Professional Documents

Culture Documents

Trade Liberalization, Poverty and Inequality Nexus: A Case Study of India

Uploaded by

editoraessCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trade Liberalization, Poverty and Inequality Nexus: A Case Study of India

Uploaded by

editoraessCopyright:

Available Formats

Asian Economic and Financial Review, 1(3),pp.

114-119

2011

Trade Liberalization, Poverty and Inequality Nexus: A Case Study of India

Abstract Author Rana Ejaz Ali Khan

Associate Professor/Head Department of Management Sciences. COMSATS Institute of Information Technology. Sahiwal, Pakistan. E-mails: ranaejazalikhan@yahoo.com

The paper attempted to see the relationship between trade liberalization and poverty and inequality in India. For trade liberalization, volume of trade as ratio of GDP, head count ratio for poverty and Gini-coefficient has been used for income inequality. The granger causality technique is applied to time series data for the years 1970-2009. The results indicate that trade has no significant effect on poverty and poverty has no effect on trade. However, trade has increased inequality in the short-run and inequality affected the trade in the long-run negatively. It partially contradicts the prediction of the StolperSamuelson theorem.

Nadia Bashir

Ph.D. Scholar, Department of Economics. The Islamia University of Bahawalpur, Pakistan. E-mails: nadia_bashir@hotmail.com

Key words: India, Trade liberalization, Income distribution, Poverty.

Introduction Hecksher-Ohlin model predicts that gains to trade should flow to abundant factors, which suggests that in developing countries, unskilled labor would benefit most from trade liberalization. The rising skill-premium in the US is often cited in support of standard trade theory. However, these predictions have been challenged by Cunat and Maffezzoli (2001) and Kremer and Maskin (2003). According to them, trade liberalization could reduce the wages of unskilled labor even in a labor abundant country, thereby widening the gap between the rich and the poor. Moreover, even if global economic integration induces faster economic growth in the long-run and substantial reduction in poverty, the adjustment might be costly with the burden falling disproportionately on the poor (Banergee and Newman 2004). Due to such ambiguity the question of how trade liberalization affects poverty and inequality remains largely an empirical one. Several plausible links in trade, poverty and inequality chain are estimated in literature. Yet the reality is far more complicated. Numerous studies claim that globalization reduces poverty (Dollar and Kraay 2002; Neutel and Hesmati 2006). On the other hand, a number of studies argue that trade liberalization adversely affects the poor and threatens employment and living standards of the poor. For instance, Anwar (2002) opined that AESS Publications, 2011

globalization did not lead to poverty reduction in Pakistan. Besides showing a positive or negative relationship between poverty and trade liberalization researchers have revealed a more subtle relationship, which explains that in some cases trade liberalization may favor poverty reduction but in some other situations it may worsen poverty. The researchers argue that poor do not share in the gains from trade particularly in countries with an abundance of unskilled labor. They may be more likely to share in the gains from trade liberalization when they enjoy maximum mobility, especially from contracting sectors of the economy into expanding ones. In agrarian economies, gains likewise arise when poor farmers have access to credit and technical know-how, when they have social safety nets like income support and when food aid is well targeted. India enjoyed historically unprecedented average annual growth rate of GDP and remained committed to trade liberalization (see Topalova 2005 for details). The effect is not entirely attributable to trade liberalization as it introduced domestic economic reforms allowing a greater role for markets and the private sector in the economy, but trade liberalization no doubt has played a large role. The country may be a good specimen to analyze the relationship between trade

Page 114

Asian Economic and Financial Review, 1(3),pp.114-119

2011

liberalization, poverty and inequality and to see whether poor have gained from trade or not. The precise objective of the study is to see the causal relationship between trade and poverty as well as trade and inequality in India. Literature Review The empirical evidence on the relationship between globalization (broadly defined) and poverty in the developing countries is discussed by Figini and Santarelli (2006). To measure globalization they used, among others, standard indices of trade openness, financial openness and privatization. For poverty they used both indices of relative and absolute poverty averaged over five and ten years. Both descriptive statistics and econometric analysis have been used to sketch the complex framework of relationships. They concluded that trade openness has not significantly affected relative poverty, while financial openness tended to be linked with higher relative poverty. Rama (2003) reviewing the literature on trade openness concluded that wages have grown faster in economies that integrated with the rest of the world. Trade openness could have a negative impact on wages in the short-run but it may take a few years to change the sign. Jaumotte, et. al. (2008) examined the role of trade and financial globalization towards inequality in a group of countries. The study concluded that trade resulted into a reduction in inequality, while financial globalization (and foreign direct investment in particular) increased it. Hussain, et. al. (2009) concluded that openness of economies have positively affected the distribution of income in developing countries. However, the change in countries trade exposure and world market may negatively affect the distribution of resources with in the countries. Majority of the studies concerning trade liberalization are panel data studies of groups of countries. A few studies existed on time series analysis of a particular economy. One of them is the analysis of trade, growth and inequality in Bangladesh by Nath and Al-mamun (2004). The empirical results from vector autoregression (VAR) model evidenced that trade has accelerated growth in Bangladesh. But it is also evidenced that trade has affected income distribution. The troika of trade, growth and poverty is analyzed by Khan and Sattar (2010) for Pakistan. Granger causality results based on Error-correction models have shown that there exits two way relationship between trade and growth but for the poverty and growth, there exists uni-directional relationship between growth to poverty. For India, Topalova (2004) measured the causal impact of trade AESS Publications, 2011

