Professional Documents

Culture Documents

IRS Notice 1036

Uploaded by

jimmbu1046Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IRS Notice 1036

Uploaded by

jimmbu1046Copyright:

Available Formats

Department of the Treasury

Internal Revenue Service

Notice 1036

(Rev. December 2011)

Early Release Copies of the 2012

Percentage Method Tables for Income

Tax Withholding

Future Developments

The IRS has created a page on IRS.gov for information about

Notice 1036, at www.irs.gov/notice1036. Information about any

future developments affecting Notice 1036 (such as legislation

enacted after we release it) will be posted on that page.

Social Security and Medicare Tax for 2012

The employee tax rate for social security is 4.2% on wages

paid and tips received before March 1, 2012. The employee

tax rate for social security increases to 6.2% on wages paid

and tips received after February 29, 2012. The employer tax

rate for social security remains unchanged at 6.2%. The social

security wage base limit is $110,100. The Medicare tax rate is

1.45% each for the employee and employer, unchanged from

2011. There is no wage base limit for Medicare tax.

Employers should implement the 4.2% employee social

security tax rate as soon as possible, but not later than

January 31, 2012. After implementing the 4.2% rate,

employers should make an offsetting adjustment in a

subsequent pay period to correct any overwithholding of social

security tax as soon as possible, but not later than March 31,

2012.

CAUTION

At the time this notice was prepared for release, the

rate for the employees share of social security tax was

4.2% and scheduled to increase to 6.2% for wages paid

after February 29, 2012. However, Congress was

discussing an extension of the 4.2% employee tax rate

for social security beyond February 29, 2012. Check for

updates at www.irs.gov/notice1036.

IRS.gov

Percentage Method Tables for Income Tax

Withholding

Attached are early release copies of the Percentage Method

Tables for Income Tax Withholding that will appear in

Publication 15 (Circular E), Employers Tax Guide (For use in

2012). Publication 15 (Circular E) will be posted on IRS.gov in

January 2012. It also will be available at IRS offices in January

and mailed to new employers when they apply for an employer

identification number.

The wage amounts shown in the Percentage Method

Tables for Income Tax Withholding are net wages after the

deduction for total withholding allowances. The withholding

allowance amounts by payroll period have changed. For 2012,

they are:

Payroll Period

Weekly

One Withholding

Allowance

$ 73.08

Biweekly

146.15

Semimonthly

158.33

Monthly

316.67

Quarterly

950.00

Semiannually

1,900.00

Annually

3,800.00

Daily or Miscellaneous

(each day of the payroll period)

14.62

When employers use the Percentage Method Tables for Income Tax Withholding, the tax for the pay period may be

rounded to the nearest dollar. (If rounding is used, it must be

used consistently.) Withheld tax amounts should be rounded to

the nearest dollar by dropping amounts under 50 cents and

increasing amounts from 50 to 99 cents to the next higher

dollar. For example, $2.30 becomes $2 and $2.50

becomes $3.

Catalog No. 21974B

Withholding Adjustment for Nonresident Aliens

For 2012, apply the procedure discussed below to figure the

amount of income tax to withhold from the wages of

nonresident alien employees performing services within the

United States.

Note. Nonresident alien students from India and business

apprentices from India are not subject to this procedure.

Instructions. To figure how much income tax to withhold from

the wages paid to a nonresident alien employee performing

services in the United States, use the following steps.

Step 1. Add to the wages paid to the nonresident alien

employee for the payroll period the amount shown in the chart

below for the applicable payroll period.

Amount to Add to Nonresident Alien Employees

Wages for Calculating Income Tax Withholding Only

Payroll Period

Weekly

Add Additional

$ 41.35

Biweekly

82.69

Semimonthly

89.58

Monthly

179.17

Quarterly

537.50

Semiannually

1,075.00

Annually

2,150.00

Daily or Miscellaneous

(each day of the payroll period)

8.27

Step 2. Use the amount figured in Step 1 and the number

of withholding allowances claimed (generally limited to one

allowance) to figure income tax withholding. Determine the

value of withholding allowances by multiplying the number of

withholding allowances claimed by the appropriate amount in

the table shown on the previous page. Reduce the amount

figured in Step 1 by the value of withholding allowances and

use that reduced amount to determine the wages subject to

income tax withholding. Figure the income tax withholding

using the Percentage Method Tables for Income Tax

Withholding provided on the next two pages. Alternatively, you

can figure the income tax withholding using the Wage Bracket

Tables for Income Tax Withholding included in Publication 15

(Circular E) (For use in 2012).

