Professional Documents

Culture Documents

Bank of India Result Updated

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank of India Result Updated

Uploaded by

Angel BrokingCopyright:

Available Formats

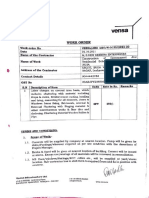

3QFY2012 Result Update | Banking

January 31, 2012

Bank of India

Performance Highlights

Particulars (` cr) NII Pre-prov. profit PAT

Source: Company, Angel Research

NEUTRAL

CMP Target Price

% chg (qoq) 8.6 11.6 45.8 3QFY11 1,987 1,389 653 % chg (yoy) 4.1 24.7 9.6

`344 -

3QFY12 2,068 1,732 716

2QFY12 1,904 1,552 491

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

Banking 18,813 1.0 498/261 113,355 10 17,194 5,199 BOI.BO BOI@IN

For 3QFY2012, Bank of India posted a moderate set of results, with net profit growing by 9.6% yoy to `716cr, above our estimates on account of higher sequential rise in NIM than expected by us. We recommend Neutral on the stock. NPA levels decline sequentially; NIM improves sequentially: The banks advances growth picked up during 3QFY2012, growing by 7.5% qoq (up 19.5% yoy). Deposit growth was moderate during the quarter, growing by 2.7% qoq (up 21.7% yoy). As a result of faster rise in advances sequentially, credit-to-deposit (CD) ratio increased by 331bp qoq to 75.0%. CASA deposits grew by rather moderate 13.4% yoy with SA deposits growing at a slightly better pace of 14.3% yoy. Domestic CASA ratio improved sequentially to 32.4% in 3QFY2012 from 31.3% in 2QFY2012. Domestic NIM of the bank improved by 14bp qoq in 3QFY2012 to 2.9%, on the back of uptick in yield on advances (up 24bp qoq) to 11.9%. Fee income performance was robust during the quarter, growing by 31.5% yoy (up 1.2% qoq). Recoveries from written-off accounts nearly trebled on a yoy basis to `186cr. The banks NPA levels improved during 3QFY2012, with both gross and net NPA levels declining by 2.5% and 3.6% sequentially, respectively. As of 3QFY2012, gross NPA ratio stood at 2.7% (3.0% in 2QFY2012), while net NPA ratio stands at 1.8% (2.0% in 2QFY2012). Provision coverage ratio continued to remain low at 60.9% in 3QFY2012 (59.1% in 2QFY2012). The 9MFY2012 annualized slippage ratio for the bank stands at 3.1% compared to 1.5% for 9MFY2011. The bank witnessed a chunky slippage of ~`500cr from its aviation account during the quarter. Outlook and valuation: At the CMP, the stock is trading at cyclically moderate valuations of 1.1x FY2013E ABV compared to historical range of 1.05-1.55x, with a median of 1.25x. However, valuations are higher than peers, considering the poor RoE outlook for the bank due to the macro headwinds. Accordingly, we recommend Neutral on the stock.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 65.9 11.9 15.7 6.6

Abs. (%) Sensex Bank of India

3m (2.9) 3.8

1yr (6.2) (21.6)

3yr 89.6 43.4

Key financials

Y/E March (` cr) NII % chg Net profit % chg NIM (%) EPS (`) P/E (x) P/ABV (x) RoA (%) RoE (%)

Source: Company, Angel Research

FY2010 5,756 4.7 1,741 (42.1) 2.4 33.1 10.4 1.5 0.7 14.2

FY2011 7,811 35.7 2,489 42.9 2.6 45.5 7.6 1.2 0.8 17.3

FY2012E 7,996 2.4 2,441 (1.9) 2.2 44.6 7.7 1.2 0.7 14.4

FY2013E 9,374 17.2 2,603 6.6 2.3 47.6 7.2 1.1 0.6 13.7

Vaibhav Agrawal

022 3935 7800 Ext: 6808 vaibhav.agrawal@angelbroking.com

Shrinivas Bhutda

022 3935 7800 Ext: 6845 shrinivas.bhutda@angelbroking.com

Varun Varma

022 3935 7800 Ext: 6847 varun.varma@angelbroking.com

Please refer to important disclosures at the end of this report

Bank of India | 3QFY2012 Result Update

Exhibit 1: 3QFY2012 performance

Particulars (` cr) Interest earned - on Advances / Bills - on investments - on balance with RBI & others - on others Interest Expended Net Interest Income Other income Other income excl. treasury - Fee Income - Treasury Income - Recov. from written off a/cs - Others Operating income Operating expenses - Employee expenses - Other Opex Pre-provision Profit Provisions & Contingencies - Provisions for NPAs - Provisions for Investments - Other Provisions PBT Provision for Tax PAT Effective Tax Rate (%)

