Professional Documents

Culture Documents

Infosys Corporate Governance Compliance

Uploaded by

Akash Mohanty0 ratings0% found this document useful (0 votes)

48 views1 pageThe document summarizes Infosys' compliance with various corporate governance codes and recommendations from organizations like the OECD, UN, and SEBI of India. It states that Infosys substantially complies with guidelines from these institutions on areas like board responsibilities, audit functions, whistleblower policies, human rights, labor standards, and environmental practices. A full compliance report is available on Infosys' website.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes Infosys' compliance with various corporate governance codes and recommendations from organizations like the OECD, UN, and SEBI of India. It states that Infosys substantially complies with guidelines from these institutions on areas like board responsibilities, audit functions, whistleblower policies, human rights, labor standards, and environmental practices. A full compliance report is available on Infosys' website.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

48 views1 pageInfosys Corporate Governance Compliance

Uploaded by

Akash MohantyThe document summarizes Infosys' compliance with various corporate governance codes and recommendations from organizations like the OECD, UN, and SEBI of India. It states that Infosys substantially complies with guidelines from these institutions on areas like board responsibilities, audit functions, whistleblower policies, human rights, labor standards, and environmental practices. A full compliance report is available on Infosys' website.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

F.

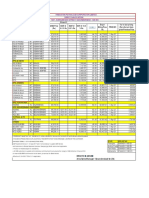

Compliance with the corporate governance codes

Corporate Governance Voluntary Guidelines 2009

During the year, the Ministry of Corporate Affairs, Government of India, published the Corporate Governance Voluntary Guidelines 2009. These Guidelines have been published keeping in view the objective of encouraging the use of better practices through voluntary adoption, which not only serve as a benchmark for the corporate sector but also help them in achieving the highest standard of corporate governance. These guidelines provide corporate India a framework to govern themselves voluntarily as per the highest standards of ethical and responsible conduct of business. The Ministry hopes that adoption of these guidelines will also translate into a much higher level of stakeholders confidence which is crucial to ensure the long-term sustainability and value generation by business. The guidelines broadly focuses on areas such as Board of Directors, responsibilities of the Board, audit committee functions, roles and responsibilities, appointment of auditors, Compliance with Secretarial Standards and a mechanism for whistle blower support. We substantially comply with the Corporate Governance Voluntary Guidelines.

in American capital markets. The Commission addressed three key areas executive compensation, corporate governance, and audit and accounting issues, and issued its first set of findings and recommendations. We substantially comply with these recommendations.

OECD Principles of Corporate Governance

The governments of the 30 countries in the OECD have recently approved a revised version of the OECD's Principles of Corporate Governance adding new recommendations for good practice in corporate behavior with a view to rebuilding and maintaining public trust in companies and stock markets. We comply with these recommendations. A detailed compliance report with the recommendations of various committees listed in this section is available on our website www.infosys.com.

United Nations Global Compact policy

Announced by the United Nations Secretary-General, Kofi Annan, at the World Economic Forum in Davos, Switzerland, in January 1999, and formally launched at the UN Headquarters in July 2000, the Global Compact policy calls on companies to embrace ten principles in the areas of human rights, labor standards and environment. The policy is a value-based platform designed to promote institutional learning. It utilizes the power of transparency and dialog to identify and disseminate good practices based on universal principles. The ten principles are drawn from the Universal Declaration of Human Rights, the International Labor Organizations Fundamental Principles on Rights at Work, and the Rio Principles on Environment and Development. According to these principles, businesses should : Support and respect the protection of internationally proclaimed human rights Ensure that they are not complicit in human rights abuses Uphold the freedom of association and the effective recognition of the right to collective bargaining Support the elimination of all forms of forced and compulsory labor Support the effective abolition of child labor Eliminate discrimination with respect to employment and occupation Support a precautionary approach to environmental challenges Undertake initiatives to promote greater environmental responsibility Encourage the development and diffusion of environment friendly technologies Work against corruption in all its forms, including extortion and bribery On August 27, 2001, we adopted the United Nations Global Compact policy and became a partner with the United Nations in this initiative. A strong sense of social responsibility is an integral part of our value system. We adhere to the principles of the United Nations Global Compact policy.