liberalization on poverty and inequality in districts of the country. Variation in pre-liberalization industrial composition across districts and the variation in the degree of liberalization across industries allow for a difference-in-difference approach, establishing whether certain areas benefited more, or bore a disproportionate share of the burden of liberalization. The study found that trade liberalization led to an increase in poverty and poverty gap in the rural districts where industries more exposed to liberalization were concentrated. According to the estimates, compared to a rural district experiencing no change in tariff, a district experiencing the mean level of tariff changes have a two percent increase in poverty incidence and a 0.6 percent increase in poverty depth. The study did not estimate the effect of liberalization on poverty in India, but rather the relative impact on areas more or less exposed to liberalization. In fact the study captured that whether the effects of trade liberalization were equal throughout the country, or certain areas and certain segments of the society benefited (or suffered) more from liberalization. But liberalization may have had an overall effect of increasing or lowering the poverty rate and inequality, that is the core of current study.

Data and Model Specifications We are concerned with the relationship between trade liberalization, poverty and inequality in India. For trade liberalization we used the proxy of (Imports + Exports) as share of GDP. Head count ratio has been used for poverty and Gini coffiecient for income inequality, though Nicole (2011) has raised the question of measurement of poverty, inequality and free trade (see also, Goldberg and Pavenik 2004 for definitional problems of poverty and inequality). The annual time series data for the years 1970-2009 has been taken from Economic Survey of India (various years) and World Bank data source. Such type of data is usually nonstationery, for meaningful results, first difference of all variables should be stationery. If variables are non-stationary, they inflate R2 and t scores, in this condition regression known as spurious regression means the results become meaningless. Augmented Dickey-Fuller test (ADF) is a standard unit root test. We analyzed the order of integration of the data series through it. Engle and Granger (1987) pointed out that only variables with the same order of integration could be tested for cointegration. Having established that all of these variables are integrated at one level, we proceeded to determine the order of integration of series for the analysis of long-run relationships between trade, poverty and inequality. Johansen cointegration test (Johansen 1988: Johansen and

Page 115

Asian Economic and Financial Review, 1(3),pp.114-119

2011

Juselius 1990) is used to test the long-run movement of the variables. It is based on the maximum likelihood estimate of the K-dimensional vector Auto regression. Two tests for cointegration have been given in the literature (Engle and Granger 1987; Johansen and Juselius 1990). In the multivariate case, if the I(1) variables are linked by more than one cointegrating vector, the EngleGranger procedure is not applicable. The test for cointegration used here is the likelihood ratio forward by Johansen and Juselius (1990), indicating that the maximum likelihood method is more appropriate in a multivariate system. Therefore we used this method to identify the number of co-integrated vectors in the model. Finally, we used the Granger causality test to analyze the causality between variables which are integrated order one, I(1), and there is cointegration relationship between them. It is based on error correction model (ECM) in which the movement of the variables in any period is related to previous period. ECM measures the correction from disequilibrium of the pervious period. ECM is formulated in term of first difference which typically eliminates trends from the variables which may raise the problem of spurious regression. ECM comes from the fact that the disequilibrium error term is stationary variable. For the short-run, causality is tested by using Toda and Yamamoto (1995) technique, interpreted and further expanded by Rambaldi and Doran (1994) and Zapata and Rambaldi (1997). Zapata and Rambaldi (1997) argued that this test needs no prior knowledge of the cointegration among the variables and the used lag selection scheme to the systems can still be applied in a case where there exists no cointegration or the rank conditions and stability are not satisfied. The attractiveness of applying this technique to test causality lies in its simplicity to apply and ability to overcome many shortcomings of other alternative cumbersome econometric procedures such as developed by Toda and Phillips (1993) and Mosconi and Giannini (1992). In this method first we set the optimal lag from VAR system then we use Toda Yamamoto technique to check the causality. The optimal lag is (k+dmax) where d=maximum order of integration while k=optimal lag determined by VAR. The Wald Test Static asymptotically distribute chi-square, with degree of freedom equal to the number of zero restriction, irrespective of I(0), I(1), or I(2) Empirical Results We empirically estimated whether a statistically significant relationship exists between trade liberalization, poverty and inequality in the long AESS Publications, 2011

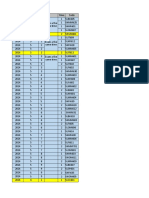

run. The preliminary step in this analysis was establishing the degree of integration of each variable. For the existence of a unit root in the level and first difference of each of the variables of our sample we used the Augmented Dickey Fuller (ADF) test. ADF test statistics check the stationarity of series. The results presented in table1 reveal that all variables are non-stationary in their level data. However, stationarity is found in the first differencing level of the variables trade, poverty and inequality.