Source: Company, Angel Research

3QFY12 2QFY12 % chg (qoq) 3QFY11 % chg (yoy) 7,150 5,171 1,841 182 (45) 5,083 2,068 852 781 320 71 186 275 2,920 1,188 759 429 1,732 693 333 119 241 1,039 323 716 31.1 6,886 4,886 1,843 133 24 4,982 1,904 842 687 326 154 88 274 2,746 1,194 728 467 1,552 1,154 824 151 179 397 (94) 491 (23.7) 3.8 5.8 (0.1) 37.0 (290.2) 2.0 8.6 1.2 13.6 (1.7) (53.9) 112.1 0.3 6.3 (0.5) 4.3 (8.1) 11.6 (40.0) (59.6) (21.2) 34.4 161.6 (443.4) 45.8 5472bp 5,468 4,023 1,275 151 18 3,481 1,987 648 589 284 59 66 239 2,635 1,246 837 409 1,389 498 124 66 309 891 238 653 26.7 30.8 28.5 44.4 20.5 (353.0) 46.0 4.1 31.5 32.6 12.9 20.3 182.4 14.7 10.8 (4.7) (9.3) 4.8 24.7 39.2 169.4 80.9 (21.9) 16.6 35.8 9.6 438bp

Exhibit 2: 3QFY2012 Actual vs. Estimates

Particulars (` cr) NII Non-interest income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Company, Angel Research

Actual 2,068 852 2,920 1,188 1,732 693 1,039 323 716

Estimates 1,962 797 2,758 1,216 1,543 710 832 208 624

Var (%) 5.4 6.9 5.8 (2.3) 12.3 (2.4) 24.8 55.1 14.7

January 31, 2012

Bank of India | 3QFY2012 Result Update

Exhibit 3: 3QFY2012 performance analysis

Particulars Balance sheet Advances (` cr) Deposits (` cr) Credit-to-Deposit Ratio (%) Domestic current deposits (` cr) Domestic saving deposits (` cr) Domestic CASA deposits (` cr) Global CASA ratio (%) CAR (%) Tier 1 CAR (%) Profitability Ratios (%) Cost of deposits Yield on advances Yield on investments Yield on funds Cost of funds Reported NIM Cost-to-income ratio Asset quality Gross NPAs (` cr) Gross NPAs (%) Net NPAs (` cr) Net NPAs (%) Provision Coverage Ratio (%) LLP to avg assets (%) 6,386 2.7 4,093 1.8 60.9 0.4 6,548 3.0 4,245 2.0 59.1 0.9 (2.5) (28)bp (3.6) (20)bp 174bp (57)bp 4,542 2.4 1,660 0.9 74.5 0.2 40.6 38bp 146.5 90bp (1365)bp 19.5 7.1 11.9 7.9 9.3 6.7 2.9 40.7 7.1 11.7 8.0 9.2 6.5 2.8 43.5 (1)bp 24bp (6)bp 7bp 21bp 14bp (281)bp 5.6 10.4 7.9 8.3 5.3 3.5 47.3 145bp 158bp (4)bp 98bp 136bp (58)bp (661)bp 230,355 214,332 307,252 299,074 75.0 14,965 63,606 78,571 25.6 11.2 7.7 71.7 13,140 63,513 76,652 25.6 12.0 8.3 7.5 192,754 2.7 252,526 331bp 13.9 0.1 2.5 (6)bp (79)bp (61)bp 76.3 13,621 55,667 69,287 27.4 12.4 8.0 19.5 21.7 (136)bp 9.9 14.3 13.4 (187)bp (123)bp (32)bp 3QFY12 2QFY12 % chg (qoq) 3QFY11 % chg (yoy)

Source: Company, Angel Research; Note: Profitability ratios excluding CIR for domestic operations

Credit offtake picks up sequentially

The banks advances growth picked up during 3QFY2012, growing by 7.5% qoq (up 19.5% yoy) to `230,355cr. Deposit growth was moderate during the quarter, growing by 2.7% qoq (up 21.7% yoy) to `307,252cr. As a result of faster rise in advances sequentially, the credit-to-deposit (CD) ratio increased by 331bp qoq to 75.0%. Domestic gross advances for the bank grew by 8.2% yoy, while international advances growth was healthy at 60.2% yoy. However, removing the effect of rupee depreciation, growth in the international book was at normalized levels. Share of international advances in the total loan book has, thus, moved up to 29.1% as of 2QFY2012 from 26.3% as of 2QFY2012. On the deposits side, CASA deposits grew by rather moderate 13.4% yoy, with saving account deposits growing at a slightly better pace of 14.3% yoy. Domestic CASA ratio improved sequentially to 32.4% in 3QFY2012 from 31.3% in 2QFY2012.

