Professional Documents

Culture Documents

IEC LR 12-01 (Valuation of A Meal)

Uploaded by

Colorado Ethics WatchOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IEC LR 12-01 (Valuation of A Meal)

Uploaded by

Colorado Ethics WatchCopyright:

Available Formats

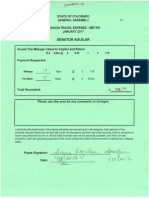

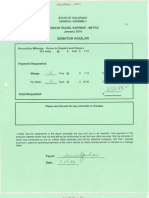

State of Colorado

Dan Grossman, Chairperson Sally H. Hopper, Vice-Chairperson Bill Pinkham, Commissioner Matt Smith, Commissioner Jane T. Feldman, Executive Director

INDEPENDENT ETHICS COMMISSION

101 West Colfax Ave., Ste 500, Denver, CO 80202 Ph.: 303/837-2339 Fax: 303/837-2344 E-mail: jane.feldman@state.co.us www.colorado.gov/ethicscommission

Le t t e r Rulin g 1 2 -0 1 (Valuation of a Meal)

SUMMARY: For purposes of determining the value of a gift of a meal from a nonprofit organization, the Commission finds that the value of meal is the lowest price available to the event to the general public. I. BACKGROUND The Independent Ethics Commission (IEC or Commission) has received a request for a letter ruling from the Colorado Nonprofit Association (Association)1 , asking the IEC to reconsider its previous decision that in determining the amount of the gift of a meal, the cost of the ticket to the event is determinative. See, Advisory Opinion 10-14 (Acceptance of a Luncheon from a Political Subdivision), at page 4. According to the request, the Association is an Internal Revenue Code section 501(c)(3) tax exempt organization. The Association works with and for all of Colorados nonprofits to create impact in our communities. (It does) so by providing cost-saving membership benefits, up-to-date resources and practical information to help nonprofits. For the past 16 years, the Association has hosted an annual fundraising luncheon at which it presents several awards to individuals who have made contributions to the nonprofit community. The cost of the ticket to a member of the

The Association has waived confidentiality relating to this request.

public for the luncheon ranges from $55 a person to $90 per person, depending upon whether or not the individual is a member of the Association and the date of registration for the event. Five state-wide elected officials including the Governor, the Lieutenant Governor and the Attorney General, are invited to give a speech or make a presentation. They receive a complimentary ticket to the event. Because the five public officials speak and/or answer questions as part of the Associations scheduled program, their tickets fall within the exception to the gift ban contained in Article XXIX, section 3(3)(e). The Association also invites other public employees and officials to attend the luncheon on a complimentary basis, to improve public employees and officials familiarity with the nonprofit community and vice-versa. The Association contends that the value of each of the complimentary tickets should be considered to be the cost of the meal to the Association, $41.91, therefore falling below the $53 gift limit. The Association cites Internal Revenue Service (IRS) guidance for its position. IRS Publication 526 (2010) states at page 3 that in determining the amount of a charitable contribution for purposes of an income tax deduction, the taxpayer should look at the cost to the donor. If the amount paid by the donor is more than the cost to the donee, then the difference is deductible as a charitable contribution. II. JURISDICTION The IEC issues letter rulings pursuant to C.R.S. 24-18.5-101(2)(b)(1). The question concerns gifts to public officials and employees who are subject to the jurisdiction of the Commission.

III. APPLICABLE LAW Article XXIX, section 3, reads in relevant part:(2) No public officer, member of the general assembly, local government official, or government employee, either directly or indirectly as the beneficiary of a gift or thing of value given to such person's spouse or dependent child, shall solicit, accept or receive any gift or other thing of value having either a fair market value or aggregate actual cost greater than fifty dollars ($50)2 in any calendar year, including but not limited to, gifts, loans, rewards, promises or negotiations of future employment, favors or services, honoraria, travel, entertainment, or special discounts, from a person, without the person receiving lawful consideration of equal or greater value in return from the public officer, member of the general assembly, local government official, or government employee who solicited, accepted or received the gift or other thing of value. (emphasis supplied).

III. DISCUSSION The question of how a meal should be valued depends on the construction of the terms fair market value and aggregate actual cost contained in Article XXIX. This construction should guide the Commission in its determination of whether the focus should be on the cost of the lunch paid provided by the Association, $41.91, or instead, on the cost of a ticket to the event, $55 to $90 per ticket. The Commission has reviewed advisory opinions from several other jurisdictions, and other ethics commissions are split on whether the gift is the amount of the ticket, or the cost of the meal. See, e.g., Massachusetts Ethics Commission-COI-92-32, NYC Conflicts of Interest Board, Advisory Opinion No. 2000-4; City of Honolulu Ethics Commission Advisory Opinion 2003-3 (finding that the value of the gift is the cost of the ticket), and Ohio Ethics Commission Advisory Opinion 2009-03, and Hawaii State Ethics Commission (finding that the value of the gift is the actual cost of the meal to the donor).

