Professional Documents

Culture Documents

Ion of A Floating Charge

Uploaded by

edoolawOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ion of A Floating Charge

Uploaded by

edoolawCopyright:

Available Formats

Crystallisation Of A Floating Charge

http://www.proeconomics.com/Law/Company/Drafting_of_Automatic_Crystallisation_C lauses.html Until a floating charge crystallises, a company can continue to deal with the assets which are the subject-matter of the security in the ordinary course of its business. The scope of a company's 'ordinary course of business' for this purpose is sometimes equated with its objects under its memorandum of association. The common practice of having very extensive objects means that, adopting this approach, there is little or nothing that a company can do which would fall outside the scope of its power to continue to use assets which are the subject of a floating charge. However, if a company does something authorised by its objects which triggers the cessation of its business, this may cause the floating charge to crystallise in accordance with the principles discussed in this section. The existence of an uncrystallised floating charge does not prevent the company's debtors from claiming rights of set-off against it, nor does it preclude any of the company's other creditors from enforcing judgment against its assets. When a floating charge crystallises into a fixed charge, it attaches to the existing assets of the company within the ambit of the charge and, unless the charge excludes this, all such assets that are subsequently acquired. A crystallised floating charge ranks as a fixed charge for the purposes of determining its priority against others' interests in the company's property which are created or acquired after crystallisation. Although there is one case to the contrary,the better view is that crystallisation does not affect the priority of a floating charge against other interests in the same property which predate crystallisation. Crystallisation has the effect of postponing execution creditors to the chargee's interest, and once debtors of the company have notice of crystallisation they are largely precluded from claiming rights of set-off. As charges are essentially contractual documents, it is for the parties to determine crystallising events but, in the absence of any other provision, three crystallising events will be implied. These are intervention by the holder of the charge to take control of the security, such as by appointing a receiver under the terms of the charge, the commencement of the winding up of the company2 and the cessation of its business. It is also possible for the parties to agree additional crystallising events in the terms of the charge. For example, a floating charge may contain a provision which entitles its holder to trigger crystallisation by serving a notice to that effect on the company. Until the 1980s it was uncertain whether under English law it was possible to provide for automatic crystallisation upon the happening of an event that did not require intervention from the holder of the charge and which, unlike liquidation or cessation of business, did not signal the end of the company's business. Dicta in some old cases suggested that, outside situations of cessation of business, the holder of the charge had to intervene positively in order to bring about crystallisation. In England, the powerful dicta of Hoffmann J in Re Brightlife Ltd and his decision in Re Permanent Houses

(Holdings) Ltd heralded the acceptance of the legal effectiveness of automatic crystallisation clauses that did not require the charge-holder to intervene. Elsewhere in the Commonwealth, it has also been specifically held that automatic crystallisation in this form is possible. This acceptance of non-interventionist automatic crystallisation, despite certain policy objections to it, represents a triumph for freedom of contract: a floating charge is a consensual security and it is therefore for the parties to determine its features including the circumstances in which it will crystallise. There is a case here for statutory intervention, with a possible way forward being to follow the Irish model under which debts secured by fixed charges on book debts enjoy no priority over revenue debts; this approach allows companies and their creditors to structure their lending arrangements as they think fit within the bounds of legal possibility but ensures that the preferential status given to certain debts by the insolvency legislation is not deprived of meaningful effect. Automatic crystallisation clause There are now two recognised forms of automatic crystallisation clause: the first is where crystallisation is to happen upon the occurrence of specified events without positive intervention from the holder of the charge; and the second is where crystallisation is to happen if and when the holder of the charge serves a notice to that effect. The first type of clause places the occurrence of crystallisation outside the control of the holder of the charge and, unless the clause is narrowly and carefully drafted, may result in situations where the charge crystallises even though the charge-holder is content for it to continue to exist in uncrystallised form. In anticipation of this, an automatic crystallisation clause may be coupled with an express clause entitling its holder to decrystallise it again. In the absence of such a clause, it should be possible to achieve decrystallisation with the express or implied consent of the holder of the charge. However, there is a risk that if the automatic crystallisation is so widely drafted that the holder of the charge has frequently to agree to decrystallisation, this pattern of events may lead a court to conclude that the original agreement was later varied by the parties so as to exclude the automatic crystallisation provision. The second form of automatic crystallisation clause avoids the issue of unwanted crystallisation by keeping the trigger for crystallisation within the control of the holder of the charge. On the other hand, automatic crystallisation clauses in this form have an in-built delay factor which could operate to the detriment of the holder of the charge in its claim to priority over other interests in the same property.