January 31, 2012

Bank of India | 3QFY2012 Result Update

Exhibit 4: Business momentum remains slows

Adv. qoq chg (%) 20.0 Dep. qoq chg (%) CDR (%, RHS) 75.0 77.0 74.0 71.0

Exhibit 5: Domestic CASA ratio improves

Doemstic CASA ratio (%) 35.0 32.0 29.0 26.0 22.2 18.3 14.3 12.6 13.4 10.0 20.0 CASA yoy growth (%, RHS) 30.0

10.6

15.0 10.0

76.3

73.3 71.7

6.2 4.8

2.0

7.5 2.7

5.0 (5.0)

18.4

71.3

32.3

28.9

30.2

31.3

0.9 (1.9)

23.0 20.0

(0.3)

65.0

32.4

68.0

3QFY11 4QFY11 1QFY12 2QFY12 3QFY12

3QFY11 4QFY11 1QFY12 2QFY12 3QFY12

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 6: International segment higher due to sharp rupee depreciation

Particulars (` cr) Agricultural SME Corporates Retail Domestic advances International Global advances 3QFY12 2QFY12 % chg (qoq) 3QFY11 % chg (yoy) % to total 20,780 31,150 93,391 18,004 67,030 19,641 30,524 91,304 16,395 56,468 5.8 2.1 2.3 9.8 18.7 20,540 27,858 86,885 15,620 41,851 1.2 11.8 7.5 15.3 8.2 60.2 19.5 9.0 13.5 40.5 7.8 70.9 29.1 100.0

163,325 157,864 230,355 214,332

3.5 150,903 7.5 192,754

Source: Company, Angel Research

Domestic NIM improves sequentially on uptick in yield on advances

Domestic NIM of the bank improved by 14bp qoq in 3QFY2012 to 2.9% on the back of uptick in yield on advances (up 24bp qoq) to 11.9%. Cost of deposits for the bank remained flat sequentially at 7.1%. Management has guided for domestic NIM to be ~3% and global NIM to be ~2.6% for FY2013.

Exhibit 7: Trend in yield and cost ratios (Global)

Particulars (%) Cost of deposits Yield on advances Yield on investments Yield on funds Cost of funds Reported NIM

Source: Company, Angel Research

3QFY12 6.0 9.5 7.7 8.0 5.7 2.6

2QFY12 6.1 9.4 7.8 8.1 5.6 2.4

% chg (qoq) (13)bp 4bp (8)bp (7)bp 8bp 11bp

3QFY11 5.0 8.8 7.7 7.4 4.7 3.1

% chg (yoy) 99bp 67bp 3bp 56bp 95bp (54)bp

January 31, 2012

Bank of India | 3QFY2012 Result Update

Exhibit 8: Uptick in domestic yield on advances...

(%) 12.5 12.0 11.5 11.0 10.5 10.0 9.5 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 10.35 10.67 10.84 11.69 11.93

Exhibit 9: ...leads to 14bp qoq increase in domestic NIM

(%) 4.00 3.50 3.00 2.50 2.00 1.50 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 2.43 3.49 3.38 2.77 2.91

Source: Company, Angel Research

Source: Company, Angel Research

Recoveries see a sharp rise in 3QFY2012

Overall, other income performance was robust, growing by 31.5% yoy (up 1.2% qoq) during 3QFY2012. Recoveries from written-off accounts nearly trebled to `186cr, although on a low base. Treasury income also registered a strong performance, growing by 20.3% yoy to `71cr. Growth in commission and brokerage was moderate at 12.9% yoy to `320cr.

Exhibit 10: Moderate fee income growth

Particulars (` cr) CEB Treasury Forex Recoveries Others Other income Other income excl. treasury

Source: Company, Angel Research

3QFY12 2QFY12 320 71 124 186 151 852 781 326 154 148 88 126 842 687

% chg (qoq) 3QFY11 (1.7) (53.9) (16.5) 112.1 20.0 1.2 13.6 284 59 127 66 112 648 589

% chg (yoy) 12.9 20.3 (2.5) 182.4 34.3 31.5 32.6

NPA levels decline for 3QFY2012

The banks NPA levels improved during 3QFY2012, with both gross and net NPA levels declining by 2.5% and 3.6% sequentially, respectively. As of 3QFY2012, gross NPA ratio stands at 2.7% (3.0% in 2QFY2012), while net NPA ratio stood at 1.8% (2.0% in 2QFY2012). Provision coverage ratio continued to remain low at 60.9% (59.1% in 2QFY2012). The 9MFY2012 annualized slippage ratio for the bank stands at 3.1% compared to 1.5% for 9MFY2011. The bank witnessed a chunky slippage of ~`500cr from its aviation account during the quarter. The bank restructured `3,010cr worth accounts during 3QFY2012. Slippages from the restructured book during 3QFY2012 stood at `514cr.

