Professional Documents

Culture Documents

No 3 Docs For Formation of Company

Uploaded by

roukaiya_peerkhanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

No 3 Docs For Formation of Company

Uploaded by

roukaiya_peerkhanCopyright:

Available Formats

The documents necessary, and the procedure to be followed, in registering a public limited company under the provisions of the

Companies Act 2006.

Section 7 Companies Act 2006 (CA) sets out the method for forming a company, which is that one or more persons must subscribe their name to a memorandum of association and comply with the requirements of the provisions of the Act as to registration. Under s.9, the memorandum of association must be submitted to the companies registrar together with an application for registration, which in turn lists other documents that must be submitted. Application may be made in hard copy or electronically. As a result the following documents are required to be submitted. (a) INOI Form This form states the proposed companys name, the proposed registered office and whether the liability of the members are limited (if so by share or guarantee) Although the 2006 Act only requires the memorandum and application for registration to be submitted, s.9 sets out other documents as well as the specific information that must be delivered to the registrar when an application for registration is made. Section 9 provides that in all cases the application for registration must state: the companys proposed name; whether the companys registered office is to be situated in England and Wales (or Wales), in Scotland or in Northern Ireland; a statement of the intended address of the companys registered offi ce (that is, its postal address as opposed to the preceding statement confirming the jurisdiction in which the companys registered offi ce is to be situated); whether the liability of the companys members is to be limited and if so whether it is to be limited by shares or by guarantee; whether the company is to be a private or a public company (b) The memorandum of association Although the 2006 Act retains the previous requirement for individuals wishing to form a company to subscribe their names to a memorandum of association it nonetheless significantly reduces the importance of the memorandum and as a consequence it is no longer possible to amend or update the memorandum of a company formed under the 2006 Act. Nonetheless the memorandum of association, which must be in the prescribed form, remains an important, document to the extent that, as required by s.8, it evidences the intention of the subscribers to the memorandum to form a company and become members of that company on formation. Also in relation to a company limited by shares, the memorandum also provides evidence of the members agreement to take at least one share each in the company. (c) Articles of Association The articles govern the internal management and organisation of the company. The articles are secondary to the memorandum - if there is conflict between the articles and the memorandum, the memorandum prevails. Companies (Tables A - F) Regulations 1985 provides a model set of articles for a company limited by shares. (d) Statement of capital and initial shareholdings This document is required where the company is to have a share capital. Alternatively a statement of guarantee is required where that is not the case (CA 2006 ss.10 & 11 set out the detailed provisions in these regards).

Page 1 of 6

(e) A statement of the companys proposed officers Section 12 explains that this requirement relates to: any person/persons who are to be the first director or directors of the company the person/s who is/are to be the first secretary. (f) A copy of any proposed articles As the model articles apply by default this requirement operates to the extent that the company does not intend to use the model articles. (g) A statement of compliance This requirement to the effect that the rules relating to registration have been followed is as set out in s.13. Such a statement does not need to be witnessed and may be made in either paper or electronic form. Under s.1068, the registrar is authorised to specify the rules relating to, and who may make, such a statement. Section 1112 makes it a criminal offence to make a false statement of compliance, as is the case in relation to all documents delivered to, or statements made to, the registrar. The appropriate fee must accompany the foregoing documents and once the registrar is satisfied that the requirements of the Act have been met, he shall issue a certificate that the company is duly incorporated. As previously, once issued the certificate is conclusive evidence that the requirements of this Act as to registration have been complied with and that the company is duly registered under the Act. (h) Fee 50 Certificate of Incorporation If the Registrar is satisfied that the registration requirements have been complied with, it will issue a certificate of Incorporation. The certificate of Incorporation is as if the birth certificate of the company. The Registrars certificate is conclusive evidence that the company has been validly incorporated on the date stated in the certificate. Case: Jubilee Cotton Mills V Lewis Facts: The certificate was dated 6 January although it was signed on 8 January. On 6 January the directors allotted shares but the allottees refused to pay, arguing that the company did not exist on that date. Held: The date of certificate was conclusive as to the date of Incorporation of the company. The allottees had to pay for the shares. NB: prior to the certificate of incorporation 1. The company does not legally exist 2. The promoters are personally liable on all contracts entered into (even in the name of the company) 3. The company cannot ratify a contract made before it is incorporated 4. Contracts are known as per-incorporation contracts. Trading Certificate