Table-1 Results of Unit Root Test for Trade, Poverty and Inequality Variables Level First difference TCritical TCritical value value value values -0.550 -3.509 -8.618* -3.509 Trade Poverty Inequality -2.521 -2.150 -3.548 -3.548 -7.550* -4.973* -3.548 -3.552

* Significant at 5 percent level of significance

Trade and Poverty The results of lag under selection criteria for trade and poverty in India are shown in table-2. The optimal lag is 2 here. The results of selection of optimal model for trade and poverty are shown in table-3. Table -2 Results of Lag Order Selection Criteria for Trade and Poverty lag AIC SC 0 1 2 3 13.663 9.638 9.515* 9.661 13.754 9.911* 9.969 10.295

* indicates lag order selected by the criteria AIC: Akaike information criterion. SC: Schwarz information criterion

Table-3 Result of Selection of Optimal Model for Trade and Poverty Rank or Akaikes Schwartz no of CEs Information Bayesian Criteria Criteria None intercept no None intercept trend no trend 9.573 10.035* 0 9.378* 10.296 1 9.596 10.719 2

* Optimal model in both AIC and SC criteria.

Page 116

Asian Economic and Financial Review, 1(3),pp.114-119

2011

Table -4 Results of Cointegration Test for Trade and Poverty NullTrace5 Maxim 5 Hypothesis Test Percent um Percent values Critical Eigen- Critical Value values Value 15.223 18.397 14.418 17.1476 None 9 0.804 3.841 0.804 3.84146 At most 1 6

Trace test and Max-eigen value indicates 1 cointegrating eqn(s) at the 0.05 level *denotes acceptance of the hypothesis at 5 percent level of significance

Table-7 Results of Cointegration Test for Trade and Inequality Maximum NullTrace5 5 EigenHypothesis Test Percent Percent values values Critical Critical Value Value 14.401 12.320 12.756 11.224 None * 1.644 4.129 1.644 4.129 At most 1

Trace test and Max-eigenvalue test indicates 1 cointegrating eqn(s) at the 0.05 level *denotes rejection of the hypothesis at the 0.05 level.

For the cointegration between trade and poverty, the results of Johansen Cointegration analysis are shown in Table-4 where both the maximum Eigen value and trace-test value examine the null hypothesis of nocointegration against the alternative of cointegration. For the null hypothesis of no-cointegration ( R = 0 ) among the variables, the trace-test statistics is 15.22, that is less than the 5% critical value of 18.39 and the Maximum Eigen value statistics is 14.41 that is less than the 5% critical value of 17.14. Hence null hypothesis is accepted. It reveals that there exists cointegration (long-run relation) between trade and poverty. Trade and Inequality The results of the lag under selection criteria for trade and inequality are shown in table-5 and the results of selection of optimal model for trade and inequality are shown in table-6. The results show that optimal lag is 2 in both AIC and SC criteria.

The results of Johansen cointegration analysis are shown in table-7. The trace-test statistics is 14.40, which is above the 5% critical value of 12.32 and the Maximum Eigenvalue statistics is 12.75 that is above the 5% critical value of 11.22. Hence it rejects the null hypothesis in favor of the general alternative. It explains that there is cointegration (long-run relation) between trade and inequality. Table-8 Results of Short-run Causality for Trade and Inequality Dependent variable: Trade Chi-sq df Prob. Excluded 0.149 2 0.928 Inequality 0.149 2 0.928 All Dependent variable: Inequality Chi-sq df Prob. Excluded 10.010 2 0.006 Trade 10.011 2 0.006 All Table- 9 Results of Long-run Causality between Trade and Inequality Hypothesis EC term (T-Statics) 1.49322 Trade does not effect inequality 3.30354* Inequality does not effect trade

*denotes rejection of the hypothesis at 5 percent level of significance

Table-5 Result of Lag Order Selection Criteria for Trade and Inequality LAG AIC SC 10.183 10.422 0 8.012 7.388 1 7.935* 7.028* 2 8.093 7.236 3

* indicates lag order selected by the criteria AIC: Akaike information criterion. SC: Schwarz information criterion

The table-8 and 9 show that trade has an impact on inequality in the short-run but inequality affects the trade in the long-run. Discussion and Conclusion In the present study we have focused on a key issue of economic development, i.e. the effect of trade liberalization on poverty and inequality in India. Our results have shown that trade liberalization has no significant effect on poverty in India, although theoretically free markets should provide the opportunities for poor. The postulated link between trade liberalization and poverty is missing in reality. Openness should not be viewed as a reliable substitute for poverty reduction. The explanation may be that reduced tariff and removal of non-tariff

Table -6 Results of Selection of Optimal Model for Trade and Inequality Rank or Akaikes Schwartz No of Information Bayesian CEs Criteria Criteria Linear Linear intercept intercept trend trend 8.293 7.448 0 8.149* 5.475* 1 8.342 6.101 2

