Professional Documents

Culture Documents

US Investment in Automotive Industry in Turkey

Uploaded by

Vaska StevkovskaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Investment in Automotive Industry in Turkey

Uploaded by

Vaska StevkovskaCopyright:

Available Formats

Global Business Environment

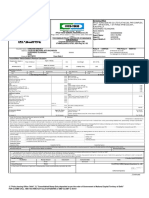

US Investment in Automotive industry in Turkey Why to invest in Turkey? Successful economy: Turkey has a bright future and is expected to be the fastest growing economy among the OECD members during 2011-2017 with an annual average real GDP growth rate of 6.7 percent. Foreign direct investments have been an important part of building Turkeys economy since 2003. It has enjoyed a sustainable economic growth with 4.3 percent annual average real GDP increase for the last 7 years and GDP growth from USD 230 billion in 2002 to USD 618 billion in 2009. Turkey is the 16th largest economy in the world and the 6th largest economy compared to the EU area in 2009; FDI inflow in total for the last 7 years is over USD 83 billion and it is ranked as the 15 th most attractive FDI destination for 2008-2010 (UNCTAD). FDI Inflow to Turkey is presented below (USD billion):

Turkey has attracted a high amount of FDI. Inflow by the most significant countries is presented below (USD million):

The legislation, by providing increased rights and more secure environment for foreign capital, helped the country attract more foreign direct investment; furthermore, this was supported by guaranteed profit transfers and equal treatment for the domestic and foreign investors. The company establishment procedures have been simplified to a great extent as well. Competitive tax system: Corporate income tax is reduced to 20 percent and individual income tax is between 15 and 35 percent. Tax benefits and incentives in Technology Development Zones, Industrial Zones and Free Zones could include total or partial exemption from corporate income tax. Developed infrastructure: Turkey has developed technological infrastructure in telecommunications and transportation; furthermore, it has low-cost sea transportation and good railway transportation to Central and Eastern Europe.

Global Business Environment

Employment: Foreign capital companies may employ foreign personnel; in addition, Turkey is offering high quality and cost-effective labour force who is young, well-educated and motivated. Geographical position: Turkey is offering significant opportunities for foreign investors with its unique positioning between Europe, Middle East and Central Asia. It is an opportunity for access to other markets with 1.5 billion consumers in Europe, Eurasia, the Middle East and North Africa. Domestic market: It is important due to the large size of the domestic market; furthermore, as the economy has been developing the individuals are gaining increasing purchasing power. Why to invest in automotive industry in Turkey? Automotive sector: Its development began in the 50s in a protected domestic market with production under licenses from Ford, Renault and Fiat and since then, it has grown substantially.

Global Business Environment

Global Business Environment

Automotive industry statistics: Consisting of 17 domestic and foreign principal producers supplemented by approximately 4,000 sub-industry companies, the sector directly employs 300,000 qualified workers. As of 2005, the three most significant export items in Turkey are automotive products. Turkey is the 15th largest producer in the world, and the 5th largest manufacturer in Europe of motor vehicles. Domestic market for automotive product: Turkeys GNP per capita in recent years has exceeded USD 10,000; therefore, automobile ownership in Turkey rose rapidly between 2003 and 2009, with a CAGR of 7.1 percent. 75 percent of households still do not own a car, so there is a strong potential for continuous long-term growth.

FDI Inflow to Turkey by Sector: During the last six years, manufacturing sectors have attracted one of the highest amounts of FDI. The FDI amounts for Manufacture of motor vehicles, trailers, and semi-trailers, are presented below (in USD million):

Foreign capital companies: As of the end of 2010, there are more than 25.800 companies with foreign capital operating in Turkey, presented below (in thousands):

Source: Undersecretaries of the Treasury

Foreign capital companies in Manufacture of motor vehicles, trailers and semi-trailers sector, are presented below:

Global Business Environment

Automotive sector, imports & exports: It is highly international. Around 76 percent of Turkish vehicle production in 2009 was exported, mainly to Europe. However, around 56 percent of motor vehicle sales in Turkey during 2009 were imported vehicles. Turkey is one of the largest exporters of passenger cars to Europe, with total exports of USD 16.8 billion in 2009 and Toyota, Ford Otosan, Tofas and Oyak-Renault rank among Turkeys top ten exporting companies.

Global Business Environment

Global Business Environment

Global Business Environment

Global Business Environment

Automotive manufacturers: There are 22 automotive manufacturers in Turkey and many world brands are present:

Weakness -Taxation in automotive sector: The growth of car sales and car ownership in Turkey has been significant even though there is substantial tax burden on new passenger car sales which is the same for the domestically-produced and imported.