Source : www.unglobalcompact.org

Revised Clause 49 of the Listing Agreement

SEBI, with a view to improve corporate governance standards in India and to enhance the transparency and integrity of the market, constituted the Committee on Corporate Governance under the chairmanship of N. R. Narayana Murthy. The committee issued two sets of recommendations : the mandatory recommendations and the non-mandatory recommendations. SEBI has incorporated the recommendations made by the Narayana Murthy Committee on Corporate Governance in Clause 49. A revised Clause 49 was made effective from January 1, 2006. We fully comply with the revised Clause 49 of the Listing Agreement.

Naresh Chandra Committee

Following instances of irregularities involving auditors in the U.S. and in India, the Government of India, by an order dated August 21, 2002, constituted a high-level committee under the chairmanship of Naresh Chandra to examine the auditor-company relationship and to regulate the role of auditors. Chapters 2, 3 and 4 of the NareshChandra Committee report are relevant to us. We comply with these recommendations.

Kumar Mangalam Birla Committee

SEBI appointed the Committee on Corporate Governance on May 7, 1999, under the chairmanship of Kumar Mangalam Birla, to promote and raise the standards of corporate governance. The SEBI Board adopted the recommendations of the committee on January 25, 2000. We comply with these recommendations.

Euroshareholders Corporate Governance Guidelines 2000

Euroshareholders is the confederation of European shareholders associations, constituted to represent the interests of individual shareholders in the European Union. The guidelines are based on the general principles of corporate governance issued by the Organization for Economic Co-operation and Development (OECD) in 1999, but are more specific and detailed. Subject to the statutory regulations in force in India, we comply with these recommendations.

Compliance with findings and recommendation of The Conference Board Commission on Public Trust and Private Enterprises in the U.S.

The Conference Board Commission on Public Trust and Private Enterprises was convened to address the circumstances which led to corporate irregularities and the subsequent decline of confidence

Infosys Annual Report 2009-10

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Accuracy Obligation GuideDocument4 pagesAccuracy Obligation GuideClement ChanNo ratings yet

- G.R. No. 173849 Passi V BoclotDocument18 pagesG.R. No. 173849 Passi V BoclotRogie ToriagaNo ratings yet

- Citibank V.dinopol, GR 188412Document7 pagesCitibank V.dinopol, GR 188412vylletteNo ratings yet

- HPCL PRICE LIST FOR VISAKH, MUMBAI, CHENNAI, VIJAYAWADA AND SECUNDERABAD DEPOTSDocument1 pageHPCL PRICE LIST FOR VISAKH, MUMBAI, CHENNAI, VIJAYAWADA AND SECUNDERABAD DEPOTSaee lweNo ratings yet

- Filinvest Land v. NgilaDocument6 pagesFilinvest Land v. NgilashallyNo ratings yet

- OSHA Complaint Regarding Oakdale Federal Correctional ComplexDocument4 pagesOSHA Complaint Regarding Oakdale Federal Correctional ComplexmcooperkplcNo ratings yet

- Social Security System v. Moonwalk Development and Housing CorporationDocument6 pagesSocial Security System v. Moonwalk Development and Housing CorporationRimvan Le SufeorNo ratings yet

- Architectural Consultancy AgreementDocument6 pagesArchitectural Consultancy AgreementprashinNo ratings yet

- Project of Family LawDocument13 pagesProject of Family LawMINNU MINHAZ100% (1)

- Prejudicial QuestionDocument36 pagesPrejudicial QuestionVanessa Marie100% (1)

- Heirs of Hilario Ruiz Vs Edmond RuizDocument2 pagesHeirs of Hilario Ruiz Vs Edmond RuizParis Valencia100% (1)

- Cocomangas Hotel Beach Resort V ViscaDocument7 pagesCocomangas Hotel Beach Resort V Viscahehe kurimaoNo ratings yet

- Objectives and Risks for Payroll ManagementDocument2 pagesObjectives and Risks for Payroll ManagementEric Ashalley Tetteh100% (3)

- Chronicle Nov 5 08Document15 pagesChronicle Nov 5 08chronicleononly100% (1)

- People Vs de Los SantosDocument8 pagesPeople Vs de Los Santostaktak69No ratings yet