* Optimal model in both AIC and SC criteria

AESS Publications, 2011

Page 117

Asian Economic and Financial Review, 1(3),pp.114-119

2011

barriers are likely to augment the imports and decrease in employment and output of potential industries. The phenomenon adversely affected the poor workers. Due to reallocation of resources from non-tradable sector to tradable sector, the adjustment costs surpass the benefits of trade openness. So trade openness cannot dent the poverty in India. Another explanation of no effect of trade openness on poverty may be that trade reforms lead to lower government revenue as trade taxes were reduced. So in an effort to maintain the macroeconomic stability government has to cut the social expenditures or impose new taxes which make it failure to get the fruits of trade openness. The matter of unilateral trade liberalization in developing countries, raised by Goldberg and Pavenick (2004) may be concerned with no effect of trade liberalization on poverty in India like other developing economies, the impact evaluation of trade liberalization in India is estimated based on outcome of the unilateral trade liberalization in developing economies. Various policies in developed countries, such as export and production subsidies, import tariffs, and quotas that shelter agriculture and food products in the developed world from foreign competition potentially have important implications for poverty in developing countries like India. Trade liberalization may be beneficial for the economy if it lead to reduction in income inequality. Our results have shown that trade liberalization has increased income equality in the short-run while income inequality has negatively affected the trade in the long-run. According to Stolper-Samuelson theorem that link product prices to wages in a Hecksher-Ohlin model, the price decrease in the import sector (of a developing economy due to trade liberalization) will reduce the wages of skilled workers (used intensively in the import-competing sector) and benefit the unskilled workers (used intensively in the export sector). Because the model assumes that the factors of production can move across sectors within a country, the price changes affect only the economywide returns to factors of production. Thus, trade liberalization should be associated with reduction in poverty and inequality in developing economies. Our results partially contradict the predictions of the Stolper-Samuelson theorem, showing no effect of trade liberalization on inequality in India. They make the relationship between trade liberalization, poverty ands inequality more complicated. Our results have further shown that inequality has decreased the trade of the economy. Due to increased inequality the share of the middle class in the income decreased resulting into shrinkage of small and medium size business along with less demand for imports.

References Anwar, T. (2002) Growth and Sectoral Inequality in Pakistan: 2001-02 to 2004-05. Pakistan Economic and Social Review, Vol.45, No.2,pp.141154. Banergee, A. and A. Newman (2004) Inequality, Growth and Trade Policy, (Unpublished manuscript). MIT. Cunat, A. and M. Maffezzoli (2001) Growth and Interdependence Under Complete Specialization. Working Paper No.183/2001. Bocconi University. Dollar, D. and A. Kraay (2002) Growth is Good for Poor Journal of Economic Growth, Vo.7, No.3, pp.195-225. Engle, R. and C. Granger (1987) Cointegration and Error Correction: Representation, Estimation and Testing Econometrica, Vol. 55, pp.251-276. Figini, P. and E. Santarelli (2006) Openness, Economic Reforms, Poverty and Globalization in Developing Countries Journal of Developing Areas, Vol. 39, No.2, pp.129-151. Goldberg, P. K. and N. Pavenik (2004) Trade, Inequality and Poverty: What Do we Know? Evidence from Recent Trade Liberalization Episodes in Developing Countries. Working Paper No.10593. NBER Working Paper Series, National Bureau of Economic Research (NBER), Cambridge. Hussain, S., I. S. Chaudhary and M. Hassan (2009) Globalization and Income Distribution: Evidence from Pakistan European Journal of Social Sciences, Vol.8, No.4,pp.683-691. Jaumotte, F., S. Lall and Papageorgiou (2008) Rising Income Inequality: Technology or Trade and Financial Globalization. IMF Working Paper No. 08/185. International Monetary Fund (IMF), Washington, D.C. Johansen, S. (1988) Statistical Analysis of Cointegration Vectors. Journal of Economic Dynamics and Control, Vol.12, pp.213-254. Johansen, S. and K. Juselius (1990) Maximum Likelihood Estimation and Inference on Cointegration with Application to the Demand for Money. Oxford Bulletin of Economics and Statistics, Vol.52, pp.169-210. Khan, R. E. A. and R. Sattar (2010) Trade, Growth and Poverty. Pakistan Journal of

AESS Publications, 2011

Page 118

Asian Economic and Financial Review, 1(3),pp.114-119

2011

Commerce of Social Sciences, Vol.4, No.2, pp.173184. Kremer, M. and E. Maskin (2003) Globalization and Inequality. (Unpublished manuscript). MIT. Mosconi, R. and C. Giannini (1992) No Causality in Cointegration Systems: Representation, Estimation and Testing. Oxford Bulletin of Economics and Statistics, Vol.54, pp. 399-417. Nath, H. and K. Al-mamun (2004) Trade Liberalization, Growth and Inequality in Bangladesh: An Empirical Analysis. Working Paper, Department of Economics, Southern Methodist University, Dallas. Neutel, M. and A. Hesmati (2006) Globalization, Inequality and Poverty Relationship: A Cross Country Evidence. IZA Discussion Paper No.2223. Institute for Study of Labor (IZA), Germany. Nicole, H. (2011) Free Trade, Poverty and Inequality. Journal of Moral Philosophy, Vol.8, No.1, pp.5-44. Rama, M. (2003) Globalization and Workers in Developing Countries. Policy Research Working Paper 2958. Development Research Group, The World Bank, Washington, D.C. Rambaldi, A. N. and H. E. Doran (1996) Testing for Granger Non-causality in Cointegration Systems Made Easy. Working Paper No.88. Department of Econometrics, University of New England. Toda, H. Y. and P. C. B. Phillips (1993) Vector Autoregression and Causality. Econometrica, Vol.61, pp.1367-1373. Toda, H. Y. and T. Yamamoto (1995) Statistical Inference in Vector Autoregression with Possibly Integrated Processes. The Journal of Econometrics, Vol. 66, pp.225-50. Topalova, P. (2005) Trade Liberalization, Poverty and Inequality: Evidence from Indian Districts. Working Paper No.11614. NBER Working Paper Series, National Bureau of Economic Research (NBER), Cambridge. Zapata, H. O. and A. N. Rambaldi (1997) Monte Carlo Evidence on Cointegration and Causation. Oxford Bulletin of Economics and Statistics, Vol.59, pp.285-298.