Special Consumption Tax and VAT raise the domestic purchase price of a vehicle to 60-100 percent above the pre-tax price. Taxes on petrol are also high, some of the highest in Europe. The vehicle excise tax paid every six months is significant.

Threats:

The transfer of production which could be expected from high-cost EU

countries to Turkey is resisted by the strong labour unions in EU countries. Dependence on EU markets Rapid growth in China and India.

As a result of all these parameters, it may be concluded that Turkey is one of the most favourable options for investment, specifically in automotive sector.

(Words: 850)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Newcastle Council Supercars Working GroupDocument34 pagesNewcastle Council Supercars Working GroupBetina Hughes100% (1)

- MERITOR 9 10 Platform G Transmission PDFDocument115 pagesMERITOR 9 10 Platform G Transmission PDFemmanuelNo ratings yet

- Analysis of Hyundai Motor Company SWOT in 2013 and NowDocument5 pagesAnalysis of Hyundai Motor Company SWOT in 2013 and NowPyaihsone AungNo ratings yet

- BMW DrivesDocument7 pagesBMW DrivesJay ShahNo ratings yet

- Autogreider Hidromek HMK MG 460Document2 pagesAutogreider Hidromek HMK MG 460diconNo ratings yet

- Baja PresentationDocument42 pagesBaja PresentationNaveen Sajja RsaNo ratings yet

- Dawg Scooter ManualDocument26 pagesDawg Scooter ManualStephanie Parker100% (2)

- Mithun Project Tata MotorsDocument69 pagesMithun Project Tata MotorstmithunnsNo ratings yet

- Air Filter For TurbineDocument8 pagesAir Filter For TurbineAnonymous Q9i062VNo ratings yet

- Two Wheeler Insurance Package PolicyDocument2 pagesTwo Wheeler Insurance Package Policy332233% (3)

- Armstrong ArmaCoil TwinCoilDocument12 pagesArmstrong ArmaCoil TwinCoilAce Industrial SuppliesNo ratings yet

- Section 1: Introduction About FirmDocument1 pageSection 1: Introduction About FirmAhmadDaimNo ratings yet

- Structure of Taxi Market in KarnatakaDocument23 pagesStructure of Taxi Market in KarnatakaVINEET0% (1)

- Aircraft Specifications - Model A320-212Document7 pagesAircraft Specifications - Model A320-212simon100% (1)

- 5r55e Valve Body SonnaxDocument8 pages5r55e Valve Body SonnaxjoshetoNo ratings yet

- I M Mech PTODocument21 pagesI M Mech PTOedwin23a100% (1)

- Pressure Die Casting - Al - NewDocument17 pagesPressure Die Casting - Al - Newhardeep SinghNo ratings yet

- Consumer Buying Behaviour at Time To Purchase Hero Honda BikeDocument59 pagesConsumer Buying Behaviour at Time To Purchase Hero Honda Biketariquewali11No ratings yet

- Entrepreneur's Profile: Harish Vasdev CUHP13MBA29Document39 pagesEntrepreneur's Profile: Harish Vasdev CUHP13MBA29Pulkit JainNo ratings yet

- Createds PDFDocument1 pageCreateds PDFROHIT KUMARNo ratings yet

- Police Log May 29, 2016Document12 pagesPolice Log May 29, 2016MansfieldMAPoliceNo ratings yet

- Tata MotorsDocument14 pagesTata MotorsADITYA GURJARNo ratings yet

- Jimmy Co Vs CADocument2 pagesJimmy Co Vs CASage LingatongNo ratings yet

- Variable Fill Fluid CouplingsDocument8 pagesVariable Fill Fluid CouplingsAnupam XessNo ratings yet

- STSMDocument278 pagesSTSMMiguel Ruiz TatajeNo ratings yet

- Automobile Sector-Two Wheeler SegmentDocument41 pagesAutomobile Sector-Two Wheeler SegmentSandhya UpadhyayNo ratings yet

- Deed of Sale (Toyota Vios NNQ 698)Document2 pagesDeed of Sale (Toyota Vios NNQ 698)Angelica Jade100% (3)

- Ford Strategic AnalysisDocument32 pagesFord Strategic AnalysisFahad100% (5)

- Fiat Bravo 1.4 Tjet EngineDocument165 pagesFiat Bravo 1.4 Tjet EngineRajivChandran100% (4)

- Tata-Indica Project - Final EditedDocument68 pagesTata-Indica Project - Final EditedSunil SomaNo ratings yet