment

Social and cultural forces are those factors social and cultural factors that affect peoples attitudes, beliefs, behaviours, preferences, customs and lifestyles (ELLIOTT, thiele, & WALLER, 2010). Social and cultural forces that may influence the organisation include religion, subcultures, multiculturalism, beliefs, attitudes and population trends (ELLIOTT, thiele, & WALLER, 2010). As we have learned throughout this book, at the heart of marketing is the creation of value for customers. Because that value is determined by individuals beliefs, attitudes, and experiences and so on, and the major forces at play in their society, value is intimately connected with the culture and society in which those consumers live. The cultural factors like religion, subcultures, multiculturalism looks not impact the organisation of Super Cheap Auto much as target countries New Zealand and Australia have the similar culture. Furthermore, Super Cheap Auto is a domestic enterprise in Australia which states it understands the local beliefs, perception and attitudes more (Supercheap Auto, 2011). Actually, super cheap have done very well in the social and cultural force. From the super cheap website, the distribution of the Super Cheap Auto market is related to the population trends and the production package such as colour is according to Australia beliefs (Super Cheap Auto Group Limited, 2010). The culture between export country and import country is totally different. To have a good negotiation with the manufacturing company in China, Super Cheap Auto

importing faculty should have a good understanding about the culture difference and some ordinary behaviour.

Technological environment

Technology has become a great enabling force in international marketing over the past 20 years with the advent and relatively cheap price of communications technologies which enable easy transfer of information between different countries in moments (ELLIOTT, thiele, & WALLER, 2010). The distinctive change of the advanced technology is the cheap cost of the communication and travel across the broad. SCA is a retailer that communication and transport across the broad is really important part of the business (Annual Report 2010, 2010). The reduced barriers of the international connection help SCA to observe the price advantage, which means that Super Cheap Auto can get the product information easily. SCA has the import faculty in China, Internet development increase the connection of two faculties in China and Australia. Furthermore, the technological advances have resulted in an increase usage of the internet which expands the retailer to a new channel: offering service, marketing and selling products over the internet. The SCA has a very convenient online market, which help the consumers to find the products they want easily (Super Cheap Auto Group Limited, 2010). Online shop also is really a good advertisement for SCA. We can compare the price of same product in different store.

Competitor analysis

The automotive aftermarket industry has many sellers competing for a large amount of buyers since Australia has the 3rd highest automotive ownership rate in the world at 600 vehicles per 1000 people (Diagonal Reports 2002). Characteristic of monopolistic competition, the industry is extremely fragmented, with a broad range of competitors who specialize in different sectors of the market. There is general consensus within the industry that the days of small owner-operated stores are numbered and that rationalization of the industry has already progressed. The Table 1.1 below shows the market share in the Australian automotive aftermarket industry. Sellers include corporate retailers, mass merchants, franchises, marketing groups, independent retailers, OEM franchise dealers and other channels like, which compete based on non-price differences (product differentiation). These competitors

can be identified as indirect competitors to SCA because they may not offer exactly the same product or service as SCA do. However, they do target the same customers as SCA.

Market Share by sector Corporate Retailers: eg Super Cheap Auto, Repco Mass Merchants: eg Kmart, Big W Franchises: eg Automotive Brands, Auto One Marketing Groups: eg Auto Pro Independents OEM Franchise Dealers: eg Ford, Toyota etc Other Channels: eg SUV, Performance, Tyre Table 1.1

20% 10% 12% 10% 9% 24% 15%

SCA have identified their main direct competitors in the Australian automotive aftermarket to be: Repco (part of Automotive Parts Group (APG)) and Autobarn. Autobarn is Australias largest franchise retailer of automotive aftermarket accessories and parts, 100 stores throughout Australia. Its One of Australias most reputable franchise systems and successful over 20 years, Autobarn is now running out of gas. The chain has failed to build an effective national store network and expansion. The problem is that franchising is no longer the best option for growth for retailers like Autobarn. Private equity capital or a public float on the Stock Exchange (like Super cheap auto) a better alternative to fund growth than franchising. However, according to the Roy Morgan Retail Customer Satisfaction report in the Auto stores category recently. Autobarn has the highest rate in customers satisfaction. Autobarns advertising campaign hosted by Pauly and the Fat Pizza cast clearly targets younger customers. Repco is the largest reseller and supplier in the automotive parts and accessories aftermarket in Australia and New Zealand with almost 400 stores across both countries. Has a huge range of over 175000 parts available that cover all things automotive. The problem for Repco is that the store locations dont match consumer expectations in design, consistency, ranging and especially location. Porters Five Forces Michel Porters five forces is a good and effective technique for competitor analysis.