Page 2 of 6

Although every company is in existence as a legal person as from its date of incorporation, a public company cannot do business or exercise any borrowing powers unless it has obtained the certificate of entitlement to do business also known as the Trading Certificate from the Registrar. To obtain the trading certificate, the public company must deliver to the Registrar a statutory declaration in the prescribed Form signed by a director or secretary stating; (i)

(ii)

(iii)

(iv)

That the nominal value of the companys allotted share capital is at least $50,000. That each allotted share is paid up to at least 25% on the nominal value and the whole of any premium. That the preliminary expenses of the company and who has paid or is to pay, them. That any benefits given or intended to be given to Promoters

It is an offence for a public company to; (a) do business or exercise borrowing powers (b) to enter into transaction with any third party. If it does not have the Trading Certificate. Private company can commence trading immediately on incorporation. Changes in a companys status A company may initially register as one type of company but it may wish to change to another type. E.g. a private company may wish to change to a public company because it has grown and wishes to offer its shares to the public. Re-registration of private company as public company (Sc 43- 47) CA 85 A private company may re-register as a public company if: (i) A special resolution is passed for such re-registration.

In such circumstances, the companys memorandum of Association is altered so that it states that the company is a public company and other alterations are made to comply with the requirements relating to public company as required by CA 85. The special resolution requires a majority in favor of at least 75% of those present and 21 days notice should be given voting. (ii) An application for the purpose in the prescribed form and signed by a director or secretary of the company is delivered to the Registrar accompanied by; (a) Copy of the amended memorandum of Association and Articles of Association. (b) Copy of the companys Balance Sheet made up to date not more than 7 months prior to the application together with the auditors report. (c) A Certificate from the companys auditors that the Balance Sheet shows the companys net assets to be not less than the aggregate of its called-up share capital undistributed reserves, and (d) A statutory declaration by a director or secretary that the re-registration requirements have been complied. The procedure, to be found at CA 1985, s. 43, is as follows: 1 The members pass a special resolution that the company should be re-registered as a plc. 2 They may also need to pass an ordinary resolution increasing the authorised share capital to at least 50,000 if the companys authorised share capital is less than that figure.

Page 3 of 6

3 The companys Memorandum and Articles are amended to make them conform to the Companies Acts requirements for public companies (including the companys name becoming plc or public limited company rather than limited). 4 The directors complete an application in the required form and send it to the Registrar of Companies together with the above documentation. 5 The companys auditors must provide the Registrar of Companies with a statement confirming that in their opinion the companys net assets, as indicated on a balance sheet prepared not more than seven months before the application for reregistration, are not less than the aggregate of the companys called-up share capital and undistributable reserves. 6 The directors must provide a copy of the relevant balance sheet referred to by the auditors, and the relevant balance sheet must bear an unqualified report by the auditors confirming that the balance sheet was properly prepared in accordance with the provisions of the Companies Acts. 7 The directors must also provide a valuation report if shares have been allotted in the period between the balance sheet date and the application date and those shares were allotted either wholly or partly for non-cash consideration; in which event that consideration must be valued in accordance with the provisions of CA 1985, s. 108 unless the consideration was in the form of shares, or a class of shares, in another company. If the consideration was in the form of work or services, the work or services must already have been performed, while if the consideration is for an undertaking to be carried for the company, that undertaking must contractually be stated to be performed within five years of the resolution in (1) above. 8 The directors must also provide a statutory declaration in the required form confirming that the special resolution was properly passed and that between the balance sheet date and the application for re-registration there has been no deterioration in the net asset position of the company such that the net assets are less than the aggregate of the called-up share capital and the undistributable reserves. 9 The directors must also ensure that each share is paid up to the extent of one quarter. Re-registration of public company as private company A public company may re-register as a private company if: (i) (ii) A special resolution is passed to that effect and the companys memorandum and Articles are altered to state that the company is no longer a public company. An application form signed by a director or secretary is delivered to the Registrar.