You might also like

- Crystallisation - JCLSDocument19 pagesCrystallisation - JCLSamyorourke12No ratings yet

- Consequences of Floating ChargeDocument3 pagesConsequences of Floating ChargeAtiyah AliasNo ratings yet

- Pre EmptiveDocument18 pagesPre EmptiveharshitanandNo ratings yet

- Global Restructuring Insolvency Guide New Logo South AfricaDocument12 pagesGlobal Restructuring Insolvency Guide New Logo South AfricaBranice OkisoNo ratings yet

- Inso (Law)Document3 pagesInso (Law)NURUL A'TIKAHNo ratings yet

- Floating Charge - WikipediaDocument48 pagesFloating Charge - WikipediaGhulam AliNo ratings yet

- Corporate Veil 4Document3 pagesCorporate Veil 4silvernitrate1953No ratings yet

- Expansion of Personal Guarantors LiabilitiesDocument6 pagesExpansion of Personal Guarantors LiabilitiesAdv Sneha SolankiNo ratings yet

- New Bankruptcy LawDocument10 pagesNew Bankruptcy Lawdirunraj3269No ratings yet

- Overview of The Insolvency Regime in HK Tanner de Witt 2011Document20 pagesOverview of The Insolvency Regime in HK Tanner de Witt 2011clam@whitecase.comNo ratings yet

- Debentures & Loan Capital (Part 2)Document36 pagesDebentures & Loan Capital (Part 2)David Yew Jie MingNo ratings yet

- Corporate Laws II - Fraudulent Preference and Voluntary TransfersDocument37 pagesCorporate Laws II - Fraudulent Preference and Voluntary Transfersarvind667No ratings yet

- Exam ScriptDocument9 pagesExam ScriptRunyararoNo ratings yet

- Procedure and Challenges For Insolvency Under Part IIIDocument5 pagesProcedure and Challenges For Insolvency Under Part IIIVimal AgarwalNo ratings yet

- Caltex (Phils.), Inc. v. PNOC Shipping and Transport Corp., 498 SCRA 400 (2006)Document29 pagesCaltex (Phils.), Inc. v. PNOC Shipping and Transport Corp., 498 SCRA 400 (2006)inno KalNo ratings yet

- Registering Corporate Guarantees as ChargesDocument5 pagesRegistering Corporate Guarantees as ChargesManishaNo ratings yet

- 01 Ramoso V. Ca (Agapito)Document44 pages01 Ramoso V. Ca (Agapito)Adi CruzNo ratings yet

- Debentures and ChargesDocument4 pagesDebentures and Chargesrobertkarabo.jNo ratings yet

- COMPANY LAW Corporate VeilDocument10 pagesCOMPANY LAW Corporate Veilcristina plesoiuNo ratings yet

- Agbayani: There Are Certain Notes Containing Acceleration Provisions. These Provisions (1) Make ItDocument2 pagesAgbayani: There Are Certain Notes Containing Acceleration Provisions. These Provisions (1) Make ItShazna SendicoNo ratings yet

- Icsi-Ccgrt: Charges & Its Registration (Through The Court's Eyes)Document5 pagesIcsi-Ccgrt: Charges & Its Registration (Through The Court's Eyes)Muthu KumaranNo ratings yet