Low Threat of substitutes - nearly no substitutes can instead of aftermarket products, however, people can turn to public transportation such as buses, will decrease the consumption in automotive aftermarket, but even buses need aftermarket products, therefore, pretty low threat of substitutes Low Bargaining power of suppliers - Automotive manufacturers in Australia have set up plants offshore to take advantage of the cheap labour and raw materials. Most of them set up new plants in China and India. - Suppliers to be price takers High Bargaining power of buyers - Numerous substitutable firms selling similar products- a large range of products are produced - Prices of these products are set by the customers by the demand and supply relationship -increased competition among the OEM manufacturers and independent up price war manufacturers will set up in customer service. Medium to High Threat of potential entrants - The automotive aftermarket industry in Australia is considered a matured industry with limited growth rate. The industry is highly fragmented - Barriers of entry into this industry is relatively low for local players - New foreign players are difficult to penetrate the industry because of the recent of regulations required by the Australian Design Rules Potential entrants networks were and required to invest in setting up distribution services stations - Potential entrants had to overcome the reputation and large customer base of the existing increased companies through

Profitability of Industry - Have increasing profitability: - as explained within specific component of the Five Factor Model - market is attractive

therefore the industry is most likely to end

Customer/client analysis

The Australian automotive aftermarket in industry generally is estimated to be worth between $5-6 billion, split evenly between local producers and imports in Australia (Joe 2010), therefore, Super cheap Auto had a large retail customer base, with an estimated 1,845,000 customers in the target profile group in Australia (Roy Morgan Research 2010). The biggest spenders are male (of whom 69% of customers) aged 5060 years. Even though the biggest spenders in the industry are males aged 45 55 years (Marlows Limited 2002). The female customer sector is growing especially

in young female due to the increase in young female motor vehicle ownership, there will be a change in the traditional demographic profile of customer in the auto aftermarket. Super cheap Auto can target the female market segment to be its potential customers based on this change in the automotive aftermarket. The most important value for consumers in the automotive aftermarket industry are convenient services, these include easy- access store locations, more parking base, longer opening hours, fast and reliable turnaround times for services; services on demand; transparent or pre-set prices; and service guarantees.

SWOT analysis

Strengths Experienced management team with professional knowledge, clear goals, culture and values. Large categories of products Strong brand awareness and image Convenient and accessible store formats Relax, Modern, informative shopping environment Motivated and skilled employees Power merchandising techniques including bulk stacking and prominent signage, with product presentation across all stores governed by the Super Cheap Auto Merchandising Manual. On-line service Comparable quality own-branded products are offered at lower retail prices with higher margins Promote heavily in TV, radio and press advertising in the Australian auto aftermarket sector Weaknesses Damaged corporate reputation through ads Incomplete on-line fulfillment Limited R&D expenditure

Opportunities Development of 'own' brand products Overseas markets Domestic markets will be protected due to the regulation required by the Australian Design Rules Government new plan of "A New Car Plan for a Greener Future" - launch the spare parts for new cars.

Threats face competition mainly from market leader Repco Limited and Autobarn increasingly on-line competition Increasing environmental consideration will reduce drivers

Objectives

Mission Statement Corporate strategy

Target market

Out of large range of customers, Super Cheap Auto is mainly targets the: People who are 17-25 years old as many people may get their first car at this age range and would like to decorate it as the way they want it to be. People who want to spend less on car parts to beauty up their cars.

Super Cheap Auto mainly focuses on the demographic segmentation. In focusing this segmentation, Super Cheap Auto will cast on the group of people who are at the above age range and want to decorate their cars, but dont have too much money to spend on buying the car parts.

Positioning strategy

Super Cheap Auto will position itself in the market as a premium quality with lower price products retailer in Australia and New Zealand. It focuses on improving

profitability using its well understanding of demographic segmentation and its unique methodology.