January 31, 2012

Bank of India | 3QFY2012 Result Update

Exhibit 11: Credit costs down after jumping in 2QFY2012

(%) 1.0 0.8 0.6 0.4 0.2 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 0.2 0.4 0.4 0.4 0.9

Exhibit 12: NPA levels decline sequentially

Gross NPAs (%) 3.5 3.0 2.5 2.0 1.5 1.0 59.1 66.8 60.9 74.5 Net NPAs (%) PCR (%, RHS) 79.0 72.2 75.0 71.0 67.0 63.0 59.0 55.0 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12

Source: Company, Angel Research

2.4 0.9

2.2 0.9

2.7 1.3

3.0 2.0

Source: Company, Angel Research

Exhibit 13: Trend in opex

Staff expenses (` cr) Other opex (` cr)

Exhibit 14: Cost ratios at normalized levels

Cost-to-income ratio (%) 70.0 60.0 50.0 40.0 30.0 20.0 10.0 80.0 60.0 40.0 1.7 1.3 1.4 1.3 2.4 Opex to average assets (%, RHS) 2.5 2.0 1.5 1.0

47.3

61.5

44.2

43.5

40.7

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

2,100 1,800 1,500 1,200 900 600 300 -

47.3

464

61.5 44.2 43.5 40.7

409

1,462

837

700

405

728

467

759

429

20.0 -

2.7 1.8

0.5

0.5 -

3QFY11 4QFY11 1QFY12 2QFY12 3QFY12

Source: Company, Angel Research

Source: Company, Angel Research

Investment arguments

Embattled with asset-quality issues

Asset-quality pressures, which had moderated in FY2011 post the severe stress witnessed in FY2010, once again re-surfaced in 1HFY2012 with slippages rate rising to 4.2%. As of 9MFY2012, slippage ratio remains high at 3.1%. While the spike in 1HFY2012 was partly due to migration to system-based NPA recognition platform, the rate of slippages could remain on the higher side in the coming quarters as well due to the weak macro environment. As a result, earnings, which are expected to decline by ~2% yoy in FY2012 due to lower NIMs, are likely to remain subdued even in FY2013. Consequently, the banks RoEs, which were unsustainably high at 28% in FY2008 and FY2009 and subsequently declined to 14% in FY2010 itself, are likely to remain at sub-14% until FY2013 as well, as the bank continues to pay the price for high risk-taking in FY2008-09.

January 31, 2012

Bank of India | 3QFY2012 Result Update

Reasonably high fee income with a moderate funding mix

The banks international operations contribute a substantial 25.0% to its advances. International operations enable a wider spectrum of fee-based services to the banks domestic corporate and retail customers, foreign currency fund-based services to Indian corporates and savings products to the banks PIO clients abroad. The bank has a better funding mix, with domestic CASA ratio at 32.4% as of 3QFY2012.

Outlook and valuation

At the CMP, the stock is trading at cyclically moderate valuations of 1.1x FY2013E ABV compared to its historical range of 1.05-1.55x with a median of 1.25x. However, valuations are higher than peers considering the poor RoE outlook for the bank due to macro headwinds. Accordingly, we recommend a Neutral rating on the stock.

January 31, 2012

Bank of India | 3QFY2012 Result Update

Exhibit 15: Key assumptions

Particulars (%) Credit growth Deposit growth CASA ratio NIMs Other income growth Growth in staff expenses Growth in other expenses Slippages Coverage

Source: Company, Angel Research

Earlier estimates FY2012 17.0 15.0 25.3 2.1 18.3 (15.0) 15.0 4.5 62.0 FY2013 16.0 16.0 25.1 2.1 6.7 14.0 14.0 3.8 60.0

Revised estimates FY2012 16.0 13.0 25.8 2.2 18.3 (15.0) 12.0 4.4 62.0 FY2013 16.0 16.0 25.5 2.3 6.9 14.0 14.0 3.5 63.0

Exhibit 16: Change in estimates

FY2012 Particulars (` cr) NII Non-interest income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT Earlier estimates 7,761 3,125 10,886 4,786 6,100 3,088 3,012 663 2,349 Revised estimates 7,996 3,126 11,121 4,738 6,383 3,128 3,255 814 2,441 % chg 3.0 0.0 2.2 (1.0) 4.6 1.3 8.1 22.8 3.9 Earlier estimates 8,930 3,335 12,265 5,456 6,809 3,120 3,689 1,197 2,492 FY2013 Revised estimates 9,374 3,341 12,715 5,401 7,314 3,461 3,853 1,250 2,603 % chg 5.0 0.2 3.7 (1.0) 7.4 10.9 4.4 4.4 4.4