- Lecturers HO No. 9 2023 Pre Week in Commercial LawDocument94 pagesLecturers HO No. 9 2023 Pre Week in Commercial LawElle WoodsNo ratings yet

- 2023 Pre Week Dean DivinaDocument189 pages2023 Pre Week Dean DivinaYeye Farin PinzonNo ratings yet

- 15561_CLW201Document15 pages15561_CLW201VickyLim02No ratings yet

- Chapter 3Document10 pagesChapter 3Eko WaluyoNo ratings yet

- RoseDocument4 pagesRosePriyanka GirdariNo ratings yet

- Corpo Cases ConsolidatedDocument130 pagesCorpo Cases ConsolidatedAdi LimNo ratings yet

- A Quick Insight To Corporate Restructuring and Insolvency in England and WalesDocument12 pagesA Quick Insight To Corporate Restructuring and Insolvency in England and WalesADAMS UVEIDANo ratings yet

- German Insolvency Code's objectives and grounds for filingDocument3 pagesGerman Insolvency Code's objectives and grounds for filingAmeya Gawhane100% (1)

- Corporate Insolvency Law Exam NotesDocument167 pagesCorporate Insolvency Law Exam NotesBrandon Tee100% (3)

- Winding Up of CompaniesDocument18 pagesWinding Up of CompaniesAbbas HaiderNo ratings yet

- The Companies Act, 2013: Guarantee Company and A Company Having Share Capital. ProvisionDocument10 pagesThe Companies Act, 2013: Guarantee Company and A Company Having Share Capital. ProvisionMansimar SinghNo ratings yet

- CCC INSURANCE CORPORATION, Petitioner, vs. KAWASAKIDocument21 pagesCCC INSURANCE CORPORATION, Petitioner, vs. KAWASAKINoirahgap AnigerNo ratings yet

- Grno July: July Philippine Supreme Court Decisions On Commercial LawDocument2 pagesGrno July: July Philippine Supreme Court Decisions On Commercial LawMisc EllaneousNo ratings yet

- Cases (09-08)Document24 pagesCases (09-08)Mika RapananNo ratings yet

- U P & E S S: Niversity OF Etroleum Nergy Tudies Chool OF LAWDocument18 pagesU P & E S S: Niversity OF Etroleum Nergy Tudies Chool OF LAWpriyanka_kajlaNo ratings yet

- 1NALSARStudLRev51Document8 pages1NALSARStudLRev51Priya PakksNo ratings yet

- Corporate Rehab: What You Need To KnowDocument26 pagesCorporate Rehab: What You Need To KnowJvsticeNickNo ratings yet

- Karj Global Marketing Network, Inc., V. Miguel P. MaraDocument1 pageKarj Global Marketing Network, Inc., V. Miguel P. MaraMark Anthony ReyesNo ratings yet

- Reclamation Bonds From The Surety PerspectiveDocument5 pagesReclamation Bonds From The Surety PerspectiveUjjwayinee BiswasNo ratings yet

- Maricalum Mining Corporation v. Florentino (DATILES)Document4 pagesMaricalum Mining Corporation v. Florentino (DATILES)Homer SimpsonNo ratings yet

- Lwcyp 2019 Dec ADocument8 pagesLwcyp 2019 Dec AgeneetohNo ratings yet

- Assignment On Effects of Ultra Vires TransactionsDocument5 pagesAssignment On Effects of Ultra Vires Transactionssaksham ahuja100% (1)

- Damages and Liability Limitations in Qatar - A Comprehensive ReviewDocument5 pagesDamages and Liability Limitations in Qatar - A Comprehensive ReviewAzman YahayaNo ratings yet

- Commercial Law Handout on Rehabilitation ProceedingsDocument9 pagesCommercial Law Handout on Rehabilitation ProceedingssikarlNo ratings yet

- Corporate-Personality EasyDocument4 pagesCorporate-Personality EasyNaim AhmedNo ratings yet