Marketing mix strategy

Product

As Super Cheap Auto is a reseller (REF), its products are not produced by the company itself. There is not just one identifiable product line in Super Cheap Auto (SCA) and the product image is not so easily (if at all) changeable by the organisation. With this in consideration, the product strategy will specifically focus on one of Super Cheap Autos more popular product lines; engine oil. This product can be analysed by utilising the total product concept (REF). As a core product, engine oils key benefit would be to keep a car performing at its peak by helping to maintain the condition of its engine. In order to differentiate brand-identical products at competing retailers, SCA have augmented their product in several ways. For instance, the company has online services which provide a step-by-step guide to replacing a cars engine oil, loyalty programs, as well as helpful and supportive customer service. This is the case for many other Super Cheap Auto products. Super Cheap Auto should also consider further developing its products or creating potential features for the product. Possible considerations include introducing engine oils which are suitable to the development of new fuel-efficient and low emission vehicles (particularly those suited to vehicles produced under the New Car Plan for a Greener Future - REF). They could also invest in employee demonstrations on how to replace engine oil, developing a product capable of indicating whether engine oil requires changing without manually testing, or even just including extras with the engine oil itself. For example, a do-it-yourself kit for changing engine oil, which would include the extra equipment required to perform this task.

Price

Some products provided by the Auto Aftermarket industry are considered quite essential. However, others are not. For the industry as a whole, prices are likely to be price inelastic, particularly for Australian consumers who are highly reliant on

motor vehicles as a mode of transport (REF). This is advantageous for SCA itself, but because it has a number of competitors who provide identical products; prices are more likely to be elastic in this sense. This is more so the case for Auto Aftermarket products that may not be as essential to maintaining the condition of motor vehicles (e.g. performance add-ons, car accessories, etc.) With this in consideration, SCA products need to be reasonably priced, but also high enough to sustain a profitable return. They do need to keep in mind their price-beat policy of lowest price guarantee Well beat any price in town on products we stock! (REF - SCA website) as they have created and need to maintain the perception (or even expectation) in consumers, that SCA provide the lowest prices for automotive products. To uphold their promotional promise of lower prices, regular research into competitor prices would be required to avoid consumers from pricesearching elsewhere. With all this said, SCA must bear in mind that its low-priced products would require further positioning in order to create a sense of added-value, for the consumers who assume low-prices equate to a reduction in quality. Due to the highly fragmented market that SCA finds itself in and highly price elastic products, it is vital for SCA to differentiate its brand. Other possible strategies, in the form of promotions, can also help to achieve differentiation. This will be discussed in the following section.

Promotion

As will be illustrated later in the budget, financial resources can restrict Super Cheap Autos marketing strategy as with any company. However, what will be outlined here are several possible promotional options which Super Cheap Auto may select from in order to market their products and brand name. At present, SCA has several successful promotional strategies mass marketing in the form of television advertisements; print advertisements such as their store catalogue; their own company website with the option of subscribing to E-news; partnering with driversafety.com to provide tips on staying safe on the roads; being involved in the National Packaging Covenant Action Plan to reduce wastage (REF); and of particular importance, their long-surviving sponsorship of Bathurst 1000 since 1995 (REF).

Even with these strategies in place, SCA can continue to attempt other tactical marketing endeavours. Some possible additions to the promotional mix includes an improvement to SCAs public relations, particularly after one of their New South Wales television advertisements came under scrutiny for seemingly advocating vigilante-style assaults on motorcyclists by car drivers as they tried to filter between stationary cars (REF motorcycle council). They could improve public relations by emphasising their partnership with driversafety.com, and reiterate that the advertisement was not one which encouraged motor vehiclists to act dangerously on roads, but rather to encourage safe road practices by motorcyclists. With technology having such a large part in society at present, PR attempts could take place virtually rather than face-to-face. Strategies aimed towards the internet-driven Generation Y could include opening an official SCA Facebook page and also sponsoring links to YouTube for additional doit-yourself maintenance videos in an attempt to increase exposure and for the sake of convenience. If the budget permits, the company could also explore the concept of Super Cheap Autos own mobile servicing vans (a venture to compete with existing companies such as Lube Mobile) or further developing SCAs private brand label possibly changing its packaging. Or even more so, further promote that it is SCAs own private label. Through more efficient distribution and promotion, private brands can achieve better economies of scale. However, consumers are not always seen to be brand loyal to this form of brand ownership (REF textbook pg 222).