Source: Company, Angel Research

Exhibit 17: P/ABV band

Price (`) 800 0.8x 1.1x 1.4x 1.7x 2x

600

400

200

Dec-03

Dec-10

Jul-04

Apr-06

Aug-08

Mar-02

Mar-09

Oct-02

Oct-09

Jul-11

Feb-05

Sep-05

Nov-06

May-03

Source: Company, Angel Research

January 31, 2012

May-10

Feb-12

Jun-07

Jan-08

Bank of India | 3QFY2012 Result Update

Exhibit 18: Recommendation summary

Company AxisBk FedBk HDFCBk ICICIBk* SIB YesBk AllBk AndhBk BOB BOI BOM CanBk CentBk CorpBk DenaBk IDBI# IndBk IOB J&KBk OBC PNB SBI* SynBk UcoBk UnionBk UtdBk VijBk Reco. Buy Neutral Accumulate Buy Neutral Accumulate Neutral Neutral Buy Neutral Accumulate Accumulate Neutral Accumulate Accumulate Accumulate Neutral Neutral Neutral Neutral Accumulate Accumulate Accumulate Neutral Reduce Neutral Reduce CMP (`) 1,074 400 491 902 23 330 162 102 753 344 48 471 85 414 68 101 221 88 830 256 940 2,061 96 69 229 70 56 Tgt. price (`) 1,361 516 1,061 367 907 53 528 450 72 107 1,059 2,359 106 217 52 Upside (%) 26.7 5.2 17.7 11.1 20.3 12.1 12.1 8.7 6.4 5.9 12.6 14.4 10.5 (5.3) (7.4) FY2013E P/ABV (x) 1.7 1.1 3.3 1.7 1.1 2.1 0.7 0.8 1.0 1.1 0.7 0.9 0.7 0.7 0.5 0.7 0.9 0.6 0.9 0.7 1.1 1.7 0.6 0.8 1.0 0.7 0.8 FY2013E Tgt P/ABV (x) 2.2 3.5 2.0 2.3 1.3 0.8 1.1 0.8 0.5 0.7 1.2 1.9 0.7 0.9 0.7 FY2013E P/E (x) 9.3 8.6 17.1 14.2 6.9 10.9 4.5 5.0 5.8 7.2 4.9 6.0 5.3 4.5 3.5 5.0 5.3 4.6 4.8 5.6 5.8 10.0 4.1 4.4 5.8 4.9 6.3 FY2011-13E EPS CAGR (%) 18.2 16.2 30.4 19.2 13.5 20.1 9.1 (4.8) 9.8 2.3 26.3 (7.4) (24.3) (1.8) 2.4 9.9 3.8 5.3 16.7 (5.9) 7.3 26.0 13.7 10.9 0.1 4.3 0.7 FY2013E RoA (%) 1.5 1.2 1.8 1.3 0.9 1.4 0.9 0.8 1.1 0.6 0.7 0.8 0.4 0.8 0.8 0.7 1.2 0.5 1.4 0.7 1.0 0.8 0.7 0.6 0.7 0.6 0.4 FY2013E RoE (%) 20.2 13.2 21.0 14.4 17.5 20.6 17.3 14.6 19.3 13.7 16.9 15.8 11.4 15.5 14.9 13.4 18.4 12.8 19.0 11.3 19.7 17.9 16.5 15.4 15.8 12.1 11.1

Source: Company, Angel Research; Note:*Target multiples=SOTP Target Price/ABV (including subsidiaries), #Without adjusting for SASF

January 31, 2012

Bank of India | 3QFY2012 Result Update

Income statement

Y/E March (` cr) NII - YoY Growth (%) Other Income - YoY Growth (%) Operating Income - YoY Growth (%) Operating Expenses - YoY Growth (%) Pre - Provision Profit - YoY Growth (%) Prov. & Cont. - YoY Growth (%) Profit Before Tax - YoY Growth (%) Prov. for Taxation - as a % of PBT PAT - YoY Growth (%) FY08 4,229 22.9 2,117 35.4 6,346 26.8 2,645 1.4 3,701 54.5 1,017 17.9 2,685 75.1 675 25.2 2,009 78.9 FY09 5,499 30.0 3,052 44.2 8,551 34.7 3,094 17.0 5,457 47.4 1,292 27.1 4,164 55.1 1,157 27.8 3,007 49.7 FY10 5,756 4.7 2,617 (14.3) 8,373 (2.1) 3,668 18.5 4,705 (13.8) 2,211 71.1 2,494 (40.1) 753 30.2 1,741 (42.1) FY11 7,811 35.7 2,642 1.0 10,452 24.8 5,068 38.2 5,384 14.4 1,889 (14.6) 3,495 40.2 1,007 28.8 2,489 42.9 FY12E 7,996 2.4 3,126 18.3 11,121 6.4 4,738 (6.5) 6,383 18.6 3,128 65.6 3,255 (6.9) 814 25.0 2,441 (1.9) FY13E 9,374 17.2 3,341 6.9 12,715 14.3 5,401 14.0 7,314 14.6 3,461 10.6 3,853 18.4 1,250 32.4 2,603 6.6

Balance sheet

Y/E March (` cr) Share Capital Reserves & Surplus Deposits - Growth (%) Borrowings Tier 2 Capital Other Liab & Prov. Total Liabilities Cash balances Bank balances Investments Advances - Growth (%) Fixed Assets Other Assets Total Assets - Growth (%) FY08 526 10,063 150,012 25.1 7,172 4,946 6,110 178,830 11,742 5,976 41,803 113,476 33.6 2,426 3,407 178,830 26.3 FY09 526 12,969 189,708 26.5 9,487 6,186 6,625 225,502 8,915 12,846 52,607 142,909 25.9 2,532 5,692 225,502 26.1 FY10 526 13,704 229,762 21.1 14,079 8,320 8,590 274,982 15,603 15,628 67,080 168,491 17.9 2,352 5,829 274,982 21.9 FY11 547 16,743 298,886 30.1 12,862 9,160 12,975 351,173 21,782 15,528 85,872 213,096 26.5 2,481 12,413 351,173 27.7 FY12E 547 18,676 337,741 13.0 14,449 10,625 12,469 394,507 21,953 17,444 94,229 247,192 16.0 2,703 10,986 394,507 12.3 FY13E 547 20,738 391,780 16.0 16,741 12,325 14,963 457,095 25,466 20,211 108,908 286,742 16.0 3,038 12,729 457,095 15.9