2

Pursuant to Position Statement 11-01, the applicable amount is now fifty three dollars ($53).

These opinions analyze their respective states statutes and codes, or in some circumstances, make a policy decision regarding the appropriate interpretation. Neither the term fair market value nor the term aggregate actual cost is defined in the Constitution or clarified in the Review and Comment Hearing Transcript or in the Blue Book. However, the term fair market value is commonly used in Colorado statutes and the term typically is defined in case law as the price at which property would change hands between a willing buyer and a willing seller when neither party is under an obligation to act. Pueblo Bancorporation v. Lindoe, Inc., 63 P.3d 353, 362 (Colo. 2003); Hawes v. Colo. Div. of Insurance, 32 P.3d 571, 574 (Colo.App. 2001). In the usual case of sale of consumer goods or services, the price to the manufacturer or provider is irrelevant. The fair market value is the price the item is offered for sale or service. The price of a meal at a restaurant is not the cost of providing the meal, but the price listed on the menu. The fair market value is the price the item is offered for sale or service. This amount of the gift, therefore, is the price that the ticket is offered to the general public. Because the price for the event is staggered based on when the ticket is purchased, the Commission finds that the value of the gift is the lowest price at which the ticket is available to the general public, for 2012, $65. The IEC believes that in the situation where the actual ticket price is higher than the gift limit, but close, a public employee may pay the difference between the gift limit and the price of the ticket, in this example, $12. In addition, the Association may consider publicly setting a government employee and official price which would be within the gift ban limit.

IV. CONCLUSION The Commission finds that in determining the value of a complimentary ticket to a luncheon for purposes of the gift ban, the appropriate valuation is the lowest cost at which the ticket is available to the general public. The Independent Ethics Commission Dan Grossman, Chair Sally H. Hopper, Vice Chairperson Bill Pinkham, Commissioner Matt Smith, Commissioner

Dated: February 12, 2012

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Treasurer Stapleton Calendar Feb-Apr 2017Document13 pagesTreasurer Stapleton Calendar Feb-Apr 2017Colorado Ethics WatchNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 2017 Coleg Per Diem 2 of 6Document95 pages2017 Coleg Per Diem 2 of 6Colorado Ethics WatchNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 2017 Coleg Per Diem 6 of 6Document114 pages2017 Coleg Per Diem 6 of 6Colorado Ethics WatchNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Oct 2017 Comment On CPF RulemakingDocument2 pagesOct 2017 Comment On CPF RulemakingColorado Ethics WatchNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- 2017 Coleg Per Diem 1 of 6Document122 pages2017 Coleg Per Diem 1 of 6Colorado Ethics WatchNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Attorney General Cynthia Coffman Calendar Jan-Mar 2017Document13 pagesAttorney General Cynthia Coffman Calendar Jan-Mar 2017Colorado Ethics WatchNo ratings yet

- 2017 Coleg Per Diem 4 of 6Document108 pages2017 Coleg Per Diem 4 of 6Colorado Ethics WatchNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 2017 Coleg Per Diem 3 of 6Document93 pages2017 Coleg Per Diem 3 of 6Colorado Ethics WatchNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 2017 Coleg Per Diem 5 of 6Document76 pages2017 Coleg Per Diem 5 of 6Colorado Ethics WatchNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Treasurer Stapleton Calendar 8.1.2016-10.31.2016Document14 pagesTreasurer Stapleton Calendar 8.1.2016-10.31.2016Colorado Ethics WatchNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- LT Governor Donna Lynne Calendar Jan-Mar 2017Document95 pagesLT Governor Donna Lynne Calendar Jan-Mar 2017Colorado Ethics WatchNo ratings yet

- Governor Hickenlooper Calendar Jan-Mar 2017Document155 pagesGovernor Hickenlooper Calendar Jan-Mar 2017Colorado Ethics WatchNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- SoS Wayne Williams Calendar Dec 2016-Feb 2017Document14 pagesSoS Wayne Williams Calendar Dec 2016-Feb 2017Colorado Ethics WatchNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- IEC Draft Position Statement On Frivolous DeterminationsDocument2 pagesIEC Draft Position Statement On Frivolous DeterminationsColorado Ethics WatchNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Treasurer Stapleton Calendar Nov 1 2016-Jan 31 2017Document14 pagesTreasurer Stapleton Calendar Nov 1 2016-Jan 31 2017Colorado Ethics WatchNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Electioneering Gap ReportDocument1 pageElectioneering Gap ReportColorado Ethics WatchNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hickenlooper Calendar Oct-Dec 2016Document155 pagesHickenlooper Calendar Oct-Dec 2016Colorado Ethics WatchNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- 2016 Colorado General Assembly Per Diem and Mileage Part 3Document100 pages2016 Colorado General Assembly Per Diem and Mileage Part 3Colorado Ethics WatchNo ratings yet