AESS Publications, 2011

Page 119

You might also like

- DISMANTLING AND PACKING OF GE Fr.9E Gas Turbine Plant - Eng ProposalDocument6 pagesDISMANTLING AND PACKING OF GE Fr.9E Gas Turbine Plant - Eng Proposalvarun100% (1)

- Parkinmacro15 1300Document17 pagesParkinmacro15 1300Avijit Pratap RoyNo ratings yet

- Glenn D Ellison Solutions To Exercises From Fudenberg TiroleDocument202 pagesGlenn D Ellison Solutions To Exercises From Fudenberg TiroleMarcosNo ratings yet

- Quiz 3. (2) Adjusting Entries - Attempt ReviewDocument11 pagesQuiz 3. (2) Adjusting Entries - Attempt ReviewErika Yasto100% (2)

- MBA exam questions on business environment, managerial economics, organizational behavior, finance, and management controlDocument8 pagesMBA exam questions on business environment, managerial economics, organizational behavior, finance, and management controlrajsolankibarmer0% (1)

- Is FDI An Instrument For Poverty Reduction: Case of KenyaDocument10 pagesIs FDI An Instrument For Poverty Reduction: Case of KenyaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Which Lag Length Selection Criteria Should We EmployDocument9 pagesWhich Lag Length Selection Criteria Should We EmployrunawayyyNo ratings yet

- Unit Root Test and Its InterpretationDocument6 pagesUnit Root Test and Its InterpretationSaima MunawarNo ratings yet

- Consumption, Saving, and InvestmentDocument50 pagesConsumption, Saving, and InvestmentMinerva EducationNo ratings yet

- Challenges of Infrastructure Development in India (Type The Document Title)Document20 pagesChallenges of Infrastructure Development in India (Type The Document Title)Sanjit TambeNo ratings yet

- CH04 Consumption and SavingDocument64 pagesCH04 Consumption and SavingSihem SmidaNo ratings yet

- The Effects of Technological Change On Productivity and Factor Demand...Document39 pagesThe Effects of Technological Change On Productivity and Factor Demand...Mahmoud Rezagholi100% (2)

- Kuznets Hypothesis of Income Inequality: Empirical Evidence From EuDocument10 pagesKuznets Hypothesis of Income Inequality: Empirical Evidence From EuSayantan Sanyal100% (1)

- Advanced Macroeconomics An Introduction For Undergraduates 1786349140 9781786349149 CompressDocument170 pagesAdvanced Macroeconomics An Introduction For Undergraduates 1786349140 9781786349149 CompressJose FilhoNo ratings yet

- Inflation and Income InequalityDocument31 pagesInflation and Income Inequalityhuat huatNo ratings yet

- ARDL and Unit Root Testing Using Eviews - An ' EconomistDocument7 pagesARDL and Unit Root Testing Using Eviews - An ' EconomistabdulraufhccNo ratings yet

- EViews Help: Unit Root Tests with BreakpointDocument15 pagesEViews Help: Unit Root Tests with BreakpointvitaNo ratings yet

- Chandan Mukherjee, Howard White, Marc Wuyts - (1998) Econometrics and Data Analysis For Developing Countries-RoutledgeDocument515 pagesChandan Mukherjee, Howard White, Marc Wuyts - (1998) Econometrics and Data Analysis For Developing Countries-RoutledgeJessica Parra Gómez100% (1)

- Infrastructure Development A Key Indicator of Economic DevelopmentDocument18 pagesInfrastructure Development A Key Indicator of Economic DevelopmentMadhu Mahesh RajNo ratings yet

- Trade Openness and Income Inequality, GINIDocument3 pagesTrade Openness and Income Inequality, GINIAnonymous r2FQcl4jNo ratings yet

- Theory of National Income DeterminationDocument50 pagesTheory of National Income DeterminationKunal KunduNo ratings yet

- Money growth and inflation drives price increasesDocument42 pagesMoney growth and inflation drives price increasesKING RAMBONo ratings yet

- Cross-Country Comparisons of Income InequalityDocument5 pagesCross-Country Comparisons of Income InequalitySamir ParikhNo ratings yet

- Global Inequality Crisis Report Highlights Gender Divide and Need for Taxing WealthDocument8 pagesGlobal Inequality Crisis Report Highlights Gender Divide and Need for Taxing WealthshikharohraNo ratings yet