January 31, 2012

10

Bank of India | 3QFY2012 Result Update

Ratio analysis

Y/E March NIMs Cost to Income Ratio RoA RoE B/S ratios (%) CASA Ratio Credit/Deposit Ratio CAR - Tier I Asset Quality (%) Gross NPAs Net NPAs Slippages Loan Loss Prov./Avg. Assets Provision Coverage Per Share Data (`) EPS ABVPS DPS Valuation Ratios PER (x) P/ABVPS (x) Dividend Yield DuPont Analysis (%) NII (-) Prov. Exp. Adj. NII Treasury Int. Sens. Inc. Other Inc. Op. Inc. Opex PBT Taxes RoA Leverage (x) RoE 2.6 0.6 2.0 0.2 2.2 1.1 3.3 1.7 1.7 0.4 1.3 22.0 27.6 2.7 0.6 2.1 0.4 2.4 1.1 3.6 1.5 2.1 0.6 1.5 19.6 29.2 2.3 0.9 1.4 0.2 1.7 0.8 2.5 1.5 1.0 0.3 0.7 20.4 14.2 2.5 0.6 1.9 0.1 2.0 0.7 2.7 1.6 1.1 0.3 0.8 21.8 17.3 2.1 0.8 1.3 0.1 1.4 0.7 2.1 1.3 0.9 0.2 0.7 22.0 14.4 2.2 0.8 1.4 0.0 1.4 0.7 2.2 1.3 0.9 0.3 0.6 22.5 13.7 9.0 2.1 1.2 6.0 1.6 2.3 10.4 1.5 2.0 7.6 1.2 2.0 7.7 1.2 2.3 7.2 1.1 2.5 38.2 167.8 4.0 57.2 215.2 8.0 33.1 229.4 7.0 45.5 287.1 7.0 44.6 291.8 8.0 47.6 321.6 8.5 1.7 0.5 1.6 0.4 75.6 1.7 0.4 1.8 0.3 56.1 2.9 1.3 2.9 0.7 65.5 2.2 0.9 1.7 0.3 72.2 4.3 2.3 4.4 0.7 62.0 5.4 2.5 3.5 0.8 63.0 30.6 75.6 13.0 8.2 26.8 75.3 13.0 8.9 27.8 73.3 12.9 8.5 25.4 71.3 12.2 8.3 25.8 73.2 12.3 8.2 25.5 73.2 12.0 7.8 FY08 2.7 41.7 1.3 27.6 FY09 2.8 36.2 1.5 29.2 FY10 2.4 43.8 0.7 14.2 FY11 2.6 48.5 0.8 17.3 FY12E 2.2 42.6 0.7 14.4 FY13E 2.3 42.5 0.6 13.7

January 31, 2012

11

Bank of India | 3QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Bank of India No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

January 31, 2012

12

You might also like

- Franchise BrochureDocument3 pagesFranchise BrochurePari SavlaNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- (Indian Economy - 2) UNIT - 1 POLICIES AND PERFORMANCE IN AGRICULTUREDocument31 pages(Indian Economy - 2) UNIT - 1 POLICIES AND PERFORMANCE IN AGRICULTUREAndroid Boy71% (7)

- Internal and External IssuesDocument8 pagesInternal and External Issuesreda100% (1)

- Stakeholder Theory - PresentationDocument12 pagesStakeholder Theory - PresentationMuhammad Khurram Shabbir100% (1)

- Homeroom Pta Financial ReportDocument1 pageHomeroom Pta Financial ReportRoxanne Tiffany Dotillos SarinoNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Business Strategy of SbiDocument23 pagesBusiness Strategy of Sbichitra_sweetgirl100% (1)

- Danone Universal Registration Document 2020 ENGDocument319 pagesDanone Universal Registration Document 2020 ENGJosh VeigaNo ratings yet

- Exam Timetable Full 13-14Document7 pagesExam Timetable Full 13-14Muhammad KaShifNo ratings yet

- Bank of Maharashtra Result UpdatedDocument11 pagesBank of Maharashtra Result UpdatedAngel BrokingNo ratings yet

- Bank of India Result UpdatedDocument12 pagesBank of India Result UpdatedAngel BrokingNo ratings yet

- Bank of BarodaDocument12 pagesBank of BarodaAngel BrokingNo ratings yet

- Central Bank, 4th February, 2013Document10 pagesCentral Bank, 4th February, 2013Angel BrokingNo ratings yet