Statutory Books, Records and Returns

Accounting records maintained by the company. Every company has to keep accounting records which must be sufficient to show and explain the companys transactions, disclosing with reasonable accuracy, at any time, the financial position of the company; to enable the directors to ensure that any balance sheet or profit and loss account prepared by them gives a true and fair view of the companys state of affairs. The companys accounting records must contain: Entries from day to day of all money received and expended by the company and the matters I r o which the receipt and expenditure takes place. A records of assets and liabilities of the company Where the companys business involves dealing in goods, stock held at the end of financial year, statement of all goods sold and bought. Annual financial statements

Page 4 of 6

A companys annual financial statements are comprised of its accounts (the balance sheet and the profit and loss account) and its reports (the directors report and the auditors report). Companies must have an accounting reference date Delivery of accounts to Registrar: - for a private company: within ten months after the end of the relevant accounting reference period - for a public company: within seven months after the end of that period Listed companies are allowed to issue summary financial statements to their shareholders instead of the full annual report and accounts There are filing exemptions for certain small or medium-sized private limited companies. Summarised Financial Statement

Companies were permitted to issue summary financial statements to avoid overwhelming private investors with detailed and complex annual accounts. Their use also saves companies with large shareholder bases substantial costs in the printing and postage of annual accounts. Summary financial statements may be issued in either printed paper copy or electronically, for example, when agreed with a shareholder, on a website, or sent by e-mail to those who have requested it. Annual return A company is required to make an annual return to the Registrar of Companies within 28 days after the return date (which is the anniversary of the companys incorporation). There are some fifteen categories of information in the annual return. The main categories are the following: (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) (ix) (x) (xi) (xii) (xiii) the company number; the company name in full; the date of the current return, i.e. the date at which it is made up, not more than one year since the previous one; the date of the next return; the registered office address; principal business activities (based on the UK Standard Industrial Classification Codes); the location of the register of members, together with the address where the register is kept if this is not the registered office; the location of the register of debenture holders (if there are such holders); the company type, e.g. private company limited by shares; the company secretarys name and address (if any); the directors and their notifiable details; the issued share capital; list of past and present shareholders (a full list of shareholders for a private or nontraded public company / a list of shareholders holding at least 5% of the issued shares of any share class for a traded public company. Shareholders addresses must not be given for non-traded public companies); whether the company is or is not a traded company; signature of a director or the company secretary and the date it is signed; contact details of a person who can be contacted should there be any queries.

(xiv) (xv) (xvi)

When a company is required to file annual returns with the Registrar of Companies? The annual return is made up to a specific date called the return date. The return date is not more than 12 months after the previous return, or 12 months after incorporation. The annual return must be submitted to Companies House within 28 days of the relevant return date, together with a filing fee.

Page 5 of 6

Directors report The directors report should set out the following: The name of the directors The amount of any recommended dividends Proposed transfers to reserve Particulars of any important events affecting the company or any of its subsidiaries, which have occurred since the end of that year. An indication of activities (if any) of the company and its subsidiaries in the field of research and development Information regarding the health, safety and welfare at work of employees of the company its subsidiaries. Detailed of any political donation in excess of $200

Auditors report The auditors must report to the company on accounts examined by them, and on every Balance Sheet, P & L accounts and all group accounts laid before the company in general meeting during the tenure of office. The report usually states that a true and fair view has been given in respect of: (i) The balance sheet and the state of affairs of the company as at the end of the financial year. (ii) The profit and loss account of the company for the financial year. (iii) If applicable, the group accounts, including the subsidiary undertakings. In addition, the following information is usually found: (i) (ii) (iii) (iv) A statement that, in the opinion of the auditors, the annual accounts have been prepared in accordance with the Companies Act 1985 (or Companies Act 2006). The names and signatures of the auditors, and the date on which the report was signed If the auditor is a firm, the name and signature of the senior statutory auditor must appear in the auditors report on behalf of the firm. Any qualification in respect of the accounts. A statement of the responsibilities of the auditor.