Distribution (Place)

At present, Super Cheap Auto has opened over 250 stores across Australia and New Zealand (ref: 2010 annual report). With such an expansive reach, they are quite a dominant company, but they still have the potential to grow. In fact, SCA still plan to open more stores (REF), so it is important for them to think about strategic areas. Opening new stores in developing or planned to be developed areas would enable SCA to gain an initial competitive advantage over others. This is particularly the case, as potential residents will rely on motor vehicles for transport, as they are yet to have an established public transport system. They also have the option of opening stores in the vicinity of hardware stores such as Bunnings, as their customers potentially have the same mindset as SCA customers, with regards to

repairing and maintaining personal possessions (as a so-called hobby). Locating within the vicinity of car yard retailers, could also be effective as SCA could compete against the retailers auto aftermarket products by providing cheaper alternatives. If we are specifically speaking about individual SCA stores, the placement of products and set up within the store is important. The objective here is to create ease for customers who are wishing to search, locate and make their purchases as quickly as possible. Super Cheap Auto could also follow the lead of Melbourne, which developed a SCA logistics facility there, instead of freighting stock from the Queensland facility. This was actually in response to business growth in South Australia and Melbourne. The possibility of business growth in Western Australia could mean the development of a logistics facility within the state for improved transport efficiency and cost effectiveness (REF-2005 annual report). On a larger scale, an idea still under consideration is the establishment of a consolidation centre in China for imported products. The reasoning this idea was based on was that it would allow the company to pre-pack and hold stock (in China) ready for SCA stores thus avoiding the need to hold some of their imported lines in their Australian distribution centres. It is suggested that this proposal should certainly go ahead if it is viable to do so (2005 annual report).

People

As SCA is a retailer, many of their products are identical to their competitors. Thus, customer service is a key differentiator of the companys brand, because the values and attitudes of each employee will influence the customers first impression. Retaining employees who are technically competent means personal selling is of higher quality, good impressions are made, and an increase in sales is more likely. This is because customers may judge the offerings based on the employees that they interact with. If a customer is served by an unfriendly employee, the customer would not choose to buy the product that s/he is after from Super Cheap Auto or would choose not to make repeat purchases.

Employees should take the initiative to serve customers who seem to require assistance. When approaching customers, employees firstly need to find out what kind of products the customer is after. Secondly, help the customer to look for those products. In situations where a customer is after a particular product, but not sure which brand is more reliable or cheaper, the employee then needs to introduce some suitable products so that the customer can make a decision from a range of choices. A thorough knowledge of each periods promotions is also important, so employees are able to inform customers of suitable products that are also on special. The basic knowledge of prices and the location of different types of products are mandatory this not only saves the employees time to check for the price and the location, but also reduces customer waiting time. Employees must have strong communication skills and have quality personal selling skills in order to promote products. They need to do this by keeping in mind that all customers have different wants and needs. Hence, SCA staff should make customers feel welcome; have patience when introducing/explaining products to customers and avoid getting irritable in front of customers.

In order to make the selling system go smoothly, deployment must be planned. For example, only one employee is needed at the counter during quieter periods, and their role is to operate the cash register and respond to customer queries., The number employees required to walk around in the store to serve customers, depends on the size of the store, and there should be a sufficient number so customers do not need to spend time looking around for assistance. If there are no customers, employees should take the chance to organize the shelves and restock products, to ensure that the store is neat and tidy.

Process

In order to increase sales, detailed market research and analysis must take place, as it provides an indication of customers demands for particular products. Once popular product demands are known, the purchase frequency of each product must be

known as well as the price at which they are willing to pay. With this in mind, store managers will then be able to determine which products the store is going to purchase the most of, how much needs to be purchased and how to keep the inventory at an average level. The time that each employee takes to serve a customer cannot be too long, particularly during busy periods. As a rule of thumb, after finding out what product the customer is after, the process of checking for the products availability in the stores system, looking for the product in the storage room and handing it to the customer for a check should take no longer than 10 minutes. This is to avoid customers waiting too long as they may become agitated and poor customer service reviews may result. If a particular product is not available in the store, the employees should verify on the computer whether or not the same product is available in nearby stores. If this is the case, the employee should provide details on how the customer can go about retrieving the required product. Mailing catalogues to customers can be a wasteful form of advertising, particularly when customers tend to throw out what they consider junk mail, or they do not get a chance to flick through them after a busy day. Therefore, by creating a membership program, Super Cheap Auto may be able to promote its products in a less costly way. Each customer can apply for their own SCA membership for free after purchasing a product from Super Cheap Auto, and then if customers allow this, the membership system would record some basic information of each member, especially email address. Through the internet, Super Cheap Auto will be able to send its promotions and offerings to customers, so they can view the most recent news from Super Cheap Auto whenever they access their emails.