IRS.gov

Catalog No. 21974B

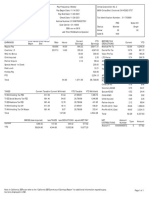

Percentage Method Tables for Income Tax Withholding

(For Wages Paid in 2012)

TABLE 1 WEEKLY Payroll Period

(a) SINGLE person (including head of household)

(b) MARRIED person

If the amount of wages (after

subtracting withholding allowances)

is:

If the amount of wages (after

subtracting withholding allowances)

is:

The amount of income tax

to withhold is:

The amount of income tax

to withhold is:

Not over $41 . . . . . . . . . . . . . . . . $0

Not over $156 . . . . . . . . . . . . . . . . $0

Over

Over

$156

$490

$1,515

$2,900

$4,338

$7,624 . . . . . .

$41

$209

$721

$1,688

$3,477

$7,510

But not over

$209 . . . .

$721 . . . .

$1,688 . . . .

$3,477 . . . .

$7,510 . . . .

.................

of excess over

$0.00 plus 10%

$41

$16.80 plus 15%

$209

$93.60 plus 25%

$721

$335.35 plus 28%

$1,688

$836.27 plus 33%

$3,477

$2,167.16 plus 35%

$7,510

But not over

of excess over

$490 . . . . $0.00 plus 10%

$156

$1,515 . . . . $33.40 plus 15%

$490

$2,900 . . . . $187.15 plus 25%

$1,515

$4,338 . . . . $533.40 plus 28%

$2,900

$7,624 . . . . $936.04 plus 33%

$4,338

. . . . . . . . . . . . $2,020.42 plus 35%

$7,624

TABLE 2 BIWEEKLY Payroll Period

(a) SINGLE person (including head of household)

(b) MARRIED person

If the amount of wages (after

subtracting withholding allowances)

is:

If the amount of wages (after

subtracting withholding allowances)

is:

The amount of income tax

to withhold is:

The amount of income tax

to withhold is:

Not over $83 . . . . . . . . . . . . . . . . $0

Not over $312 . . . . . . . . . . . . . . . . $0

Over

But not over

of excess over

$83

$417 . . . . $0.00 plus 10%

$83

$417

$1,442 . . . . $33.40 plus 15%

$417

$1,442

$3,377 . . . . $187.15 plus 25%

$1,442

$3,377

$6,954 . . . . $670.90 plus 28%

$3,377

$6,954

$15,019 . . . . $1,672.46 plus 33%

$6,954

$15,019 . . . . . . . . . . . . . . . . . $4,333.91 plus 35%

$15,019

Over

But not over

of excess over

$312

$981 . . . . $0.00 plus 10%

$312

$981

$3,031 . . . . $66.90 plus 15%

$981

$3,031

$5,800 . . . . $374.40 plus 25%

$3,031

$5,800

$8,675 . . . . $1,066.65 plus 28%

$5,800

$8,675

$15,248 . . . . $1,871.65 plus 33%

$8,675

$15,248 . . . . . . . . . . . . . . . . . . $4,040.74 plus 35%

$15,248

TABLE 3 SEMIMONTHLY Payroll Period

(a) SINGLE person (including head of household)

(b) MARRIED person

If the amount of wages (after

subtracting withholding allowances)

is:

If the amount of wages (after

subtracting withholding allowances)

is:

The amount of income tax

to withhold is:

The amount of income tax

to withhold is:

Not over $90 . . . . . . . . . . . . . . . . $0

Not over $338 . . . . . . . . . . . . . . . . $0

Over

But not over

of excess over

$90

$452 . . . . $0.00 plus 10%

$90

$452

$1,563 . . . . $36.20 plus 15%

$452

$1,563

$3,658 . . . . $202.85 plus 25%

$1,563

$3,658

$7,533 . . . . $726.60 plus 28%

$3,658

$7,533

$16,271 . . . . $1,811.60 plus 33%

$7,533

$16,271 . . . . . . . . . . . . . . . . . $4,695.14 plus 35%

$16,271

Over

But not over

of excess over

$338

$1,063 . . . . $0.00 plus 10%

$338

$1,063

$3,283 . . . . $72.50 plus 15%

$1,063

$3,283

$6,283 . . . . $405.50 plus 25%

$3,283

$6,283

$9,398 . . . . $1,155.50 plus 28%

$6,283

$9,398

$16,519 . . . . $2,027.70 plus 33%

$9,398

$16,519 . . . . . . . . . . . . . . . . . . $4,377.63 plus 35%

$16,519

TABLE 4 MONTHLY Payroll Period

(a) SINGLE person (including head of household)

(b) MARRIED person

If the amount of wages (after

subtracting withholding allowances)

is:

If the amount of wages (after

subtracting withholding allowances)

is:

The amount of income tax

to withhold is:

The amount of income tax

to withhold is:

Not over $179 . . . . . . . . . . . . . . . $0

Not over $675 . . . . . . . . . . . . . . . . $0

Over

$179

$904

$3,125

$7,317

$15,067

$32,542 . . . . .

Over

$675

$2,125

$6,567

$12,567

$18,796

$33,038 . . . . .

IRS.gov

But not over

$904 . . . .

$3,125 . . . .

$7,317 . . . .

$15,067 . . . .

$32,542 . . . .

............

of excess over

$0.00 plus 10%

$179

$72.50 plus 15%

$904

$405.65 plus 25%

$3,125

$1,453.65 plus 28%

$7,317

$3,623.65 plus 33%

$15,067

$9,390.40 plus 35%

$32,542

But not over

of excess over

$2,125 . . . . $0.00 plus 10%

$675

$6,567 . . . . $145.00 plus 15%

$2,125

$12,567 . . . . $811.30 plus 25%

$6,567

$18,796 . . . . $2,311.30 plus 28%

$12,567

$33,038 . . . . $4,055.42 plus 33%

$18,796

. . . . . . . . . . . . . $8,755.28 plus 35%

$33,038

Catalog No. 21974B

Percentage Method Tables for Income Tax Withholding (continued)

(For Wages Paid in 2012)

TABLE 5 QUARTERLY Payroll Period

(a) SINGLE person (including head of household)

(b) MARRIED person

If the amount of wages (after

subtracting withholding allowances)

is:

If the amount of wages (after

subtracting withholding allowances)

is:

The amount of income tax

to withhold is:

The amount of income tax

to withhold is:

Not over $538 . . . . . . . . . . . . . . . $0

Not over $2,025 . . . . . . . . . . . . . . $0

Over

$538

$2,713

$9,375

$21,950

$45,200

$97,625 . . . . .

Over

$2,025

$6,375

$19,700

$37,700

$56,388

$99,113 . . . . .

But not over

of excess over

$2,713 . . . $0.00 plus 10%

$538

$9,375 . . . $217.50 plus 15%

$2,713

$21,950 . . . $1,216.80 plus 25%

$9,375

$45,200 . . . $4,360.55 plus 28%

$21,950

$97,625 . . . $10,870.55 plus 33%

$45,200

. . . . . . . . . . . . $28,170.80 plus 35%

$97,625

But not over

$6,375 . . .

$19,700 . . .

$37,700 . . .

$56,388 . . .

$99,113 . . .