- Hickenlooper Calendar Jul-Sep 2016Document132 pagesHickenlooper Calendar Jul-Sep 2016Colorado Ethics WatchNo ratings yet

- Re: Draft Position Statement Regarding Home Rule Municipalities Ethics CodesDocument10 pagesRe: Draft Position Statement Regarding Home Rule Municipalities Ethics CodesColorado Ethics WatchNo ratings yet

- Treasurer Stapleton Calendar May-July 2016Document14 pagesTreasurer Stapleton Calendar May-July 2016Colorado Ethics WatchNo ratings yet

- SoS Wayne Williams Jun-Aug 2016 CalendarDocument92 pagesSoS Wayne Williams Jun-Aug 2016 CalendarColorado Ethics WatchNo ratings yet

- 2016 Colorado General Assembly Per Diem & Mileage 2016 Part 5Document95 pages2016 Colorado General Assembly Per Diem & Mileage 2016 Part 5Colorado Ethics WatchNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Ethics Watch Comment On July 26 CPF RulemakingDocument8 pagesEthics Watch Comment On July 26 CPF RulemakingColorado Ethics WatchNo ratings yet

- 2016 Colorado General Assembly Per Diem & Mileage Part 4Document96 pages2016 Colorado General Assembly Per Diem & Mileage Part 4Colorado Ethics WatchNo ratings yet

- CO Ethics Watch 2016session3 Part I PDFDocument100 pagesCO Ethics Watch 2016session3 Part I PDFColorado Ethics WatchNo ratings yet

- Hickenlooper Calendar Apr-Jun 2016Document1 pageHickenlooper Calendar Apr-Jun 2016Colorado Ethics WatchNo ratings yet

- 2016 Colorado General Assembly Per Diem & Mileage Part 2Document164 pages2016 Colorado General Assembly Per Diem & Mileage Part 2Colorado Ethics WatchNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Crowley County Ethics PolicyDocument2 pagesCrowley County Ethics PolicyColorado Ethics WatchNo ratings yet

- 2016 Colorado General Assembly Per Diem & Mileage Part 1Document130 pages2016 Colorado General Assembly Per Diem & Mileage Part 1Colorado Ethics WatchNo ratings yet

- Indian Contract Act assignment novationDocument2 pagesIndian Contract Act assignment novationZaman Ali100% (1)

- Separation of Powers: Dr. Sushma Sharma, Associate Professor, NLIU, BhopalDocument26 pagesSeparation of Powers: Dr. Sushma Sharma, Associate Professor, NLIU, BhopalEkansh AroraNo ratings yet

- Is Community Service Really A PunishmentDocument3 pagesIs Community Service Really A PunishmentcigaraintcoolyallNo ratings yet

- MarkingsDocument153 pagesMarkingsSamuele FasciaNo ratings yet

- Auten vs. AutenDocument5 pagesAuten vs. AutenRomy IanNo ratings yet

- Uggi Lindamand Therkelsen Vs Republic - FulltextDocument1 pageUggi Lindamand Therkelsen Vs Republic - Fulltextscartoneros_1No ratings yet

- Constitution and By-Laws of The Teachers and Employees Association of Batac National High School Batac CityDocument6 pagesConstitution and By-Laws of The Teachers and Employees Association of Batac National High School Batac CityJoe Jayson CaletenaNo ratings yet

- Aml& Kyc PDFDocument133 pagesAml& Kyc PDFmayur kulkarniNo ratings yet

- 15 USC 1641 - Liability of Assignees - LII: Legal Information InstituteDocument4 pages15 USC 1641 - Liability of Assignees - LII: Legal Information InstituteJulio VargasNo ratings yet

- Umali Vs ComelecDocument2 pagesUmali Vs ComelecAnasor Go100% (4)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Guidelines On Corporate Surety BondsDocument12 pagesGuidelines On Corporate Surety Bondscyclone41926100% (1)

- QCS 2010 Section 21 Part 29 Underfloor DuctsDocument6 pagesQCS 2010 Section 21 Part 29 Underfloor Ductsbryanpastor106No ratings yet

- Uniform Plumbing Code 2015pdfDocument443 pagesUniform Plumbing Code 2015pdfcarlo carlitoNo ratings yet