- Challenges of Infra finance and role of private investorsDocument32 pagesChallenges of Infra finance and role of private investorsDhananjay MallyaNo ratings yet

- The Effect of Income Inequality On Human DevelopmentDocument18 pagesThe Effect of Income Inequality On Human Developmentpijangg00-1No ratings yet

- Effects of PPS On Infrastructure Development in KenyaDocument88 pagesEffects of PPS On Infrastructure Development in KenyaGabrielNo ratings yet

- Impact of GDP, Foreign Direct Investment, InflationDocument12 pagesImpact of GDP, Foreign Direct Investment, InflationMuhammad MansoorNo ratings yet

- Impact of New Technology in Banking SectorDocument58 pagesImpact of New Technology in Banking SectorKanchan KanojiaNo ratings yet

- Asumadu-Sarkodie2016 - VECM Vs ARDLDocument15 pagesAsumadu-Sarkodie2016 - VECM Vs ARDLNha LeNo ratings yet

- Income Inequality and Voter TurnoutDocument53 pagesIncome Inequality and Voter TurnoutTARKI_ResearchNo ratings yet

- Econometrics EnglishDocument62 pagesEconometrics EnglishATHANASIA MASOURANo ratings yet

- Demand Supply For MoneyDocument17 pagesDemand Supply For MoneyThabarak ShaikhNo ratings yet

- Ricardian or Classical Theory of Income DistributionDocument15 pagesRicardian or Classical Theory of Income DistributionketanNo ratings yet

- The Role of Banks, Non-Banks and The Central Bank in The Money Creation ProcessDocument21 pagesThe Role of Banks, Non-Banks and The Central Bank in The Money Creation Processwm100% (1)

- Unit Root Ev4 1Document9 pagesUnit Root Ev4 1Gautam BoyanapallyNo ratings yet

- Macro Questions 1Document9 pagesMacro Questions 1Vipul RanjanNo ratings yet

- Time Series With EViews PDFDocument37 pagesTime Series With EViews PDFashishankurNo ratings yet

- Introduction To Panel Data Analysis Using EviewsDocument43 pagesIntroduction To Panel Data Analysis Using EviewsDAVID WONG LEE KANG LEE KANGNo ratings yet

- ECS3706 001 2018 4 b-22Document157 pagesECS3706 001 2018 4 b-22Vusi Mazibuko100% (1)

- Public Private Partnership-: Lessons from Gujarat for Uttar PradeshFrom EverandPublic Private Partnership-: Lessons from Gujarat for Uttar PradeshNo ratings yet

- What Is Public-Private Partnership (PPP)Document20 pagesWhat Is Public-Private Partnership (PPP)RaymanSoe Oo100% (1)

- Error Correction Models ExplainedDocument16 pagesError Correction Models ExplainedJames DownesNo ratings yet

- StasioneritasDocument32 pagesStasioneritasBojes WandiNo ratings yet

- Income Inequality in America: Fact and FictionDocument35 pagesIncome Inequality in America: Fact and FictionAmerican Enterprise InstituteNo ratings yet

- The Rational Expectations Revolution TheoryDocument6 pagesThe Rational Expectations Revolution TheoryOyek DanNo ratings yet

- Final Project - Climate Change PlanDocument32 pagesFinal Project - Climate Change PlanHannah LeeNo ratings yet

- Chapter 06 Cost-Benefit Analysis and Government InvestmentsDocument21 pagesChapter 06 Cost-Benefit Analysis and Government InvestmentsClarissa BoocNo ratings yet

- Bangladesh's Growing Income InequalityDocument15 pagesBangladesh's Growing Income Inequalityফারুক হোসেন রিমন0% (1)

- Econometrics Lecture Notes BookletDocument81 pagesEconometrics Lecture Notes BookletilmaNo ratings yet

- DPM 2100 Lecture 4Document27 pagesDPM 2100 Lecture 4Shawaz HusainNo ratings yet

- IGNOU MEC-001 Free Solved Assignment 2012Document8 pagesIGNOU MEC-001 Free Solved Assignment 2012manuraj40% (1)

- Econ 1 - Problem Set 6 With SolutionsDocument13 pagesEcon 1 - Problem Set 6 With SolutionsChilly Wu100% (4)

- EconomicsDocument32 pagesEconomicsSahil BansalNo ratings yet

- Infrastructure Development in IndiaDocument42 pagesInfrastructure Development in IndiaSah AnuragNo ratings yet

- Egypt Environmental IssuesDocument7 pagesEgypt Environmental IssuesAbdelrahman NoureldinNo ratings yet

- Multicollinearity Among The Regressors Included in The Regression ModelDocument13 pagesMulticollinearity Among The Regressors Included in The Regression ModelNavyashree B MNo ratings yet

- Groves Clark ExampleDocument10 pagesGroves Clark ExampleOvidiu HutuleacNo ratings yet

- Chapter No.73Document13 pagesChapter No.73Kamal SinghNo ratings yet

- Macro 95 Ex 4Document18 pagesMacro 95 Ex 4Nimra Pervaiz100% (1)