Physical evidence

Super Cheap Auto has been around for almost 40 years, it has grown to become one of Australia and New Zealand's largest retailers. Since Super Cheap Auto is fairly established, it is important to maintain the original look of its stores. For example, the architectural design should be simple, no fashion elements need to be added and the shop fittings should be yellow, red or black.

In each store, no special dcor is needed. The aim is try to keep all the shelves and inventories as neat as possible; the classification of products must be clear so the customers are able to find products with greater ease. All employees should wear black pants and dark colored polo shirts, in order to prevent visible dirt and markings. If employees wear light color uniforms, dirts can be easily seen and hard to remove making customers feel uncomfortable when being served by an untidy staff member. The placement of catalogues should usually be in a basket near the entrance, so that whenever customers enter a store, they can easily grab it on their way in and have a look at the catalogue whilst they are browsing. This also informs the customers of which of their intended purchases are on special all of which contribute to the quality customer service that SCA is after, to differentiate themselves from its competitors.

Implementation

Tactic 1. Modify website and promotions to focus on augmented product and core product benefits 2. Determine price discounts and rollout strategy to clients 3. Create television and print advertisements to introduce products 4. Email promotions customers 5. Update E-news on Super Cheap Auto website Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

6. Search for distributors with which to form channel partnerships 7. Expand business to more locations

Evaluation It is evaluation, throughout and after marketing efforts, that makes the marketing process cyclical in nature (ELLIOTT, thiele, & WALLER, 2010). It enables a marketing organisation to know and understand their position in the market and how to respond the changes in the market (ELLIOTT, thiele, & WALLER, 2010). Super cheap auto is one of the biggest retailers in the Australia and New Zealand (Supercheap Auto, 2011). The small change in the environment will have uncertain effect due to the high competitive environment, so it must continually evaluate the store performance and marketing environment. There are some important tactics for the super cheap auto performance evaluation. Metric Net profit Net revenue Net debt Annualised sales Performance compared between 2005 and 2010 Detail for Super Cheap Auto (2010) Increased by 18.4%. Increase of 13.2%. Reduced by $35.9 million. Approximately $400 million. At the beginning of 2005, Super Cheap Auto with 200 stores and sales of close to $500 million. Today, we have about 400 stores with combined sales are projected to be over $1.1 billion in the Investor profit Corporate investment 2010/11 year. Earnings per share increasing by 13.7%. $32.9 million invested in new and

refurbished Supercheap Auto and BCF Boating Camping Fishing stores. Gross margin Grew by a further 80 basis points over the prior comparative period. Acquisition costs Group Costs consist of $1.8 million of Rays Outdoors acquisition costs Cash flow from operations Cash flow from operations was $52.6 million which was $10.1 million below the prior period. Social responsibility SCA is a supporter of safe driving campaigns. Online shop performance Super cheap auto has been awarded the No 1 Hitwise site for the Retail Automotive Industry category. Price discounting It was a regular feature of the retail market in 2010. Revenue Revenue from trading operations for the year was $938,602,000. Expand business to more locations We expect to open between 10 and 15 new stores in the Auto and Cycle Retailing division and around 20 stores in the Leisure Retailing division in the coming 12 months. Knowledge and Skill We continue to invest in learning and development initiatives across the Group as one of our strategic differentiators.

Conclusion

In conclusion, Super Cheap Auto through the year certainly has gained

market share and has been successful in growing both its gross and net margins in what certainly have been difficult trading conditions. We suggest that SCA should

keep an eye on operating cash flow via inventory optimisation and self- funded growth during difficult times and reduce advertising costs whilst improving service levels and market share, turn their supply chain capabilities into a sustained competitive advantage therefore, will be recognized as both retail and supply chain market leaders. Super Cheap Auto also needs to focus on broader their current target market, improve the customer service.