- Company Law Assignment 1Document24 pagesCompany Law Assignment 1management1997No ratings yet

- Corporate Veil & Governance-1Document24 pagesCorporate Veil & Governance-1silvernitrate1953No ratings yet

- Corporate Veil & GovernanceDocument4 pagesCorporate Veil & Governancesilvernitrate1953No ratings yet

- Kahn-Freund, Some Reflections On Company Law ReformDocument13 pagesKahn-Freund, Some Reflections On Company Law ReformLam Ching Ting Cally100% (2)

- Project 1Document14 pagesProject 1Deepak SharmaNo ratings yet

- Debentures and Loan Capital ExplainedDocument26 pagesDebentures and Loan Capital ExplainedhaninadiaNo ratings yet

- Set-Off, Netting and AbatementDocument89 pagesSet-Off, Netting and Abatementa lNo ratings yet

- Issue 2Document7 pagesIssue 2Satyam SinghNo ratings yet

- Tavonga Banking Law and PracticeDocument6 pagesTavonga Banking Law and PracticeTavonga Enerst MasweraNo ratings yet

- UAE Receivable Financing With Prohibition Against AssignmentDocument3 pagesUAE Receivable Financing With Prohibition Against AssignmentAman Kumar YadavNo ratings yet

- Study Unit 2 Discussion Questions and AnswersDocument4 pagesStudy Unit 2 Discussion Questions and AnswersArap KimalaNo ratings yet

- Capital Insurance and Surety Co. vs. Del Monte MotorworksDocument22 pagesCapital Insurance and Surety Co. vs. Del Monte MotorworksLeizl A. VillapandoNo ratings yet

- Comments on the SEC's Proposed Rules for Regulation CrowdfundingFrom EverandComments on the SEC's Proposed Rules for Regulation CrowdfundingNo ratings yet

- Equal Opportunities & DiscriminationDocument2 pagesEqual Opportunities & DiscriminationedoolawNo ratings yet

- Advantages Disadvantages of A Company Limited by GuaranteeDocument5 pagesAdvantages Disadvantages of A Company Limited by GuaranteeedoolawNo ratings yet

- Insolvency (Administration Equal Treatment To Classes Ofcreditors) Regul. (Apr. 2020)Document1 pageInsolvency (Administration Equal Treatment To Classes Ofcreditors) Regul. (Apr. 2020)edoolawNo ratings yet

- Powerful Dua for Health, Protection, Forgiveness and JannahDocument2 pagesPowerful Dua for Health, Protection, Forgiveness and JannahedoolawNo ratings yet

- The Importance of Darood ShariffDocument10 pagesThe Importance of Darood ShariffedoolawNo ratings yet

- Science IndiaDocument5 pagesScience IndiaedoolawNo ratings yet

- The Importance of Darood ShariffDocument10 pagesThe Importance of Darood ShariffedoolawNo ratings yet

- Powerful Dua for Health, Protection, Forgiveness and JannahDocument2 pagesPowerful Dua for Health, Protection, Forgiveness and JannahedoolawNo ratings yet

- In The Name of Allah Most GraciousDocument2 pagesIn The Name of Allah Most GraciousedoolawNo ratings yet

- The Indian Trusts Act, 1882Document53 pagesThe Indian Trusts Act, 1882akash_shah_42No ratings yet

- Credit For Feb 27Document82 pagesCredit For Feb 27Jhea MillarNo ratings yet

- Tax 2 4Document9 pagesTax 2 4amlecdeyojNo ratings yet

- Sale and Purchase Agreement - With TitleDocument37 pagesSale and Purchase Agreement - With Titledenesh11No ratings yet

- AdvertisingDocument5 pagesAdvertisingHapi HernandezNo ratings yet

- Partnership Liquidation (Installment)Document3 pagesPartnership Liquidation (Installment)Johncel TawatNo ratings yet