- Keynesian Vs Classical Models and PoliciesDocument18 pagesKeynesian Vs Classical Models and PoliciesSarah Alviar-EismaNo ratings yet

- Econometrics Notes PDFDocument8 pagesEconometrics Notes PDFumamaheswariNo ratings yet

- The Relative Effectiveness of Monetary and Fiscal Policies in Economic Growth: A Case Study of PakistanDocument10 pagesThe Relative Effectiveness of Monetary and Fiscal Policies in Economic Growth: A Case Study of PakistaneditoraessNo ratings yet

- Unemployment and Property Crimes in PakistanDocument10 pagesUnemployment and Property Crimes in PakistaneditoraessNo ratings yet

- Vulnerability of Southern Mediterranean Countries To Exogenous Shocks: Structural VAR ApproachDocument23 pagesVulnerability of Southern Mediterranean Countries To Exogenous Shocks: Structural VAR Approacheditoraess100% (1)

- Insurance Market Activity and Economic Growth: Evidence From NigeriaDocument10 pagesInsurance Market Activity and Economic Growth: Evidence From NigeriaeditoraessNo ratings yet

- Public Expenditure and Economic Growth in NigeriaDocument10 pagesPublic Expenditure and Economic Growth in NigeriaeditoraessNo ratings yet

- A Study On Individual Competencies-An Empirical StudyDocument11 pagesA Study On Individual Competencies-An Empirical StudyeditoraessNo ratings yet

- An ARDL Analysis of The Exchange Rates Principal Determinants: ASEAN-5 Aligned With The YenDocument21 pagesAn ARDL Analysis of The Exchange Rates Principal Determinants: ASEAN-5 Aligned With The YeneditoraessNo ratings yet

- Tax Structure and Economic Growth in Côte D'ivoire: Are Some Taxes Better Than Others?Document11 pagesTax Structure and Economic Growth in Côte D'ivoire: Are Some Taxes Better Than Others?editoraessNo ratings yet

- The Determinants of Stock Prices in PakistanDocument17 pagesThe Determinants of Stock Prices in PakistaneditoraessNo ratings yet

- Financial Management of Imminent Business Prospect in PunjabDocument5 pagesFinancial Management of Imminent Business Prospect in PunjabeditoraessNo ratings yet

- Exports-Led Growth Hypothesis in Pakistan: Further EvidenceDocument16 pagesExports-Led Growth Hypothesis in Pakistan: Further EvidenceeditoraessNo ratings yet

- Effect of Workers' Remittances On Private Savings Behavior in PakistanDocument9 pagesEffect of Workers' Remittances On Private Savings Behavior in PakistaneditoraessNo ratings yet

- The Arabo-Mediterranean Momentum StrategiesDocument9 pagesThe Arabo-Mediterranean Momentum StrategieseditoraessNo ratings yet

- The Effect of Global Liquidity On Macroeconomic ParametersDocument15 pagesThe Effect of Global Liquidity On Macroeconomic ParameterseditoraessNo ratings yet

- Impact of Ownership Concentration On The Operating Performance of Pakistani FirmsDocument4 pagesImpact of Ownership Concentration On The Operating Performance of Pakistani FirmseditoraessNo ratings yet

- Wage Rate, Regional Trade Bloc and Location of Foreign Direct Investment DecisionsDocument13 pagesWage Rate, Regional Trade Bloc and Location of Foreign Direct Investment DecisionseditoraessNo ratings yet

- Determinants of Foreign Direct Investment in Developing Countries: A Panel Data AnalysisDocument8 pagesDeterminants of Foreign Direct Investment in Developing Countries: A Panel Data AnalysiseditoraessNo ratings yet

- Driving Forces of Globalization in Emerging Market Economies Developing CountriesDocument12 pagesDriving Forces of Globalization in Emerging Market Economies Developing Countrieseditoraess100% (1)

- Factors Affecting The Real Estate Prices in PakistanDocument10 pagesFactors Affecting The Real Estate Prices in PakistaneditoraessNo ratings yet

- Determinants of Earnings: Evidence From Pakistan Engineering SectorDocument9 pagesDeterminants of Earnings: Evidence From Pakistan Engineering SectoreditoraessNo ratings yet

- The Corruption and The Quality of Auditing StandardsDocument4 pagesThe Corruption and The Quality of Auditing StandardseditoraessNo ratings yet

- An Overview of The New Emerging Balance of Forces - The BRICS, G 20 and G 7' Response To The Global Financial CrisisDocument16 pagesAn Overview of The New Emerging Balance of Forces - The BRICS, G 20 and G 7' Response To The Global Financial CrisiseditoraessNo ratings yet

- The Forecasting Performance of Seasonal and Nonlinear ModelsDocument14 pagesThe Forecasting Performance of Seasonal and Nonlinear ModelseditoraessNo ratings yet

- Economic Freedom Verses Economic Growth: Cross Countries Analysis in The Form of ARDL ApproachDocument12 pagesEconomic Freedom Verses Economic Growth: Cross Countries Analysis in The Form of ARDL ApproacheditoraessNo ratings yet

- Dimensions of Globalization and Their Effects On Economic Growth and Human Development IndexDocument13 pagesDimensions of Globalization and Their Effects On Economic Growth and Human Development IndexeditoraessNo ratings yet