Diagonal Reports, 2002. Global Aftermarket Panel, Australia. Available from: Diagonal Reports. [1 February 2011]. Joe, W 2010, Australia's Automotive Aftermarket Analysis Prepared for Tenet Powering Systems Pte Ltd. 23 November 2010. Joe Wang: Blog. Available from: <http://joewong83.blogspot.com/2010/11/australias-automotive-aftermarket.html>. [1 February 2011]. Marlows Limited: a retrospective, 2002. Available from: <http://www.johnwiley.com.au/highered/stratmgm/student-res/case-studies/001-smc200310.pdf>. [8 January 2011]. Roy Morgan Research 2010, Roy Morgan Retail Satisfaction Report. Available from: Roy Morgan Research. [20 January 2011]. Datamonitor 2010,Supercheap Auto Annual Report 2010. Available from: Business Source Premier. [21 January 2011]. Bilateral and regional trade relationships 2008, Available from: Australia Government. ELLIOTT, g., thiele, S. R., & WALLER, D. 2010, Marketing. Australia: John Wiley& Sons Australia,Ltd, Sydney. Datastream 2011, Top Stocks index data 2000-2011, Available from: Datastream [15 January 2011]. William M. Pride, O. C. 2010, Marketing. Cengage Learning, Sydney.

You might also like

- Precision Turned Products World Summary: Market Values & Financials by CountryFrom EverandPrecision Turned Products World Summary: Market Values & Financials by CountryNo ratings yet

- Transportation And Logistics A Complete Guide - 2021 EditionFrom EverandTransportation And Logistics A Complete Guide - 2021 EditionNo ratings yet

- Digikala-Ramin Shabanpour (2016)Document19 pagesDigikala-Ramin Shabanpour (2016)Ramin ShabNo ratings yet

- HoustonKemp Report Containerised Trade Trends and Implications For Australia 31 Jan 2019Document50 pagesHoustonKemp Report Containerised Trade Trends and Implications For Australia 31 Jan 2019Matthew KellyNo ratings yet

- AppleDocument21 pagesAppleFun Toosh345No ratings yet

- Revolutionize Your Warehouse: Embrace the Smart Technology That Will Transform Your BusinessFrom EverandRevolutionize Your Warehouse: Embrace the Smart Technology That Will Transform Your BusinessNo ratings yet

- Business Developmnet On Auto PartsDocument39 pagesBusiness Developmnet On Auto PartsAyush GiriNo ratings yet

- Harman Speakers On Tata Tiago and Its Future Marketing Strategy For India/ Asia Pacific RegionDocument7 pagesHarman Speakers On Tata Tiago and Its Future Marketing Strategy For India/ Asia Pacific RegionPreeti SoniNo ratings yet

- PDF 1 PDFDocument28 pagesPDF 1 PDFAkash MohataNo ratings yet

- Introduction EBayDocument3 pagesIntroduction EBayIqra TanveerNo ratings yet

- Toyota Marketing EnvironmentDocument3 pagesToyota Marketing Environmentmohammedakbar88No ratings yet

- Gamification in Consumer Research A Clear and Concise ReferenceFrom EverandGamification in Consumer Research A Clear and Concise ReferenceNo ratings yet

- Cutting plastics pollution: Financial measures for a more circular value chainFrom EverandCutting plastics pollution: Financial measures for a more circular value chainNo ratings yet

- Investing in Natural Capital for a Sustainable Future in the Greater Mekong SubregionFrom EverandInvesting in Natural Capital for a Sustainable Future in the Greater Mekong SubregionNo ratings yet

- Fashion Retail Brand Protection at Calvin Klein Underwear.Document7 pagesFashion Retail Brand Protection at Calvin Klein Underwear.Nihad MatinNo ratings yet

- 2015 Spring Semester Organization Theory Exam How Samsung Electronics Organizational Structure and Culture Affect Its Innovation Name Jeen Chun CPR Number Date March 13 TH 2015 SignatureDocument13 pages2015 Spring Semester Organization Theory Exam How Samsung Electronics Organizational Structure and Culture Affect Its Innovation Name Jeen Chun CPR Number Date March 13 TH 2015 SignatureTuấn Minh NguyễnNo ratings yet

- Auto Survey Report-12!1!10lDocument77 pagesAuto Survey Report-12!1!10lyudhie_7No ratings yet

- DellDocument4 pagesDellPruteanu VladNo ratings yet

- Study of 3PL in GranularityDocument14 pagesStudy of 3PL in Granularitymasrit123No ratings yet