- Tri LegalDocument4 pagesTri LegalShreyashkarNo ratings yet

- ObliconDocument16 pagesObliconDante EscuderoNo ratings yet

- Testate Estate of Lazaro MotaDocument2 pagesTestate Estate of Lazaro Motakingley leanderNo ratings yet

- Panlilio vs. VictorioDocument8 pagesPanlilio vs. VictoriojeiromeNo ratings yet

- Section 3 Condonation or Remission of The DebtDocument2 pagesSection 3 Condonation or Remission of The DebtMariaFaithFloresFelisartaNo ratings yet

- Compensation To Novation - Case DigestDocument4 pagesCompensation To Novation - Case DigestMarife Tubilag ManejaNo ratings yet

- Collateral Agreement: % Per MonthDocument2 pagesCollateral Agreement: % Per MonthGlaiza Flores50% (6)

- Fitness & Probity DeclarationDocument3 pagesFitness & Probity DeclarationCarlos Uriel Rojas ContrerasNo ratings yet

- Ancisco Realty and Development Corporation v. CADocument1 pageAncisco Realty and Development Corporation v. CAJeric Angelo GalonNo ratings yet

- Recovery of Debt Act Provides for Speedy RecoveryDocument7 pagesRecovery of Debt Act Provides for Speedy RecoveryLakhbir BrarNo ratings yet

- Bankruptcy OutlineDocument5 pagesBankruptcy OutlineElle Allen0% (2)

- Protea Biosciences Amended Complaint Against Barry Honig 11.30.19Document29 pagesProtea Biosciences Amended Complaint Against Barry Honig 11.30.19Teri BuhlNo ratings yet

- Southwest AirlinesDocument8 pagesSouthwest AirlinesVikk ShahNo ratings yet

- Great Asian Sales Vs CADocument2 pagesGreat Asian Sales Vs CAJoshua Erik Madria100% (1)

- Case DigestDocument5 pagesCase DigestAlexylle Garsula de ConcepcionNo ratings yet

- Logistics-II Mid (Accounts)Document3 pagesLogistics-II Mid (Accounts)David Raju GollapudiNo ratings yet

- Board of Directors Composition, Structure, Duties & PowersDocument29 pagesBoard of Directors Composition, Structure, Duties & PowersbrijeshbhaiNo ratings yet

- Joinder TemplateDocument4 pagesJoinder TemplateergodocNo ratings yet

- 9TH NLIU NATIONAL CORPORATE LAW MOOT COURT COMPETITIONDocument15 pages9TH NLIU NATIONAL CORPORATE LAW MOOT COURT COMPETITIONpratham mohantyNo ratings yet

- Carta de CMS A ConstellationDocument8 pagesCarta de CMS A ConstellationEl Nuevo DíaNo ratings yet

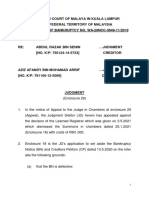

- BANKRUPTCY - Abdul Razak Senin-Appeal Ag BN - PublishDocument12 pagesBANKRUPTCY - Abdul Razak Senin-Appeal Ag BN - Publishhafeez benignNo ratings yet

- Explain Sale and Essentials of Contract of Sale.Document5 pagesExplain Sale and Essentials of Contract of Sale.Erica DsouzaNo ratings yet

- Reorganization and Troubled Debt Restructuring - 2Document32 pagesReorganization and Troubled Debt Restructuring - 2Marie GarpiaNo ratings yet

- In Re James Thomas and Linda Thomas, Debtors. Southtrust Bank of Alabama, N.A., As Assignee of Southtrust Mobile Services v. James Thomas and Linda Thomas, 883 F.2d 991, 11th Cir. (1989)Document12 pagesIn Re James Thomas and Linda Thomas, Debtors. Southtrust Bank of Alabama, N.A., As Assignee of Southtrust Mobile Services v. James Thomas and Linda Thomas, 883 F.2d 991, 11th Cir. (1989)Scribd Government DocsNo ratings yet