- United Bank of India Result UpdatedDocument12 pagesUnited Bank of India Result UpdatedAngel BrokingNo ratings yet

- ICICI Bank Result UpdatedDocument15 pagesICICI Bank Result UpdatedAngel BrokingNo ratings yet

- Union Bank of India: Performance HighlightsDocument11 pagesUnion Bank of India: Performance HighlightsAngel BrokingNo ratings yet

- Central Bank of India Result UpdatedDocument10 pagesCentral Bank of India Result UpdatedAngel BrokingNo ratings yet

- State Bank of IndiaDocument16 pagesState Bank of IndiaAngel BrokingNo ratings yet

- Indian Bank, 12th February 2013Document11 pagesIndian Bank, 12th February 2013Angel BrokingNo ratings yet

- ICICI Bank Result UpdatedDocument15 pagesICICI Bank Result UpdatedAngel BrokingNo ratings yet

- Bank of Baroda, 7th February, 2013Document12 pagesBank of Baroda, 7th February, 2013Angel BrokingNo ratings yet

- Corporation Bank Result UpdatedDocument11 pagesCorporation Bank Result UpdatedAngel BrokingNo ratings yet

- Jammu and Kashmir Bank: Performance HighlightsDocument10 pagesJammu and Kashmir Bank: Performance HighlightsAngel BrokingNo ratings yet

- Indian Bank: Performance HighlightsDocument11 pagesIndian Bank: Performance HighlightsAngel BrokingNo ratings yet

- South Indian Bank Result UpdatedDocument13 pagesSouth Indian Bank Result UpdatedAngel BrokingNo ratings yet

- Oriental Bank of Commerce: Performance HighlightsDocument11 pagesOriental Bank of Commerce: Performance HighlightsAngel BrokingNo ratings yet

- IDBI Bank: Performance HighlightsDocument13 pagesIDBI Bank: Performance HighlightsAngel BrokingNo ratings yet

- Bank of Maharashtra: Performance HighlightsDocument11 pagesBank of Maharashtra: Performance HighlightsAngel BrokingNo ratings yet

- Bank of Baroda: Performance HighlightsDocument12 pagesBank of Baroda: Performance HighlightsAngel BrokingNo ratings yet

- Bank of Baroda Result UpdatedDocument12 pagesBank of Baroda Result UpdatedAngel BrokingNo ratings yet

- Oriental Bank, 1Q FY 2014Document11 pagesOriental Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Dena Bank Result UpdatedDocument10 pagesDena Bank Result UpdatedAngel BrokingNo ratings yet

- IDBI Bank Result UpdatedDocument13 pagesIDBI Bank Result UpdatedAngel BrokingNo ratings yet

- Dena BankDocument11 pagesDena BankAngel BrokingNo ratings yet

- IDBI Bank: Performance HighlightsDocument13 pagesIDBI Bank: Performance HighlightsAngel BrokingNo ratings yet

- Federal Bank, 1Q FY 2014Document11 pagesFederal Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Bank of Maharashtra Result UpdatedDocument11 pagesBank of Maharashtra Result UpdatedAngel BrokingNo ratings yet

- Bank of Baroda, 1Q FY 2014Document12 pagesBank of Baroda, 1Q FY 2014Angel BrokingNo ratings yet

- Dena Bank, 1Q FY 2014Document11 pagesDena Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Syndicate Bank Result UpdatedDocument11 pagesSyndicate Bank Result UpdatedAngel BrokingNo ratings yet

- Indian Overseas BankDocument11 pagesIndian Overseas BankAngel BrokingNo ratings yet

- Canara Bank, 12th February 2013Document11 pagesCanara Bank, 12th February 2013Angel BrokingNo ratings yet

- Canara Bank Result UpdatedDocument11 pagesCanara Bank Result UpdatedAngel BrokingNo ratings yet

- Union Bank of IndiaDocument11 pagesUnion Bank of IndiaAngel BrokingNo ratings yet

- Yes Bank: Performance HighlightsDocument12 pagesYes Bank: Performance HighlightsAngel BrokingNo ratings yet

- ICICI Bank Result UpdatedDocument16 pagesICICI Bank Result UpdatedAngel BrokingNo ratings yet

- Axis Bank: Performance HighlightsDocument13 pagesAxis Bank: Performance HighlightsRahul JagdaleNo ratings yet

- Syndicate Bank, 1Q FY 2014Document11 pagesSyndicate Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Central Bank of India Result UpdatedDocument10 pagesCentral Bank of India Result UpdatedAngel BrokingNo ratings yet

- Bank of India: Performance HighlightsDocument12 pagesBank of India: Performance HighlightsAngel BrokingNo ratings yet

- Axis Bank: Performance HighlightsDocument13 pagesAxis Bank: Performance HighlightsAngel BrokingNo ratings yet

- Axis Bank: Performance HighlightsDocument13 pagesAxis Bank: Performance HighlightsAngel BrokingNo ratings yet

- Union Bank 4Q FY 2013Document11 pagesUnion Bank 4Q FY 2013Angel BrokingNo ratings yet