- E - Commerce On Romania MarketDocument15 pagesE - Commerce On Romania MarketAlexandra BenyőNo ratings yet

- TN Transnational + International StrategyDocument10 pagesTN Transnational + International StrategyTrần Thị Thanh NgânNo ratings yet

- Future GroupDocument32 pagesFuture GroupFinola FernandesNo ratings yet

- Honda FinalDocument12 pagesHonda FinalUmair Saeed100% (1)

- Automobile Car Industry ProposalDocument6 pagesAutomobile Car Industry Proposalsavaliyamahesh100% (1)

- Target Marketing PlanDocument17 pagesTarget Marketing PlanBrigitta Ballai67% (3)

- Auto PartsDocument16 pagesAuto PartsBisal SubbaNo ratings yet

- Philippine Special Economic ZonesDocument14 pagesPhilippine Special Economic ZonesAabc EdNo ratings yet

- Financial Ratios AnalysisDocument17 pagesFinancial Ratios AnalysisRamneet ParmarNo ratings yet

- Service Sector in India - A SWOT AnalysisDocument12 pagesService Sector in India - A SWOT AnalysisMohammad Miyan0% (1)

- Group J - Tesla Model S PDFDocument21 pagesGroup J - Tesla Model S PDFTika KMNo ratings yet

- Roche StrategyDocument26 pagesRoche StrategyChitresh Motwani100% (1)

- RECKITT BENCKISER Audit Report AnalysisDocument6 pagesRECKITT BENCKISER Audit Report AnalysisSohel MahmudNo ratings yet

- Porter Worksheet - Pontier E-CigarettesDocument4 pagesPorter Worksheet - Pontier E-CigarettesCharlesPontier100% (1)

- Strategic Management Term PaperDocument43 pagesStrategic Management Term PaperSharad Pateriya100% (1)

- Aircraft Equipment Maker Business PlanDocument25 pagesAircraft Equipment Maker Business PlanAarthi SivarajNo ratings yet

- New Presentation BEPZADocument45 pagesNew Presentation BEPZABEPZA Automation SystemNo ratings yet

- Egyptian Retail IndustryDocument16 pagesEgyptian Retail IndustryJosef WasinskiNo ratings yet

- Centra SotwareDocument9 pagesCentra Sotwareadityagoel300No ratings yet

- VodafoneDocument12 pagesVodafonekshaswat147No ratings yet

- SAMSUNGDocument6 pagesSAMSUNGchenlyNo ratings yet

- A Case Study On Acquisition "Tatasteel and Natsteel"Document15 pagesA Case Study On Acquisition "Tatasteel and Natsteel"ashwinchaudhary100% (1)

- NokiaDocument64 pagesNokiaAnuj Pratap100% (1)

- Comparative Analysis of Integrated Marketing Communications Mix Strategy For Laptop ManufacturersDocument9 pagesComparative Analysis of Integrated Marketing Communications Mix Strategy For Laptop ManufacturerskristokunsNo ratings yet

- Role of Auto Sector in The Growth of Pak GDPDocument66 pagesRole of Auto Sector in The Growth of Pak GDPatique092828867% (3)

- Marketing ProjectDocument5 pagesMarketing ProjectBalindo KhanaNo ratings yet

- Cutco Case Analysis QuestionsDocument4 pagesCutco Case Analysis QuestionshssyanNo ratings yet

- The Product Life Cycle (PLC)Document5 pagesThe Product Life Cycle (PLC)tejaNo ratings yet

- KSB - Annual Report 2002 PDFDocument100 pagesKSB - Annual Report 2002 PDFLymeParkNo ratings yet

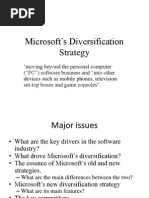

- Microsoft's Diversification StrategyDocument12 pagesMicrosoft's Diversification StrategypoijiNo ratings yet

- Keywords: 1. Supply Chain ManagementDocument6 pagesKeywords: 1. Supply Chain Managementmushtaque61No ratings yet

- Case Study - Nike Product & Brand ManagementDocument8 pagesCase Study - Nike Product & Brand Managementkanuhanda0% (1)

- IB Automobile Industry Import - Export PotentialDocument68 pagesIB Automobile Industry Import - Export PotentialBurhan BeighNo ratings yet