- Credit Management in Indian Overseas BankDocument60 pagesCredit Management in Indian Overseas BankAkash DixitNo ratings yet

- Case Study No 1 First Mid Cpc2 Law 402Document3 pagesCase Study No 1 First Mid Cpc2 Law 402Tanvir Ahmed TuhinNo ratings yet

- Pass Your Learners Licence TestDocument21 pagesPass Your Learners Licence TestlalalinesNo ratings yet

- Anti Ragging NoticesDocument3 pagesAnti Ragging NoticesAmit KumarNo ratings yet

- Piper Jaffray & Co. v. Schumacher Et Al - Document No. 16Document11 pagesPiper Jaffray & Co. v. Schumacher Et Al - Document No. 16Justia.comNo ratings yet

- Shalu Ojha Vs Prashant Ojha On 23 July, 2018Document15 pagesShalu Ojha Vs Prashant Ojha On 23 July, 2018SandeepPamaratiNo ratings yet

- Confiscation of Jewish Property in EuropeDocument156 pagesConfiscation of Jewish Property in EuropeRadu Simandan100% (2)

- Fajardo acquitted of illegal possessionDocument2 pagesFajardo acquitted of illegal possessionAlbert CaranguianNo ratings yet

- Trinidal vs. Court of Appeals G.R. No. 118904, April 20, 1998Document2 pagesTrinidal vs. Court of Appeals G.R. No. 118904, April 20, 1998jack100% (1)

- Manual of Corporate GovernanceDocument21 pagesManual of Corporate GovernanceRoizen AzoresNo ratings yet

- Massey Ferguson Tractors MF 255 MF 265 MF 270 MF 275 MF 290 Shop ManualDocument22 pagesMassey Ferguson Tractors MF 255 MF 265 MF 270 MF 275 MF 290 Shop Manualjamesmiller060901qms100% (25)

- Up To MalotoDocument34 pagesUp To MalotoNombs NomNo ratings yet

- Securities and Exchange Commission (SEC) - Form11-KDocument2 pagesSecurities and Exchange Commission (SEC) - Form11-Khighfinance100% (1)

- LAW 112 Legal Methods II PDFDocument97 pagesLAW 112 Legal Methods II PDFPaulo Massawe100% (9)

- Rental Policy and Liability Waiver for Watercraft RentalsDocument6 pagesRental Policy and Liability Waiver for Watercraft RentalsallukazoldyckNo ratings yet

- Lopez Vs HeesenDocument2 pagesLopez Vs HeesenAna AdolfoNo ratings yet

- Obli Cases For DigestDocument42 pagesObli Cases For DigestJanila BajuyoNo ratings yet

- Gambling Strategies Bundle: 3 in 1 Bundle, Gambling, Poker and Poker BooksFrom EverandGambling Strategies Bundle: 3 in 1 Bundle, Gambling, Poker and Poker BooksNo ratings yet

- Molly's Game: The True Story of the 26-Year-Old Woman Behind the Most Exclusive, High-Stakes Underground Poker Game in the WorldFrom EverandMolly's Game: The True Story of the 26-Year-Old Woman Behind the Most Exclusive, High-Stakes Underground Poker Game in the WorldRating: 3.5 out of 5 stars3.5/5 (129)

- Alchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningFrom EverandAlchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningRating: 5 out of 5 stars5/5 (3)

- POKER MATH: Strategy and Tactics for Mastering Poker Mathematics and Improving Your Game (2022 Guide for Beginners)From EverandPOKER MATH: Strategy and Tactics for Mastering Poker Mathematics and Improving Your Game (2022 Guide for Beginners)No ratings yet

- Poker Satellite Strategy: How to qualify for the main events of high stakes live and online poker tournamentsFrom EverandPoker Satellite Strategy: How to qualify for the main events of high stakes live and online poker tournamentsRating: 4 out of 5 stars4/5 (7)

- THE POKER MATH BIBLE : Achieve your goals developing a good poker mind. Micro and Small StakesFrom EverandTHE POKER MATH BIBLE : Achieve your goals developing a good poker mind. Micro and Small StakesRating: 3.5 out of 5 stars3.5/5 (14)

- Poker: A Beginners Guide To No Limit Texas Holdem and Understand Poker Strategies in Order to Win the Games of PokerFrom EverandPoker: A Beginners Guide To No Limit Texas Holdem and Understand Poker Strategies in Order to Win the Games of PokerRating: 5 out of 5 stars5/5 (49)

- Phil Gordon's Little Green Book: Lessons and Teachings in No Limit Texas Hold'emFrom EverandPhil Gordon's Little Green Book: Lessons and Teachings in No Limit Texas Hold'emRating: 4 out of 5 stars4/5 (64)