............

of excess over

$0.00 plus 10%

$2,025

$435.00 plus 15%

$6,375

$2,433.75 plus 25%

$19,700

$6,933.75 plus 28%

$37,700

$12,166.39 plus 33%

$56,388

$26,265.64 plus 35%

$99,113

TABLE 6 SEMIANNUAL Payroll Period

(a) SINGLE person (including head of household)

(b) MARRIED person

If the amount of wages (after

subtracting withholding allowances)

is:

If the amount of wages (after

subtracting withholding allowances)

is:

The amount of income tax

to withhold is:

The amount of income tax

to withhold is:

Not over $1,075 . . . . . . . . . . . . . . $0

Not over $4,050 . . . . . . . . . . . . . . $0

Over

But not over

of excess over

$1,075

$5,425 . . . $0.00 plus 10%

$1,075

$5,425

$18,750 . . . $435.00 plus 15%

$5,425

$18,750

$43,900 . . . $2,433.75 plus 25%

$18,750

$43,900

$90,400 . . . $8,721.25 plus 28%

$43,900

$90,400

$195,250 . . . $21,741.25 plus 33%

$90,400

$195,250 . . . . . . . . . . . . . . . . . $56,341.75 plus 35%

$195,250

Over

But not over

$4,050

$12,750 . . .

$12,750

$39,400 . . .

$39,400

$75,400 . . .

$75,400

$112,775 . . .

$112,775

$198,225 . . .

$198,225 . . . . . . . . . . . . . . . . .

of excess over

$0.00 plus 10%

$4,050

$870.00 plus 15%

$12,750

$4,867.50 plus 25%

$39,400

$13,867.50 plus 28%

$75,400

$24,332.50 plus 33%

$112,775

$52,531.00 plus 35%

$198,225

TABLE 7 ANNUAL Payroll Period

(a) SINGLE person (including head of household)

(b) MARRIED person

If the amount of wages (after

subtracting withholding allowances)

is:

If the amount of wages (after

subtracting withholding allowances)

is:

The amount of income tax

to withhold is:

The amount of income tax

to withhold is:

Not over $2,150 . . . . . . . . . . . . . . $0

Not over $8,100 . . . . . . . . . . . . . . $0

Over

But not over

of excess over

$2,150

$10,850 . . . $0.00 plus 10%

$2,150

$10,850

$37,500 . . . $870.00 plus 15%

$10,850

$37,500

$87,800 . . . $4,867.50 plus 25%

$37,500

$87,800

$180,800 . . . $17,442.50 plus 28%

$87,800

$180,800

$390,500 . . . $43,482.50 plus 33%

$180,800

$390,500 . . . . . . . . . . . . . . . . . $112,683.50 plus 35%

$390,500

Over

$8,100

$25,500

$78,800

$150,800

$225,550

$396,450 . . . .

But not over

$25,500 . . .

$78,800 . . .

$150,800 . . .

$225,550 . . .

$396,450 . . .

.............

of excess over

$0.00 plus 10%

$8,100

$1,740.00 plus 15%

$25,500

$9,735.00 plus 25%

$78,800

$27,735.00 plus 28%

$150,800

$48,665.00 plus 33%

$225,550

$105,062.00 plus 35%

$396,450

TABLE 8 DAILY or MISCELLANEOUS Payroll Period

(a) SINGLE person (including head of household)

(b) MARRIED person

If the amount of wages (after

subtracting withholding allowances)

divided by the number of days in the The amount of income tax

payroll period is:

to withhold per day is:

If the amount of wages (after

subtracting withholding allowances)

divided by the number of days in the The amount of income tax

payroll period is:

to withhold per day is:

Not over $8.30 . . . . . . . . . . . . . . . $0

Not over $31.20 . . . . . . . . . . . . . . $0

Over

But not over

$8.30

$41.70 . . . $0.00 plus 10%

$41.70

$144.20 . . . $3.34 plus 15%

$144.20

$337.70 . . . $18.72 plus 25%

$337.70

$695.40 . . . $67.10 plus 28%

$695.40

$1,501.90 . . . $167.26 plus 33%

$1,501.90 . . . . . . . . . . . . . . . . . $433.41 plus 35%

IRS.gov

of excess over

$8.30

$41.70

$144.20

$337.70

$695.40

$1,501.90

Over

But not over

$31.20

$98.10 . . .

$98.10

$303.10 . . .

$303.10

$580.00 . . .

$580.00

$867.50 . . .

$867.50

$1,524.80 . . .

$1,524.80 . . . . . . . . . . . . . . . . .