- Model S PDFDocument19 pagesModel S PDFffkefeNo ratings yet

- Toyota MarketingDocument291 pagesToyota Marketing2mq55dkbm6No ratings yet

- Indian Tyre Industry: Segments For The Tyre Industry Are Two-Wheelers, Passenger Cars and Truck and Bus (T&B)Document10 pagesIndian Tyre Industry: Segments For The Tyre Industry Are Two-Wheelers, Passenger Cars and Truck and Bus (T&B)Sunaina AgrawalNo ratings yet

- Volume 4 - Analytical Framework & Model Descriptions: Part FDocument44 pagesVolume 4 - Analytical Framework & Model Descriptions: Part FMwawiNo ratings yet

- Training Manual PPDocument26 pagesTraining Manual PPKingsmond EhimareNo ratings yet

- Prasad SOPDocument3 pagesPrasad SOPprasadmehta100% (1)

- History of The Automobile - Wikipedia, The Free EncyclopediaDocument18 pagesHistory of The Automobile - Wikipedia, The Free EncyclopediaMi SyamNo ratings yet

- GEET Fuel Procesor RevisitedDocument111 pagesGEET Fuel Procesor Revisitedibis_pilotNo ratings yet

- An Duong Vuong High School Mock Test 8 ThreeDocument5 pagesAn Duong Vuong High School Mock Test 8 ThreeKIMTHOANo ratings yet

- Project ReportDocument63 pagesProject ReportBharath MahendrakarNo ratings yet

- 2009 H2 Econ Prelim Case Study - Question PaperDocument9 pages2009 H2 Econ Prelim Case Study - Question PaperNaix Niy GnoNo ratings yet

- Automobile SafetyDocument8 pagesAutomobile SafetyIftekhar AnamNo ratings yet

- Amul Ind. Pvt. Ltd. Project Report-Prince DudhatraDocument35 pagesAmul Ind. Pvt. Ltd. Project Report-Prince DudhatrapRiNcE DuDhAtRaNo ratings yet

- The Impact of Road Widening On The Local EconomyDocument5 pagesThe Impact of Road Widening On The Local EconomyMhiaBuenafeNo ratings yet

- Project Profile On Plastic ProductsDocument7 pagesProject Profile On Plastic ProductsOm SharmaNo ratings yet

- Research Project On Electric BikeDocument55 pagesResearch Project On Electric Bikenobaje75% (16)

- QCVN 13-2018-BXD National Technical Regulation On Car Parking (Eng)Document29 pagesQCVN 13-2018-BXD National Technical Regulation On Car Parking (Eng)lwin_oo2435100% (1)

- Which Paragraph Contains..Document14 pagesWhich Paragraph Contains..nguyenkhanhhuyen2k51110No ratings yet

- For BOSCHDocument99 pagesFor BOSCHAdministración DieseltruckNo ratings yet

- Volkswagen and The European Automobile Industry in 1993: International Graduate School of ManagementDocument4 pagesVolkswagen and The European Automobile Industry in 1993: International Graduate School of ManagementMerly Garcia FernandezNo ratings yet

- CNG Market AnalysisDocument57 pagesCNG Market AnalysisDeepak VermaNo ratings yet

- Theory and Design of Automotive Engines - Dinesh Prabhu PDFDocument288 pagesTheory and Design of Automotive Engines - Dinesh Prabhu PDFhenevil100% (2)

- Internationalization of Tata Motors: Strategic Analysis Using Flowing Stream Strategy ProcessDocument18 pagesInternationalization of Tata Motors: Strategic Analysis Using Flowing Stream Strategy ProcessHedayatullah PashteenNo ratings yet

- 6T40 Gen III - Start StopDocument3 pages6T40 Gen III - Start Stopchoco84No ratings yet

- Management Decision & Control - Paper 11Document8 pagesManagement Decision & Control - Paper 11Jacob Baraka OngengNo ratings yet

- Hortatory Expositions, Ma'am EviDocument3 pagesHortatory Expositions, Ma'am EviVera AlfianiNo ratings yet

- Hyderabad Road SafetyDocument34 pagesHyderabad Road SafetyCiscoCCIE9No ratings yet

- Practice Automotive Industries Tarea 2Document3 pagesPractice Automotive Industries Tarea 2Oscar FerNo ratings yet

- Urban-Transport PDFDocument116 pagesUrban-Transport PDFM .U.KNo ratings yet