- Trans - Border Communities Planning and The Problems of Arms Smuggling in The West African Sub-Region: The Case Study of Nigeria - Benin Border DevelopmentDocument11 pagesTrans - Border Communities Planning and The Problems of Arms Smuggling in The West African Sub-Region: The Case Study of Nigeria - Benin Border DevelopmenteditoraessNo ratings yet

- Global Paradigm Shift in Pedagogy and English Language Teachers' Professional Development in PakistanDocument8 pagesGlobal Paradigm Shift in Pedagogy and English Language Teachers' Professional Development in PakistaneditoraessNo ratings yet

- Education Institute Ministry of Education Malaysia)Document9 pagesEducation Institute Ministry of Education Malaysia)editoraessNo ratings yet

- Researching School Leadership Through Ethnography: in Search For The Best AlternativeDocument13 pagesResearching School Leadership Through Ethnography: in Search For The Best AlternativeeditoraessNo ratings yet

- Structural Changes in Indian EconomyDocument38 pagesStructural Changes in Indian EconomyArif_Khan_1268No ratings yet

- Maple Leaf Case Study AssignmentDocument7 pagesMaple Leaf Case Study AssignmentafzaalmoinNo ratings yet

- Carrefour S.A.Document10 pagesCarrefour S.A.sjc1789No ratings yet

- Property ID ListDocument153 pagesProperty ID ListDecember RealtyNo ratings yet

- Ap Macroeconomics Syllabus - MillsDocument6 pagesAp Macroeconomics Syllabus - Millsapi-311407406No ratings yet

- Bolt BM Dimensional DrawingDocument1 pageBolt BM Dimensional DrawingJavier Enrrique Iglesias PelcastreNo ratings yet

- Invitation of Bid: (Date of First Publication 2076/02/01)Document1 pageInvitation of Bid: (Date of First Publication 2076/02/01)nitish JhaNo ratings yet

- Swot Analysis of Revlon IncDocument5 pagesSwot Analysis of Revlon IncSubhana AsimNo ratings yet

- CAT 2 Urgent DBM EveningDocument3 pagesCAT 2 Urgent DBM EveningCollins WandatiNo ratings yet

- Quiz 5 Income TaxDocument9 pagesQuiz 5 Income TaxjohndanielsantosNo ratings yet

- BLR - Electives For MBA Class of 2024 - Sem III & IVDocument6 pagesBLR - Electives For MBA Class of 2024 - Sem III & IVbhagyesh taleleNo ratings yet

- Boarding Pass (BLR MAA)Document1 pageBoarding Pass (BLR MAA)Rakendu BhattacharjeeNo ratings yet

- Annual Program Agric Advisory and Services Unit FOR YEAR 2021Document15 pagesAnnual Program Agric Advisory and Services Unit FOR YEAR 2021Rose Asman Samsul BahrinNo ratings yet

- Joe Mark P. Salvadora BSED FILIPINO 1 Contemporary ACTIVITYDocument4 pagesJoe Mark P. Salvadora BSED FILIPINO 1 Contemporary ACTIVITYJoe Mark Periabras SalvadoraNo ratings yet

- Economics: Interdependence and The Gains From TradeDocument32 pagesEconomics: Interdependence and The Gains From TradeHưng Đào ViệtNo ratings yet

- My - Invoice - Feb 2022Document2 pagesMy - Invoice - Feb 2022VijayNo ratings yet

- 17th & 18th June 2023 Current AffairsDocument17 pages17th & 18th June 2023 Current AffairsRohan DineshNo ratings yet

- WWW - Tenders.ongc - Co.in " and The Link For The Same Has Also Been Provided On The Login Page of E-Tender WebsiteDocument4 pagesWWW - Tenders.ongc - Co.in " and The Link For The Same Has Also Been Provided On The Login Page of E-Tender WebsiteRameshchandra SolankiNo ratings yet

- BUSINESS ENVIRONMENT - ECONOMIC FACTORS</TITLEDocument25 pagesBUSINESS ENVIRONMENT - ECONOMIC FACTORS</TITLEarun_idea50No ratings yet

- DR Rohit JainDocument1 pageDR Rohit JainlxshNo ratings yet

- DRC-Uganda Cross-Border Road ProjectsDocument28 pagesDRC-Uganda Cross-Border Road ProjectsasdasdNo ratings yet

- Macd PDFDocument5 pagesMacd PDFSandeep MishraNo ratings yet

- GKInvest New Account Types 2022Document1 pageGKInvest New Account Types 2022AJI PANGESTUNo ratings yet

- Measuring and Evaluating The Performance of Banks and Their Principal CompetitorsDocument22 pagesMeasuring and Evaluating The Performance of Banks and Their Principal CompetitorsMarwa HassanNo ratings yet

- Prefabricated Concrete Slabs and Their AdvantagesDocument24 pagesPrefabricated Concrete Slabs and Their AdvantagesmUSINo ratings yet

- Shutdown SIS Previous ScreenDocument2 pagesShutdown SIS Previous ScreenArmando Vara ChavezNo ratings yet