$0.00 plus 10%

$6.69 plus 15%

$37.44 plus 25%

$106.67 plus 28%

$187.17 plus 33%

$404.08 plus 35%

of excess over

$31.20

$98.10

$303.10

$580.00

$867.50

$1,524.80

Catalog No. 21974B

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- Income From Property 1Document18 pagesIncome From Property 1aisha jabeenNo ratings yet

- Income Tax On IndividualsDocument25 pagesIncome Tax On IndividualsMohammadNo ratings yet

- Taxation Assignment 3 SolutionsDocument3 pagesTaxation Assignment 3 SolutionsShane KimNo ratings yet

- Cuestionario Fiscal Sobre Información TributariaDocument2 pagesCuestionario Fiscal Sobre Información TributariaCarlos Jose NuñezNo ratings yet

- Challan No. ITNS 280Document2 pagesChallan No. ITNS 280RAHUL AGARWALNo ratings yet

- Taxation of TrustDocument4 pagesTaxation of TrustRahul ARNo ratings yet

- AAAJT1833E - Issue Letter - 1049437802 (1) - 06022023Document2 pagesAAAJT1833E - Issue Letter - 1049437802 (1) - 06022023Basavaraj KorishettarNo ratings yet

- Child Tax Credit Rates 2005-7Document3 pagesChild Tax Credit Rates 2005-7frankieb99No ratings yet

- SRO 586 of 1991Document2 pagesSRO 586 of 1991Abdul QadirNo ratings yet

- Get Payslip by OffsetDocument1 pageGet Payslip by OffsetDarryl WhiteheadNo ratings yet

- Taxation Unit 2 NewDocument4 pagesTaxation Unit 2 NewgarntethNo ratings yet

- Quiz 1 Midterm - TaxDocument3 pagesQuiz 1 Midterm - TaxHazel Grace PaguiaNo ratings yet

- AnswerDocument4 pagesAnswerZati TyNo ratings yet

- GHMC Property Tax 10-7-163-NRDocument1 pageGHMC Property Tax 10-7-163-NRndeepak9291384506No ratings yet

- Trugo, Karluz BT - SW1 - C9Document15 pagesTrugo, Karluz BT - SW1 - C9moreNo ratings yet

- Economy,: Why Study Public Finance? Facts On Government in The United States and Around The WorldDocument1 pageEconomy,: Why Study Public Finance? Facts On Government in The United States and Around The WorldpenelopegerhardNo ratings yet

- Project Topic: Income Tax Systems in Pakistan, India & UKDocument53 pagesProject Topic: Income Tax Systems in Pakistan, India & UKAfzal RocksxNo ratings yet

- Chapter 1 - Fundamental Principles: TAXATION - The Process by Which The Sovereign, Through Its Law-Making BodyDocument11 pagesChapter 1 - Fundamental Principles: TAXATION - The Process by Which The Sovereign, Through Its Law-Making BodyLiRose SmithNo ratings yet

- Practical Question Bank: Faculty of Commerce, Osmania UniversityDocument4 pagesPractical Question Bank: Faculty of Commerce, Osmania Universitymekala sailajaNo ratings yet

- Personal Reliefs and RebatesDocument3 pagesPersonal Reliefs and RebatesJong HannahNo ratings yet

- FM 116 25D Homework 2Document4 pagesFM 116 25D Homework 2Sofia BruzualNo ratings yet

- Form 16 TDS CertificateDocument2 pagesForm 16 TDS CertificateHari Krishnan ElangovanNo ratings yet

- PCSC vs. CIRDocument15 pagesPCSC vs. CIRrobinNo ratings yet

- Pre Termination of LongDocument5 pagesPre Termination of LongBisag AsaNo ratings yet

- Employee's Salary FormDocument2 pagesEmployee's Salary FormConnie AlisasisNo ratings yet

- Jawaban Kieso Intermediate Accounting p19-4Document3 pagesJawaban Kieso Intermediate Accounting p19-4nadiaulyNo ratings yet

- Hemanshu Joshi 23Document4 pagesHemanshu Joshi 23HEMANSHU JOSHINo ratings yet

- FORM 16A CERTIFICATEDocument2 pagesFORM 16A CERTIFICATERashmi RanaNo ratings yet

- ViewPDF AspxDocument1 pageViewPDF Aspxbanny beesettyNo ratings yet