- Guanio V ShangrilaDocument13 pagesGuanio V Shangrilavon jesuah managuitNo ratings yet

- ENP LawDocument15 pagesENP LawArnoldAlarcon100% (1)

- IFLA Code of Ethics For LibrariansDocument6 pagesIFLA Code of Ethics For LibrariansImran SiddiqueNo ratings yet

- Yapyuco Vs Sandiganbayan 674 Scra 420Document4 pagesYapyuco Vs Sandiganbayan 674 Scra 420Cecille Bautista100% (2)

- Senior-citizen tax discounts clarifiedDocument2 pagesSenior-citizen tax discounts clarifiedJianSadakoNo ratings yet

- Ambedkar's view on protests and restoring the ConstitutionDocument6 pagesAmbedkar's view on protests and restoring the ConstitutionAyushNo ratings yet

- Rivera Family Property Dispute ResolvedDocument1 pageRivera Family Property Dispute ResolvedMalen Crisostomo Arquillo-SantosNo ratings yet

- Olaf Peter Juda v. Dennis Michael Nerney, Assistant U.S. Attorney, Northern District of California Stephen R. Kotz, Assistant U.S. Attorney, Albuquerque, New Mexico John J. Kelly, U.S. Attorney, Albuquerque, New Mexico Michael Yamaguchi, U.S. Attorney, San Francisco, California Robert L. Holler, District Director, U.S. Customs Service, El Paso, Texas Leonard S. Walton, Acting Assistant Commissioner, U.S. Customs Service, Washington, D.C. Bonnie L. Gay, Foia Unit, Attorney-In-Charge, Washington, D.C. John and Jane Does 1-25 United States of America, Olaf Peter Juda v. United States Customs Service, Robert L. Holler, Joy M. Hughan, Daniel Luar, Rita Alfaro, Dolores Payan, Gina E. Fuentes, Internal Revenue Service, George Terpack, Carolyn Leonard, Timothy A. Towns, John Does, Jane Does, 149 F.3d 1190, 10th Cir. (1998)Document13 pagesOlaf Peter Juda v. Dennis Michael Nerney, Assistant U.S. Attorney, Northern District of California Stephen R. Kotz, Assistant U.S. Attorney, Albuquerque, New Mexico John J. Kelly, U.S. Attorney, Albuquerque, New Mexico Michael Yamaguchi, U.S. Attorney, San Francisco, California Robert L. Holler, District Director, U.S. Customs Service, El Paso, Texas Leonard S. Walton, Acting Assistant Commissioner, U.S. Customs Service, Washington, D.C. Bonnie L. Gay, Foia Unit, Attorney-In-Charge, Washington, D.C. John and Jane Does 1-25 United States of America, Olaf Peter Juda v. United States Customs Service, Robert L. Holler, Joy M. Hughan, Daniel Luar, Rita Alfaro, Dolores Payan, Gina E. Fuentes, Internal Revenue Service, George Terpack, Carolyn Leonard, Timothy A. Towns, John Does, Jane Does, 149 F.3d 1190, 10th Cir. (1998)Scribd Government DocsNo ratings yet

- Microsoft Collaborate Terms of UseDocument6 pagesMicrosoft Collaborate Terms of UseZeeshan OpelNo ratings yet

- CIR v. Mirant PagbilaoDocument4 pagesCIR v. Mirant Pagbilaoamareia yap100% (1)

- Andhra Pradesh Town Planning Service Rules, 1992 - Amendment G.O. Ms. No. 42 MA UD, DT 09-03-2024Document5 pagesAndhra Pradesh Town Planning Service Rules, 1992 - Amendment G.O. Ms. No. 42 MA UD, DT 09-03-2024RaghuNo ratings yet

- Domingo v. Sandiganbayan DigestDocument2 pagesDomingo v. Sandiganbayan DigestDan Christian Dingcong Cagnan100% (3)

- Should Business Lobbying Be Legalized in India - Implication On Business?Document6 pagesShould Business Lobbying Be Legalized in India - Implication On Business?Divyank JyotiNo ratings yet

- Central: EducationalDocument2 pagesCentral: EducationalBhaskar BethiNo ratings yet

- University of London La2024 ZADocument3 pagesUniversity of London La2024 ZASaydul ImranNo ratings yet