The auditors report, which must contain the auditors names and signatures, must be sent with the accounts to members, be laid before the general meeting and filed with the Registrar.

Page 6 of 6

You might also like

- No 6 Directors 2012Document14 pagesNo 6 Directors 2012roukaiya_peerkhanNo ratings yet

- No 5 Benefits in Kind-1Document11 pagesNo 5 Benefits in Kind-1roukaiya_peerkhanNo ratings yet

- No 1 - Nature of LTD CoDocument12 pagesNo 1 - Nature of LTD Coroukaiya_peerkhanNo ratings yet

- No 3 Docs For Formation of CompanyDocument6 pagesNo 3 Docs For Formation of Companyroukaiya_peerkhanNo ratings yet

- No 2 Tax Adjusted ProfitsDocument4 pagesNo 2 Tax Adjusted Profitsroukaiya_peerkhanNo ratings yet

- Workplan Paper LawDocument1 pageWorkplan Paper Lawroukaiya_peerkhanNo ratings yet

- No 3 Docs For Formation of CompanyDocument6 pagesNo 3 Docs For Formation of Companyroukaiya_peerkhanNo ratings yet

- No 4 - MemorudumDocument5 pagesNo 4 - Memorudumroukaiya_peerkhanNo ratings yet

- Past ACCA QuestionsDocument13 pagesPast ACCA Questionsroukaiya_peerkhanNo ratings yet

- The Debater's Guide (Third Edition) (PDFDrive) PDFDocument136 pagesThe Debater's Guide (Third Edition) (PDFDrive) PDFsamantha masudze100% (2)

- No 2 - PromoterDocument6 pagesNo 2 - Promoterroukaiya_peerkhan100% (1)

- Workshop F3 May 2011 UpdatedDocument16 pagesWorkshop F3 May 2011 Updatedroukaiya_peerkhanNo ratings yet

- No 1 - Nature of LTD CoDocument12 pagesNo 1 - Nature of LTD Coroukaiya_peerkhanNo ratings yet

- No 6a Corporate GovernanceDocument3 pagesNo 6a Corporate Governanceroukaiya_peerkhanNo ratings yet

- Resolution TemplateDocument3 pagesResolution Templateroukaiya_peerkhanNo ratings yet

- No 6 PartnershipDocument2 pagesNo 6 Partnershiproukaiya_peerkhanNo ratings yet

- FTfeesDocument1 pageFTfeesroukaiya_peerkhanNo ratings yet

- Workshop F2 May 2011Document18 pagesWorkshop F2 May 2011roukaiya_peerkhanNo ratings yet

- Profile Notice 2011Document4 pagesProfile Notice 2011roukaiya_peerkhanNo ratings yet

- Profile Notice 2011Document4 pagesProfile Notice 2011roukaiya_peerkhanNo ratings yet

- No 4 Business Property IncomeDocument4 pagesNo 4 Business Property Incomeroukaiya_peerkhanNo ratings yet

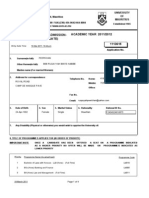

- Application For Admission - (Undergraduate) ACADEMIC YEAR 2011/2012 1113615Document4 pagesApplication For Admission - (Undergraduate) ACADEMIC YEAR 2011/2012 1113615roukaiya_peerkhanNo ratings yet

- Enrolment FormDocument2 pagesEnrolment Formroukaiya_peerkhanNo ratings yet

- Application for Admission to University of TechnologyDocument4 pagesApplication for Admission to University of Technologymanoj5463No ratings yet

- Acca - MauritiusDocument5 pagesAcca - MauritiusbowlosanjooNo ratings yet

- Acca - MauritiusDocument5 pagesAcca - MauritiusbowlosanjooNo ratings yet

- 5054 Y11 Sy 2Document43 pages5054 Y11 Sy 2Usman NazimNo ratings yet

- 5054 Y11 Sy 2Document43 pages5054 Y11 Sy 2Usman NazimNo ratings yet

- SyllabusDocument1 pageSyllabusroukaiya_peerkhanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)