- Jammu and Kashmir Bank: Performance HighlightsDocument11 pagesJammu and Kashmir Bank: Performance HighlightsAngel BrokingNo ratings yet

- Andhra Bank: Performance HighlightsDocument10 pagesAndhra Bank: Performance HighlightsAngel BrokingNo ratings yet

- Allahabad Bank Result UpdatedDocument11 pagesAllahabad Bank Result UpdatedAngel BrokingNo ratings yet

- Syndicate Bank 4Q FY 2013Document11 pagesSyndicate Bank 4Q FY 2013Angel BrokingNo ratings yet

- Allahabad Bank, 1Q FY 2014Document11 pagesAllahabad Bank, 1Q FY 2014Angel BrokingNo ratings yet

- State Bank of India: Performance HighlightsDocument14 pagesState Bank of India: Performance HighlightsAngel BrokingNo ratings yet

- UnitedBoI-1QFY2013RU 10 TH AugDocument11 pagesUnitedBoI-1QFY2013RU 10 TH AugAngel BrokingNo ratings yet

- Union Bank of India Result UpdatedDocument11 pagesUnion Bank of India Result UpdatedAngel BrokingNo ratings yet

- Allahabad Bank Result UpdatedDocument11 pagesAllahabad Bank Result UpdatedAngel BrokingNo ratings yet

- UCO Bank: Performance HighlightsDocument11 pagesUCO Bank: Performance HighlightsAngel BrokingNo ratings yet

- Vijaya Bank, 1Q FY 2014Document11 pagesVijaya Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Jammu and Kashmir Bank Result UpdatedDocument10 pagesJammu and Kashmir Bank Result UpdatedAngel BrokingNo ratings yet

- UCO Bank: Performance HighlightsDocument11 pagesUCO Bank: Performance HighlightsAngel BrokingNo ratings yet

- Corporation Bank 4Q FY 2013Document11 pagesCorporation Bank 4Q FY 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Course Outline - Principles of Marketing BcomDocument4 pagesCourse Outline - Principles of Marketing Bcomwairimuesther506No ratings yet

- Letter of Intent For Financial AssistanceDocument9 pagesLetter of Intent For Financial AssistanceecsanjuanNo ratings yet

- Challenges and Opportunities Facing Brand Management - An IntroducDocument12 pagesChallenges and Opportunities Facing Brand Management - An IntroducLeyds GalvezNo ratings yet

- E1.developments in The Indian Money MarketDocument16 pagesE1.developments in The Indian Money Marketrjkrn230% (1)

- International TaxationDocument46 pagesInternational TaxationsridhartksNo ratings yet

- EU Compendium of Spatial PlanningDocument176 pagesEU Compendium of Spatial PlanningVincent NadinNo ratings yet

- Mayor Kasim Reed's Proposed FY 2015 BudgetDocument585 pagesMayor Kasim Reed's Proposed FY 2015 BudgetmaxblauNo ratings yet

- Regional Trade Integration in SEE Benefits and ChallengesDocument178 pagesRegional Trade Integration in SEE Benefits and ChallengesRakip MaloskiNo ratings yet

- Daniyal - Business Plan ...Document19 pagesDaniyal - Business Plan ...kamran bajwaNo ratings yet

- Aviva Easy Life PlusDocument14 pagesAviva Easy Life PlusManju LoveNo ratings yet

- Strategic Management 2Document46 pagesStrategic Management 2Ritz Talent HubNo ratings yet

- Vensa WorkorderDocument9 pagesVensa WorkorderAshutosh Kumar DwivediNo ratings yet

- MERCHANDISINGDocument74 pagesMERCHANDISINGKisha Nicole R. EnanoriaNo ratings yet

- Avrio PLT Corporate ProfileDocument16 pagesAvrio PLT Corporate Profilemiss anuarNo ratings yet

- Punjab Spatial Planning StrategyDocument12 pagesPunjab Spatial Planning Strategybaloch47No ratings yet

- L4DB - Y12 - UBO Assignment - Sep - 2020 PDFDocument4 pagesL4DB - Y12 - UBO Assignment - Sep - 2020 PDFsnapNo ratings yet

- CPALE Syllabi 2018 PDFDocument32 pagesCPALE Syllabi 2018 PDFLorraine TomasNo ratings yet

- Techno 101 LESSON 1 Week 2Document16 pagesTechno 101 LESSON 1 Week 2JaneGuinumtadNo ratings yet

- Marketing Strategies of JK Bank Debit CardsDocument51 pagesMarketing Strategies of JK Bank Debit Cardshoneydeol00733% (3)

- ABC Practice Problems Answer KeyDocument10 pagesABC Practice Problems Answer KeyKemberly AribanNo ratings yet

- Geographical Analysis PDFDocument7 pagesGeographical Analysis PDFDhiraj DaimaryNo ratings yet

- John Deere Case Study 12 27 11Document3 pagesJohn Deere Case Study 12 27 11Rdx ProNo ratings yet